Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Coleman Technologies Case

Caricato da

chandel08Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Coleman Technologies Case

Caricato da

chandel08Copyright:

Formati disponibili

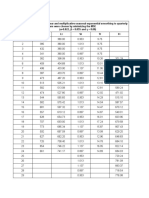

What is the market interest rate on Coleman’s debt and its component cost of debt?

Coupon rate 12%

Coupons per year 2

Years to maturity 15

Price $1,153.72

Face value $1,000

Tax rate 40%

N 30

PV $1,153.72

PMT $60

FV $1,000

rd 10.0%

rd (1 – T) 6.0%

PART C

(1) What is the firm’s cost of preferred stock?

Nominal dividend rate 10%

Dividends per year 4

Par value $100

Price $111.10 rp = Dp/Pp

rp 9.00%

PART D

(2) What is Coleman’s estimated cost of common equity using the CAPM approach?

β 1.2

rRF 7%

RPM 6% rs = rRF + (RPM)(b)

rS 14.20%

PART E

What is the estimated cost of common equity using the DCF approach?

Price $50

Current dividend $4.19

Constant growth rate 5%

D1 $4.40 rs = [D0(1 + g)/P0] + g

rs 13.80%

PART F

What is the bond-yield-plus-risk-premium estimate for Coleman’s cost of common equity?

"Bond yield + RP" premium 4%

rs = 14.00% rs = rd + RP

PART G

What is your final estimate for rs?

METHOD ESTIMATE

CAPM 14.20%

DCF 13.80%

rd + RP 14.00% Range: 13.80% to 14.20%

Average 14.00% Midpt: 14.00%

PART I

(2) Coleman estimates that if it issues new common stock, the flotation cost will be 15%. Coleman

incorporates the flotation costs into the DCF approach. What is the estimated cost of newly issued

common stock, considering the flotation cost?

% Flotation cost 15%

Net proceeds after flotation $42.50 rs = [D0(1 + g)/P0(1 – F)] + g

rs 15.35%

PART J

What is Coleman’s overall, or weighted average, cost of capital (WACC)? Ignore flotation costs.

wd 30% rd (1 – T) 6.00% WACC = wdrd(1 – T) + wprp + wcrs

wp 10% rp 9.00% WACC = 11.10%

wc 60% rs 14.00%

Potrebbero piacerti anche

- FM19 Finals Q1 Stocks Bonds PortfolioDocumento4 pagineFM19 Finals Q1 Stocks Bonds PortfolioJuren Demotor DublinNessuna valutazione finora

- The Campus Wedding Case: Submitted byDocumento5 pagineThe Campus Wedding Case: Submitted byPallavi SinghNessuna valutazione finora

- Accounting AnswersDocumento6 pagineAccounting AnswersSalman KhalidNessuna valutazione finora

- Lloyd's Register GroupDocumento6 pagineLloyd's Register GroupRhegina Mariztelle ForteNessuna valutazione finora

- Philippine airline SWOT analysisDocumento3 paginePhilippine airline SWOT analysisVanNessuna valutazione finora

- Jasper Valley Motors JVM Is A Family Run Auto Dealership SellingDocumento1 paginaJasper Valley Motors JVM Is A Family Run Auto Dealership SellingAmit Pandey0% (1)

- Case 11Documento10 pagineCase 11Trương Quốc VũNessuna valutazione finora

- Vision, Mission and ValuesDocumento4 pagineVision, Mission and ValuesHossain Mohammad NeaziNessuna valutazione finora

- Company Analysis-NetflixDocumento7 pagineCompany Analysis-NetflixMr. Tharindu Dissanayaka - University of KelaniyaNessuna valutazione finora

- Pre ImerssionDocumento7 paginePre ImerssionGail PerezNessuna valutazione finora

- Chapter 6 Review in ClassDocumento32 pagineChapter 6 Review in Classjimmy_chou1314Nessuna valutazione finora

- 17 International Capital Structure and The Cost of CapitalDocumento29 pagine17 International Capital Structure and The Cost of CapitalOnkar Singh AulakhNessuna valutazione finora

- Presentation On WACCDocumento12 paginePresentation On WACCIF387Nessuna valutazione finora

- C14 - Tutorial Answer PDFDocumento5 pagineC14 - Tutorial Answer PDFJilynn SeahNessuna valutazione finora

- Strama Continental AirlinesDocumento4 pagineStrama Continental AirlinesNadine SantiagoNessuna valutazione finora

- FMGT 3510 Midterm Exam Review Questions MC Summer 2019Documento38 pagineFMGT 3510 Midterm Exam Review Questions MC Summer 2019Jennifer AdvientoNessuna valutazione finora

- Dividend Policies and Stock SplitsDocumento3 pagineDividend Policies and Stock SplitslenakaNessuna valutazione finora

- Final Ratio Analysis (2) - 2Documento4 pagineFinal Ratio Analysis (2) - 2anjuNessuna valutazione finora

- Chapter 13Documento17 pagineChapter 13Aly SyNessuna valutazione finora

- Chap 14 - Bret Company (Case Study)Documento5 pagineChap 14 - Bret Company (Case Study)Al HiponiaNessuna valutazione finora

- Lecture 4 Time Value of MoneyDocumento16 pagineLecture 4 Time Value of MoneyA.D. Home TutorsNessuna valutazione finora

- Balance Sheet 2014 (In Millions) Mcdonalds: Current Assets Sub-Total $ 4,185.50Documento10 pagineBalance Sheet 2014 (In Millions) Mcdonalds: Current Assets Sub-Total $ 4,185.50jackNessuna valutazione finora

- Option Pricing With Applications To Real OptionsDocumento77 pagineOption Pricing With Applications To Real OptionsAbdullahRafiq100% (1)

- Input Output: Flight Promos Flight Tend MonitoringDocumento2 pagineInput Output: Flight Promos Flight Tend MonitoringDayanara CuevasNessuna valutazione finora

- Chapter 7 Location Decisions Planning and AnalysisDocumento20 pagineChapter 7 Location Decisions Planning and AnalysisFadzillah AhmadNessuna valutazione finora

- Midterm Audcis ReviewerDocumento29 pagineMidterm Audcis Reviewerintacc recordingsNessuna valutazione finora

- Case CoffeeeDocumento8 pagineCase CoffeeeAashish JanardhananNessuna valutazione finora

- AC2101 SemGrp4 Team5 UpdatedDocumento42 pagineAC2101 SemGrp4 Team5 UpdatedKwang Yi JuinNessuna valutazione finora

- Collabrys Group 5Documento12 pagineCollabrys Group 5Adil100% (1)

- M12 Titman 2544318 11 FinMgt C12Documento80 pagineM12 Titman 2544318 11 FinMgt C12marjsbarsNessuna valutazione finora

- Operating LeverageDocumento2 pagineOperating LeveragePankaj2cNessuna valutazione finora

- Chapter 11 - Questions Pool PDFDocumento31 pagineChapter 11 - Questions Pool PDFPT Thanh TrúcNessuna valutazione finora

- Probability Concepts and Applications: To AccompanyDocumento98 pagineProbability Concepts and Applications: To AccompanyChincel G. ANINessuna valutazione finora

- AirTran Airways Case StudyDocumento18 pagineAirTran Airways Case StudyMa AnNessuna valutazione finora

- 10 KFC Cast Study Report MommyDocumento3 pagine10 KFC Cast Study Report MommyXnort G. XwestNessuna valutazione finora

- AssignmentDocumento78 pagineAssignmentFarhan Sheikh MuhammadNessuna valutazione finora

- IM - Chapter 2 AnswersDocumento4 pagineIM - Chapter 2 AnswersEileen WongNessuna valutazione finora

- Economics 3and4Documento55 pagineEconomics 3and4James prajwal.R100% (1)

- Mark XDocumento10 pagineMark XJennifer Ayers0% (2)

- Discounted Cash Flow Valuation ExerciseDocumento2 pagineDiscounted Cash Flow Valuation ExerciseJulia NicoleNessuna valutazione finora

- ACT1208 Auditing in CIS Environment v4Documento12 pagineACT1208 Auditing in CIS Environment v4Gio Manuel SantosNessuna valutazione finora

- Afman24-204 13 JULY 2017Documento530 pagineAfman24-204 13 JULY 2017Meshal AlhaimodNessuna valutazione finora

- AccountingDocumento5 pagineAccountingMaitet CarandangNessuna valutazione finora

- Survey questions explore corporate sustainability programsDocumento4 pagineSurvey questions explore corporate sustainability programssupertarzanmanNessuna valutazione finora

- Performance 6.10Documento2 paginePerformance 6.10George BulikiNessuna valutazione finora

- WACC: Understanding the Weighted Average Cost of CapitalDocumento17 pagineWACC: Understanding the Weighted Average Cost of CapitalSiddharth JainNessuna valutazione finora

- Corporate Finance Assignment 1Documento3 pagineCorporate Finance Assignment 1tientran91Nessuna valutazione finora

- Benchmark - Organizational Design, Structure, and Change PresentationDocumento12 pagineBenchmark - Organizational Design, Structure, and Change PresentationVikram . PanchalNessuna valutazione finora

- United Housewares BlankDocumento15 pagineUnited Housewares BlankSulaimanAl-Sulaimani0% (1)

- Abc - Classic PenDocumento14 pagineAbc - Classic PenVinay GoyalNessuna valutazione finora

- Recovery Year Property Class 3-Year 5-Year 7-Year 10-Year 1 2 3 4 5 6 7 8 9 10 11 TotalsDocumento2 pagineRecovery Year Property Class 3-Year 5-Year 7-Year 10-Year 1 2 3 4 5 6 7 8 9 10 11 Totalssneha sm0% (1)

- Cebu Tour PackageDocumento5 pagineCebu Tour PackageGlen Thephany QuintanaNessuna valutazione finora

- Cafe ProjectDocumento15 pagineCafe Projectaqsaamjad07Nessuna valutazione finora

- 15 Dividend DecisionDocumento18 pagine15 Dividend Decisionsiva19789Nessuna valutazione finora

- Strategic Decisions - Complex Long-Term Choices That Shape OrganizationsDocumento3 pagineStrategic Decisions - Complex Long-Term Choices That Shape OrganizationsGanesh Tripathi0% (1)

- Operating and Financial Leverage Slides PDFDocumento27 pagineOperating and Financial Leverage Slides PDFBradNessuna valutazione finora

- Fin 221 Nov 06 Discussion Chapter 10 Cost CapitalDocumento18 pagineFin 221 Nov 06 Discussion Chapter 10 Cost CapitalPranav Pratap SinghNessuna valutazione finora

- Chapter 9. Integrated Case Model: RF M RFDocumento6 pagineChapter 9. Integrated Case Model: RF M RFHAMMADHRNessuna valutazione finora

- New Microsoft PowerPoint PresentationDocumento4 pagineNew Microsoft PowerPoint PresentationMuhammad MuzahidNessuna valutazione finora

- Cost of Capital Tut. MemoDocumento2 pagineCost of Capital Tut. MemoSEKEETHA DE NOBREGANessuna valutazione finora

- Term VI ElectiveDocumento121 pagineTerm VI Electivechandel08Nessuna valutazione finora

- Holts Winters MethodDocumento3 pagineHolts Winters Methodchandel08Nessuna valutazione finora

- Exercises On Dummy VariableDocumento2 pagineExercises On Dummy Variablechandel08Nessuna valutazione finora

- Case3-1 (Murphy)Documento6 pagineCase3-1 (Murphy)chandel08Nessuna valutazione finora

- Forecasting TechniquesDocumento2 pagineForecasting Techniqueschandel08Nessuna valutazione finora

- QDDocumento1 paginaQDchandel08Nessuna valutazione finora

- Holts DataDocumento3 pagineHolts Datachandel08Nessuna valutazione finora

- Imc-10.10.18 SPDocumento18 pagineImc-10.10.18 SPchandel08Nessuna valutazione finora

- MC II Project Work 2018Documento1 paginaMC II Project Work 2018chandel08Nessuna valutazione finora

- Cunard Lines-Case & Questions-Sept.'18Documento5 pagineCunard Lines-Case & Questions-Sept.'18chandel08Nessuna valutazione finora

- FINAL & UPDATED-MK 612 IMC-Course Structure - September - December 2014Documento8 pagineFINAL & UPDATED-MK 612 IMC-Course Structure - September - December 2014chandel08Nessuna valutazione finora

- MOC-Role Play ExercisesDocumento2 pagineMOC-Role Play Exerciseschandel08Nessuna valutazione finora

- Getting The Most Out of Your Promotions and AdvtDocumento4 pagineGetting The Most Out of Your Promotions and Advtchandel08Nessuna valutazione finora

- Imc Case 1 - Psi India - 27.09. 14Documento1 paginaImc Case 1 - Psi India - 27.09. 14chandel08Nessuna valutazione finora

- IMC-TERI Case Related IMC Class ConceptsDocumento5 pagineIMC-TERI Case Related IMC Class Conceptschandel08Nessuna valutazione finora

- PGDM B&FS 2015 16 (Groups)Documento2 paginePGDM B&FS 2015 16 (Groups)chandel08Nessuna valutazione finora

- Case: Kay Sunderland - Session 2: Discussion QuestionsDocumento2 pagineCase: Kay Sunderland - Session 2: Discussion Questionschandel08Nessuna valutazione finora

- One To Two Max-1-2 Slides 1-2 Slides) (2 Slides) : 5 6 (10-12 Slides Only Brief and Concise)Documento4 pagineOne To Two Max-1-2 Slides 1-2 Slides) (2 Slides) : 5 6 (10-12 Slides Only Brief and Concise)Sayan MitraNessuna valutazione finora

- Questions - The Globalization of MarketsDocumento1 paginaQuestions - The Globalization of Marketschandel08Nessuna valutazione finora

- HRM PGDM Groups MC IIDocumento2 pagineHRM PGDM Groups MC IIchandel08Nessuna valutazione finora

- Section A-PGDM-MC-II (Sept-Dec-2016) : Name Group NumberDocumento2 pagineSection A-PGDM-MC-II (Sept-Dec-2016) : Name Group Numberchandel08Nessuna valutazione finora

- Creative Brief - Group 2Documento2 pagineCreative Brief - Group 2chandel08Nessuna valutazione finora

- Cunard Lines-Case & Questions-Sept.'18Documento5 pagineCunard Lines-Case & Questions-Sept.'18chandel08Nessuna valutazione finora

- Section BDocumento2 pagineSection Bchandel08Nessuna valutazione finora

- Pgdm-Sec C - 2015-16Documento2 paginePgdm-Sec C - 2015-16chandel08Nessuna valutazione finora

- PGDM Sec D 2015 16 (Groups)Documento2 paginePGDM Sec D 2015 16 (Groups)chandel08Nessuna valutazione finora

- LM - Optimization - Sensitivity Analysis - Problem 1Documento2 pagineLM - Optimization - Sensitivity Analysis - Problem 1chandel08Nessuna valutazione finora

- Course Outline Logistics Modelling Term VI HarishRaoDocumento5 pagineCourse Outline Logistics Modelling Term VI HarishRaochandel08Nessuna valutazione finora

- Answer 1Documento3 pagineAnswer 1chandel08Nessuna valutazione finora

- Sensitivity Problems - ExerciseDocumento17 pagineSensitivity Problems - Exercisechandel08Nessuna valutazione finora

- Core Satellite FrameworkDocumento4 pagineCore Satellite FrameworkEMILIOALFONSONessuna valutazione finora

- January 13, 2021 Philippine Stock ExchangeDocumento5 pagineJanuary 13, 2021 Philippine Stock Exchangekjcnawkcna calkjwncaNessuna valutazione finora

- Application Form (For Resident Applicants) Asba Application Form India Infoline Finance LimitedDocumento2 pagineApplication Form (For Resident Applicants) Asba Application Form India Infoline Finance LimitedMosses HarrisonNessuna valutazione finora

- The Complete Breakout Trader Day Trading John Connors PDFDocumento118 pagineThe Complete Breakout Trader Day Trading John Connors PDFKaushik Matalia88% (8)

- Trish Joy Foundation 990: 2016Documento22 pagineTrish Joy Foundation 990: 2016Tony OrtegaNessuna valutazione finora

- Adaptive Asset Allocation: A Primer: Butler - Philbrick - Gordillo & AssociatesDocumento30 pagineAdaptive Asset Allocation: A Primer: Butler - Philbrick - Gordillo & AssociatesAlexandreLegaNessuna valutazione finora

- Articlesofincorporation PDFDocumento13 pagineArticlesofincorporation PDFJowi SuNessuna valutazione finora

- Basic Financial StatementsDocumento14 pagineBasic Financial StatementssajjadNessuna valutazione finora

- Loan CalculatorDocumento3 pagineLoan CalculatorAnupam BaliNessuna valutazione finora

- Pooled Investment ProcessDocumento34 paginePooled Investment ProcessanoopbopteNessuna valutazione finora

- Membership ApplicationDocumento5 pagineMembership ApplicationAbhishek VijayNessuna valutazione finora

- Principles of Investments Class Mutual Funds and Other Investment CompaniesDocumento6 paginePrinciples of Investments Class Mutual Funds and Other Investment CompaniesSanghoon JeongNessuna valutazione finora

- (Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueDocumento12 pagine(Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueMert Can GencNessuna valutazione finora

- Sony v. CIRDocumento2 pagineSony v. CIRMaya Julieta Catacutan-EstabilloNessuna valutazione finora

- Numerical Analysis MCQDocumento15 pagineNumerical Analysis MCQmansoormani20167% (9)

- Golden Book of Accounting Finance Interviews Part I Site Version V 1.0 PDFDocumento62 pagineGolden Book of Accounting Finance Interviews Part I Site Version V 1.0 PDFRAJESH M S100% (2)

- Dow Chemical Company Annual Report - 1945Documento17 pagineDow Chemical Company Annual Report - 1945fresnoNessuna valutazione finora

- NIL MidtermDocumento28 pagineNIL MidtermAnonymous B0aR9GdNNessuna valutazione finora

- Project Report On Mutual FundDocumento98 pagineProject Report On Mutual FundPriya MalikNessuna valutazione finora

- Chart of Entity ComparisonDocumento4 pagineChart of Entity ComparisonDee BeldNessuna valutazione finora

- TycoonDocumento5 pagineTycoonRasyd MuhammadNessuna valutazione finora

- 5 Candle Chart Essentials and Trading CoursesDocumento3 pagine5 Candle Chart Essentials and Trading Coursesrbp_1973Nessuna valutazione finora

- Chapter 16: Fixed Income Portfolio ManagementDocumento20 pagineChapter 16: Fixed Income Portfolio ManagementSilviu TrebuianNessuna valutazione finora

- THEORIES OF CAPITAL STRUCTUREDocumento9 pagineTHEORIES OF CAPITAL STRUCTURESoumendra RoyNessuna valutazione finora

- Finance 2021 23Documento16 pagineFinance 2021 23GAURAV UPADHYAYNessuna valutazione finora

- FRIA NotesDocumento6 pagineFRIA Notesaquanesse21100% (1)

- CH 03Documento122 pagineCH 03Mar Sih100% (1)

- The Mutual Fund Marketing and Sales Strategies at NJ India InvestDocumento29 pagineThe Mutual Fund Marketing and Sales Strategies at NJ India InvestbatmanNessuna valutazione finora

- LeasingDocumento6 pagineLeasingShubham DhimaanNessuna valutazione finora