Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Management Accounting - M1: Examination: Mid Term

Caricato da

Zargham AliTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Management Accounting - M1: Examination: Mid Term

Caricato da

Zargham AliCopyright:

Formati disponibili

MANAGEMENT ACCOUNTING -M1

Examination: Mid Term

SUBMITTED TO: PROF INTAZAR JAVED

SUBMITTED BY: SYED MUHAMMAD ZARGHAM ALI (2183184)

Question No 1

Requirement No 1

1) Compute the company’s break-even point in both units and sales dollars. Use the

equation method.

Answer

Break even points in Units:

Formula: “Fixed cost ÷ Contribution margin per unit”

Putting values: FC = 240000 ÷ CM per unit = 15

= 16000 units

Break even points in Dollars:

Formula: “Fixed cost ÷ Contribution margin per unit”

1) As we know “Contribution margin = Selling price – Variable price”

2) Contribution to sales ratio = contribution margin / selling price

Contribution margin = $60 – $45 = 15

Contribution to sales ratio = $15 / $60 = 0.25

Break even in Dollars: $240000 / 0.25 = $960000

Requirement No 2

2) Assume that sales increase by $400,000 next year. If cost behavior patterns

remain unchanged, by how much will the company’s net operating income increase? Use the

CM ratio to compute your answer

Answer:

First, we have to find CM ratio

Formula: CM ratio = Contribution margin / Selling price

Putting their values: $15 / #60 = 25%

Increase in sales= $40000 X CM ratio 25% = 100,000

So, Increase in operating income = $100,000

Question No 2

Answer:

1) Direct materials inventory:

Direct materials inventory $105

Add: Direct materials purchased 365

Subtract: Direct materials used (385)

Direct materials inventory $85

2) Fixed manufacturing overhead costs:

Total manufacturing overhead costs $450

Subtract: Variable manufacturing overhead costs (265)

Fixed manufacturing overhead costs $185

3) Direct manufacturing labor costs:

Total manufacturing costs incurred during Oct $1,610

Subtract: Direct materials used (385)

Total manufacturing overhead costs (450)

Direct Labor $775

4) Work-in-process inventory:

Total manufacturing costs incurred during Oct $1,610

Add: Work-in-process inventory 10/1/2011 230

Subtract: Cost of goods manufactured (1,660)

Work-in-process inventory 10/31/2011 $180

5) Cost of finished goods available for sale:

Cost of goods manufactured $1,660

Add: Finished-goods inventory 10/1/2011 130

Cost of finished goods available for sale $1,790

6) Finished goods inventory:

Cost of goods manufactured 1,660

Add: Finished-goods inventory 10/1/2011 130

Subtract: Cost of goods sold 1,770

Finished goods inventory 10/31/2011 #20

Potrebbero piacerti anche

- Quiz 1 - Cost Terms, Inventory - PrintableDocumento8 pagineQuiz 1 - Cost Terms, Inventory - PrintableEdward Prima KurniawanNessuna valutazione finora

- Final Exam - Ba 213Documento6 pagineFinal Exam - Ba 213api-408647155100% (1)

- Accounitng Answers Mid Term QuizDocumento9 pagineAccounitng Answers Mid Term QuizWarda Tariq0% (1)

- WorkDay Employee Hiring Process 02042014Documento205 pagineWorkDay Employee Hiring Process 02042014dhanz_9925% (8)

- Vicenzo Bernard Leandro Tioriman - 01011182025009Documento6 pagineVicenzo Bernard Leandro Tioriman - 01011182025009ImVicNessuna valutazione finora

- Incremental AnalysisDocumento17 pagineIncremental AnalysisSen Aquino100% (1)

- Problems: 2-58. Cost ConceptsDocumento16 pagineProblems: 2-58. Cost ConceptsChristy HabelNessuna valutazione finora

- Introduction To Management Accounting 16th Edition Horngren Solutions Manual 1Documento58 pagineIntroduction To Management Accounting 16th Edition Horngren Solutions Manual 1andrea100% (48)

- Cost Accounting Hilton 14Documento13 pagineCost Accounting Hilton 14Vin TenNessuna valutazione finora

- Homework Solution 7Documento56 pagineHomework Solution 7chiiengNessuna valutazione finora

- Assignment 3 Accounting PDFDocumento11 pagineAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Consult RESUMEDocumento1 paginaConsult RESUMESûbhãm Kümår SahanaNessuna valutazione finora

- 2005 ISDA Commodity Definitions and Users Guide To The 2005 ISDA Commodity Definitions PDFDocumento526 pagine2005 ISDA Commodity Definitions and Users Guide To The 2005 ISDA Commodity Definitions PDFdummyNessuna valutazione finora

- 14.1 Multiple-Choice Questions: Chapter 14 Chemical KineticsDocumento43 pagine14.1 Multiple-Choice Questions: Chapter 14 Chemical KineticsanonNessuna valutazione finora

- Charles Lyell Vol 3 Principles of Geology PDFDocumento559 pagineCharles Lyell Vol 3 Principles of Geology PDFBrock BarnesNessuna valutazione finora

- Customer AnalysisDocumento2 pagineCustomer AnalysisAli Tariq Butt100% (1)

- Cost AccountingDocumento37 pagineCost Accountingtito mohamedNessuna valutazione finora

- Jawaban MGT BiayaDocumento9 pagineJawaban MGT BiayaRessa LiniNessuna valutazione finora

- Exam 1 Review SessionDocumento8 pagineExam 1 Review SessionNémesis FiguereoNessuna valutazione finora

- Ankitastic Exams SolutionsDocumento30 pagineAnkitastic Exams SolutionsAnkitastic tutoring ServicesNessuna valutazione finora

- Group1 Variable CostingDocumento13 pagineGroup1 Variable CostingAika May GarbeNessuna valutazione finora

- Chapter 3 Part 1Documento5 pagineChapter 3 Part 1Aya MasoudNessuna valutazione finora

- Quiz Week 1 ACCT 592Documento4 pagineQuiz Week 1 ACCT 592Muhammad M Bhatti100% (1)

- Answer Key To Test #1 - ACCT-312 - Fall 2019Documento8 pagineAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNessuna valutazione finora

- Session 4 Practice ProblemsDocumento11 pagineSession 4 Practice ProblemsRishika RathiNessuna valutazione finora

- Sample Midterm PDFDocumento9 pagineSample Midterm PDFErrell D. GomezNessuna valutazione finora

- HW 1accountingDocumento2 pagineHW 1accountingMarjorie PalmaNessuna valutazione finora

- Ankitastic Exams Solutions MCQ and Long AnswerDocumento29 pagineAnkitastic Exams Solutions MCQ and Long AnswerAnkitastic tutoring ServicesNessuna valutazione finora

- Assignment No.2 206Documento5 pagineAssignment No.2 206Halimah SheikhNessuna valutazione finora

- QS07 - Class Exercises SolutionDocumento8 pagineQS07 - Class Exercises Solutionlyk0texNessuna valutazione finora

- Chapter 3 Job Order CostingDocumento31 pagineChapter 3 Job Order CostingzamanNessuna valutazione finora

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocumento4 pagineFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNessuna valutazione finora

- Mgt402 Cost and Management Accounting Short Questions VuabidDocumento22 pagineMgt402 Cost and Management Accounting Short Questions Vuabidsaeedsjaan100% (4)

- Prob 2Documento2 pagineProb 2Elliot RichardNessuna valutazione finora

- ACCA Level 2&3 Foundation Course (Text II)Documento8 pagineACCA Level 2&3 Foundation Course (Text II)CarnegieNessuna valutazione finora

- MGT Accounting, Intermideiate-SolutionsDocumento31 pagineMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZINessuna valutazione finora

- CH 3Documento17 pagineCH 3trishanjaliNessuna valutazione finora

- Examination Answer Booklet: To Be Filled by Student Before Completing The Examination STUDENT ID NUMBER 120-634 .Documento26 pagineExamination Answer Booklet: To Be Filled by Student Before Completing The Examination STUDENT ID NUMBER 120-634 .Shaxle Shiiraar shaxleNessuna valutazione finora

- Module 5-Variable and Absorption CostingDocumento13 pagineModule 5-Variable and Absorption CostingAna ValenovaNessuna valutazione finora

- Chapter 5 - A2, B1, & 59Documento5 pagineChapter 5 - A2, B1, & 59詹鎮豪Nessuna valutazione finora

- Chapter 3 - Part 2Documento9 pagineChapter 3 - Part 2Aya MasoudNessuna valutazione finora

- Managerial Set 2Documento5 pagineManagerial Set 2Dan OrbisoNessuna valutazione finora

- Acct 260 CHAPTER 8Documento25 pagineAcct 260 CHAPTER 8John Guy0% (1)

- Chapter 02 Test BankDocumento13 pagineChapter 02 Test BankNada AlhenyNessuna valutazione finora

- Assignment 2Documento4 pagineAssignment 2Sahil KumarNessuna valutazione finora

- ABC-sample ProblemDocumento5 pagineABC-sample ProblemLee Jap OyNessuna valutazione finora

- Product Cost/unit Cost of 1 Unit Product Cost/unit Cost of 1 UnitDocumento6 pagineProduct Cost/unit Cost of 1 Unit Product Cost/unit Cost of 1 UnitFatima SNessuna valutazione finora

- 2 172 18 ToànDocumento3 pagine2 172 18 ToànlongphungspNessuna valutazione finora

- 4524 Robby Wangsa Saputra 1601226743 AkuntansiDocumento3 pagine4524 Robby Wangsa Saputra 1601226743 AkuntansiGatau JdodksjsjNessuna valutazione finora

- Bài Tập 2-27 - Nhóm8LớpKN007Documento6 pagineBài Tập 2-27 - Nhóm8LớpKN007nguyenhongNessuna valutazione finora

- Teaching Introduction To Managerial Accounting Using An Excel Spreadsheet ExampleDocumento16 pagineTeaching Introduction To Managerial Accounting Using An Excel Spreadsheet Examplesamuel kebedeNessuna valutazione finora

- AkbiDocumento37 pagineAkbiCenxi TVNessuna valutazione finora

- Answer Key To Test #2 - ACCT-312 - Fall 2019Documento6 pagineAnswer Key To Test #2 - ACCT-312 - Fall 2019Amir ContrerasNessuna valutazione finora

- Soal Akuntansi ManajemenDocumento7 pagineSoal Akuntansi ManajemenInten RosmalinaNessuna valutazione finora

- Cost Concepts AssignmentDocumento4 pagineCost Concepts AssignmentInageaNessuna valutazione finora

- KJ TGL 28 COst AcctDocumento4 pagineKJ TGL 28 COst Acctirene fionaliaNessuna valutazione finora

- Exercises - Chapter08 - Decision Making - GUI LOPDocumento8 pagineExercises - Chapter08 - Decision Making - GUI LOPQuỳnh ChâuNessuna valutazione finora

- Tugas Kelompok - 4 - AR E - Akuntansi ManajemenDocumento15 pagineTugas Kelompok - 4 - AR E - Akuntansi ManajemenSAMUEL SILALAHI 200503147Nessuna valutazione finora

- ACC4206 Topic 2 Tutorial Q1 - Q5Documento3 pagineACC4206 Topic 2 Tutorial Q1 - Q5natlyhNessuna valutazione finora

- ACCA MA Management Accounting F2 IPass 2Documento16 pagineACCA MA Management Accounting F2 IPass 2randoNessuna valutazione finora

- Job Order QuizDocumento6 pagineJob Order QuizJohn Elly Cadigoy CoproNessuna valutazione finora

- Soal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DDocumento4 pagineSoal Review Praktikum Akuntansi Biaya Dan Manajemen I Paket DSarah Dzuriyati SamiyahNessuna valutazione finora

- Assignment CVPDocumento4 pagineAssignment CVPKwason TaylorNessuna valutazione finora

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsDa EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNessuna valutazione finora

- Communication Theory - M2: Final Term ExamDocumento3 pagineCommunication Theory - M2: Final Term ExamZargham AliNessuna valutazione finora

- Psychology-M1: Creativity and AgingDocumento3 paginePsychology-M1: Creativity and AgingZargham AliNessuna valutazione finora

- Microeconomics: Examination: Midterm Program: BBA Semester: 2ndDocumento5 pagineMicroeconomics: Examination: Midterm Program: BBA Semester: 2ndZargham AliNessuna valutazione finora

- Can Advertising Make You Do Something That You Don't Want To?Documento3 pagineCan Advertising Make You Do Something That You Don't Want To?Zargham AliNessuna valutazione finora

- Assignment 04Documento1 paginaAssignment 04Zargham AliNessuna valutazione finora

- Environmental Management (M1) : Final Term ExaminationDocumento4 pagineEnvironmental Management (M1) : Final Term ExaminationZargham AliNessuna valutazione finora

- Name Roll No Subject: Syed Muhammad Zargham Ali 2183184 Environmental Management (M1) QuizDocumento1 paginaName Roll No Subject: Syed Muhammad Zargham Ali 2183184 Environmental Management (M1) QuizZargham AliNessuna valutazione finora

- Quiz No 3 PsychologyDocumento2 pagineQuiz No 3 PsychologyZargham AliNessuna valutazione finora

- Project - Final (MM) Ahmed DarDocumento10 pagineProject - Final (MM) Ahmed DarZargham AliNessuna valutazione finora

- Philsophy - M1: Submitted To: Prof Irum Saba Submitted By: Syed Muhammad Zargham Ali (2183184)Documento2 paginePhilsophy - M1: Submitted To: Prof Irum Saba Submitted By: Syed Muhammad Zargham Ali (2183184)Zargham AliNessuna valutazione finora

- Philosophy Is A Way of Thinking About The World, The Universe, and SocietyDocumento7 paginePhilosophy Is A Way of Thinking About The World, The Universe, and SocietyZargham AliNessuna valutazione finora

- Environmental Management (M1) : Assignment No: 2 (Plant Evaluation)Documento4 pagineEnvironmental Management (M1) : Assignment No: 2 (Plant Evaluation)Zargham AliNessuna valutazione finora

- Relevance To Business Management of Microeconomics and Microeconomic Policy (Summary of Chapter 3 in Microeconomic Policy: A New Perspective 2nd Edn)Documento4 pagineRelevance To Business Management of Microeconomics and Microeconomic Policy (Summary of Chapter 3 in Microeconomic Policy: A New Perspective 2nd Edn)Zargham AliNessuna valutazione finora

- Relevance To Business Management of Microeconomics and Microeconomic Policy (Summary of Chapter 3 in Microeconomic Policy: A New Perspective 2nd Edn)Documento4 pagineRelevance To Business Management of Microeconomics and Microeconomic Policy (Summary of Chapter 3 in Microeconomic Policy: A New Perspective 2nd Edn)Zargham AliNessuna valutazione finora

- Baca PDFDocumento2 pagineBaca PDFZargham AliNessuna valutazione finora

- Models of Communication: Communication Theory - M2 Assignment No: 01Documento12 pagineModels of Communication: Communication Theory - M2 Assignment No: 01Zargham AliNessuna valutazione finora

- What Are The General Factors in Group Communication and Explain The Roles People Play in GroupsDocumento3 pagineWhat Are The General Factors in Group Communication and Explain The Roles People Play in GroupsZargham AliNessuna valutazione finora

- Formal Feasibility Study For Dell ComputersDocumento3 pagineFormal Feasibility Study For Dell ComputersZargham AliNessuna valutazione finora

- What Are The Methods of SpeakingDocumento3 pagineWhat Are The Methods of SpeakingZargham AliNessuna valutazione finora

- What Is Libertarian Theory of PressDocumento2 pagineWhat Is Libertarian Theory of PressZargham AliNessuna valutazione finora

- Statements of Cash Flows Three ExamplesDocumento7 pagineStatements of Cash Flows Three Examplesmohamed arbi taifNessuna valutazione finora

- 08 Chapter-5Documento114 pagine08 Chapter-5Lamico Dellavvoltoio100% (1)

- CitibankDocumento20 pagineCitibankjosh321Nessuna valutazione finora

- NP - WD19 - CS1-4a - Raja RaghavenderReddy - 1Documento6 pagineNP - WD19 - CS1-4a - Raja RaghavenderReddy - 1raja reddyNessuna valutazione finora

- MU - Project Proposal Group 13 December 2016 V3Documento21 pagineMU - Project Proposal Group 13 December 2016 V3mihiret lemmaNessuna valutazione finora

- Springer Agreement Copy of The Authorsome Results Related With ?-Variables Non Conformable Fractional DerivativesDocumento10 pagineSpringer Agreement Copy of The Authorsome Results Related With ?-Variables Non Conformable Fractional DerivativesMiguel Vivas CortezNessuna valutazione finora

- RBG - CRM BRD - Service - v6.0Documento58 pagineRBG - CRM BRD - Service - v6.0Manvi PareekNessuna valutazione finora

- Brochure (KD 3.7 and 4.7)Documento8 pagineBrochure (KD 3.7 and 4.7)zahwa shezaNessuna valutazione finora

- IBR - New Boiler RegistrationDocumento1 paginaIBR - New Boiler RegistrationAmeer MeerNessuna valutazione finora

- Topic 11 - Open-Economy Macroeconomics - Basic Concepts.Documento36 pagineTopic 11 - Open-Economy Macroeconomics - Basic Concepts.Trung Hai TrieuNessuna valutazione finora

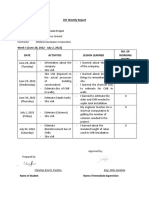

- OJT Weekly Report: Project Name: GEELY Showroom ProjectDocumento9 pagineOJT Weekly Report: Project Name: GEELY Showroom ProjectGintokiNessuna valutazione finora

- Invoice: Hurb CoDocumento2 pagineInvoice: Hurb ComesrawrNessuna valutazione finora

- Idm Jury AssignmentDocumento10 pagineIdm Jury AssignmentKetanDhillonNessuna valutazione finora

- Offer of Kiln TyreDocumento3 pagineOffer of Kiln TyreNapoleon DasNessuna valutazione finora

- Transaction HistoryDocumento1 paginaTransaction HistoryKhoa Phan MinhNessuna valutazione finora

- Glory Mpcs LTDDocumento1 paginaGlory Mpcs LTDkartik DebnathNessuna valutazione finora

- Surity FormDocumento5 pagineSurity FormRaaM E RNessuna valutazione finora

- Bill PDFDocumento15 pagineBill PDFJose AlmonteNessuna valutazione finora

- Asif Mahmud Rayhan - INTL - OFFER LETTER PDFDocumento3 pagineAsif Mahmud Rayhan - INTL - OFFER LETTER PDFatlest munniNessuna valutazione finora

- Appointment CalendarDocumento4 pagineAppointment CalendarVeronica G SchilloksNessuna valutazione finora

- Resume Khanh (Lisa), DuongDocumento2 pagineResume Khanh (Lisa), DuongLisa DuongNessuna valutazione finora

- Challenger 3500Documento54 pagineChallenger 3500Santiago Ro DaNessuna valutazione finora

- Cepsa Paraffin Wax BrochureDocumento12 pagineCepsa Paraffin Wax BrochureJhefersonAmaoRojasNessuna valutazione finora

- Havi ExpressDocumento24 pagineHavi Expressghulam hussainNessuna valutazione finora