Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RMO No. 34-2020

Caricato da

Joel SyCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

RMO No. 34-2020

Caricato da

Joel SyCopyright:

Formati disponibili

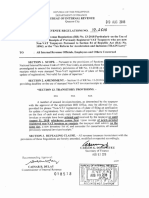

REPUBLIC OF THE PHILIPPINES

6 DEPARTMENT OF FINANCE

BUREAU OF INTERNAL RE\'ENUE

Quezon City

September 17,2020

REVENUE MEMORANDUM ORDER NO. O4.,,DTD

SUBJECT : Creation of Alphanumeric Tax Code (ATC) for Voluntary Assessment and Payment

Program Pursuantto the lmplementation of Revenue Regulations (RR) No. 21-2020

(Voluntary lsssssment and Payment Program forTaxableYear2OlS Under Certain

Conditions)

TO : All Collection Agents, Revenue District Officers and Other lntemal Revenue Officers

Concerned

I. OBJECTIVE:

To facilitate the proper identification and monitoring of tax collection from Voluntary Assessment

and Payment Program (VAPP) in connection with the implementation of RR No. 21-2020

and for inclusion in BIR Form Nos.2119 [Voluntary Assessment and Payment Program (VAPP)

Application Forml and 0622 [Voluntary Assessment and Payment Program (VAPP) Payment Form],

the following ATCs are hereby created:

BIR

ATC Description Legal Basis Form

No.

On the revenue collected through Voluntary Assessment and RR No. 21-2020 2119

Payment Program (VAPP): 0622

MC341 1. lncome Tax (lT), Value-Added Tax (VAT), Percentage Tax

(PT), Excise Tax (ET), and Documentary Stamp Tax

(DST) other than DST on One-Time Transactions (ONETT)

MC342 2. Final Withholding Taxes (on Compensation, Fringe

Benefits, etc.) and Creditable Withholding Taxes (CWT)

other than CWT on ONETT

MC343 3. Taxes on ONETT, such as Estate Tax, Donor's Tax,

Capital Gains Tax (CGT), ONETT-related CwT/Expanded

Withholding Tax, and DST

II. REPEALING CI.AUSE:

f

This Revenue Memorandum Order (RMO) revises portions of all other issuances inconsistent

herewith.

III. EFFECTIVITY:

This RMO shall take effect immediately.

a

ffirEF

TTW

N AL REVENIJE,

7E

J-

IV

Jt^.q^fu

CAESAR R. DUI.AY

B-3

ihilt ffi

RECORDS MG T.

lr ryD

VISION

Commissioner of lnternal Revenue

036e?t

Potrebbero piacerti anche

- Wiley IFRS: Practical Implementation Guide and WorkbookDa EverandWiley IFRS: Practical Implementation Guide and WorkbookNessuna valutazione finora

- RMC No. 92-102-2020Documento5 pagineRMC No. 92-102-2020nathalie velasquezNessuna valutazione finora

- RR No. 6-2022Documento3 pagineRR No. 6-2022chato law officeNessuna valutazione finora

- RR No. 34-2020 v2Documento3 pagineRR No. 34-2020 v2JejomarNessuna valutazione finora

- RR No. 12-2021Documento3 pagineRR No. 12-2021eric yuulNessuna valutazione finora

- Rmo No.47-2019Documento2 pagineRmo No.47-2019Sid CandelariaNessuna valutazione finora

- SAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.Documento56 pagineSAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.imran mughalNessuna valutazione finora

- Act 1Documento6 pagineAct 1sergio muñoz cervantesNessuna valutazione finora

- Zojd: A Key Cy Revenue EmployeesDocumento1 paginaZojd: A Key Cy Revenue EmployeesCliff DaquioagNessuna valutazione finora

- RMC No 19-2019 PDFDocumento2 pagineRMC No 19-2019 PDFRobea Marie GaspayNessuna valutazione finora

- Chapter 1 Department of RevenueDocumento19 pagineChapter 1 Department of RevenueMANISH KUMAWATNessuna valutazione finora

- CITIRA Bill (Senate Version)Documento9 pagineCITIRA Bill (Senate Version)Tan GonzalesNessuna valutazione finora

- Concept Note Sales Tax On ServicesDocumento7 pagineConcept Note Sales Tax On ServicesAhmed RehanNessuna valutazione finora

- BB No. 2020-14Documento1 paginaBB No. 2020-14Joel SyNessuna valutazione finora

- flg-20 ?RT: Republic Philippines Department of Finance InternalDocumento1 paginaflg-20 ?RT: Republic Philippines Department of Finance InternalJayvee OlayresNessuna valutazione finora

- XX. CIR vs. Fitness by Design, IncDocumento11 pagineXX. CIR vs. Fitness by Design, IncStef OcsalevNessuna valutazione finora

- RMO No.34-2018Documento3 pagineRMO No.34-2018kkabness101 YULNessuna valutazione finora

- RMC No. 36-2022Documento2 pagineRMC No. 36-2022SittyNessuna valutazione finora

- Finance Bill 2010Documento51 pagineFinance Bill 2010riddhivakhariaNessuna valutazione finora

- 06-Target-10-K-Key-Extracts NewDocumento18 pagine06-Target-10-K-Key-Extracts NewKumar SinghNessuna valutazione finora

- GST Ready Reckoner 2020 - 10062020Documento240 pagineGST Ready Reckoner 2020 - 10062020P S AmritNessuna valutazione finora

- GST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormDocumento3 pagineGST RFD-01 - 37AABCJ1299A1ZS - EXPWOP - 201904 - FormkotisanampudiNessuna valutazione finora

- Revenue Memorandum Order No. 7-2007: CY 2007 Goals (In Millions) Tax Classification TotalDocumento7 pagineRevenue Memorandum Order No. 7-2007: CY 2007 Goals (In Millions) Tax Classification TotaltoniNessuna valutazione finora

- Tri Hita Karana ForumDocumento14 pagineTri Hita Karana Forumtonitoni27Nessuna valutazione finora

- Revenue Regulation 1-2013Documento7 pagineRevenue Regulation 1-2013Jerwin DaveNessuna valutazione finora

- Who To File RPTDocumento9 pagineWho To File RPTLacie Hohenheim (Doraemon)Nessuna valutazione finora

- RMO No. 42-2020Documento2 pagineRMO No. 42-2020Miming BudoyNessuna valutazione finora

- EODB Cluster Taxation (English)Documento57 pagineEODB Cluster Taxation (English)Ryan NugrahaNessuna valutazione finora

- Overview of Income Tax 2017 by Masum PDFDocumento44 pagineOverview of Income Tax 2017 by Masum PDFAl-Muzahid EmuNessuna valutazione finora

- Bureau of Internal RevenueDocumento3 pagineBureau of Internal RevenueReymund S BumanglagNessuna valutazione finora

- RMO No. 6-2023Documento11 pagineRMO No. 6-2023Anostasia NemusNessuna valutazione finora

- RMO Nos. 30-31-2020Documento8 pagineRMO Nos. 30-31-2020nathalie velasquezNessuna valutazione finora

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocumento4 pagineBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNessuna valutazione finora

- Internal Revenue: Republic of Pfiilippines DepartmentDocumento1 paginaInternal Revenue: Republic of Pfiilippines DepartmentJohn RoeNessuna valutazione finora

- Tax Memo14-OCT-2015 PDFDocumento43 pagineTax Memo14-OCT-2015 PDFMuhammad Sameer AzharNessuna valutazione finora

- RR No. 33-2020Documento2 pagineRR No. 33-2020JejomarNessuna valutazione finora

- Zamboanga City Executive Summary 2020Documento6 pagineZamboanga City Executive Summary 2020Kate Baja BrendiaNessuna valutazione finora

- RMO No. 34-2020 - DigestDocumento1 paginaRMO No. 34-2020 - DigestJoel SyNessuna valutazione finora

- Tax Alert - 2007 - MarDocumento10 pagineTax Alert - 2007 - MarKeats QuindozaNessuna valutazione finora

- Explanatory Memorandum On Federal ReceiptsDocumento101 pagineExplanatory Memorandum On Federal ReceiptsM Sikander HaiderNessuna valutazione finora

- MGI Q3 2010 EarningsDocumento5 pagineMGI Q3 2010 EarningsBrian_Markwort_5393Nessuna valutazione finora

- RMO No. 29-2021Documento4 pagineRMO No. 29-2021Rhona CacanindinNessuna valutazione finora

- Taxation Law ReviewerDocumento18 pagineTaxation Law ReviewerFrancis Puno100% (2)

- RMC No. 23-2022Documento3 pagineRMC No. 23-2022Shiela Marie MaraonNessuna valutazione finora

- Bir1600 July52019 - 2 PDFDocumento2 pagineBir1600 July52019 - 2 PDFMaureen AlapaapNessuna valutazione finora

- TIMTADocumento6 pagineTIMTAKarl Anthony Rigoroso MargateNessuna valutazione finora

- GST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormDocumento3 pagineGST Rfd-01 07aabcw4620l1z8 Expwop 202204 FormSANDEEP SINGHNessuna valutazione finora

- Pa Tax Brief - February 2020Documento12 paginePa Tax Brief - February 2020Teresita TibayanNessuna valutazione finora

- RMC No. 3-2022Documento2 pagineRMC No. 3-2022Shiela Marie MaraonNessuna valutazione finora

- 8 Explanatory Memorandum of Federal Receipts 2021 22Documento101 pagine8 Explanatory Memorandum of Federal Receipts 2021 22Azhar AliNessuna valutazione finora

- 61397cajournal Oct2020 28Documento4 pagine61397cajournal Oct2020 28Anupam BaliNessuna valutazione finora

- Central Action Plan 2021-22Documento73 pagineCentral Action Plan 2021-22raj27385Nessuna valutazione finora

- WWW - Incometax.gov - In: Ress EleaseDocumento14 pagineWWW - Incometax.gov - In: Ress EleaseJanani SubramanianNessuna valutazione finora

- Special Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocumento47 pagineSpecial Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityLady Paul SyNessuna valutazione finora

- RMC No. 125-2020Documento1 paginaRMC No. 125-2020Raine Buenaventura-EleazarNessuna valutazione finora

- GSTR-9 AND GSTR-9C - OutwardDocumento39 pagineGSTR-9 AND GSTR-9C - OutwardRahul KLNessuna valutazione finora

- Casa Systems, Inc: United States Securities and Exchange Commission FORM 10-QDocumento54 pagineCasa Systems, Inc: United States Securities and Exchange Commission FORM 10-QtmaillistNessuna valutazione finora

- Taxation 2 Remedies - P.M. ReyesDocumento31 pagineTaxation 2 Remedies - P.M. ReyesGlossier PlayNessuna valutazione finora

- Circular 14 2020Documento2 pagineCircular 14 2020NESL WebsiteNessuna valutazione finora

- 2015 MCQS and NotesDocumento26 pagine2015 MCQS and NotesKb AliNessuna valutazione finora

- RMC No. 16-2022Documento2 pagineRMC No. 16-2022Joel SyNessuna valutazione finora

- RMC No. 111-2020Documento7 pagineRMC No. 111-2020Kram Ynothna BulahanNessuna valutazione finora

- Revenue Memorandum Circular No.Documento5 pagineRevenue Memorandum Circular No.Joel SyNessuna valutazione finora

- RMC No. 46-2021Documento1 paginaRMC No. 46-2021Joel SyNessuna valutazione finora

- RMC No. 111-2020 (Digest)Documento4 pagineRMC No. 111-2020 (Digest)Joel SyNessuna valutazione finora

- Bir Form No. 0622Documento2 pagineBir Form No. 0622Joel SyNessuna valutazione finora

- BB No. 2020-14Documento1 paginaBB No. 2020-14Joel SyNessuna valutazione finora

- RMC No. 108-2020 Annex BDocumento2 pagineRMC No. 108-2020 Annex BJoel SyNessuna valutazione finora

- Annex C - Vapp Bir NoticeDocumento2 pagineAnnex C - Vapp Bir NoticeJoel SyNessuna valutazione finora

- RMC No. 108-2020 (Digest)Documento1 paginaRMC No. 108-2020 (Digest)Joel SyNessuna valutazione finora

- RMC No. 108-2020 Annex ADocumento3 pagineRMC No. 108-2020 Annex AJoel SyNessuna valutazione finora

- RMC No. 108-2020Documento1 paginaRMC No. 108-2020Joel SyNessuna valutazione finora

- RMO No. 34-2020 - DigestDocumento1 paginaRMO No. 34-2020 - DigestJoel SyNessuna valutazione finora

- RMO No. 39-2020 DigestDocumento2 pagineRMO No. 39-2020 DigestJoel SyNessuna valutazione finora

- Annex E - Availments of VAPP FiledDocumento1 paginaAnnex E - Availments of VAPP FiledJoel SyNessuna valutazione finora

- Annex D - Availments of VAPP FiledDocumento1 paginaAnnex D - Availments of VAPP FiledJoel SyNessuna valutazione finora

- Annex F - Cancelled LAs-TVNsDocumento2 pagineAnnex F - Cancelled LAs-TVNsJoel SyNessuna valutazione finora

- Annex C - Vapp Bir NoticeDocumento2 pagineAnnex C - Vapp Bir NoticeJoel SyNessuna valutazione finora

- Annex A - Certificate of AvailmentDocumento1 paginaAnnex A - Certificate of AvailmentJoel SyNessuna valutazione finora

- RMO No. 39-2020Documento6 pagineRMO No. 39-2020Joel SyNessuna valutazione finora

- Payment Form: Voluntary Assessment and Payment Program (VAPP)Documento2 paginePayment Form: Voluntary Assessment and Payment Program (VAPP)Joel SyNessuna valutazione finora

- Annex CDocumento1 paginaAnnex CJoel SyNessuna valutazione finora

- RR 21-2020 (Digest)Documento4 pagineRR 21-2020 (Digest)Joel SyNessuna valutazione finora

- RR No. 21-2020Documento10 pagineRR No. 21-2020Joel SyNessuna valutazione finora

- Delisted Top Withholding Agents - Non-IndividualDocumento20 pagineDelisted Top Withholding Agents - Non-IndividualJoel SyNessuna valutazione finora

- Annex A - Application Form BIR Form 2119Documento2 pagineAnnex A - Application Form BIR Form 2119Antonio Reyes IVNessuna valutazione finora

- BIR Updates Issue No. 15Documento1 paginaBIR Updates Issue No. 15Joel SyNessuna valutazione finora

- Included Individual TAMP Dec 16 2019Documento6 pagineIncluded Individual TAMP Dec 16 2019CROCS Acctg & Audit Dep'tNessuna valutazione finora

- Additional Withholding Agents - Non-IndividualsDocumento14 pagineAdditional Withholding Agents - Non-IndividualsJoel SyNessuna valutazione finora

- Padura V BaldovinoDocumento2 paginePadura V BaldovinoAnjNessuna valutazione finora

- FOI To Frankie Mercieca's Director General Courts - Copies of Judgments Removed From Online DatabaseDocumento3 pagineFOI To Frankie Mercieca's Director General Courts - Copies of Judgments Removed From Online DatabaseTransparency MaltaNessuna valutazione finora

- Group 2 Ra 6713Documento57 pagineGroup 2 Ra 6713Resurreccion MajoNessuna valutazione finora

- Collective SecurityDocumento9 pagineCollective SecurityRishabh Singh100% (1)

- OC Objection PDFDocumento7 pagineOC Objection PDFArvind PremNessuna valutazione finora

- Theodore Griffin v. Frank L. Valenta, Jr. Court of Common Pleas For Richland County, 976 F.2d 726, 4th Cir. (1992)Documento2 pagineTheodore Griffin v. Frank L. Valenta, Jr. Court of Common Pleas For Richland County, 976 F.2d 726, 4th Cir. (1992)Scribd Government DocsNessuna valutazione finora

- Assignment Bbun2103 May 2016 PDF FreeDocumento14 pagineAssignment Bbun2103 May 2016 PDF FreeCity HunterNessuna valutazione finora

- Larkins Vs NLRCDocumento13 pagineLarkins Vs NLRCChocola Vi BriataniaNessuna valutazione finora

- Oposa Vs Factoran Case DigestDocumento4 pagineOposa Vs Factoran Case DigestJhanelyn V. Inopia100% (2)

- Rule 92-95Documento11 pagineRule 92-95Bea Charisse MaravillaNessuna valutazione finora

- Admin Cases Set 3 AgeDocumento125 pagineAdmin Cases Set 3 AgeDixie Mae JulveNessuna valutazione finora

- Republic Act No. 6679 - Amending R.A. No. 6653 (Re - Postponement of Barangay Elections To March 28, 1989)Documento2 pagineRepublic Act No. 6679 - Amending R.A. No. 6653 (Re - Postponement of Barangay Elections To March 28, 1989)Kheem GinesNessuna valutazione finora

- Chapter 4 Legal Regulatory and Political IssuesDocumento2 pagineChapter 4 Legal Regulatory and Political IssuesLovely MoronNessuna valutazione finora

- MANUEL C. SUNGA Vs COMMISSION ON ELECTIONS and FERDINAND B. TRINIDADDocumento3 pagineMANUEL C. SUNGA Vs COMMISSION ON ELECTIONS and FERDINAND B. TRINIDADJoanna Grace LappayNessuna valutazione finora

- Esper vs. DODDocumento18 pagineEsper vs. DODWashington ExaminerNessuna valutazione finora

- CASTELLS, Manuel (2004) Global Governance and Global Politics PDFDocumento8 pagineCASTELLS, Manuel (2004) Global Governance and Global Politics PDFIgor MikhailovNessuna valutazione finora

- USCIS Draft SolicitationDocumento65 pagineUSCIS Draft SolicitationZenger News100% (1)

- Macailing Vs AndradaDocumento6 pagineMacailing Vs AndradaReth GuevarraNessuna valutazione finora

- Indian Penal Code (Ipc 1860) Solved MCQS: 9 of 38 SetsDocumento6 pagineIndian Penal Code (Ipc 1860) Solved MCQS: 9 of 38 SetsCA OFFICE MKS&CONessuna valutazione finora

- Original Registration 13 Steps - Land TitlesDocumento42 pagineOriginal Registration 13 Steps - Land TitlesBoy Kakak Toki100% (14)

- CIPP - E Authoritative Resource List 4.0 PDFDocumento3 pagineCIPP - E Authoritative Resource List 4.0 PDFIanis janisNessuna valutazione finora

- Sem 4 Political Science MajorDocumento19 pagineSem 4 Political Science MajorMuskan Khatri100% (1)

- Application Form For Entry Permit: (Dd/mm/yyyy)Documento1 paginaApplication Form For Entry Permit: (Dd/mm/yyyy)SAURAV12345Nessuna valutazione finora

- Christiana Itiowe v. NBC Universal Inc, 3rd Cir. (2014)Documento5 pagineChristiana Itiowe v. NBC Universal Inc, 3rd Cir. (2014)Scribd Government DocsNessuna valutazione finora

- Volume I - TENDER RANCHI MUNICIPAL CORPDocumento85 pagineVolume I - TENDER RANCHI MUNICIPAL CORPStephen Rajkumar JayakumarNessuna valutazione finora

- MIA Audit and Assurance Practice Guide AAPG 3Documento30 pagineMIA Audit and Assurance Practice Guide AAPG 3HBL AFGHANISTANNessuna valutazione finora

- CHAPTER 5 (Arts. 1370-1379)Documento3 pagineCHAPTER 5 (Arts. 1370-1379)Kaye RabadonNessuna valutazione finora

- Features of Presidential Form of GovernmentDocumento14 pagineFeatures of Presidential Form of GovernmentLilly SinghNessuna valutazione finora

- Bonostro Vs LunaDocumento1 paginaBonostro Vs LunaCharles Roger Raya100% (1)

- Agbayani Vs PNB DigestDocumento2 pagineAgbayani Vs PNB DigestChickoy RamirezNessuna valutazione finora