Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Activity 2 - Receivable

Caricato da

Ma. Alexandra Teddy BuenTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Activity 2 - Receivable

Caricato da

Ma. Alexandra Teddy BuenCopyright:

Formati disponibili

Activity 2_ Receivables

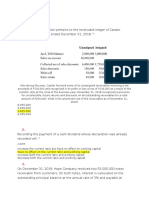

1. Vic Vivar started business on January 1, 2019. His ledger on December 31, 2019 among others showed:

Accounts receivable P125,650

Sales 367,280

Sales returns and allowances 3,180

Bad debts provided for 2019 was 3% of net sales. During 2020, sales amounted P460,700 out of which P3,700

were returned by the customers. Cash received from customers amounted to P235,112.50, of which P132,112.50,

after 2-1/2 percent discount, pertains to 2020 sales.

Of the 2019 accounts, P1,500 are worthless.

Bad debts provision for 2020 is 2% of net sales.

Required: all entries should have explanation (To record sales computed as follows:. Etc.)

a) Entries to record sales in 2019, including its subsequent collection.

b) Entry to record the allowance for bad debts on December 31, 2019.

c) Entries to record sales in 2020, including collection of previous and current receivables.

d) Entry to record the write-off of worthless accounts.

e) Entry to record the allowance for bad debts on December 31, 2020.

f) How much is net sales for the year 2020?

g) How much is net realizable value of the accounts receivable on December 31, 2020?

2. Gus received from a customer a one-year, P375,000 note bearing annual interest of 8%. After holding the note

for six months, Gus discounted the note at Platinum Bank at an effective rate of 10%. If the discounting is treated

as a sale, what amount of loss on discounting should Gus recognize?

3. On December 1, 2019, Matilda Company assigned on a non-notification basis accounts receivable of P3,000,000

to a bank in consideration for a loan of 80% of the receivables less a 5% service fee on the accounts assigned. The

interest rate of the loan is 12% per annum. The company collected assigned accounts of P2,000,000 and remitted

the collections to the bank in partial payment for the loan. The bank applied first the collection to the interest and

the balance to the principal. The interest rate is 1% per month on the outstanding balance of the loan.

In its December 31, 2019 balance sheet, what amount of note payable should Matilda report as current liability?

4. Matt Corporation had a specific receivable from a customer in the amount of P600,000 as of December 31, 2019.

During 2020, the customer informed Matt Corporation that servicing of its payable will be made once there is

significant improvement in their financial capabilities. Since there are no available historical data relating to

similar borrowers, Matt Corporation uses its experienced judgment to estimate the amount of impairment loss.

Reasonable estimate revealed that the fair value of the receivable as of December 31, 2020 represents 40% of the

outstanding receivable.

What amount of impairment loss on its receivable should Matt report for 2020?

Instruction: Write in your own handwriting using a 10-12 column worksheet if you have any or intermediate

paper. Use black/blue ballpen. Show solutions in good accounting form. All amounts should be captioned, no

abbreviations. Submit a picture of your work by turning it in. Make sure that it is properly and clearly captured

(not upside down, portrait orientation) Remember to solve it on your own, it is ungraded but part of formative

assessment (10%).

Potrebbero piacerti anche

- Chapter 2Documento8 pagineChapter 2cindyNessuna valutazione finora

- Far FinalDocumento24 pagineFar FinalJon MickNessuna valutazione finora

- Practice Problems - Notes and Loans Receivable: General InstructionsDocumento2 paginePractice Problems - Notes and Loans Receivable: General Instructionseia aieNessuna valutazione finora

- Receivables Mock QuizDocumento5 pagineReceivables Mock QuizChester CariitNessuna valutazione finora

- ACCTG 103 Notes Receivable and Payable ReviewDocumento12 pagineACCTG 103 Notes Receivable and Payable ReviewLyn AbudaNessuna valutazione finora

- Receivables QuizDocumento3 pagineReceivables QuizAshianna KimNessuna valutazione finora

- MC QuestionsDocumento11 pagineMC QuestionsKatrina Dela CruzNessuna valutazione finora

- 5.1 - AUDIT ON RECEIVABLES (Problems)Documento10 pagine5.1 - AUDIT ON RECEIVABLES (Problems)LorraineMartinNessuna valutazione finora

- Answer Key - M1L2 PDFDocumento4 pagineAnswer Key - M1L2 PDFEricka Mher IsletaNessuna valutazione finora

- ACCTGREV1 - 002 Notes Payable and RestructuringDocumento2 pagineACCTGREV1 - 002 Notes Payable and RestructuringRenz Angel M. RiveraNessuna valutazione finora

- Financial LiabilitiesDocumento4 pagineFinancial LiabilitiesNicah AcojonNessuna valutazione finora

- Intermediate Accounting 2 Reviewer PDFDocumento133 pagineIntermediate Accounting 2 Reviewer PDFCarl CagampzNessuna valutazione finora

- Calculate Long-Term Receivables for NGO CorporationDocumento8 pagineCalculate Long-Term Receivables for NGO CorporationCindy CrausNessuna valutazione finora

- Module 1 and 3 AssignmentDocumento12 pagineModule 1 and 3 AssignmentPrincess Maeca OngNessuna valutazione finora

- Correct!: Accrued and DisclosedDocumento111 pagineCorrect!: Accrued and DisclosedJaeNessuna valutazione finora

- Sabina Company Quiz #1 Questions and SolutionsDocumento6 pagineSabina Company Quiz #1 Questions and SolutionsJames Daniel SwintonNessuna valutazione finora

- Receivables Problem 5Documento2 pagineReceivables Problem 5Ken Ashton NombradoNessuna valutazione finora

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDocumento6 pagine02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNessuna valutazione finora

- 1st Compre NR and LR PDFDocumento3 pagine1st Compre NR and LR PDFHelton Jun M. TuralbaNessuna valutazione finora

- Far Review - Notes and Receivable AssessmentDocumento6 pagineFar Review - Notes and Receivable AssessmentLuisa Janelle BoquirenNessuna valutazione finora

- Assignment 2Documento1 paginaAssignment 2mallarijhoana21Nessuna valutazione finora

- Prac 1 Final PreboardDocumento10 paginePrac 1 Final Preboardbobo kaNessuna valutazione finora

- Mock Test - ReceivablesDocumento5 pagineMock Test - ReceivablesANJELLA LIZETTE TEENessuna valutazione finora

- Intermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterDocumento3 pagineIntermediate - Accounting - 2 - Quiz - 1.pdf Filename - UTF-8''InterClaire Magbunag AntidoNessuna valutazione finora

- Quiz No. 2 - ReceivablesDocumento1 paginaQuiz No. 2 - ReceivablesJi BaltazarNessuna valutazione finora

- Far 2 LQDocumento14 pagineFar 2 LQJennifer AdvientoNessuna valutazione finora

- IA 2 Quiz #1 - Investment in BondsDocumento2 pagineIA 2 Quiz #1 - Investment in BondsSkeeter Britney CostaNessuna valutazione finora

- Cherry Company accounts receivable adjustmentsDocumento6 pagineCherry Company accounts receivable adjustmentsEdemson NavalesNessuna valutazione finora

- HW On Receivables CDocumento5 pagineHW On Receivables CAmjad Rian MangondatoNessuna valutazione finora

- Far Quiz 2Documento13 pagineFar Quiz 2Shiela Jane CrismundoNessuna valutazione finora

- Chapter 10 - Prior Period Errors: Problem 10-1 (IAA)Documento12 pagineChapter 10 - Prior Period Errors: Problem 10-1 (IAA)Asi Cas JavNessuna valutazione finora

- Receivables ProblemsDocumento4 pagineReceivables ProblemsLarpii MonameNessuna valutazione finora

- Prae03 HoDocumento3 paginePrae03 HoDiane MagnayeNessuna valutazione finora

- Far 103 - Accounting For Receivables and Notes ReceivableDocumento4 pagineFar 103 - Accounting For Receivables and Notes ReceivablePatrishaNessuna valutazione finora

- Current LiabilitiesDocumento3 pagineCurrent LiabilitiesAhlaya Lyrica Cadence SadoresNessuna valutazione finora

- D. Discounted - YES Pledged - NODocumento9 pagineD. Discounted - YES Pledged - NOJasper LuagueNessuna valutazione finora

- 4 FAR Handout Notes ReceivableDocumento2 pagine4 FAR Handout Notes Receivablealford sery CammayoNessuna valutazione finora

- Bank Loan Receivable CalculationDocumento19 pagineBank Loan Receivable CalculationLyca Jane OlamitNessuna valutazione finora

- Blank Quiz Results and AnalysisDocumento10 pagineBlank Quiz Results and AnalysisJoyluxxiNessuna valutazione finora

- Financial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)Documento2 pagineFinancial Liabilities - Notes Payable - Practice Set (QUESTIONNAIRE)ashleydelmundo14Nessuna valutazione finora

- Accruals and Deferrals ActivityDocumento2 pagineAccruals and Deferrals ActivityReese KimNessuna valutazione finora

- AUD02 - A - 04 Misstatement in The Financial StatementsDocumento2 pagineAUD02 - A - 04 Misstatement in The Financial StatementsMark BajacanNessuna valutazione finora

- Mock Board Exam QuestionsDocumento7 pagineMock Board Exam QuestionsKenneth Christian WilburNessuna valutazione finora

- Estimated Liabilities: Lecture NotesDocumento7 pagineEstimated Liabilities: Lecture NotesDaniel Apuan SalviejoNessuna valutazione finora

- RB Company Financial Statements and Notes Receivable ProblemsDocumento1 paginaRB Company Financial Statements and Notes Receivable ProblemsPanda ErarNessuna valutazione finora

- TradesDocumento3 pagineTradesAlber Howell MagadiaNessuna valutazione finora

- Chapter 7 AssignmentDocumento27 pagineChapter 7 Assignmentsanskritishukla2020Nessuna valutazione finora

- Quiz in AE 09 (Current Liabilities)Documento2 pagineQuiz in AE 09 (Current Liabilities)Arlene Dacpano0% (1)

- Quiz AP Receivables 2ndsetDocumento7 pagineQuiz AP Receivables 2ndsetMaritessNessuna valutazione finora

- Chapter-4 Homework ReceivablesDocumento3 pagineChapter-4 Homework ReceivablesKenneth Christian WilburNessuna valutazione finora

- Philippine School of Business Administration Financial Accounting and Reporting Problems Final ExamDocumento11 paginePhilippine School of Business Administration Financial Accounting and Reporting Problems Final ExamNicole Aragon0% (1)

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocumento3 pagineIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAbigail Ann PasiliaoNessuna valutazione finora

- Activity: Notes PayableDocumento3 pagineActivity: Notes PayablePiaNessuna valutazione finora

- Cordillera Career Development CollegeDocumento12 pagineCordillera Career Development CollegeDonalyn BannagaoNessuna valutazione finora

- FAR First Pre BoardDocumento18 pagineFAR First Pre BoardKIM RAGANessuna valutazione finora

- Prelim Lecture 1 Assignment: Multiple ChoiceDocumento4 paginePrelim Lecture 1 Assignment: Multiple Choicelinkin soyNessuna valutazione finora

- True or False Accounting Concepts ExplainedDocumento7 pagineTrue or False Accounting Concepts ExplainedJan Allyson BiagNessuna valutazione finora

- Private Sector Operations in 2019: Report on Development EffectivenessDa EverandPrivate Sector Operations in 2019: Report on Development EffectivenessNessuna valutazione finora

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Da EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Valutazione: 5 su 5 stelle5/5 (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionDa EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNessuna valutazione finora

- Accounting 19Documento1 paginaAccounting 19Ma. Alexandra Teddy BuenNessuna valutazione finora

- Question To Answer: 1. If The Assets Could Be Sold For P 228,000, What Is The Minimum Amount That W's Creditors Would Have Received?Documento1 paginaQuestion To Answer: 1. If The Assets Could Be Sold For P 228,000, What Is The Minimum Amount That W's Creditors Would Have Received?Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 12Documento1 paginaAccounting 12Ma. Alexandra Teddy BuenNessuna valutazione finora

- ACCT 2A&B: Accounting For Partnership & Corporation BCSVDocumento1 paginaACCT 2A&B: Accounting For Partnership & Corporation BCSVMa. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 18Documento1 paginaAccounting 18Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 14Documento1 paginaAccounting 14Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 10Documento1 paginaAccounting 10Ma. Alexandra Teddy BuenNessuna valutazione finora

- True/False QuestionsDocumento2 pagineTrue/False QuestionsMa. Alexandra Teddy BuenNessuna valutazione finora

- ACCT 2A&B: Accounting For Partnership & Corporation BCSVDocumento1 paginaACCT 2A&B: Accounting For Partnership & Corporation BCSVMa. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 3Documento1 paginaAccounting 3Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 20Documento1 paginaAccounting 20Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 15Documento1 paginaAccounting 15Ma. Alexandra Teddy BuenNessuna valutazione finora

- Questions To Answer: 1. How Much Is The Gain (Loss) On Realization?Documento1 paginaQuestions To Answer: 1. How Much Is The Gain (Loss) On Realization?Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 9Documento1 paginaAccounting 9Ma. Alexandra Teddy BuenNessuna valutazione finora

- Determine The Following: 1. The Loss On Realization. 2. The Amount of Cash Received by PiaDocumento1 paginaDetermine The Following: 1. The Loss On Realization. 2. The Amount of Cash Received by PiaMa. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 11Documento1 paginaAccounting 11Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 8Documento1 paginaAccounting 8Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 19Documento1 paginaAccounting 19Ma. Alexandra Teddy BuenNessuna valutazione finora

- Ibasco Partnership Liquidation Distribution AmountsDocumento1 paginaIbasco Partnership Liquidation Distribution AmountsMa. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 2Documento1 paginaAccounting 2Ma. Alexandra Teddy BuenNessuna valutazione finora

- Questions To Answer: 1. How Much Cash Did A Received From The First Distribution?Documento1 paginaQuestions To Answer: 1. How Much Cash Did A Received From The First Distribution?Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 1Documento2 pagineAccounting 1Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 18Documento1 paginaAccounting 18Ma. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 20Documento1 paginaAccounting 20Ma. Alexandra Teddy BuenNessuna valutazione finora

- ACCT 2A&B: Accounting For Partnership & Corporation BCSVDocumento1 paginaACCT 2A&B: Accounting For Partnership & Corporation BCSVMa. Alexandra Teddy BuenNessuna valutazione finora

- Multiple Choice: P2.06 P1.96 P2.00 P2.058Documento10 pagineMultiple Choice: P2.06 P1.96 P2.00 P2.058Ma. Alexandra Teddy BuenNessuna valutazione finora

- True/False QuestionsDocumento2 pagineTrue/False QuestionsMa. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 9Documento1 paginaAccounting 9Ma. Alexandra Teddy BuenNessuna valutazione finora

- Ibasco Partnership Liquidation Distribution AmountsDocumento1 paginaIbasco Partnership Liquidation Distribution AmountsMa. Alexandra Teddy BuenNessuna valutazione finora

- Accounting 10Documento1 paginaAccounting 10Ma. Alexandra Teddy BuenNessuna valutazione finora

- Tax and The Taxpayer by Lord TemplemanDocumento9 pagineTax and The Taxpayer by Lord TemplemannarkooNessuna valutazione finora

- Overview of Company: Ranks Amongst The Top 5 Private CompaniesDocumento9 pagineOverview of Company: Ranks Amongst The Top 5 Private Companiessimran salujaNessuna valutazione finora

- Weighted Average Cost of Capital (WACCDocumento19 pagineWeighted Average Cost of Capital (WACCFahad AliNessuna valutazione finora

- Safari - Jul 12, 2019 at 2:32 PM PDFDocumento1 paginaSafari - Jul 12, 2019 at 2:32 PM PDFNick SitarasNessuna valutazione finora

- Chapter 16 - Consol. Fs Part 1Documento17 pagineChapter 16 - Consol. Fs Part 1PutmehudgJasdNessuna valutazione finora

- Accounting For Developers 101Documento7 pagineAccounting For Developers 101Albin StigoNessuna valutazione finora

- Exercises Chapter 11Documento3 pagineExercises Chapter 11Fatima BeenaNessuna valutazione finora

- Chapter 4Documento10 pagineChapter 4Seid KassawNessuna valutazione finora

- Republic of the Philippines Department of Education Pulungmasle High School Ten Most and Least Mastered Competencies Unit TestDocumento1 paginaRepublic of the Philippines Department of Education Pulungmasle High School Ten Most and Least Mastered Competencies Unit Testwilhelmina romanNessuna valutazione finora

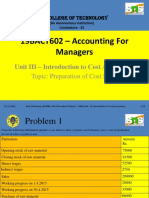

- 19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingDocumento12 pagine19BACT602 - Accounting For Managers: Unit III - Introduction To Cost AccountingReetaNessuna valutazione finora

- Hotel Maharaja - Subham Anil Gade 26012023Documento12 pagineHotel Maharaja - Subham Anil Gade 26012023Nikhil PawaseNessuna valutazione finora

- Golf club's exclusive voting rights disputeDocumento4 pagineGolf club's exclusive voting rights disputeIsabella RodriguezNessuna valutazione finora

- Quiz 1A - Cash and Cash Equivalents Bank ReconciliationDocumento9 pagineQuiz 1A - Cash and Cash Equivalents Bank ReconciliationLorence Ibañez100% (1)

- Cpa Review School of The Philippines ManilaDocumento5 pagineCpa Review School of The Philippines ManilaSamuel Cedrick AbalosNessuna valutazione finora

- ACTG Prelim ExamDocumento11 pagineACTG Prelim ExamRecruitment JMSStaffingNessuna valutazione finora

- Funda of AcctngDocumento5 pagineFunda of AcctngHLeigh Nietes-GabutanNessuna valutazione finora

- Press Release - WPG Commences Voluntary Chapter 11 Financial Restructuring (FINAL)Documento3 paginePress Release - WPG Commences Voluntary Chapter 11 Financial Restructuring (FINAL)NBC MontanaNessuna valutazione finora

- Muhammad Thoriq Nabawi Tugas 3 Chapter 1 BusinessDocumento9 pagineMuhammad Thoriq Nabawi Tugas 3 Chapter 1 BusinessThoriq NabawiNessuna valutazione finora

- Introduction To Business Processes: True-False QuestionsDocumento4 pagineIntroduction To Business Processes: True-False QuestionsDoan Thi Thanh ThuyNessuna valutazione finora

- Learn Financial Modelling & Get NSE CertifiedDocumento25 pagineLearn Financial Modelling & Get NSE CertifiedSukumarNessuna valutazione finora

- Dhaka Bank Limited and Its Subsidiary Consolidated Balance SheetDocumento8 pagineDhaka Bank Limited and Its Subsidiary Consolidated Balance Sheetshahid2opuNessuna valutazione finora

- Ipo ReportDocumento94 pagineIpo Reportbindiya sharma71% (7)

- Single 287967086580186410492Documento13 pagineSingle 287967086580186410492carlNessuna valutazione finora

- The Growth in Corporate Governance CodesDocumento15 pagineThe Growth in Corporate Governance CodesSudip BaruaNessuna valutazione finora

- ENTREPRENEURSHIPDocumento22 pagineENTREPRENEURSHIPR ApigoNessuna valutazione finora

- JACOBE Ryzel-Mid-Term Exam Financial ManagementDocumento4 pagineJACOBE Ryzel-Mid-Term Exam Financial ManagementRYZEL JACOBENessuna valutazione finora

- Comparative Study of Financial Statement Ratios Between Dell and EpsonDocumento7 pagineComparative Study of Financial Statement Ratios Between Dell and EpsonMacharia NgunjiriNessuna valutazione finora

- CH 4Documento72 pagineCH 4yosephworkuNessuna valutazione finora

- Insider TradingDocumento2 pagineInsider TradingSanju VargheseNessuna valutazione finora

- Bhushan SteelDocumento3 pagineBhushan Steelharshad19855457Nessuna valutazione finora