Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Current Year Base Year Base Year X 100

Caricato da

Kathlyn TajadaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Current Year Base Year Base Year X 100

Caricato da

Kathlyn TajadaCopyright:

Formati disponibili

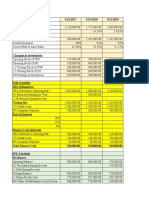

ASSETS 2013 2014 % 2015 %

(Base Year)

Cash 100,000 120,000 20% 130,000 30%

Receivable 120,000 140,000 17% 80,000 -33%

Trading Securities 50,000 50,000 0% 80,000 60%

Inventories 170,000 180,000 6% 160,000 -6%

Other Current Assets 25,000 20,000 20% 20,000 -20%

Total Current Asset 465,000 510,000 10% 470,000 1%

Property, Plant & 300,000 310,000 7% 400,000 33%

equipment

Total Asset 765,000 830,000 8% 870,000 14%

Liability & Equity

Accounts Payable 220,000 240,000 9% 200,000 9%

Accrued Expense 120,000 70,000 -25% 120,000 0%

Total Current Liability 340,000 310,000 9% 320,000 6%

Non-Current Liability 100,000 100,000 0% 150,000 50%

Total Liability 440,000 410,000 7% 470,000 7%

Shareholder Equity 325,000 420,000 29% 400,000 23%

Total Liability &Equity 765,000 830,000 8% 870,000 14%

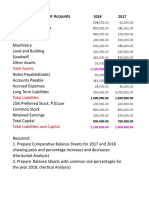

PROBLEM 3

A. Perform a horizontal analysis using 2013 as the base year for the analysis.

Current Year−Base Year

x 100

Base Year

2013 2014 % 2015 %

Sales 1,200,000 1,440,000 20% 1,584,000 32%

Cost of Sale 800,000 1,040,000 30% 1,144,000 43%

Gross Profit 400,000 400,000 0% 440,000 10%

Operating Expense 150,000 120,000 -20% 140,000 -7%

Operating Income 250,000 280,000 12% 300,000 20%

Interest Expense 12,000 12,000 0% 18,000 50%

Income before Taxes 238,000 268,000 13% 282,000 18%

Tax(30%) 71,400 80,400 13% 84,600 18%

Net Income 166,600 187,600 13% 197,400 18%

ASSETS 2013 2014 % 2015 %

%

(Base Year)

Cash 100,000 13% 120,000 14% 130,000 15%

Receivable 120,000 16% 140,000 17% 80,000 9%

Trading Securities 50,000 7% 50,000 6% 80,000 9%

Inventories 170,000 22% 180,000 22% 160,000 18%

Other Current Assets 25,000 3% 20,000 2% 20,000 2%

Total Current Asset 465,000 510,000 470,000

Property, Plant & 300,000 310,000 400,000

39% 37% 46%

equipment

Total Asset 765,000 100% 830,000 100% 870,000 100%

Liability & Equity

Accounts Payable 220,000 29% 240,000 29% 200,000 23%

Accrued Expense 120,000 16% 70,000 8% 120,000 14%

Total Current Liability 340,000 310,000 320,000

Non-Current Liability 100,000 13% 100,000 12% 150,000 17%

Total Liability 440,000 410,000 470,000

Shareholder Equity 325,000 42% 420,000 51% 400,000 46%

Total Liability &Equity 765,000 100% 830,000 100% 870,000 100%

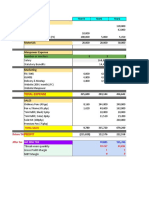

B. Construct the company’s common size financial statements.

2013 2014 % 2015 %

Sales 1,200,000 100% 1,440,000 100% 1,584,000 100%

Cost of Sale 800,000 67% 1,040,000 72% 1,144,000 72%

Gross Profit 400,000 400,000 440,000

Operating Expense 150,000 13% 120,000 8% 140,000 9%

Operating Income 250,000 280,000 300,000

Interest Expense 12,000 1% 12,000 1% 18,000 1%

Income before Taxes 238,000 268,000 282,000

Tax(30%) 71,400 6% 80,400 6% 84,600 5%

Net Income 166,600 14% 187,600 13% 197,400 12%

C . Perform ratio analysis to evaluate the company’s risks and profitability

Short Term Risk

2013 2014 2015

465,000 510,000 470 , 000

CR= CR= CR=

Current Ratio = TCA/TCL 340,000 310 , 000 32 0,000

¿1.37 ¿1. 65 ¿1. 4 7

465 K −170 K 510 K −18 0 K 470 K −16 0 K

TCA−INV Q R= ¿ QR=

Quick Ratio= 340,000 31 0,000 320,000

TCL

¿ 0.87 ¿ 1.06 ¿ 0. 97

Long Term Risk 2013 2014 2015

440,000 41 0,000 47 0,000

Debt Ratio= Total DR= D R= D R=

765,000 830 , 000 870 , 000

Liabilities/Total Assets

¿ 0.58 ¿ 0. 49 ¿ 0. 54

440,000 410,000 470 ,000

Equity Ratio=Total E R= ER= ER=

32 5,000 420 ,000 400 ,000

liability/Total Equity

¿1.35 ¿ 0.98 ¿ 1.18

Profitability 2013 2014 2015

166,600 187,600 197,400

Net income ROA= ROA= ROA=

ROA= 765,000 830 , 000 870 , 000

Ave .Total Asset

¿ 0.22 ¿ 0. 23 ¿ 0. 23

166,600 187 ,600 197,4 00

Net income ROE= ROE= ROE=

ROE= 32 5,000 420 , 000 400 , 000

Shareholders ' equity

¿ 0. 51 ¿ 0. 45 ¿ 0 .49

Potrebbero piacerti anche

- Tran Thi Thu Nguyet-PA3-HWCHAPTER18Documento3 pagineTran Thi Thu Nguyet-PA3-HWCHAPTER18Nguyet Tran Thi ThuNessuna valutazione finora

- Vertical Analysis Base Denominator Company ADocumento6 pagineVertical Analysis Base Denominator Company AYesha SibayanNessuna valutazione finora

- Regular Profit Analysis Common Size Profit Analysis: Income Statement Company A Percent Company B Percent RevenueDocumento2 pagineRegular Profit Analysis Common Size Profit Analysis: Income Statement Company A Percent Company B Percent RevenueGolamMostafaNessuna valutazione finora

- Three Statement Model 14-07-2021 (F3)Documento16 pagineThree Statement Model 14-07-2021 (F3)Vaibhav BorateNessuna valutazione finora

- Revised Verti On SFP 2019Documento2 pagineRevised Verti On SFP 2019cheesekuhNessuna valutazione finora

- 03.2018 Question Answer Horizontal-2Documento17 pagine03.2018 Question Answer Horizontal-2umeshNessuna valutazione finora

- 04.2018 Question Answer HorizontalDocumento28 pagine04.2018 Question Answer HorizontalumeshNessuna valutazione finora

- PDF Balance General El Restaurante Quotdel Pasoquot - CompressDocumento2 paginePDF Balance General El Restaurante Quotdel Pasoquot - CompressHassan Vasquez LuisNessuna valutazione finora

- Balance Sheet Accounts: Total AssetsDocumento4 pagineBalance Sheet Accounts: Total AssetsJing SagittariusNessuna valutazione finora

- Gate of Aden Plan 2020Documento1 paginaGate of Aden Plan 2020Mohammad HanafyNessuna valutazione finora

- Tri-Star Company Financial Statement AnalysisDocumento10 pagineTri-Star Company Financial Statement AnalysisJuliana Angela VillanuevaNessuna valutazione finora

- Vertical Horizontal Analysis Balance TemplateDocumento4 pagineVertical Horizontal Analysis Balance TemplateGAZA MARY ANGELINENessuna valutazione finora

- Operation Expenses and Sales Analysis for Stationery Business Over 5 YearsDocumento31 pagineOperation Expenses and Sales Analysis for Stationery Business Over 5 YearsJanine PadillaNessuna valutazione finora

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Documento5 pagineComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNessuna valutazione finora

- Mooc FinanzasDocumento2 pagineMooc FinanzasAlvaro LainezNessuna valutazione finora

- 5-Year Income Projection for Access-so-realDocumento2 pagine5-Year Income Projection for Access-so-realKamille SumaoangNessuna valutazione finora

- DARIA Assig2 Tren CorpDocumento2 pagineDARIA Assig2 Tren CorpNina PaulaNessuna valutazione finora

- 2020 Expenses: What SUP, Inc. Income Statement For The Year EndedDocumento5 pagine2020 Expenses: What SUP, Inc. Income Statement For The Year EndedRi BNessuna valutazione finora

- Analysis and Interpretation of FS-Part 1Documento2 pagineAnalysis and Interpretation of FS-Part 1Rhea RamirezNessuna valutazione finora

- Balance Sheet (Vertical & Horizontal Analysis)Documento7 pagineBalance Sheet (Vertical & Horizontal Analysis)Nguyen Dac ThichNessuna valutazione finora

- CLN Company financial position comparison 2014-2015Documento4 pagineCLN Company financial position comparison 2014-2015Vince Lloyd RaborNessuna valutazione finora

- AF Ch. 4 - Analysis FS - ExcelDocumento9 pagineAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNessuna valutazione finora

- WBS WPL PT Palu GadaDocumento10 pagineWBS WPL PT Palu GadaLucky AristioNessuna valutazione finora

- Sotalbo, Norhie Anne O. 3BSA-2Documento11 pagineSotalbo, Norhie Anne O. 3BSA-2Acads PurpsNessuna valutazione finora

- ABC Corporation's 2019 Financial Statement AnalysisDocumento15 pagineABC Corporation's 2019 Financial Statement AnalysisHallasgo, Elymar SorianoNessuna valutazione finora

- Case Ascend The Finnacle FinalRound 2ADocumento3 pagineCase Ascend The Finnacle FinalRound 2ASAHIL BERDENessuna valutazione finora

- Financial Statement of The Gems Mfg. Corp. Are As Foll Vertically Horizontally 2015 2014 Amount PercentageDocumento9 pagineFinancial Statement of The Gems Mfg. Corp. Are As Foll Vertically Horizontally 2015 2014 Amount PercentageCollen EsmaelNessuna valutazione finora

- Personnel For Startups NewDocumento5 paginePersonnel For Startups NewBiki BhaiNessuna valutazione finora

- Laurenz R. Patawe - Activity 1PART2 PDFDocumento2 pagineLaurenz R. Patawe - Activity 1PART2 PDFJonellNessuna valutazione finora

- Activity-1 Unit 2 Financial Analysis 3BSA-1Documento2 pagineActivity-1 Unit 2 Financial Analysis 3BSA-1JonellNessuna valutazione finora

- Financial StatementDocumento36 pagineFinancial StatementJigoku ShojuNessuna valutazione finora

- Local Media2551384955216348707Documento4 pagineLocal Media2551384955216348707alinashane obleaNessuna valutazione finora

- Elite, S.A. de C.V.: Balance GeneralDocumento6 pagineElite, S.A. de C.V.: Balance GeneralGuadalupe e ZamoraNessuna valutazione finora

- Lettuce ProductionDocumento14 pagineLettuce ProductionJay ArNessuna valutazione finora

- Business PlanDocumento12 pagineBusiness PlanPapa HarjaiNessuna valutazione finora

- Analysis of FS PDF Vertical and HorizontalDocumento9 pagineAnalysis of FS PDF Vertical and HorizontalJmaseNessuna valutazione finora

- Potato Corner Sample BreakevenDocumento1 paginaPotato Corner Sample Breakevenphuri.siaNessuna valutazione finora

- Analysis and Interpretation of Financial StatementsDocumento9 pagineAnalysis and Interpretation of Financial StatementsMckayla Charmian CasumbalNessuna valutazione finora

- Assignment ..Documento5 pagineAssignment ..Mohd Saddam Saqlaini100% (1)

- Financial Statement Analysis of Jenny CompanyDocumento5 pagineFinancial Statement Analysis of Jenny CompanyAshley Rouge Capati QuirozNessuna valutazione finora

- Excel Referencing TypesDocumento17 pagineExcel Referencing TypesStephen FosuNessuna valutazione finora

- Common Size AnalysisDocumento3 pagineCommon Size Analysisjose miguel baezNessuna valutazione finora

- YubarajDocumento4 pagineYubarajYubraj ThapaNessuna valutazione finora

- Latihan Analisis Horizontal VertikalDocumento4 pagineLatihan Analisis Horizontal Vertikaltheresia paulintiaNessuna valutazione finora

- Emergency Response Master Budget FormatDocumento51 pagineEmergency Response Master Budget FormatNaveed UllahNessuna valutazione finora

- JanetDocumento11 pagineJanetHassanNessuna valutazione finora

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Documento4 pagineProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioNessuna valutazione finora

- Aspira 2 Sum FinDocumento5 pagineAspira 2 Sum FinYork Daily Record/Sunday NewsNessuna valutazione finora

- Financial Statement Analysis of Gerald and Marie CompaniesDocumento5 pagineFinancial Statement Analysis of Gerald and Marie CompaniesAshley Rouge Capati QuirozNessuna valutazione finora

- Paki Check BiDocumento5 paginePaki Check BiAusan AbdullahNessuna valutazione finora

- Potato Corner Sample BreakevenDocumento1 paginaPotato Corner Sample BreakevenOver Mango50% (2)

- Cost Sheet - GenX - Team 4 .2Documento7 pagineCost Sheet - GenX - Team 4 .2sanketmistry32Nessuna valutazione finora

- V - Common SizeDocumento2 pagineV - Common SizeKyriye OngilavNessuna valutazione finora

- Reckitt Benckiser Group PLC Balance Sheet Analysis 2014-2018Documento19 pagineReckitt Benckiser Group PLC Balance Sheet Analysis 2014-2018EryllNessuna valutazione finora

- Ejercicio LogisticaDocumento4 pagineEjercicio Logisticajonathan ramoaNessuna valutazione finora

- Common Size Analysis TemplateDocumento4 pagineCommon Size Analysis TemplateMuhammad FarooqNessuna valutazione finora

- 2016 PPDocumento13 pagine2016 PPumeshNessuna valutazione finora

- Financial AnalysisDocumento8 pagineFinancial AnalysisMaxine Lois PagaraganNessuna valutazione finora

- Ratio and Trend Analysis (FC)Documento26 pagineRatio and Trend Analysis (FC)Cindelyn LibodlibodNessuna valutazione finora

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionDa EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNessuna valutazione finora

- CAAT Usage 151 VillarinDocumento16 pagineCAAT Usage 151 VillarinKathlyn TajadaNessuna valutazione finora

- INCOME STATEMENT FinalsDocumento1 paginaINCOME STATEMENT FinalsKathlyn TajadaNessuna valutazione finora

- SAMBOANS-RATIONALEDocumento4 pagineSAMBOANS-RATIONALEKathlyn TajadaNessuna valutazione finora

- Kath Exercise 1.1, 1.2, 2.1 & 2.2Documento9 pagineKath Exercise 1.1, 1.2, 2.1 & 2.2Kathlyn TajadaNessuna valutazione finora

- Standard Form Number 1S Title Approval For Student ResearchesDocumento2 pagineStandard Form Number 1S Title Approval For Student ResearchesKathlyn TajadaNessuna valutazione finora

- Joey C. Tajada Grade 11-Charity: Blog - A Website ContainingDocumento1 paginaJoey C. Tajada Grade 11-Charity: Blog - A Website ContainingKathlyn TajadaNessuna valutazione finora

- Activity Writing 2 3 Management and Accounting Practices in Samboans Tourism IndustryDocumento5 pagineActivity Writing 2 3 Management and Accounting Practices in Samboans Tourism IndustryKathlyn TajadaNessuna valutazione finora

- Balance Sheet: OEC Computers UKDocumento2 pagineBalance Sheet: OEC Computers UKKathlyn TajadaNessuna valutazione finora

- GENERAL LEDGER FinalsDocumento13 pagineGENERAL LEDGER FinalsKathlyn TajadaNessuna valutazione finora

- SAMBOANS-RATIONALEDocumento4 pagineSAMBOANS-RATIONALEKathlyn TajadaNessuna valutazione finora

- Purchasing Process Exercise 3.1, 3.2 & 3.3Documento3 paginePurchasing Process Exercise 3.1, 3.2 & 3.3Kathlyn TajadaNessuna valutazione finora

- Employee motivation and performance researchDocumento10 pagineEmployee motivation and performance researchKathlyn TajadaNessuna valutazione finora

- SocioDocumento2 pagineSocioKathlyn TajadaNessuna valutazione finora

- Intermediate Acctg AssignmentDocumento12 pagineIntermediate Acctg AssignmentKathlyn TajadaNessuna valutazione finora

- ANGTUD, MARY JOY BSMA-3B Journal EntriesDocumento3 pagineANGTUD, MARY JOY BSMA-3B Journal EntriesKathlyn TajadaNessuna valutazione finora

- Globalization of The Asia Pacific and South AsiaDocumento69 pagineGlobalization of The Asia Pacific and South AsiaKathlyn TajadaNessuna valutazione finora

- E5 10Documento1 paginaE5 10Kathlyn TajadaNessuna valutazione finora

- Mas 11 14 2020Documento5 pagineMas 11 14 2020Kathlyn TajadaNessuna valutazione finora

- 11Documento2 pagine11Kathlyn TajadaNessuna valutazione finora

- Intermediate Acctg AssignmentDocumento12 pagineIntermediate Acctg AssignmentKathlyn TajadaNessuna valutazione finora

- Statement of Financial Position Problems (CHAPTER 1) Acctg 313 Problem 1 (TRUE OR FALSE)Documento2 pagineStatement of Financial Position Problems (CHAPTER 1) Acctg 313 Problem 1 (TRUE OR FALSE)Kathlyn TajadaNessuna valutazione finora

- Exercise 5.1: Angtud, Mary Joy Bsma-3BDocumento8 pagineExercise 5.1: Angtud, Mary Joy Bsma-3BKathlyn TajadaNessuna valutazione finora

- SAMBOANS-RATIONALEDocumento4 pagineSAMBOANS-RATIONALEKathlyn TajadaNessuna valutazione finora

- Final Research 2Documento55 pagineFinal Research 2Kathlyn TajadaNessuna valutazione finora

- SocioDocumento2 pagineSocioKathlyn TajadaNessuna valutazione finora

- Globalization and The Asia-Pacific and South AsiaDocumento2 pagineGlobalization and The Asia-Pacific and South AsiaKathlyn TajadaNessuna valutazione finora

- Kath Exercise 1.1, 1.2, 2.1 & 2.2Documento9 pagineKath Exercise 1.1, 1.2, 2.1 & 2.2Kathlyn TajadaNessuna valutazione finora

- GROUP A - SDL KathDocumento3 pagineGROUP A - SDL KathKathlyn TajadaNessuna valutazione finora

- Activity Writing 2 3 Management and Accounting Practices in Samboans Tourism IndustryDocumento5 pagineActivity Writing 2 3 Management and Accounting Practices in Samboans Tourism IndustryKathlyn TajadaNessuna valutazione finora

- Globalization and The Asia-Pacific and South AsiaDocumento2 pagineGlobalization and The Asia-Pacific and South AsiaKathlyn TajadaNessuna valutazione finora

- ACC10008 Financial Information Systems Mid Semester Test - Semester 1, 2020Documento8 pagineACC10008 Financial Information Systems Mid Semester Test - Semester 1, 2020Pratik GhimireNessuna valutazione finora

- Usefu L Busin ESS Usefu L Busin ESS Englis H Expr Ession S Englis H Expr Ession SDocumento67 pagineUsefu L Busin ESS Usefu L Busin ESS Englis H Expr Ession S Englis H Expr Ession SMaría del Pilar Mancha BoteNessuna valutazione finora

- Solution Manual For Accounting Information Systems 13th Edition Romney, SteinbartDocumento10 pagineSolution Manual For Accounting Information Systems 13th Edition Romney, Steinbarta672546400100% (1)

- Sample Exercises On Drafting A Software Development Agreement and Drafting Terms of Use For A WebsiteDocumento4 pagineSample Exercises On Drafting A Software Development Agreement and Drafting Terms of Use For A WebsitePrachi ThakurNessuna valutazione finora

- TechnoFino LTF - List - AU - BankDocumento22 pagineTechnoFino LTF - List - AU - BankbengaltigerNessuna valutazione finora

- Module 4 - Statement of Comprehensive Income PDFDocumento18 pagineModule 4 - Statement of Comprehensive Income PDFSandyNessuna valutazione finora

- Chapter 1 and DIYDocumento8 pagineChapter 1 and DIYJymldy EnclnNessuna valutazione finora

- EV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20Documento13 pagineEV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20minita sharmaNessuna valutazione finora

- Lee, Hur, Watkins (2018) Visual Communication of Luxury Fashion Brands On Social Media - Effects of Visual Complexity and Brand FamiliarityDocumento14 pagineLee, Hur, Watkins (2018) Visual Communication of Luxury Fashion Brands On Social Media - Effects of Visual Complexity and Brand FamiliarityAgung PurnamaNessuna valutazione finora

- Choir Constitution BDocumento5 pagineChoir Constitution BWandile NkomoNessuna valutazione finora

- Prof. Dolly Sunny BiodataDocumento66 pagineProf. Dolly Sunny Biodatapankaj bbauNessuna valutazione finora

- Update CVDocumento3 pagineUpdate CVMd Rowshon AliNessuna valutazione finora

- Content Marketing Specialist - Job DescriptionDocumento2 pagineContent Marketing Specialist - Job DescriptionjkNessuna valutazione finora

- Ankit - SIP Final ReportDocumento42 pagineAnkit - SIP Final ReportShubham SuryavanshiNessuna valutazione finora

- Document 1Documento18 pagineDocument 1tharaNessuna valutazione finora

- Management Accounting in Industry 4.0Documento13 pagineManagement Accounting in Industry 4.0aNessuna valutazione finora

- Big Basket Analysis OverviewDocumento6 pagineBig Basket Analysis OverviewAkshaya LakshminarasimhanNessuna valutazione finora

- Samcis CMPC 131 Module v1Documento80 pagineSamcis CMPC 131 Module v1Gab IgnacioNessuna valutazione finora

- FCODocumento3 pagineFCOSani Bismar100% (3)

- Commerce: Name - Prashant Singh Chauhan Class - Bba 6 SemesterDocumento14 pagineCommerce: Name - Prashant Singh Chauhan Class - Bba 6 Semesterprashant singh chauhanNessuna valutazione finora

- Emaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementsDocumento52 pagineEmaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementssafSDgSggNessuna valutazione finora

- Code of ConductDocumento6 pagineCode of ConductPrabu PappuNessuna valutazione finora

- CASE 5 Plattsburgh Motor ServiceDocumento4 pagineCASE 5 Plattsburgh Motor ServiceNURUL FARIHIN MHD NASIRNessuna valutazione finora

- Marine Inventory Routing and Shipments PlanningDocumento8 pagineMarine Inventory Routing and Shipments Planningmajid yazdaniNessuna valutazione finora

- Shipping Statistics and Market ReviewDocumento17 pagineShipping Statistics and Market ReviewMiguel PachecoNessuna valutazione finora

- Human Resource Management in KFCDocumento7 pagineHuman Resource Management in KFCfidelpal67% (6)

- Profit & LossDocumento4 pagineProfit & Lossmanan nagpalNessuna valutazione finora

- Career Concept Internship ReportDocumento26 pagineCareer Concept Internship Reporthimali100% (1)

- Ensuring Supply Chain Quality Through CoordinationDocumento5 pagineEnsuring Supply Chain Quality Through CoordinationJohn MwangiNessuna valutazione finora

- Master Interview (Answered1)Documento18 pagineMaster Interview (Answered1)Tran LyNessuna valutazione finora