Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

42 ITCSI v. FGU Insurance

Caricato da

GSSCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

42 ITCSI v. FGU Insurance

Caricato da

GSSCopyright:

Formati disponibili

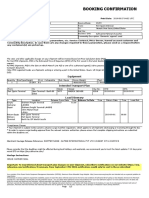

Title: #42 ITCSI v. FGU Insurance the coverage.

the coverage. This was also the ruling of the Court in Home Insurance Corporation v. Court of

Details: G.R. No. 161539 | June 27, 2008 | J. Austria-Martinez Appeals.

Topic: On Presentation of Policies However, as in every general rule, there are admitted exceptions. In Delsan Transport Lines, Inc.

Doctrine: v. Court of Appeals, the Court stated that the presentation of the insurance policy was not fatal

Facts: because the loss of the cargo undoubtedly occurred while on board the petitioner's vessel, unlike

1. ITCSI’s liability arose from a lost shipment of 14 Cardboards 400 kgs. of Silver Nitrate 63.53 in Home Insurance in which the cargo passed through several stages with different parties and it

FCT Analytically Pure (purity 99.98 PCT), shipped by Hapag-Lloyd AG through the could not be determined when the damage to the cargo occurred, such that the insurer should be

vessel Hannover Express from Hamburg, Germany on July 10, 1994, with Manila, Philippines as liable for it.

the port of discharge, and Republic Asahi Glass Corporation (RAGC) as consignee. As in Delsan, there is no doubt that the loss of the cargo in the present case occurred while in

2. Said shipment was insured by FGU Insurance Corporation (FGU). When RAGC's customs petitioner's custody. Moreover, there is no issue as regards the provisions of Marine Open Policy

broker, Desma Cargo Handlers, Inc., was claiming the shipment, ICTSI, which was No. MOP-12763, such that the presentation of the contract itself is necessary for perusal, not to

the arrastre contractor, could not find it in its storage area. mention that its existence was already admitted by petitioner in open court.

3. At the behest of petitioner, the National Bureau of Investigation (NBI) conducted an And even though it was not offered in evidence, it still can be considered by the court as long as

investigation. The AAREMA Marine and Cargo Surveyors, Inc. also conducted an inquiry. Both they have been properly identified by testimony duly recorded and they have themselves been

found that the shipment was lost while in the custody and responsibility of petitioner. incorporated in the records of the case.

4. After trial, the RTC rendered its Decision finding ICTSI liable.

5. Petitioner appealed to the Court of Appeals (CA), which affirmed the RTC Decision.

Issue:

WON the CA erred in not dismissing the complaint on the ground of failure to offer the

insurance policy in evidence. – NO

Held:

Petitioner insists that Marine Open Policy No. MOP-12763 under which the shipment was

insured was no longer in force at the time it was loaded on board the Hannover Express on June

10, 1994, as provided in the Endorsement portion of the policy, which states: IT IS HEREBY

DECLARED AND AGREED that effective June 10, 1994, this policy is deemed

CANCELLED.

FGU, on the other hand, insists that it was under Marine Risk Note No. 9798, which was

executed on May 26, 1994, that said shipment was covered.

It must be emphasized that a marine risk note is not an insurance policy. It is only an

acknowledgment or declaration of the insurer confirming the specific shipment covered by its

marine open policy, the evaluation of the cargo and the chargeable premium.

It is the marine open policy which is the main insurance contract. In other words, the marine open

policy is the blanket insurance to be undertaken by FGU on all goods to be shipped by RAGC

during the existence of the contract, while the marine risk note specifies the particular

goods/shipment insured by FGU on that specific transaction, including the sum insured, the

shipment particulars as well as the premium paid for such shipment.

In any event, as it stands, it is evident that even prior to the cancellation by FGU of Marine Open

Policy No. MOP-12763 on June 10, 1994, it had already undertaken to insure the shipment of the

400 kgs. of silver nitrate, specially since RAGC had already paid the premium on the insurance

of said shipment.

Indeed, jurisprudence has it that the marine insurance policy needs to be presented in evidence

before the trial court or even belatedly before the appellate court.

In Malayan Insurance Co., Inc. v. Regis Brokerage Corp., the Court stated that the presentation

of the marine insurance policy was necessary, as the issues raised therein arose from the very

existence of an insurance contract between Malayan Insurance and its consignee, ABB Koppel,

even prior to the loss of the shipment.

In Wallem Philippines Shipping, Inc. v. Prudential Guarantee and Assurance, Inc., the Court

ruled that the insurance contract must be presented in evidence in order to determine the extent of

Potrebbero piacerti anche

- CIR V CA, CTA and YMCADocumento2 pagineCIR V CA, CTA and YMCAJeunaj LardizabalNessuna valutazione finora

- Nego Ebc Vs IacDocumento4 pagineNego Ebc Vs IacMon CheNessuna valutazione finora

- Taxation Review - CIR Vs Jerry OcierDocumento1 paginaTaxation Review - CIR Vs Jerry OcierMaestro LazaroNessuna valutazione finora

- AverageDocumento2 pagineAverageChin MartinzNessuna valutazione finora

- Case Digest - InsurancelawDocumento6 pagineCase Digest - InsurancelawOffice of City Councilor BalanayNessuna valutazione finora

- Facts:: PILMICO-MAURI FOODS CORP. v. CIR,, GR No. 175651, 2016-09-14Documento9 pagineFacts:: PILMICO-MAURI FOODS CORP. v. CIR,, GR No. 175651, 2016-09-14Andrew M. AcederaNessuna valutazione finora

- DBP vs. Guarina Agricultural Ruling on Loan ForeclosureDocumento5 pagineDBP vs. Guarina Agricultural Ruling on Loan ForeclosurePatricia Anne SorianoNessuna valutazione finora

- GR 171165 Nievera Vs HernandezDocumento16 pagineGR 171165 Nievera Vs HernandezChristian Mark ValenciaNessuna valutazione finora

- CTA Decision on Systra Philippines Tax Refund ClaimDocumento13 pagineCTA Decision on Systra Philippines Tax Refund ClaimRuther Marc P. NarcidaNessuna valutazione finora

- Case Digests Legal Reasearch 2Documento6 pagineCase Digests Legal Reasearch 2Kyle HernandezNessuna valutazione finora

- Philippine Employ Services and Inc Vs Paramio 2C Salvador Joshua Philippe S.Documento2 paginePhilippine Employ Services and Inc Vs Paramio 2C Salvador Joshua Philippe S.Phi SalvadorNessuna valutazione finora

- Jose Sison, et al. vs. F. M. Yap Tico, et al. Case Decides Payment to Original Mortgagee Relieves DebtorDocumento3 pagineJose Sison, et al. vs. F. M. Yap Tico, et al. Case Decides Payment to Original Mortgagee Relieves DebtorRicca ResulaNessuna valutazione finora

- 26Documento5 pagine26Michael Granville MonNessuna valutazione finora

- Ford Vs CADocumento5 pagineFord Vs CAEller-JedManalacMendozaNessuna valutazione finora

- Court Upholds Cancellation of Bank's Mortgage on Property Subject of Prior Contracts to SellDocumento12 pagineCourt Upholds Cancellation of Bank's Mortgage on Property Subject of Prior Contracts to SellDessa ReyesNessuna valutazione finora

- 2 - Van Twest Vs CADocumento9 pagine2 - Van Twest Vs CAJesi CarlosNessuna valutazione finora

- Banco Filipino Savings and Mortgage Bank vs. Central Bank G.R. No. 70054, December 11, 1991Documento14 pagineBanco Filipino Savings and Mortgage Bank vs. Central Bank G.R. No. 70054, December 11, 1991Ronald LasinNessuna valutazione finora

- Evangelista Vs ScreenexDocumento11 pagineEvangelista Vs ScreenexJoel ArzagaNessuna valutazione finora

- Home Insurance V CADocumento2 pagineHome Insurance V CAJonBelzaNessuna valutazione finora

- Martires V ChuaDocumento11 pagineMartires V Chuajade123_129Nessuna valutazione finora

- Vintola v Insular Bank: Dismissal of Estafa Charge Doesn't Relieve LiabilityDocumento2 pagineVintola v Insular Bank: Dismissal of Estafa Charge Doesn't Relieve LiabilityErika Mariz CunananNessuna valutazione finora

- Revalida - 4. Cha Vs CADocumento2 pagineRevalida - 4. Cha Vs CADonna Joyce de BelenNessuna valutazione finora

- Court rules in favor of petitioners in property sale disputeDocumento2 pagineCourt rules in favor of petitioners in property sale disputenadgbNessuna valutazione finora

- Sps Franco Vs IAC Case DigestDocumento3 pagineSps Franco Vs IAC Case DigestYeb CedulloNessuna valutazione finora

- Lorcom Thirteen (Pty) LTD V Zurich Insurance Company South Africa LTD (54 - 08) (2013) ZAWCHC 64 2013 (5) SA 42 (WCC) (2013) 4 All SA 71 (WCC) (29 April 2013)Documento21 pagineLorcom Thirteen (Pty) LTD V Zurich Insurance Company South Africa LTD (54 - 08) (2013) ZAWCHC 64 2013 (5) SA 42 (WCC) (2013) 4 All SA 71 (WCC) (29 April 2013)sdfoisaiofasNessuna valutazione finora

- SPCL Case DigestsDocumento107 pagineSPCL Case DigestsMahaize TayawaNessuna valutazione finora

- B11 Allied Banking Corporation V Lim Sio WanDocumento3 pagineB11 Allied Banking Corporation V Lim Sio WanJ CaparasNessuna valutazione finora

- Unlawful Detainer Sample ComplaintDocumento4 pagineUnlawful Detainer Sample ComplaintD.F. de LiraNessuna valutazione finora

- Pacific Vegetable Oil Corp. vs. Singson (1955)Documento1 paginaPacific Vegetable Oil Corp. vs. Singson (1955)eunice demaclidNessuna valutazione finora

- Court rules surety not liable for paymentDocumento1 paginaCourt rules surety not liable for paymentJoan Tan-CruzNessuna valutazione finora

- Definition and elements of a contract of saleDocumento12 pagineDefinition and elements of a contract of saleJurisNessuna valutazione finora

- Uy v. ZamoraDocumento3 pagineUy v. ZamoraKristineSherikaChyNessuna valutazione finora

- AVON Vs CADocumento3 pagineAVON Vs CAbetuuu09Nessuna valutazione finora

- Human Rights Case Digest: Stonehill v. Diokno (1967Documento2 pagineHuman Rights Case Digest: Stonehill v. Diokno (1967Olek Dela CruzNessuna valutazione finora

- CPB General Insurance Co vs Masagana Telemart on Premium Payment Grace PeriodDocumento1 paginaCPB General Insurance Co vs Masagana Telemart on Premium Payment Grace PeriodCresteynTeyngNessuna valutazione finora

- COLLECTION OF SUM OF MONEY, Motion For Leave To InterveneDocumento3 pagineCOLLECTION OF SUM OF MONEY, Motion For Leave To InterveneDats FernandezNessuna valutazione finora

- 2d Xii. Lim Cuan Sy vs. Northern AssDocumento2 pagine2d Xii. Lim Cuan Sy vs. Northern AssJunmer OrtizNessuna valutazione finora

- Abacus v. Manila BankingDocumento3 pagineAbacus v. Manila BankingSean GalvezNessuna valutazione finora

- Spouses Lumo's registration under Act 496 prevailsDocumento1 paginaSpouses Lumo's registration under Act 496 prevailsBananaNessuna valutazione finora

- Heirs of Maramag V Maramag Et Al.Documento4 pagineHeirs of Maramag V Maramag Et Al.Alexandria ThiamNessuna valutazione finora

- ANTONINA LAMPANOvDocumento5 pagineANTONINA LAMPANOvYour Public ProfileNessuna valutazione finora

- 03 GR NO 255099 Beacon Currency Exchange, Inc. v. RepublicDocumento1 pagina03 GR NO 255099 Beacon Currency Exchange, Inc. v. RepublicLawNessuna valutazione finora

- 24 Assoc of Baptist Vs First BaptistDocumento1 pagina24 Assoc of Baptist Vs First BaptistmelfabianNessuna valutazione finora

- Deed of Sale vs Equitable MortgageDocumento3 pagineDeed of Sale vs Equitable MortgagejafernandNessuna valutazione finora

- Claridades v. MercaderDocumento2 pagineClaridades v. MercaderPeter Joart RallaNessuna valutazione finora

- Mahinay V Duratire. DigestDocumento3 pagineMahinay V Duratire. DigestRaff GonzalesNessuna valutazione finora

- Miranda V. Philippine Deposit Insurance Corp. G.R No. 169334 - September 8, 2006 - J.YNARES-SANTIAGO - MendozaDocumento3 pagineMiranda V. Philippine Deposit Insurance Corp. G.R No. 169334 - September 8, 2006 - J.YNARES-SANTIAGO - MendozaKathrine TingNessuna valutazione finora

- 74 - WT Construction V DPWHDocumento2 pagine74 - WT Construction V DPWHJanine Castro100% (1)

- Phil. National Bank vs. Vda. de Villarin 66 SCRA 590, September 05, 1975Documento8 paginePhil. National Bank vs. Vda. de Villarin 66 SCRA 590, September 05, 1975Eunice AmbrocioNessuna valutazione finora

- Legal Rights in Property Transfer DisputeDocumento4 pagineLegal Rights in Property Transfer DisputeYPENessuna valutazione finora

- TEC BI & CO v CHARTERED BANK OF INDIA PLEDGE DISPUTEDocumento1 paginaTEC BI & CO v CHARTERED BANK OF INDIA PLEDGE DISPUTEJillian AsdalaNessuna valutazione finora

- Filipino Merchants Insurance v. CA: Consignee Has Insurable InterestDocumento1 paginaFilipino Merchants Insurance v. CA: Consignee Has Insurable InterestSopongco ColeenNessuna valutazione finora

- Tolentino v. Sy ChiamDocumento2 pagineTolentino v. Sy ChiamEricka Harriet CaballesNessuna valutazione finora

- Fernando U. Juan, Petitioner, V. Roberto U. Juan (Substituted by His Son Jeffrey C. Juan) and Laundromatic Corporation, Respondents. FactsDocumento12 pagineFernando U. Juan, Petitioner, V. Roberto U. Juan (Substituted by His Son Jeffrey C. Juan) and Laundromatic Corporation, Respondents. FactsJohn Carlo DizonNessuna valutazione finora

- Commercial and Specialty Laws SyllabusDocumento5 pagineCommercial and Specialty Laws SyllabusgianelleNessuna valutazione finora

- Cavite Development Bank Vs SpsDocumento2 pagineCavite Development Bank Vs SpsJug HeadNessuna valutazione finora

- Gulf Resorts Insurance Case Analyzes Earthquake Coverage IntentDocumento9 pagineGulf Resorts Insurance Case Analyzes Earthquake Coverage Intentmartina lopezNessuna valutazione finora

- 42 Ictsi v. Fgu Insurance Corporation (Lorenzo)Documento2 pagine42 Ictsi v. Fgu Insurance Corporation (Lorenzo)Mico Lrz100% (1)

- (A. Subject Matter) Eastern Shipping Lines, Inc. vs. Prudential Guarantee and Assurance, Inc., 599 SCRA 565, G.R. No. 174116 September 11, 2009Documento13 pagine(A. Subject Matter) Eastern Shipping Lines, Inc. vs. Prudential Guarantee and Assurance, Inc., 599 SCRA 565, G.R. No. 174116 September 11, 2009Alexiss Mace JuradoNessuna valutazione finora

- (A. Subject Matter) Eastern Shipping Lines, Inc. vs. Prudential Guarantee and Assurance, Inc., 599 SCRA 565, G.R. No. 174116 September 11, 2009Documento13 pagine(A. Subject Matter) Eastern Shipping Lines, Inc. vs. Prudential Guarantee and Assurance, Inc., 599 SCRA 565, G.R. No. 174116 September 11, 2009Alexiss Mace JuradoNessuna valutazione finora

- Sps. Nisce v. Equitable PCI BankDocumento3 pagineSps. Nisce v. Equitable PCI BankGSSNessuna valutazione finora

- PCAB v. Manila Water rules nationality-based contractor licensing invalidDocumento1 paginaPCAB v. Manila Water rules nationality-based contractor licensing invalidGSSNessuna valutazione finora

- 58 SERRANO v. COURT OF APPEALSDocumento1 pagina58 SERRANO v. COURT OF APPEALSGSSNessuna valutazione finora

- 35 SPS. PARAS v. KIMWA CONSTRUCTIONDocumento1 pagina35 SPS. PARAS v. KIMWA CONSTRUCTIONGSSNessuna valutazione finora

- 29 VINTOLA v. IBAADocumento1 pagina29 VINTOLA v. IBAAGSSNessuna valutazione finora

- Phil Stock Exchange Inc Vs CA: 125469: October 27, 1997: J. Torres, JR: Second DivisionDocumento11 paginePhil Stock Exchange Inc Vs CA: 125469: October 27, 1997: J. Torres, JR: Second DivisionGSSNessuna valutazione finora

- PNCC Obligated to Honor Lease AgreementDocumento1 paginaPNCC Obligated to Honor Lease AgreementGSSNessuna valutazione finora

- 27 DIZON v. GABORRODocumento1 pagina27 DIZON v. GABORROGSS100% (1)

- Stronghold Insurance liable for surety bondsDocumento1 paginaStronghold Insurance liable for surety bondsGSSNessuna valutazione finora

- 28 SPS. LITONJUA v. L&R CORP.Documento1 pagina28 SPS. LITONJUA v. L&R CORP.GSSNessuna valutazione finora

- Textile Corp. v. Home Bankers Savings & Trust CoDocumento1 paginaTextile Corp. v. Home Bankers Savings & Trust CoGSSNessuna valutazione finora

- Negligent police officer liableDocumento1 paginaNegligent police officer liableGSSNessuna valutazione finora

- 13 GARCIA v. VILLARDocumento1 pagina13 GARCIA v. VILLARGSSNessuna valutazione finora

- 12 GAMES AND GARMENTSDEVELOPERS, INC. v. ALLIED BANKING CORP.Documento1 pagina12 GAMES AND GARMENTSDEVELOPERS, INC. v. ALLIED BANKING CORP.GSSNessuna valutazione finora

- Title: #79 MAGBANUA v. UY Details: G.R. No. 161003 - May 6, 2005 - J. Panganiban Topic: Novation (Subjective or Personal) Doctrine: FactsDocumento1 paginaTitle: #79 MAGBANUA v. UY Details: G.R. No. 161003 - May 6, 2005 - J. Panganiban Topic: Novation (Subjective or Personal) Doctrine: FactsGSSNessuna valutazione finora

- City of Manila v. Del RosarioDocumento1 paginaCity of Manila v. Del RosarioGSSNessuna valutazione finora

- People v. IrangDocumento1 paginaPeople v. IrangGSSNessuna valutazione finora

- JARAVATA v. SANDIGANBAYANDocumento1 paginaJARAVATA v. SANDIGANBAYANGSSNessuna valutazione finora

- CIR v. Calanoc Tax Exemption DeniedDocumento1 paginaCIR v. Calanoc Tax Exemption DeniedGSS100% (1)

- CMTA NotesDocumento7 pagineCMTA NotesGSSNessuna valutazione finora

- People V LungayanDocumento1 paginaPeople V LungayanGSSNessuna valutazione finora

- People V ComilingDocumento2 paginePeople V ComilingGSSNessuna valutazione finora

- 61 Campos V. People of The Philippines and First Women'S Credit CorpDocumento1 pagina61 Campos V. People of The Philippines and First Women'S Credit CorpGSSNessuna valutazione finora

- Borromeo Estate RulingDocumento1 paginaBorromeo Estate RulingGSSNessuna valutazione finora

- Presumption of cancellation of willDocumento1 paginaPresumption of cancellation of willGSSNessuna valutazione finora

- Trust Receipts Secure RTMC's Loan ObligationsDocumento1 paginaTrust Receipts Secure RTMC's Loan ObligationsGSS100% (1)

- Jinggoy Estrada v. SandiganbayanDocumento2 pagineJinggoy Estrada v. SandiganbayanGSSNessuna valutazione finora

- Javier v. Ancheta (CTA) ruling on erroneous bank transfer as taxable incomeDocumento1 paginaJavier v. Ancheta (CTA) ruling on erroneous bank transfer as taxable incomeGSSNessuna valutazione finora

- Jaravata v. SandiganbayanDocumento1 paginaJaravata v. SandiganbayanGSSNessuna valutazione finora

- Hapag-Lloyd Container Specifications GuideDocumento48 pagineHapag-Lloyd Container Specifications GuideRobertLouisNoyaNessuna valutazione finora

- Physical Distribution of LogisticsDocumento20 paginePhysical Distribution of LogisticsDrisya K DineshNessuna valutazione finora

- NATO AECTP-240 MECHANICAL CONDITIONS DOCUMENTDocumento395 pagineNATO AECTP-240 MECHANICAL CONDITIONS DOCUMENTKeith NeumanNessuna valutazione finora

- Marine Products ExportDocumento76 pagineMarine Products Exportpradeepsiib80% (5)

- Mooney M20J Manual Updates and Service PartsDocumento835 pagineMooney M20J Manual Updates and Service PartsJUAN BAEZA PAREDES100% (2)

- Cargo Hold CleaningDocumento6 pagineCargo Hold CleaningSoyHan BeLen100% (1)

- Tariffs & Pricing in Liner ShippingDocumento25 pagineTariffs & Pricing in Liner ShippingDeepesh Shenoy100% (1)

- HD 9 Manual 5900123 Rev F 10 1 13Documento60 pagineHD 9 Manual 5900123 Rev F 10 1 13Karito NicoleNessuna valutazione finora

- 160000MT White Sugar Cane Tender On Edition 2Documento31 pagine160000MT White Sugar Cane Tender On Edition 2KoMoLoKo100% (1)

- CanRail - User Guide v1.1Documento51 pagineCanRail - User Guide v1.1Alex GeorgeNessuna valutazione finora

- About TVSDocumento39 pagineAbout TVSVinodh Kumar LNessuna valutazione finora

- Schneider Shipment Tender: Online Carrier Check-InDocumento3 pagineSchneider Shipment Tender: Online Carrier Check-InfernandoNessuna valutazione finora

- Mohammad Fasih Akhter: Genuine Communicative Independent Ethical Intelligent DrivenDocumento4 pagineMohammad Fasih Akhter: Genuine Communicative Independent Ethical Intelligent DrivenFasih Akhter BaigNessuna valutazione finora

- Supply Chain & Freight ExamDocumento5 pagineSupply Chain & Freight ExamVishwas JNessuna valutazione finora

- Warehousing PPT TemplateDocumento3 pagineWarehousing PPT TemplateSandip BesraNessuna valutazione finora

- Sana Logistics WarehoseDocumento17 pagineSana Logistics WarehoseHina0% (1)

- PTC 072715 Nym Ex DCM 001Documento77 paginePTC 072715 Nym Ex DCM 001LOLA PATRICIA MORALES DE LA CUBANessuna valutazione finora

- C 10Documento90 pagineC 10Valentine MichaelangeloNessuna valutazione finora

- Shipping VocabularyDocumento11 pagineShipping VocabularyNoe S. SoriaNessuna valutazione finora

- Bulk Handling ManualDocumento45 pagineBulk Handling Manualabinbbm1495100% (1)

- Maersk Line Vs CA DigestDocumento2 pagineMaersk Line Vs CA DigestHans B. TamidlesNessuna valutazione finora

- Iron Ore Fines Triton 2-2010Documento2 pagineIron Ore Fines Triton 2-2010Anastasis ThemelakisNessuna valutazione finora

- English in Shipping and Maritime LawDocumento188 pagineEnglish in Shipping and Maritime LawPaulo VukovićNessuna valutazione finora

- CroDocumento2 pagineCroAqeel AhmedNessuna valutazione finora

- Elements of Aviation SecurityDocumento7 pagineElements of Aviation SecurityZainab AshrafNessuna valutazione finora

- Procedure and Steps Involved in Import of GoodsDocumento13 pagineProcedure and Steps Involved in Import of GoodsDevNessuna valutazione finora

- Hazardous Materials Transportation Training ModulesDocumento41 pagineHazardous Materials Transportation Training ModulesClarence PieterszNessuna valutazione finora

- How Do We Deliver Truck Trailer To You by Sea (Shipping Procedure)Documento16 pagineHow Do We Deliver Truck Trailer To You by Sea (Shipping Procedure)DTG GroupNessuna valutazione finora

- English Logistics Unit 8Documento8 pagineEnglish Logistics Unit 8Enith1570% (1)

- Airport SchipolDocumento12 pagineAirport Schipolteuku riza syahrialNessuna valutazione finora