Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Crownford General Corp. Notes To Financial Statements: (Amounts in Philippine Pesos)

Caricato da

Mel VillahermosaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Crownford General Corp. Notes To Financial Statements: (Amounts in Philippine Pesos)

Caricato da

Mel VillahermosaCopyright:

Formati disponibili

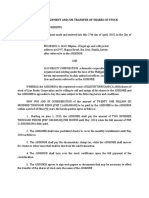

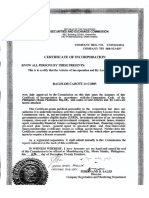

CROWNFORD GENERAL CORP.

NOTES TO FINANCIAL STATEMENTS

As of and for the year ended December 31, 2014 and 2013

(Amounts in Philippine Pesos)

1. CORPORATE INFORMATION

CROWNFORD GENERAL CORP. was incorporated with the Philippine Securities

and Exchange Commission on June 18, 2013 with SEC Registration No.

CS201311548. The Company’s primary purpose is to engage in, conduct and carry

in the business of buying, selling, distributing, marketing at wholesale and in so

far as maybe permitted by Law, all kinds of goods, wares and merchandise of

every kind and description, to enter into all kinds of for the export/import

purchase, acquisition, sale at wholesale and other disposition for its own accounts

as principal or in representative capacity as manufacturers, representative

merchandise broker, indentor, commission merchant, factors or agents upon

consignment of all kinds of goods, wares, merchandise or products whether

natural or artificial.

The registered principal office of the company is at 190 D. Tuazon St. Sta, Mesa

Heights, Quezon City, with Tax Identification No. 008-555-552.

The Company has 15 regular employees as of December 31, 2014.

The financial statements of the company for the years ended December 31, 2014

and 2013 were authorized for issue by the Company’s Board of Directors on

February 18, 2015.

2. Summary of Significant Accounting Policies

The principal accounting policies applied in the preparation of these financial

statements are set out below. These policies have been consistently applied to all

the years presented, unless otherwise stated.

2.1 Basis of Preparation

The Company’s financial statements have been prepared under the historical cost

basis and are presented in Philippine peso, which is the company’s functional and

presentation currency. All values are rounded to the nearest peso, except when

otherwise indicated.

The accompanying financial statements have been prepared on a going concern

basis, which contemplate the realization of assets and settlement of liabilities in

the normal course of business.

Notes to Financial Statements Page 1

2.2 Statement of Compliance

The financial statements of the Company have been prepared in accordance with

the Philippine Financial Reporting Standards for Small and Medium-sized Entities

(PFRS for SMEs).

2.3 Accounting Policies Adopted

The following accounting standards that have been published and issued by the

International Accounting Standards Board (IASB) and adopted by the FRSC which

became effective for accounting periods beginning on or after January 1, 2009

were adopted by the Company:

Section 1 - Small and Medium – Sized Entities

Section 2 - Concepts and Pervasive Principles

Section 3 - Financial Statement Presentations

Section 4 - Statement of Financial Position

Section 5 Statement of Comprehensive Income and

Income Statement

Section 6 - Statement 0f Changes in Equity and

Statement of Income And Retained

Earnings

Section 7 - Statement of Cash Flows

Section 8 - Notes to Financial Statements

Section 10 - Accounting Policies, Estimates and Errors

Section 11 - Basic Financial Instruments

Section 13 - Inventories

Section 17 - Property and Equipment

Section 20 - Leases

Section 21 - Provisions and Contingencies

Section 22 - Liabilities and Equity

Section 23 - Revenue

Section 27 - Impairment of Assets

Section 28 - Employee Benefits

Section 29 - Income Tax

Section 32 - Events after the End of the Reporting

Period

Section 33 - Related Party Disclosures

The effects of these new standard, amendments and interpretations on the

Company’s accounting policies and on the amounts disclosed in the financial

statements are summarized as follows:

Section 1, “Small and Medium-Sized Entities”, IFRS for SME’s is intended for

Non Publicly Accountable Entities that publish general purpose financial

statements for external users

Section 2,” Concepts and Pervasive Principles” describes the objective of

financial statements of small and medium-sized entities (SMEs) and the

Notes to Financial Statements Page 2

qualities that make the information in the financial statements of SMEs useful.

It also sets out the concepts and basic principles underlying the financial

statements of SMEs.

Section 3, “Financial Statement Presentation,” provides a framework within

which an entity assesses how to present fairly the effects of transactions and

other events. It requires that an entity shall make an explicit and unreserved

statement of compliance with IFRS for SMEs in the notes, complete sets of

financial statements must be presented at least annually and at least one year

comparative statements and note data, and items should be consistently

presented and classified from one period to the next.

Section 4, “Statement of Financial Position”, provides specific requirements

on the presentation, classification and related disclosures of entity’s assets,

liabilities and equity as of a specific date.

Section 5, “Statement of Comprehensive Income and Income Statement”,

provides specific requirements on the presentation, classification and related

disclosures of entity’s total comprehensive income, its financial performance

for the period in one or two financial statements.

Section 6, “Statement of Changes in Equity and Statement of Income and

Retained Earnings”, sets out requirements for presenting the changes in an

entity’s equity for a period, either in a statement of changes in equity or, if

specified conditions are met and an entity chooses, in a statement of income

and retained earnings the cost of inventories is no longer acceptable.

Section 7, “Statement of Cash Flows”, requires the provision of information

about the historical changes in cash and cash equivalents of an entity by

means of a cash flow statement which classifies cash flows during the period

from operating, investing and financing activities.

Section 8, “Notes to Financial Statements”, sets out the principles underlying

information that is to be presented in the notes to the financial statements

and how to present it. Notes contain information in addition to that presented

in the statement of financial position, statement of comprehensive income,

income statement (if presented), combined statement of income and retained

earnings (if presented), statement of changes in equity, and statement of cash

flows. Notes provide narrative descriptions or desegregations of items

presented in those statements and information about items that do not qualify

for recognition in those statements. In addition to the requirements of this

section, nearly every other section of this IFRS requires disclosures that are

normally presented in the notes.

Section 10, “Accounting Policies, Estimates and Errors,” eliminates the

concept of fundamental error and the allowed alternative to retrospective

application of voluntary changes in accounting policies and retrospective

restatement to correct prior period errors. The section defines material

Notes to Financial Statements Page 3

omissions and misstatements and describes how to apply the concept of

materiality when applying accounting policies and correcting errors.

Section 11, “Basic Financial Instruments’, applies to basic financial

instruments and is relevant to all entities. An entity shall recognize a financial

asset or a financial liability only when the entity becomes a party to the

contractual provisions of the instrument. When a financial asset or financial

liability is recognized initially, an entity shall measure it at the transaction

price unless the arrangement constitutes, in effect, a financing transaction.

Section 13, “Inventories”, limits the alternatives for measurement of

inventories. Inventories are measured at the lower of cost and estimated

selling price less costs to complete and sell. Cost is determined using specific

identification for large items and FIFO or weighted average for others.

Inventory cost includes cost to purchase, costs of conversion and costs to

bring the asset to present location and condition. Impairment write down to

net realizable value.

Section 17, “Property and Equipment,” prescribes the accounting treatment

and related disclosures for property and equipment, investment property, and

non-current assets held for sale whose fair value cannot be measured reliably

without undue cost and effort. It provides guidance on initial and subsequent

recognition as well as measurement after recognition. It requires

depreciation for each significant part of an item of property, plant and

equipment. The standard also provides guidance on the determination of the

carrying amount of the assets, the residual value, and depreciation period and

derecognition principles to be observed.

Section 20, “Leases”, prescribes that lease payments under operating leases

shall be recognized as income/expense on a straight-line basis unless another

basis is more representative of the timing of the benefits obtained by the user

of the asset or the payments are structured to increase in line with expected

general inflation.

Section 21, “Provisions and Contingencies”, ensures that appropriate

recognition criteria and measurement basis are applied to provisions,

contingent liabilities and contingent assets and that sufficient information is

disclosed in the notes to financial statements to enable users to understand

their nature, timing and amount.

Section 22, “Liabilities and Equity”, establishes principles for classifying

financial instruments as either liabilities or equity and addresses accounting

for equity instruments issued to individuals or other parties acting in their

capacity as investors in equity instruments (ie in their capacity as owners).

Section 23, “Revenue”, provides additional guidelines as to the timely

recognition of revenue, which is measured at the fair value of the

consideration received or receivable.

Notes to Financial Statements Page 4

Section 27, “Impairment of Assets”, prescribes the procedures that an entity

applies to ensure that its assets are carried at no more than their recoverable

amount if its carrying amount exceeds the amount to be recovered through

use or sale of the asset. If this is the case, the asset is described to be impaired

and the standard requires the entity to recognize an impairment loss. The

section also specifies when an entity should reverse an impairment loss

previously recognized.

Section 28, “Employee Benefits,” applies to all employee benefits offered by

an employer to employees and their dependents and beneficiaries. This

section applies to employee benefits under: (i) formal plans and agreements

between an enterprise and its employees, (ii) national, local, industry or

multi-employer plans; and informal practices giving rise to a constructive

obligation. This section also identifies the following categories of employee

benefits such as short-term employee benefits, post employment benefits,

other long-term employee benefits and termination benefits.

Section 29, “Income tax,” covers accounting for income tax. It requires an

entity to recognize the current and future tax consequences of transactions

and other events that have been recognized in the financial statements.

Section 32, “Events After the End of the Reporting Period,” defines events

after the end of the reporting period and sets out principles for recognizing,

measuring and disclosing such events.

Section 33, “Related Party Disclosures,” provides additional guidance and

clarity in the scope, definitions and the disclosures for related parties. It

requires disclosure of the compensation of key management personnel.

The adoption of the above standards, amendments and interpretations, upon

which the Company has opted to adopt, did not have any significant effect on

the Company’s financial statements. These, however, require additional

disclosures on the Company’s financial statements.

Financial Assets

Financial assets include cash, trade & other receivables.

Cash

Cash are stated at face value. Cash includes cash in bank and petty cash fund.

Accounts Receivables

Trade receivables, which are based on normal credit terms and do not bear

interest, are recognized and carried at original invoice amounts. Where credit

is extended beyond normal credit terms, receivables are measured at

amortized cost using the effective interest rate (EIR) method. At the end of

each reporting period, the carrying amounts of trade and other receivables

are reviewed to determine whether there is objective evidence that the

amounts are not recoverable. If so, an impairment loss is recognized

immediately in profit or loss.

Notes to Financial Statements Page 5

Inventories

Inventories are valued at the lower of cost or net realizable value (NVR). NVR

is the estimated selling price in the ordinary course of business, less the

estimated costs of completion, marketing and distribution.

Other Current Assets

Other current assets are carried at its transaction cost, and include

prepayments and Advances to fiber dealers which pertain to acquisition of

abaca fibers.

Input Taxes

Input taxes represent value added tax (VAT) paid to suppliers that can be

claimed as credits against the company’s Output Tax liabilities.

Property and Equipment

Property and equipment are stated at cost, excluding the costs of day-to-day

servicing, less accumulated depreciation and amortization and any

impairment in value.

The initial cost of property and equipment comprises its purchase price and

any directly attributable costs of bringing the asset to its working condition

and location for its intended use. Expenditures incurred after the property

and equipment have been put into operations, such as repairs and

maintenance and overhaul costs, are normally charged to operations in the

period the costs are incurred. In situations where it can be clearly

demonstrated that the expenditures have resulted in an increase in the future

economic benefits expected to be obtained from the use of an item of

property, and equipment beyond its originally assessed standard of

performance, the expenditures are capitalized as additional costs of property

and equipment. Interests on borrowed funds are normally charged to

operations. When assets are sold or retired, their costs and accumulated

depreciation, amortization and impairment losses, if any, are eliminated from

the accounts and any gain or loss resulting from their disposal is included in

the statement of operations of such period.

Depreciation and amortization are calculated on a straight-line basis over the

useful lives of the assets.

The assets' residual values, useful lives and depreciation and amortization

method are reviewed, and adjusted if appropriate, if there is an indication that

there has been indication of significant change since the last annual reporting

date.

An item of property and equipment is derecognized upon disposal or when no

future economic benefits are expected to arise from the continued use of the

asset. Any gain or loss arising on derecognition of the asset (calculated as the

difference between the net disposal proceeds and the carrying amount of the

item) is included in the statement of operations in the year the item is

derecognized.

Notes to Financial Statements Page 6

Financial Liabilities

Financial liabilities include trade and other payables and non-interest bearing

borrowings.

Financial liabilities are recognized when the Company becomes a party to the

contractual provisions of the instrument.

Trade and Other Payables

Trade payables represent accounts payables and are recognised initially at the

transaction price and subsequently measured at amortised cost less

subsequent payments. Other payables include accruals such as utility

expenses. Accruals are liabilities to pay for goods or services that have been

received or supplied but have not been paid, invoiced or formally agreed with

the supplier, including amounts if any due to employees. It is necessary to

estimate the amount or timing of accruals, however, the uncertainty is

generally much less than for provisions

Other Current Liabilities

Represents statutory obligations such as SSS payable

Borrowings

Borrowings are recognized initially at the transaction price (that is, the

present value of cash payable to the bank, including transaction costs).

Borrowings are subsequently stated at amortized cost. Interest expense is

recognized on the basis of the effective interest method and is included in

finance costs. Borrowings are classified as current liabilities unless the

Company has an unconditional right to defer settlement of the liability for at

least 12 months after the reporting date.

Financial Instruments

Date of Recognition

The Company recognizes a financial asset or a financial liability in the balance

sheets when it becomes a party to the contractual provisions of the

instrument.

Initial Recognition of Financial Instruments

All financial assets are initially recognized at fair value.

Determination of Fair Value

For all financial instruments not listed in an active market, the fair value is

determined by using appropriate valuation techniques. Valuation techniques

include net present value techniques, comparison to similar instruments for

Notes to Financial Statements Page 7

which market observable prices exist, options pricing models, and other

relevant valuation models.

Impairment of Financial Assets

The Company assesses at each balance sheet date whether there is objective

evidence that a financial asset or group of financial assets is impaired. A

financial asset or a group of financial assets is deemed to be impaired if, and

only if, there is objective evidence of impairment as a result of one or more

events that has occurred after the initial recognition of the asset (an incurred

‘loss event’) and that loss event (or events) has an impact on the estimated

future cash flows of the financial asset or the group of financial assets that can

be reliably estimated. Evidence of impairment may include indications that

the borrower or a group of borrowers is experiencing significant financial

difficulty, default or delinquency in interest or principal payments, the

probability that they will enter bankruptcy or other financial reorganization

and where observable data indicate that there is measurable decrease in the

estimated future cash flows, such as changes in arrears or economic

conditions that correlate with defaults.

Derecognition of Financial Assets and Financial Liabilities

Financial assets

A financial asset (or, where applicable a part of financial asset or part of a

group of similar financial assets) is derecognized when:

the rights to receive cash flows from the asset have expired;

the Company retains the right to receive cash flows from the asset, but

has assumed an obligation to pay them in full without material delay to

a third party under a pass-through arrangement; or

the Company has transferred its rights to receive cash flows from the

asset and either (a) has transferred substantially all the risks and

rewards of the asset, or (b) has neither transferred nor retained

substantially all the risks and rewards of the asset, but has transferred

control of the asset.

Financial Liabilities

A financial liability is derecognized when the obligation under the liability is

discharged, cancelled or expired. Where an existing financial liability is

replaced by another from the same lender on substantially different terms, or

the terms of an existing liability are substantially modified, such an exchange

or modification is treated as a derecognition of the original liability and the

recognition of a new liability, and the difference in the respective carrying

amounts is recognized in the statement of income.

Offsetting Financial Instruments

Financial assets and financial liabilities are offset and the net amount reported

in the balance sheet if, and only if, there is a currently enforceable legal right

Notes to Financial Statements Page 8

to offset the recognized amounts and there is an intention to settle on a net

basis, or to realize the asset and settle the liability simultaneously. This is not

generally the case with master netting agreements, and the related assets and

liabilities are presented gross in the balance sheet.

Impairment of Non-financial Assets

The Company assesses as at reporting date whether there is an indication that

an asset may be impaired. If any such indication exists, or when annual

impairment testing for an asset is required, the Company makes an estimate

of the asset’s recoverable amount. An asset’s recoverable amount is calculated

as the higher of the asset’s or cash-generating unit’s fair value less costs to sell

and its value in use or its net selling price and is determined for an individual

asset, unless the asset does not generate cash inflows that are largely

independent of those assets or groups of assets. Where the carrying amount of

an asset exceeds it recoverable amount, the asset is considered impaired and

is written down to its recoverable amount. In assessing value in use, the

estimated future cash flows are discounted to their present value using a pre-

tax discount rate that reflects current market assessment of the time value of

money and the risks specific to the asset. Impairment losses are recognized in

the statements of income in those expense categories consistent with the

function of the impaired asset.

An assessment is made at each reporting date as to whether there is an

indication that previously recognized impairment losses may no longer exist

or may have decreased. If such indication exists, the recoverable amount is

estimated. A previously recognized impairment loss is reversed only if there

has been a change in the estimates used to determine the asset’s recoverable

amount since the last impairment loss was recognized. If that is the case, the

carrying amount of the asset is increased to its recoverable amount. That

increased amount cannot exceed the carrying amount that would have been

determined, net of depreciation and amortization, had no impairment loss

been recognized for the asset in prior years. Such reversal is recognized in the

statements of income unless the asset is carried at revalued amount, in which

case the reversal is treated as revaluation increase. After such a reversal, the

depreciation charge is adjusted in future periods to allocate the asset’s revised

carrying amount, less any residual value, on a systematic basis over its

remaining useful life.

Share Capital

Share capital represents ordinary shares which are classified as equity.

Equity instruments are measured at the fair value of the cash or other

resources received or receivable, net of the direct costs of issuing the equity

instruments. If payment is deferred and the time value of money is material,

the initial measurement is on a present value basis.

Any costs of acquiring Company’s own shares are shown as a deduction from

equity attributable to the Company’s equity holders until the shares are

Notes to Financial Statements Page 9

cancelled or reissued. When such shares are subsequently sold or reissued,

any consideration received, net of directly attributable incremental

transaction costs and the related income tax effects, is included in equity

attributable to the Company’s equity holders.

Cumulative Earnings

Cumulative earnings include all current and prior period results as disclosed

in the statement of income.

Revenue and cost recognition

Revenue comprises the fair value of the consideration received or receivable

for the sale of goods in the ordinary course of the Company’s activities.

Revenue is shown net of sales/value-added tax, returns, rebates and

discounts.

The Company recognizes revenue when: the amount of revenue can be

reliably measured; it is probable that future economic benefits will flow to the

entity; and specific criteria have been met for each of the Company’s, as

described below.

(a) Sales

Sales of goods are recognized when the Company sells a product to the

customer as control passes to the customer on the day the transaction takes

place.

Cost, distribution and administrative expenses are recognized in the

statement of income upon utilization of the service or in the date they are

incurred.

Employees’ Benefits

Short-term Benefits

The Company recognizes a liability net of amounts already paid and an

expense for services rendered by employees during the accounting period.

Short-term benefits given by the Company to its employees include

compensation, social security contributions, short-term compensated

absences, bonuses and other non-monetary benefits.

Long-term Benefits

The Company provides retirement benefits to entitled employees as

mandated by law.

Income Taxes

Notes to Financial Statements Page 10

Current tax assets and liabilities for the current and prior periods are

measured at the amount expected to be recovered from or paid to the taxation

authorities. The tax rates and tax laws used to compute the amount are those

that are enacted or substantively enacted by the balance sheet date.

Deferred income tax is provided, using the balance sheet liability method, on

all temporary differences at the balance sheet date between the tax bases of

assets and liabilities and their carrying amounts for financial reporting

purposes.

Deferred income tax liabilities are recognized for all taxable temporary

differences. Deferred income tax assets are recognized for all deductible

temporary differences and carry forward benefits of unused net operating

loss carryover (NOLCO), to the extent that it is probable that taxable profit

will be available against which the deductible temporary differences and carry

forward of NOLCO can be utilized.

The carrying amount of deferred tax assets is reviewed at each balance sheet

date and reduced to the extent that is no longer probable that sufficient

taxable profit will be available to allow all or part of the deferred income tax

asset to be utilized. Unrecognized deferred tax assets are reassessed at each

balance date and are recognized to the extent that it has become probable that

future taxable profit will allow the deferred tax asset to be recovered.

Deferred tax asset and liabilities are measured at the tax rates expected in the

year when the asset is realized or the liability is settled, based on tax rates and

tax laws that have been enacted or substantively enacted at the balance sheet

date.

Value-Added Tax

Revenues, expenses and assets are recognized net of the amount of value-

added tax except:

Where the value-added tax incurred on a purchase of assets or services is not

recoverable from the taxation authority, in which case the value-added tax is

recognized as part of the costs of acquisition of the asset or as part of the

expense item as applicable; and

Receivables and payables that are stated with the amount of value-added tax

included.

The net amount of value-added tax recoverable from, or payable to, the

taxation authority is included as part of other current assets or payables in the

balance sheets.

Contingencies

Notes to Financial Statements Page 11

Contingent liabilities are not recognized in the financial statements. They are

disclosed unless the possibility of an outflow of resources embodying

economic benefits is remote. A contingent asset is not recognized in the

financial statements but disclosed when an inflow of economic benefits is

probable.

Events after the End of the Reporting Period

Post-year-end events up to the date of the auditor’s report that provide

additional information about the Company’s position at the balance sheet date

(adjusting events) are reflected in the financial statements. Post-year-end

events that are not adjusting events are disclosed in the notes to financial

statements when material.

Related Parties

Related party relationships exist when one party has the ability to control,

directly or indirectly through one or more intermediaries, the other party or

exercise significant influence over the other party in making financial and

operating decisions. This includes: (1) individual owning, directly or indirectly

through one or more intermediaries, control, or are controlled by, or under

common control with, the Company; (2) associates; and (3) individuals

owning, directly or indirectly, an interest in the voting power of the Company

that gives them significant influence over the Company and close members of

the family of any such individual.

3. Management’s Significant Accounting Judgment and Estimate

3.1 Judgments

The preparation of the Company’s financial statements in conformity with

PFRS for SMEs requires management to make estimates and assumptions that

affect the amounts reported in the Company’s financial statements and

accompanying notes. The estimates and assumptions used in the Company’s

financial statements are based upon management’s evaluation of relevant

facts and circumstances as of the date of the Company’s financial statements.

Actual results could differ from such estimates, judgments and estimates are

continually evaluated and are based on historical experience and other factors,

including expectations of future events that are believed to be reasonable

under the circumstances.

3.2 Estimates

In the application of the Company’s accounting policies, management is

required to make judgements, estimates and assumptions about the carrying

amounts of assets and liabilities that are not readily apparent from other

sources. The estimates and associated assumptions are based on historical

Notes to Financial Statements Page 12

experience and other factors that are considered to be relevant. Actual results

may differ from these estimates.

The estimates and underlying assumptions are reviewed on an ongoing basis.

Revisions to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period, or in the period of

the revision and future periods if the revision affects both current and future

periods.

Estimated Useful Lives of Property and Equipment

The Company estimates the useful lives of property and equipment based

on the period over which the property and equipment are expected to be

available for use. The estimated useful lives of the property and

equipment are reviewed periodically and are updated if expectations

differ from previous estimates due to physical wear and tear, technical or

commercial obsolescence and legal or other limits on the use of the

property and equipment. In addition, the estimation of the useful lives of

property and equipment is based on the collective assessment of industry

practice, internal technical evaluation and experience with similar assets.

It is possible, however, that future financial performance could be

materially affected by changes in the estimates brought about by changes

in factors mentioned above. The amounts and timing of recorded

expenses for any period would be affected by changes in these factors and

circumstances.

A reduction in the estimated useful lives of the property and equipment

would increase the recorded expenses and decrease the noncurrent assets.

Depreciation is computed on a straight-line method over the estimated

useful lives of the assets as follows:

PROPERTY AND EQUIPMENT USEFUL LIVES

Furniture & Fixtures 10 years

Delivery Equipment 10 years

Office Equipment 10 years

The foregoing estimated useful lives and depreciation method are

reviewed from time to time to ensure that these are consistent with the

expected economic benefits of the property and equipment.

Impairment of Non-financial Assets

The Company assesses the value of property and equipment which require

the determination of future cash flows expected to be generated from the

continued use and ultimate disposition of such assets, and require the

Company to make estimates and assumptions that can materially affect the

financial statements. Future events could cause the Company to conclude

that property, plant and equipment and other long-lived assets are

Notes to Financial Statements Page 13

impaired. Any resulting impairment loss could have a material adverse

impact on the Company's financial condition and results of operations.

The preparation of the estimated future cash flows involves significant

judgment and estimations. While the Company believes that its

assumptions are appropriate and reasonable, significant changes in these

assumptions may materially affect the Company's assessment of

recoverable values and may lead to future additional impairment charges.

Land is based on acquisition cost and subject for review for asset valuation

based on fair market value or assessed value whichever is higher.

Revenue recognition

The Company’s revenue recognition policies require the use of estimates

and assumptions that may affect the reported amounts of revenues and

receivables. Differences between the amounts initially recognized and

actual settlements are taken up in the accounts upon reconciliation.

However, there is no assurance that such use of estimates may not result

to material adjustments in future periods.

4. Financial risk management objectives and policies

The Company’s activities expose it to a variety of financial risks: credit risk and

liquidity risk The Company’s overall risk management program seeks to

minimize potential adverse effects on the financial performance of the Company.

The policies for managing specific risks are summarized below.

Governance Framework

The Company has established a risk management function with clear terms of

reference and with the responsibility for developing policies on market, credit,

liquidity and operational risk. It also supports the effective implementation of

policies.

The policies define the Company’s identification of risk and its interpretation, limit

structure to ensure the appropriate quality and diversification of assets to the

corporate goals and specify reporting requirements.

Capital Management Framework

The Company’s risk management function has developed and implemented certain

minimum stress and scenario tests for identifying the risks to which the Company

are exposed, quantifying their impact on the volatility of economic capital. The

results of these tests, particularly, the anticipated impact on the realistic balance

sheet and revenue account, are reported to the Company’s risk management

function. The risk management function then considers the aggregate impact of the

overall capital requirement revealed by the stress testing to assess how much

capital is needed to mitigate the risk of insolvency to a selected remote level.

Notes to Financial Statements Page 14

Regulatory Framework

The operation of the Company is also subject to the regulatory requirements of

SEC. Such regulations not only prescribe approval and monitoring of activities but

also impose certain restrictive provisions.

Financial Risk

The Company is also exposed to financial risk through its financial assets and

financial liabilities. The most important components of these financial risks are:

credit risk, liquidity risk and market risk.

Credit risk

The table below shows the maximum exposure to credit risk for the components

of the 2014 and 2013 balance sheet. The maximum exposure is shown gross,

without taking into account collateral and other credit enhancement.

The Company’s credit risk is primarily attributable to its trade and other

receivables. The Company has adopted stringent procedure in extending credit

terms to customers and in monitoring its credit risk.

Receivable balances are being monitored on a periodic basis to ensure timely

execution of necessary intervention efforts.

As of balance sheet date, there were no significant concentrations of credit risk.

Liquidity Risk

The Company’s objective is to maintain a balance between continuity of funding

and flexibility through the use of generated funds. Liquidity risk is the risk that

the Company will be unable to meet its payment obligations when they fall due.

The Company manages this risk through periodical monitoring of cash flows in

consideration of future payment due dates and daily collection amounts. The

Company also ensures that there are sufficient, available and approved working

capital lines that it can draw from anytime.

The Company maintains an adequate amount of cash and cash equivalents in the

event of unforeseen interruption of its cash collections. The Company also

maintains accounts with several relationship banks to avoid significant

concentration of cash with one institution.

5. Cash and Cash Equivalents

This account consists of cash in banks and funds on hand such as undeposited

collections and cash funds. Petty cash fund and operating fund are the working

capital funds wherein small amount of expenses are being disbursed. Cash in

banks consist of savings and current account deposits in reputable banks which

earn interest at the prevailing bank deposit rates.

2014 2013

Cash in Bank/on Hand 592,631 494,211

Notes to Financial Statements Page 15

6. Trade and Other Receivables

Trade and other receivables are stated at original invoice amount. Trade

receivables represent non-interest bearing receivables from various customers.

2014 2013

Accounts Receivables 1,729,468 557,350

7. Inventories

2014 2013

Merchandise Inventory 595,854 350,117

8. Property and Equipment-net

The company carries property and equipment are carried at cost less

accumulated depreciation.

Property & Equipment consist of:

2014 2013

Furniture & Fixtures 50,000 50,000

Delivery Vehicle 350,000 350,000

Office Equipment 100,000 100,000

Res for Depreciation (37,500) (12,500)

Net Book Value 462,500 487,500

The Carrying value of the property and equipment approximate their fair

values.

9. Trade and Other Payables

Trade payables are liabilities to pay for goods and services that have been received,

measured initially at their nominal values and subsequently recognized at amortized

costs less settlement payments. These are non-interest bearing payable.

2014 2013

Vat Payable 32,019 22,005

Income Tax Payable 224,726 152,101

SSS/PHIC/HDMF 8,265 6,612

Withholding Taxes 18,117 12,675

Accounts Payable 119,581 134,581

TOTAL 402,708 327,975

Notes to Financial Statements Page 16

10.INCOME TAX PAYABLE

2014 2013

Income tax computed at Normal tax rate 30% 607,089 347,659

Income tax computed at MCIT rate 2% of

Gross Profit 76,952 51,013

Whichever is higher – RCIT/MCIT 607,089 347,659

Less: Deferred MCIT tax 2012

Creditable Tax Withheld 2307

Payments - 1st, 2nd, and 3rd qtr. 382,363 195,558

Total 382,363 195,558

Income tax Still Due 224,726 152,101

The company is subject to Regular Corporate Income Tax (RCIT) as presented.

Any deferred income tax assets are recognized for all deductible temporary

differences, carry forward of unused tax credits from excess minimum corporate

income tax (MCIT) and unused tax losses, to the extent that it is probable that

taxable profit will be available against which the deductible temporary

differences and carry forward of unused tax credits and unused tax losses can be

utilized.

11.SHARE CAPITAL

2014 2013

Authorized Capital 30,000 shares 30,000 shares

Subscribed Capital Stock 30,000 shares 30,000 shares

Subscription Receivables 22,500 shares 22,500 shares

Subscribed and Paid Up 7,500 shares 7,500 shares

Par Value Per Share 100.00 100.00

Paid Up Capital 750,000.00 750,000.00

12.SALES

Sales of goods are recognized when the Company sells a product to the

customer as control passes to the customer on the day the transaction takes

place.

2014 2013

Sales 10,672,867 7,335,116

13.OPERATING EXPENSES

2014 2013

Salaries and Wages 1,239,808 991,846

SSS/PHIC/HDMF 99,185 79,348

Notes to Financial Statements Page 17

Taxes and Licenses 95,282 92,507

Representation 36,775 35,000

Utilities 144,907 97,696

Gas and Oil 97,114 55,775

Delivery 85,895 27,117

Depreciation Vehicle 17,500 8,750

Depreciation Furniture 2,500 1,250

Depreciation-Office Equipment 5,000 2,500

Total 1,823,967 1,391,790

14.TAXES AND LICENSES

This account consists of:

2014 2013

Business License 95,282 92,507

TOTAL 95,282 92,507

15.INCOME TAX EXPENSE

Republic Act (R.A.) No. 9337

On May 24, 2005, Republic Act No. 9337 was enacted into law amending various

provisions in the existing 1997 National Internal Revenue Code. Among the

reforms introduced by the said R.A., which became effective on November 2, 2005,

are as follows:

Increase in the corporate income tax rate from 32% to 35% with a reduction

thereof to 30% beginning January 1, 2009;

Increase in Value-Added Tax (VAT) rate from 10% to 12% effective February

1, 2006 as authorized by the Philippine President pursuant to the

recommendation of the Secretary of Finance;

Revised invoicing and reporting requirements for VAT; and

Expanded scope of transactions subject to VAT.

On October 10, 2007, the BIR issued Revenue Regulations No. 12-2007, which

amended the timing of the calculation and payment of MCIT from an annual basis to

quarterly basis, i.e. excess MCIT from a previous quarter during the current taxable

year may be applied against subsequent quarterly or current annual income tax

due, whether MCIT or Regular Corporate Income Tax (RCIT). However, excess

MCIT from the previous taxable year/s is not creditable against MCIT due for a

subsequent quarter and are only creditable against quarterly and annual RCIT.

R.A. No. 9337 was enacted into law amending various provisions in the existing 1997

National Internal Revenue Code. Among the reforms introduced by the said R.A.

effective November 1, 2005 are as follows:

Increased corporate income tax rate from 32% to 35% with a reduction thereof to

30% beginning January 1, 2009;

Notes to Financial Statements Page 18

Increased nondeductible interest expense rate from 38% to 42% with a reduction

thereof to 33% beginning January 1, 2009;

Granted authority to the Philippine President to increase the 10% VAT rate to

12%, effective February 1, 2006, subject to compliance with certain economic

conditions. On January 31, 2006, the Bureau of Internal Revenue issued Revenue

Memorandum Circular No. 7-2006 increasing the VAT rate from 10% to 12%

effective February 1, 2006;

Revised invoicing and reporting requirements for VAT;

Expanded scope of transaction subject to VAT; and

Provided thresholds and limitation on the amounts of VAT credits that can be

claimed. On November 21, 2006, R.A. No. 9361 was issued repealing the threshold

on the amount of VAT credits that can be claimed.

16. FINANCIAL INSTRUMENTS

The company’s financial assets and liabilities are recognized initially at cost

which is the fair value of the consideration given (in the case of assets) or

received (in the case of liability).

Fair values are determined by reference to market-based evidence, which is the

amount for which the financial assets could be exchanged between a

knowledgeable willing buyer and a knowledgeable willing seller in an arm’s

length transaction as at the valuation date

Generally, the maximum credit risk exposure of financial assets is the carrying

amount of the financial assets as shown on the face of the balance sheet (or in the

detailed analysis provided in the notes to the financial statements).

Notes to Financial Statements Page 19

Potrebbero piacerti anche

- Uno Flex Int'L Thread Corp. Notes To Financial Statements: (Amounts in Philippine Pesos)Documento19 pagineUno Flex Int'L Thread Corp. Notes To Financial Statements: (Amounts in Philippine Pesos)Mel VillahermosaNessuna valutazione finora

- Notes To FsDocumento10 pagineNotes To FsCynthia PenoliarNessuna valutazione finora

- SH CO. NOTES-konti Na LangDocumento15 pagineSH CO. NOTES-konti Na LangDare QuimadaNessuna valutazione finora

- SH Co. NotesDocumento15 pagineSH Co. NotesJojo GumacalNessuna valutazione finora

- Notes To Interim Finacial StatementsDocumento7 pagineNotes To Interim Finacial StatementsJhoanna Marie Manuel-AbelNessuna valutazione finora

- Financial StatementDocumento7 pagineFinancial StatementEunice SorianoNessuna valutazione finora

- NFS 2019Documento24 pagineNFS 2019Maria MelissaNessuna valutazione finora

- INTACC 3.1LN Presentation of Financial StatementsDocumento9 pagineINTACC 3.1LN Presentation of Financial StatementsAlvin BaternaNessuna valutazione finora

- Ifrs For SMEsDocumento104 pagineIfrs For SMEsApril AcboNessuna valutazione finora

- Notes To Financial Powerventure-2014Documento12 pagineNotes To Financial Powerventure-2014M C Dela CrzNessuna valutazione finora

- CFAS Unit 1 Module 2Documento25 pagineCFAS Unit 1 Module 2KC PaulinoNessuna valutazione finora

- Lars Garfin NotesDocumento7 pagineLars Garfin NotesJomel G MangrobangNessuna valutazione finora

- Module 03 - Presentation of Financial StatementsDocumento19 pagineModule 03 - Presentation of Financial Statementspaula manaloNessuna valutazione finora

- Financial Statement Presentation. Theory of Accounts GuideDocumento20 pagineFinancial Statement Presentation. Theory of Accounts GuideCykee Hanna Quizo LumongsodNessuna valutazione finora

- TOAMOD2 Financial Statement PresentationDocumento20 pagineTOAMOD2 Financial Statement PresentationCukeeNessuna valutazione finora

- Ias 1 Presentation of Financial Statements - A Closer Look: Munich Personal Repec ArchiveDocumento15 pagineIas 1 Presentation of Financial Statements - A Closer Look: Munich Personal Repec Archiveaditya pandianNessuna valutazione finora

- Toa Pas 1 Financial StatementsDocumento14 pagineToa Pas 1 Financial StatementsreinaNessuna valutazione finora

- Midterm Exam CfasDocumento81 pagineMidterm Exam Cfasjessamae gundanNessuna valutazione finora

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Documento9 pagineIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNessuna valutazione finora

- Pa1 To 27Documento63 paginePa1 To 27iyahvrezNessuna valutazione finora

- Summary of IASDocumento10 pagineSummary of IASSongs WorldNessuna valutazione finora

- ScanDocumento37 pagineScanFritzie Mae Ruzhel GuimbuayanNessuna valutazione finora

- Financial Accounting IDocumento47 pagineFinancial Accounting Inerurkar_tusharNessuna valutazione finora

- CHAPTER 24 - SMEs DefinitionDocumento17 pagineCHAPTER 24 - SMEs DefinitionChristian GatchalianNessuna valutazione finora

- Ptfi PDFDocumento17 paginePtfi PDFJohniza AsisNessuna valutazione finora

- UntitledDocumento150 pagineUntitledRica Ella RestauroNessuna valutazione finora

- Ipsas 1 NoteDocumento12 pagineIpsas 1 NoteNwogboji EmmanuelNessuna valutazione finora

- Globe Reflection aCyFaR1 AWItDocumento9 pagineGlobe Reflection aCyFaR1 AWIt123r12f1Nessuna valutazione finora

- Notes To Financial StatementDocumento8 pagineNotes To Financial StatementSally SiaotongNessuna valutazione finora

- Mother of Perpetual Hel Funeral Homes: Notes To Financial StatementDocumento9 pagineMother of Perpetual Hel Funeral Homes: Notes To Financial StatementSally SiaotongNessuna valutazione finora

- Ias 1Documento5 pagineIas 1summerfashionlimitedNessuna valutazione finora

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Documento10 pagineIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNessuna valutazione finora

- Pas 1Documento52 paginePas 1Justine VeralloNessuna valutazione finora

- THEORIES PAS 1 and PAS 8Documento28 pagineTHEORIES PAS 1 and PAS 8PatrickMendozaNessuna valutazione finora

- Presentation of Financial StatementsDocumento27 paginePresentation of Financial StatementsMaica BarreraNessuna valutazione finora

- #3 Pas 1Documento6 pagine#3 Pas 1Shara Joy B. ParaynoNessuna valutazione finora

- NFRS IiiDocumento105 pagineNFRS Iiikaran shahiNessuna valutazione finora

- MELC2016 NotesDocumento12 pagineMELC2016 NotesChris WongNessuna valutazione finora

- C39e54c7 1617599931071Documento13 pagineC39e54c7 1617599931071Abby NavarroNessuna valutazione finora

- Expo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsDocumento26 pagineExpo NG Stan Tion of Osure D Ndard (A Financ Draft AS) 1 (Cial Sta (Revise Atement D) TsratiNessuna valutazione finora

- Sme Discussion TemplateDocumento5 pagineSme Discussion TemplateLeahmae OlimbaNessuna valutazione finora

- IAS 1 Provides Guidelines On The Presentation of TheDocumento6 pagineIAS 1 Provides Guidelines On The Presentation of ThemulualemNessuna valutazione finora

- Conceptual Framework For Financial Reporting: BackgroundDocumento6 pagineConceptual Framework For Financial Reporting: Backgroundbakhtawar soniaNessuna valutazione finora

- 08 Handout 1 (CFAS)Documento12 pagine08 Handout 1 (CFAS)laurencedechosa907Nessuna valutazione finora

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocumento58 paginePhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNessuna valutazione finora

- 02 Lec Financial StatementsDocumento5 pagine02 Lec Financial StatementsYoung MetroNessuna valutazione finora

- Presentation of Financial Statements (Copy) (Copy) - TaskadeDocumento5 paginePresentation of Financial Statements (Copy) (Copy) - Taskadebebanco.maryzarianna.olaveNessuna valutazione finora

- INTRODUCTION DesarrolloDocumento8 pagineINTRODUCTION DesarrolloPilar Fernandez hoyosNessuna valutazione finora

- De Vera - Alexa Toni Mari - ASW2 - CFASDocumento2 pagineDe Vera - Alexa Toni Mari - ASW2 - CFASAlexsiah De VeraNessuna valutazione finora

- Arsi University: College of Business and Economics Department of Accounting and FinanceDocumento39 pagineArsi University: College of Business and Economics Department of Accounting and FinanceMuktar AdileNessuna valutazione finora

- Unit 2 Tutrorial NotesDocumento7 pagineUnit 2 Tutrorial NotesDavdi HansonNessuna valutazione finora

- Presentation of Financial Statements PDFDocumento16 paginePresentation of Financial Statements PDFalabwala100% (1)

- Group 47 Assignment Acc306Documento18 pagineGroup 47 Assignment Acc306Nathanael MudohNessuna valutazione finora

- MGT401 Course HandoutsDocumento224 pagineMGT401 Course HandoutsUsman Ali100% (1)

- Chapter 22Documento6 pagineChapter 22JOANNE PEÑARANDANessuna valutazione finora

- IFRS For Small and Medium-Sized Entities: Pocket Guide 2009Documento8 pagineIFRS For Small and Medium-Sized Entities: Pocket Guide 2009Robin SicatNessuna valutazione finora

- A Complete Set of Financial Statements ComprisesDocumento9 pagineA Complete Set of Financial Statements Comprisesۦۦۦۦۦ ۦۦ ۦۦۦNessuna valutazione finora

- International Public Sector Accounting Standards (IPSAS)Documento40 pagineInternational Public Sector Accounting Standards (IPSAS)budsy.lambaNessuna valutazione finora

- Objective of Financial Statements:: 1. Understandability 2. Relevance 3. MaterialityDocumento14 pagineObjective of Financial Statements:: 1. Understandability 2. Relevance 3. Materialityredearth2929Nessuna valutazione finora

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Da Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Nessuna valutazione finora

- Corp Sec - FOR RE APPROPRIATIONDocumento1 paginaCorp Sec - FOR RE APPROPRIATIONMel VillahermosaNessuna valutazione finora

- Letter Annaliza Yu Lim 102017Documento1 paginaLetter Annaliza Yu Lim 102017Mel VillahermosaNessuna valutazione finora

- Reply Letter Bir Everfirst Inv Taxable Year 2019Documento1 paginaReply Letter Bir Everfirst Inv Taxable Year 2019Mel VillahermosaNessuna valutazione finora

- DEED OF ASSIGNMENT Liao Realty CorpDocumento1 paginaDEED OF ASSIGNMENT Liao Realty CorpMel VillahermosaNessuna valutazione finora

- Reply Letter Bir Pentagold Inv Taxable Year 2019Documento1 paginaReply Letter Bir Pentagold Inv Taxable Year 2019Mel VillahermosaNessuna valutazione finora

- Manila Imperial Motor Sales Letter 11222017Documento1 paginaManila Imperial Motor Sales Letter 11222017Mel VillahermosaNessuna valutazione finora

- Reply Letter Bir SWAT NUTRENE Taxable Year 2016-2017Documento1 paginaReply Letter Bir SWAT NUTRENE Taxable Year 2016-2017Mel VillahermosaNessuna valutazione finora

- Waiver of Rights I, MARK P. DIZON, of Legal Age, Filipino, Married, and A Resident ofDocumento1 paginaWaiver of Rights I, MARK P. DIZON, of Legal Age, Filipino, Married, and A Resident ofJoshua Elli BajadaNessuna valutazione finora

- Unit Owners MLCDocumento3 pagineUnit Owners MLCMel VillahermosaNessuna valutazione finora

- Reply Letter Bir Comford Textile Co Penalty On TCVD Taxable Year 2014Documento1 paginaReply Letter Bir Comford Textile Co Penalty On TCVD Taxable Year 2014Mel VillahermosaNessuna valutazione finora

- Reply Letter Bir Everfirst Inv Taxable Year 2019Documento1 paginaReply Letter Bir Everfirst Inv Taxable Year 2019Mel VillahermosaNessuna valutazione finora

- RCSM Trading On Line RegDocumento1 paginaRCSM Trading On Line RegMel VillahermosaNessuna valutazione finora

- Affidavit of Own Damage To Vehicle TemplateDocumento1 paginaAffidavit of Own Damage To Vehicle TemplateMel Villahermosa0% (2)

- House Rules Ligaya MemoDocumento2 pagineHouse Rules Ligaya MemoMel VillahermosaNessuna valutazione finora

- Rose - SurveyDocumento1 paginaRose - SurveyMel VillahermosaNessuna valutazione finora

- Silver Tower CorpDocumento1 paginaSilver Tower CorpMel VillahermosaNessuna valutazione finora

- Letter Request Time Extension Loa 2018 Glitz ElektroDocumento1 paginaLetter Request Time Extension Loa 2018 Glitz ElektroMel VillahermosaNessuna valutazione finora

- A. 8% Business Income Tax RateDocumento4 pagineA. 8% Business Income Tax RateMel VillahermosaNessuna valutazione finora

- A. 8% Business Income Tax RateDocumento4 pagineA. 8% Business Income Tax RateMel VillahermosaNessuna valutazione finora

- Affidavit of Loss Sss CardDocumento1 paginaAffidavit of Loss Sss CardMel VillahermosaNessuna valutazione finora

- Bagolor Cabote 14 Corp. Sec Reg-1Documento17 pagineBagolor Cabote 14 Corp. Sec Reg-1Mel VillahermosaNessuna valutazione finora

- HHP - Indonesia Now Has A Specific E-Commerce RegulationDocumento8 pagineHHP - Indonesia Now Has A Specific E-Commerce RegulationOsc GerhatNessuna valutazione finora

- AFISCO Insurance Corporation v. CADocumento2 pagineAFISCO Insurance Corporation v. CAlealdeosa100% (2)

- Assignment 1 Group 0Documento7 pagineAssignment 1 Group 0MiorSyadiNessuna valutazione finora

- International Taxation: Mcgraw-Hill/Irwin Rights ReservedDocumento33 pagineInternational Taxation: Mcgraw-Hill/Irwin Rights ReservedChuckNessuna valutazione finora

- Copy B-To Be Filed With Employee's FEDERAL Tax ReturnDocumento1 paginaCopy B-To Be Filed With Employee's FEDERAL Tax ReturnJoshua WagonerNessuna valutazione finora

- Form B-1Documento64 pagineForm B-1Maulik RavalNessuna valutazione finora

- Annual Report 2018-EnGDocumento250 pagineAnnual Report 2018-EnGHenry DP SinagaNessuna valutazione finora

- 08 - Form G-4 - 2Documento2 pagine08 - Form G-4 - 2Dredd ScottNessuna valutazione finora

- Pestle AnalysisDocumento20 paginePestle AnalysisSandip Kumar100% (3)

- Car Lease PolicyDocumento6 pagineCar Lease PolicyShubham RaiNessuna valutazione finora

- E-Tender ET 717 2018Documento78 pagineE-Tender ET 717 2018Trapti SinghNessuna valutazione finora

- Fisher Vs Trinidad DigestDocumento3 pagineFisher Vs Trinidad DigestKT100% (1)

- B2B Streamlined Bill Sample - Phone Bill Template FormDocumento9 pagineB2B Streamlined Bill Sample - Phone Bill Template FormBrendon DrewNessuna valutazione finora

- Eastland Center - Loan Prop DetailDocumento10 pagineEastland Center - Loan Prop DetailClickon DetroitNessuna valutazione finora

- Republic Act NoDocumento37 pagineRepublic Act NoNikolai BacunganNessuna valutazione finora

- The Stickman 1Documento1 paginaThe Stickman 1Michael O AdamsNessuna valutazione finora

- 2016 LHC 3157Documento61 pagine2016 LHC 3157Muhammad RaheelNessuna valutazione finora

- Commercial Invoice TemplateDocumento3 pagineCommercial Invoice TemplateRoy ElvisNessuna valutazione finora

- KALMAN (Kenneth) H. RYESKY, Esq.: Curriculum VitaeDocumento11 pagineKALMAN (Kenneth) H. RYESKY, Esq.: Curriculum VitaeKennethRyeskyNessuna valutazione finora

- Tax 01-General PrinciplesDocumento9 pagineTax 01-General PrinciplesDin Rose Gonzales0% (1)

- Affidavit of Exempt Sale StandardDocumento2 pagineAffidavit of Exempt Sale StandardAnna AtienzaNessuna valutazione finora

- Case Digest Roberto Gonzales Vs NLRCDocumento20 pagineCase Digest Roberto Gonzales Vs NLRCjjnjamNessuna valutazione finora

- Account Name Header Balance Account Type Account NumberDocumento5 pagineAccount Name Header Balance Account Type Account NumberJohanNessuna valutazione finora

- International Finance W2013Documento20 pagineInternational Finance W2013Bahrom Maksudov0% (1)

- Form PDF 820116700251122Documento6 pagineForm PDF 820116700251122Anonymous PzLXgCmNessuna valutazione finora

- CBK POWER LTD Vs CIRDocumento2 pagineCBK POWER LTD Vs CIRJM Ragaza67% (3)

- San Antonio Independent School Dist. v. Rodriguez, 411 U.S. 1 (1973)Documento102 pagineSan Antonio Independent School Dist. v. Rodriguez, 411 U.S. 1 (1973)Scribd Government DocsNessuna valutazione finora

- K.F.C. FORM 14 (See Chapter VII, Article 143) Form of TenderDocumento11 pagineK.F.C. FORM 14 (See Chapter VII, Article 143) Form of Tendermail2ramsharmaNessuna valutazione finora

- How To Start A Business in India SuccessfullyDocumento4 pagineHow To Start A Business in India SuccessfullyReshmi VarmaNessuna valutazione finora

- RTM Feb 2020 Magazine PDFDocumento142 pagineRTM Feb 2020 Magazine PDFveeruvishwa2Nessuna valutazione finora