Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cost Audit

Caricato da

Saumya AllapartiTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cost Audit

Caricato da

Saumya AllapartiCopyright:

Formati disponibili

16

Cost Audit

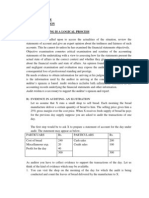

Question 1

For what purposes the Cost Auditor refers to financial records while conducting Cost Audit of

an entity?

Answer

A cost auditor is ultimately required to express an opinion as to whether the company has

maintained proper cost accounting records so as to give a true and fair view of cost of

production, etc. In arriving at this opinion, the cost auditor is required to ascertain about

multitude of information such as cost of raw materials consumed, cost of power, cost of

inventory, employer costs, provision for depreciation, royalty and technical payment, abnormal

cost, scrap, fuel etc. Annexure to the cost audit reports require detailed information in respect

of financial position including capital employed, net worth, profit, net rates, operating profit, unit

cost of power and fuel, total wages and salaries, etc. It is obvious therefore that cost audit

cannot be done without reference to financial books, more so in the context of the statutory

requirement to have a statement of reconciliation with financial accounts as part of cost audit

report. Further the cost statements also contain a summary of all expenditure incurred by the

company and the share in such expenditure attributable to the activities; Overhead expenditure

also needs allocation between activities covered by rules and activities not so covered. Naturally

this can be done only with reference to financial ledger. Under Part II of Schedule III to the

Companies Act, 2013, quite a few matters which were to be mentioned in the Statement of Profit

and Loss of the company are also to be covered in cost statements such as consumption of raw

materials, purchases of stock-in-trade, sales of products/services, changes in inventories in

respect of finished goods, work-in-progress, stock-in-trade etc. A correlation between

consumption of raw materials as per cost records and financial records may throw up the need

for inquiry into errors, mistakes and manipulation. Material discrepancy between financial

records and cost records will be highlighted in the reconciliation statement which would required

that the cost auditor may examine deviation before reporting on the same. Thus it is imperative

for the cost auditor to refer to financial records for conducting the cost audit.

Question 2

“Like every other audit, a systematic planning for cost audit is also necessary”. Indicate the

matters to be included in a Cost Audit Programme.

© The Institute of Chartered Accountants of India

16.2 Advanced Auditing and Professional Ethics

Answer

Matters to be included in Cost Audit Programme: It is a true statement that like any other

audit a systematic planning for cost audit is also necessary. Therefore, the cost audit

programme should include all the usual broad steps that a financial auditor includes in his audit

programme. This would require that the various aspects like what to be done, when to be done

and by whom to be done are adequately takes care of. However, looking to the basic difference

in cost audit and financial audit as allocation and apportionment of expenses, statutory

requirement etc. should require special consideration. Cost audit, in order to be effective, should

be completed at one time as far as practicable. Based on above factors a set of procedures and

instructions are evolved which may be termed the cost audit programme. Matters to be included

in the Cost Audit Programme may be divided into following two stages:

(a) Review of Cost accounting record: This will include:

(i) Method of costing in use - batch, process or unit.

(ii) Method of accounting for raw materials; stores and spares, wastages, spoilage

defectives, etc.

(iii) System of recording wages, salaries, overtime and spares, wastages, etc.

(iv) Basis of allocation of overheads to cost centres and of absorption by products and

apportionment of service department’s expenses.

(v) Treatment of interest, recording of royalties, research and development expenses,

etc.

(vi) Method of accounting of depreciation.

(vii) Method of inventory-taking and its valuation including inventory policies.

(viii) System of budgetary control.

(ix) System of internal auditing.

(b) Verification of cost statement and other data: This will mainly cover:

(i) Licensed, installed and utilised capacities.

(ii) Financial ratios.

(iii) Production data.

(iv) Cost of raw material consumed, wages and salaries, stores, power and fuel,

overheads provision for depreciation etc.

(v) Sales realisation.

(vi) Abnormal non-recurring and special costs.

(vii) Cost statements.

(viii) Reconciliation with financial books.

© The Institute of Chartered Accountants of India

Cost Audit 16.3

Some other factors which need to be brought into cost audit programme includes system of cost

accounting, range of products, areas to be covered etc. indicating allocation of manpower and

the time to be taken for computing the audit.

Question 3

What are the advantages that accrue because of a Cost audit?

Answer

Cost Audit will be advantageous to the stockholders in the following manner:

To Management -

(i) Management will get reliable data for its day-to-day operations like price fixing, control,

decision-making, etc.

(ii) A close and continuous check on all wastages will be kept through a proper system of

reporting to management.

(iii) Inefficiencies in the working of the company will be brought to light to facilitate corrective

action.

(iv) Management by exception becomes possible through allocation of responsibilities to in-

dividual managers.

(v) The system of budgetary control and standard costing will be greatly facilitated.

(vi) A reliable check on the valuation of closing inventory and work-in-progress can be

established.

(vii) It helps in the detection of errors and fraud.

To Society -

(i) Cost audit is often introduced for the purpose of fixation of prices. The prices so fixed are

based on the correct costing data and so the consumers are saved from exploitation.

(ii) Since price increase by some industries is not allowed without proper justification as to

increase in cost of production, inflation through price hikes can be controlled and con-

sumers can maintain their standard of living.

To Shareholder - Cost audit ensures that proper records are kept as to purchases and

utilisation of materials and expenses incurred on wages, etc. It also makes sure that the

valuation of closing inventories and work- in-progress is on a fair basis. Thus the shareholders

are assured of a fair return on their investment.

To Government -

(i) Where the Government enters into a cost-plus contract, cost audit helps government to fix

the price of the contract at a reasonable level.

(ii) Cost audit helps in the fixation of ceiling prices of essential commodities and thus undue

profiteering is checked.

(iii) Cost audit enables the government to focus its attention on inefficient units.

© The Institute of Chartered Accountants of India

16.4 Advanced Auditing and Professional Ethics

(iv) Cost audit enables the government to decide in favour of giving protection to certain

industries.

(v) Cost audit facilitates settlement of trade disputes brought to the government.

(vi) Cost audit and consequent management action can create a healthy competition among

the various units in an industry. This imposes an automatic check on inflation.

Question 4

Write a short note on - True and Fair Cost of Production.

Answer

True and Fair Cost of Production: A cost auditor checks the cost accounting records to verify

that the cost statements are properly drawn up as per the records and that they present a true

and fair view of the cost of production and marketing of various products dealt with by the

undertaking. The Companies (cost records and audit) Rules, 2014, prescribe the rules regarding

the cost audit report and also prescribes the classes of companies required to include cost

records in their books of account, applicability of cost audit, maintenance of records etc. The

prescribed format of the report contains assertions regarding whether cost accounting records

have been properly kept so as to give a true and fair view of the cost of production/ etc. The

provisions of sub-section (12) of section 143 of the Companies Act, 2013 and the relevant rules

on duty to report on fraud shall apply mutatis mutandis to a cost auditor during performance of

his functions under section 148 of the Act and these rules. In any case, the true and fair concept

is known to us in the context of financial accounts. Based on that knowledge, it may be assumed

that the following are the relevant considerations in determining whether the cost of production

determined is true and fair:

(i) Determination of cost following the generally accepted cost accounting principles.

(ii) Application of the costing system appropriate to the product.

(iii) Materiality.

(iv) Consistency in the application of costing system and cost accounting principles.

(v) Maintenance of cost records and preparation of cost statements in the prescribed form and

having the prescribed contents.

(vi) Elimination of material prior-period adjustments.

(vii) Abnormal wastes and losses and other unusual transactions being ignored in

determination of cost.

Question 5

Write a short note on - Reconciliation of cost and financial accounts.

Answer

Reconciliation of Cost and Financial Accounts: A cost auditor is ultimately required to

express an opinion as to whether the company has maintained proper cost accounting records

so as to give a true and fair view of cost of production etc. In arriving at this opinion, the cost

© The Institute of Chartered Accountants of India

Cost Audit 16.5

auditor is required to ascertain about multitude of information such as cost of raw materials

consumed, cost of power and scrap fuel cost of inventory, employer costs, provision for

depreciation, royalty and technical payment, abnormal cost, etc. Annexure to the cost audit

reports requires detailed information in respect of financial position including capital employed,

net worth, profit, net rates, operating profit, unit cost of power and fuel, total wages and salaries

etc. It is obvious therefore that cost audit cannot be done without reference to financial books,

more so in the context of the statutory requirement to have a statement of reconciliation with

financial accounts as part of cost audit report. Further the cost statements are to contain a

summary of all expenditure incurred by the company and the share in such expenditure

attributable to the activities; Overhead expenditure also needs allocation between activities

covered by rules and activities not so covered. Naturally this can be done only with reference to

financial ledger. Under Part II of Schedule III to the Companies Act, 2013, quite a few matters

which were to be mentioned in the Statement of Profit and Loss of the company are also to be

covered in cost statements such as consumption of raw materials, purchases of stock-in-trade,

sales of products/services, changes in inventories in respect of finished goods, work-in-

progress, stock-in-trade etc. A correlation between consumption of raw materials as per cost

records and financial records may through up the need for inquiry into errors, mistakes and

manipulation. Material discrepancy between financial records and cost records will be

highlighted in the reconciliation statement which would required that the cost auditor may

examine deviation before reporting on the same. Thus it is imperative for the cost auditor to

refer to financial records.

Question 6

What is the purpose served by Introduction of Cost audit?

Answer

According to the Institute of Cost and Management Accountants of England, cost audit

represents the verification of cost accounts and a check on the adherence to cost accounting

plan. Cost audit, therefore, comprises:

(i) verification of the cost accounting records such as the accuracy of the cost accounts, cost

reports, cost statements, cost data and costing techniques and

(ii) examination of these records to ensure that they adhere to the cost accounting principles,

plans, procedures and objectives.

The undernoted circumstances may warrant the introduction of cost audit:

(a) Price fixation - The need for fixation of retention prices in the case of materials of national

importance, like steel, cement etc. may be useful in knowing the true cost of production.

(b) Cost variation within the industry - Where the cost of production varies significantly from

unit to unit in the same industry, cost audit may be necessary to find the reasons for such

differences.

(c) Inefficient management - Where a factory is run inefficiently and uneconomically,

institution of cost audit may be necessary. It may be particularly useful for the Government

before it takes over any unit.

© The Institute of Chartered Accountants of India

16.6 Advanced Auditing and Professional Ethics

(d) Tax-assessment - Where a duty or tax is levied on products based on cost of production,

the levying authorities may ask for cost audit to determine the correct cost of production.

(e) Trade disputes - Cost audit may be useful in settling trade disputes about claim for higher

wages, bonus, etc.

Question 7

Write a short note on Cost Audit.

Answer

Cost Audit: It is covered by Section 148 of the Companies Act, 2013. As per section 148 the

Central Government may by order specify audit of items of cost in respect of certain companies.

Further, the Central Government may, by order, in respect of such class of companies engaged

in the production of such goods or providing such services as may be prescribed, direct that

particulars relating to the utilisation of material or labour or to other items of cost as may be

prescribed shall also be included in the books of account kept by that class of companies.

It is provided that the Central Government shall, before issuing such order in respect of any

class of companies regulated under a special Act, consult the regulatory body constituted or

established under such special Act

The audit shall be conducted by a Cost Accountant in Practice who shall be appointed by the

Board of such remuneration as may be determined by the members in such manner as may be

prescribed.

No person appointed under section 139 as an auditor of the company shall be appointed for

conducting the audit of cost records and also that the auditor conducting the cost audit shall

comply with the cost auditing standards

The qualifications, disqualifications, rights, duties and obligations applicable to auditors under

Chapter X of the Companies Act, 2013 shall, so far as may be applicable, apply to a cost auditor

appointed under this section and it shall be the duty of the company to give all assistance and

facilities to the cost auditor appointed under this section for auditing the cost records of the

company.

It is provided that the report on the audit of cost records shall be submitted by the cost

accountant in practice to the Board of Directors of the company.

A company shall within thirty days from the date of receipt of a copy of the cost audit report

prepared (in pursuance of a direction issued by Central Government) furnish the Central

Government with such report along with full information and explanation on every reservation

or qualification contained therein.

© The Institute of Chartered Accountants of India

Potrebbero piacerti anche

- Single Line DiagramDocumento1 paginaSingle Line DiagramGhanshyam Singh100% (2)

- Assignment On Industrial Relation of BDDocumento12 pagineAssignment On Industrial Relation of BDKh Fahad Koushik50% (6)

- Ped Med HandbookDocumento27 paginePed Med HandbookSoad Shedeed0% (1)

- Cost Audit: Audit of An Entity?Documento6 pagineCost Audit: Audit of An Entity?Vipra BhatiaNessuna valutazione finora

- Cost AuditDocumento0 pagineCost Audit90vijayNessuna valutazione finora

- Cost AcDocumento0 pagineCost AcKishan KudiaNessuna valutazione finora

- Cost Audit: Write A Short Note On Cost Audit. (4 Marks, November, 2014)Documento6 pagineCost Audit: Write A Short Note On Cost Audit. (4 Marks, November, 2014)casarokarNessuna valutazione finora

- 16.1 Concept of Cost AuditDocumento18 pagine16.1 Concept of Cost AuditJONNALAGADDA MUNI SUBRAMANYAMNessuna valutazione finora

- Cost AuditDocumento34 pagineCost Auditrutika2611Nessuna valutazione finora

- Cost AuditDocumento4 pagineCost AuditsanyamNessuna valutazione finora

- Cost Audit FullDocumento33 pagineCost Audit Fullnishaji86% (7)

- Cost Audit FullDocumento21 pagineCost Audit FullbuviaroNessuna valutazione finora

- Cost AuditDocumento15 pagineCost AuditseesawupndownNessuna valutazione finora

- Strategic Cost Accounting M. Com (Semester IV) Topic-Cost AuditDocumento6 pagineStrategic Cost Accounting M. Com (Semester IV) Topic-Cost AuditJKonsultoresNessuna valutazione finora

- Chapter 30 Cost AuditDocumento5 pagineChapter 30 Cost AuditRajesh TncNessuna valutazione finora

- Unit - V Cost AuditDocumento20 pagineUnit - V Cost AuditHari VenkatesanNessuna valutazione finora

- My Hand NoteDocumento144 pagineMy Hand NoteHasanur RaselNessuna valutazione finora

- Audit Evidence A) IntroductionDocumento5 pagineAudit Evidence A) IntroductionAmit ManwaniNessuna valutazione finora

- Concept of Cost Audit in IndiaDocumento68 pagineConcept of Cost Audit in IndiaAnonymous vbcCw4WAdNessuna valutazione finora

- Cost and Management AccountingDocumento52 pagineCost and Management Accountings.lakshmi narasimhamNessuna valutazione finora

- 4 Sem Bcom - Cost AccountingDocumento54 pagine4 Sem Bcom - Cost Accountingraja chatterjeeNessuna valutazione finora

- Cost Accounting - IV SemDocumento98 pagineCost Accounting - IV SemramkumarNessuna valutazione finora

- Cost Audit ProjectDocumento49 pagineCost Audit Projectashuti75% (4)

- Overview of Cost AccountingDocumento21 pagineOverview of Cost AccountingVinayNessuna valutazione finora

- Cost AccountingDocumento27 pagineCost AccountingLkjiklNessuna valutazione finora

- COst SheetDocumento52 pagineCOst SheetAshwini Harwale SonwaneNessuna valutazione finora

- Cost AuditDocumento5 pagineCost AuditJigna KusakiyaNessuna valutazione finora

- MBA Cost RecordsDocumento8 pagineMBA Cost RecordsGurneet KaurNessuna valutazione finora

- Cost AccountingDocumento263 pagineCost AccountingSaciid Xaji AxmedNessuna valutazione finora

- Ca - Unit 1Documento22 pagineCa - Unit 1SHANMUGHA SHETTY S SNessuna valutazione finora

- Unit 4 by Ravi Recent TrendsDocumento43 pagineUnit 4 by Ravi Recent TrendsChintan Kalpesh Modi100% (2)

- Unit - 1: Introduction To Cost AccountingDocumento262 pagineUnit - 1: Introduction To Cost AccountingSamuel AnthrayoseNessuna valutazione finora

- Chapter 1 Basic Concepts & Product Cost SheetDocumento72 pagineChapter 1 Basic Concepts & Product Cost SheetRupee Vs DollarNessuna valutazione finora

- 1.4 Planning and Structuring The Cost Audit 1.4.1 Need For Planning An AuditDocumento5 pagine1.4 Planning and Structuring The Cost Audit 1.4.1 Need For Planning An AuditAnu Yashpal KapoorNessuna valutazione finora

- 1meaning and Origin of Cost Accounting 1Documento3 pagine1meaning and Origin of Cost Accounting 1Jyoti GuptaNessuna valutazione finora

- Cost AccountingDocumento64 pagineCost AccountingPerpetual Insight TeamNessuna valutazione finora

- Cost Audit RepairDocumento7 pagineCost Audit RepairkayseNessuna valutazione finora

- Cost Audit: Dhirendra KR ChaudharyDocumento14 pagineCost Audit: Dhirendra KR ChaudharyMurali RaviNessuna valutazione finora

- UNIT-1 Introduction To Cost Accounting: Sri Krishna Adithya College of Arts & Sciencepage 1Documento17 pagineUNIT-1 Introduction To Cost Accounting: Sri Krishna Adithya College of Arts & Sciencepage 1princeNessuna valutazione finora

- Unit 1 IntroductionDocumento14 pagineUnit 1 IntroductionIrfan KhanNessuna valutazione finora

- Unit 1 IntroductionDocumento14 pagineUnit 1 IntroductionIrfan KhanNessuna valutazione finora

- Cost Accounting: Cost Accounting May Be Defined As "Accounting For Costs Classification and Analysis ofDocumento37 pagineCost Accounting: Cost Accounting May Be Defined As "Accounting For Costs Classification and Analysis ofsajjadNessuna valutazione finora

- Cost Accounting SystemsDocumento10 pagineCost Accounting SystemsvictorNessuna valutazione finora

- 2 Overview of Cost AccountingDocumento18 pagine2 Overview of Cost AccountingHarsh KhatriNessuna valutazione finora

- Topic One Cost AccountingDocumento11 pagineTopic One Cost Accountingmercy kirwaNessuna valutazione finora

- Chapter One Cost AccDocumento11 pagineChapter One Cost AccAbdullahi AliNessuna valutazione finora

- Part 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewDocumento12 paginePart 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewkhengmaiNessuna valutazione finora

- Cost AccountingDocumento201 pagineCost AccountingMikhil Pranay Singh100% (4)

- Cost AccountancyDocumento197 pagineCost AccountancymirjapurNessuna valutazione finora

- Cost 3Documento17 pagineCost 3Nandan Kumar JenaNessuna valutazione finora

- Study Notes On Cost AccountingDocumento69 pagineStudy Notes On Cost AccountingPriyankaJainNessuna valutazione finora

- Cost Accounting Notes PDFDocumento55 pagineCost Accounting Notes PDFadv suryakant jadhavNessuna valutazione finora

- Hapter: Need For Cost AccountingDocumento28 pagineHapter: Need For Cost AccountingAhamed WajidNessuna valutazione finora

- Audit - Addl Ques-36-39Documento4 pagineAudit - Addl Ques-36-39Dheeraj VermaNessuna valutazione finora

- Cost Audit Unit-IvDocumento7 pagineCost Audit Unit-Ivvarshasharma988747Nessuna valutazione finora

- Tools and Techniques of Cost ReductionDocumento27 pagineTools and Techniques of Cost Reductionপ্রিয়াঙ্কুর ধর100% (2)

- Ch1 - Introduction of Cost Accounting PDFDocumento22 pagineCh1 - Introduction of Cost Accounting PDFDarshitaNessuna valutazione finora

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Da EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Nessuna valutazione finora

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18Da EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Nessuna valutazione finora

- Cost Management: A Case for Business Process Re-engineeringDa EverandCost Management: A Case for Business Process Re-engineeringNessuna valutazione finora

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Da Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Nessuna valutazione finora

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- Audit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Da EverandAudit Risk Alert: Government Auditing Standards and Single Audit Developments: Strengthening Audit Integrity 2018/19Nessuna valutazione finora

- Facts: Salomon V SalomonDocumento4 pagineFacts: Salomon V SalomonSaumya AllapartiNessuna valutazione finora

- Investment Decisions NotesDocumento2 pagineInvestment Decisions NotesSaumya AllapartiNessuna valutazione finora

- Corporate Veil The Case of Salomon v. Salomon and Co. LTD., (1897) A.C. 22Documento6 pagineCorporate Veil The Case of Salomon v. Salomon and Co. LTD., (1897) A.C. 22Saumya AllapartiNessuna valutazione finora

- Prime Cost (1+2+3) XXXDocumento1 paginaPrime Cost (1+2+3) XXXSaumya AllapartiNessuna valutazione finora

- Deductions and TDS SectionsDocumento6 pagineDeductions and TDS SectionsSaumya AllapartiNessuna valutazione finora

- Demand and RecoveryDocumento9 pagineDemand and RecoverySaumya AllapartiNessuna valutazione finora

- Costing of Service SectorDocumento42 pagineCosting of Service SectorSaumya AllapartiNessuna valutazione finora

- Advance Ruling: © The Institute of Chartered Accountants of IndiaDocumento5 pagineAdvance Ruling: © The Institute of Chartered Accountants of IndiaSaumya AllapartiNessuna valutazione finora

- Appeals and RevisionDocumento9 pagineAppeals and RevisionSaumya AllapartiNessuna valutazione finora

- Dungeon Magazine 195 PDFDocumento5 pagineDungeon Magazine 195 PDFGuillaumeRicherNessuna valutazione finora

- A Branding Effort of Walt DisneyDocumento17 pagineA Branding Effort of Walt DisneyKanishk GuptaNessuna valutazione finora

- Node MCU CarDocumento4 pagineNode MCU CarYusuf MuhthiarsaNessuna valutazione finora

- LTE Radio Network Design Guideline (FDD)Documento33 pagineLTE Radio Network Design Guideline (FDD)Tri Frida NingrumNessuna valutazione finora

- CIVPRO - Case Compilation No. 2Documento95 pagineCIVPRO - Case Compilation No. 2Darla GreyNessuna valutazione finora

- Ultrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedDocumento2 pagineUltrajet 376 Installation Data: Ultra Dynamics Marine, LCC Ultra Dynamics LimitedhaujesNessuna valutazione finora

- System Error Codes (0-499)Documento33 pagineSystem Error Codes (0-499)enayuNessuna valutazione finora

- Flexi Multiradio Introduction - Sharing SessionDocumento96 pagineFlexi Multiradio Introduction - Sharing SessionRobby MiloNessuna valutazione finora

- SDS enDocumento6 pagineSDS enAnup BajracharyaNessuna valutazione finora

- OS Lab ManualDocumento37 pagineOS Lab ManualVenkatanagasudheer ThummapudiNessuna valutazione finora

- Food Safety and StandardsDocumento8 pagineFood Safety and StandardsArifSheriffNessuna valutazione finora

- CHAPTER 22-Audit Evidence EvaluationDocumento27 pagineCHAPTER 22-Audit Evidence EvaluationIryne Kim PalatanNessuna valutazione finora

- Brochure PVM enDocumento36 pagineBrochure PVM enBenny Kurniawan LimNessuna valutazione finora

- Maxillofacial Trauma and Management - Dental Ebook & Lecture Notes PDF Download (Studynama - Com - India's Biggest Website For BDS Study Material Downloads)Documento24 pagineMaxillofacial Trauma and Management - Dental Ebook & Lecture Notes PDF Download (Studynama - Com - India's Biggest Website For BDS Study Material Downloads)Vinnie SinghNessuna valutazione finora

- M.Tech VLSI SyllabusDocumento10 pagineM.Tech VLSI SyllabusAshadur RahamanNessuna valutazione finora

- TQM - Juran ContributionDocumento19 pagineTQM - Juran ContributionDr.K.Baranidharan100% (2)

- Reading 36 Using Multifactor Models - AnswersDocumento23 pagineReading 36 Using Multifactor Models - Answersdhanh.bdn.hsv.neuNessuna valutazione finora

- COA DBM JOINT CIRCULAR NO 2 s2022 DATED NOVEMBER 10 2022Documento2 pagineCOA DBM JOINT CIRCULAR NO 2 s2022 DATED NOVEMBER 10 2022John Christian ReyesNessuna valutazione finora

- Ge Washing Machine ManualDocumento52 pagineGe Washing Machine Manuallillith1723Nessuna valutazione finora

- Taifun GT User GuideDocumento5 pagineTaifun GT User GuidecarloslarumbeNessuna valutazione finora

- a27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eDocumento762 paginea27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eRed DiggerNessuna valutazione finora

- Lamaran NongyiDocumento12 pagineLamaran NongyiTonoTonyNessuna valutazione finora

- Crude Palm OilDocumento4 pagineCrude Palm OilpalmoilanalyticsNessuna valutazione finora

- Westermo MRD 330-3xx & GreenBow IPSec VPN Client Software ConfigurationDocumento12 pagineWestermo MRD 330-3xx & GreenBow IPSec VPN Client Software ConfigurationgreenbowNessuna valutazione finora

- IBM Tivoli Monitoring Implementation and Performance Optimization For Large Scale Environments Sg247443Documento526 pagineIBM Tivoli Monitoring Implementation and Performance Optimization For Large Scale Environments Sg247443bupbechanhNessuna valutazione finora

- Definition of Unit HydrographDocumento5 pagineDefinition of Unit HydrographPankaj ChowdhuryNessuna valutazione finora

- Om - 3M CaseDocumento18 pagineOm - 3M CaseBianda Puspita Sari100% (1)