Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Vda de Maglana v. Consolacion

Caricato da

Julia Camille RealDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Vda de Maglana v. Consolacion

Caricato da

Julia Camille RealCopyright:

Formati disponibili

B2022 REPORTS ANNOTATED VOL 32 [August 6, 1992]

Light Rail Transit Authority v. Navidad Light Rail Transit Authority v. Navidad

I. Recit-ready summary II. Facts of the case

Lope Maglana was on his way to his work station, driving a motorcycle. He Lope Maglana was an employee of the Bureau of Customs whose work

met an accident that resulted in his death. The PUJ that bumped Maglana station was at Lasa, Davao City. One early morning, Lope Maglana was on

was driven by Pepito Into, operated and owned by Destrajo. The PUJ was his way to his work station, driving a motorcycle owned by the Bureau of

overtaking another passenger jeep that was going towards the city, Customs. At Km. 7, Lanang, he met an accident that resulted in his death.

Poblacion. While overtaking, the PUJ of Destrajo running abreast with the He died on the spot. The PUJ jeep that bumped the deceased was driven by

overtaken jeep, bumped the motorcycle driven by Maglana who was going Pepito Into, operated and owned by defendant Destrajo. From the

towards the direction of Laasa, Davao City. The point of impact was on the investigation by the traffic investigator, the PUJ jeep was overtaking

lane of the motorcycle and Maglane was thrown from the road and met his another passenger jeep that was going towards the city of poblacion. While

untimely death. Thereafter, the heirs of Maglane filed an action against overtaking, the PUJ jeep of defendant Destrajo running abreast with the

Destrajo and Afisco Insurance Corporation (AFISCO) for damages and overtaken jeep, bumped the motorcycle driven by the deceased who was

attorney’s fees. going towards the direction of Lasa, Davao. The point of impact was on the

lane of the motorcycle and the deceased was thrown from the road and met

The trial court ruled that Destrajo did not exercise extraordinary diligence

his untimely death.

as the operator of the jeepney and ordered him to pay for the damages. Also

held AFISCO to be only secondarily liable and ordered it to reimburse Consequently, the heirs of Maglana, Sr., petitioners in this case, filed an

Destrajo whatever amount the latter shall have paid only up to the extent of action for damages and attorney's fees against operator Destrajo and the

its insurance coverage. Afisco Insurance Corporation (AFISCO) before the CFI of Davao. An

information for homicide through reckless imprudence was also filed

Whether or not the insurance company is directly and solidarily liable with

against Into.prcd

the negligent operator up to the extent of its insurance coverage. – YES.

During the pendency of the civil case, Into was sentenced to suffer an

The provisions in the insurance contract leads to no other conclusion but

indeterminate penalty of 1 year, 8 months and 1 day of prision correccional,

that AFISCO can be held directly liable by petitioners. The underlying

as minimum, to 4 years, 9 months and 11 days of prision correccional, as

reason behind the third party liability (TPL) of the Compulsory Motor

maximum and to indemnify the heirs of Maglana, Sr. in the amount of

Vehicle Liability Insurance is "to protect injured persons against the

P12,000.00 plus P5,000.00 in the concept of moral and exemplary damages

insolvency of the insured who causes such injury, and to give such injured

with costs. No appeal was interposed by the accused who later applied for

person a certain beneficial interest in the proceeds of the policy.”

probation. 2

But AFISCO is not solidarily liable with Destrajo.

The lower court rendered a decision finding that Destrajo had not exercised

In Malayan Insurance Co., Inc. v. Court of Appeals: While it is true that sufficient diligence as the operator of the jeepney. The Court found

where the insurance contract provides for indemnity against liability to third judgment in favor of the plaintiffs and against Destrajo, ordering him to pay

persons, such third persons can directly sue the insurer, however, the direct the former P28,000.00 for loss of income; P5,901.70 representing funeral

liability of the insurer under indemnity contracts against third party liability and burial expenses of the deceased; P5,000.00 as moral damages;

does not mean that the insurer can be held solidarily liable with the insured P3,000.00 as attorney's fees and the costs of suit. AFISCO was ordered to

and/or the other parties found at fault. The liability of the insurer is based reimburse Destrajo whatever amounts the latter shall have paid only up to

on contract; that of the insured is based on tort. the extent of its insurance coverage.

G.R. NO: 60506 PONENTE: Romero, J.

ARTICLE; TOPIC OF CASE: Nature of liability of joint tortfeasors DIGEST MAKER: Julia Real

B2022 REPORTS ANNOTATED VOL 32 [August 6, 1992]

Light Rail Transit Authority v. Navidad Light Rail Transit Authority v. Navidad

Petitioners filed a motion for the reconsideration of the second paragraph of 2. ....

the dispositive portion of the decision contending that AFISCO should not

3. In the event of the death of any person entitled to indemnity under this

merely be held secondarily liable because the Insurance Code provides that

Policy, the Company will, in respect of the liability incurred to such person

the insurer's liability is "direct and primary and/or jointly and severally with

indemnify his personal representatives in terms of, and subject to the terms

the operator of the vehicle, although only up to the extent of the insurance

and conditions hereof."

coverage. They argued that the P20,000.00 coverage of the insurance policy

issued by AFISCO, should have been awarded in their favor. AFISCO This leads to no other conclusion but that AFISCO can be held directly

argued that since the Insurance Code does not expressly provide for a liable by petitioners. As this Court ruled in Shafer vs. Judge, RTC of

solidary obligation, the presumption is that the obligation is joint. Olongapo City “where an insurance policy insures directly against liability,

the insurer's liability accrues immediately upon the occurrence of the injury

The lower court denied the motion for reconsideration ruling that since the

or event upon which the liability depends, and does not depend on the

insurance contract "is in the nature of suretyship, then the liability of the

recovery of judgment by the injured party against the insured." The

insurer is secondary only up to the extent of the insurance coverage."

underlying reason behind the third party liability (TPL) of the Compulsory

Petitioners filed a second motion for reconsideration reiterating that the Motor Vehicle Liability Insurance is "to protect injured persons against the

liability of the insurer is direct, primary and solidary with the jeepney insolvency of the insured who causes such injury, and to give such injured

operator because the petitioners became direct beneficiaries under the person a certain beneficial interest in the proceeds of the policy” Since

provision of the policy which, in effect, is a stipulation pour autrui. This petitioners had received from AFISCO the sum of P5,000.00 under the no-

motion was likewise denied for lack of merit.Cdpr fault clause, AFISCO's liability is now limited to P15,000.00.

Hence, the instant petition for certiorari which prays for the setting aside or However, we cannot agree that AFISCO is likewise solidarily liable with

modification of the second paragraph of the dispositive portion of the Destrajo.

assailed decision.

In Malayan Insurance Co., Inc. v. Court of Appeals, this Court had

III. Issue/s the opportunity to resolve the issue as to the nature of the liability

of the insurer and the insured vis-a-vis the third party injured in an

Whether or not the insurance company is directly and solidarily liable with

accident. We categorically ruled thus:

the negligent operator up to the extent of its insurance coverage. – YES.

While it is true that where the insurance contract provides for

IV. Ratio/Legal Basis

indemnity against liability to third persons, such third persons can

We grant the petition. directly sue the insurer, however, the direct liability of the insurer

The particular provision of the insurance policy on which petitioners base under indemnity contracts against third party liability does not

their claim is as follows: mean that the insurer can be held solidarily liable with the insured

and/or the other parties found at fault. The liability of the insurer is

SECTION 1 LIABILITY TO THE PUBLIC based on contract; that of the insured is based on tort.

1. The Company will, subject to the Limits of Liability, pay all sums In the case at bar, petitioner as insurer of Sio Choy, is liable to

necessary to discharge liability of the insured in respect of. respondent Vallejos (the injured third party), but it cannot, as be

(a) death of or bodily injury to any THIRD PARTY (b) .... made `solidarily' liable with the two principal tortfeasors, namely

Sio Choy and San Leon Rice Mill, Inc. For if petitioner-insurer

G.R. NO: 60506 PONENTE: Romero, J.

ARTICLE; TOPIC OF CASE: Nature of liability of joint tortfeasors DIGEST MAKER: Julia Real

B2022 REPORTS ANNOTATED VOL 32 [August 6, 1992]

Light Rail Transit Authority v. Navidad Light Rail Transit Authority v. Navidad

were solidarily liable with said 2 respondents by reason of the WHEREFORE, premises considered, the present petition is hereby

indemnity contract against third party liability — under which an GRANTED. The award of P28,800.00 representing loss of income is

insurer can be directly sued by a third party — this will result in a INCREASED to P192,000.00 and the death indemnity of P12,000.00 to

violation of the principles underlying solidary obligation and P50,000.00.

insurance contracts.” SO ORDERED.

The Court then proceeded to distinguish the extent of the liability and VI. Notes

manner of enforcing the same in ordinary contracts from that of insurance

Transcript

contracts. While in solidary obligations, the creditor may enforce the entire

obligation against one of the solidary debtors, in an insurance contract, the Hang on, what do you mean by secondary? Isn’t the nature of the liability

insurer undertakes for a consideration to indemnify the insured against loss, of AFISCO under the Third-Party Liability (TPL) insurance policy direct?

damage or liability arising from an unknown or contingent event. Thus, It’s direct. The Insurance Code provides that the insurer’s liability is “direct

petitioner therein, which, under the insurance contract is liable only up to and primary and/or jointly and severally with the operator of the vehicle,”

P20,000.00, cannot be made solidarily liable with the insured for the entire although only up to the extent of the insurance coverage.

obligation of P29,013.00 otherwise there would result "an evident breach of

How is it direct?

the concept of solidary obligation."

Atty. Jess Lopez: If you drive or if you purchase a car, you’re required by

Since under both the law and the insurance policy, AFISCO's liability is law to acquire insurance under a TPL, and as you’ll learn over the course in

only up to P20,000.00, the second paragraph of the dispositive portion of Insurance, the injured party may sue the insurer directly under TPL without

the decision in question may have unwittingly sown confusion among the a prior recourse against the insured party. So, here, the SC affirmed that

petitioners and their counsel. What should have been clearly stressed as to principle that the heirs of Maglana may sue the insurer directly without

leave no room for doubt was the liability of AFISCO under the explicit having to go through a prior recourse against Destrajo alone.

terms of the insurance contract.

SC Ruling: AFISCO is direct, but not solidarily liable with Destrajo.

In fine, we conclude that the liability of AFISCO based on the insurance

the direct liability of the insurer under indemnity contracts against TPL

contract is direct, but not solidary with that of Destrajo which is based on does not mean that the insurer can be held solidarily liable with the

Article 2180 of the Civil Code. As such, petitioners have the option either

to claim the P15,000 from AFISCO and the balance from Destrajo or 35

enforce the entire judgment from Destrajo subject to reimbursement from insured and/or the other parties found at fault. The liability of the insurer is

AFISCO to the extent of the insurance coverage. based on contract, while that of the insured is based on tort. And if insurer

were solidarily liable with the insured, this will result in a violation of the

While the petition seeks a definitive ruling only on the nature of AFISCO's

principles underlying solidary obligation and insurance contracts.

liability, we noticed that the lower court erred in the computation of the

probable loss of income. Using the formula: 2/3 of (80-56) x P12,000.00, it What does it mean when an obligation is solidary?

awarded P28,000.00. Upon recomputation, the correct amount is It means the creditor can run after any of the debtors for the entire

P192,000.00. Being a "plain error," we opt to correct the same. obligation.

Furthermore, in accordance with prevailing jurisprudence, the death

indemnity is hereby increased to P50,000.00. Except that, if you apply that principle against the insurer, what may

happen?

V. Disposition

G.R. NO: 60506 PONENTE: Romero, J.

ARTICLE; TOPIC OF CASE: Nature of liability of joint tortfeasors DIGEST MAKER: Julia Real

B2022 REPORTS ANNOTATED VOL 32 [August 6, 1992]

Light Rail Transit Authority v. Navidad Light Rail Transit Authority v. Navidad

Then the insurer will be liable for more than what is stated in the insurance

contract.

And that is not allowed because?

Because the insurer is only liable up to the extent of the insurance coverage.

What was the extent of the insurance coverage?

P20,000.00.

In the meantime, the insurer had already paid out how much?

P5,000.00.

So, there was P15,000.00 left under the insurance policy. So, according to

the Court, what are the options of the heirs of Maglana in this case?

The heirs of Maglana can either: (1) Go after AFISCO for the remaining

P15,000.00 and go after Destrajo for the remaining amount; or (2) Can

enforce the whole obligation against Destrajo, subject to Destrajo’s right of

reimbursement against AFISCO, but only to the extent of the insurance

coverage.

G.R. NO: 60506 PONENTE: Romero, J.

ARTICLE; TOPIC OF CASE: Nature of liability of joint tortfeasors DIGEST MAKER: Julia Real

Potrebbero piacerti anche

- Vda. de Maglana Et Al Vs Consolacion and Afisco Insurance GR NO. 60506 August 6, 1992Documento4 pagineVda. de Maglana Et Al Vs Consolacion and Afisco Insurance GR NO. 60506 August 6, 1992Marianne Shen PetillaNessuna valutazione finora

- Figuracion Vda de Maglana v. Hon. ConsolacionDocumento3 pagineFiguracion Vda de Maglana v. Hon. ConsolacionEzra Dan BelarminoNessuna valutazione finora

- 01 Vda de Maglana Vs IonDocumento3 pagine01 Vda de Maglana Vs IonKym Buena-RegadoNessuna valutazione finora

- Jose B. Guyo For Petitioners. Angel E. Fernandez For Private RespondentDocumento6 pagineJose B. Guyo For Petitioners. Angel E. Fernandez For Private Respondentmieai aparecioNessuna valutazione finora

- VDA DE MAGLANA VDocumento2 pagineVDA DE MAGLANA Vxerah0808Nessuna valutazione finora

- G.R. No. 60506 FIGURACION VDA. DE MAGLANA, Et - Al., vs. HONORABLE FRANCISCO Z. CONSOLACION, Et. Al.Documento4 pagineG.R. No. 60506 FIGURACION VDA. DE MAGLANA, Et - Al., vs. HONORABLE FRANCISCO Z. CONSOLACION, Et. Al.christopher d. balubayanNessuna valutazione finora

- 59 Vda de Maglana V ConsolacionDocumento6 pagine59 Vda de Maglana V ConsolacionRoland ApareceNessuna valutazione finora

- Vda. de Maglana v. Hon. ConsolacionDocumento1 paginaVda. de Maglana v. Hon. ConsolacionBinkee VillaramaNessuna valutazione finora

- Insurance Law Case DigestsDocumento65 pagineInsurance Law Case DigestsPaul Tristan Sato100% (2)

- Part I. Indemnity For DeathDocumento65 paginePart I. Indemnity For Deathabi_robeniolNessuna valutazione finora

- Part I. Indemnity For DeathDocumento65 paginePart I. Indemnity For DeathjohnmiggyNessuna valutazione finora

- 8 - Figuracion Vda. de Maglana Vs ConsolacionDocumento6 pagine8 - Figuracion Vda. de Maglana Vs ConsolacionVincent OngNessuna valutazione finora

- Vda. de Maglana Vs Hon. Consolacion and Afisco Insurance Corp (1992)Documento1 paginaVda. de Maglana Vs Hon. Consolacion and Afisco Insurance Corp (1992)Henri VasquezNessuna valutazione finora

- Vda. de Maglana vs. Hon. ConsolacionDocumento1 paginaVda. de Maglana vs. Hon. ConsolacionZaira Gem GonzalesNessuna valutazione finora

- Maglana V ConsolacionDocumento1 paginaMaglana V ConsolacionninaNessuna valutazione finora

- VDA de Maglana vs. ConsolacionDocumento1 paginaVDA de Maglana vs. ConsolacionJoel FerrerNessuna valutazione finora

- Insurance Case DigestsDocumento4 pagineInsurance Case DigestsBing MiloNessuna valutazione finora

- Fieldmen's Insurance Co. v. Vda. de SongcoDocumento2 pagineFieldmen's Insurance Co. v. Vda. de SongcoIldefonso Hernaez100% (1)

- Fieldmen's Insurance Co., Inc. vs. Vda. de SongcoDocumento8 pagineFieldmen's Insurance Co., Inc. vs. Vda. de SongcoYeu GihNessuna valutazione finora

- Insurance #4 Travellers V CA GR 82036 May 22 1997Documento1 paginaInsurance #4 Travellers V CA GR 82036 May 22 1997RoseNessuna valutazione finora

- Vda de Maglana vs. ConsolacionDocumento2 pagineVda de Maglana vs. ConsolacionHABUYO, SARAH MAE L.Nessuna valutazione finora

- Coquia v. Fieldmen S Insurance Co. Inc. 23276Documento6 pagineCoquia v. Fieldmen S Insurance Co. Inc. 23276Mary LeandaNessuna valutazione finora

- Plaintiffs-Appellees vs. vs. Defendant-Appellant Antonio de Venecia Rufino JavierDocumento6 paginePlaintiffs-Appellees vs. vs. Defendant-Appellant Antonio de Venecia Rufino JavierVirgil SawNessuna valutazione finora

- De Maglana Vs Consolacion Aug 6, 1992Documento1 paginaDe Maglana Vs Consolacion Aug 6, 1992Alvin-Evelyn GuloyNessuna valutazione finora

- Torts & Damages - Cases Batch 1Documento45 pagineTorts & Damages - Cases Batch 1Kaye100% (1)

- Vda. de Maglana Vs ConsolacionDocumento2 pagineVda. de Maglana Vs ConsolacionNC BergoniaNessuna valutazione finora

- Fieldmen's Insurance Co., Inc. vs. Vda. de SongcoDocumento1 paginaFieldmen's Insurance Co., Inc. vs. Vda. de Songcomack100% (1)

- Johaina Rule 2 FullDocumento33 pagineJohaina Rule 2 FullJoh MadumNessuna valutazione finora

- Finman General Assurance Corporation vs. Court of Appeals 213 SCRA 493 September 2, 1992Documento4 pagineFinman General Assurance Corporation vs. Court of Appeals 213 SCRA 493 September 2, 1992JayNessuna valutazione finora

- Cha vs. Court of AppealsDocumento5 pagineCha vs. Court of Appeals유니스Nessuna valutazione finora

- 1 23Documento9 pagine1 23Sam SamNessuna valutazione finora

- VOL. 25, SEPTEMBER 23, 1968 71: Fieldmen's Insurance Co., Inc. vs. Vda. de SongcoDocumento5 pagineVOL. 25, SEPTEMBER 23, 1968 71: Fieldmen's Insurance Co., Inc. vs. Vda. de Songcoceilo coboNessuna valutazione finora

- Insurance Law Case DigestsDocumento80 pagineInsurance Law Case DigestsVincent ArnadoNessuna valutazione finora

- MALAYAN INSURANCE CO., INC., Petitioner, vs. Philippines First Insurance Co., Inc. and Reputable Forwarder Services, INC., RespondentsDocumento18 pagineMALAYAN INSURANCE CO., INC., Petitioner, vs. Philippines First Insurance Co., Inc. and Reputable Forwarder Services, INC., RespondentsdanexrainierNessuna valutazione finora

- #4 Fieldsman Vs Vda de SongcoDocumento2 pagine#4 Fieldsman Vs Vda de SongcoDon SumiogNessuna valutazione finora

- Fieldmen's Insurance Co., Inc. vs. Vda. de Songco, Et Al.Documento2 pagineFieldmen's Insurance Co., Inc. vs. Vda. de Songco, Et Al.Maria TalaNessuna valutazione finora

- Travellers Insurance v. CADocumento4 pagineTravellers Insurance v. CAAngelie Maningas100% (1)

- Fieldmen's Insurance Co. v. Vda. de SongcoDocumento2 pagineFieldmen's Insurance Co. v. Vda. de SongcoRandy SiosonNessuna valutazione finora

- Equitable Leasing Corp V SuyomDocumento12 pagineEquitable Leasing Corp V SuyomStruggling StudentNessuna valutazione finora

- Torts ReviewerDocumento121 pagineTorts ReviewerJingJing Romero100% (9)

- Eastern Assurance v. IAC, G.R. No. L-69450 (1989)Documento5 pagineEastern Assurance v. IAC, G.R. No. L-69450 (1989)YanilyAnnVldzNessuna valutazione finora

- Plaintiffs-Appellees Defendant-Appellant Antonio de Venecia Rufino JavierDocumento6 paginePlaintiffs-Appellees Defendant-Appellant Antonio de Venecia Rufino JavierNikki PanesNessuna valutazione finora

- Life, Accident and Health Insurance in the United StatesDa EverandLife, Accident and Health Insurance in the United StatesValutazione: 5 su 5 stelle5/5 (1)

- Principles of Insurance Law with Case StudiesDa EverandPrinciples of Insurance Law with Case StudiesValutazione: 5 su 5 stelle5/5 (1)

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyDa EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNessuna valutazione finora

- Property, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Da EverandProperty, Liability and Auto Insurance: A Handbook and Guide for Insurance Concepts and Coverage!Valutazione: 5 su 5 stelle5/5 (1)

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Da EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Nessuna valutazione finora

- Starting An Independent Insurance Agency Made EasyDa EverandStarting An Independent Insurance Agency Made EasyNessuna valutazione finora

- Chapter 13 Bankruptcy in the Western District of TennesseeDa EverandChapter 13 Bankruptcy in the Western District of TennesseeNessuna valutazione finora

- First Demand Guarantees: The relevance of Fraud and Illegality in the English and Italian JurisdictionsDa EverandFirst Demand Guarantees: The relevance of Fraud and Illegality in the English and Italian JurisdictionsNessuna valutazione finora

- Gillespie Management Corp. v. Terrace PropertiesDocumento1 paginaGillespie Management Corp. v. Terrace PropertiesJulia Camille RealNessuna valutazione finora

- Heritage Hotel v. SecretaryDocumento2 pagineHeritage Hotel v. SecretaryJulia Camille RealNessuna valutazione finora

- Duncan v. Neptunia Corp.Documento2 pagineDuncan v. Neptunia Corp.Julia Camille RealNessuna valutazione finora

- Case Name: Adderson v. Adderson Citation: 36 DLR (4th) 631 (Alta. CA) Date of Decision: 1987 Origin According To Syllabus: Canadian Case DoctrineDocumento2 pagineCase Name: Adderson v. Adderson Citation: 36 DLR (4th) 631 (Alta. CA) Date of Decision: 1987 Origin According To Syllabus: Canadian Case DoctrineJulia Camille RealNessuna valutazione finora

- Maharanee of Baroda v. WildensteinDocumento2 pagineMaharanee of Baroda v. WildensteinJulia Camille RealNessuna valutazione finora

- Benguet Electric Cooperative v. Ferrer-CallejaDocumento1 paginaBenguet Electric Cooperative v. Ferrer-CallejaJulia Camille RealNessuna valutazione finora

- Manila Electric Company v. Secretary of Labor and EmploymentDocumento1 paginaManila Electric Company v. Secretary of Labor and EmploymentJulia Camille Real0% (1)

- American Case Name: Rathbone v. Coe Citation: 50 N.W. 620 Date of Decision: October 10, 1888 Origin According To Syllabus: American Case DoctrineDocumento2 pagineAmerican Case Name: Rathbone v. Coe Citation: 50 N.W. 620 Date of Decision: October 10, 1888 Origin According To Syllabus: American Case DoctrineJulia Camille RealNessuna valutazione finora

- Employees Union of Bayer v. BayerDocumento8 pagineEmployees Union of Bayer v. BayerJulia Camille RealNessuna valutazione finora

- Milliken V Pratt RealDocumento8 pagineMilliken V Pratt RealJulia Camille RealNessuna valutazione finora

- Samahan NG Manggagawa Sa Hanjin Shipyard v. BLRDocumento2 pagineSamahan NG Manggagawa Sa Hanjin Shipyard v. BLRJulia Camille RealNessuna valutazione finora

- Eagle Ridge Golf and Country Club v. CADocumento2 pagineEagle Ridge Golf and Country Club v. CAJulia Camille RealNessuna valutazione finora

- Kapatiran Sa Meat and Canning Division v. Ferrer-CallejaDocumento1 paginaKapatiran Sa Meat and Canning Division v. Ferrer-CallejaJulia Camille RealNessuna valutazione finora

- Acosta v. CADocumento1 paginaAcosta v. CAJulia Camille RealNessuna valutazione finora

- Samahang Manggagawa Sa Charter Chemical (SMCC-SUPER) v. Charter Chemical and Coating Corp.Documento2 pagineSamahang Manggagawa Sa Charter Chemical (SMCC-SUPER) v. Charter Chemical and Coating Corp.Julia Camille RealNessuna valutazione finora

- AIM v. AIM Faculty AssociationDocumento1 paginaAIM v. AIM Faculty AssociationJulia Camille RealNessuna valutazione finora

- Samahang Manggagawa Sa Charter Chemical (SMCC-SUPER) v. Charter Chemical and Coating Corp.Documento2 pagineSamahang Manggagawa Sa Charter Chemical (SMCC-SUPER) v. Charter Chemical and Coating Corp.Julia Camille RealNessuna valutazione finora

- Holy Child Catholic School v. HCCS-TELU-PIGLASDocumento2 pagineHoly Child Catholic School v. HCCS-TELU-PIGLASJulia Camille RealNessuna valutazione finora

- S.S. Ventures International v. S.S. Ventures Labor UnionDocumento2 pagineS.S. Ventures International v. S.S. Ventures Labor UnionJulia Camille RealNessuna valutazione finora

- NUWHRAIN-Manila Pavilion Hotel Chapter v. SecretaryDocumento2 pagineNUWHRAIN-Manila Pavilion Hotel Chapter v. SecretaryJulia Camille RealNessuna valutazione finora

- San Miguel Corporation Employees Union-Philippine Transport and General Workers Organization v. San Miguel Packaging Products Employees UnionPambansang Diwa NG Manggagawang PilipinoDocumento2 pagineSan Miguel Corporation Employees Union-Philippine Transport and General Workers Organization v. San Miguel Packaging Products Employees UnionPambansang Diwa NG Manggagawang PilipinoJulia Camille RealNessuna valutazione finora

- SJC V Miranda Case DigestDocumento3 pagineSJC V Miranda Case DigestJulia Camille RealNessuna valutazione finora

- Grandteq Industrial Steel Products Inc v. Margallo Case DigestDocumento4 pagineGrandteq Industrial Steel Products Inc v. Margallo Case DigestJulia Camille RealNessuna valutazione finora

- CICL v. People Case DigestDocumento5 pagineCICL v. People Case DigestJulia Camille Real100% (3)

- Torio V Fontanilla Case DigestDocumento4 pagineTorio V Fontanilla Case DigestJulia Camille RealNessuna valutazione finora

- Tan V Valeriano Case DigestDocumento3 pagineTan V Valeriano Case DigestJulia Camille RealNessuna valutazione finora

- FGU Insurance V SarmientoDocumento3 pagineFGU Insurance V SarmientoJulia Camille RealNessuna valutazione finora

- Conquilla V Judge BernardoDocumento10 pagineConquilla V Judge BernardoYram DulayNessuna valutazione finora

- Maneka Gandhi CasenoteDocumento5 pagineManeka Gandhi Casenotesorti nortiNessuna valutazione finora

- Professional Ethics Law Course File-1Documento23 pagineProfessional Ethics Law Course File-1Kshamaa KshamaaNessuna valutazione finora

- (PubCorp) 6 - PNCC V Pabion - ParafinaDocumento4 pagine(PubCorp) 6 - PNCC V Pabion - ParafinaAlecParafinaNessuna valutazione finora

- National Steel Corp Vs CA (Digested)Documento2 pagineNational Steel Corp Vs CA (Digested)Lyn Lyn Azarcon-Bolo100% (4)

- Limitations On The Power of TaxationDocumento5 pagineLimitations On The Power of TaxationAnonymous LtbnZ46zUdNessuna valutazione finora

- MarriageDocumento25 pagineMarriagesagar sehrawat HERONessuna valutazione finora

- 4D Classes of InsuranceDocumento19 pagine4D Classes of InsuranceNurul SyazwaniNessuna valutazione finora

- CIRTEKDocumento11 pagineCIRTEKMIKAELA THERESE OBACHNessuna valutazione finora

- Notice of DeathDocumento3 pagineNotice of DeathSalva Maria0% (1)

- ASLARONA V ECHAVEZDocumento2 pagineASLARONA V ECHAVEZCheza BiliranNessuna valutazione finora

- W&L Article ReviewDocumento5 pagineW&L Article Reviewchethan gowdaNessuna valutazione finora

- First Optima Realty Corporation vs. Securitron Security Services, Inc., 748 SCRA 534, January 28, 2015Documento20 pagineFirst Optima Realty Corporation vs. Securitron Security Services, Inc., 748 SCRA 534, January 28, 2015Mark ReyesNessuna valutazione finora

- Crimsocio Notes RKM 1Documento159 pagineCrimsocio Notes RKM 1Carlo Jay CajandabNessuna valutazione finora

- Comfort Dental vs. Dr. Sally PrestonDocumento5 pagineComfort Dental vs. Dr. Sally PrestonDentist The MenaceNessuna valutazione finora

- WP-326-22.doc: Digitally Signed by Balaji Govindrao Panchal Date: 2022.10.15 14:28:22 +0530Documento4 pagineWP-326-22.doc: Digitally Signed by Balaji Govindrao Panchal Date: 2022.10.15 14:28:22 +0530SHAURYASINGH CHOWHANNessuna valutazione finora

- Mock Trial HandoutDocumento2 pagineMock Trial Handoutapi-334810559Nessuna valutazione finora

- Chapter 4 2021 NteboDocumento16 pagineChapter 4 2021 NteboNaya Naledi MokoanaNessuna valutazione finora

- StAR - Stolen Asset Recovery Initiative - Corruption Cases - Mansur Ul-HaqDocumento2 pagineStAR - Stolen Asset Recovery Initiative - Corruption Cases - Mansur Ul-Haqسید ہارون حیدر گیلانیNessuna valutazione finora

- Interim Report of Raju Ramachandran On Gujarat RiotsDocumento13 pagineInterim Report of Raju Ramachandran On Gujarat RiotsCanary TrapNessuna valutazione finora

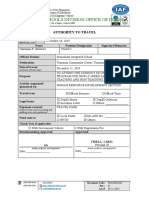

- Schools Division Office of Isabela: Authority To TravelDocumento1 paginaSchools Division Office of Isabela: Authority To TravelCharmaine Paragas GalleneroNessuna valutazione finora

- A Sample Set of NGO byDocumento4 pagineA Sample Set of NGO bySana WaheedNessuna valutazione finora

- Lakeport City Council AgendaDocumento2 pagineLakeport City Council AgendaLakeCoNewsNessuna valutazione finora

- Cover Sheet For AssignmentDocumento1 paginaCover Sheet For AssignmentShanu Shahina0% (1)

- MPEP E8r7 - 2200 - Prior Art Citation & Ex Parte ReexamDocumento170 pagineMPEP E8r7 - 2200 - Prior Art Citation & Ex Parte ReexamespSCRIBDNessuna valutazione finora

- Digest Tax CasesDocumento6 pagineDigest Tax CasesharveypugongNessuna valutazione finora

- The Gift Tax Act 1990Documento6 pagineThe Gift Tax Act 1990mislam_888881848Nessuna valutazione finora

- HMROA Bylaws (Abridged)Documento5 pagineHMROA Bylaws (Abridged)cab0rtzNessuna valutazione finora

- General Assembly: United NationsDocumento6 pagineGeneral Assembly: United NationsNarayan SharmaNessuna valutazione finora

- Triple TalaqDocumento11 pagineTriple Talaqyashwanth singhNessuna valutazione finora