Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Performance and Characteristics of Retail Equity Mutual Funds

Caricato da

Purandhara ReddyTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Performance and Characteristics of Retail Equity Mutual Funds

Caricato da

Purandhara ReddyCopyright:

Formati disponibili

Performance and Characteristics of Retail Equity Mutual Funds in India

B.Suresh Naidu,

Research Scholar,

Department of Management Studies,

Sri Venkateswara University, Tirupati-517502

Dr.B.SUDHIR

Associate Professor,

Department of Management Studies,

Sri Venkateswara University, Tirupati-517502.

Abstract:

The study examined the relation between the performance and characteristics of 108 retail

equity mutual funds in India to know whether mutual fund characteristics can be used to

distinguish superior from inferior performance of mutual fund schemes. The study used a

multiple regression model to examine whether mutual fund characteristics, such as the

expense ratio, portfolio turnover ratio and other attributes useful in explaining fund

performance measured by using the risk adjusted measures. The results indicate that superior

performance on an average occurs among larger funds with average trading activity and

higher betas having low cash levels. So investors should be aware of these fund

characteristics before investing.

Keywords: Equity mutual funds, performance, characteristics

Volume:01, Number:01, Nov-2011 : RJCBS Page 41

www.theinternationaljournal.org

Introduction:

The Indian mutual fund industry has been steadily growing with assets under management

worth 596976.8 crore as on March 2011. The retail assets under management are worth

16225 crore as on March 2011.The story of mutual fund industry in India started in 1963 with

the formation of Unit Trust of India, at the initiative of the Government of India and Reserve

Bank.

Mutual funds have opened new vistas to millions of small investors by virtually taking

investment to their doorstep. In India, a small investor generally goes for bank deposits,

which do not provide hedge against inflation and often have negative real returns. He has

limited access to price sensitive information and if available, may not be able to comprehend

publicly available information contained in technical and legal jargons. He finds himself to be

an odd man out in the investment game. Mutual funds have come, as a much needed help to

these investors. MFs are looked upon by individual investors as financial portfolio managers

process information, identify investment opportunities, formulate investment strategies,

invest funds and monitor progress at a very low cost. Thus the success of MFs is essentially

the result of the combined efforts of competent fund managers and alert investors.

Significance of the study:

Though the MF Industry has been in existence since 1963 in India, no major study was done

to examine the relation between fund performance and fund characteristics or attributes. An

important issue facing investors is whether they can use mutual fund characteristics to

distinguish superior from inferior performance. So this study was taken to find the relation

between fund performance and fund attributes namely Expense Ratios, Cash Level, Dividend

Yield, Asset Size, Portfolio Turnover rate, Beta for retail equity mutual funds in India as 80%

of the investment in mutual funds is in equity mutual funds by the retail investors.

Literature Review:

Haslem, J. A., Baker, H. K., & Smith, D. M. (2008) investigated the relation between the

performance and characteristics of 1,779 domestic, actively managed retail equity mutual

funds with diverse expense ratios. They show that using expense ratio standard deviation

classes is an effective method for characterizing fund expenses for investors. Using various

performance measures including Russell-index-adjusted returns, the results indicate that

superior performance, on average, occurs among large funds with low expense ratios, low

trading activity, and no or low front-end loads. Performance is invariant with respect to

whether funds have12b-1 fees or not.

Edelen et al. (2007) find that for funds with relatively small (large) average trade size, trading

is positively (negatively) related to fund returns. Trading costs are comparable in size to

expense ratios and increasingly reduce fund performance as relative trade size increases.

They find that portfolio turnover has a marginally negative relation to fund performance.

Dr.R.Madhumati, Sharad Panwar (2006) studied a sample of public-sector sponsored &

private-sector sponsored mutual funds of varied net assets to investigate the differences in

characteristics of assets held, portfolio diversification, and variable effects of diversification

Volume:01, Number:01, Nov-2011 : RJCBS Page 42

www.theinternationaljournal.org

on investment performance for the period May, 2002 to May, 2005.The study found that

public-sector sponsored funds do not differ significantly from private-sector sponsored funds

in terms of mean returns%. However, there is a significant difference between public-sector

sponsored mutual funds and private-sector sponsored mutual funds in terms of average

standard deviation, average variance and average coefficient of variation(COV).The study

also found that there is a statistical difference between sponsorship classes in terms of e

SDAR(excess standard deviation adjusted returns)as a performance measure. When residual

variance (RV) is used as the measure of mutual fund portfolio diversification characteristic,

there is a statistical difference between public-sector sponsored mutual funds and private-

sector sponsored mutual funds for the study period.

Dukes, W. P., English, P. C., II, & Davis, S. M. (2006) provide evidence that even after

adjusting for economies of scale, funds with 12b-1 fees have higher expense ratios net of the

12b-1 fees than do funds without such fees. This finding suggests that 12b-1 fees are more

than just a deadweight cost. They also demonstrate that 12b-1 fees are highest for funds that

ultimately fail, that the proportion of funds with 12b-1 fees is increasing over time, and that

the level of those fees is also increasing over time.

Dowen, R. J., & Mann, T. (2004) examined pure no-load funds over a 5-year period. For

equity funds, trading activity is negatively related to returns. Expense ratios are not

significantly related to returns. Potential capital gains exposure and tax cost ratio are

positively related to return. For fixed income funds, trading activity is positively related to

returns. Expense ratios and tax cost ratios are negatively related to returns. Mutual funds

exhibit economies of scale and managers experience scale and scope economies. The

individual investor is better off in a large fund that is a member of a large fund family.

Jan and Hung (2003) studied the mutual fund performance of America from 1961 to 2000.

They believed that better performance funds charge a selling expense, have a larger scale,

have a higher turnover rate or have lower fees.

Wermers, R. (2000) find that funds hold stocks that outperform the market by 1.3 percent per

year, but their net returns underperform by one percent. Of the 2.3 percent difference between

these results, 0.7 percent is due to the underperformance of non stock holdings, whereas 1.6

percent is due to expenses and transactions costs. Thus, funds pick stocks well enough to

cover their costs. Also, high-turnover funds beat the Vanguard Index 500 fund on a net return

basis. The evidence supports the value of active mutual fund management.

Wilfred L. Dellva, Gerard T. Olson (1998) found that, on average, 12b-1 fees, deferred sales

charges, and redemption fees increase expenses whereas funds with front-end loads generally

have lower expenses. They also found that funds with 12b-1 fees and redemption fees, on

average, earn higher risk adjusted returns but funds with front-end load charges earn lower

risk adjusted returns. They also find that turnover activity increases fund expenses, but does

not necessarily lead to better performance. The effect of mutual fund’s holding cash on

performance is positive and significant and higher performance reflects lower expense ratios.

Funds with higher percentages of cash have lower transaction costs (and higher performance)

because of greater liquidity to meet redemptions. They show a negative relation between fund

net returns and expense levels. They report mixed results between dividend yield and various

performance measures.

Volume:01, Number:01, Nov-2011 : RJCBS Page 43

www.theinternationaljournal.org

Carhart,M.M.(1997), on persistence of mutual fund performance found that expense ratios,

portfolio turnover and load fees are significant and negatively related to performance

Malhotra and McLeod (1997) focused specifically on analyzing the several key determinants

of fund expense ratios. The authors argue that since fund expenses are more stable and more

predictable than fund returns, investors should use fund expenses as a selection criterion

when buying a mutual fund. They conclude that investors should pay attention to fund size,

age, fund complex, turnover ratio, cash ratio, and the presence of 12b-1 fees before investing.

Their findings show that larger and more mature funds have lower expense ratio. On

average, load funds and 12b-1 funds have higher expense ratios than no-load and non-12b-1

funds. Additionally, funds that belong to a large fund family have lower expense ratios due to

economies of scope and funds with higher portfolio turnover are associated with higher

expense ratios. The authors find no evidence that a fund’s expense ratio is related to the

fund’s risk level and investment objective.

Elton,Gruber, Das and Hlavka (1993) find that funds with higher fees and turnover

underperform those with lower fees and turnover.

Objectives of the Study:

To evaluate the performance of Retail Equity Mutual Fund Schemes.

To study the relation between the Fund performance and Fund characteristics.

Methodology:

Data Collection:

Data is collected from secondary sources. Yearly data on adjusted NAVs and Fund attributes

of equity mutual fund schemes was collected from the websites valuereasearchonline.com,

Moneycontrol.com, mutualfundsindia.com, amfiindia.com and NSE S&P CNX Nifty data is

obtained from nseindia.com for the period from April 2006 to March 2011.

Sample Design:

Using secondary data the study analyzes the performance and characteristics of 100 actively

managed equity schemes and 8 index schemes. All the sample schemes are open ended in

nature and are predominantly equity based with growth as their objective.

Data Analysis:

The data collected was analyzed with the help of statistical techniques like T – test, F– test

and multiple regression techniques. Apart from these statistical techniques the popular risk

adjusted performance measures namely Treynor’s ratio, Sharpe’s ratio and Jenson’s alpha are

employed in this study to measure the performance of selected schemes of selected mutual

fund companies. Multiple regression model was used to examine whether mutual fund

characteristics, such as the expense ratio, portfolio turnover ratio and other attributes useful in

explaining fund performance. Front end & exit loads were not considered as there is no front

end loads and also exit load for the funds invested for more than one year for all the sample

schemes. 12b-1 fees were not considered separately as these charges are part of expense ratio.

The regression model tests several factors that could affect mutual fund performance.

First, the expense ratios may have a significant impact on the returns generated by the mutual

fund schemes. Studies by Carhart (1997), Dellva and Olson (1998), and Jan and Hung (2003),

Volume:01, Number:01, Nov-2011 : RJCBS Page 44

www.theinternationaljournal.org

show a negative relation between fund net returns and expense levels. Therefore, the study

expects a negative relation between expense ratios and performance.

Second, higher performing mutual funds are likely to attract more investor purchases. Study

by Haslem, J. A., Baker, H. K., & Smith, D. M (2008) find that larger equity funds tend to

outperform smaller equity funds, which may reflect economies of scale. As funds increase in

size, they experience operating efficiencies from scale economies resulting in lower expense

ratios for the mutual fund investors. So this study expects a positive relation between fund

asset size and performance.

Third, portfolio turnover represents mutual fund trading activity. Studies by Haslem, J. A.,

Baker, H. K., & Smith, D. M (2008) ,Elton, Gruber, Das and Hlavka (1993), Dowen and

Mann (2004) and Edelen et al. (2007) find that funds with higher fees and turnover

underperform those with lower fees and turnover. They find that portfolio turnover has

negative relation to fund performance. Therefore, this study expects a negative relation

between portfolio turnover and fund performance.

Fourth, beta as a measure of systematic risk may explain the mutual fund performance.

Study by Haslem, J. A., Baker, H. K., & Smith, D(2008) found mixed performance results for

beta. Funds with riskier portfolios have higher betas and therefore higher performance. So we

expect a positive relation between beta and fund performance.

Fifth, mutual funds normally meet shareholder redemptions by selling securities or reducing

cash. By selling securities, funds incur transaction costs and reduce fund performance. By

holding a higher percentage of cash, funds have lower transaction costs because they have

greater liquidity to meet redemptions, but cash holdings also lower returns. Study by Wilfred

L. Dellva, Gerard T. Olson (1998) find that mutual fund’s holding cash on performance is

positive and significant and higher performance reflects lower expense ratios but study by

Haslem, J. A., Baker, H. K., & Smith, D(2008) found mixed performance results for the cash

level. Despite this tradeoff, the study expects a positive relation between cash and fund

performance.

Sixth, the dividend yields may have positive impact on the fund performance. But studies by

Haslem, J. A., Baker, H. K., & Smith, D (2008) and Dellva and Olson (1998) report mixed

results between dividend yield and various performance measures. However, the study

expects a positive relation between dividend yield and fund performance.

The study used a regression model to estimate the characteristics that explain fund

performance.

The hypothesis is:

Performancepi = b0 + b1 (Expense ratio) +b2 (Net assets) +b3 (Turnover)

+b4 (Beta)+b5 (Cash) +b6 (dividend yield)+ ei -----------(1)

Performancepi is the value for performance measure p, measured net of expenses, for fund i.

Performance measures are the Sharpe ratio, Treynor’s ratio and Jensen’s alpha, each

measured over a period of five years. Expense Ratio is the fees charged by the fund. Net

assets is the natural logarithm of fund i net assets (in crores) because this variable may be

nonlinearly related to performance. Turnover is the annual portfolio turnover as a whole

percentage for fund i. Beta is the five year beta for fund i used to indicate the systematic risk

of a fund. Cash is the whole percentage of fund i assets. Dividend yield is the prospective

fund i yield over the next12 months, calculated as the value-weighted average dividend yield

for all stocks in the fund, and ei is the error term.

Volume:01, Number:01, Nov-2011 : RJCBS Page 45

www.theinternationaljournal.org

In summary, the hypothesized signs of the coefficients of the explanatory variables relative to

mutual fund performance are: expense ratio class (-), asset size (+), turnover (-) beta (+), cash

(+), and dividend yield (+).

Results:

Table 1 below presents the results of a regression model, as depicted by Eq. (1), used to

examine the relation between mutual fund performance and fund characteristics. The results

are directionally similar in many respects to those reported by Haslem, J. A., Baker, H. K., &

Smith, D(2008) and Dellva and Olson (1998). The adjusted R2 for the three regressions range

from 0.0739 to 0.2487. By the normal measures of cross-sectional analysis, the regression

model performed well in explaining fund returns. F values for each regression are significant

at the 0.01 and 0.05 levels respectively. The results reflect the sensitivity of the funds’

average performance to the choice of the performance measure. The expense ratio is negative

and statistically significant at normal levels for the performance measure Sharpe ratio and not

significant for Treynor’s ratio and Jensen’s alpha measures. These mixed results do not lead

to a definitive interpretation on the relation between expense ratio and performance. By

contrast, the results of Haslem, J. A., Baker, H. K., & Smith, D (2008) find that the

probability of a fund achieving a positive risk-adjusted return increases as its expense ratio

decreases. The results show that fund size is positive and significant at the 0.01 level for all

performance measures, which suggests that fund size is a distinguishing variable for

explaining performance. The results are consistent with the results of Haslem, J. A., Baker,

H. K., & Smith, D (2008) that larger equity funds tend to outperform smaller equity funds,

which may reflect economies of scale. The portfolio trading activity is positive and

significant for all the three performance measures at 0.01 level and 0.05 levels. The evidence

shows that superior mutual funds tend to engage in frequent portfolio trading activity than do

inferior funds. The findings are inconsistent with the results of Haslem, J. A., Baker, H. K., &

Smith, D (2008) that superior mutual funds tend to engage in less portfolio trading activity

than do inferior funds and by Dellva and Olson (1998) that no difference exists in turnover

activity for superior and inferior performing funds. The coefficient for dividend yield is

significantly positive for the Sharpe ratio, but not significant for the performance measures

treynor ratio and Jensen’s alpha. These inconsistent results show that each measure captures

different aspects of performance. The effects of a mutual fund’s cash holdings on

performance is negative and significant at the 0.01 level for the Sharpe ratio and Jensen’s

alpha and not significant for trenyor ratio. Using these performance measures, the study

found that funds that hold more cash typically underperform those that hold less cash. By

contrast, study by Haslem, J. A., Baker, H. K., & Smith, D (2008) find mixed results for cash

level versus performance of the fund. For the performance measures Sharpe ratio and Jensen

measure the coefficient for beta is positive and significant at the 0.01 level and not significant

for the performance measure Jensen alpha. In these instances, there appears to be a linear

relation between systematic risk and performance. Study by Haslem, J. A., Baker, H. K., &

Smith, D (2008) found mixed results for beta versus performance, depending on the measure

used.

Volume:01, Number:01, Nov-2011 : RJCBS Page 46

www.theinternationaljournal.org

Table 1

Regression results for the performance and characteristics of retail equity mutual

funds

Dependant Variables

Explanatory variables Hypothesized sign sharpe ratio Treynor ratio Jensen Alpha

Intercept * 0.0737 -3.4099 -6.0715

Expense Ratio (%) (-) *-0.0231 -2.1033 -0.2460

Net Assets (+) *0.0172 *0.7084 *0.8782

Turnover ratio (-) *0.00004 *0.0022 **0.00009

Dividend Yield (%) (+) *0.0137 2.1132 0.5208

Cash Level (%) (+) *-0.0015 -0.02444 *-0.0621

Beta(5 year) (+) *0.1065 *8.6777 1.4075

F *3.1413 *6.9054 **2.4248

Adjusted R2 0.1072 0.2487 0.0739

*, ** indicates statistical significance at 0.01, 0.05 levels respectively.

Summary and conclusions:

The study provides strong evidence on the performance and characteristics of 108 domestic,

retail equity mutual funds in India. The study provides evidence that supports links between

mutual fund performance and fund characteristics. Based on the regression analysis, the study

found evidence suggesting that larger equity funds tend to outperform smaller equity funds,

which may reflect economies of scale. The study found a negative relation between

performance and expense ratio and statistically significant only using Sharpe ratio

performance measure. So expense ratios are not strongly significant to mutual fund returns.

The study found a significant positive relation between performance and turnover for all the

three performance measures. The study also found significant positive relation between

performance and beta for Jensen and Sharpe ratio performance measures. In addition, the

results indicate a significant negative relation between performance and cash level using

Sharpe and Jensen performance measures. The study found a positive relation between fund

performance and dividend yield but only significant for Sharpe performance measure.

So the study concludes that superior performance on an average occurs among larger funds

with average trading activity and higher betas having low cash levels. So investors should be

aware of these fund characteristics before investing.

References:

Carhart,M.M.(1997), “on persistence of mutual fund performance”, Journal Of

Finance,52,57-82.

Dowen, R. J., & Mann, T. (2004). Mutual fund performance, management behavior, and

investor costs. Financial Services Review, 13, 79–91.

Dukes, W. P., English, P. C., II, & Davis, S. M. (2006). Mutual fund mortality, 12b-1 fees,

and the net expense ratio. Journal of Financial Research, 24, 235–252.

Dr.R.Madhumati, Sharad Panwar (2006) “Characteristics and performance evaluation of

selected mutual funds in India, Capital Market Conference, 2006.

Edelen, R. M., Evans, R., & Kadlec, G. B. (2007). Scale effects in mutual fund performance:

The role of trading costs. Echo Investment Advisors, LLC working paper.

Elton,E.J.Gruber;S,Das;M.Hlavka. “Efficiency with costly interpretation of evidence from

managed portfolios” Review of Financial Studies, 6(1993).1-22.

Volume:01, Number:01, Nov-2011 : RJCBS Page 47

www.theinternationaljournal.org

Haslem, J. A., Baker, H. K., & Smith, D. M. . Performance and characteristics of actively

managed retail equity mutual funds with diverse expense ratios, Financial Services Review

17 (2008) 49–68.

Jan, Y. C., & Hung, M. W. (2003). Mutual fund attributes and performance. Financial

Services Review, 12, 165–178.

Malhotra, D. K., & McLeod, R. W. (1997). An empirical analysis of mutual fund expenses.

Journal of Financial Research, 20, 175–190.

Wermers, R. (2000). Mutual fund performance: an empirical decomposition into stock-

picking talent, style, transactions costs, and expenses. Journal of Finance, 50, 1655–1695.

Wilfred L. Dellva, Gerard T. Olson (1998).” The relationship between mutual fund fees

and expenses and their effects on performance”. Financial Review, 33, 85-104.

APPENDIX-1: FUND ATTRIBUTES OF RETAIL EQUITY MUTUAL FUNDS

Expense Portfolio Dividend Cash

Fund Type/Scheme Ratio Turnover Yield Level Beta Assets

Equity: index

Birla Sunlife Index 1.5 165 1.12 1.81 1.00137 25.76

Canara Robeco Nifty

Index 1 159 1.22 0.52 0.99081 34.71

Franklin India Index Nse

Nifty 1 3 1.22 2.63 0.99884 4.98

HDFC Index Nifty 1 18.29 1.22 0.24 0.93833 130.67

LICMF Index Nifty 0.88 247.71 1.22 2.97 0.95887 53.47

Principle Index 1 60 1.22 0.09 0.99578 18.38

SBI Magnum Index Fund 1.5 11 1.22 0.23 1.00487 62.12

UTI Nifty Fund 1.5 68.98 1.22 0.03 0.98749 204.18

Equity: Technology

DSPBR Technology .com

Reg 2.48 133 1.23 1.52 1.5799 67.68

Franklin Infotech 2.42 1.31 1.55 1.86 1.4186 148.4

ICICI Prudential

Technology 2.46 11 1.75 6.75 1.69755 117.08

SBI Magnum IT 2.5 49 1.52 4.11 1.77268 49.71

Birla Sunlife New

Milllennium 2.5 18 1.25 5.61 1.33794 60.62

Equity: Tax Saving

BNP Paribas Tax

advantage plan 2.5 21 1.24 3.43 1.09796 48.66

Canara Robeco Equity

Tax Saver 2.38 51 1.08 9.32 1.34979 243.82

Escorts Tax Plan 2.5 47.55 1.25 10.39 1.17236 14.88

Franklin India Taxshield 2.14 42.19 1.12 7.68 1.14348 796.63

HDFC Tax Saver 1.86 26.01 1.22 9.86 1.35163 2823.02

ICICI Prudential Tax Plan 1.99 153 1.2 7.87 1.48817 1251.55

ING Tax savings 2.5 92.8 1.45 6.23 1.37206 37.19

Volume:01, Number:01, Nov-2011 : RJCBS Page 48

www.theinternationaljournal.org

Kotak Taxsaver 2.22 119.58 1.12 1.71 1.2015 530.76

L&T Taxsaver 2.5 60 1.18 3.08 1.3517 29.02

LICMF Tax Gain 2.11 44 1.21 7.78 0.92344 39.18

Reliance Tax Saver 1.88 32 1.16 3.07 1.11832 2070.93

Sahara Tax gain 2.5 67.44 1.31 3.95 1.18784 11.11

SBI Magnum Tax gain 1.81 34 1.08 4.46 1.15468 5413.99

Sundaram Tax Saver 1.96 237 0.99 5.8 1.05549 1466.5

Tata Tax Saving 2.43 127 1.32 6.57 1.15417 135.97

UTI Equity Tax Savings 2.25 42.84 1.29 5.61 1.04955 488.45

BSL infra 2.22 84 1.1 8.12 1.40707 438.14

Equity: Infrastructure

Canara Robeco

Infrastructure 2.4 57 1.27 5.81 1.28507 140.52

ICICI PRU Infrastructure 1.85 108 1.21 10.22 0.97643 2997.66

Tata Infrastructure 2.5 34 1.12 1.58 1.22031 1641.06

UTI Infrasturcture 1.93 30.18 1.25 1.32 1.01135 2646.05

Equity: Pharma

Franklin Pharma 2.46 8.74 0.93 13.47 1.42424 147.62

Reliance Pharma 2.27 9 1.03 2.38 1.53588 551.19

SBI Magnum Pharma 2.5 65 0.98 5.07 1.34843 38.14

UTI Pharma and Health

care fund 2.5 27.02 0.87 6.72 0.91988 88.99

Equity: Largecap

DSPBR Top 100 Equity

Reg 1.86 277 1.16 3.32 0.94079 2700.6

DWS Alpha Equity

Regular 2.39 58 1.24 4.04 0.92662 137.86

Franklin India Bluechip 1.85 45.37 1.14 8.68 1.11076 3396.48

HSBC Equity 2 0.17 1.11 5.01 0.83635 951.34

ICICI PRU Top 100 2.32 177 1.14 8.52 0.91685 380.88

ING large cap equity fund 2.5 37.96 1.41 2.21 0.97354 8.5

Kotak 50 2.04 86.97 1.33 0.36 0.98446 864.57

Sahara Growth 2.5 88.93 1.39 8.77 0.84984 11.9

Sundaram Select Focus

Reg 2.02 304 1.11 2.17 1.04158 861.77

UTI Master Plus 91 2.08 39.9 1.28 1.87 0.98686 898.85

Equity: Multicap

Birla Sunlife Equity 2.01 79 1.08 5.67 1.31885 951.31

BNP Paribas

Opportunities 2.5 36 1.23 2.89 1.0361 43.43

DWS investment

Opprtunities reg 2.39 71 1.29 6.27 1.14664 124.22

HDFC Equity 1.79 48.39 1.18 3.13 1.37223 8404.84

HDFC Premier Multicap 2.24 21.19 1.13 13.18 1.40919 466.41

ING Domestic 2.5 59.39 1.43 6.43 1.13137 56.89

Volume:01, Number:01, Nov-2011 : RJCBS Page 49

www.theinternationaljournal.org

Opprtunities

JM Equity 2.5 38 1.05 2.89 -0.1523 28.13

Kotak Contra 2.5 146.49 1.26 1.1 1.08014 71.26

Reliance Regular Savings

Equity 1.85 37 0.88 3.88 1.41729 3263.7

Tata Equity PE 2.5 46 1.54 2.05 1.34887 721.88

Templeton India Growth 2.12 2.81 1.53 4.48 1.35588 1135.07

Equity:Large & Midcap

Baroda Pioneer Growth 2.5 63 1.21 4.92 1.10287 59.92

Birla Sunlife Advantage 2.31 31 0.97 0.15 1.25412 347.31

Birla sunlife Frontline

equity 1.88 69 1.13 3.57 1.16735 2741.94

Birla Sunlife Top 100 2.32 57 1.12 8.67 0.98471 323.16

BNP Paribas Equity 2.5 61 1.2 0.99 0.84586 58.51

canara Robeco equity

diversified 2.32 44 1.16 0.53 1.34775 392.7

DSPBR Opporutinities 2.09 66 1.1 4.32 1.13495 765.38

Fidelity Equity 1.85 7 1.1 7.06 1.1037 3062.96

Franklin India Flexi Cap 1.9 55.02 1.29 3.36 1.22265 2034.97

Franklin India

Opportunities 2.31 153.05 1.1 4.17 1.06578 406.72

Franklin India Primaplus 1.93 43.26 1.11 3.04 1.05046 1703.72

HDFC TOP 200 1.79 31.03 1.29 2.58 1.17699 9591.25

HSBC India Opportunities 2.36 14 1.15 4.83 0.88978 188.06

HSBC Progressive

Themes 2.32 41 1.43 8.09 0.92328 232.77

ICICI Pru top 200 2.22 49 1.26 9.41 1.11135 553.24

IDFC Classic Equity Plan

A 1.2 240 0.96 1.64 1.02865 211.84

ING Core Equity 2.5 79.06 1.4 4.84 1.11449 42.39

L&T Growth 2.5 79 1.02 14.66 1.15814 17.6

LIC MF Growth 1.27 56 1.31 1.74 1.08074 109.16

Morganstanely Growth 1.9 36 1.02 2.37 1.19411 1633.54

Principal Growth 2.36 100 1.29 0.12 1.13679 244.57

Reliance Equity 1.89 122 1.14 5.83 0.37153 1443.61

SBI Bluechip 2.11 64 1.31 6.81 1.12217 840.1

SBI Magnum Equity 2.3 168 1.09 3.7 1.20713 422.59

Sundaram growth reg 2.4 173 1.09 5.11 1.2372 168.08

Tata pure equity 2.5 90 1.25 1.57 1.11162 606.42

UTI equity 1.9 116.42 1.19 3.83 1.04977 2006.93

Equity: Mid & Small

Cap

SBI Magnum Emerging

Business 2.35 187 1.18 8.07 1.92173 296.88

Birla Sunlife Midcap 1.91 73 1.1 1.74 1.78379 1683.81

Volume:01, Number:01, Nov-2011 : RJCBS Page 50

www.theinternationaljournal.org

Canara Robeco Emerging

Equity 2.5 51 1.12 8.2 1.92799 39.18

Escorts Growth 2.5 46.75 1.18 23.76 1.4344 6.48

Franklin India Prima 2.12 36.16 1.24 6.52 1.63648 821.05

HSBC Midcap Equity 2.35 55 0.95 9.29 1.54188 145.88

ICICI Pru Discovery 1.94 86 1.4 7.53 1.79255 1611.71

IDFC Premier Equity Plan

A 1.93 112 0.78 1.05 1.40886 1806.09

ING Midcap 2.5 99.84 1.74 7.22 1.42688 15.41

JM Emerging Leader 2.37 42.49 1 8.24 1.90144 140.43

KOTAK Midcap 2.39 170.31 1.19 2.92 1.43068 277.76

L &T Midcap 2.5 68 1.39 3.7 1.71899 52.36

Reliance Growth 1.79 29 1 4.77 1.38393 7059.95

Sahara Midcap 2.49 66.01 1.35 6.75 1.6782 13.32

SBI Magnum Midcap 2.34 106 1.37 6.8 1.62745 260.62

Sundaram S.M.I.L.E Reg 2.16 210 1.5 3.06 1.62561 650.47

Tata Growth 2.5 119 1.52 5.84 1.44466 45.64

UTI Master Value 2.24 55.74 1.35 1.35 1.53961 680.64

Equity:FMCG

Franklin FMCG 2.5 2.43 1.3 4.75 0.79546 47.66

ICICI PRU FMCG 2.5 46 2.21 3.98 0.91687 69.62

Equity:Banking

Reliance Banking Retial 1.99 20 1.28 6.36 1.38668 1647.46

UTI Banking Sector Reg 2.39 308.4 1.13 3.17 1.32487 347.96

APPENDIX-2: FUNDS RISK ADJUSTED MEASURES

sharpe treynor jensen

Fund Type Scheme Ratio Ratio Measure

Equity: index Birla Sunlife Index 0.2896 10.2360 0.7058

Canara Robeco Nifty Index 0.2821 9.9211 0.3865

Franklin India Index Nse

Nifty 0.3005 10.5623 1.0300

HDFC Index Nifty 0.2171 7.6199 -1.7933

LICMF Index Nifty 0.1902 6.6850 -2.7291

Principle Index 0.2584 9.0884 -0.4408

SBI Magnum Index Fund 0.2712 9.5236 -0.0075

UTI Nifty Fund 0.2913 10.2380 0.6981

DSPBR Technology .com

Equity: Technology Reg 0.3288 12.2096 4.2318

Franklin Infotech 0.2718 11.2435 2.4292

ICICI Prudential Technology 0.3227 12.3885 4.8505

SBI Magnum IT 0.2835 11.1075 2.7944

Birla Sunlife New

Milllennium 0.1939 7.2874 -3.0020

Volume:01, Number:01, Nov-2011 : RJCBS Page 51

www.theinternationaljournal.org

BNP Paribas Tax advantage

plan 0.0690 2.4318 -7.7948

Canara Robeco Equity Tax

Equity: Tax Saving Saver 0.3716 13.4318 5.2651

Escorts Tax Plan 0.1290 4.6146 -5.7638

Franklin India Taxshield 0.2995 10.7129 1.3514

HDFC Tax Saver 0.2946 10.6612 1.5275

ICICI Prudential Tax Plan 0.2528 9.2933 -0.3539

ING Tax savings 0.1643 5.9691 -4.8872

Kotak Taxsaver 0.1990 6.9996 -3.0416

L&T Taxsaver 0.1807 6.5029 -4.0932

LICMF Tax Gain 0.0638 2.2633 -6.7114

Reliance Tax Saver 0.2248 8.2355 -1.4489

Sahara Tax gain 0.3169 11.4577 2.2885

SBI Magnum Tax gain 0.2614 9.2233 -0.3554

Sundaram Tax Saver 0.2797 9.9575 0.4500

Tata Tax Saving 0.1941 6.9054 -3.0305

UTI Equity Tax Savings 0.1517 5.4214 -4.3133

Equity: Infrastructure BSL infra 0.2567 9.1751 -0.5010

Canara Robeco Infrastructure 0.3057 11.1667 2.1019

ICICI PRU Infrastructure 0.3958 15.3110 5.6436

Tata Infrastructure 0.2855 10.4318 1.0991

UTI Infrasturcture 0.1958 7.2675 -2.2893

Equity: Pharma Franklin Pharma 0.3124 12.8419 4.7154

Reliance Pharma 0.4122 16.4661 10.6514

SBI Magnum Pharma 0.1357 5.2580 -5.7620

UTI Pharma and Health care

fund 0.2326 9.3599 -0.1575

Equity: Largecap DSPBR Top 100 Equity Reg 0.4270 15.0618 5.2032

DWS Alpha Equity Regular 0.3128 11.3855 1.7183

Franklin India Bluechip 0.3555 12.5950 3.4033

HSBC Equity 0.3128 11.2752 1.4587

ICICI PRU Top 100 0.2969 10.4379 0.8314

ING large cap equity fund 0.2922 10.2615 0.7111

Kotak 50 0.3163 11.2853 1.7270

Sahara Growth 0.3634 13.0495 2.9901

Sundaram Select Focus Reg 0.3076 10.9545 1.4826

UTI Master Plus 91 0.2248 7.8937 -1.6159

Equity: Multicap Birla Sunlife Equity 0.2813 9.9708 0.5799

BNP Paribas Opportunities 0.0516 1.8434 -7.9652

DWS investment Opprtunities

reg 0.3330 12.3404 3.2213

HDFC Equity 0.4006 14.4072 6.6911

HDFC Premier Multicap 0.2914 10.4954 1.3589

ING Domestic Opprtunities 0.2427 8.5295 -1.1332

Volume:01, Number:01, Nov-2011 : RJCBS Page 52

www.theinternationaljournal.org

JM Equity 0.0995 -26.1979 5.4416

Kotak Contra 0.1969 7.1009 -2.6250

Reliance Regular Savings

Equity 0.4799 17.2372 10.9217

Tata Equity PE 0.3774 13.5151 5.3738

Templeton India Growth 0.3606 12.9584 4.6470

Equity:Large &

Midcap Baroda Pioneer Growth 0.3405 12.3223 3.0784

Birla Sunlife Advantage 0.1851 6.6102 -3.6631

Birla sunlife Frontline equity 0.4300 15.1711 6.5839

Birla Sunlife Top 100 0.2488 8.8249 -0.6954

BNP Paribas Equity 0.1901 6.7742 -2.3320

canara Robeco equity

diversified 0.3168 11.4635 2.6044

DSPBR Opporutinities 0.3122 11.0049 1.6727

Fidelity Equity 0.3855 13.6178 4.5105

Franklin India Flexi Cap 0.3053 10.9025 1.6768

Franklin India Opportunities 0.2135 7.4969 -2.1680

Franklin India Primaplus 0.3700 13.0324 3.6780

HDFC TOP 200 0.4246 15.0978 6.5520

HSBC India Opportunities 0.2327 8.2156 -1.1705

HSBC Progressive Themes -0.0098 -0.3574 -9.1299

ICICI Pru top 200 0.2770 9.7809 0.2777

IDFC Classic Equity Plan A 0.2106 7.4758 -2.1142

ING Core Equity 0.2649 9.3406 -0.2123

L&T Growth 0.2356 8.2806 -1.4483

LIC MF Growth 0.1148 4.1731 -5.7906

Morganstanely Growth 0.1505 5.3680 -4.9712

Principal Growth 0.0626 2.2080 -8.3249

Reliance Equity -0.3966 -17.6301 -10.0910

SBI Bluechip 0.1594 5.6587 -4.3455

SBI Magnum Equity 0.3492 12.2854 3.3248

Sundaram growth reg 0.2427 8.5920 -1.1619

Tata pure equity 0.2987 10.6061 1.1950

UTI equity 0.2856 10.3165 0.8245

Equity: Mid & Small SBI Magnum Emerging

Cap Business 0.2725 9.8089 0.5338

Birla Sunlife Midcap 0.3225 11.6886 3.8485

Canara Robeco Emerging

Equity 0.2546 9.2791 -0.4859

Escorts Growth 0.2226 8.0243 -2.1614

Franklin India Prima 0.2030 7.4245 -3.4474

HSBC Midcap Equity 0.1188 4.2870 -8.0858

ICICI Pru Discovery 0.3073 11.6315 3.7650

IDFC Premier Equity Plan A 0.4490 16.4033 9.6820

Volume:01, Number:01, Nov-2011 : RJCBS Page 53

www.theinternationaljournal.org

ING Midcap 0.1806 6.4406 -4.4098

JM Emerging Leader 0.0747 2.6874 -13.0128

KOTAK Midcap 0.1620 5.8364 -5.2860

L &T Midcap 0.2688 9.7790 0.4261

Reliance Growth 0.3534 12.5946 4.2397

Sahara Midcap 0.2855 10.3385 1.3549

SBI Magnum Midcap 0.1848 6.5440 -4.8614

Sundaram S.M.I.L.E Reg 0.3051 11.1035 2.5562

Tata Growth 0.2254 7.9811 -2.2392

UTI Master Value 0.2949 10.7755 1.9159

Equity:FMCG Franklin FMCG 0.2931 11.3771 1.4684

ICICI PRU FMCG 0.2570 9.3034 -0.2088

Equity:Banking Reliance Banking Retial 0.6342 22.6656 18.2134

UTI Banking Sector Reg 0.5386 19.1037 12.6825

***

Volume:01, Number:01, Nov-2011 : RJCBS Page 54

www.theinternationaljournal.org

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- YASKAWA DX100 Operator-s-Manual PDFDocumento744 pagineYASKAWA DX100 Operator-s-Manual PDFjmorenoh103100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Current Affairs January 2018 SummaryDocumento11 pagineCurrent Affairs January 2018 SummaryyogiNessuna valutazione finora

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

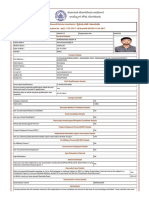

- Application Details - KPSC Job NotificationDocumento2 pagineApplication Details - KPSC Job NotificationPurandhara ReddyNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (894)

- Vision and Mission AnalysisDocumento9 pagineVision and Mission AnalysisPurandhara ReddyNessuna valutazione finora

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Prevention of NPAs A Comparative Study On Indian BanksDocumento6 paginePrevention of NPAs A Comparative Study On Indian BanksPurandhara ReddyNessuna valutazione finora

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Koodo Bill ExplainerDocumento1 paginaKoodo Bill ExplainerAliceNessuna valutazione finora

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Caf 6 PT ST PDFDocumento295 pagineCaf 6 PT ST PDFRubina AshrafNessuna valutazione finora

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- BIR Form 2306 Certificate of Final Tax Withheld At SourceDocumento14 pagineBIR Form 2306 Certificate of Final Tax Withheld At SourceBrianSantiagoNessuna valutazione finora

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Comptroller Steals $53 Million From City Funds: EthicsDocumento4 pagineComptroller Steals $53 Million From City Funds: EthicsChess NutsNessuna valutazione finora

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- (9781800375949 - FinTech) Chapter 1 - INTRODUCTION - WHAT IS FINTECHDocumento21 pagine(9781800375949 - FinTech) Chapter 1 - INTRODUCTION - WHAT IS FINTECHMonica VeressNessuna valutazione finora

- Micro and Small Enterprises in India PDFDocumento23 pagineMicro and Small Enterprises in India PDFSuryamaniNessuna valutazione finora

- HDFC Bank's 1st Annual ReportDocumento20 pagineHDFC Bank's 1st Annual ReportTotmolNessuna valutazione finora

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Documento2 pagineIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNessuna valutazione finora

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (73)

- Korean Stock TradingDocumento5 pagineKorean Stock TradingcasefortrilsNessuna valutazione finora

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Test Bank For Financial Accounting An Integrated Approach 5th Edition TrotmanDocumento24 pagineTest Bank For Financial Accounting An Integrated Approach 5th Edition Trotmanaudreycollinsnstjaxwkrd100% (48)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Og 23 1701 1802 00242559Documento7 pagineOg 23 1701 1802 00242559tushar gargNessuna valutazione finora

- Bollinger Band (Part 2)Documento5 pagineBollinger Band (Part 2)Miguel Luz RosaNessuna valutazione finora

- Paper 1.4Documento137 paginePaper 1.4vijaykumartaxNessuna valutazione finora

- Start-Up India: An Analysis of The Indian Entrepreneurial LandscapeDocumento4 pagineStart-Up India: An Analysis of The Indian Entrepreneurial LandscapeYash VermaNessuna valutazione finora

- NJ MoneyDocumento2 pagineNJ MoneywilberespinosarnNessuna valutazione finora

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Select City Walk (Tarun)Documento15 pagineSelect City Walk (Tarun)Tarun BatraNessuna valutazione finora

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- TABANGDocumento81 pagineTABANGGuilbert CimeneNessuna valutazione finora

- Fin Aw7Documento84 pagineFin Aw7Rameesh DeNessuna valutazione finora

- Applicability of IND AS: Phases of adoptionDocumento2 pagineApplicability of IND AS: Phases of adoptionSamyu MemoriesNessuna valutazione finora

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Finance Project For McomDocumento40 pagineFinance Project For McomSangeeta Rachkonda100% (1)

- Interview With Andrew Cardwell On RSIDocumento27 pagineInterview With Andrew Cardwell On RSIpsoonek86% (7)

- 0452 Accounting: MARK SCHEME For The May/June 2014 SeriesDocumento8 pagine0452 Accounting: MARK SCHEME For The May/June 2014 SeriessimplesaiedNessuna valutazione finora

- Credit Analysis. A Comprehensive E-Learning Product Covering Ratio Analysis and Cash Flow Analysis. After Completing This Course, You Will Be Able ToDocumento6 pagineCredit Analysis. A Comprehensive E-Learning Product Covering Ratio Analysis and Cash Flow Analysis. After Completing This Course, You Will Be Able ToASHENAFI GIZAWNessuna valutazione finora

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Current Liabilities, Contingencies, and Time Value of Money Chapter ExercisesDocumento44 pagineCurrent Liabilities, Contingencies, and Time Value of Money Chapter ExercisesAarti J0% (2)

- Autoloan Form Application IndividualDocumento2 pagineAutoloan Form Application IndividualEumell Alexis PaleNessuna valutazione finora

- Capital AllocationDocumento75 pagineCapital Allocationak87840% (1)

- Assign 4Documento3 pagineAssign 4Guangjun OuNessuna valutazione finora

- Marching Uniform ContractDocumento1 paginaMarching Uniform ContractHanson MendezNessuna valutazione finora

- Quiz 2Documento4 pagineQuiz 2Dax CruzNessuna valutazione finora

- Flow of Accounting Entries in Oracle AppDocumento19 pagineFlow of Accounting Entries in Oracle AppSrinivas AzureNessuna valutazione finora

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)