Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

PART 2 Essay

Caricato da

Adam CuencaCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

PART 2 Essay

Caricato da

Adam CuencaCopyright:

Formati disponibili

Name: Edmalyn R.

Canton – BSA 1 – BE 302 Morning

Course/code: 893 – ACCPB 100

PART 2 Essay

A. Discuss how Sarbanes-Oxley Act of 2002 was passed and the reason of its

creation.

B. Discuss its importance (SOX Act of 2002) in present times.

Sarbanes-Oxley Act 2002 (SOX 2002) is a federal law in United States (US)

Congress was signed by US President George W. Bush on July 30, 2002 to help protect

investors from fraudulent financial reporting by its corporations. By the virtue of law,

aims to enhance accuracy of corporate disclosures, corporate governance, and

accountability and it implies strict new rules for accountants, auditors, and corporate

officers and imposed more stringent recordkeeping requirements. This act was authored

by U.S. Congressmen Paul Sarbanes and Michael Oxley.

Citing Article 3, section 302 of Corporate responsibility for financial reports, this

financial statements must certify that: the documents have been reviewed by signing

officers and passed internal controls within the last 90 days. The documents are free of

untrue statements or misleading omissions. The documents truthfully represent the

company’s financial health and position. The documents must be accompanied by a list

of all deficiencies or changes in internal controls and information on any fraud involving

company employees.

So, in every entity or corporations must publish a detailed statement in their

yearly financial reports to explain the structure of internal controls used. The data must

also be must be evident regarding the procedures used for financial reporting. The

statement should also weigh the effectiveness of the internal controls and reporting

procedures. The accounting firm auditing the statements must also assess the internal

controls and reporting procedures as part of the audit process. SOX changes

management's responsibility for financial reporting. It requires that top managers

personally endorsing accuracy of financial reports. This law tackles not just only

accountability, it also includes management and ethics in a corporate world. It relates

aftermath from corporate misconduct and scandals including retaliation against

whistleblowers.

For more than decade, SOX has been relevant and successful in changing the

landscape of corporate governance to the benefit of investors. It has increased investor

confidence and the accountability expectations investors have for corporate directors

and officers, and for their legal and accounting advisers as well.

Hence, SOX Act of 2002 makes corporations liable for accuracy and fairness and

up to date reporting of financial data. The cost of implementing SOX requirements are

high, but the benefit of investor’s confidence is higher. There are going to be some

situations where fraud is foreseeable.

Potrebbero piacerti anche

- Managerial FinanceDocumento4 pagineManagerial Financeinnies duncanNessuna valutazione finora

- Assignment On Sarbanes Oaxley Act 9Documento3 pagineAssignment On Sarbanes Oaxley Act 9Haris MunirNessuna valutazione finora

- Lesson 1 Governance Additional NotesDocumento6 pagineLesson 1 Governance Additional NotesCarmela Tuquib RebundasNessuna valutazione finora

- Responsibilities of Companies under Sarbanes-Oxley ActDocumento4 pagineResponsibilities of Companies under Sarbanes-Oxley ActXabi meerNessuna valutazione finora

- Basic Facts of Sox LawDocumento2 pagineBasic Facts of Sox LawnamuNessuna valutazione finora

- Sarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014Documento12 pagineSarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014jadeen serviceNessuna valutazione finora

- 10 - SoxDocumento2 pagine10 - Soxreina maica terradoNessuna valutazione finora

- Ba772 Sox - BrownDocumento16 pagineBa772 Sox - BrownDanika GraceNessuna valutazione finora

- Assignment On Sarbanes Oaxley Act 2Documento4 pagineAssignment On Sarbanes Oaxley Act 2Haris MunirNessuna valutazione finora

- What Is The Sarbanes-Oxley Act?Documento3 pagineWhat Is The Sarbanes-Oxley Act?Avianne Montañez100% (1)

- Ass 2Documento5 pagineAss 2albert cumabigNessuna valutazione finora

- Sarbanes Oxley GuidelineDocumento3 pagineSarbanes Oxley Guidelinesdfsdf1581Nessuna valutazione finora

- Sarbanes Oxley Vs PH LegislationsDocumento5 pagineSarbanes Oxley Vs PH LegislationsJNessuna valutazione finora

- SOX and ERPDocumento10 pagineSOX and ERPVanshika KhannaNessuna valutazione finora

- Sarbanes-Oxley's Widespread Impact After 7 YearsDocumento12 pagineSarbanes-Oxley's Widespread Impact After 7 YearsbrzachryNessuna valutazione finora

- Sarbanes Oxley FinalDocumento3 pagineSarbanes Oxley Finalbrucelutz1Nessuna valutazione finora

- Case StudyDocumento17 pagineCase StudyAmit RajoriaNessuna valutazione finora

- NAME: Neha Mundra Class: Mba FT SEM 4 B' ROLL NO.: 68082 DATE: 13 MAY 2021 Internal 2Documento3 pagineNAME: Neha Mundra Class: Mba FT SEM 4 B' ROLL NO.: 68082 DATE: 13 MAY 2021 Internal 2neha mundraNessuna valutazione finora

- Corporate Governance - Enhanced RevisionDocumento53 pagineCorporate Governance - Enhanced RevisionMoamar IsmulaNessuna valutazione finora

- Akshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleDocumento27 pagineAkshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleBhavya KapoorNessuna valutazione finora

- Sarbanes Oxley ActDocumento17 pagineSarbanes Oxley Actglenndso100% (2)

- Sarbanes OxleyDocumento3 pagineSarbanes Oxleyzouz3000100% (1)

- Sarbanes-Oxley ActDocumento22 pagineSarbanes-Oxley ActJalpa PithavaNessuna valutazione finora

- Sarbanes - Oxley Act of 2002Documento17 pagineSarbanes - Oxley Act of 2002joseph_kachappillyNessuna valutazione finora

- Sarbanes-Oxley Act 2002Documento6 pagineSarbanes-Oxley Act 2002Gabriella Goodfield100% (1)

- The SarbanesDocumento1 paginaThe SarbanesZoro RoronoaNessuna valutazione finora

- Sarbanes Oxley Act: Limitations in The Pakistan's ContextDocumento2 pagineSarbanes Oxley Act: Limitations in The Pakistan's ContextAli KhanNessuna valutazione finora

- Sarbanes Oxley CADocumento19 pagineSarbanes Oxley CAKusum MachalNessuna valutazione finora

- Sarbanes-Oxley (SOX) ActDocumento20 pagineSarbanes-Oxley (SOX) Actjanaki ramanNessuna valutazione finora

- Corporate Governance & Insurance Industry.Documento42 pagineCorporate Governance & Insurance Industry.Parag MoreNessuna valutazione finora

- Ans:-The Determinants of Structure of Financial Markets AreDocumento3 pagineAns:-The Determinants of Structure of Financial Markets Aresajeev georgeNessuna valutazione finora

- Auditing and Assurance Services A Systematic Approach 8th Edition Messier Solutions ManualDocumento25 pagineAuditing and Assurance Services A Systematic Approach 8th Edition Messier Solutions ManualDebraPricemkw100% (45)

- Health South Corp - The First Test of Sarbanes OxleyDocumento27 pagineHealth South Corp - The First Test of Sarbanes OxleyShaun1906Nessuna valutazione finora

- Corporate America and SarbanesDocumento2 pagineCorporate America and SarbanesMohammad Nowaiser MaruhomNessuna valutazione finora

- Executive Summary of The Sarbanes-Oxley Act of 2002 P.L.107-204Documento6 pagineExecutive Summary of The Sarbanes-Oxley Act of 2002 P.L.107-204Antonio AshbyNessuna valutazione finora

- Corporate GovernanceDocumento14 pagineCorporate GovernanceJhelykha GonzalesNessuna valutazione finora

- Acct 201 - Chapter 4Documento24 pagineAcct 201 - Chapter 4Huy TranNessuna valutazione finora

- What Impact Did The SarbanesDocumento7 pagineWhat Impact Did The SarbanesJan Celine LandichoNessuna valutazione finora

- FraudDocumento23 pagineFraudsheengaleria11Nessuna valutazione finora

- soxDocumento12 paginesoxgs2018339Nessuna valutazione finora

- Copy (3) of Copy of Corporate Governance 1Documento20 pagineCopy (3) of Copy of Corporate Governance 1bappa85Nessuna valutazione finora

- Sox 2002Documento2 pagineSox 2002commoNessuna valutazione finora

- Statutory and Regulatory Framework for Audit and AccountingDocumento62 pagineStatutory and Regulatory Framework for Audit and AccountingKehinde OjoNessuna valutazione finora

- Running Head: SOX EFFECTIVENESS 1Documento6 pagineRunning Head: SOX EFFECTIVENESS 1Sonny MaciasNessuna valutazione finora

- Auditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions ManualDocumento26 pagineAuditing and Assurance Services A Systematic Approach 9th Edition Messier Solutions ManualDebraPricemkw100% (50)

- SoxDocumento16 pagineSoxArmand MauricioNessuna valutazione finora

- Solution Manual For Auditing and Assurance Services A Systematic Approach 7th Edition Messier, Glover, PrawittDocumento11 pagineSolution Manual For Auditing and Assurance Services A Systematic Approach 7th Edition Messier, Glover, Prawitta420344589Nessuna valutazione finora

- U.S. Securities and Exchange Commission - Fiscal Year 2013 Agency Financial ReportDocumento156 pagineU.S. Securities and Exchange Commission - Fiscal Year 2013 Agency Financial ReportVanessa SchoenthalerNessuna valutazione finora

- What Is SarbanesDocumento7 pagineWhat Is Sarbanestony alvaNessuna valutazione finora

- Uncover $3.8B Financial FraudDocumento39 pagineUncover $3.8B Financial FraudJosé Moura Rodrigues100% (1)

- Congress Disclosures Enron Corporation Worldcom Financial StatementsDocumento4 pagineCongress Disclosures Enron Corporation Worldcom Financial StatementsMichael Olmedo NeneNessuna valutazione finora

- International AccountingDocumento4 pagineInternational AccountingJoey WongNessuna valutazione finora

- Oxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesDocumento21 pagineOxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesposttoamitNessuna valutazione finora

- Operation Audit Case AnalysisDocumento3 pagineOperation Audit Case AnalysisEu RiNessuna valutazione finora

- Enron Scandal That Prompted Sarbanes-Oxley ActDocumento4 pagineEnron Scandal That Prompted Sarbanes-Oxley ActArceeNessuna valutazione finora

- ACCT 10001 Accounting Reports & Analysis Review Questions - Topic 1 Chapter 1: Introduction To Accounting and Business Decision MakingDocumento5 pagineACCT 10001 Accounting Reports & Analysis Review Questions - Topic 1 Chapter 1: Introduction To Accounting and Business Decision MakingHui Ying LimNessuna valutazione finora

- Corporate Governance: A practical guide for accountantsDa EverandCorporate Governance: A practical guide for accountantsValutazione: 5 su 5 stelle5/5 (1)

- Implementing Financial Regulation: Theory and PracticeDa EverandImplementing Financial Regulation: Theory and PracticeNessuna valutazione finora

- Ge 15 Part 2 AssignmentDocumento4 pagineGe 15 Part 2 AssignmentAdam CuencaNessuna valutazione finora

- Problem 14-5 Advance Accounting 2 GuerreroDocumento3 pagineProblem 14-5 Advance Accounting 2 GuerreroAdam CuencaNessuna valutazione finora

- Basic Values and Self-AwarenessDocumento3 pagineBasic Values and Self-AwarenessAdam CuencaNessuna valutazione finora

- Remulla To Explain Philippines Rights Record Before UN BodyDocumento1 paginaRemulla To Explain Philippines Rights Record Before UN BodyAdam CuencaNessuna valutazione finora

- Maymay Entrata Nominated at MTV EMA, K-Pop Idol Covers 'Amakabogera'Documento1 paginaMaymay Entrata Nominated at MTV EMA, K-Pop Idol Covers 'Amakabogera'Adam CuencaNessuna valutazione finora

- Ukraine Says Dozens of Villages Recaptured Amid Russian RetreatDocumento1 paginaUkraine Says Dozens of Villages Recaptured Amid Russian RetreatAdam CuencaNessuna valutazione finora

- Income Taxation Quiz On General ProceduresDocumento5 pagineIncome Taxation Quiz On General ProceduresAdam CuencaNessuna valutazione finora

- NGCP To Appeal ERC PenaltyDocumento1 paginaNGCP To Appeal ERC PenaltyAdam CuencaNessuna valutazione finora

- IFRS 4 Insurance ContractsDocumento27 pagineIFRS 4 Insurance ContractsAdam CuencaNessuna valutazione finora

- Saving A WatershedDocumento1 paginaSaving A WatershedAdam CuencaNessuna valutazione finora

- Marcos Jr. To Cambodian Biz Leaders - Invest in PhilippinesDocumento1 paginaMarcos Jr. To Cambodian Biz Leaders - Invest in PhilippinesAdam CuencaNessuna valutazione finora

- IFRIC 12 - Service Concession ArrangementsDocumento4 pagineIFRIC 12 - Service Concession ArrangementsAdam CuencaNessuna valutazione finora

- Expanding NATO Squares Up To Russia As Putin Slams 'Imperial' AllianceDocumento1 paginaExpanding NATO Squares Up To Russia As Putin Slams 'Imperial' AllianceAdam CuencaNessuna valutazione finora

- Mikee Cojuangco Annoyed With 2 Actors Who Fought Over HerDocumento1 paginaMikee Cojuangco Annoyed With 2 Actors Who Fought Over HerAdam CuencaNessuna valutazione finora

- Hipon Girl Impresses Miss Grand International's Nawat MGI To Move To Miss Universe PHDocumento1 paginaHipon Girl Impresses Miss Grand International's Nawat MGI To Move To Miss Universe PHAdam CuencaNessuna valutazione finora

- Rody Takes A BowDocumento1 paginaRody Takes A BowAdam CuencaNessuna valutazione finora

- IFRS 17 - Insurance ContractsDocumento7 pagineIFRS 17 - Insurance ContractsAdam CuencaNessuna valutazione finora

- Financial Rehabilitation and Insolvency Act (FRIA) of 2010Documento32 pagineFinancial Rehabilitation and Insolvency Act (FRIA) of 2010Adam CuencaNessuna valutazione finora

- PFS Chapter 4Documento50 paginePFS Chapter 4Adam CuencaNessuna valutazione finora

- File The Charges Bureau of CustomsDocumento1 paginaFile The Charges Bureau of CustomsAdam CuencaNessuna valutazione finora

- Blocking & Forcing Through CombinedDocumento1 paginaBlocking & Forcing Through CombinedAdam CuencaNessuna valutazione finora

- GPE4 History On BasketballDocumento2 pagineGPE4 History On BasketballAdam CuencaNessuna valutazione finora

- Pro-Forma Journal EntriesDocumento4 paginePro-Forma Journal EntriesAdam CuencaNessuna valutazione finora

- Envisioning The Future of Japan-Philippines Relations With President MarcosDocumento1 paginaEnvisioning The Future of Japan-Philippines Relations With President MarcosAdam CuencaNessuna valutazione finora

- Salaries and Wages, PBO Expense, Taxes and Licenses ComputationDocumento6 pagineSalaries and Wages, PBO Expense, Taxes and Licenses ComputationAdam CuencaNessuna valutazione finora

- Principled and Fair in All DealingsDocumento1 paginaPrincipled and Fair in All DealingsAdam CuencaNessuna valutazione finora

- PIE GRAPH (Physical Survey and Google Form)Documento7 paginePIE GRAPH (Physical Survey and Google Form)Adam CuencaNessuna valutazione finora

- RA 11032 Ease of Doing Business Act AmendmentsDocumento12 pagineRA 11032 Ease of Doing Business Act AmendmentsAdam CuencaNessuna valutazione finora

- San Juan Deals Iloilo 2nd Wesley Cup LossDocumento1 paginaSan Juan Deals Iloilo 2nd Wesley Cup LossAdam CuencaNessuna valutazione finora

- Matrix On Fria Law: Insolvent Debtor Creditor or Group of Creditors Insolvent DebtorDocumento2 pagineMatrix On Fria Law: Insolvent Debtor Creditor or Group of Creditors Insolvent DebtorAdam CuencaNessuna valutazione finora

- DGCL and Model ActDocumento20 pagineDGCL and Model Actnitr0x99100% (5)

- Article Writing - Winding Up of A CompanyDocumento6 pagineArticle Writing - Winding Up of A Companysanan inamdarNessuna valutazione finora

- By Kaushal Pal:: The List of Bins Card These Are Non VBV Cards Bins and BanksDocumento13 pagineBy Kaushal Pal:: The List of Bins Card These Are Non VBV Cards Bins and BanksJaveed Ahamed100% (2)

- Redemption of Preference SharesDocumento9 pagineRedemption of Preference SharesRahul VermaNessuna valutazione finora

- Auditing Important QuestionsDocumento6 pagineAuditing Important QuestionsSureshArigelaNessuna valutazione finora

- Code of Corporate Governance: The Board'S Governance ResponsibilitiesDocumento12 pagineCode of Corporate Governance: The Board'S Governance ResponsibilitiesMartha TanNessuna valutazione finora

- Japanese Corporate Governance Model ExplainedDocumento17 pagineJapanese Corporate Governance Model ExplainedMikaela Gale CatabayNessuna valutazione finora

- Incorporation - Teach FileDocumento11 pagineIncorporation - Teach FileAmy WittavatNessuna valutazione finora

- Case Study - Dhirubhai AmbaniDocumento2 pagineCase Study - Dhirubhai AmbaniBhawnaNessuna valutazione finora

- PWC Guide Financing Transactions Debt EquityDocumento333 paginePWC Guide Financing Transactions Debt EquityDavid Lee Chee YongNessuna valutazione finora

- QFI Quant Exam: S D S GDocumento9 pagineQFI Quant Exam: S D S GTyler LorenziNessuna valutazione finora

- $5-10 Million Texas PPP LoansDocumento30 pagine$5-10 Million Texas PPP LoansMary Claire PattonNessuna valutazione finora

- Corporate Finance, Home AssignmentDocumento17 pagineCorporate Finance, Home Assignmentsyedsuhail20014u8724100% (9)

- Resignation of President of Liquidation Channel, USA (Company Update)Documento1 paginaResignation of President of Liquidation Channel, USA (Company Update)Shyam SunderNessuna valutazione finora

- Corporate Governance Need and Significance in Nepalese Banking System by Rajan Bikram ThapaDocumento7 pagineCorporate Governance Need and Significance in Nepalese Banking System by Rajan Bikram Thapaashish100% (1)

- AAPL stock close at $500 analyzed for manipulation vs hedgingDocumento18 pagineAAPL stock close at $500 analyzed for manipulation vs hedgingNeal EricksonNessuna valutazione finora

- ITC Annual Report 2007 2008Documento160 pagineITC Annual Report 2007 2008Abhirami SvNessuna valutazione finora

- LLC Law: BOD Roles & ResponsibilitiesDocumento27 pagineLLC Law: BOD Roles & ResponsibilitiesDewa Gede Praharyan Jayadiputra100% (1)

- University of The Philippines College of Law - Corporation Law - D2021Documento5 pagineUniversity of The Philippines College of Law - Corporation Law - D2021Maria AnalynNessuna valutazione finora

- IFRS BrochureDocumento8 pagineIFRS Brochurevhiep1988Nessuna valutazione finora

- Business Associations OutlineDocumento50 pagineBusiness Associations OutlinemasskonfuzionNessuna valutazione finora

- Greek Letters Multiple Choice Test BankDocumento4 pagineGreek Letters Multiple Choice Test BankKevin Molly KamrathNessuna valutazione finora

- Galgotias University Corporate Law CourseDocumento17 pagineGalgotias University Corporate Law CourseIayushsingh SinghNessuna valutazione finora

- Hoyle Chap 3 Yoel 12e StudentsDocumento60 pagineHoyle Chap 3 Yoel 12e StudentsJustin StraubNessuna valutazione finora

- Notice: Banks and Bank Holding Companies: Formations, Acquisitions, and MergersDocumento1 paginaNotice: Banks and Bank Holding Companies: Formations, Acquisitions, and MergersJustia.comNessuna valutazione finora

- Final Examination Assignment of Spring 2020: Course: Legal Environment of Business Course Code: Law 200Documento10 pagineFinal Examination Assignment of Spring 2020: Course: Legal Environment of Business Course Code: Law 200Ishtiaq Ahmed MugdhaNessuna valutazione finora

- Offshore Company Structure ExplainedDocumento10 pagineOffshore Company Structure ExplainedIoana ȚecuNessuna valutazione finora

- LWR Wordings Issued 2021 - at 28 February 2021Documento3 pagineLWR Wordings Issued 2021 - at 28 February 2021Farrukh KhanNessuna valutazione finora

- FL RFBTDocumento13 pagineFL RFBTalyssagd100% (1)

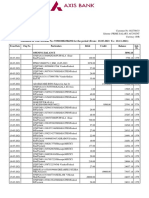

- Statement of Axis Account No:919010082384292 For The Period (From: 10-05-2021 To: 10-11-2021)Documento23 pagineStatement of Axis Account No:919010082384292 For The Period (From: 10-05-2021 To: 10-11-2021)Rohitpavan PuppalaNessuna valutazione finora