Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Julio Gacayan

Caricato da

Glaiza Fe GomezTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Julio Gacayan

Caricato da

Glaiza Fe GomezCopyright:

Formati disponibili

8/4/2020 rpt-sfc/generate_rptop?

rptopid=85804

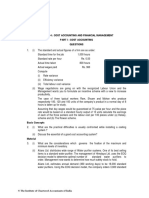

Annex "A"

REPUBLIC OF THE PHILIPPINES

CITY OF SAN FERNANDO

RPTOP84363

JULIO GACAYAN

(Property Owner)

Apaleng August 04 2020

(Address) (Date)

Sir/Madam:

This is to inform you that the Real Property Tax(es) due and payable for the year 2020 on the property/properties in this city/municipality and

ownership of which is/are stated in your name for taxation purposes, (as well as for subsquent years until you are informed of any change/s), is

/are as follows:

A. NOTICE OF ASSESSMENT B. TAX BILL

SUMMARY OF REAL PROPERTY ASSESSMENT TAXES DUE

T.D. Property Owner Location Classi cation Total Total Year Basic SEF Tax Discount Penalty Total

No. Index Market Assessed Tax

No. Value Value

43516 008-01- JULIO Apaleng Pasture (Taxable) ₱ 9,718.26 ₱ 3,890.00 2015 ₱ 77.80 ₱ 38.90 0 84.024 ₱ 200.72

006-07- GACAYAN

011

43516 008-01- JULIO Apaleng Pasture (Taxable) ₱ 9,718.26 ₱ 3,890.00 2016 ₱ 77.80 ₱ 38.90 0 84.024 ₱ 200.72

006-07- GACAYAN

011

43516 008-01- JULIO Apaleng Pasture (Taxable) ₱ 9,718.26 ₱ 3,890.00 2017 ₱ 77.80 ₱ 38.90 0 84.024 ₱ 200.72

006-07- GACAYAN

011

43516 008-01- JULIO Apaleng Pasture (Taxable) ₱ 9,718.26 ₱ 3,890.00 2018 ₱ 77.80 ₱ 38.90 0 72.354 ₱ 189.05

006-07- GACAYAN

011

43516 008-01- JULIO Apaleng Pasture (Taxable) ₱ 9,718.26 ₱ 3,890.00 2019 ₱ 77.80 ₱ 38.90 0 44.346 ₱ 161.05

006-07- GACAYAN

011

43516 008-01- JULIO Apaleng Pasture (Taxable) ₱ 9,718.26 ₱ 3,890.00 2020 ₱ 77.80 ₱ 38.90 0 16.338 ₱ 133.04

006-07- GACAYAN

011

TOTAL: ₱ 58,309.56 ₱ 23,340.00 ₱ 466.80 ₱ 233.40 ₱ 1,085.30

THELMA JUCUTAN EDMAR C. LUNA

City Assessor City Treasurer

NOTE: 1. Kindly inform the Assessor's O ce of any error or omission that you may have discovered in this Notice.

2. Please present this Notice to the Treasurer when payment is made. Payments may be made every quarter in four (4) equal installments not later than March 31st (1st Quarter); June 30th (2nd

Quarter); September 30th (3rd Quarter) and December 31st (4th Quarter).

3. Payments for the entire year should be made not later than March 31st.

4. This Notice pertains only to current year taxes and does not include deliquencies for previous year which are subject of a separate Notice when applicable Delinquent payments are assessed a

penalty of 2% per month of a deliquency or a fraction thereof.

5. This Notice of Assessment is ONLY e ective within the current month of application. Ask for another Notice of Assessment if processed beyond said dates.

REALPROPERTYTAX|RPTOP|PRINTED BY:Glaiza Fe Abenoja Gomez

rpt-sfc/generate_rptop?rptopid=85804 1/1

Potrebbero piacerti anche

- Report of Accountability For Accountable FormsDocumento12 pagineReport of Accountability For Accountable FormsGlaiza Fe GomezNessuna valutazione finora

- Application Letter SampleDocumento1 paginaApplication Letter SampleGlaiza Fe GomezNessuna valutazione finora

- Basic Grammar Rules - LMTDocumento3 pagineBasic Grammar Rules - LMTGlaiza Fe GomezNessuna valutazione finora

- Understanding Verbs - Their Forms and UsageDocumento24 pagineUnderstanding Verbs - Their Forms and UsageGlaiza Fe GomezNessuna valutazione finora

- Avon Case AnalysisDocumento10 pagineAvon Case Analysiskmassey101580100% (1)

- Management Process Goods and Services Concept Coordination Elements Marketing Selection Development Distribution Channel Customer'sDocumento10 pagineManagement Process Goods and Services Concept Coordination Elements Marketing Selection Development Distribution Channel Customer'sGlaiza Fe GomezNessuna valutazione finora

- Thesis Documentation (Example)Documento9 pagineThesis Documentation (Example)Glaiza Fe GomezNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- 2021 APC ASM DIS With Attachments 06182021 PSEDocumento146 pagine2021 APC ASM DIS With Attachments 06182021 PSESeifuku ShaNessuna valutazione finora

- A.Income Statement: Pre-Operation Year 1Documento5 pagineA.Income Statement: Pre-Operation Year 1Benjie MariNessuna valutazione finora

- Adtp Fee 2022 IntiDocumento1 paginaAdtp Fee 2022 IntiAsma AkterNessuna valutazione finora

- Online Guide For UTP RegistrationDocumento72 pagineOnline Guide For UTP RegistrationwhateveroilNessuna valutazione finora

- ApplicationForm - WB 001 108617 00286102Documento4 pagineApplicationForm - WB 001 108617 00286102anishmistri8333Nessuna valutazione finora

- Mmi 07 Bma 14 Corporate FinancingDocumento20 pagineMmi 07 Bma 14 Corporate FinancingchooisinNessuna valutazione finora

- Solutions 67Documento7 pagineSolutions 67dklus12Nessuna valutazione finora

- Chapter 21 (Saunders)Documento21 pagineChapter 21 (Saunders)sdgdfs sdfsf100% (1)

- McKinney Module 2 Rent Vs BuyDocumento8 pagineMcKinney Module 2 Rent Vs BuyAbhinav KumarNessuna valutazione finora

- Prize Winners For December 2016 Executive & ProfessionalDocumento31 paginePrize Winners For December 2016 Executive & ProfessionalM Nidhi MallyaNessuna valutazione finora

- Franchise AccountingDocumento17 pagineFranchise AccountingCha EsguerraNessuna valutazione finora

- Worksheet 4 AcctsysDocumento2 pagineWorksheet 4 AcctsysJillian Mae Sobrino BelegorioNessuna valutazione finora

- Pengaruh Ukuran Perusahaan Dan Leverage Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel InterveningDocumento7 paginePengaruh Ukuran Perusahaan Dan Leverage Terhadap Nilai Perusahaan Dengan Profitabilitas Sebagai Variabel InterveningREHANI ALIA PUTRINessuna valutazione finora

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocumento3 pagineStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNessuna valutazione finora

- Mint Delhi 03-04-2024Documento18 pagineMint Delhi 03-04-2024shashankstsNessuna valutazione finora

- QutotionDocumento1 paginaQutotionmanishsngh24Nessuna valutazione finora

- Isurance CarDocumento506 pagineIsurance CarLatif SugandiNessuna valutazione finora

- m339w Sample ThreeDocumento8 paginem339w Sample ThreeMerliza JusayanNessuna valutazione finora

- Wiley P2 Sec-A FlashcardDocumento29 pagineWiley P2 Sec-A FlashcardnaxahejNessuna valutazione finora

- FinalDocumento31 pagineFinalAniruddha RantuNessuna valutazione finora

- Professional Ethics - , Accountancy For Lawyers and Bench-BarDocumento27 pagineProfessional Ethics - , Accountancy For Lawyers and Bench-BarArpan Kamal100% (6)

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Documento8 paginePakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaNessuna valutazione finora

- CH 11Documento12 pagineCH 11Cary Lee33% (3)

- ExmDocumento18 pagineExmRoy Mitz Bautista0% (2)

- Paper 4Documento44 paginePaper 4Mayuri KolheNessuna valutazione finora

- Shriram City Union Finance - Shriramcity - inDocumento20 pagineShriram City Union Finance - Shriramcity - inRamesh GaonkarNessuna valutazione finora

- TLMDocumento32 pagineTLMsampada_shekharNessuna valutazione finora

- Cost Benefit Analysis Is Done To Determine How WellDocumento5 pagineCost Benefit Analysis Is Done To Determine How WellShaikh JahirNessuna valutazione finora

- AT.2900b - Auditing (AUD) SyllabusDocumento2 pagineAT.2900b - Auditing (AUD) SyllabusBryan Christian MaragragNessuna valutazione finora