Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Accounting and Reporting

Caricato da

Pauline IdraCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Accounting and Reporting

Caricato da

Pauline IdraCopyright:

Formati disponibili

I: PARTNERSHIP FORMATION

TRUE OR FALSE

1. You and I formed a partnership. You contributed P100 cash, while

I contributed a stapler which I bought 10 years ago for Pl,000.

If we sell the stapler currently, we would probably sell it for

only P2. My capital account should be credited for Pl,000.

2. The assets contributed to (and related liabilities assumed by)

the partnership are -measured in the partnership books at

carrying amount or cost to the contributing partner.

3. Mr. A contributed equipment with historical cost of P1,000,000

and fair value of P800,000 to a partnership. If no bonus is

given to any partner, Mr. A's capital account will be credited

for P800,000.

4. A bonus exists when the capital account of a partner is credited

for an amount greater than or less than the total fair value of

his net contributions.

5. A bonus given to a partner is treated as an adjustment to the

capital accounts of the other partners.

Use the following information for the next two questions:

You and I formed a partnership. We both contributed P100 cash.

However, we agreed that because you have special skills which you

will be bringing into the partnership, you should receive an

initial capital credit of P140.

6. Your bonus is P140.

7. After recording our contributions, my equity account in the

partnership books would have a balance of P60.

Use the following information for the nextfour questions:

You and I formed a partnership. You contributed P150 cash while I

contributed a machine with fair value of P50. We agreed that we

should have equal interests in the partnership. Our initial capital

credits should reflect this agreement. No bonus shall be given to

any of us.

8. If we agreed that the initial partnership capital should remain

at P200, you should pay me 950.

9. Continuing #8 above, your initial capital credit would be P100

instead of P150.

10. If we agreed that the initial partnership capital should be

P300, I should provide additional cash of P100 to the business.

PROBLEMS:

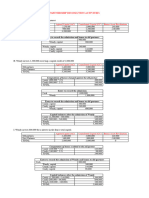

1. On January 1, 2020, Mr. A and Ms. B formed a partnership. Mr. A

contributed cash of ₱500,000 while Ms. B contributed a building

with carrying amount of ₱400,000 and fair value of ₱800,000.

The building has an unpaid mortgage of ₱200,000 which is not

assumed by the partnership.

Requirement: Provide the journal entry to record the

contributions of the partners.

2. A and B formed a partnership. The following are their

contributions:

A B

Cash 500,000 -

Accounts

receivable 100,000 -

Building 700,000

Total 600,000 700,000

A, capital 600,000

B, capital 700,000

Total 600,000 700,000

Additional information:

• The accounts receivable includes a ₱20,000 account that is

deemed uncollectible.

• The building is over-depreciated by ₱50,000.

• The building has an unpaid mortgage ₱100,000, which is assumed

by the partnership.

Requirement: Provide the journal entry to record the contributions

of the partners in the partnership books.

3. A and B agreed to form a partnership. A contributed ₱40,000 cash

while B contributed equipment with fair value of ₱100,000.

However due to the expertise that A will be bringing to the

partnership, the partners agreed that they should initially have

a 60:40 in the partnership capital.

II: PARTNERSHIP OPERATION

True or False- Answers beside the number. If false, correct

the statement by crossing the wrong word(s) or amounts(s) and place

your correction above it.

_____1. Partner’s regular cash withdrawal is credited to a

separate withdrawal account.

_____2. In closing the accounts at the end of a period, the

partners' capital accounts are credited for their share of

the partnership loss or debited for their share of the

partnership net income

_____3. The statement of changes in partners' equity shows the

beginning balance only in the capital accounts if the

accountant uses the fixed capital method.

_____4. The statement of changes in partners’ equity should present

regular salary drawings as a reduction from equity whether

salary allowances withdrawn are of the same amount or not as

agreed in their profit sharing agreement.

_____5. If partners devote their time and services to their

partnership, their salaries should be presented as expenses.

_____6. An industrial partner may receive salary allowance but not

interest profit.

_____7. A limited partner may receive interest profit and salary

allowance.

_____8. Reggie is a partner in Time To Sleep. An analysis of her

capital account indicates that during the year, her residual

share was a loss of P16,000 after a salary allowance of

P20,000 which she withdrew during the year. Her total loss

share for the year was P36,000.

_____9. Refer to. No. 8. If Reggie’s capital account at the end of

the year reached P150,000 after she made an additional mid

year contribution of P10,000, her capital balance at the

start of the year must have been P144,000 including beginning

drawing balance.

_____10. The accountant briefly explained this entry as cash

investment of Helen with bonus given by the other

partners:

Cash 900,000

Ben Chan, Capital 50,000

Rose Jocson, Capital 50,000

Helen Reyes, Capital 800,000

PROBLEMS

I. The JR Asia Consultancy Firm which is owned and managed by two

CPAS, Joffre and Ric started operation on March 31, 2015. Initial

investments of the partners are: Mat P800,000 and Stella P400,000.

Profit agreement as shown in the articles of co-partnership

follows:

Distribute profit by giving partners a 6.75% interest on

contributions, a 10% bonus treated as a distribution of profit

to Mat, remaining profit divided equally as both are CPAs.

1. If profit at the end of Dec 31 is reported as P200,000, how

much will be Mat’s profit share?

2. If Stella earns a total profit share of P69,750 at the

end of 2015, how much will Mat earn?

3. Stella was not satisfied with the agreement. She wants

the bonus to be 10% after interest and bonus. If Stella earns

P69,750, how much will the bonus be?

II. Beth, Luz and Ana established an internet shop and agreed to

divide profit and loss in the ratio of 2:1:1 respectively, after

giving a monthly salary of P10,000 to each partner and bonus of

20% to Beth. What is the profit share of Beth based on the

following independent situations?

4. Net taxable income earned is P480,000 and 20% bonus is

based on net income before salaries but after bonus and the

tax rate is 30%.

5. Net income after salaries but before tax and bonus is P480,000.

20% bonus is based on net income after tax, salaries and bonus.

6. Net income is P480,000 including salaries and bonus. 20% Bonus

is based on net income before salaries but after bonus.

7. Net income is P480,000 before salaries bonus and tax.

Bonus is based on net income after salaries, bonus and tax.

Salaries and bonus are treated as deductible expenses . Tax

rate is 30%.

PARTNERSHIP DISSOLUTION

Problem 1. Assume that A and B share profits and losses equally.

C is to be as a partner by contributing cash to the firm. The

capital balances of A and B before the admission of C are as

follows:

A, Capital P32,000

B. Capital 40,000

Total P72,000

Required: Prepare a table showing the equity structure under each

of the following cases:

Case 1. Bonus to old partners. C invests P48, 000 for a one-third

interest in the partnership. The total agreed capital of the new

firm is P120, 000.

Case 2. Bonus to new partner. C invests P24, 000 for a one-third

interest in the partnership. The total agreed capital of the new

firm is P96, 000.

Problem 2. Assume that A and B share profits and losses 60:40. C

is to be as a partner by contributing cash to the firm. The capital

balances of A and B before the admission of C are as follows:

A, Capital P26,000

B. Capital 10,000

Total P36,000

Required: Prepare a table showing the equity structure under each

of the following cases:

Case 1. Bonus to new partner. C invests P10, 000 for a one-fourth

interest in the new partnership.

Case 2. Bonus to old partners. C invests P10, 000 for a 20% interest

in the new partnership.

Problem 3. Ferraro, Castillo, and Franco have equities in a

partnership of P500,000, P800,000, and P700,000, respectively, and

share profits and losses in a ratio of 5:3:2, respectively. The

partners have agreed to admit Retada to the partnership.

Required: Calculate the capital balances of each of the partner

after admission of the new partner.

Problem 4. After intangible assets have been adjusted to fair

values, the capital accounts of Rey Refozar and Rogelio Ceradoy

have balances of P75,000 and P125,000, respectively. Elmer

Dimayuga is to be admitted to the partnership, contributing P50,000

cash to the partnership, for which he is to receive an equity of

P65,000. All partners share equally in profit.

Required: Calculate the capital balances of each of the partner

after admission of the new partner.

Problem 5. The partnership of Angel Investors began operations on

January 1, 2020, with contributions from two partners as follows:

Angel Samson P1,200,000

Jr.

Amalia Dela

Cruz 800,000

The following additional partner transactions took place during

the year:

1. In early January, Renante Balocating is admitted to the

partnership by contributing P500,000 cash for a 20% interest.

2. Profit of P2,500,000 was earned in 2020. In addition, Angel

Samson Jr. received a salary allowance of P450,000 for the

year. The three partners agreed to an income-sharing ratio

equal to their capital balances after admitting Balocating.

3. The partners’ withdrawals are equal to half of the increase

in their capital balances from salary allowances and profit.

Required: Prepare a statement of changes in partners’s equity for

the year ended December 31, 2020.

Potrebbero piacerti anche

- BAM 201 Second Periodical Exam AnswersDocumento5 pagineBAM 201 Second Periodical Exam AnswersCai De JesusNessuna valutazione finora

- Par CorDocumento27 paginePar CorPam LlanetaNessuna valutazione finora

- Parcor Chap 6 DoneDocumento10 pagineParcor Chap 6 DoneJohn Carlo CastilloNessuna valutazione finora

- Problem #2 Lump-Sum Liquidation With Loss On RealizationDocumento4 pagineProblem #2 Lump-Sum Liquidation With Loss On Realizationjelai anselmoNessuna valutazione finora

- Miranda, Leon and EstoqueDocumento1 paginaMiranda, Leon and EstoqueHana0% (1)

- BA 2 Discussion Chapter 2Documento10 pagineBA 2 Discussion Chapter 2iamamayNessuna valutazione finora

- Stephanie Calamba and Allan Brillantes SolutionDocumento6 pagineStephanie Calamba and Allan Brillantes SolutionGerald RamiloNessuna valutazione finora

- Untitled Document 6Documento7 pagineUntitled Document 6lee doroNessuna valutazione finora

- Cfas ReviewerDocumento7 pagineCfas ReviewerDarlene Angela IcasiamNessuna valutazione finora

- Parcor Proj (Version 1)Documento45 pagineParcor Proj (Version 1)Jwhll MaeNessuna valutazione finora

- Chapter 2 #20Documento3 pagineChapter 2 #20spp50% (2)

- PARTNERSHIP2Documento13 paginePARTNERSHIP2Anne Marielle Uy0% (2)

- Win Ballada Parcor Chapter 4 ProblemDocumento2 pagineWin Ballada Parcor Chapter 4 ProblemKrngyxNessuna valutazione finora

- Multiple Choice - ProblemsDocumento2 pagineMultiple Choice - ProblemsAnthony Koko Carlobos0% (1)

- Learning Task 1 - Shareholders Equity TransactionsDocumento3 pagineLearning Task 1 - Shareholders Equity TransactionsFeiya Liu100% (1)

- Prelim AFAR 1Documento6 paginePrelim AFAR 1Chris Phil Dee75% (4)

- Basic Finance Major OutputDocumento3 pagineBasic Finance Major OutputKazia PerinoNessuna valutazione finora

- Chapter 3 Case Part 2Documento3 pagineChapter 3 Case Part 2graceNessuna valutazione finora

- Problem #9 Two Sole Proprietorship Form A PartnershipDocumento3 pagineProblem #9 Two Sole Proprietorship Form A PartnershipNiño Rey LopezNessuna valutazione finora

- Liquidation 2Documento3 pagineLiquidation 2Kenneth CuencaNessuna valutazione finora

- FISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007Documento4 pagineFISH R US - Proprietorship Post Closing Trial Balance Dec. 31, 2007MayaNessuna valutazione finora

- Multiple Choice Practice 1Documento3 pagineMultiple Choice Practice 1sppNessuna valutazione finora

- This Study Resource WasDocumento2 pagineThis Study Resource WasMaster Nistro0% (1)

- Acfar1130 - Chapter 12 ProblemsDocumento2 pagineAcfar1130 - Chapter 12 ProblemsMae BarsNessuna valutazione finora

- Partnership OperationDocumento2 paginePartnership OperationCjhay MarcosNessuna valutazione finora

- CIPRES ADORA R Drill On Partnership LiquidationDocumento7 pagineCIPRES ADORA R Drill On Partnership LiquidationGumafelix, Jose Eduardo S.Nessuna valutazione finora

- Chapter 4Documento5 pagineChapter 4Billy Vince AlquinoNessuna valutazione finora

- Acp311 OperationDocumento2 pagineAcp311 OperationAngeline Patac LumiguidNessuna valutazione finora

- Partnership Dissolution ActivitiesDocumento9 paginePartnership Dissolution Activitieschrstncstllj100% (1)

- Parcor Proj (Version 1)Documento33 pagineParcor Proj (Version 1)Jwhll MaeNessuna valutazione finora

- C4 Partnership - Review - QuestionsDocumento3 pagineC4 Partnership - Review - QuestionsJizelle BianaNessuna valutazione finora

- Accounting Corporation ExerciseDocumento5 pagineAccounting Corporation ExerciseJennifer AdvientoNessuna valutazione finora

- Requirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20ADocumento4 pagineRequirement 1 Digos Trading Statement of Partnership Liquidation June 30, 20AGvm Joy MagalingNessuna valutazione finora

- Guide Questions For Chapter 2Documento5 pagineGuide Questions For Chapter 2Kathleen Mangual0% (1)

- Bajao-Activity 1-AccountingDocumento21 pagineBajao-Activity 1-AccountingShen Calotes50% (2)

- MC With Answers Partnership Operation CorporationDocumento19 pagineMC With Answers Partnership Operation CorporationASHLEY ROLAINE VICENTENessuna valutazione finora

- Solved Gloria Detoya and Esterlina Gevera Have Operated A Successful... - Course HeroDocumento4 pagineSolved Gloria Detoya and Esterlina Gevera Have Operated A Successful... - Course HeroeannetiyabNessuna valutazione finora

- Fish RUsDocumento11 pagineFish RUseia aieNessuna valutazione finora

- LiquidationDocumento4 pagineLiquidationWenjunNessuna valutazione finora

- CAlAMBA AND SANTIAGO - TUGOTDocumento2 pagineCAlAMBA AND SANTIAGO - TUGOTAndrea Tugot100% (1)

- Win Ballada Parcor Chapter 4 ProblemDocumento2 pagineWin Ballada Parcor Chapter 4 ProblemKrngyxNessuna valutazione finora

- PARTNERSHIP2Documento13 paginePARTNERSHIP2Anne Marielle UyNessuna valutazione finora

- Activity 3Documento7 pagineActivity 3Rishaan Dominic100% (1)

- Batch 2021 - Corporation AccountingDocumento34 pagineBatch 2021 - Corporation AccountingZia NuestroNessuna valutazione finora

- FA#7Documento10 pagineFA#7Gvm Joy MagalingNessuna valutazione finora

- Corporation Issuance of Shares Illutsrative ProblemDocumento15 pagineCorporation Issuance of Shares Illutsrative ProblemHoney MuliNessuna valutazione finora

- PARCORDocumento1 paginaPARCORRhea Royce Cabuhat43% (7)

- Problem 20-23Documento5 pagineProblem 20-23Teresa Pantallano DivinagraciaNessuna valutazione finora

- December 8 DiscussionDocumento6 pagineDecember 8 DiscussionMark Domingo MendozaNessuna valutazione finora

- ParCor Chapter 5 - Hernandez - BSA 1-1 PDFDocumento5 pagineParCor Chapter 5 - Hernandez - BSA 1-1 PDFBSA 1-1Nessuna valutazione finora

- Corporation Problems-1Documento18 pagineCorporation Problems-1Avia Chelsy DeangNessuna valutazione finora

- Instructions: Prepare A Statement of Partnership LiquidationDocumento6 pagineInstructions: Prepare A Statement of Partnership LiquidationLeinard AgcaoiliNessuna valutazione finora

- CORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Documento9 pagineCORPORATIONEXERCISES28PROBLEMS29ONORGANIZATION21FEB21Jasmine ActaNessuna valutazione finora

- PROBLEMDocumento3 paginePROBLEMSam VNessuna valutazione finora

- Sample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersDocumento8 pagineSample/practice Exam 29 March 2019, Answers Sample/practice Exam 29 March 2019, AnswersRachel Green0% (1)

- Chapter 2 Partnership Operations and Financial ReportingDocumento28 pagineChapter 2 Partnership Operations and Financial Reportingpia guiret0% (2)

- Quiz 1Documento5 pagineQuiz 1cpacpacpa100% (2)

- Partnership MyDocumento13 paginePartnership MyHoneylyne PlazaNessuna valutazione finora

- Advacc Quiz On PartnershipDocumento10 pagineAdvacc Quiz On PartnershipLenie Lyn Pasion TorresNessuna valutazione finora

- Question 3 and 4 Are Based On The FollowingDocumento5 pagineQuestion 3 and 4 Are Based On The Following03LJNessuna valutazione finora

- Outsource Service CompaniesDocumento9 pagineOutsource Service CompaniesPauline IdraNessuna valutazione finora

- The Entrepreneurial Mindset Darc 1Documento25 pagineThe Entrepreneurial Mindset Darc 1Pauline IdraNessuna valutazione finora

- Distribution ManagementDocumento257 pagineDistribution ManagementPauline IdraNessuna valutazione finora

- Reviewer Law On Sales and AgencyDocumento50 pagineReviewer Law On Sales and AgencyBelle100% (3)

- 4 PDFDocumento9 pagine4 PDFJhona NinalgaNessuna valutazione finora

- International Marketing IntroductionDocumento4 pagineInternational Marketing IntroductionPauline IdraNessuna valutazione finora

- Antonio Pigafetta - The First Voyage Around The World by MagellanDocumento354 pagineAntonio Pigafetta - The First Voyage Around The World by MagellanBillie White75% (4)

- Facilities and EquipmentDocumento3 pagineFacilities and EquipmentPauline IdraNessuna valutazione finora

- Sentence FragmentsDocumento2 pagineSentence FragmentsPauline IdraNessuna valutazione finora

- Republic Act No. 1425 or The Rizal LawDocumento2 pagineRepublic Act No. 1425 or The Rizal LawPauline IdraNessuna valutazione finora

- Antonio Pigafetta - The First Voyage Around The World by MagellanDocumento354 pagineAntonio Pigafetta - The First Voyage Around The World by MagellanBillie White75% (4)

- The PriceDocumento60 pagineThe PricePauline IdraNessuna valutazione finora

- How To Play Badminton and Its TerminologiesDocumento5 pagineHow To Play Badminton and Its TerminologiesPauline IdraNessuna valutazione finora

- Basic Skills in Playing Badminton 1. Gripping The Racquet Forehand GripDocumento3 pagineBasic Skills in Playing Badminton 1. Gripping The Racquet Forehand GripJenjen Gammad50% (2)

- History of Badminton: Lesson 1Documento3 pagineHistory of Badminton: Lesson 1Pauline IdraNessuna valutazione finora

- Listening As A Member of A Live AudienceDocumento4 pagineListening As A Member of A Live AudiencePauline Idra100% (1)

- Principle of TrainingDocumento14 paginePrinciple of TrainingabavoNessuna valutazione finora

- U1P2 Health and Skill Related FitnessDocumento18 pagineU1P2 Health and Skill Related FitnessNabilZaedNessuna valutazione finora

- Defence Against Hostile TakeoversDocumento2 pagineDefence Against Hostile TakeoversAhmad AfghanNessuna valutazione finora

- Numis PresentationDocumento20 pagineNumis PresentationthenumiscoinNessuna valutazione finora

- Learning Activity 3 - Inc TaxDocumento3 pagineLearning Activity 3 - Inc TaxErica FlorentinoNessuna valutazione finora

- MGT657 Chapter 7Documento49 pagineMGT657 Chapter 7adamNessuna valutazione finora

- Percent Per Day Binary Options CalculatorDocumento4 paginePercent Per Day Binary Options CalculatorJohn BoydNessuna valutazione finora

- Assignment On Mutual Trust Bank HR ManagementDocumento13 pagineAssignment On Mutual Trust Bank HR ManagementRedwan FerdousNessuna valutazione finora

- ATP 108 Commercial Transactions Course Outline 2023 - 2024Documento5 pagineATP 108 Commercial Transactions Course Outline 2023 - 2024Topz TrendzNessuna valutazione finora

- Journal of Financial Economics: Progress PaperDocumento17 pagineJournal of Financial Economics: Progress PapersaidNessuna valutazione finora

- Artificial Flowers Import Business PlanDocumento34 pagineArtificial Flowers Import Business PlanZUZANI MATHIYANessuna valutazione finora

- OLIP Immigration StrategyDocumento124 pagineOLIP Immigration StrategyAmfieNessuna valutazione finora

- EprgDocumento13 pagineEprgRajveer RathoreNessuna valutazione finora

- GTE Financial Capacity Matrix (S) - Title & Name (2021)Documento4 pagineGTE Financial Capacity Matrix (S) - Title & Name (2021)Anupriya RoyNessuna valutazione finora

- 1.1 Introduction To EconomicsDocumento9 pagine1.1 Introduction To EconomicsManupa PereraNessuna valutazione finora

- 2007 FRM Practice ExamDocumento116 pagine2007 FRM Practice Examabhishekriyer100% (1)

- Advisory For Action Fake Itc Recipients Date 19.1.21Documento2 pagineAdvisory For Action Fake Itc Recipients Date 19.1.21GroupA PreventiveNessuna valutazione finora

- MBA - 101 - AnswersDocumento9 pagineMBA - 101 - AnswersramtgemNessuna valutazione finora

- 23-24. Mrunal Economy Lecture 23-24 PDFDocumento29 pagine23-24. Mrunal Economy Lecture 23-24 PDFHemachandar RaviNessuna valutazione finora

- Account StatementDocumento18 pagineAccount StatementLollyNessuna valutazione finora

- MIGA Presentation For KCCIDocumento20 pagineMIGA Presentation For KCCIahmed mohammedNessuna valutazione finora

- CH3 - Corporate Law PDFDocumento5 pagineCH3 - Corporate Law PDFGiane Fks MarieNessuna valutazione finora

- M1 Post-Task Essay On The History of GlobalizationDocumento2 pagineM1 Post-Task Essay On The History of GlobalizationJean SantosNessuna valutazione finora

- Literature Review - Fashion and The Environment 1Documento5 pagineLiterature Review - Fashion and The Environment 1api-508580203Nessuna valutazione finora

- Dividend PolicyDocumento24 pagineDividend PolicyKômâl MübéèñNessuna valutazione finora

- Introduction To "Services Export From India Scheme" (SEIS)Documento6 pagineIntroduction To "Services Export From India Scheme" (SEIS)Prathaamesh Chorge100% (1)

- Standalone Accounts 2008Documento87 pagineStandalone Accounts 2008Noore NayabNessuna valutazione finora

- Trade Finance Presentation - 24-01-2024Documento22 pagineTrade Finance Presentation - 24-01-2024Anup KhanalNessuna valutazione finora

- Drain of Wealth JrPUzLp PreviewDocumento3 pagineDrain of Wealth JrPUzLp PreviewAjay KumarNessuna valutazione finora

- Chapter8 TaxationonindividualsDocumento12 pagineChapter8 TaxationonindividualsChristine Joy Rapi MarsoNessuna valutazione finora

- Banking Course Outline 6th SemesterDocumento2 pagineBanking Course Outline 6th Semestersami ullahNessuna valutazione finora

- Effect of Liquidity and Bank Size On The Profitability of Commercial Banks in BangladeshDocumento4 pagineEffect of Liquidity and Bank Size On The Profitability of Commercial Banks in BangladeshdelowerNessuna valutazione finora

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassDa EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNessuna valutazione finora

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantDa EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantValutazione: 4 su 5 stelle4/5 (104)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDa EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNessuna valutazione finora

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- How To Budget And Manage Your Money In 7 Simple StepsDa EverandHow To Budget And Manage Your Money In 7 Simple StepsValutazione: 5 su 5 stelle5/5 (4)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- The Best Team Wins: The New Science of High PerformanceDa EverandThe Best Team Wins: The New Science of High PerformanceValutazione: 4.5 su 5 stelle4.5/5 (31)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsDa EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNessuna valutazione finora

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyDa EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyValutazione: 4.5 su 5 stelle4.5/5 (37)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditDa EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditValutazione: 5 su 5 stelle5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsDa EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNessuna valutazione finora

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationDa EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationValutazione: 4.5 su 5 stelle4.5/5 (18)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora