Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Buscom Sample Prob

Caricato da

Joresol AlorroTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Buscom Sample Prob

Caricato da

Joresol AlorroCopyright:

Formati disponibili

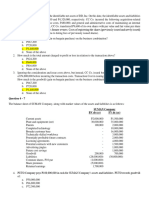

On Dec.

31, 20x4, PP Corporation enters into a business combination by acquiring the assets and assumed the liabilities

of SS Corporation in which SS Corp. will be dissolved. PP’s consideration transferred consist of the ff:

- 25,000 unissued shares of its P10 par common stock, with MV of P25.

- P150,000 in long term 8% notes payable, and

- a contingent payment of P100,000 on Jan. 1, 20x7, if the average income of during the 2-year period of 20x5

and 20x6 exceeds P250,000 per year. PP estimates that there is a 30% chance or probability that the P100,000

payment will be required.

In addition, PP pays the ff at the time of merger:

- finder’s fee P10,000

- accounting fees P20,000

- legal fees to arrange the buscom P35,000

- cost of SEC registration of stocks, including legal fees P15,000

- cost of printing and issuing stocks certificate P12,000

- indirect cost of combining including executive salaries and overhead P23,000

Balance sheet and FV information for the 2 corporations on Dec. 31, 20x4, immediately before the merger are as

follows:

PP SS

BV FV BV FV

Cash 230,000 230,000 20,000 20,000

AR-net 80,000 80,000 40,000 40,000

Inventories 240,000 300,000 100,000 60,000

Land 90,000 200,000 60,000 200,000

Buildings – net (10 year) 400,000 600,000 200,000 300,000

Equipment – net (5 yr) 360,000 490,000 180,000 250,000

In-process R&D 0 0 0 50,000

AP 180,000 180,000 60,000 60,000

Other Liabilities 200,000 180,000 120,000 140,000

Common stock at par 600,000 200,000

APIC 200,000 160,000

RE 220,000 60,000

REQUIRED:

1. Goodwill or gain

2. Entries by PP Corporation to record the acquisition…

3. The balance of the ff. immediately after the acquisition:

1. Cash

2. Goodwill (if there is any)

3. APIC in excess of Par

4. Retained Earnings

4. Construct PP Corporation Balance Sheet as December 31, 20x4

Potrebbero piacerti anche

- Project in Government Accounting and Accounting FoDocumento11 pagineProject in Government Accounting and Accounting FoRosy MoradosNessuna valutazione finora

- BusCom AssetAcquisitionDocumento5 pagineBusCom AssetAcquisitionDanna Claire0% (1)

- Rizal Module 1Documento21 pagineRizal Module 1Joresol Alorro100% (5)

- 1 Question-1Documento5 pagine1 Question-1Varchas0% (2)

- DIFFICULTDocumento7 pagineDIFFICULTQueen ValleNessuna valutazione finora

- 2 - BuscomDocumento9 pagine2 - BuscomDeryl GalveNessuna valutazione finora

- Problems Chapter 7-1: RequiredDocumento16 pagineProblems Chapter 7-1: RequiredTanyelle Louv0% (1)

- Business CombinationDocumento8 pagineBusiness CombinationCharla SuanNessuna valutazione finora

- ST Chapter 1 2Documento3 pagineST Chapter 1 2Joresol AlorroNessuna valutazione finora

- Oiler ReviewerDocumento6 pagineOiler ReviewerJoresol AlorroNessuna valutazione finora

- Business Strategy: Section A Q1Documento9 pagineBusiness Strategy: Section A Q1Flash PartiesNessuna valutazione finora

- SeatworkDocumento10 pagineSeatworkRochelle Mae DiestroNessuna valutazione finora

- Net Asset AcquisitionDocumento2 pagineNet Asset AcquisitionRafael BarbinNessuna valutazione finora

- Net Asset AcquisitionDocumento2 pagineNet Asset AcquisitionRafael BarbinNessuna valutazione finora

- Set A: Problem 1Documento6 pagineSet A: Problem 1FINAH MEL DIVINANessuna valutazione finora

- Lesson Title: Business Combination (Part 1) : Learning Targets: MDocumento4 pagineLesson Title: Business Combination (Part 1) : Learning Targets: MjhammyNessuna valutazione finora

- Name: Section: Date:: Angel SantaDocumento5 pagineName: Section: Date:: Angel SantaJoebet DebuyanNessuna valutazione finora

- Conso FS LessonDocumento54 pagineConso FS Lessondbpcastro8Nessuna valutazione finora

- BUSINESS COMBI (Activity On Goodwill Computation) - PALLERDocumento5 pagineBUSINESS COMBI (Activity On Goodwill Computation) - PALLERGlayca PallerNessuna valutazione finora

- Accounting GovernmentDocumento21 pagineAccounting GovernmentJolianne SalvadoOfcNessuna valutazione finora

- Unit II CFS Subsequent To Date of AcquisitionDocumento10 pagineUnit II CFS Subsequent To Date of AcquisitionDaisy TañoteNessuna valutazione finora

- Business CombinationDocumento3 pagineBusiness Combinationlov3m3Nessuna valutazione finora

- Finals Quiz 2 Buscom Version 2Documento3 pagineFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNessuna valutazione finora

- Business Combi PDF FreeDocumento13 pagineBusiness Combi PDF FreeEricka RedoñaNessuna valutazione finora

- Module 2 Foundation ProblemDocumento4 pagineModule 2 Foundation ProblemasdasdaNessuna valutazione finora

- Partnership Formation Activity 1 January 28 2023Documento12 paginePartnership Formation Activity 1 January 28 2023Jerlyn SaynoNessuna valutazione finora

- Corporate Liquidation (Integration) PDFDocumento5 pagineCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Multiple Choice Problems 9Documento15 pagineMultiple Choice Problems 9Dieter LudwigNessuna valutazione finora

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocumento6 pagineCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONessuna valutazione finora

- C1 Buscom Classroom Activity With AnswersDocumento3 pagineC1 Buscom Classroom Activity With AnswerskimberlyroseabianNessuna valutazione finora

- Acct52 Buisness Combination QuizesDocumento24 pagineAcct52 Buisness Combination QuizesCzarmae DumalaonNessuna valutazione finora

- ABC CH1 SeatworkDocumento3 pagineABC CH1 SeatworkMaurice AgbayaniNessuna valutazione finora

- Financial Statements PreparationDocumento6 pagineFinancial Statements Preparationana lopezNessuna valutazione finora

- AA 4101 Midterm With AnswersDocumento9 pagineAA 4101 Midterm With AnswersAlyssa AnnNessuna valutazione finora

- Business Com ActivityDocumento2 pagineBusiness Com ActivityAlyssa AnnNessuna valutazione finora

- Cash Flow 05 With Answers Just Give SolutionsDocumento21 pagineCash Flow 05 With Answers Just Give SolutionsEdi wow WowNessuna valutazione finora

- Chapter 14 Advacc2Documento58 pagineChapter 14 Advacc2Aimee DyingNessuna valutazione finora

- ACCTG 14 Lesson 1 Introduction To Business Combination ExercisesDocumento4 pagineACCTG 14 Lesson 1 Introduction To Business Combination ExercisesRUBIO FHEA J.Nessuna valutazione finora

- Soal Akuntansi LanjutanDocumento2 pagineSoal Akuntansi LanjutanDion Bonaventura ManaluNessuna valutazione finora

- Learning Unit 7 - Elimination of Intragroup TransactionsDocumento61 pagineLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNessuna valutazione finora

- Pricilla AFAR Question PaperDocumento2 paginePricilla AFAR Question PaperjasonnumahnalkelNessuna valutazione finora

- PROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan IDocumento4 paginePROBLEM 1: Intercompany Transfer of Inventory: Asistensi Akuntansi Keuangan Lanjutan Izsaw zsawNessuna valutazione finora

- Malabanan - Activity Chapter 2 2 PDFDocumento5 pagineMalabanan - Activity Chapter 2 2 PDFJv MalabananNessuna valutazione finora

- Manatad - Accounting 14NDocumento5 pagineManatad - Accounting 14NJullie Carmelle ChattoNessuna valutazione finora

- Problems Week 1 2Documento6 pagineProblems Week 1 2Maria Jessa HernaezNessuna valutazione finora

- Consolidated FS ExerciseDocumento6 pagineConsolidated FS ExerciseJealyn Noblesa LlagasNessuna valutazione finora

- Fernandez Acctg 14N Finals ExamDocumento5 pagineFernandez Acctg 14N Finals ExamJULLIE CARMELLE H. CHATTONessuna valutazione finora

- Bus Com 12Documento3 pagineBus Com 12Chabelita MijaresNessuna valutazione finora

- Accounting 315 - Quiz Business CombinationDocumento5 pagineAccounting 315 - Quiz Business CombinationAlexNessuna valutazione finora

- Cash Flow ProblemsDocumento9 pagineCash Flow ProblemsSharu BsNessuna valutazione finora

- GPV & SCF (Assignment)Documento16 pagineGPV & SCF (Assignment)Mica Moreen GuillermoNessuna valutazione finora

- Book Value Fair Value Book Value Fair ValueDocumento18 pagineBook Value Fair Value Book Value Fair ValueCharla SuanNessuna valutazione finora

- Financial Statements Answers FFFFFFFFFFF PDFDocumento27 pagineFinancial Statements Answers FFFFFFFFFFF PDFJHEYNessuna valutazione finora

- Problem 2.3.Documento4 pagineProblem 2.3.ArtisanNessuna valutazione finora

- Buscom 3Documento4 pagineBuscom 3dmangiginNessuna valutazione finora

- Ga ParcorDocumento3 pagineGa ParcorSky RamirezNessuna valutazione finora

- PARTNERSHIP Formation and OperationDocumento6 paginePARTNERSHIP Formation and OperationDaniela ParreñoNessuna valutazione finora

- Drill Business CombinationDocumento4 pagineDrill Business CombinationPrankyJellyNessuna valutazione finora

- AssignmentDocumento3 pagineAssignmentJayzell MonroyNessuna valutazione finora

- Problem: I - Comprehensive Problem: Goodwill Computation With Contingent ConsiderationDocumento5 pagineProblem: I - Comprehensive Problem: Goodwill Computation With Contingent Considerationasdasda100% (4)

- Problem ADocumento3 pagineProblem AadieNessuna valutazione finora

- 150.curren and Non Current Assets and Liabilities 2Documento3 pagine150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNessuna valutazione finora

- Multi-Year Consolidation: Non-Controlling Interests Recognised at Fair ValueDocumento37 pagineMulti-Year Consolidation: Non-Controlling Interests Recognised at Fair ValuewarsidiNessuna valutazione finora

- Enabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesDa EverandEnabling the Business of Agriculture 2016: Comparing Regulatory Good PracticesNessuna valutazione finora

- Container Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortDa EverandContainer Port Performance Index 2022: A Comparable Assessment of Performance Based on Vessel Time in PortNessuna valutazione finora

- Stat Analysis Module 1Documento4 pagineStat Analysis Module 1Joresol AlorroNessuna valutazione finora

- A. Sources of Measurement DifferencesDocumento4 pagineA. Sources of Measurement DifferencesJoresol AlorroNessuna valutazione finora

- Hbo Module 1Documento11 pagineHbo Module 1Joresol Alorro100% (1)

- Getting Started in Research PaperDocumento2 pagineGetting Started in Research PaperJoresol AlorroNessuna valutazione finora

- Accounting For Special TransactionDocumento2 pagineAccounting For Special TransactionJoresol AlorroNessuna valutazione finora

- PROJECT ProposalDocumento4 paginePROJECT ProposalJoresol Alorro50% (4)

- AA LiabilitiesDocumento2 pagineAA LiabilitiesJoresol AlorroNessuna valutazione finora

- Galindo Part 1Documento10 pagineGalindo Part 1Joresol AlorroNessuna valutazione finora

- Op EdDocumento15 pagineOp EdJoresol AlorroNessuna valutazione finora

- Problem 8 COSTDocumento2 pagineProblem 8 COSTJoresol AlorroNessuna valutazione finora

- Mathematics in NatureDocumento6 pagineMathematics in NatureJoresol AlorroNessuna valutazione finora

- Discover MindorDocumento49 pagineDiscover MindorJoresol Alorro100% (1)

- 6-Final AccountsDocumento43 pagine6-Final AccountsPriya RanjanNessuna valutazione finora

- Debt Securities MarketDocumento21 pagineDebt Securities MarketILOVE MATURED FANSNessuna valutazione finora

- Corp Fin Test 2 PDFDocumento9 pagineCorp Fin Test 2 PDFT Surya Kandhaswamy100% (2)

- Blackrock PeriodicDocumento2 pagineBlackrock Periodicsameer1987kazi4405Nessuna valutazione finora

- GROUP ASSIGNMENT - 7-ELEVEN COMPANY - PDFDocumento17 pagineGROUP ASSIGNMENT - 7-ELEVEN COMPANY - PDFNurul AzlinNessuna valutazione finora

- Angel Investor List - Smallbiz America CapitalDocumento6 pagineAngel Investor List - Smallbiz America CapitalJohn BanaskiNessuna valutazione finora

- Consolidated Technique Procedure4Documento45 pagineConsolidated Technique Procedure4imamNessuna valutazione finora

- 2nd Midterm Quiz Assignment QuestionnaireDocumento6 pagine2nd Midterm Quiz Assignment QuestionnaireAthena Fatmah AmpuanNessuna valutazione finora

- IFA s2 2Documento17 pagineIFA s2 2Ксения НиколоваNessuna valutazione finora

- Market-Neutral Strategies: An All-Weather Investment OptionDocumento12 pagineMarket-Neutral Strategies: An All-Weather Investment OptionfelipeNessuna valutazione finora

- Intacc ReceivablesDocumento9 pagineIntacc Receivablesaugustokita5Nessuna valutazione finora

- December 2021 Financial Acocunting and Reporting UK GAAPDocumento11 pagineDecember 2021 Financial Acocunting and Reporting UK GAAPChoo LeeNessuna valutazione finora

- ACCA Chapter 1Documento37 pagineACCA Chapter 1oakleyhouNessuna valutazione finora

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Documento8 pagineIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloNessuna valutazione finora

- Cash Flow Online April 6 2024 For StudentsDocumento5 pagineCash Flow Online April 6 2024 For Studentsraven.jumaoas.eNessuna valutazione finora

- Chapter 6 - Using Discounted Cash Flow Analysis To Make Investment DecisionsDocumento14 pagineChapter 6 - Using Discounted Cash Flow Analysis To Make Investment DecisionsSheena Rhei Del RosarioNessuna valutazione finora

- Chapter 1 - FMDocumento23 pagineChapter 1 - FMYoutube OnlyNessuna valutazione finora

- Sharpe Ratio: R R E (R RDocumento17 pagineSharpe Ratio: R R E (R Rvipin gargNessuna valutazione finora

- Merger Between RIL and RPLDocumento3 pagineMerger Between RIL and RPLSaurabh LambaNessuna valutazione finora

- ACCT 221 Chapter 2Documento29 pagineACCT 221 Chapter 2Shane Hundley100% (1)

- Plca Reconciliations Answers To Questions 1Documento4 paginePlca Reconciliations Answers To Questions 1amna zamanNessuna valutazione finora

- Case 8 Finance CPK - Syndicate 2 YP56BDocumento13 pagineCase 8 Finance CPK - Syndicate 2 YP56BBerni RahmanNessuna valutazione finora

- Pertemuan 1 - Shareholder EquityDocumento11 paginePertemuan 1 - Shareholder EquityIvonie NursalimNessuna valutazione finora

- Business Studies Chapter 22 Statement of Financial PositionDocumento8 pagineBusiness Studies Chapter 22 Statement of Financial Position牛仔danielNessuna valutazione finora

- Op Transaction History 04!07!2023Documento13 pagineOp Transaction History 04!07!2023Sachin PatelNessuna valutazione finora

- Chapter - Strategy Implementation MCQDocumento11 pagineChapter - Strategy Implementation MCQgamergeeeNessuna valutazione finora

- Pintaras-AnnualReport 2000Documento50 paginePintaras-AnnualReport 2000Alex PutuhenaNessuna valutazione finora

- Chapter 1Documento29 pagineChapter 1MadCube gamingNessuna valutazione finora