Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Kamala Harris 2019 Tax Return

Caricato da

David Caplan0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

5K visualizzazioni125 pagineKamala Harris 2019 Tax Return

Copyright

© © All Rights Reserved

Formati disponibili

PDF o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoKamala Harris 2019 Tax Return

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

5K visualizzazioni125 pagineKamala Harris 2019 Tax Return

Caricato da

David CaplanKamala Harris 2019 Tax Return

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF o leggi online su Scribd

Sei sulla pagina 1di 125

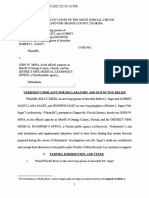

$1040 15 tran income Tax Ratu "| 2019

Fame Seus [] sinle Flare fing ety [] Maret ing sera (HF) []Heata betas OH). Oalig weno ov)

Fina Sat ynaheaad te tomer be ae ct spore yooh HO r Oho etre Ns rat ann ean

ene box. __achildbutnatyour dependent.

"Your Tetra and madi init Lastname Tour ETT aT

DOUGLAS C. MHOPF

Tijint retun, spouses fret name and midate nial [Last name ou eae

KAMALA D. IARRIS

Home address (moe and ari). you havea, box, see nsinuctons “otro. [presidental eletion Campaign

Becton eynon i

sonst Cig

‘ly, or pesto, sat, a Z cod you have oan odes, alc comple spaces Blom (se stveons) einer

a mee Spouse

eset T yee

Foreign county name Foragn provhcelstete/eouniy Fotegnposalcode | More tan fur dependents,

2a nstucions and / hare |

‘Standard Someone can claim; []Youss a dependent |] Your spouse as a dependent

Deduction _[ ] Spouse itemizes on a separste retum or you were a dushstalus.aben

‘Agetotindness Yow: ["] ce bore before Janury 21268 [] Ave bline spouse: [] was orn betoresiuary2, 1985 _[]'s bind

Dependents {Bhscsasroris nanan | (8)pawtp yee (0) tr ono

)Fieteane Lsstoane ont et Cite oma

ELLA R EMEOFF _DACCHTER

Wages aaa tps ate Ath Fors) W'2 SNe x 157,327.

20 Taxoxempt intrest 2 1 ee 2 T2341.

3a Qusliied dividends 38 Ta] peters [8 i.

sine [te tra dotroutions b Taxable aout ab

Sepugemen |e Ponion and aus Taxable anount ad

Leg | 58 Social secutybentie [0 Tobe anout eb

fEige.”” [6 captal gan or oss Attach Schedule Ditrequred. not equred, check hae >Use =ia3-

Siowek | 7a Other income feo Schedule 7, ne 9 ia 7108, 097.

[Be |p acces 1,20,3b, 4,0 8, 6, and 7a, This your total income [ze] 3277627.

TBisss | 90 Adjustments toincomo tom Schedule 1 too 22 om Tez, 027.

lear cane [LP Subtract ne Ba from ine 7b, Tiss your adjusted gross Income >| eb. 095,590.

QRS y' standord deduction or temizad deductions (rom Senet 8) | 77,31.

Stacnse, _ff0 Qualfled business income deduction. Atach Frm 8905 or Form 8995- [ 40 32.

Sete (Ogee parga0 18 77,463.

1b Taxable income, Sita ne 1. om ne Bb

t2ao oles enter 0 sw] 3,018,127.

i For Dinatoaur, Privacy Ack and Paperwork Reduction Act Notoe, see separate instructions orm 1040215

9

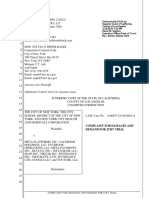

Cas WN exxore, vouczas Ee)

fone DOUGLAS C, EMHOFF & KAMALA D. HARRIS age 2

‘a Tax eyinvonn tL]ee 2] ] are 3[] twa]__1, 054,847.

1b Ada Sched 2 ne 3, ans ino 72a and onor te total Pls] 1,054,847.

188 Child tx cro or erect for othe dopandente ‘ae

Add Schedule, ine 7, and ine 198 and eter th etl ® [106 587.

14 Subtract Ew 196 rom ine 12, zero oss, ener 14 | __1,054, 260.

15 Other taxes, incuing setemployment tax, rom Schedule 2 ne 10 15 131,368.

18 Addines 14 snd 15. This your total >is 1,185,628.

17 Fedaralieome tax withheld rom Forms Wand 1059 7 7805.

Ipiyeimey U8 Other payments and refundable orate:

‘iiliociie 3 Eamed income ore (E10) 180

Jee (b accitiona chit crt, tach chad Bote “ab

Nate |e American opportunity ert em Form 8863, Ine 8 186

ismeieer "] Schedule, ina 14 180, 732,000,

‘© Add Ines 18a through 18d These ae your otal other payments and refundable reds, | 188 732,000.

19 Add ings 17 and 180, Those are your otal payments bl 754,609.

Refund 20 tine 19s more than ine 16, subract ine 16 kom fre 19, This is the amount you overpaid | 20

24a Amount ofl 1 want refunded to you. I Form 8888 is attached, check here... *L] [ata

Strestusinm. rb Routing number Dee twe: [Tonecine ['} Savings

Dea Acountaumber

‘22 _ Amount af ina 20 you want applied to you 2020 estimated ax Be] 22 |

Kmount — 23 Amount you owe. Sbtrect tne 19 rom ne 16. For gerals on ew to pay, see eiructons | 23 F352, 205.

You Owe 24 _Estmated tax penaty (ce inctruction | 2 1,386.

Third Party oyou vantto alow anter person (me tan your pl prepare to cute ist wt he RS? Seems El Yes, Conse bow,

Designee —omiyars tm rexmativetien [ [No

SSetgm re DMICHAEL SOBELMAN so_ 8189812600 unter Nd

eee tte ee: esa

- = SPTORNEY Ee

ra — or a

7

Goren rcuasn soamwan | CLIENT'S COPY

SQUAR MILNER LLP 118-981-2600

15760 VENTURA BLVD, SUITE 1100

iéap ENCINO, CA_91436

‘Go to munis. gov/Farmi040for Instructions and the latest Formation Fee 1040 010)

10

anne GG eorr, vovcias [Saag

scveouis +] Additional Income and Adjustments to Income | arq™

inhi b- tento Form 0409714058 2019

Stearn seve” > Go to wmwirs.gov/Form1040 for instructions and the latest information. Sraaoneto.O1

Fane aero OOOO ara ey

DOUGLAS C. EMHOFF & KAMALA D. HARRIS |

Fay a age you cae sl so hn cee SS 3) ARISTON Oy

vidual currency? [7 ves_O1 no

Part! Additional Income STATEMENT 5_

4 Taxable refunds, credits, or offsats of state anc local income taxes: Smt f STMT 7_ |

a Ary eared

ban renal avec spun se wae

3 Business income or (loss). Attach Schedule C 3 264,825.

4 One pe cress Atco e707 ns

5 Rental real estate, royalties, partnerships, S corporations, trusts, ete, Attach Schedule & 2,843,272.

@Femcome ero Ach Sowa .

+ Cronlomont snp rr

&Oberrcome Ln pe and ant Be

.

9. Combine nes 1 rough 8 Ener here and on Form 1040 or 104087 iho 7a ot 3,108,097.

Baril Rajustnonts to Income

SD eiaserepeet : 7s

1 Geamasonrengeae seeming is odie gener ess

Fomatce | |

12 Homo ant edo ic amb 2

{Sten eperesormamber fe As ocx Ach Fam 983 ra

44 Deductible part of self-employment tax, Attach Schedule SE 44 50,347.

15 Selfemployed SEP, SIMPLE, and qualified plans 6 Tar, 930.

46 Self-employed health insurance deduction 16 3,750.

buatyor on) whens tesres =

fia Amey [ss]

eer >

2 Bivona vc Spi peat aeons

20 Swot om ia den ea

21 Tatonenotne tach rom e677 a

Be Maelo move we youradioers elcome how nd on For 140 er

1040-SR, line. 22 182,027.

pe eat roaccon hat oe your tet von eb otone Sie a0 oT

at

[esses Ones HEE =wtiorr,, doveras

SCHEDULE 2 Additional Taxes

(orm 1040 1040-88)

Deore Teng D> Attach to Form 1080 oF 1040-5R.

Ine evra vce Go to www.irs.gov/Form1040 for instructions and the latest information.

Tame{eyshoan on Far 10" or HOSA

DOUGLAS C. EMHOFF & KAMALA D. HARRIS

Parti Tax

(ou8 No. 548.074

2019

‘Savousra 02

1 Aematverinimam tax Atach Form 6251 1 o-

2 Excess advance premium tax cre epayment. tach Form 6962 2

3 _Add fines 1 and 2. Enter hore and include on Form 1040 0° 10408, nw 12 3 wT

Partil__ Other Taxes.

“4 Salfemployment tax. Attach Schedule SE z 2 TOU, 694.

5 Unreported social security and Medicare tax tom Form: a [—laisy & LJ esi9 s

{© Adctonl tex on as, ther cuales reteement plans, and ater axtaverds accounts. tach Form

‘30 frequres 6

Ta Household employment texes, Atach Scheele Ta Tete.

'b Repayment of fsttime horebuyer cet fom Ferm 5408. Altach Form S405 if equ 7

8 Taxestrom a LX) Fonesse §—& LX) Forman

: wrcoces)_ SEE STATEMENT 8 ® 25,828.

8 Section 965 net ax abit nstaver am Form 955A 2

10 Adtines 4 tecugh 8. These ao your total other taxes, Err har and on Farm $040 or TOAOSA,

na 15 +o] 131,368.

Ti For Paperwork Reduction Act Netice, see your tox retum instructions.

Ce]

12

ES MEE stor, vouczas

‘Schedule 2 (Form 1040 or f040-SA) 2018

ao es) Additional Credits and Payments

OMB No, 1546-0074,

2019

> Attach te Form 1040 oF 1040-SR.

ashen,

‘iat Reena es > Go to wwwrirs.gowForm1040 for instructions and the latest information. Siesarea io, 08

amet] shown on Form 10101 TOUS out saa secriy umber

DOUGLAS C. EMHOFF & KAMALA D. HARRIS SSS

Parti_Nonretundable Credits

T Fesgn ox red. tach For 177 eae a

2 Grae orcs end dopnder cae expenses tach Fam i 2

33 dation ered om Fo 889, ne 18 bs]

4 Retromert aang conrauors cet, Ach Foon 8580 “

Spent energy cet Ach Fer S205 5

€ onecenston tom afceao bL]eeo oll :

+f nest oan. Ete hse adn on Form 040 1040S, tne 13 7

Parl Other Payments and Refundable Gredits.

@ 2019 estimated tax payments and amount applied from 2018 return ‘STMT 8 732,000.

© Netoronum exced tach Form B62 2

10 Amount pu wth requet retro fo easton) 0

1 Eroe soi! sect and i 1 ARTA tax tet rn

12 Gmdtireer!tan ono ach Fr 195 2

je Godtsvonfam e []2402 b L]Resoned e Lleoos al] 3

Tasos tnen tou 13.Ererhre gd on Fo 1040 $4098, 6188 rn T3Z,000,

mad tor Paper oduoton Act tc, se you tx run nso Seine 3 Fam Dr THEY TTS

—

13

ae GR enorr, Doveias a

Hamel} shawn ov axe

DOUGLAS C. EMHOFF & KAMALA D. HARRIS

Underpayment of Estimated Tax by

Individuals, Estates, and Trusts

> Go to wuwirs.gov/Form2210 fr instructions and the latest information

> attach to Form 1090, 1040-SA, 1040-NA, 1040-NRVEZ, oF 1081.

2019

Seecome ta OF

Taentfying aumber

Do You Have To File Form 2210?

penalty because the IRS wil fgureit and send you abilfor any

‘Unpaid snount you want to iui, you may use Part I or

Part V as a worksheot and enter your penalty amount on your tx |

‘Complete tines 1 through 7 below. le ine 7 es than $1,002 |_Y®S __» [ Don’ file Form 2210, You dont owe a penalty.

wo

y

Compl tnes Band Obeinw lobe aqaiocrmeretian | Yoo [ Vou dont one a ports Dont ile Form 2210

ae >| at fboc etn Par apps you must pape tf

Fam 20

Tr

‘You may owe a penalty. Doas any boxin Part below apply? |-Y8* __» [ You must fie Form 2210, Does box B, ©, or D in Part ll apply?

No “

No Lies _. [yermoat re our pray

v

Donte Form 2270, You sore ooo yoa "You ro eaued to igure your poaly besa he RS wl

figure tard eend you ebil for any unsaid amu. If you went to

figure, you may use Part Il or Part Was a worksheet and enter

‘your penalty amount on your tax otu, but file only page 1 of

‘tin, but dan’ fle For 2210, Form 2210,

[Part] Required Annual Payment

tr your 2079 taxa rect rom Form 1040 or Form 1040-GR, ie 14 (eee mabucbos Wot

fling Form 1040 or Form 4040-53) 1 | 4,054,260.

2 bier tare, incluting seitemplayment tx ad, #appabe, Akional Mca Tex andor Ne ivestnent

‘nome Tax (see nsrctos) 2 131,368.

14 Ratundabie cra, nung tne premium tx ea (es insructns) 3

“4 urontyear tax. Combine ns 1, 2a 3, less than $100, stop; you dont ove a Renal. Dente Farm 2210 trees

5 Mutipy re by 90% (90) 5 67,065

5 Wicking ses. Donitcudeestinated ax payments (Ge insiutions) 6 22,809.

Subic ne 6 rom ine 4 ss tan $1,000, stop; you don't one a penal. Dose Form 2210, 7 | 1,162,819.

{avin equted annua payment based on pir years x (se istrucons) 6 767, 372.

9 Require annual payment. Entre smaller of tne 5 one 8 2 naTae

Hues toe 9 more tan be 6?

Tito Youdontowes penny, dorm Form 220 uns ox Ete spl.

(EE Yes. Youray ave a pent, ut dnt e Frm 210 vale neo ore bots Part eo aps,

«Woo 3 or Date, ou mut re your erly an Frm 2210

* itbox Kor Eales (at 0B, 0) lan page Ha Frm 2210 You aren aqute ue your pea; Be wl fque Ran sen you

2 otr any und amount you vantage you pny you may ee Part rl as wefsen and en you pay nyo rer, ut le

‘ny page to Fom 210,

Parti] Reasons Tor FIG, Greck appleabie bares (nore spphy don't te Farm P20

‘A [J You request a waiver (see instructions) of your entire penalty. You must check this box and fae page 1 of Farm 2210, but you

are equited tofre our pea.

8 [5 Youreqvesa waver sex sucons of part your pea. You mus grey ery and weber mount and Ne For 210.

¢ [ Yeurncome var rg the ara yur pray educa or lente en gue sh he annus come stalin mes. You ms

fur te pny use Sched Aan ta Fem 220.

0 Your pesty tower when ured vat te fadea nee x wiht om your same ae pion he cles kn tal hes teas of

ceva amounts one pyar ue dats, Yu st gure your pray a fe ar 2210,

€ 2 Youtted oar tin trun eite 2018 201, butt fr bot yeas ad ne 8 ebveis mle fe ne Stbve. You mst We page tof

fer 210, but you aren cured a ue you enay ress bo 8,01 Depots).

Til Fer Peperwork Reduction Act Notice, eee separate instructions.

Form 2270 (2018)

sr

13.2

ee emnorr, poucias eae

For 22102019) DOUGLAS C. EMHOFF & KAMALA D. HARRIS

Regular Method (Sec the rtructions it you are fling Form 1040.NR or 1040NREZ)

[Pat

Payment Due Dates

Section A - Figure Your Underpayment m, 2) 0) @

aise wish enh vista

TE Roqued taimets box a Part appes ener

amounts rom Sched AL ne 27. thes, enter

25% (0.25) of 9, Form 221, neach cima | 191,843.| 191,843.|__191,843.| 191,843.

10 cues na fren et.

Seattcteraiavudearyooswexedavorrarit| 19 | 191,702.| 150,702.| _191,702.| 220,703.

Complete ines 20 through 28 of ne eolome

Deore gla ine 20 fhe aes clemn,

20 nate amount, any, om ie 28 in the pevons

caluma 20

21 Aeelis 18and 20 2 150, 702.|_191, 702,|

22 ncdtemnavtsontees nd Bnepevomerune [AE Tat 41, 282.[ 41,423.

28 Subtracting 2 am fe 2, eros, et 0

Forcshe a)ontyeneriesmuntron ine ©... {2a | 191,702.| _150,561.| _150,420.| 179,280.

24 1 281 zr, svat ine 21 rom ne 22,

ners, enter EA o 0.

25 underpayment ifn is equal or more than ne

2, sua e 2 fom ie 18. Then go tone 2.0f

‘heme cob, ONES gO 10 HE any DP | 2S 4i.| _41,282.|__43,423.| 12,563.

28 Ontpayent. ne 2 8 more tha ne 1, eran oe

18 tom in 23, Then goto ne 20 ofthe netcoumn | 25

‘Section B - Figure the Penalty (Use the Workaheot for Form 2210, Part IV, Seation 8 Figure the Penalty in the hetrvetions.)

Penal. Err th total peray For Te (of be Works or Form 227, Par V, Seaton B= Figur th Perl. Abo

‘etude is ameuntan Form 1040 or 1040-8R, Ine 24 Form TOAD, Ine 7; For YOADNR-EZ Ine 2; Fm 108,

{ne 27. Denil Form 2210 ules you checked a box in Patt pla 1,386.

13.3

GEE =norr, vovcras

Fora 2210(20%9)

SEE ATTACHED WORKSHEET

UNDERPAYMENT OF ESTIMATED TAX WORKSHEET

wa ete

DOUGLAS C. EMHOFF & KAMALA D. HARRIS Pere eel

a a a oy @ 0

pie Ancunt dance ve ‘taorebes Pel ata Penalty

:

04/15/19 191,843.| 191,843,

04/15/19 -5,702. 186,141.)

04/15/19 186,000.) 141.) 61 -000164384! 1,

06/15/19 191,843. 191,984.)

06/15/19 5,702. 186, 282.)

06/15/19 -145,000. 41,282.) i 000164384) 102.

06/30/19 0. 41,282.) V7 +000136986) 435.

09/15/19 191,843.) 233,125.

09/15/19 -5,702.) 227,423.

09/15/19 -186,000.| 41, 423.| 107 + 000136986) 607.)

12/31/19 0. 41, 423.,| 15 + 000136612) 85.

01/15/20 191, 843.| 233,266.

01/15/20 -5,703.| 227,563.

o1sis/20 | -215,000| 12,563, 91 000136614 156,

‘Penalty Due (Sum af Column F},_ 1,386.

|

13.4

aS EE anor, vovctas =e

‘SCHEDULE A Itemized Deductions eee eee

Frm 00% 100-5]. mauiheyenele instr nie test ron 2019

eae > Attach to Form 1040 or 1040-SR. =.

Brean TEENY wei] Caution: f you ete claiming a net qualilied disaster loss on Form 4624, see the instructions for ne 16. Sogeonce 0.07

Frog nomen TO TIDE er oT

DOUGEAS C. EMHOFF & KAMALA D. HARRIS

Medical ‘Caution: Do not include expenses reimbursed or paid by others, Tet

and 1. Maca! on ntl expenses (ersten) 1

Dental 2 teranmant tem rom 100r70:08, Ine 6b Ls

Expenses 9 talpyine by 75% 0079) 3

4 Subtract ine 3 from ling 1, If line 3 is more than fine 1, entor C- Ta

Taras You 5 Stats andal ives

Paid Sat aoca cae tres or goer aise. Younny

‘otra eterneome tars or ena ales tes on a

turret both you eee once gen eis os tend

‘of income taxes, check this box SEE STATEMENT 10» [7] |sa|_ 258,238.

'b State and local real estate taxes (288 instructions) 5b 57,738.|

¢ State and local personal property taxes: [sc 447 |

d Add tines 5a through 5c ‘sa] 316,423.)

‘Snore sma oti ec 5,600 (8300 maria ing

seowreh) co] 10, 000,

6 martes Let ype and amount

*

1_ Kid lines S2 and 6 Iz 10,000.

Taterest Vou 6 Hone notgeoe iar on pore yo sr use ot aurhome

Pai rmonge onto buy. uo nprove your hme, 2

Caan var tuted check box >o

enan — Home motgage eres and pots eparted 1 eon Fem 108. See

‘tmitad (see instructions it limited Ey 32,041.

Seely Home morgage tant parade youn ern 7098 See

etnclera tied I pate para fom won youboug he

rare ton nstetons and sow that prensa ong 9. and

nares

es

Faia nt vpatediayouen Fors TR Sa Haan Tr

soostinies ec

a notoage surance premio ee neces ea

‘@ Add lines Ba through 6d se] 1041.

0” vestments tac Fo 495 Fagus. See

instuctons 2

10 Add ines Be and & Tio! 32,041.

GHRSTo Atty one or nae ye made ay gi of 250 oro,

‘Charity ‘see instructions: 44 35,390.) STMT 11

aaretyon 1 Oe thay sash orcs yams ay of 0 ere,

care geeismcions. You must an Form 8203 ot $00 ta

selabeteor 49 Caryover rom proc year rel

44 Add lines 11 through 13. 14) 35,390.

Seasty md AE Caray a et ost fom a faay coc dst ar an nt aatfos

‘Theft Lossos: disaster losses). Attach Form 4684 and enter the amount from line 18 of that form. See

istucions 15

Ober tom tra ratwctoe Ut ype ana ant

a

TTR acra na TON Or Ties # Bog TAO TO

Ferm 10:00 OH05R, ina jo|77,431.

Deductions 19 youd to komze cocucaseien though they we ues than yor inde

deduction, check this box >

Far Paperwork Reduation Act Notie, see te SR] 2078

a BEBE 280rF, Dovczas Ee]

Potrebbero piacerti anche

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Saget Family LawsuitDocumento10 pagineSaget Family LawsuitCharles Frazier100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- Trump Organization IndictmentDocumento25 pagineTrump Organization IndictmentDaniel Uhlfelder100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- 2021.08.03 Nyag - Investigative ReportDocumento168 pagine2021.08.03 Nyag - Investigative ReportNew York Post100% (2)

- Piccolo Filed EEOC ChargeDocumento21 paginePiccolo Filed EEOC ChargeDavid Caplan0% (1)

- Riley Williams Charging DocumentDocumento6 pagineRiley Williams Charging DocumentLaw&CrimeNessuna valutazione finora

- Campaign Legal Center - Rep. George Santos Complaint - Jan. 9 2023Documento50 pagineCampaign Legal Center - Rep. George Santos Complaint - Jan. 9 2023David Caplan100% (1)

- Articles of Impeachment - Incitement of Insurrection PDFDocumento4 pagineArticles of Impeachment - Incitement of Insurrection PDFLiz Johnstone92% (39)

- Mt. Vernon Robbery ComplaintDocumento9 pagineMt. Vernon Robbery ComplaintDavid CaplanNessuna valutazione finora

- Court Agreement Between Mayor Eric Adams Administration and Texas Charter Bus CompanyDocumento3 pagineCourt Agreement Between Mayor Eric Adams Administration and Texas Charter Bus CompanyDavid CaplanNessuna valutazione finora

- NYC DOT's Pay by Plate Implementation ScheduleDocumento12 pagineNYC DOT's Pay by Plate Implementation ScheduleDavid Caplan100% (1)

- NATIONAL COALITION ON BLACK CIVIC PARTICIPATION, Et Al. v. JACOB WOHL, Et Al.Documento13 pagineNATIONAL COALITION ON BLACK CIVIC PARTICIPATION, Et Al. v. JACOB WOHL, Et Al.David CaplanNessuna valutazione finora

- Attorneys For Plaintiffs Additional Counsel Listed On Signature PageDocumento311 pagineAttorneys For Plaintiffs Additional Counsel Listed On Signature PageDavid CaplanNessuna valutazione finora

- Joa Liu and Steven Rodriguez Indictment - Feb. 17, 2022Documento17 pagineJoa Liu and Steven Rodriguez Indictment - Feb. 17, 2022David CaplanNessuna valutazione finora

- United States of America vs. Fetty WapDocumento4 pagineUnited States of America vs. Fetty WapDavid CaplanNessuna valutazione finora

- State Senator Zellnor Myrie and Assemblywoman Diana Richardson Sue NYPDDocumento58 pagineState Senator Zellnor Myrie and Assemblywoman Diana Richardson Sue NYPDDavid CaplanNessuna valutazione finora

- NJ Executive OrderDocumento6 pagineNJ Executive OrderDavid CaplanNessuna valutazione finora

- SAG AFTRAResignationLetterfromPresidentDonaldJTrumpDocumento1 paginaSAG AFTRAResignationLetterfromPresidentDonaldJTrumpDavid Moye100% (1)

- Bulletin: Summary of Terrorism Threat To The U.S. HomelandDocumento1 paginaBulletin: Summary of Terrorism Threat To The U.S. HomelandAustin DeneanNessuna valutazione finora

- Pfizer-Biontech COVID-19 Vaccine Briefing DocumentDocumento92 paginePfizer-Biontech COVID-19 Vaccine Briefing DocumentDavid CaplanNessuna valutazione finora

- Myremote Access Using Onelogin 2-Factor AuthenticationDocumento3 pagineMyremote Access Using Onelogin 2-Factor AuthenticationDavid CaplanNessuna valutazione finora

- Board of EducationDocumento15 pagineBoard of EducationDavid CaplanNessuna valutazione finora

- FDA - 162nd Meeting of The Vaccines and Related Biological ProductsDocumento2 pagineFDA - 162nd Meeting of The Vaccines and Related Biological ProductsDavid CaplanNessuna valutazione finora

- Emailbttachment-October 7, 2020 Press ReleaseDocumento2 pagineEmailbttachment-October 7, 2020 Press ReleaseDavid CaplanNessuna valutazione finora

- Joe Biden's 2019 Tax ReturnDocumento38 pagineJoe Biden's 2019 Tax ReturnDavid Caplan50% (2)