Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Factsheet Nifty Alpha50

Caricato da

sumonTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Factsheet Nifty Alpha50

Caricato da

sumonCopyright:

Formati disponibili

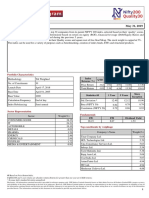

August 31, 2020

NIFTY Alpha 50 Index aims to measure the performance of securities listed on NSE with high alphas. It is a well-diversified 50 stock

index. In order to make the 50 stock index investible and replicable, criteria's such as liquidity and market capitalization are applied

while selection of securities.

Weights of securities in the index are assigned based on the alpha values i.e. security with highest alpha in the index gets highest

weight.

NIFTY Alpha 50 Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs

and structured products.

Index Variant: NIFTY Alpha 50 Total Returns Index.

Portfolio Characteristics

Methodology Alpha based weighting Index Since

QTD YTD 1 Year 5 Years

Returns (%) Inception

No. of Constituents 50

Price Return 12.91 18.13 30.77 10.95 17.83

Launch Date November 19, 2012 Total Return 13.22 18.73 31.56 12.10 18.99

Base Date December 31, 2003

Since

Base Value 1000 Statistics ## 1 Year 5 Years

Inception

Calculation Frequency Online Daily Std. Deviation * 28.20 21.22 25.94

Index Rebalancing Quarterly Beta (NIFTY 50) 0.83 0.94 0.96

Correlation (NIFTY 50) 0.92 0.80 0.85

Sector Representation

Fundamentals

Sector Weight(%)

P/E P/B Dividend Yield

CONSUMER GOODS 21.02 42.66 7.46 0.61

PHARMA 18.59

FINANCIAL SERVICES 15.57 Top constituents by weightage

CHEMICALS 8.24

POWER 7.02 Company’s Name Weight(%)

FERTILISERS & PESTICIDES 5.87

Adani Green Energy Ltd. 7.02

HEALTHCARE SERVICES 5.43

Dixon Technologies (India) Ltd. 4.22

AUTOMOBILE 5.00

OIL & GAS 4.61 Navin Fluorine International Ltd. 3.83

IT 4.55 Deepak Nitrite Ltd. 3.44

TELECOM 1.96 Granules India Ltd. 3.33

INDUSTRIAL MANUFACTURING 1.65 Abbott India Ltd. 3.19

CEMENT & CEMENT PRODUCTS 0.50 Tata Consumer Products Ltd. 3.10

Multi Commodity Exchange of India Ltd. 3.02

ICICI Securities Ltd. 2.92

Escorts Ltd. 2.85

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy

and reliability of the above information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of

the information contained herein and disclaim any and all liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information

provided herein. The information contained in this document is not intended to provide any professional advice.

1

August 31, 2020

Index Methodology

Eligibility Criteria for Selection of Constituent Stocks:

i. Companies must rank within the top 300 companies by average freefloat market capitalisation and average daily turnover for the

last six months.

ii. The company should have a listing history of 1 year.

iii. The company's trading frequency should be 100% in the last one year period.

iv. The alpha of the eligible securities is calculated using trailing 1 year prices (Adjusted for corporate actions). They are ranked in

descending order.

v. Final selection of 50 companies shall be done based on scrips' Alpha values.

vi. Securities having positive alpha will be selected to form part of the index at each review. In case this criterion is not fulfilled, scrip

with highest alpha in replacement pool will be considered for selection.

Index Re-Balancing:

The index review is carried out using data of six month period ending last trading day of February, May, August and November

respectively.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

NIFTY 50 NIFTY Bank NIFTY CPSE NIFTY100 Equal Weight NIFTY 10 yr Benchmark G-Sec

NIFTY Next 50 NIFTY IT NIFTY Commodities NIFTY50 PR 1x Inverse NIFTY 8-13 yr G-Sec

NIFTY 100 NIFTY PSU Bank NIFTY Energy NIFTY50 PR 2x Leverage NIFTY 4-8 yr G-Sec

NIFTY 200 NIFTY FMCG NIFTY Shariah 25 NIFTY50 Value 20 NIFTY 11-15 yr G-Sec

NIFTY 500 NIFTY Private Bank NIFTY 100 Liquid15 NIFTY100 Quality 30 NIFTY 15 yr and above G-Sec

NIFTY Midcap 50 NIFTY Metal NIFTY Infrastructure NIFTY Low Volatility 50 NIFTY Composite G-Sec

NIFTY Midcap 100 NIFTY Financial Services NIFTY Corporate Group NIFTY Alpha 50 NIFTY 1D Rate

Contact Us: Bloomberg - CNXAP Index

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com Thomson Reuters - .CNXALI

2

Potrebbero piacerti anche

- Valuing Services in Trade: A Toolkit for Competitiveness DiagnosticsDa EverandValuing Services in Trade: A Toolkit for Competitiveness DiagnosticsNessuna valutazione finora

- Factsheet Nifty Alpha50Documento2 pagineFactsheet Nifty Alpha50Sunil ChawdaNessuna valutazione finora

- Factsheet Nifty High Beta50Documento2 pagineFactsheet Nifty High Beta50siddharthNessuna valutazione finora

- Factsheet Nifty Alpha50Documento2 pagineFactsheet Nifty Alpha50SUMITNessuna valutazione finora

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Documento2 paginePortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNessuna valutazione finora

- Factsheet Nifty100 Alpha30Documento2 pagineFactsheet Nifty100 Alpha30Aswin PoomangalathNessuna valutazione finora

- Ind Niftysmallcap 50Documento2 pagineInd Niftysmallcap 50Google finderNessuna valutazione finora

- Method Nifty High Beta 50Documento2 pagineMethod Nifty High Beta 50BirenNessuna valutazione finora

- Factsheet Nifty Alpha50Documento2 pagineFactsheet Nifty Alpha50Course ModeratorNessuna valutazione finora

- Factsheet NIFTY100 ESG IndexDocumento2 pagineFactsheet NIFTY100 ESG IndexTash KentNessuna valutazione finora

- Ind NIFTY ADITYA BIRLA GROUPDocumento2 pagineInd NIFTY ADITYA BIRLA GROUPUmesh ThawareNessuna valutazione finora

- Ind Nifty 100Documento2 pagineInd Nifty 100Srisilpa KadiyalaNessuna valutazione finora

- Factsheet NFTY Alpha Q LV 30Documento2 pagineFactsheet NFTY Alpha Q LV 30Ankit JoshiNessuna valutazione finora

- Factsheet NIFTY Alpha Low-Volatility 30Documento2 pagineFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNessuna valutazione finora

- Ind NIFTY TATA GROUPDocumento2 pagineInd NIFTY TATA GROUPGautam NatrajNessuna valutazione finora

- Factsheet NIFTY LargeMidcap 250 IndexDocumento2 pagineFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNessuna valutazione finora

- Factsheet Nifty100 Alpha30Documento2 pagineFactsheet Nifty100 Alpha30sumonNessuna valutazione finora

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Documento2 paginePortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Nitin KumarNessuna valutazione finora

- Factsheet NIFTY LargeMidcap 250 IndexDocumento2 pagineFactsheet NIFTY LargeMidcap 250 Indexrahulojha123Nessuna valutazione finora

- Ind Nifty PseDocumento2 pagineInd Nifty Pserajit kumarNessuna valutazione finora

- Factsheet NIFTY Quality Low-Volatility 30Documento2 pagineFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNessuna valutazione finora

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Documento2 paginePortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNessuna valutazione finora

- Ind Nifty Midcap50Documento2 pagineInd Nifty Midcap50Samriddh DhareshwarNessuna valutazione finora

- Ind Next50Documento2 pagineInd Next50bhattjgNessuna valutazione finora

- Nifty100 Quality30 PDFDocumento2 pagineNifty100 Quality30 PDFGita ThoughtsNessuna valutazione finora

- Factsheet NIFTY50 Equal WeightDocumento2 pagineFactsheet NIFTY50 Equal Weightashwin_gajghateNessuna valutazione finora

- Ind Nifty PseDocumento2 pagineInd Nifty PseHarDik PatelNessuna valutazione finora

- Factsheet NIFTY LargeMidcap 250 IndexDocumento2 pagineFactsheet NIFTY LargeMidcap 250 IndexRahul RanjanNessuna valutazione finora

- Alpha Low-Vy 30Documento2 pagineAlpha Low-Vy 30Ankit JoshiNessuna valutazione finora

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Documento2 paginePortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNessuna valutazione finora

- Factsheet Nifty500 ShariahDocumento2 pagineFactsheet Nifty500 ShariahAejaz shaikhNessuna valutazione finora

- Ind Nifty 500Documento2 pagineInd Nifty 500R SarkarNessuna valutazione finora

- Ind Nifty 100Documento2 pagineInd Nifty 100Gita ThoughtsNessuna valutazione finora

- Factsheet NiftySmallcap250Quality50Documento2 pagineFactsheet NiftySmallcap250Quality50S SinghNessuna valutazione finora

- Ind Nifty 100Documento2 pagineInd Nifty 100Sagar V SoniNessuna valutazione finora

- Ind Nifty 200Documento2 pagineInd Nifty 200Sagar V SoniNessuna valutazione finora

- In123d Nifty50Documento2 pagineIn123d Nifty50praNessuna valutazione finora

- Factsheet NY ALVDocumento2 pagineFactsheet NY ALVAnkit JoshiNessuna valutazione finora

- Factsheet Nifty200 Momentum30Documento2 pagineFactsheet Nifty200 Momentum30Kiran SunkuNessuna valutazione finora

- Factsheet Nifty200 Momentum30Documento2 pagineFactsheet Nifty200 Momentum30Umesh ThawareNessuna valutazione finora

- Factsheet NIFTY Alpha Quality Value Low-Volatility 30Documento2 pagineFactsheet NIFTY Alpha Quality Value Low-Volatility 30drsubramanianNessuna valutazione finora

- Factsheet Nifty50 ShariahDocumento2 pagineFactsheet Nifty50 ShariahMonu GamerNessuna valutazione finora

- January 31, 2020: Portfolio CharacteristicsDocumento2 pagineJanuary 31, 2020: Portfolio Characteristicskishore kumarNessuna valutazione finora

- Factsheet Nifty50 ShariahDocumento2 pagineFactsheet Nifty50 ShariahAjmal Lakshadweep AJNessuna valutazione finora

- Ind Nifty50 PDFDocumento2 pagineInd Nifty50 PDFwartan solarNessuna valutazione finora

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Documento2 paginePortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNessuna valutazione finora

- Factsheet NFTY A Quality LVy 30Documento2 pagineFactsheet NFTY A Quality LVy 30Ankit JoshiNessuna valutazione finora

- Factsheet NiftyMidcapSelectDocumento2 pagineFactsheet NiftyMidcapSelectRishabh GeeteNessuna valutazione finora

- Factsheet Nifty500 Multicap50-25-25 IndexDocumento2 pagineFactsheet Nifty500 Multicap50-25-25 Indexramesh kumarNessuna valutazione finora

- Ind Nifty50Documento2 pagineInd Nifty50Hiren PatelNessuna valutazione finora

- Ind Nifty50gdsgDocumento2 pagineInd Nifty50gdsgPayal AgarwalNessuna valutazione finora

- Ind Niftymidcap100Documento2 pagineInd Niftymidcap100Anil Kumar RanjanNessuna valutazione finora

- Nifty Low VolatilityDocumento2 pagineNifty Low VolatilityRajesh KumarNessuna valutazione finora

- Factsheet Nifty 100 EW IndexDocumento2 pagineFactsheet Nifty 100 EW IndexAnkit JoshiNessuna valutazione finora

- Factsheet NIFTY200 Quality30Documento2 pagineFactsheet NIFTY200 Quality30Rajesh KumarNessuna valutazione finora

- Ind Nifty 100Documento2 pagineInd Nifty 100ketuNessuna valutazione finora

- Nifty Top 50Documento2 pagineNifty Top 50BillionaireNessuna valutazione finora

- Ind Next50Documento2 pagineInd Next50blessNessuna valutazione finora

- Factsheet Nifty Alpha50Documento2 pagineFactsheet Nifty Alpha50aimailid01Nessuna valutazione finora

- Factsheet NIFTY LargeMidcap 250 IndexDocumento2 pagineFactsheet NIFTY LargeMidcap 250 IndexSumitNessuna valutazione finora

- Summary - A Short Course On Swing TradingDocumento2 pagineSummary - A Short Course On Swing TradingsumonNessuna valutazione finora

- 9 Share Market Tips For Beginners - ABC of Money PDFDocumento5 pagine9 Share Market Tips For Beginners - ABC of Money PDFsumonNessuna valutazione finora

- 239 Excel Shortcuts: How To Read The ListDocumento17 pagine239 Excel Shortcuts: How To Read The ListsumonNessuna valutazione finora

- Top 6 Tips To Choose Best Debt Mutual Funds To Invest - FincashDocumento8 pagineTop 6 Tips To Choose Best Debt Mutual Funds To Invest - FincashsumonNessuna valutazione finora

- Summary - Quality StocksDocumento5 pagineSummary - Quality StockssumonNessuna valutazione finora

- Summary of Changes BPVC-V 2015 Edition ItemsDocumento6 pagineSummary of Changes BPVC-V 2015 Edition ItemssumonNessuna valutazione finora

- How To Choose - Pick Mutual Funds in IndiaDocumento8 pagineHow To Choose - Pick Mutual Funds in IndiasumonNessuna valutazione finora

- Day Trading Strategies - For Beginners To Advanced Day Traders, Strategy Is KeyDocumento16 pagineDay Trading Strategies - For Beginners To Advanced Day Traders, Strategy Is KeysumonNessuna valutazione finora

- 15 Must Read Books On Investing, Stock Markets, & Trading - GrowwDocumento9 pagine15 Must Read Books On Investing, Stock Markets, & Trading - GrowwsumonNessuna valutazione finora

- Factsheet Nifty100 Alpha30Documento2 pagineFactsheet Nifty100 Alpha30sumonNessuna valutazione finora

- Buffett's - Big Four - Sleep-At-Night Strategy - InvestingAnswersDocumento6 pagineBuffett's - Big Four - Sleep-At-Night Strategy - InvestingAnswerssumonNessuna valutazione finora

- B17 Basic Computer Bangla PDFDocumento11 pagineB17 Basic Computer Bangla PDFKalam Khan100% (1)

- Swing Trading - Top Strategies For Technical Analysis - InvestingAnswersDocumento11 pagineSwing Trading - Top Strategies For Technical Analysis - InvestingAnswerssumon50% (2)

- RESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofDocumento5 pagineRESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofsumonNessuna valutazione finora

- What Is The IoT - Everything You Need To Know About The Internet of Things Right NowDocumento25 pagineWhat Is The IoT - Everything You Need To Know About The Internet of Things Right NowsumonNessuna valutazione finora

- Top 10 Trading Indicators Every Trader Should Know - IG ENDocumento15 pagineTop 10 Trading Indicators Every Trader Should Know - IG ENsumonNessuna valutazione finora

- Strategy2 Pair Trading PDFDocumento2 pagineStrategy2 Pair Trading PDFsumonNessuna valutazione finora

- Markus Heitkoetter - The Complete Guide To Day Trading™ PDFDocumento275 pagineMarkus Heitkoetter - The Complete Guide To Day Trading™ PDFKelve Aragao100% (3)

- 11 Proven Health Benefits of GingerDocumento20 pagine11 Proven Health Benefits of GingersumonNessuna valutazione finora

- IBReg FormDocumento1 paginaIBReg FormAbhishek KoliNessuna valutazione finora

- Ultrasonic Testing HandbookDocumento221 pagineUltrasonic Testing Handbook133997990% (21)

- Software and MindDocumento934 pagineSoftware and MindAndrei Sorin100% (1)

- 10 Best Value Investing Books in India 2020 You MUST Read PDFDocumento14 pagine10 Best Value Investing Books in India 2020 You MUST Read PDFsumonNessuna valutazione finora

- 6 Ways To Naturally Add Vitamins To Your CoffeeDocumento14 pagine6 Ways To Naturally Add Vitamins To Your CoffeesumonNessuna valutazione finora

- Neem - Benefits, Side Effects, and PreparationsDocumento10 pagineNeem - Benefits, Side Effects, and PreparationssumonNessuna valutazione finora

- 11 Proven Health Benefits of GingerDocumento20 pagine11 Proven Health Benefits of GingersumonNessuna valutazione finora

- 7 Turmeric Tea Benefits For Your HealthDocumento13 pagine7 Turmeric Tea Benefits For Your HealthsumonNessuna valutazione finora

- 11 Proven Health Benefits of Garlic PDFDocumento21 pagine11 Proven Health Benefits of Garlic PDFsumonNessuna valutazione finora

- Giloy Benefits, Uses and Side Effects - Ayur TimesDocumento5 pagineGiloy Benefits, Uses and Side Effects - Ayur TimessumonNessuna valutazione finora

- Homework CHP 8 and 5Documento6 pagineHomework CHP 8 and 5Black starNessuna valutazione finora

- TailRiskHedging SébastienJacques PDFDocumento46 pagineTailRiskHedging SébastienJacques PDFdarthrispalNessuna valutazione finora

- Module 5Documento22 pagineModule 5AliceJohnNessuna valutazione finora

- Chapter 6 Cost of CapitalDocumento37 pagineChapter 6 Cost of CapitalAkshat SinghNessuna valutazione finora

- An Investment Analysis Case StudyDocumento4 pagineAn Investment Analysis Case Studyella marie toscanoNessuna valutazione finora

- SFM Case4 Group7Documento5 pagineSFM Case4 Group7AMAAN LULANIA 22100% (1)

- MS 3411 Risks Returns and Capital StructureDocumento4 pagineMS 3411 Risks Returns and Capital StructureMonica GarciaNessuna valutazione finora

- Barra Handbook GEM PDFDocumento166 pagineBarra Handbook GEM PDFAnil GowdaNessuna valutazione finora

- Financial Economics 6th Sem Compiled by Aasif-Ur-RahmanDocumento45 pagineFinancial Economics 6th Sem Compiled by Aasif-Ur-RahmanKhan HarisNessuna valutazione finora

- 10 Risk and Return - Student VersionDocumento59 pagine10 Risk and Return - Student VersionKalyani GogoiNessuna valutazione finora

- Rate Vol PDFDocumento56 pagineRate Vol PDFNasim Akhtar100% (1)

- Research Paper - EVA Indian Banking SectorDocumento14 pagineResearch Paper - EVA Indian Banking SectorAnonymous rkZNo8Nessuna valutazione finora

- Arbitrage Pricing TheoryDocumento32 pagineArbitrage Pricing TheorySumit ChopraNessuna valutazione finora

- Management Advisory Services Part 1 Pre-ExamDocumento6 pagineManagement Advisory Services Part 1 Pre-ExamJeepee JohnNessuna valutazione finora

- SP Capital IQDocumento11 pagineSP Capital IQemirav2100% (1)

- 20081MS Ibs535Documento12 pagine20081MS Ibs535anuragrp1988@gmail.comNessuna valutazione finora

- Chapter 15 Company AnalysisDocumento52 pagineChapter 15 Company AnalysisSamantha WrightNessuna valutazione finora

- Ch. 19 Capital Asset PricingDocumento6 pagineCh. 19 Capital Asset PricingJesse SandersNessuna valutazione finora

- Assignment Finance Review ChapterDocumento22 pagineAssignment Finance Review ChapterSafuan HalimNessuna valutazione finora

- Stock Prices Will Appear To Follow A Random WalkDocumento7 pagineStock Prices Will Appear To Follow A Random WalkrssarinNessuna valutazione finora

- SOALDocumento5 pagineSOALrio hendriadiNessuna valutazione finora

- Risk, Return, and The Capital Asset Pricing ModelDocumento52 pagineRisk, Return, and The Capital Asset Pricing ModelFaryal ShahidNessuna valutazione finora

- Credit Suisse's Guide To Global Tradable and Benchmark Index ProductsDocumento115 pagineCredit Suisse's Guide To Global Tradable and Benchmark Index ProductsHeathcliff NyambiyaNessuna valutazione finora

- Return and Risk: The Capital Asset Pricing Model (CAPM)Documento41 pagineReturn and Risk: The Capital Asset Pricing Model (CAPM)Ngô Hoàng Bích KhaNessuna valutazione finora

- My Notes of BG's Value Investing SeminaryDocumento12 pagineMy Notes of BG's Value Investing SeminarysilviocastNessuna valutazione finora

- Unit 3: Risk, Return, and Capital Asset Pricing Model (CAPMDocumento30 pagineUnit 3: Risk, Return, and Capital Asset Pricing Model (CAPMCyrine Miwa RodriguezNessuna valutazione finora

- Lupin CaseDocumento15 pagineLupin CaseSanjit Sinha0% (1)

- Mutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToDocumento43 pagineMutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToNidhi Kaushik100% (1)

- Reading 71.7 Guidance For Standard VDocumento22 pagineReading 71.7 Guidance For Standard VAbhishek KundliaNessuna valutazione finora

- fn3023 Exc14Documento29 paginefn3023 Exc14ArmanbekAlkinNessuna valutazione finora