Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CA Foundation Home Work Sheet Inventory Questions

Caricato da

Amit JainTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

CA Foundation Home Work Sheet Inventory Questions

Caricato da

Amit JainCopyright:

Formati disponibili

CA FOUNDTION (ACCOUNT)

INVENTORY

HOME WORK SHEET

Q.1 M/s Kumar & Brothers close their financial books on 31st March. Stock-taking is completed over a

period of two weeks. In 2008 the value of the closing stock thus arrived at was Rs 25,000. During

the two weeks (a) purchases made were Rs 1,000 and (b) Sales totalled Rs 4,000. The firm makes

a gross profit of 30% on sales. Ascertain the value of closing stock on 31st March 2008.

Q.2 Mr. Vijay's financial year ends on 30th June, but actual stock is not taken until the following 8th

July, when it is ascertained at Rs 7,425.

You find that:

1. Sales are entered in the Sale Book on the same day as dispatched and returns inward is the

Return Inward Book the day the goods are received back.

2. Purchases are entered in the purchases Day Book as the invoices are received.

3. Sales between 30th June and 8th July as per the Sales Day Book and Cash Book are Rs

8,600.

4. Purchases between 30th June and 8th July as per the Purchases Day Book are Rs 660 but of

these goods amounting to Rs 60 are not received until after the stock was taken.

5. Goods invoiced during June (before 30th June), but not received until after 30th June,

amounted to Rs 500 of which Rs 350 worth are received between 30th June and 8th July.

6. Rate of gross profit is 33 1/3% on cost. )

Q.3 A trader prepares his account on 31st March each year. Due to some avoidable reasons, no

stock-taking could be possible till 15th April 2002, on which date total cost of goods in his godown

came to Rs 50,000.

The following facts were established between 31st March and 15th April 2002:

i. Sales Rs 41,000 (including cash sale Rs 10,000)

ii. Purchase Rs 5,034 (including cash purchase Rs 1,990)

iii. Sales Return Rs 1,000

iv. On 15th March goods of the sale value of Rs 10,000 were sent on sale or return basis to

customer, the period of approval being four weeks. He returned 40% of the goods on 10th

April approving the rest. The customer was billed on 16th April,

v. A trader has also received goods costing Rs 8,000 in March, for sale on consignment basis,

20% of the goods had been sold by 31st March, and another 50% by the 15th April. These

sales are not included inabove sales.

Goods are sold by the trader at a profit of 20% on sales.

You are required to ascertain the value of inventory as on 31st March 2002.

*****All the best*****

Potrebbero piacerti anche

- SecuritizationDocumento102 pagineSecuritizationag maniac100% (14)

- Survey Questionnier For Startup BarriersDocumento5 pagineSurvey Questionnier For Startup BarriersSarhangTahir100% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- MCQs On MotivationDocumento12 pagineMCQs On MotivationSubhadip Das Sarma93% (100)

- UntitledDocumento1 paginaUntitledapi-260945806Nessuna valutazione finora

- Telgi scam mastermind ran operations from prison using mobile phonesDocumento8 pagineTelgi scam mastermind ran operations from prison using mobile phonesPlacement CellNessuna valutazione finora

- Practical Problems: Unit - 3: Insurance Claims 2 MarksDocumento11 paginePractical Problems: Unit - 3: Insurance Claims 2 Marksbinu100% (1)

- Cash BudgetDocumento4 pagineCash BudgetSANDEEP SINGH0% (1)

- Volatility and the Allegory of the Prisoner’s DilemmaDocumento20 pagineVolatility and the Allegory of the Prisoner’s Dilemmajacek100% (1)

- Inventories - PDF - FoundationDocumento2 pagineInventories - PDF - FoundationArjun M AcharyaNessuna valutazione finora

- Paper found 2024 exam vDocumento8 paginePaper found 2024 exam vtherealbeetch99Nessuna valutazione finora

- AfaDocumento8 pagineAfaBharathNessuna valutazione finora

- Accounts - First Half TestDocumento4 pagineAccounts - First Half TestPeriyanan VNessuna valutazione finora

- Insurance Claim PDFDocumento15 pagineInsurance Claim PDFbinuNessuna valutazione finora

- MTP RTP InventoriesDocumento4 pagineMTP RTP Inventoriessejaldharamshi1909Nessuna valutazione finora

- Account MOCK Test - 2Documento6 pagineAccount MOCK Test - 2CA ASPIRANTNessuna valutazione finora

- Fire Insurance ClaimDocumento4 pagineFire Insurance ClaimAMIN BUHARI ABDUL KHADERNessuna valutazione finora

- QuestionsDocumento9 pagineQuestionsCfa Deepti BindalNessuna valutazione finora

- Class 11 Accounts SP 1Documento6 pagineClass 11 Accounts SP 1UdyamGNessuna valutazione finora

- Cnu 2112 Accounts Paper 1 - Question Paper.Documento3 pagineCnu 2112 Accounts Paper 1 - Question Paper.Yash VyasNessuna valutazione finora

- Fire Insurance Claim TypeDocumento5 pagineFire Insurance Claim TypeAMIN BUHARI ABDUL KHADERNessuna valutazione finora

- Ledger & Trial BalanceDocumento45 pagineLedger & Trial BalancealihussainpidNessuna valutazione finora

- Question Bank by CA P.S. BeniwalDocumento497 pagineQuestion Bank by CA P.S. BeniwalTushar MittalNessuna valutazione finora

- Principles of Accounting ExercisesDocumento3 paginePrinciples of Accounting ExercisesAB D'oriaNessuna valutazione finora

- SUTLEJ PUBLIC SR SEC SCHOOL ANNUAL EXAMINATION ACCOUNTANCYDocumento4 pagineSUTLEJ PUBLIC SR SEC SCHOOL ANNUAL EXAMINATION ACCOUNTANCYmnmehta1990Nessuna valutazione finora

- MAA Gradable Assignment - MGT402Documento2 pagineMAA Gradable Assignment - MGT402Rajesh SinghNessuna valutazione finora

- Test 5 Principles and Practice of AccountingDocumento6 pagineTest 5 Principles and Practice of Accountingshreya shettyNessuna valutazione finora

- Inventories Home Work 5 DayDocumento1 paginaInventories Home Work 5 DayDiya JainNessuna valutazione finora

- Assignment Questions Odd Semester 2023-24Documento10 pagineAssignment Questions Odd Semester 2023-24manan chandakNessuna valutazione finora

- © The Institute of Chartered Accountants of India: TH ST THDocumento6 pagine© The Institute of Chartered Accountants of India: TH ST THomkar sawantNessuna valutazione finora

- Class 11th TestDocumento7 pagineClass 11th TestMayank GoelNessuna valutazione finora

- Assignment of Final AccountsDocumento6 pagineAssignment of Final Accountscooldude690Nessuna valutazione finora

- Bcom 3Documento26 pagineBcom 3Nayan MaldeNessuna valutazione finora

- CA Foundation MTP 2020 Paper 1 QuesDocumento6 pagineCA Foundation MTP 2020 Paper 1 QuesSaurabh Kumar MauryaNessuna valutazione finora

- © The Institute of Chartered Accountants of India: TH ST THDocumento15 pagine© The Institute of Chartered Accountants of India: TH ST THGaurav KumarNessuna valutazione finora

- ACCT1B - Prelims ReviewerDocumento2 pagineACCT1B - Prelims ReviewerAlvin TanNessuna valutazione finora

- Assigment BBM Finacial AccountingDocumento6 pagineAssigment BBM Finacial Accountingtripathi_indramani5185Nessuna valutazione finora

- 186pcc QuesbankDocumento51 pagine186pcc Quesbanksumitcaa100% (2)

- Group 2Documento51 pagineGroup 2snehaghagNessuna valutazione finora

- Inventory (Stock Counts)Documento22 pagineInventory (Stock Counts)Muhammad ArslanNessuna valutazione finora

- Accounting For Managers 1Documento43 pagineAccounting For Managers 1nivedita_h424040% (1)

- RTP June 2018 QnsDocumento14 pagineRTP June 2018 QnsbinuNessuna valutazione finora

- Class 11 Accountancy Worksheet - 2023-24Documento17 pagineClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarNessuna valutazione finora

- 02 Per. Invest 26-30Documento5 pagine02 Per. Invest 26-30Ritu SahaniNessuna valutazione finora

- Practice Questions PartnershipDocumento3 paginePractice Questions PartnershipOkasha AliNessuna valutazione finora

- Single SystemDocumento7 pagineSingle SystemRobert HensonNessuna valutazione finora

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocumento6 pagineAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanNessuna valutazione finora

- Tutorial 06Documento3 pagineTutorial 06Janidu KavishkaNessuna valutazione finora

- Blossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentDocumento3 pagineBlossems Convent School CLASS: 11 Commerce Group Subject: Accoutancy Holidays AssignmentPawanpreet KaurNessuna valutazione finora

- Mid Term Accounts - SubjectiveDocumento4 pagineMid Term Accounts - Subjectivekarishma prabagaranNessuna valutazione finora

- DDDDDocumento1 paginaDDDDGeet DharmaniNessuna valutazione finora

- Analytical Exam FA Summer2020Documento2 pagineAnalytical Exam FA Summer2020Safi SheikhNessuna valutazione finora

- J.K Shah Full Course Practice Question PaperDocumento7 pagineJ.K Shah Full Course Practice Question PapermridulNessuna valutazione finora

- Assignments For All Chapters Principle of Accounting IIDocumento6 pagineAssignments For All Chapters Principle of Accounting IITolesa MogosNessuna valutazione finora

- Assignment CMA Sanchi 2016Documento2 pagineAssignment CMA Sanchi 2016NishaTripathiNessuna valutazione finora

- Revision - Test - Paper - CAP - II - June - 2017 9Documento181 pagineRevision - Test - Paper - CAP - II - June - 2017 9Dipen AdhikariNessuna valutazione finora

- RTP-CAP II June 2017 Revision Test PaperDocumento12 pagineRTP-CAP II June 2017 Revision Test PaperbinuNessuna valutazione finora

- Journal and ledger assignmentsDocumento39 pagineJournal and ledger assignmentsIndu GuptaNessuna valutazione finora

- Accountancy WorksheetDocumento5 pagineAccountancy WorksheetAnimesh RajNessuna valutazione finora

- FireinsuranceDocumento9 pagineFireinsurancesmit9993Nessuna valutazione finora

- Accounts Worksheet 1.4 Class XIDocumento4 pagineAccounts Worksheet 1.4 Class XIMuskan AgarwalNessuna valutazione finora

- Chapter 3: Accounting Cycle: Accounting 1 (Aa015) Tutorial QuestionsDocumento10 pagineChapter 3: Accounting Cycle: Accounting 1 (Aa015) Tutorial QuestionsIna NaaNessuna valutazione finora

- Acc Equation 4Documento2 pagineAcc Equation 4Murtaza JamaliNessuna valutazione finora

- Assignment Comper ProblemDocumento2 pagineAssignment Comper ProblemAmir ParwarishNessuna valutazione finora

- Final Advt 04 2021 0UAKDocumento25 pagineFinal Advt 04 2021 0UAKNachiketa MithaiwalaNessuna valutazione finora

- Fci SyllabusDocumento2 pagineFci SyllabusAmit JainNessuna valutazione finora

- FM BookDocumento105 pagineFM BookAmit JainNessuna valutazione finora

- Sale of Goods Act Saurabh Sir PDFDocumento13 pagineSale of Goods Act Saurabh Sir PDFAmit JainNessuna valutazione finora

- Ebook: 500 Quadratic Equation Questions For Ibps Rrb/Po/Clerk 2017Documento160 pagineEbook: 500 Quadratic Equation Questions For Ibps Rrb/Po/Clerk 2017gayathri SNessuna valutazione finora

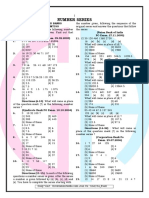

- Number SeriesDocumento72 pagineNumber SeriesAmit RajdhanNessuna valutazione finora

- FCI Recruitment 2021 for 89 VacanciesDocumento33 pagineFCI Recruitment 2021 for 89 VacanciesvijaythealmightyNessuna valutazione finora

- 10028351689201002Documento1 pagina10028351689201002dr maha laxmiNessuna valutazione finora

- Number SeriesDocumento72 pagineNumber SeriesAmit RajdhanNessuna valutazione finora

- Number SeriesDocumento72 pagineNumber SeriesAmit RajdhanNessuna valutazione finora

- Number SeriesDocumento72 pagineNumber SeriesAmit RajdhanNessuna valutazione finora

- Idioms and Phrases PDFDocumento37 pagineIdioms and Phrases PDFAmit JainNessuna valutazione finora

- Consumer preferences toward Tata Motors vs Maruti Suzuki carsDocumento4 pagineConsumer preferences toward Tata Motors vs Maruti Suzuki carsAmit JainNessuna valutazione finora

- Finance BOLTDocumento31 pagineFinance BOLTSatish MagdumNessuna valutazione finora

- Test AcropolisDocumento1 paginaTest AcropolisAmit JainNessuna valutazione finora

- Banihal-Qazigund TunnelDocumento14 pagineBanihal-Qazigund TunnelAmit JainNessuna valutazione finora

- Major Research Project: A Comparative Study of Services Between Public Bank & Private BankDocumento4 pagineMajor Research Project: A Comparative Study of Services Between Public Bank & Private BankAmit JainNessuna valutazione finora

- Banihal-Qazigund TunnelDocumento14 pagineBanihal-Qazigund TunnelAmit JainNessuna valutazione finora

- The history and impact of Amul, India's dairy cooperativeDocumento8 pagineThe history and impact of Amul, India's dairy cooperativeAmit JainNessuna valutazione finora

- The Use of Predictive Analytics in The Development of Experience StudiesDocumento10 pagineThe Use of Predictive Analytics in The Development of Experience StudiesNoura ShamseddineNessuna valutazione finora

- Cambridge O Level: Accounting 7707/13Documento12 pagineCambridge O Level: Accounting 7707/13Geerish BissessurNessuna valutazione finora

- Fintech Comparison Tool - Dentons Publisher - GlobalDocumento84 pagineFintech Comparison Tool - Dentons Publisher - GlobalOlegNessuna valutazione finora

- Ncfe-Nflat Detailed Syllabus Final 1.0Documento4 pagineNcfe-Nflat Detailed Syllabus Final 1.0sawrajNessuna valutazione finora

- California Online E-File Return Authorization For Individuals 8453-OL 2019Documento1 paginaCalifornia Online E-File Return Authorization For Individuals 8453-OL 2019Alex PanNessuna valutazione finora

- REST0001 - Presentation Rev5Documento4 pagineREST0001 - Presentation Rev5HenryNessuna valutazione finora

- Engineering Economics: Ronel E. Romero, RCE, MCEDocumento19 pagineEngineering Economics: Ronel E. Romero, RCE, MCEkate asiaticoNessuna valutazione finora

- Exam 3 Review and Sample ProblemsDocumento14 pagineExam 3 Review and Sample ProblemsCindy MaNessuna valutazione finora

- University of Nigeria Nsukka Faculty of Agriculture: Department of Human Nutrition and DieteticsDocumento29 pagineUniversity of Nigeria Nsukka Faculty of Agriculture: Department of Human Nutrition and DieteticsBright Ikpang100% (2)

- Fairfax-Backed Fairchem Speciality To Restructure Business: Insolvency DemergerDocumento40 pagineFairfax-Backed Fairchem Speciality To Restructure Business: Insolvency Demergerpriyanka valechhaNessuna valutazione finora

- Sustainability Report 2009 Yuhan-KimberlyDocumento68 pagineSustainability Report 2009 Yuhan-KimberlyBermet M.k.Nessuna valutazione finora

- Gerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonDocumento6 pagineGerrymdayanan : Prk3Crossingsalimbalan Baungon 8707bukidnonGerry DayananNessuna valutazione finora

- 2011 Q3 Call TranscriptDocumento21 pagine2011 Q3 Call TranscriptcasefortrilsNessuna valutazione finora

- Assessment 3 SolutionsDocumento3 pagineAssessment 3 SolutionsMmaleema LedwabaNessuna valutazione finora

- Answer-Introduction To FinanceDocumento10 pagineAnswer-Introduction To FinanceNguyen Hong HanhNessuna valutazione finora

- CIB OnlineDocumento22 pagineCIB OnlineRejaul KarimNessuna valutazione finora

- PARTNERSHIP FORMATION Exercises AnswersDocumento15 paginePARTNERSHIP FORMATION Exercises AnswersMarjorie NepomucenoNessuna valutazione finora

- HDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"Documento18 pagineHDFC Bank Limited: "Melioration in Asset Quality Marginal Compression in NIM Initiating Coverage With HOLD"janu_ballav9913Nessuna valutazione finora

- BPO Business Registration RequirementsDocumento6 pagineBPO Business Registration RequirementsLester PaulinoNessuna valutazione finora

- Instant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF ScribdDocumento41 pagineInstant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF Scribdlauryn.corbett387100% (41)

- PT Edelweiss MelvinoDocumento69 paginePT Edelweiss MelvinoTrainingDigital Marketing BandungNessuna valutazione finora

- Governmental and Nonprofit Accounting 10th Edition Smith Solution ManualDocumento27 pagineGovernmental and Nonprofit Accounting 10th Edition Smith Solution Manualconsuelo100% (21)

- Bond Portfolio Construction: Chapter SummaryDocumento31 pagineBond Portfolio Construction: Chapter SummaryasdasdNessuna valutazione finora

- BKAL 1013 (F) Tutorial 4 Annual Report RatiosDocumento10 pagineBKAL 1013 (F) Tutorial 4 Annual Report RatiosAmeer Al-asyraf MuhamadNessuna valutazione finora

- Prize Bond ScheduleDocumento5 paginePrize Bond Schedulehati1Nessuna valutazione finora