Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Smart Tech Portfolio

Caricato da

Prometheus1787Descrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Smart Tech Portfolio

Caricato da

Prometheus1787Copyright:

Formati disponibili

The Applied Finance Group, Ltd.

January 21, 2011

“Smart” Tech, Smart Ideas

The 2011 CES

The Applied Finance Group, Ltd.

105 W. Adams, Suite 2105

Chicago, IL 60603

(312) 362-9903

support@afgltd.com

Research

“Smart” Tech, Smart Ideas: The 2011 CES

“Smart” Tech, Smart Ideas: The 2011 CES

The International Consumer Electronics Show (CES) held every year in Las Vegas is currently

Andrew McFadden

the largest consumer technology tradeshow in the world. This year’s show featured 2,700 Research Analyst

exhibitors, and it is estimated that over 140,000 industry professionals were in attendance. (559) 892-0409

Such craze underscores the importance of understanding the future of technology and

consumer electronics through this venue, which we believe provides very valuable information amcfadden@afgltd.com

for investing in the technology segment. And just for the record, the hype surrounding this show

almost does not do it justice: the innovation on display at many of the exhibits was simply

remarkable. It’s almost as if you have taken a time machine into the future 3 years to see what Kevin Khoong

the mainstream consumer electronics world will look like. This year, the innovations at CES

ranged from “smart” phones to “smart” cars, the majority of which encompassed the idea of Research Analyst

connecting with “the cloud.” And while many of these new technologies will probably need a fair (559) 892-0408

amount of fine-tuning before they are sold in mass amounts to consumers, we got a pretty good

idea about where consumer electronics and technology markets are heading. CEA President

kkhoong@afgltd.com

Gary Shapiro said the Consumer Electronics industry is expected to grow 3% in 2011 to $186

billion – its highest mark ever – on the fast-growing success of tablets, smartphones, e-readers,

and other connected devices. It is our goal with this report to give you a better understanding of

these underlying trends, as well as a list of companies which we believe have interesting

opportunities to capitalize in these areas.

It’s all about the Tablets!

As extensively reported, the biggest wave of new products at CES centered around the tablet

device. While north of 100 tablet introductions had been expected, the actual number came in

around 80 – still very impressive considering this product category is in its infancy with only one

such successful launch thus far (iPad). However, with 17 million tablets sold worldwide in less

than 9 months in 2010, and millions of consumers aching to get their hands on one,

manufacturers everywhere have quickly realized that capturing even a small piece of this

burgeoning market would be worth the risk and investment. The exhibits at CES were proof of

that. Asus, Acer, LG, Samsung, Research in Motion, Motorola, Lenovo, and others all

introduced their tablet devices during the show, with the majority running on the Android

platform (a fair amount of the others ran on Windows 7). Part of the reason why the tablet is

gaining so much traction is that devices of this screen size have gone relatively missing to date,

with smartphones dominating the 3-5 inch size, PCs dominating the 15-25 inch size, and TV

dominating the 25-60 inch size. Thus, devices of 5-15 inches have been relatively non-existent

until recently (at least in a mass market sense), and it appears consumers are voting for tablets

over netbooks. Tablets provide a screen big enough to surf the net and watch quality videos (as

opposed to watching them on a minute 4 inch smartphone screen) but without the added

hardware weight that comes with a PC.

And as we learned from experts of the CEA, if you can dominate a screen size, you have the

potential to sell tens of millions of units per year (as Apple’s iPad has already shown). In fact,

tablet sales are already expected to double in 2011, based on conservative projections. And by

2014, tablets are expected to account for 32% of all computer shipments. It appears to be a

consensus expectation that tablet devices are here to stay, unlike many other devices

introduced at CES in past years (i.e. DigiScents’ iSmell). However, we must point out that CEA

chief economist Shawn DuBravac predicted that growth estimates for tablets in the coming year

or two are overstated and show little regard for supply chain dynamics. He believes that tablet

sales will follow more of an S-shaped adoption curve, like all consumer electronic products have

done in the past (current market projections dictate more of a linear production curve for

tablets). But while this may make for some rocky movements in tablet sales predictions, the

long-term projections are intact, and it would be silly to not try to gain exposure to this market at

such an early point in the game. We will talk further about potential investment ideas towards

the end of the report.

www.AFGView.com The Applied Finance Group, Ltd. Page 2 of 10

Research

“Smart” Tech, Smart Ideas: The 2011 CES

Wait a second… what about Smartphones?

While tablets were the hottest product at CES because of their “new-ness,” that does not take away from the fact that there

were also an abundance of new smartphones introduced by many industry stalwarts (LG, HTC, Samsung, Motorola, etc).

But the most exciting news surrounding these devices was not only the hardware (i.e. the Motorola Atrix smartphone sports

an Nvidia dual-core microchip – more processing power than the laptop you owned four years ago), but also revolves

around their ability to access 4G networks as well as the further development of Applications. Verizon, for example,

introduced several new smartphones that will run on its LTE-based 4G network, which runs at speeds up to 10 times faster

than 3G. In addition, these phones enjoy a new Skype app, which allows for video conferencing. Other creative apps were

also introduced at the show, including ones that can read your blood pressure when your phone is connected to a device

that fits around your arm. Another app we saw would turn your smartphone into a remote control for your television. The

primary trend underlying all of this app development is the personalization of consumer electronics. Manufacturers and

software developers are striving to make the smartphone experience more useful to each and every consumer. This can

happen as the smartphone learns to serve more of your needs and learn “who you are” as a consumer so that it can be a

real-life guide that adds value to many aspects of your life. The last major development connected with smartphones

illustrated at the show is the type of sensors integrated into each device which allow for different functions: capacitative and

resistive touchscreens, microphones, cameras, accelerometers, gyroscopes, compasses, pressure sensors, etc. We

believe this will be an area of significant innovation and adoption going forward as the smartphone has become the most

popular consumer electronics device in the world today. CEA experts agree, noting that smartphones have reached 39%

penetration in the U.S. in just a few short years, but still have plenty of growth opportunities as standard feature cell phones

have a penetration rate of 91%. The CEA expects smartphone units to grow at an annual rate of roughly 12% through

2014.

Into the 3rd Dimension

Also in abundance at CES were 3DTV’s, a technology which is producing an awe-inspiring experience. Toshiba even

introduced a 3DTV that did not require glasses. For 2011, CEA experts expect 1.9 million 3DTVs to be sold, up 67% from

2010. However, 3DTV is not even close to mass adoption, as the content available is limited. In fact, based on a market

survey conducted by CEA, 37% of shoppers said they are unsure if they would ever purchase a 3DTV, 19% said they

would never purchase one, and only 25% said they would purchase a 3DTV in the next 3 years. The limited 3D content

does not justify purchasing the TV let alone the inconvenience of wearing expensive 3D glasses. Therefore, while we are in

awe of the 3D experience, and expect to see 3D gain more popularity over the coming years, a mass-adoption of the

product appears to be quite a few years away, hinging on the availability of content. One thing that could speed that

process is the adoption of 3D gaming, which essentially redefines the gaming experience.

The Smart era of TV

Another type of TV in abundance at CES, which already offers a fair amount of content and therefore seems poised to grab

hold of the consumer market in the nearer future, was the “connected” TV, meaning TV connected to the internet. Unit

sales increased over 150% in 2010, to 3.2 million – a reassuring sign. In all actuality, “connected” devices – not just TVs –

were the most prominent theme throughout the whole show, an exciting development that we think will materialize rapidly

in the decade to come. Imagine this: A world where every device is connected to the internet; whether it’s a washing

machine, refrigerator, camera, phone, TV, radio, clock, car, air conditioning, home security system, etc. Now imagine the

possibilities. All of these devices will be able to seamlessly transfer data to the cloud (since they are all “connected”), which

will allow you to do things like manage your energy consumption, transfer photos to Facebook or to a printer directly from

your camera, download a song that you hear on your car radio directly to your playlist in the cloud, or view ingredients on

your smart grocery cart needed to make a recipe a friend just recommended. The key word here is “connected.” The TV

will more than likely play a pivotal role in this circle of connected devices, while the smartphone will likely be the central

device, as it is the most convenient to carry around. Connected TV unit shipments are expected to grow at an annual rate

of approximately 47% through 2014, according to CEA experts, following an S-shaped adoption curve.

All of these connected devices will require faster, stronger, and larger networks, much more software innovation, and a

way to integrate them on a platform that allows for easy communication with the cloud. And the exciting thing is, the more

we use these connected devices, the more in tune they will become with our lifestyles, and will therefore be able to make

recommendations to make our lives easier and our experiences more enjoyable.

www.AFGView.com The Applied Finance Group, Ltd. Page 3 of 10

Research

“Smart” Tech, Smart Ideas: The 2011 CES

Companies at the forefront of the “Smart” trends

Now we’ve given you a respectable view from the clouds (no pun intended) of all that is going on in the consumer

electronics world, we would like to identify companies that impressed at CES and/or are well-positioned to benefit from

these trends. Please see the list below:

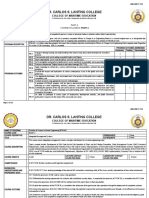

The List of “Smart” Companies

as of 1/20/2011 close

Mkt. Cap Sales Growth % Sales Growth EBITDA % (5 EBITDA %

Ticker Company Name (mil) (5 yr median) % (LFY) yr median) (LFY) MQ AFG Recommendation

Semiconductor Companies

MRVL MARVELL TECHNOLOGY GROUP LTD. $ 13,810 29.4 -4.8 5.9 12.7 1 Strong Buy

BRCM BROADCOM CORPORATION $ 23,763 11.3 -3.6 6.8 4.5 1 Buy

TXN TEXAS INSTRUMENTS INCORPORATED $ 40,109 -2.9 -16.6 21.5 21.1 1 Strong Buy

STM STMICROELECTRONICS NV $ 10,429 1.4 -13.5 3.7 -12.2 0.5 Strong Buy

SNDK SANDISK CORPORATION $ 12,077 19.6 6.4 12.9 12.9 1 Buy

CY CYPRESS SEMICONDUCTOR CORPORA $ 3,391 -6.5 -12.8 -6.0 -20.1 0 Neutral

QCOM QUALCOMM INCORPORATED $ 84,050 17.9 5.5 32.0 29.9 1 Sell

ATML ATMEL CORPORATION $ 6,382 -1.9 -22.3 2.1 -1.8 0 Neutral

Networking Companies

ALU ALCATEL-LUCENT SA $ 7,300 1.7 -15.3 -0.3 -2.1 0.5 Strong Buy

CSCO CISCO SYSTEMS INCORPORATED $ 116,113 13.2 10.9 23.9 22.9 1 Neutral

Processor Companies

NVDA NVIDIA CORPORATION $ 13,020 18.2 -2.9 14.9 -3.0 1 Neutral

ARMH ARM HOLDINGS PLC $ 11,335 6.4 -13.0 15.4 15.4 1 Neutral

OS Companies

GOOG GOOGLE INC. $ 201,676 56.5 7.0 33.9 34.2 1 Neutral

MSFT MICROSOFT CORPORATION $ 243,760 11.3 6.1 39.0 39.0 1 Neutral

Hardware Companies

MMI MOTOROLA MOBILITY HOLDINGS INC $ 10,673 -35.4 -35.4 -9.6 -8.6 0.5 Neutral

GLW CORNING INC $ 30,650 13.0 -9.3 17.4 11.8 1 Strong Buy

The trends discussed in this report are fast developing, and companies mentioned could see their competitive positioning

change quickly. We are avid observers of the “connected-ness” and hope you embrace the new technologies and the

great potential they bring like we do. We hope you keep a close eye on the stocks listed, looking for the best fit for your

portfolio.

www.AFGView.com The Applied Finance Group, Ltd. Page 4 of 10

Research

Semiconductor Companies

MRVL – Although Marvell is not among the most chased companies at CES, we believe there is

something to be said about the “unsexy” components made by Marvell which allow these ramping

devices to run smoothly. What we like most about Marvell is that its chips allow for connectivity of

devices and communication between devices – a trend that should begin to catch storm as more

applications are developed.

BRCM – Broadcom received a lot of attention at CES, as its chips can be found in various

smartphones, tablets, and other “connected” devices. Broadcom’s products continue to do especially

well in the Bluetooth and WiFi product arenas. Connectivity is the biggest trend in consumer

electronics devices, and will benefit companies like Broadcom for years to come.

TXN - Microsoft stated it has been working with TXN on an ARM-based processor (OMAP) for its

next generation operating system (along with NVDA and QCOM). With TXN providing

semiconductors for smartphones and tablets, basestations for wireless networks, as well as several

other “connected” electronics devices (including automotives), the company is well positioned to

capitalize on the developing trends.

STM – STM produces semiconductors for several products and applications including 3DTV,

“Connected” TV, and home connectivity. With areas of focus like these, the company has exposure

to several key areas that we saw growing in popularity at CES.

SNDK – Sandisk is an obvious beneficiary of the growing popularity of smartphones and tablets, as

its flash-based storage products are in major demand. As consumers look for more convenient ways

to take their digital lives with them, flash storage will become more and more necessary to support

light-weight devices capable of storing a fair amount of data.

CY – Cypress makes touch controllers that go inside of mobile devices, primarily smartphones.

Cypress has a lot of opportunity for growth, and should benefit as Motorola Mobility begins

diversifying its touch controller suppliers. As the market for touch screen devices expands, Cypress

should be able to benefit.

QCOM –The Company showcased several new tablets and smartphones powered by its

Snapdragon family of processors. The expanding Snapdragon portfolio includes dual-CPU chips

with high-performance processing and full HD graphic capabilities for the next generation of tablets

and devices, as well as the only LTE and HSPA+ multi-mode chipsets.

ATML – Atmel is the dominate leader in terms of touch controllers within tablets, and can be found in

Motorola Mobility’s yet to be released Xoom. It was also mentioned that Atmel could be found in just

about every tablet running Nvidia’s Tegra processor, another great sign.

www.AFGView.com The Applied Finance Group, Ltd. Page 5 of 10

Research

Networking Companies

ALU - As the only infrastructure provider to be providing all three elements of Verizon Wireless' 4G

LTE Mobile Broadband network – LTE Radio Access Network (RAN)/Enhanced Packet Core (EPC)/IP

Multi-Media Subsystem (IMS), plus the mobile backhaul solution – ALU appears committed to laying

the groundwork to provide the “connected” customer experience. ALU, like Cisco, will benefit from the

huge demand for networking due to the mass amounts of “connected” devices and their high quality of

content.

CSCO - At CES, Cisco unveiled its solution for service providers, which seamlessly pulls together free

and paid programming, video on demand, and videoconferencing, all in a single unit, which plugs right

into your set-top box. However, this is a product that we believe still needs some fine-tuning, though it

could still end up having a very significant market presence. The more important idea to note is that

Cisco is still the dominant vendor in 6 of the 16 main networking technologies. And if one thing is for

sure, with all of these “connected” devices being introduced and becoming mainstream, an incredibly

powerful network is needed to support it all. Cisco, in its leadership position, is capable of providing

the powerful network and poised to benefit.

www.AFGView.com The Applied Finance Group, Ltd. Page 6 of 10

Research

Computer Processor Companies

NVDA – We were most enamored at Nvidia’s exhibit at the conference. The company is a pioneer in

graphics, and has also begun making chips used as the central processor for Android smartphones

and tablets, which is very exciting (Google chose Tegra – an NVDA processor – as the lead vendor for

its Honeycomb OS update for tablets). Also, the company is developing an ARM-based CPU which

will eventually go into laptops and other devices. Lastly, the company is developing 3D graphics

solutions for gaming, photography, and video. For all the trends we mentioned, NVDA has the potential

to make a big splash and transform the entire company. Due to this potential, NVDA shares have

appreciated nearly 50% YTD and currently do not possess loads of upside. However, we believe the

latest consensus estimates could have underestimated the company’s growth potential, and urge you

to keep a very close eye on NVDA.

ARMH - Microsoft announcement that it would develop Windows Operating Systems compatible with

chips designed by ARM was obviously bigger for ARM than it was for Microsoft, attesting to the

success the company has achieved in the smartphone and tablet space. Chips designed by ARM are

likely to continue to transform the market in the years to come.

www.AFGView.com The Applied Finance Group, Ltd. Page 7 of 10

Research

Operating System Companies

GOOG – It seemed like just about every device that was introduced at CES used the Android operating

system. This was enough to attest to the rapid success Android has already achieved, and with the

lack of a serious competitor so far, Android will likely remain the primary OS of choice for all mobile

device manufacturers other than Apple, RIMM, and HP. As the smartphone, tablet, and connected TV

product segments continue to grow, Google will be one of the primary beneficiaries reaping advertising

revenues, assuming it will keep Android free.

MSFT – Microsoft CEO Steve Balmer made a big splash at his keynote, showing how the new motion-

sensing Kinect device, which attaches to the Xbox 360, is a lot of fun. The Kinect has racked up $1

billion in sales in just two months (8 million units vs. the company predicted 5 million units). Also,

Balmer interacted with one of the newer Windows smartphones and touted the rapid adoption of

Windows 7 on PCs. He also announced that Microsoft plans to design a Windows operating system

compatible with chips designed by ARM – the dominant producer of chips for smartphones and tablets.

All were great announcements/displays for the company, but the elephant in the room was Microsoft’s

unnoticeable presence in the ever-popular tablet devices. Google’s Android stole the show, and with

Apple’s iPad already leading by a large distance in the space, Microsoft’s lacking presence might be an

ominous sign for the company’s PC business.

www.AFGView.com The Applied Finance Group, Ltd. Page 8 of 10

Research

Hardware Companies

MMI – Motorola Mobility made the biggest splash of the hardware manufacturers, introducing 2

sleek and powerful new smartphones (Atrix and the Droid Bionic) and an iPad-rivaling tablet

(Xoom). The Xoom won CNET’s best in show and is based on Android’s tablet-focused

Honeycomb OS. The Atrix smartphone is equipped with a dual-core processor, touted as “the

world’s most powerful smartphone.” Motorola has developed a close relationship with Android,

and has witnessed a resurgence within its mobile business because of it. We continue to expect

Motorola Mobility to remain at the forefront on the mobile device world, backed by its rejuvenated

innovation and marketing.

GLW – Corning’s Gorilla Glass is being found in all types of new devices, primarily smartphones

and tablets, but also Microsoft’s new “Surface” table. The glass is thin and durable, exactly the

prescription needed for these oft-used but extremely mobile devices. Gorilla Glass is already

used in 20% of the phone market and is used for both the iPhone and iPad. Because of its

impressive uses so far, Gorilla Glass or variations of it will likely be found in all sorts of devices in

the years ahead, which bodes well for the company’s growth prospects.

www.AFGView.com The Applied Finance Group, Ltd. Page 9 of 10

Research

Disclaimer

The Applied Finance Group, Ltd. certifies that the views expressed in this report accurately reflect the firm’s

models. The information in this report is based on material we believe to be accurate and reliable, however, the

accuracy and completeness of the material and conclusions derived from said material in this report are not

guaranteed. The information in this report is not intended to be used as the primary basis of investment

decisions, and The Applied Finance Group, Ltd. makes no recommendation as to the suitability of such

investments for any person. Any opinions and projections expressed herein reflect our judgment at this date

and are subject to change without notice. Due to individual investor requirements, this report should not be

construed as advice meant to meet the investment needs of any investor. This report is not an offer to buy or

sell, or a solicitation of an offer to buy or sell any of the security mentioned in this report.

The Applied Finance Group, Ltd, its owners, employees and/or customers may have positions in the security

that is discussed in this report.

All historic fundamental data and analyst estimates (excluding the United States and Canada) are provided by

Worldscope and IBES, which are used by permission of Thomson Reuters. ©2011 Thomson Reuters. All

Rights Reserved. Use, duplication, or sale of this service, or data contained herein, except as described in The

Applied Finance Group™, Ltd.'s Subscription Agreement, is strictly prohibited.

Analyst earnings and analyst earnings related data for the United States and Canada are provided by Zacks

Investment Research, Inc.

The information contained in this report is the property of The Applied Finance Group, Ltd. ©2011.

Contact Us

Illinois

The Applied Finance Group, Ltd.

105 W. Adams, Suite 2105

Chicago, IL 60063

(312) 362-9903

support@afgltd.com

California

The Applied Finance Group, Ltd.

7493 N. Ingram Ave., Suite 104

Fresno, CA

(559) 436-4270

support@afgltd.com

www.AFGView.com The Applied Finance Group, Ltd. Page 10 of 10

Potrebbero piacerti anche

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Fundamentals of SwimmingDocumento7 pagineFundamentals of SwimmingSheila Mae Lira100% (1)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- STC Ratings PDFDocumento3 pagineSTC Ratings PDFDiseño SonidoNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Surface Roughness Measurement - MitutoyoDocumento2 pagineSurface Roughness Measurement - MitutoyoSelvaraj BalasundramNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- HYKDDocumento15 pagineHYKDAri RamadhanNessuna valutazione finora

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Chem Tech South 2013 - ConferenceDocumento5 pagineChem Tech South 2013 - ConferenceAbirami PriyadharsiniNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Dr. Carlos S. Lanting College: College of Maritime EducationDocumento14 pagineDr. Carlos S. Lanting College: College of Maritime EducationJeynard Moler J. TanNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Moral Theories: Presented By: Sedrick M. MallariDocumento27 pagineMoral Theories: Presented By: Sedrick M. MallariAlyssa De PaduaNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Business Plan of Easy Meal ServiceDocumento41 pagineBusiness Plan of Easy Meal ServiceCeddie UnggayNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Analytical Chemistry Lecture Exercise 2 Mole-Mole Mass-Mass: Sorsogon State CollegeDocumento2 pagineAnalytical Chemistry Lecture Exercise 2 Mole-Mole Mass-Mass: Sorsogon State CollegeJhon dave SurbanoNessuna valutazione finora

- Lea 2 PDFDocumento21 pagineLea 2 PDFKY Renz100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- GBDocumento10 pagineGBQuoctytranNessuna valutazione finora

- Dialyser Reprocessing Machine Specification (Nephrology)Documento2 pagineDialyser Reprocessing Machine Specification (Nephrology)Iftekhar AhamedNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- GCSE 1MA1 - Algebraic Proof Mark SchemeDocumento13 pagineGCSE 1MA1 - Algebraic Proof Mark SchemeArchit GuptaNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Da Memorandum Order No 6 Implementation Guidelines of The Kadiwa Ni Ani at Kita ProjectDocumento17 pagineDa Memorandum Order No 6 Implementation Guidelines of The Kadiwa Ni Ani at Kita ProjectMildred VillanuevaNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- Dr. Ghusoon Mohsin Ali: Al-Mustansiriya University College of Engineering Electrical Engineering DepartmentDocumento89 pagineDr. Ghusoon Mohsin Ali: Al-Mustansiriya University College of Engineering Electrical Engineering Departmentهمام الركابي100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- A7670 Series Hardware Design v1.03Documento69 pagineA7670 Series Hardware Design v1.03Phạm NamNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Focus Shooting Method CourseDocumento48 pagineThe Focus Shooting Method CourseKobiXDNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- Eb4069135 F enDocumento13 pagineEb4069135 F enkalvino314Nessuna valutazione finora

- Spectrophotometric Determination of Triclosan Based On Diazotization Reaction: Response Surface Optimization Using Box - Behnken DesignDocumento1 paginaSpectrophotometric Determination of Triclosan Based On Diazotization Reaction: Response Surface Optimization Using Box - Behnken DesignFitra NugrahaNessuna valutazione finora

- Tenofovir Disoproxil Fumarate: Riefing - Nfrared BsorptionDocumento4 pagineTenofovir Disoproxil Fumarate: Riefing - Nfrared BsorptionMostofa RubalNessuna valutazione finora

- National Leprosy Control Program For CHNDocumento18 pagineNational Leprosy Control Program For CHNNaomi Cyden YapNessuna valutazione finora

- Railway Electrification Projects Budget 2019-20Documento9 pagineRailway Electrification Projects Budget 2019-20Muhammad Meraj AlamNessuna valutazione finora

- PCB Table of Contents GuideDocumento3 paginePCB Table of Contents GuidePreet ChahalNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Steam Turbine Unloading and Shut-Down of Operation Turbine/Generator Shut-Down Diagram (General)Documento1 paginaSteam Turbine Unloading and Shut-Down of Operation Turbine/Generator Shut-Down Diagram (General)parthibanemails5779Nessuna valutazione finora

- Traffic Sign Detection and Recognition Using Image ProcessingDocumento7 pagineTraffic Sign Detection and Recognition Using Image ProcessingIJRASETPublicationsNessuna valutazione finora

- IB Chemistry HL Test 2nd FEBDocumento13 pagineIB Chemistry HL Test 2nd FEBprasad100% (1)

- JKF8 Intelligent Reactive Power Compensation ControllerDocumento4 pagineJKF8 Intelligent Reactive Power Compensation ControllerGuillermo Morales HerreraNessuna valutazione finora

- General Guidelines For Design and Construction of Concrete Diaphram (Slurry) WallsDocumento108 pagineGeneral Guidelines For Design and Construction of Concrete Diaphram (Slurry) WallsharleyNessuna valutazione finora

- Sherco 450 Se R Workshop Manual 1Documento79 pagineSherco 450 Se R Workshop Manual 1miguelNessuna valutazione finora

- Using Graphs To Display Data R 2-12 PDFDocumento2 pagineUsing Graphs To Display Data R 2-12 PDFShafika AidaNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)