Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment Profit

Caricato da

Franz CampuedDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment Profit

Caricato da

Franz CampuedCopyright:

Formati disponibili

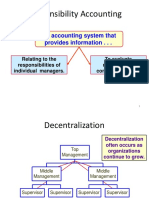

Responsibility Accounting Responsibility center managers are evaluated as follows:

☛RESPONSIBILITY ACCOUNTING Center managers Evaluation models

➢ a system of accounting in which costs are assigned to various managerial

levels according to where control of the costs is deemed rest, with Cost center manager Costs variance analysis

managers being held responsible for the difference between actual and

Revenue center Revenue variance analysis

budgeted results.

manager

☛Responsibility center Profit center manager Segment margin analysis

➢ A clearly identified part or segment of an organization that is for a

specified function or set of activities. Investment center Return on investment (ROI), Residual income model,

➢ Any part of the organization whose manager has control over cost, manager Economic value added, Equity spread, Total

revenue, or investment funds. shareholders return, and the Market value added.

TYPES OF RESPONSIBILITY CENTERS

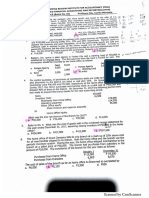

☛Segment margin is determined as follows:

1. Cost Center (or expense center) Contribution margin Pax

➢ A segment of an organization in which managers are held responsible for Less: Avoidable fixed costs and expenses xx

the costs or expenses incurred in the segment. Segment margin xx

2. Revenue Center Less: Unavoidable fixed costs and expenses xx

➢ Where management is responsible primarily for revenues. Profit xx

3. Profit Center Segment margin is the same as segment income or segment profit

➢ A segment of the organization in which the manager is held responsible for a. Return on Investment (ROI) model

both revenues and costs, ➢ It is sometimes refer to as return on assets (ROA). It is computed as

4. Investment Center follows:

➢ A segment of the organization where the manager controls revenues,

costs, and investments. The center’s performance is measured in terms of ROI= Segment income/ Investment

the use of the assets as well as the revenues earned and the costs

incurred. Three advantages of using ROI to evaluate the performance of investment

centers:

☛CENTRALIZATION 1. It encourages managers to pay careful attention to the relationship among sales,

➢ Happens when decisions rests exclusively to top management. expenses, and investment, as should be the case for a manager of an investment

☛DECENTRALIZATION center.

➢ The power to make decision is entrusted to operating managers; this is the 2. It encourages cost efficiency.

model used in designing and managing autonomous responsibility centers. 3. It discourages excessive

☛PERFORMANCE EVALUATION Two disadvantage of using ROI are:

➢ Is done within the concept of controllability (or authority). 1. It discourages managers from investing in projects that would decrease the

☛CONTROLLABILITY divisional ROI but would increase the profitability of the company as a whole.

➢ Refers to the power of the manager to decide or influence the incurrence (Generally, projects with an ROI less than a division’s current ROI would be

or non-incurrence of an item. The span of authority given to a manager rejected.)

defines the items that he has control with. The concept of controllability is 2. It can encourage myopic behavior, in that managers may focus on the short run

extremely important in measuring manager’s performance. at the expense of the long run.

Equity spread xx

☛ROI Du Pont Analysis **Return on equity= profit/ average shareholders’ equity

ROI= (Segment income/ Sales) x (Sales/ investment) or Return on Sales x Assets e. Total shareholders’ return

turnover = change in the Stock Price + dividend per share

ROI is expressed on percentage and has an inherent limitation of disregarding the Initial stock price

peso value performance of a business segment and its manager.

f. Market Value Added

b. Residual Income Model

Market value of equity

Residual income is computed as follows: (Shares outstanding x market price) xx

Segment income P xx Less: equity supplied by shareholders xx

Less: Minimum income** xx Market Value Added xx

Residual income xx

** Minimum income= investment x imputed income rate

Sometimes, the imputed rate is the cost of capital

If the residual income is positive, the performance is above standard and, is

therefore, favorable.

Residual income is considered superior than the ROI because it is determined in

peso, not in rate.

c. Economic Value added (EVA)

➢ After-tax version of the residual income model.

-

➢ Measures the marginal benefit obtained by using resources in relation to

the business of increasing shareholder value.

Operating profit after tax P xx (PBIT x ATR)

Less: MRLTE*

(TACL*) x WACOC xx

Economic Value Added xx

*TACL= Total assets – Current Liability

*MRLTE = Minimum return on long-term equity

(Where: PBIT = profit before interest and tax and WACOC = weighted average cost

of capital)

d. Equity Spread

➢ It measures managerial performance regarding creation of shareholder

value. It is computed as follows:

Shareholders’ equity-beginning P xx

X (Return on equity** – Cost of equity rate) xx%

Potrebbero piacerti anche

- STRATEGIC COST MANAGEMENT - Responsibility Accounting and Transfer Pricing - ConceptsDocumento7 pagineSTRATEGIC COST MANAGEMENT - Responsibility Accounting and Transfer Pricing - ConceptsVanna AsensiNessuna valutazione finora

- MIDTERM-MAS Responsibility Accounting Transfer PricingDocumento9 pagineMIDTERM-MAS Responsibility Accounting Transfer PricingbangtansonyeondaNessuna valutazione finora

- VALUATIONS - Responsibility Accounting and Transfer PricingDocumento13 pagineVALUATIONS - Responsibility Accounting and Transfer PricingAcademic StuffNessuna valutazione finora

- Responsibility AccountingDocumento20 pagineResponsibility AccountingaddityarajNessuna valutazione finora

- MS 08 Responsibility Accounting Transfer Pricing TheoriesDocumento4 pagineMS 08 Responsibility Accounting Transfer Pricing TheoriesQueenie DomingoNessuna valutazione finora

- Mas 08Documento9 pagineMas 08Christine Jane AbangNessuna valutazione finora

- STRACOSMAN - Chapter 3Documento2 pagineSTRACOSMAN - Chapter 3Rae WorksNessuna valutazione finora

- Responsibility Accounting LNDocumento7 pagineResponsibility Accounting LNzein lopezNessuna valutazione finora

- MAS 2 Responsibility Accounting Part 1Documento4 pagineMAS 2 Responsibility Accounting Part 1Jon garciaNessuna valutazione finora

- Responsibility Accounting, Transfer Pricing and Balance ScorecardDocumento9 pagineResponsibility Accounting, Transfer Pricing and Balance ScorecardLobenia RenalynNessuna valutazione finora

- Responsiblity AccountingDocumento30 pagineResponsiblity AccountingMarl Vinzi Tacastacas EducNessuna valutazione finora

- MAS Responsibility Acctg.Documento6 pagineMAS Responsibility Acctg.Rosalie Solomon BocalaNessuna valutazione finora

- Segment Reporting and Decentralization: Uaa - Acct 202 Principles of Managerial Accounting Dr. Fred BarbeeDocumento69 pagineSegment Reporting and Decentralization: Uaa - Acct 202 Principles of Managerial Accounting Dr. Fred BarbeeSayadi AdiihNessuna valutazione finora

- Responsibility Accounting, Transfer Pricing & Balanced ScorecardDocumento11 pagineResponsibility Accounting, Transfer Pricing & Balanced Scorecardmartinfaith958Nessuna valutazione finora

- RiskDocumento5 pagineRiskPaw AdanNessuna valutazione finora

- 5responsibility AccountingDocumento43 pagine5responsibility AccountingSayadi AdiihNessuna valutazione finora

- Strategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingDocumento10 pagineStrategic Cost Management Jpfranco: Lecture Note in Responsibility AccountingAnnamarisse parungaoNessuna valutazione finora

- Responsibility Reporting & Performance MeasurementDocumento66 pagineResponsibility Reporting & Performance MeasurementPriyanka ReddyNessuna valutazione finora

- Cpar MAS: Decentralization and Performance EvaluationDocumento15 pagineCpar MAS: Decentralization and Performance EvaluationAlliah Gianne Jacela100% (1)

- Responsibility Acctg SummaryDocumento1 paginaResponsibility Acctg SummarymnohairahNessuna valutazione finora

- Mas 2 Midterm SummaryDocumento8 pagineMas 2 Midterm SummaryDiana Rose MitoNessuna valutazione finora

- Topic 3 - Responsibility Acctg TPDocumento51 pagineTopic 3 - Responsibility Acctg TPFunyoungNessuna valutazione finora

- SC Class 3Documento39 pagineSC Class 3rodrigo.felix17012002Nessuna valutazione finora

- Responsibility AccountingDocumento7 pagineResponsibility AccountingJade Berlyn AgcaoiliNessuna valutazione finora

- SCMPE Revision Book V3 Chap7Documento11 pagineSCMPE Revision Book V3 Chap7backup mypcNessuna valutazione finora

- Ch9 DivisionPerformDocumento30 pagineCh9 DivisionPerformKieu Anh Bui LeNessuna valutazione finora

- Chapter 12Documento2 pagineChapter 12Faye GoodwinNessuna valutazione finora

- Session 11 Transfer Pricing - Rev2Documento47 pagineSession 11 Transfer Pricing - Rev2Ahmed MunawarNessuna valutazione finora

- 74f64cb9 1648891981341Documento44 pagine74f64cb9 1648891981341customsgyanNessuna valutazione finora

- B - Performance EvaluationDocumento15 pagineB - Performance Evaluationian dizonNessuna valutazione finora

- L 6 Performance MeasurementDocumento14 pagineL 6 Performance MeasurementMist FactorNessuna valutazione finora

- Lecture 26Documento29 pagineLecture 26Riaz Baloch NotezaiNessuna valutazione finora

- Responsibility Accounting and Transfer PricingDocumento6 pagineResponsibility Accounting and Transfer PricingMarielle Castañeda100% (1)

- 8 Responsibility AccountingDocumento8 pagine8 Responsibility AccountingXyril MañagoNessuna valutazione finora

- Mas-07: Responsibility Accounting & Transfer PricingDocumento7 pagineMas-07: Responsibility Accounting & Transfer PricingClint AbenojaNessuna valutazione finora

- Performance MeasurementDocumento6 paginePerformance Measurementcherrymia canomayNessuna valutazione finora

- 21decentralized Operations and Segment ReportingDocumento130 pagine21decentralized Operations and Segment ReportingAilene QuintoNessuna valutazione finora

- Responsibility CentreDocumento5 pagineResponsibility CentreataulbariNessuna valutazione finora

- Responsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesDocumento3 pagineResponsibility Accounting Responsibility Accounting - A System of Accounting Wherein Costs and RevenuesAriel DicoreñaNessuna valutazione finora

- Acctg 120 Mas Report FinalDocumento55 pagineAcctg 120 Mas Report FinalAnonymous rBxZlMNessuna valutazione finora

- Responsibility AccountingDocumento10 pagineResponsibility AccountingHeizeruNessuna valutazione finora

- Performance Evaluation For Decentralized OperationsDocumento50 paginePerformance Evaluation For Decentralized Operationsanon_355962815Nessuna valutazione finora

- FinalDocumento32 pagineFinalreegup0% (1)

- Chapter 11-MA (Garrison)Documento2 pagineChapter 11-MA (Garrison)Zaira PangesfanNessuna valutazione finora

- Summary of Responsibility AccountingDocumento2 pagineSummary of Responsibility AccountingnovyNessuna valutazione finora

- Responsibility Accounting PDFDocumento24 pagineResponsibility Accounting PDFYogesh Kumar PrajapatiNessuna valutazione finora

- Responsibility AccountingDocumento3 pagineResponsibility AccountingMilcah Deloso SantosNessuna valutazione finora

- CMA CH 5 - Responsibility Centers and Performance Measurement March 2019-1Documento39 pagineCMA CH 5 - Responsibility Centers and Performance Measurement March 2019-1Henok FikaduNessuna valutazione finora

- ACT2121 Lecture 19 Responsibility AccountingDocumento49 pagineACT2121 Lecture 19 Responsibility Accountingalangoo200Nessuna valutazione finora

- Chapter 8 - Divisional Perfomance and BudgetingDocumento34 pagineChapter 8 - Divisional Perfomance and BudgetingJeremiah NcubeNessuna valutazione finora

- Responsibility AccountingDocumento12 pagineResponsibility AccountingYannah HidalgoNessuna valutazione finora

- 8 Responsibility Accounting Transfer Price and Balance ScorecardDocumento9 pagine8 Responsibility Accounting Transfer Price and Balance ScorecardAlliah Mae ArbastoNessuna valutazione finora

- Chapter 3: Management Responsibility AND Performance MeasurementDocumento8 pagineChapter 3: Management Responsibility AND Performance MeasurementClaudia WongNessuna valutazione finora

- MAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer PricingDocumento4 pagineMAC3 Lecture 01. Responsibility Accounting Segment Evaluation and Transfer PricingAlliahData100% (1)

- 5.1 Decentralization - Responsibility AccountingDocumento1 pagina5.1 Decentralization - Responsibility AccountingLea GerodiazNessuna valutazione finora

- Cost Classification Part 2Documento10 pagineCost Classification Part 2ytuber9895Nessuna valutazione finora

- Accounting & Control: Cost ManagementDocumento40 pagineAccounting & Control: Cost ManagementBusiness MatterNessuna valutazione finora

- Accounting & Control: Cost ManagementDocumento40 pagineAccounting & Control: Cost ManagementMeriskaNessuna valutazione finora

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsDa EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNessuna valutazione finora

- ROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.Da EverandROGC, MOL, IGNC, ROE. Indicatori di redditività alberghiera tra gestione caratteristica ed extra caratteristica.: A quick reasoning-commentare about hôtellerie keys performance indicators leading to financial and economic bad or good results, considering as well the cross action of the real estate market as a driver of the increased number of hospitality spots.Nessuna valutazione finora

- Midterms Quiz 2 Answers PDFDocumento7 pagineMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- AFAR Mastery Part4 PDFDocumento3 pagineAFAR Mastery Part4 PDFFranz CampuedNessuna valutazione finora

- Finals Quiz 2Documento6 pagineFinals Quiz 2Franz CampuedNessuna valutazione finora

- Midterm Quiz 2 PDFDocumento5 pagineMidterm Quiz 2 PDFFranz Campued100% (1)

- AFAR Mastery Part1 PDFDocumento3 pagineAFAR Mastery Part1 PDFFranz CampuedNessuna valutazione finora

- Management Information System and The Systems EngagementDocumento5 pagineManagement Information System and The Systems EngagementFranz CampuedNessuna valutazione finora

- AFAR Mastery Part5 PDFDocumento7 pagineAFAR Mastery Part5 PDFFranz CampuedNessuna valutazione finora

- Taxation - 1principles of TaxationDocumento8 pagineTaxation - 1principles of TaxationFranz CampuedNessuna valutazione finora

- Financial Statements AnalysisDocumento8 pagineFinancial Statements AnalysisFranz CampuedNessuna valutazione finora

- Variable and Absorption CostingDocumento4 pagineVariable and Absorption CostingFranz CampuedNessuna valutazione finora

- CVP Analysis and Marginal Costing and BEPDocumento2 pagineCVP Analysis and Marginal Costing and BEPFranz CampuedNessuna valutazione finora

- Operating and Financial BudgetingDocumento4 pagineOperating and Financial BudgetingFranz CampuedNessuna valutazione finora

- Standard Costing and Variance AnalysisDocumento3 pagineStandard Costing and Variance AnalysisFranz CampuedNessuna valutazione finora

- Cost Terms, Concepts and BehaviorDocumento3 pagineCost Terms, Concepts and BehaviorFranz CampuedNessuna valutazione finora

- Final TaxDocumento1 paginaFinal TaxFranz CampuedNessuna valutazione finora

- 12the Auditors Report On FS (Samples)Documento22 pagine12the Auditors Report On FS (Samples)Franz CampuedNessuna valutazione finora

- 8assertions, Audit Procedures and Audit EvidenceDocumento10 pagine8assertions, Audit Procedures and Audit EvidenceFranz CampuedNessuna valutazione finora

- 4introduction To AuditingDocumento13 pagine4introduction To AuditingFranz CampuedNessuna valutazione finora

- 2nature of System of Quality ControlDocumento2 pagine2nature of System of Quality ControlFranz CampuedNessuna valutazione finora

- 1public Accounting ProfessionDocumento6 pagine1public Accounting ProfessionFranz CampuedNessuna valutazione finora

- 13auditing in A CisDocumento5 pagine13auditing in A CisFranz CampuedNessuna valutazione finora

- Goal Ball Lesson PlanDocumento4 pagineGoal Ball Lesson Planapi-378557749100% (1)

- Foxit PhantomPDF For HP - Quick GuideDocumento32 pagineFoxit PhantomPDF For HP - Quick GuidekhilmiNessuna valutazione finora

- Chinese AstronomyDocumento13 pagineChinese Astronomyss13Nessuna valutazione finora

- Introduction To Instrumented IndentationDocumento7 pagineIntroduction To Instrumented Indentationopvsj42Nessuna valutazione finora

- Customizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesDocumento191 pagineCustomizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesCalina Sechel100% (1)

- Apache Hive Essentials 2nd PDFDocumento204 pagineApache Hive Essentials 2nd PDFketanmehta4u0% (1)

- Enunciado de La Pregunta: Finalizado Se Puntúa 1.00 Sobre 1.00Documento9 pagineEnunciado de La Pregunta: Finalizado Se Puntúa 1.00 Sobre 1.00Samuel MojicaNessuna valutazione finora

- Equine PregnancyDocumento36 pagineEquine Pregnancydrdhirenvet100% (1)

- Becoming FarmersDocumento13 pagineBecoming FarmersJimena RoblesNessuna valutazione finora

- 1E Star Trek Customizable Card Game - 6 First Contact Rule SupplementDocumento11 pagine1E Star Trek Customizable Card Game - 6 First Contact Rule Supplementmrtibbles100% (1)

- Sample Midterm ExamDocumento6 pagineSample Midterm ExamRenel AluciljaNessuna valutazione finora

- The Training Toolbox: Forced Reps - The Real Strength SenseiDocumento7 pagineThe Training Toolbox: Forced Reps - The Real Strength SenseiSean DrewNessuna valutazione finora

- Term-2 - Grade 8 Science (Biology) Mock Paper-2Documento3 pagineTerm-2 - Grade 8 Science (Biology) Mock Paper-2bhagat100% (1)

- ZKAccess3.5 Security System User Manual V3.0 PDFDocumento97 pagineZKAccess3.5 Security System User Manual V3.0 PDFJean Marie Vianney Uwizeye100% (2)

- Poet Forugh Farrokhzad in World Poetry PDocumento3 paginePoet Forugh Farrokhzad in World Poetry Pkarla telloNessuna valutazione finora

- Quarter 3 Week 6Documento4 pagineQuarter 3 Week 6Ivy Joy San PedroNessuna valutazione finora

- SEx 3Documento33 pagineSEx 3Amir Madani100% (4)

- Marketing PlanDocumento41 pagineMarketing PlanMark AbainzaNessuna valutazione finora

- Playwriting Pedagogy and The Myth of IntrinsicDocumento17 paginePlaywriting Pedagogy and The Myth of IntrinsicCaetano BarsoteliNessuna valutazione finora

- Glickman - The Jewish White Slavery Trade (2000)Documento152 pagineGlickman - The Jewish White Slavery Trade (2000)Alrik G. HamerNessuna valutazione finora

- Your Free Buyer Persona TemplateDocumento8 pagineYour Free Buyer Persona Templateel_nakdjoNessuna valutazione finora

- Creative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12Documento55 pagineCreative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12QUINTOS, JOVINCE U. G-12 HUMSS A GROUP 8Nessuna valutazione finora

- Chapter 4 - Risk Assessment ProceduresDocumento40 pagineChapter 4 - Risk Assessment ProceduresTeltel BillenaNessuna valutazione finora

- GB BioDocumento3 pagineGB BiolskerponfblaNessuna valutazione finora

- Clearing Negative SpiritsDocumento6 pagineClearing Negative SpiritsmehorseblessedNessuna valutazione finora

- Essay EnglishDocumento4 pagineEssay Englishkiera.kassellNessuna valutazione finora

- Oxford Reading Circle tg-4 2nd EditionDocumento92 pagineOxford Reading Circle tg-4 2nd EditionAreeb Siddiqui89% (9)

- British Citizenship Exam Review TestDocumento25 pagineBritish Citizenship Exam Review TestMay J. PabloNessuna valutazione finora

- Eternal LifeDocumento9 pagineEternal LifeEcheverry MartínNessuna valutazione finora