Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Production Concept Extra Problems PDF

Caricato da

Rami AbdelaalTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Production Concept Extra Problems PDF

Caricato da

Rami AbdelaalCopyright:

Formati disponibili

Chapter 2

Production cost

Costs of Manufacturing Operations

2.16 Theoretically, any given production plant has an optimum output level. Suppose a certain production plant has

annual fixed costs FC = $2,000,000. Variable cost VC is functionally related to annual output Q in a manner that

can be described by the function VC = $12 + $0.005Q. Total annual cost is given by TC = FC + VC x Q. The

unit sales price for one production unit P = $250. (a) Determine the value of Q that minimizes unit cost UC,

where UC = TC/Q; and compute the annual profit earned by the plant at this quantity. (b) Determine the value of

Q that maximizes the annual profit earned by the plant; and compute the annual profit earned by the plant at this

quantity.

2.17 Costs have been compiled for a certain manufacturing company for the most recent year. The summary is shown

in the table below. The company operates two different manufacturing plants, plus a corporate headquarters.

Determine: (a) the factory overhead rate for each plant, and (b) the corporate overhead rate. These rates will be

used by the firm in the following year.

2.18 The hourly rate for a certain work center is to be determined based on the following data: direct labor rate =

$15.00/hr; applicable factory overhead rate on labor = 35%; capital investment in machine = $200,000; service

life of the machine = 5 years; rate of return = 15%; salvage value in five years = zero; and applicable factory

overhead rate on machine = 40%. The work center will be operated two 8-hour shifts, 250 days per year.

Determine the appropriate hourly rate for the work center.

2.19 In previous Problem 2.18, if the work load for the cell can only justify a one shift operation, determine the

appropriate hourly rate for the work center.

2.20 In the operation of a certain production machine, one worker is required at a direct labor rate = $10/hr.

Applicable labor factory overhead rate = 50%. Capital investment in the system = $250,000, expected service

life = 10 years, no salvage value at the end of that period, and the applicable machine factory overhead rate =

30%. The work cell will operate 2000 hr/yr. Use a rate of return of 25% to determine the appropriate hourly rate

for this work cell.

2.21 Same as previous Problem 2.20, except that the machine will be operated three shifts, or 6000 hr/yr. Note the

effect of increased machine utilization on the hourly rate compared to the rate determined in Problem 2.20.

2.22 The break-even point is to be determined for two production methods, one a manual method and the other

automated. The manual method requires two workers at $9.00/hr each. Together, they produce at a rate of 36

units/hr. The automated method has an initial cost of $125,000, a 4-year service life, no salvage value, and

annual maintenance costs = $3000. No labor (except for maintenance) is required to operate the machine, but the

power required to run the machine is 50 kW (when running). Cost of electric power is $0.05/kWh. If the

production rate for the automated machine is 100 units/hr, determine the break-even point for the two methods,

using a rate of return = 25%.

Comment: Plenty of additional capacity in one shift beyond the break-even point.

Potrebbero piacerti anche

- Microsoft Excel-Based Tool Kit for Planning Hybrid Energy Systems: A User GuideDa EverandMicrosoft Excel-Based Tool Kit for Planning Hybrid Energy Systems: A User GuideNessuna valutazione finora

- Chapter 3 SolutionDocumento6 pagineChapter 3 Solutionrobertrnicol0% (1)

- Tutorial 3 - SolutionDocumento5 pagineTutorial 3 - SolutionAbdul Aziz Wicaksono100% (1)

- Course Outline Mechanics Machines ME3033Documento4 pagineCourse Outline Mechanics Machines ME3033Mohammad Faraz AkhterNessuna valutazione finora

- Numerical Tech For Interpolation & Curve FittingDocumento46 pagineNumerical Tech For Interpolation & Curve FittingChatchai ManathamsombatNessuna valutazione finora

- Design of Robot-Centered CellDocumento7 pagineDesign of Robot-Centered CellRachnaNessuna valutazione finora

- Modern Control Technology Components & Systems (2nd Ed.)Documento2 pagineModern Control Technology Components & Systems (2nd Ed.)musarraf172Nessuna valutazione finora

- Transfer Function ExercisesDocumento2 pagineTransfer Function ExercisesrodwellheadNessuna valutazione finora

- Sheet 4Documento6 pagineSheet 4geniust0% (1)

- Fault Studies ExaminationDocumento1 paginaFault Studies ExaminationAlliver SapitulaNessuna valutazione finora

- Matlab Program Using Polynomial RegressionDocumento4 pagineMatlab Program Using Polynomial RegressionabdulbabulNessuna valutazione finora

- ICE Optim Linea PDFDocumento68 pagineICE Optim Linea PDFsatydevsinghnegiNessuna valutazione finora

- Qualitative PI ControlDocumento4 pagineQualitative PI ControlAbeer ChaudhryNessuna valutazione finora

- Manufacturing Example PDFDocumento6 pagineManufacturing Example PDFAbdul RahmanNessuna valutazione finora

- Economic Operation of Power SystemsDocumento21 pagineEconomic Operation of Power SystemsHarish Kumar GNessuna valutazione finora

- 05-Nonpilot OC Protection of Transmission LinesDocumento23 pagine05-Nonpilot OC Protection of Transmission Linesfdsfs2131Nessuna valutazione finora

- EE4004A Power SystemsDocumento4 pagineEE4004A Power Systemsbenson215Nessuna valutazione finora

- Assignment 1Documento25 pagineAssignment 1Muhammad KhalilNessuna valutazione finora

- Pic 18Documento78 paginePic 18anses1000Nessuna valutazione finora

- Multipurpose Robotic ArmDocumento7 pagineMultipurpose Robotic ArmIJRASETPublicationsNessuna valutazione finora

- Laplace Transformation - WordDocumento9 pagineLaplace Transformation - WordlovebeannNessuna valutazione finora

- PLC and SCADA Based Smart Distribution System: Submitted in Partial Fulfillment of The Requirement of The Degree ofDocumento95 paginePLC and SCADA Based Smart Distribution System: Submitted in Partial Fulfillment of The Requirement of The Degree ofNkosilozwelo SibandaNessuna valutazione finora

- CompletionDocumento128 pagineCompletionMelgie Mae Matulin DikitananNessuna valutazione finora

- Chapter 07Documento36 pagineChapter 07albgatmty100% (1)

- Assignment 1Documento2 pagineAssignment 1Tang Voon HaoNessuna valutazione finora

- Lab 5 ControlDocumento6 pagineLab 5 ControlAyaz AhmadNessuna valutazione finora

- ELECTRICAL PROJECTS USING MATLAB/SIMULINK Multi Machine Power System Stability Enhancement Using Static Synchronous Series Compensator (SSSC)Documento5 pagineELECTRICAL PROJECTS USING MATLAB/SIMULINK Multi Machine Power System Stability Enhancement Using Static Synchronous Series Compensator (SSSC)APLCTNNessuna valutazione finora

- Discussion Questions From Lecture 1Documento1 paginaDiscussion Questions From Lecture 1ELIZABETH100% (1)

- Ejercicio Segunda Parte - 2Documento1 paginaEjercicio Segunda Parte - 2Abril EsparzaNessuna valutazione finora

- Engineering Economy 16th Edition Sullivan Test BankDocumento5 pagineEngineering Economy 16th Edition Sullivan Test BankThomas Seamon100% (41)

- Breakeven and Payback Analysis: Parameter or Decision VariableDocumento5 pagineBreakeven and Payback Analysis: Parameter or Decision VariableZoloft Zithromax ProzacNessuna valutazione finora

- Literature Review 1 PageDocumento9 pagineLiterature Review 1 PageMahbub HussainNessuna valutazione finora

- Engineering Economy 16th Edition Sullivan Test BankDocumento5 pagineEngineering Economy 16th Edition Sullivan Test BankDanielThomasxjfoq100% (15)

- Break-Even Analysis: Prepared byDocumento18 pagineBreak-Even Analysis: Prepared bykhedira samiNessuna valutazione finora

- Test Bank For Engineering Economy 16th Edition by Sullivan Wicks Koelling ISBN 0133439275 9780133439274Documento35 pagineTest Bank For Engineering Economy 16th Edition by Sullivan Wicks Koelling ISBN 0133439275 9780133439274AshleyParksegn100% (24)

- Test Bank For Engineering Economy 16Th Edition by Sullivan Wicks Koelling Isbn 0133439275 9780133439274 Full Chapter PDFDocumento25 pagineTest Bank For Engineering Economy 16Th Edition by Sullivan Wicks Koelling Isbn 0133439275 9780133439274 Full Chapter PDFmindy.sorrell339100% (14)

- Break Even TutorialDocumento7 pagineBreak Even TutorialAhmed BeheryNessuna valutazione finora

- Answer CH 7 Costs of ProductionDocumento11 pagineAnswer CH 7 Costs of ProductionAurik IshNessuna valutazione finora

- Engineering Economy 16th Edition Sullivan Test BankDocumento36 pagineEngineering Economy 16th Edition Sullivan Test Bankfoxysolon8cfh5100% (20)

- Dwnload Full Engineering Economy 16th Edition Sullivan Test Bank PDFDocumento36 pagineDwnload Full Engineering Economy 16th Edition Sullivan Test Bank PDFserenafinnodx100% (12)

- Chapter 11 H WK ProblemsDocumento2 pagineChapter 11 H WK ProblemsCyn SyjucoNessuna valutazione finora

- Answers Homework # 16 Cost MGMT 5Documento7 pagineAnswers Homework # 16 Cost MGMT 5Raman ANessuna valutazione finora

- Chapter 8 - Accounting For Factory OverheadDocumento25 pagineChapter 8 - Accounting For Factory OverheadJan LumakadNessuna valutazione finora

- Machine Hours RateDocumento15 pagineMachine Hours RateRatnakar PatilNessuna valutazione finora

- Activity Based CostingDocumento10 pagineActivity Based CostingEdi Kristanta PelawiNessuna valutazione finora

- F5 Asignment 1Documento5 pagineF5 Asignment 1Minhaj AlbeezNessuna valutazione finora

- Engg Econ QuestionsDocumento7 pagineEngg Econ QuestionsSherwin Dela CruzzNessuna valutazione finora

- Initial Cash FlowDocumento3 pagineInitial Cash FlowNouman Mujahid50% (2)

- Infosys LTD Standalone Audit Report To Shareholders For FY 2019Documento3 pagineInfosys LTD Standalone Audit Report To Shareholders For FY 2019Sundarasudarsan RengarajanNessuna valutazione finora

- PPE ProblemsDocumento10 paginePPE ProblemsJhiGz Llausas de GuzmanNessuna valutazione finora

- January 2021 ExamDocumento23 pagineJanuary 2021 ExamGaurav TolaniNessuna valutazione finora

- Case 1 PDFDocumento2 pagineCase 1 PDFryanlim1996Nessuna valutazione finora

- Assignment 1 - Engineering EconomicsDocumento15 pagineAssignment 1 - Engineering EconomicsDhiraj NayakNessuna valutazione finora

- Review QuestionsDocumento22 pagineReview QuestionsJustus MusilaNessuna valutazione finora

- P 6 + 4 + 8 18 Different Models.: 5 300 000 2000,, / / Ker HR Yr HR WorDocumento3 pagineP 6 + 4 + 8 18 Different Models.: 5 300 000 2000,, / / Ker HR Yr HR WorIlhamNessuna valutazione finora

- UntitledDocumento1 paginaUntitledLabib SafeenNessuna valutazione finora

- All Work Must Be Shown It Can'T Be Just The AnswersDocumento3 pagineAll Work Must Be Shown It Can'T Be Just The AnswersJoel Christian MascariñaNessuna valutazione finora

- HW 6 KeyDocumento5 pagineHW 6 KeyRosinda ArendainNessuna valutazione finora

- 4 Learning CurvesDocumento8 pagine4 Learning Curvessabinaeghan1Nessuna valutazione finora

- Economics of Power GenerationDocumento23 pagineEconomics of Power GenerationAbdullah NawabNessuna valutazione finora

- CGDocumento164 pagineCGFabian Andres Cely100% (1)

- Empty Container Handlers: H10-12XM-12ECDocumento16 pagineEmpty Container Handlers: H10-12XM-12ECRami AbdelaalNessuna valutazione finora

- Kalmar DCG 80-100 Brochure USDocumento11 pagineKalmar DCG 80-100 Brochure USAlberto100% (1)

- Firestone AG DataBook 08-29-2016Documento221 pagineFirestone AG DataBook 08-29-2016dionisio emilio reyes jimenezNessuna valutazione finora

- Mi Jack Reach Stackers Spec A2ce6bDocumento2 pagineMi Jack Reach Stackers Spec A2ce6bRami AbdelaalNessuna valutazione finora

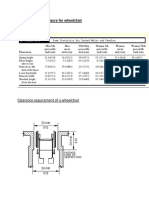

- Anthropometry Measure For WheelchairDocumento3 pagineAnthropometry Measure For WheelchairRami AbdelaalNessuna valutazione finora

- Quality For All.: The Kalmar DRU450 Essential ReachstackerDocumento9 pagineQuality For All.: The Kalmar DRU450 Essential ReachstackerRami Abdelaal100% (1)

- Contract Sheet (Mechanical Engineering) : Beirut Arab University Faculty of EngineeringDocumento1 paginaContract Sheet (Mechanical Engineering) : Beirut Arab University Faculty of EngineeringRami AbdelaalNessuna valutazione finora

- Effect of The Tyre in Ation Pressure On The Vehicle Dynamics During Braking ManoeuvreDocumento7 pagineEffect of The Tyre in Ation Pressure On The Vehicle Dynamics During Braking ManoeuvreRami AbdelaalNessuna valutazione finora

- Ind Strial Engineering and Management Industrial Engineering and ManagementDocumento38 pagineInd Strial Engineering and Management Industrial Engineering and ManagementRami AbdelaalNessuna valutazione finora

- Introduction To Human Factors: Industrial Engineering and ManagementDocumento9 pagineIntroduction To Human Factors: Industrial Engineering and ManagementRami AbdelaalNessuna valutazione finora

- Applied Anthropometry: Industrial Engineering and ManagementDocumento14 pagineApplied Anthropometry: Industrial Engineering and ManagementRami AbdelaalNessuna valutazione finora

- Design of Work Areas and Station: Industrial Engineering and ManagementDocumento17 pagineDesign of Work Areas and Station: Industrial Engineering and ManagementRami AbdelaalNessuna valutazione finora

- 11 - 8 Steps To Success in Maintenance Planning and Scheduling PDFDocumento42 pagine11 - 8 Steps To Success in Maintenance Planning and Scheduling PDFmsaad19103564100% (2)

- Industrial Engineering and Management: NoiseDocumento12 pagineIndustrial Engineering and Management: NoiseRami AbdelaalNessuna valutazione finora

- Sany Container Gantry Crane: Rubber TyreDocumento10 pagineSany Container Gantry Crane: Rubber TyreRami AbdelaalNessuna valutazione finora

- I I I I: A) Simplify 6 2 3 4Documento3 pagineI I I I: A) Simplify 6 2 3 4Rami AbdelaalNessuna valutazione finora

- PEMA IP07 Tyre Selection and MaintenanceDocumento22 paginePEMA IP07 Tyre Selection and MaintenanceJeremiah BeltranNessuna valutazione finora

- Bridgestone OTRDocumento89 pagineBridgestone OTRJuan CarvajalNessuna valutazione finora

- PDFDocumento30 paginePDFRami AbdelaalNessuna valutazione finora

- Truck Tire Data Guide: Built OnDocumento32 pagineTruck Tire Data Guide: Built OnRami AbdelaalNessuna valutazione finora

- 2017 OTR HandbookDocumento42 pagine2017 OTR HandbookirhamulfikriNessuna valutazione finora

- Bridgestone Firestone Canada Maint Safety Manual 05-12-17Documento32 pagineBridgestone Firestone Canada Maint Safety Manual 05-12-17jacobpm2010Nessuna valutazione finora

- Mobile Crawler Crane ChecklistDocumento2 pagineMobile Crawler Crane ChecklistJohn Kurong100% (5)

- Lecture 5 PDFDocumento66 pagineLecture 5 PDFRami AbdelaalNessuna valutazione finora

- TTC Forklift Manual 2012 v14Documento120 pagineTTC Forklift Manual 2012 v14Adrian StefanNessuna valutazione finora

- KC MHC Brochure enDocumento17 pagineKC MHC Brochure enacanbasri1980Nessuna valutazione finora

- Theseus Final Thesis ReportDocumento91 pagineTheseus Final Thesis ReportRami AbdelaalNessuna valutazione finora

- Terminal Tractor: Kalmar TL2Documento106 pagineTerminal Tractor: Kalmar TL2Rami AbdelaalNessuna valutazione finora

- Lecture 5 PDFDocumento66 pagineLecture 5 PDFRami AbdelaalNessuna valutazione finora

- QB Som He306 2015 2016Documento23 pagineQB Som He306 2015 2016etayhailuNessuna valutazione finora

- Booster Mock Test For NEETDocumento15 pagineBooster Mock Test For NEETDrNessuna valutazione finora

- Women's Prints & Graphics Forecast A/W 24/25: Future TerrainsDocumento15 pagineWomen's Prints & Graphics Forecast A/W 24/25: Future TerrainsPari Sajnani100% (1)

- Oscillations NotesDocumento48 pagineOscillations Notesabdulrehman881122Nessuna valutazione finora

- Feeg2003 L21Documento9 pagineFeeg2003 L21jiales225Nessuna valutazione finora

- Commissioning Valve Product BrochureDocumento14 pagineCommissioning Valve Product BrochureblindjaxxNessuna valutazione finora

- Tuesday 12 January 2021: ChemistryDocumento24 pagineTuesday 12 January 2021: Chemistryuchi haNessuna valutazione finora

- Marlinespike - Rope Breaking StrengthDocumento7 pagineMarlinespike - Rope Breaking StrengthAnonymous ycFeyuLAt100% (1)

- Midi Fighter Twister - User Guide 2016Documento25 pagineMidi Fighter Twister - User Guide 2016moxmixNessuna valutazione finora

- A. Desplat: Godzilla (2014) - Film Score AnalysisDocumento18 pagineA. Desplat: Godzilla (2014) - Film Score AnalysisR.PercacciNessuna valutazione finora

- Perbedaan Fermentasi Dan Respirasi Anaerob (Campbell Biology 12th Ed.)Documento4 paginePerbedaan Fermentasi Dan Respirasi Anaerob (Campbell Biology 12th Ed.)Oppof7 OppoNessuna valutazione finora

- System Substation Commissioning TestsDocumento8 pagineSystem Substation Commissioning TestsCvijayakumar100% (1)

- Mat11 PDFDocumento13 pagineMat11 PDFRaquel Martins E SilvaNessuna valutazione finora

- Marshall Abby - Chess Cafe - The Openings Explained - 1-63, 2015-OCR, 682pDocumento682 pagineMarshall Abby - Chess Cafe - The Openings Explained - 1-63, 2015-OCR, 682pArtur MałkowskiNessuna valutazione finora

- Malabar Cements Performance AppraisalDocumento92 pagineMalabar Cements Performance AppraisalDoraiBalamohan0% (1)

- Detector de Fum Si Temperatura Apollo XP95-55000-885Documento2 pagineDetector de Fum Si Temperatura Apollo XP95-55000-885dorobantu_alexandruNessuna valutazione finora

- 10 Powerful Mudras and How To Use Them: 1. GyanDocumento4 pagine10 Powerful Mudras and How To Use Them: 1. GyanAkrithi Akrithi100% (1)

- ED1021 - I/O Expander With UART Interface & Analog Inputs: PreliminaryDocumento9 pagineED1021 - I/O Expander With UART Interface & Analog Inputs: PreliminaryMilan NovakovićNessuna valutazione finora

- 21 Day Fasting & Prayer 2022Documento29 pagine21 Day Fasting & Prayer 2022StephenNessuna valutazione finora

- Concrete Tunnel Design and Calculation Spreadsheet Based On AASHTO and ACIDocumento3 pagineConcrete Tunnel Design and Calculation Spreadsheet Based On AASHTO and ACIFirat PulatNessuna valutazione finora

- Systems of Linear Equations With Two VariablesDocumento34 pagineSystems of Linear Equations With Two VariablesFatima KausarNessuna valutazione finora

- Chapter 11Documento10 pagineChapter 11NungkiwidyasNessuna valutazione finora

- Brooding and Rearing Baby ChicksDocumento4 pagineBrooding and Rearing Baby ChicksRaymond KatabaziNessuna valutazione finora

- HINO Dutro Fault Codes List PDFDocumento4 pagineHINO Dutro Fault Codes List PDFANH LÊNessuna valutazione finora

- Ficha Tecnica p501Documento4 pagineFicha Tecnica p501LizbethNessuna valutazione finora

- Supplier S Documentation of Equipment PDFDocumento32 pagineSupplier S Documentation of Equipment PDFzhangjieNessuna valutazione finora

- Use of Information Technology in The Flight Catering ServicesDocumento32 pagineUse of Information Technology in The Flight Catering ServicesAbhiroop SenNessuna valutazione finora

- GIRBESDocumento6 pagineGIRBESMiguel LópezNessuna valutazione finora

- Session 1Documento4 pagineSession 1Vidhi VermaNessuna valutazione finora

- MH2732-Robotics Lab ManualDocumento50 pagineMH2732-Robotics Lab Manualramzi ayadiNessuna valutazione finora