Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

RMBSModeling

Caricato da

sidhanthaDescrizione originale:

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

RMBSModeling

Caricato da

sidhanthaCopyright:

Formati disponibili

Residential Mortgage-Backed Securities

Modeling: A Fundamental Approach

Stanislav Perchev

This article surveys the recent developments in the credit markets paying special attention to the issues

surrounding the valuation of residential mortgage-backed securities (RMBS) and related collateralized

debt obligations (CDOs). It also offers a modeling framework whose purpose is to provide a robust and

transparent approach to the valuation of securities backed by real estate assets. The proposed framework

utilizes a stochastic Monte Carlo approach based on econometric analysis of underlying data at the

individual loan level paired with accurate reflection of the transactions’ financial structure, while

accounting for liquidity risk.

The RISConsulting Group LLC, Boston, MA

T he recent developments in the credit

markets have illuminated one very

important but often ignored aspect of the

financial world – the more than occasional

dichotomy between value and price. Or, maybe

debt obligations, or CDOs, in all their forms),

whose complexity has been singled out as a

root cause of the market crash. Of course, we

all know that there were many roads leading up

to that collapse and the inability to properly

it is between high-powered academic research value and account for the risk in complex

and real business applications? Or, perhaps it structured finance products was nothing but a

is between the views of deal execution teams crossroad of manifested shortcomings evident

and quantitative researchers in leading financial in practices and methods. What we offer is an

institutions across the world? Or between opportunity to leave it just as that – a crossroad,

underwriting standards and mortgage rather than a final destination.

origination practices? It is all of the above, and

we by no means claim for this to be a complete For years we have promoted a simple but

list of issues and facts explaining the credit powerful framework for risk estimation and

markets meltdown that has been propagating valuation – Monte Carlo simulations of

over the past year and which many believe is underlying drivers based on econometric

only gaining momentum. analysis of the data and processes at hand.

When implemented correctly, the data

While we at RISC do not think we can help generation processes allow you to sample

financial institutions and investors alleviate all through the range of potential outcomes and

of the above problems, we believe we can be of evaluate different financial instrument’s

great value by extending what we have done relevant cash flows with a great deal of comfort

for other businesses and industries – offer a as you are relying upon a scientific framework

transparent framework for valuation of credit based on hard, real data. This approach

instruments by focusing on the fundamental eliminates stress case assumptions and lever

drivers of the risk. Not surprisingly, we have toggling based on subjective judgments or

started with the most severely affected sector at reliance upon no-arbitrage financial models that

this stage – the residential mortgage-backed make arbitrageurs smile. Instead, it relies upon

securities (RMBS) and the resulting suite of relationships tested through time, which in their

exotic derivative instruments (collateralized apparent and powerful simplicity provide the

©The RISConsulting Group LLC January 2008

needed transparency and are accessible to a year in October, 2007 (largest decline since

wide base of investors. 1968). 2

General Trends and Market These price declines, combined with higher

interest rates, led to increased mortgage

Developments delinquencies, especially in what has become

known as the subprime mortgage market.

The year 2007 marked a dramatic turnaround of Based on its December 2007 National

what many believed to be a bull market for Delinquency Survey, the Mortgage Bankers

credit and credit-related structured finance. Association reports that the level of

The credit markets collapsed in the wake of delinquencies is at 5.59% of all loans

rising delinquencies on subprime mortgages outstanding in Q3 2007, not including the loans

and the liquidation of two high profile hedge already in foreclosure (the highest level since

funds, which led to the demise of the structured 1986). 3 They go on to point out that the

investment vehicles (SIV) market followed by percentage of loans in foreclosure stands at

significant write-offs posted by banks. Amidst 1.69%, the highest level ever recorded. In a

it all, rating agencies have been called to task January 2008 press release, RealtyTrac®

for their alleged failure to accurately measure reports that the U.S. foreclosure activity

risk. In addition to its short-term intervention, increases by 75% in 2007 (Figure 1). 4

the government is looking at policies to shore

up industry practices and to help avoid future Figure 1

crises, adding indirect cost and the threat of

increased regulation to the mix.

Credit ratings and traditional methods of

valuation of risky debt in highly structured

financial instruments, such as CDOs, have

come into question and investors are facing the

need for more information transparency, with

some (we believe far too few) searching for

more robust risk analysis and valuation tools.

The causes of the residential mortgage crisis Source: RealtyTrac®

that has led to the more general meltdown of

the structured finance market go beyond Clearly the market conditions are not painting a

subprime and have their roots in the very favorable picture – there are signs that the

fundamentals of the housing market cycle. crisis is far from over and the situation is

expected to deteriorate even further, but more

The United States experienced a real estate on that later. First, let’s cover some mortgage

boom in the period of 1996-2005, during which basics.

the percentage of home-owning households

increased from 65.4% to 68.9%, with home Mortgages and Mortgage-Backed

prices constantly on the rise, reaching annual

growth rates of 11.4% between 2000 and 2005.

Securities

This rapid expansion, however, has come to a

An excellent source for a general introduction

sudden halt. Growth in home prices slowed

to the field is Lucas (2006). We will cover

dramatically in Q1 2006, and in Q1 2007,

briefly some of the basics for the sake of

prices fell for the first time since 1991. 1 The

completeness.

median prices for new and existing homes were

down 13.2% and 6.3%, respectively, year-to-

2

Mortgage Bankers Association (Dec.14, 2007)

3

Mortgage Bankers Association (Dec.6, 2007)

1 4

McDonald and Thornton (2008) RealrtTrac® (2008)

©The RISConsulting Group LLC 2 January 2008

A mortgage is a typical loan with real estate The loans typically vary in terms of the criteria

serving as collateral. Its basic characteristics they satisfy between agencies (to the list of

include: loan amount, loan term, schedule for Fannie Mae and Freddie Mac we would have to

repayment, and contracted interest rate. There add the Government National Mortgage

are many different types of mortgages, mainly Association or Ginnie Mae) and private issuers,

depending on how the interest rate enters into with those by private issuers having less

the contract: stringent underwriting standards.

• Fixed rate, exhibiting fixed monthly The exposition would not be complete without

payment for the duration of the loan (most addressing some of the common securities

common, 70% of total mortgage market), backed by residential mortgages (RMBS). The

• Adjustable rate (ARM), where the base rate simplest one is a mortgage passthrough

adjusts periodically based on a benchmark security, where the payments from the

rate (LIBOR, Constant Maturity Treasury, underlying pool are distributed to investors on a

etc). Increased in popularity after 2002, pro-rata basis. The next level is a stripped

• Hybrid ARM, where the rate is fixed for an MBS, where the payments from the underlying

initial period and then switches to pool are directed towards an interest-only class

adjustable (e.g., 5/1 hybrid ARM, 3/27 (or IO mortgage strip) and a principal-only

hybrid ARM, etc), and class (or PO strip). Once individual loans or

• Interest only (IO), where borrower pays pools of passthroughs are tranched into

only interest for a number of years. Can be seniority-of-payment tranches, the resulting

both fixed rate and (hybrid) ARM. security is referred to as a collateralized

mortgage obligation (or CMO). Further, a

Mortgage loans are financed on a primary and a diversified pool of collateral comprising one or

secondary market basis. Traditionally the more of the above structures, results in what is

primary market has been much larger than the known as a Structured Finance Collateralized

secondary one. With the creation of the Debt Obligation (or SF CDO). Tranches of

Government National Mortgage Association CDOs themselves, when packaged together, are

(Ginnie Mae) and the government-sponsored referred to as CDO2 (where the order could be

enterprises such as the Federal National higher than 2). Structured RMBS securities are

Mortgage Association (Fannie Mae) and the designed to distill the different risks associated

Federal Home Loan Mortgage Corporation with mortgage portfolios and spread them

(Freddie Mac). Aided by growth in these across the base of investors according to their

agencies, the secondary market began to risk appetite.

expand rapidly in the 1990s and now plays a

major role in mortgage finance. This growth Risks

was turbo-charged by the increased

sophistication of the US and global financial The risks associated with mortgage lending are

markets, along with the introduction of default risk (that the borrower may default on

financial instruments and financial engineering the mortgage payments) and prepayment risk

techniques that resulted from increased (the speed of repaying the mortgage, which

specialization in mortgage finance. In affects the size and timing of the corresponding

combination, these factors led to: 5 cash flows).

• More liquidity in trading the underlying Default risk is quite intuitive – in the event of

mortgages, default, the borrower no longer meets the

• Greater utilization of capital markets with contractual obligations and the cash flows stop.

the development of securitizations, and A lender or an investor in a security backed by

• A significant increase in mortgage loan a pool to which such a mortgage belongs could

availability to all types of households with experience a loss, depending on the amount of

lower transaction costs. collateral coverage. However, in the wake of

falling prices, full collateral coverage is hardly

5

Bernanke (2007) the expected norm.

©The RISConsulting Group LLC 3 January 2008

Prepayment risk is essentially reinvestment complete without focusing on this segment of

risk. Prepayments affect the timing of the cash the market.

flows and thus, inject uncertainty.

Prepayments are a well established risk of Subprime mortgages refer to mortgage loans

mortgages, but occurrence at any rate different made to borrowers who usually display

than the expected is not a welcome feature in a previous delinquencies, foreclosure or

dynamic environment when interest rates bankruptcy, have low FICO credit scores, and a

change. ratio of debt service to income of 50% or

greater. 8 The subprime mortgage market

As interest rates fall, borrowers are likely to offers a wider range of mortgage products than

prepay, which is what lenders and investors in typically found in the prime sectors. It was a

mortgage instruments would like to avoid, new and rapidly growing sector of the

because the opportunity set for reinvestment mortgage market, which, by expanding the pool

available in the market for comparable of credit to a larger base of borrowers,

investments would have shrunk relative to what increases homeownership and the opportunity

was available on the prepaid mortgage. Thus, to create wealth. To give one a sense of the

while the value of the mortgage or the level of growth in this segment: subprime loans

instrument should actually rise with a fall in categorized as B and C increased from $65 BN

interest rates, it does so with a percentage gain in 1995 to $332BN in 2003. 9 The increased

smaller than the percentage loss for a large rise securitization of subprime mortgage loans has

in interest rates (i.e., there is convexity risk). 6 fueled this growth to a large degree. As the

authors of the referenced study note, all the

As interest rates rise, borrowers are slower at social good that the rapid expansion in this

prepaying and this is exactly when the investors market has brought does not come without a

would like to see increasing prepayments, as price – they suggest that the probability of

they can invest in instruments yielding higher default on non-prime mortgages is at least six

returns. Thus, the decline in price of the times higher than for prime loans and that

mortgage or the instrument backed by the elevated foreclosures adversely impact the

mortgage is larger (i.e., there is extension risk). value of properties in the affected

neighborhoods as a whole.

There is a great deal of research addressing the

fundamental drivers of the mortgage exposure To put things further in perspective, the market

risk. Metrics such as the FICO 7 scores, loan size for subprime mortgages is estimated at

size, and loan-to-value ratio (to name a few) $1.3 trillion outstanding loans (out of $10.4

have long been recognized as indicators of the trillion of total home mortgages outstanding). 10

likelihood to default or prepay. Other factors Subprime mortgages with adjustable interest

affecting the loss severity in the event of a rates account for two-thirds of subprime first-

default are the time it takes to foreclose and the lien mortgages or about 9% of total first-lien

then prevailing interest rates, as well as the mortgages outstanding. 11 Now, consider the

value of the real estate asset serving as the above-mentioned statistic and the fact that 43%

mortgage collateral (to name a few). of all foreclosures started during Q3 of 2007

belong to subprime mortgages with adjustable

Subprime Mortgage Market rates. 12

Since there has recently been a great deal of

attention in the media stemming from

investments in securities backed by subprime 8

mortgages, our discussion would not be For an in-depth discussion of the subprime

mortgage market, see Chomsisengphet and

Pennington-Cross (2006)

9

Ibid.

6 10

Lucas (2006) Poole (2007)

7 11

FICO scores are developed by the Fair Isaac Bernanke (2007)

12

Corp., see http://www.fairisaac.com/fic/en. Mortgage Bankers Association (Dec.6, 2007)

©The RISConsulting Group LLC 4 January 2008

How can this happen, you might ask? After all, Add to this the deterioration of home prices

all years up to 2006 were marked by strong over the last year and the expectation that they

mortgage credit quality and unprecedented are expected to go down further, and you get a

growth in the credit markets. sense of where we might be heading (Figure

3) 16 .

The answer, with the benefit of hindsight, lies

in the combination of home price deceleration Figure 3

and a general economic slowdown with a large Case-Shiller Price Index: Year to Year Percent Change

25

number of ARMs issued during a period

20

marked by a steep yield curve (2002-2004,

suggesting rising short term interest rate 15

expectations).

Percent Change

10

Add to this the fact that mortgage originators’ 5

incentives were influenced by high fees and

0

substantial spreads on non-prime ARMs, not to

forget the increased investor appetite for higher -5

securitization yields driving demand for more -10

and more securitizations, and 1988 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008

Source: S&P/Case-Shiller® Home Price Index

Figure 2

Reset Schedule for Hybrid ARMs by Sector Before wrapping up the mortgage market

50

survey, we address the issues surrounding the

45

more exotic products, such as the CDOs. The

40 excessive liquidity in the global financial

35 markets, the spike in the development and use

USD billions

30 of innovative financial structures, falling

25 interest rates and tightening credit spreads

20

increased the demand for CDOs by investors

15

seeking yield enhancement against a backdrop

10

5

of relatively low volatility. CDOs outpaced

0

corporate and municipal bond sales with about

7/1/2007 11/1/2007 3/1/2008 7/1/2008 11/1/2008

Agency Alt-A Jumbo Subprime $500 billion sold in 2006, up from $99 billion

Source: Federal Reserve Bank of Dallas/Bank of America in 2003. 17 It is reported that almost half of all

CDOs sold in the U.S. in 2006 contained

top it off with the fact that rating agencies’ subprime debt, with more than $175 billion in

incentives favor pumping more and more subprime mortgage mezzanine tranches. 18

volume through the system, 13 and you have an

answer. Better yet, a disaster. So, was it really With the unraveling of the mortgage crisis,

a surprise that the crisis happened? Moreover, investors are realizing that they have no reliable

a good number of sources suggest that the way of quantifying the risk and valuing these

worst is yet to come. An economic complex instruments. The ratings issued by

commentary by David Rosenberg at Merrill rating agencies have lost credibility as robust

Lynch suggests that the ARM resets are just indicators of underlying risk. The collapse of

beginning with more than $170 billion of resets the Bear Sterns hedge funds ignited a rash of

expected in 2008, with 70% of the volume downgrades on subprime mortgage transactions

falling into the subprime category. 14 A similar

picture is painted by Bank of America (Figure 16

Source: S&P Case-Shiller® Index

2) 15 . (http://www2.standardandpoors.com/portal/site/sp

/en/us/page.topic/indices_csmahp/0,0,0,0,0,0,0,0,

0,1,1,0,0,0,0,0.html), adapted from Rosenberg

13

Mason and Rosner (2007) (2007)

14 17

Rosenberg (2007) Evans (2007)

15 18

DiMartino (2007) Ibid.

©The RISConsulting Group LLC 5 January 2008

which, in turn, began a period of panic selling • An over-reliance by investors on ratings at

of structured debt with subprime components, the expense of doing their homework,

as investors fled to safety by moving their • Modeling of sudden liquidity withdrawal is

holdings to US Treasuries and money market critical but missing,

funds. In the meantime, the origination and • Data may be unreliable and aggregate /

trading of structured mortgage products has high-level modeling approach

virtually ground to a halt. Inevitably, the inappropriate.

rhetorical question arises: what will it take to

get another structure with subprime debt rated Where this all takes us to is the belief that there

or placed in the market? is a clear need for independent pricing and

valuation based on a transparent and accessible

By introducing transparency and fundamental framework, which utilizes analyses derived

risk drivers into our analysis, we offer a from reliable and appropriate data (including

modeling framework to assist in filling the historical loan and securities performance as

current valuation and risk-assessment vacuum, well as transaction structures). A framework,

support ongoing risk transfer activity and in short, that applies robust modeling focused

restore some of the confidence in RMBS and on the underlying asset pools at the individual

derivative securities that has been lost in the loan level, allowing for stochastic modeling of

recent past. the risks, and accounting for the presence of

liquidity risk.

Modeling Aspects

RISC RMBS Stochastic

While the preceding discussion covered a lot of

ground, we by no means view it as an in-depth

Modeling Framework

analysis of the recent crisis. We do, believe,

We believe that the appropriate analysis of

however, that a few key issues around the

RMBS requires a forward-looking stochastic

current state of modeling rise to the surface:

model that combines macroeconomic

components (such as US real GDP growth rates

• Complexity of an unprecedented nature,

and interest rates), industry-specific

the often inappropriate use of available

measurements (such as state-level gross

data, poor overall transparency (risk,

product growth rates and unemployment levels,

model, date methodology), failure to

industrial production concentration), combined

account for illiquidity,

with individual loan level analysis. In order to

• Investors’ inability to measure their levels capture the specific aspects of a certain

of exposure to subprime sector CDOs or transaction, it is critical to accurately capture its

the corresponding risk, financial structure and corresponding cash-flow

• Absence of reliable sources of statistical dynamics. And, of course, the model has to

information with respect to the default account for both the originator and servicer

rates for many of the CDOs, practices, as well as market liquidity risk.

• Traditional methodologies and credit

ratings that are no longer considered The model we are alluding to will produce cash

accurate or adequate, flows generated in a Monte Carlo stochastic

• Rating agencies no longer seen as objective simulation environment, which are then flown

since they play an active role in assembling through the transactional waterfall. As such, it

CDOs, will produce probability distributions of cash

• Presence of perverse incentives as a flows to each tranche, which, in turn, will give

substantial portion of the agencies’ an accurate representation of the risk to each of

revenues comes from rating structured the corresponding tranches, and produce

finance instruments, valuation and risk analysis calculations

• Rating agencies too slow and opaque in (expected values, percentiles, etc.)

their tackling of the subprime crisis,

©The RISConsulting Group LLC 6 January 2008

RISC RMBS Stochastic Modeling Framework

Each of the stochastic components of the References

models will be based on econometric analysis

of historical data sets at the highest level of Bernanke, Ben S. “The Subprime Mortgage

resolution (such as loan-by-loan historical Market.” Speech at the Federal Reserve

experiences) and will provide a robust and Bank of Chicago’s 43rd Annual Conference

transparent framework for understanding the on Bank Structure and Competition,

analysis assumptions and implications. Chicago, Illinois, May 17, 2007;

http://www.federalreserve.gov/news

Think of this framework as a fully integrated events/speech/bernanke20070517a.htm

stochastic model, which bases its analyses on

scientific analysis of data and provides its users Chomsisengphet, Soupala and Pennington-

with a full set of analytics, derived from the Cross, Anthony. “The Evolution of the

generated probability distributions filtered Subprime Mortgage Market.” Federal

through the contractual details of the analyzed Reserve Bank of St. Louis Review,

transaction. This approach to quantifying risk January/February 2006, 88(1), pp.31-56.

has worked for us and our clients and we

believe it will work for you. DiMartino, Danielle, and Duca, John V. “The

Rise and Fall of Subprime Mortgages.”

Conclusions Federal Reserve Bank of Dallas Economic

Letter Vol.2, No.11, November 2007;

The market needs a new approach when it http://dallasfed.org/research/eclett/2007/el0

comes to valuation of residential mortgage- 711.pdf

backed securities and the more exotic

structured credit products derived from RMBS. Evans, David. “Subprime Infects $300 Billion

We propose a stochastic framework for cash of Money Market Funds,” Bloomberg

flow generation and risk estimation based on Press, August 20, 2007;

econometric analysis of historical data. The http://www.bloomberg.com/apps/news?pid

focus is on the loan-level data and the inclusion =20601109&sid=aEUtlgwzL_qc

of key risks (other than default and

prepayment) into the framework, such as

market liquidity risk.

©The RISConsulting Group LLC 7 January 2008

Lucas, Douglas L., Goodman, Laurie S., and McDonald, Daniel J. and Thornton, Daniel L.

Fabozzi, Frank J. Collateralized “A Primer on the Mortgage Market and

Debt Obligations: Structures and Analysis, Mortgage Finance.” Federal Reserve Bank

2nd Ed. Hoboken, NJ: Wiley, 2006. of St. Louis Review, January/February

2008, 90(1), pp.31-45.

Mortgage Bankers Association, “No Sign of

Housing Market Stabilization,” Financial Poole, William. “Reputation and the Non-

Commentary, December 14, 2007; Prime Mortgage Market.” Speech to the

http://www.mortgagebankers.org/files/Bull St.Louis Association of Real Estate

etin/InternalResource/58916_.pdf Professionals, St.Louis, Missouri, July 20,

2007; http://stlouisfed.org/news/speeches/

Mortgage Bankers Association, “Delinquencies 2007/07_20_07.html

and Foreclosures Increase in Latest MBA

National Delinquency Survey,” Press RealtyTrac Staff, “U.S. Foreclosure Activity

Release, December 6, 2007; Increases 75 Percent in 2007,” January 29,

http://www.mortgagebankers.org/Newsand 2008,http://www.realtytrac.com/ContentM

Media/PressCenter/58758.htm anagement/pressrelease.aspx?ChannelID=9

&ItemID=3988&accnt=64847

Mason, Joseph R. and Rosner, Joshua. :Where

Did the Risk Go? How Misapplied Bond Rosenberg, David A. “Bidding au revoir to the

Ratings Cause Mortgage Backed Securities credit cycle.” Economic Commentary,

and Collateralized Debt Obligation Market Merrill Lynch. 30 July 2007

Disruptions.” Hudson Institute Working

Paper, May 3, 2007;

http://faculty.lebow.drexel.edu/

MasonJ/mason_rosner_v8nrl.pdf

©The RISConsulting Group LLC 8 January 2008

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- HDFC Bank Black BookDocumento58 pagineHDFC Bank Black Bookchinmay parsekar85% (13)

- LECTURE NO 4 5Cs and 7Ps of CreditDocumento5 pagineLECTURE NO 4 5Cs and 7Ps of CreditJessica Miller79% (14)

- Chapter 4 Consumer Motivation: Consumer Behavior, 10e (Schiffman/Kanuk)Documento31 pagineChapter 4 Consumer Motivation: Consumer Behavior, 10e (Schiffman/Kanuk)sidhantha100% (2)

- Chapter 03Documento31 pagineChapter 03sidhanthaNessuna valutazione finora

- Groupwork 13: Team Gorgeous 3 Chapter 13 Simple Ordinary AnnuityDocumento4 pagineGroupwork 13: Team Gorgeous 3 Chapter 13 Simple Ordinary AnnuityAdliana ColinNessuna valutazione finora

- Indian Banking System and Its Emerging Trends - 2020Documento36 pagineIndian Banking System and Its Emerging Trends - 2020RAJ PATELNessuna valutazione finora

- Chapter 10 The Family and Its Social Class Standing: Consumer Behavior, 10e (Schiffman/Kanuk)Documento31 pagineChapter 10 The Family and Its Social Class Standing: Consumer Behavior, 10e (Schiffman/Kanuk)sidhantha0% (1)

- Chapter 11 The Influence of Culture On Consumer BehaviorDocumento32 pagineChapter 11 The Influence of Culture On Consumer BehaviorsidhanthaNessuna valutazione finora

- Chapter 09Documento33 pagineChapter 09sidhanthaNessuna valutazione finora

- Chapter 05Documento33 pagineChapter 05sidhanthaNessuna valutazione finora

- Chapter 6 Consumer Perception: Consumer Behavior, 10e (Schiffman/Kanuk)Documento32 pagineChapter 6 Consumer Perception: Consumer Behavior, 10e (Schiffman/Kanuk)sidhanthaNessuna valutazione finora

- Daycare Center FacilityDocumento10 pagineDaycare Center FacilitysidhanthaNessuna valutazione finora

- Chapter 02Documento33 pagineChapter 02sidhanthaNessuna valutazione finora

- US Trends Full ReportDocumento42 pagineUS Trends Full ReportsidhanthaNessuna valutazione finora

- AM2012 0189 Paper PDFDocumento10 pagineAM2012 0189 Paper PDFsidhanthaNessuna valutazione finora

- Digital Economy Compass 2018Documento224 pagineDigital Economy Compass 2018sidhanthaNessuna valutazione finora

- Ram Nam Ki LootDocumento317 pagineRam Nam Ki LootsidhanthaNessuna valutazione finora

- How To Never Emerge From The Library Again?: HermeneuticsDocumento23 pagineHow To Never Emerge From The Library Again?: HermeneuticssidhanthaNessuna valutazione finora

- Elliott Wave CalculatorDocumento2 pagineElliott Wave CalculatorsidhanthaNessuna valutazione finora

- Philosophy of Qualitative ResearchDocumento46 paginePhilosophy of Qualitative ResearchsidhanthaNessuna valutazione finora

- Mutual FundsDocumento32 pagineMutual Fundsapi-3702030100% (3)

- Negotiable Instruments and Indian LawDocumento147 pagineNegotiable Instruments and Indian LawNeed NotknowNessuna valutazione finora

- A Study On Impact of Phone Pe Payment With Special Reference To YouthDocumento110 pagineA Study On Impact of Phone Pe Payment With Special Reference To YouthAJAY RATHORENessuna valutazione finora

- Money and Banking Chapter 12Documento8 pagineMoney and Banking Chapter 12分享区Nessuna valutazione finora

- Financial Institutin ManagementDocumento7 pagineFinancial Institutin ManagementAbu SufianNessuna valutazione finora

- Risk Management - RM CHEAT SHEET MAYBEDocumento9 pagineRisk Management - RM CHEAT SHEET MAYBEEdithNessuna valutazione finora

- Introduction of IDBI BankDocumento4 pagineIntroduction of IDBI Bankomy123100% (2)

- Retail Banking - IcicibankDocumento69 pagineRetail Banking - IcicibankKaataRanjithkumarNessuna valutazione finora

- ACH Credit / GIRO: Payment DetailsDocumento2 pagineACH Credit / GIRO: Payment Detailsmelvin taurianusNessuna valutazione finora

- Term Loan Appraisal: A New Manufacturing Unit Wants A Term Loan - What To Look For?Documento33 pagineTerm Loan Appraisal: A New Manufacturing Unit Wants A Term Loan - What To Look For?Rajesh KumarNessuna valutazione finora

- Al-Faysal Bank LTDDocumento44 pagineAl-Faysal Bank LTDqalander abbasNessuna valutazione finora

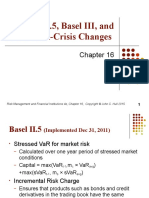

- Basel II.5, Basel III, and Other Post-Crisis ChangesDocumento18 pagineBasel II.5, Basel III, and Other Post-Crisis Changessubba raoNessuna valutazione finora

- NothingDocumento4 pagineNothingSofia Louisse C. FernandezNessuna valutazione finora

- Jaysasuman ResumeDocumento5 pagineJaysasuman ResumeJay SasumanNessuna valutazione finora

- Mortgage Securitization ExplainedDocumento10 pagineMortgage Securitization ExplainedMartin AndelmanNessuna valutazione finora

- Liquidity ManagementDocumento57 pagineLiquidity ManagementShanmuka SreenivasNessuna valutazione finora

- SBI - Post Merger List of OLD and NEW BIC For Erstwhile Associate BanksDocumento8 pagineSBI - Post Merger List of OLD and NEW BIC For Erstwhile Associate BanksTamil GoodReturnsNessuna valutazione finora

- Lehman Brothers - Leverage AnalysisDocumento16 pagineLehman Brothers - Leverage Analysisdeepshika kourNessuna valutazione finora

- United Bank of India SWOT & AnalysisDocumento4 pagineUnited Bank of India SWOT & AnalysisNitin JainNessuna valutazione finora

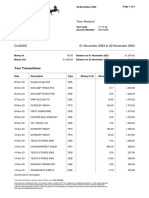

- Statement 11 2023Documento3 pagineStatement 11 2023gurdeepdeep136Nessuna valutazione finora

- Oct RakbankDocumento2 pagineOct RakbankAditya MehtaNessuna valutazione finora

- Annex G-Recon Statement of AccountabilityDocumento11 pagineAnnex G-Recon Statement of AccountabilityAllyssa GabaldonNessuna valutazione finora

- R12 Suppliers BankDocumento2 pagineR12 Suppliers BankAnton HalimNessuna valutazione finora

- Far 102 - Cash and Cash EquivalentsDocumento4 pagineFar 102 - Cash and Cash EquivalentsKeanna Denise GonzalesNessuna valutazione finora

- TNSC BankDocumento66 pagineTNSC BankJeeva Jeeva62% (13)

- Banking Laws SummaryDocumento100 pagineBanking Laws SummaryJanetGraceDalisayFabreroNessuna valutazione finora

- Business Math - Discounts Rate Interest (Version 1)Documento56 pagineBusiness Math - Discounts Rate Interest (Version 1)grace paragasNessuna valutazione finora