Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Lesson 7 - Audit Evidence

Caricato da

Allaina Uy Berbano0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni7 pagine1. Audit evidence comes in various forms including physical items, documentation, confirmations, analytical procedures, and representations. More competent evidence that is more relevant and objective provides a stronger basis for the auditor's opinion.

2. The sufficiency and appropriateness of evidence is determined based on materiality, risk, and cost considerations. Auditors aim to obtain enough evidence to remove doubt about financial statement assertions while minimizing costs.

3. Common types of evidence include physical items, mathematical recomputations, documentation, representations from management and third parties, internal control evaluation, analytical procedures, and subsequent events review. Each type of evidence provides different levels of assurance regarding financial statement accounts and assertions.

Descrizione originale:

Titolo originale

Lesson 7 - Audit Evidence.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documento1. Audit evidence comes in various forms including physical items, documentation, confirmations, analytical procedures, and representations. More competent evidence that is more relevant and objective provides a stronger basis for the auditor's opinion.

2. The sufficiency and appropriateness of evidence is determined based on materiality, risk, and cost considerations. Auditors aim to obtain enough evidence to remove doubt about financial statement assertions while minimizing costs.

3. Common types of evidence include physical items, mathematical recomputations, documentation, representations from management and third parties, internal control evaluation, analytical procedures, and subsequent events review. Each type of evidence provides different levels of assurance regarding financial statement accounts and assertions.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni7 pagineLesson 7 - Audit Evidence

Caricato da

Allaina Uy Berbano1. Audit evidence comes in various forms including physical items, documentation, confirmations, analytical procedures, and representations. More competent evidence that is more relevant and objective provides a stronger basis for the auditor's opinion.

2. The sufficiency and appropriateness of evidence is determined based on materiality, risk, and cost considerations. Auditors aim to obtain enough evidence to remove doubt about financial statement assertions while minimizing costs.

3. Common types of evidence include physical items, mathematical recomputations, documentation, representations from management and third parties, internal control evaluation, analytical procedures, and subsequent events review. Each type of evidence provides different levels of assurance regarding financial statement accounts and assertions.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 7

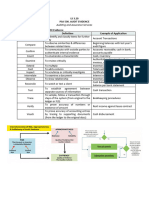

1.

More competent Less evidence

Audit Evidence, Procedures, 2. More material More evidence

3. Greater audit risk More evidence

and Working Papers 4. Prior years’ experience with client

CLIENT ASSERTIONS COMPETENCE OF AUDIT EVIDENCE

representations by mgmt. that are embodied in the quality or reliability of evidence to support opinion

FS, presented in the FS on FS

Auditor must verify the validity of these assertions, Guidelines:

must obtain and evaluate audit evidence that will 1. Obtained outside > Obtained within

prove or refute mgmt. representations 2. Good IC > Weak IC

3. Obtained directly > Obtained indirectly

Existence or occurrence 4. Written > Oral

- assets and liab presented actually exist as of the

balance sheet date DESIRABLE CHARACTERISTICS OF AN EVIDENCE

- transactions were recorded in the appropriate Relevance

accounting period - evidence must support or refute acct info

Completeness Freedom from Bias

- all transactions that occurred during the period - evidence should not tend to unduly support one

under audit were recorded decision to the disadvantage of another possible

Rights and Obligation decision

- assets are rights of the company while the Objectivity

recorded liab are actual obli of the company as of a - capability of an evidence to enable diff authors to

given date arrive at similar decision based upon the same set

Valuation or Allocation of evidence

- amounts are in the FS at appropriate amounts Persuasiveness

Presentation and Disclosure - sufficient & appropriate to form opinion

- accounts and info in the FS are properly classified, - can be evaluated only after considering the

described and discussed combination of appropriateness & sufficiency

- applies to the judgment

AUDIT EVIDENCE - Guidelines:

1. Satisfaction of auditor

NATURE OF AUDIT EVIDENCE a. Depreciation expense

Evidence – data or info assembled by an auditor b. Bad debts, doubtful accounts

that corroborates or refutes an item under audit c. Estimated liability for product warranty

– any info used by the auditor to determine 2. Within cost limits, obtained at a reasonable

whether the info being audited is in accordance w cost and within reasonable time.

the established criteria (PFRS) auditor’s goal: obtain a sufficient amt of

– used to help draw conclu about a subject matter appropriate evidence at lowest total cost

under study 3. Continue gathering evidence to remove

Evidence may consist of: substantial doubt on material items on FS

1. Underlying accounting data 4. Not examine based on 100%, only a selective

a. Books of original entries (journals) test (Sampling)

b. Ledgers

c. Worksheets w computations, ie. cost TYPES OF AUDIT EVIDENCE

allocation, reconciliation, etc 1. Physical Evidence

2. Corroborating information (Confirm) - inspection/count of a tangible asset

a. Checks - satisfies existence but not valuation and rights

b. invoices & obli

c. confirmation replies - requires:

d. minutes of meetings o examination of assets

e. Contracts on file o observation of client’s procedures

f. Data obtained by the auditor from inquiries, - normally for cash, inventories, equipment,

observation, physical examination, investments, bldgs., etc.

recomputations, etc. - provides assurance as to existence and should

No evidence = No audit be supplemented by other evidence to

determine ownership, valuation and quality of

SUFFICIENCY OF AUDIT EVIDENCE condition

quantity of evidence auditor should obtain to - Existence: verifies that an asset actually exists

support their opinion on FS

Guidelines in deciding:

Completeness: determine whether the assets a) Auditor must confirm AR

physically examined are actually recorded on b) Auditors control mailing & receipt of replies

the books c) Electronic confirmations are permitted

2. Mathematical Recomputations - Who prepares the confirmation request?

- recheck the accuracy of computations by client the client using the confirmation form

- except those needing other experts template prepared by the auditor

- Ex: extending sales invoices and inventory, Who sends the confirmation request?

adding journals and subsidiary records and the auditor

checking calculations of Dep Exp To whom should the third party reply?

3. Documentation Directly to the auditor.

- examination of supporting docus of recorded - Positive or Negative Confirmation

transactions and info appearing in FS 5. Representation by Client Personnel

- matching recorded transactions w - statements in answer to queries posed by

corresponding documents auditors

- Classifications: - obtaining of written or oral info from the client in

a. From outside client company and used by response to questions from the auditor

client (vendor’s invoices, insurance - has very limited reliability value, not usually

policies) regarded as conclusive evidence, must

b. From inside client company and used by corroborated w other types of procedures to

outside org (checks, sales invoices, debit obtain sufficient appropriate evidence

and credit memos) 6. Data Interrelationship from Analytical Review

c. From inside client company and used by Procedures

client (journals, vouchers, payroll record) - examination and comparison of relationships

- Internal Documents among data

prepared and used w/in the client’s org and - understand the client’s industry and business

are retained wo ever going to an outside - assess the entity’s ability to continue as a going

party concern

Ex: duplicate sales invoices, official - Indicate the presence of possible

receipts, employees’ time reports, and misstatements in the financial statements

receiving reports - Reduce detailed audit tests

- External Documents 7. Internal Control

handled by someone outside the client's - adequate and operating IC policies &

org who is a party to the transac being procedures enhance the reliability

documented but w/c are either currently - adequate IC = strong evidence of validity

held by the client or readily accessible - Caution:

Ex: vendors’ invoices, insurance policies, 1) Not rely completely on IC structure to

board resolutions under the custody of a gather evidence, but to merely restrict the

third party legal counsel appointed as application of audit procedures

corporate secretary 2) To restrict audit procedures = not to

more reliable than internal eliminate entire audit procedures

4. Representation by Third Parties or Confirmations 8. Subsequent Events

- from outside client company and sent directly to - events or transactions occurring subsequent to

auditor the BS date but before the issuance of audited

- More reliable than documentation FS and auditor’s opinion

- Examples: Release of

a. Bank confirmation Bal Sheet Subsequent

Date Events Audited FS &

b. AR confirmation Opinion

c. AP confirmation

d. Bond trustees Adjusting Non-Adjusting

- Success depends on ff factors: Events Events

1) parties requested to confirm are

knowledgeable Adjusting Events Non-Adjusting Events

2) auditor had a free hand in selecting parties provide addt’l evidence w provide evidence w

or samples respect to conditions respect to conditions not

3) auditors personally and directly mailed the existed on the BS date existing on the BS date

confirmation requests and affect the estimates but occur subsequent to

4) replies or returned requests are received inherent in the process of that date

directly by auditor wo interception by client prep of FS

5) exceptions expressed by third parties are Contingent Liab Addt’l issues of stocks

verifies by the auditor and discussed w after BS date

client

- Requirements: 9. Reperformance

- auditor’s independent tests of client acct o third party is requested to respond directly to

procedures or controls that were originally done the auditor regardless of whether former

10. Observation agrees or disagrees w info in request

- Use one’s senses to assess client activities. o used when: amount to be confirmed is

- Tour plant to obtain a general impression of material or when IC structure is inadequate

client’s facilities. and does not provide reasonable assurance

- Observation is rarely sufficient by itself. that the balances are accurate

- Often need to corroborate w another kind of - Negative Confirmation

evidence o third party is requested to respond directly

- rarely sufficient because of the risk of client only if the auditor disagrees w the info in

personnel changing their behavior because of request

the auditor’s presence o high risk of arriving at incorrect conclu

o used when: amount to be confirmed is small

or when IC structure is effective and provides

a reasonable assurance that balances are

accurate

3. Vouching

- examination of supporting documents of

transactions

- from the books of accounts to source docus

- “tracing back”

- from accounting records to supporting docu

- existence

4. Tracing

- tracing of docus to acct records w/c follows

reverse rule of vouching

- from sources docus to records

- from supporting docu to the accounting records

- completeness

5. Reperformance

- reviewing the work done by client staff to check

its accuracy

6. Observation

- witnessing the activities of client’s staff

7. Reconciliation

- determining agreement between sets of records

- independently maintained but related records

8. Inquiry

- asking questions to facilitate performance of

AUDIT OBJECTIVES subsequent audit steps

9. Inspection

developed by auditor to ensure only relevant

- critical examination of forms and docus to

evidence will be obtained

determine proper treatment in acct records &

Ex: Inventory balance

FS

10. Analytical Review Procedures

AUDIT TECHNIQUES AND PROCEDURES

- study of relationships, rations and trends

Audit Techniques: to achieve audit objectives 11. Scan

Audit Procedures: 12. Read

o to verify mgmt. assertions 13. Foot

o to obtain sufficient competent evidence that 14. Compare

will prove the truth or falsity of the assertions

in the FS AUDIT PROCEDURES ACCORDING TO PURPOSE

o Examples: Test of Controls Substantive Tests

1. Physical Examination (Compliance Test)

- to gather physical evidence To determine To verify assertions of

- Ex: cash & securities counts effectiveness of design & mgmt. re. FS components

2. Confirmation ope of IC structure

- involves requesting a third party to affirm

accuracy of items per records maintained by the EXAMPLES OF AUDIT PROCEDURES

client Existence or Occurrence

- Positive Confirmation 1. Inv existence: inventory observations, test counts

2. AR existence: confirmation

3. Cash existence: cash counts, bank recon 3. To express opinion on the fairness of FS, not to

4. Sales/Exp: examine relevant docus, analytical discover errors/irregularities

review procedures 4. Subject to inherent limitations of IC structure

Completeness undetected material errors/irregularities do not

1. Cash count mean negligence of auditor as long as the

2. Bank recon and cut-off bank statements examination was made in accordance w

3. Year-end accrual for payroll GAAS/PSA

4. Unrecorded liab by examining payments in next year

Rights and Obligations Actions to be taken where the auditor suspects errors or

1. Passbooks and bank statements irregularities

2. Loan agreements w creditors Material:

3. Evidence proving ownership of properties and equip 1. Discuss w mgmt. or w BOD + addt’l investigation

4. Cost of capitalized lease and lease contract 2. Obtain further evidence to know if fraud or

Valuation or Allocation irregularities exist

1. Conversion rate for foreign currency 3. Consult client’s counsel involving law

2. Recalculate prepaid expenses 4. Make necessary corrections

3. Allowance for doubtful accounts 5. Qualify opinion, disclaim or withdraw

4. Inventory pricing 6. If withdraw, consult their own counsel

Presentation & Disclosure

1. Significant assets pledged as collaterals for liab, and Immaterial:

if so, properly disclose in the notes to FS 1. Discuss w mgmt. (at least one rank higher those

2. Restriction by creditors involved)

3. Propriety of accounts classified into CA, 2. Pursue a conclu

Investments, PPE, etc. 3. Consider possibility of errors or irregularities in

4. Naming of accounts (RE vs. Earned Surplus) other control procedures

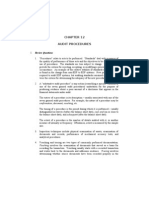

TYPES OF SUBSTANTIVE TESTS WORKING PAPERS

Analytical Review Test of Details documents accumulated showing procedures

Procedures performed, audit testing applied, info obtained, &

Study of relationships Examination of items or conclusions

among financial & non- details in acct balance or connecting link among client’s acct records, FS, &

financial data transaction class. audit report

Provides evidence on Obtain evidence that will only tangible evidence of compliance w generally

reasonableness of acct either substantiate or accepted auditing standards after the audit

balance identify misstatements

A. Test of Balances PURPOSES OF WORKING PAPER PREPARATION

- tests that make up the Primary

acct balance 1. To aid auditor in conduct & supervision

B. Test of Transactions 2. To provide proof of compliance w the standards of

- test to support entries in field work, i.e., planning, supervision, IC structure.

the acct 3. Principal support for auditor’s opinion

- debit or credit side Secondary

1. To aid in planning & conducting future audits

ERRORS & IRREGULARITIES 2. To provide info useful in MAS

3. To provide info needed for income tax return

Error Irregularities 4. To provide defense in case of litigation for

Unintentional mistakes Intentional manipulation malpractice

of records or FS for the

benefit of the entity under DESIRABLE QUALITITES OF AUDIT WP

audit, mgmt., employees, 1) Adequate planning & supervision of audit

third parties engagement

Fraudulent financial 2) Study & eval of IC structure and its NTE of audit

reporting (Mgmt.) procedures applied

Misappropriation of 3) Sufficiency & competence of evidence gathered to

assets (employees) support auditor’s opinion

Auditors has to plan examination to search for

errors and irregularities that materially distort FS. CLASSIFICATIONS OF AUDIT WORKING PAPERS

A. Permanent File

Expectation Gap - info of continuing significance to auditor in

Auditors conduct examination: performing recurring & current audits

1. Based on selective tests (sampling) - mostly accumulated during initial audit

2. Subject to inherent risks

- reference source for new staff members in J. Inventories:

aa. Summary showing quantity, cost, market & final

knowing client and for more experienced auditor valuation

in planning current year’s audit bb. Copy of inventory summary submitted w the BIR

- intended to contain data of a historical or cc. Confirmation replies

continuing nature pertinent to the current audit K. Prepayments

aa. Analysis of ledger accounts

- usual contents: bb. Detailed analysis & compu of Prep Exp

1. Articles of incorporation and by-laws

L. Investments & related dividend & Int Income:

2. Copies of significant contracts (loan agreements, bond

aa. Analysis of ledger accounts

indenture, pension plans, etc.)

bb. Analysis showing composition properly reconciled

3. Summary indicating:

cc. Securities count sheet

A. Audit report requirements

dd. Confirmation replies

aa. To the BOD or stockholders

M. AP & Accrued Expense:

bb. To banks

aa. Analysis of ledger accounts

cc. To gov’t regulatory agencies

bb. Schedule of creditors’ balances

B. Description of company and its ope

cc. Summary of confirmation results

C. Company ownership

dd. Confirmation replies

D. Company mgmt.

N. NP & related Int Exp:

4. Org chart

aa. Analysis of ledger accounts

5. Chart of accounts

bb. Schedule of notes & related int reconciled

6. Copy of company acct procedures and control manual (IC)

cc. Confirmation replies

7. Continuing analyses of:

O. Analysis of significant Inc Statement Accts

A. PPE related to AccDep

4. Tax folder

B. Long-term liab

A. Letter to and from the BIR

C. SH’s equity accounts

B. Pending tax assessments, if any

8. Results of analytical procedures from previous years’ audits

C. Draft of audit report to accompany ITR

D. Draft of ITR

B. Current File E. Peculiar accounts form inc tax computations

- evidence gathered & conclu reached relevant to aa. Non-taxable items

the audit of particular year bb. Non-deductible items

cc. Credible income tax withheld

- audit program, general info, working trial dd. New BIR pronouncements or regulations

balance, adjusting and reclassification entries, 5. Supporting Schedules

supporting schedules A. Analysis

- usual contents: B. Trial Balance or List

1. Administrative folder: C. Reconciliation of amounts

A. Engagement letter D. Tests of reasonableness

B. Audit memorandum, including: E. Summary of procedures

aa. Special audit risk F. Examination of supporting documents

bb. Accts/areas requiring special emphasis G. Informational

cc. Expected client’s assistance H. Outside documentation

dd. Use of internal auditor’s work

ee. Anticipated reliance on IC SOME BASIC CONCEPTS ON AUDIT WP

ff. ICQ & flowcharts relative to study & eval of IC

Ownership & Custody

gg. Audit program

hh. Special disclosures required in the notes to FS property of auditor

2. Correspondence folder: may be useful to client but not theirs

A. Copies of letters to and from mgmt.

B. Management letter

C. Lawyer’s letter Client-Prepared Working Papers

D. Management representation letter client & auditor agree that some schedules,

3. Ledger accounts folder analyses, reconciliations and computations are to

A. Draft of audit report

be prepared by client’s staff for submission to the

B. Draft of FS

C. Working trial bal auditor

D. Adjustments Advantages:

E. Reclassification entries 1. Auditors relieved of unimportant tasks and are

F. Cash account:

aa. Lead schedule for cash

able to devote more time to significant work

bb. Cash count sheets 2. Audit fees reduced

cc. Bank recon

dd. Bank confirmation replies Lead Schedule

G. AR:

aa. Analysis of ledger acct to combine similar accounts for a summarized

bb. Schedule of customers’ balances forwarding to the working trial balance

cc. Summary of confirmation results

dd. Confirmation replies Tick marks

ee. Analysis of ADA

H. NR & related interest: symbols to indicate audit procedures performed

aa. Analysis of ledger accounts - footings checked

bb. Schedule of NR & related interest account

cc. Summary of confirmation results - traced from general ledger

dd. Confirmation replies - confirmation

I. Advances to officers and employees and other rec. - reconciled

aa. Analysis of ledger accounts

bb. Schedules of receivables reconciled w controlling

cc. Confirmation replies Sign Off

signatures or initials of preparer/reviewer affixed & o outside source > within

dated on the working papers 2. Effectiveness of client’s IC

o effective IC > weak IC

Filing and Indexing 3. Auditor’s direct knowledge

Filing o directly through physical exam, observation,

o sequence of working papers in arrangement recalculation, and inspection > indirectly

Indexing & Cross-Indexing through inquiries or exam of supporting

o by using numbers, alphabet or both schedules or docu prepared by the client

o facilitates control, assembly and review of WP 4. Qualification of indiv providing info

o the evidence will not be reliable unless the

GUIDELINES IN PREPARATION OF WP individual providing it is qualified to do so

o For ex, info about the computation of an

Senior, Semi-Senior and Junior Auditors entity’s pension liability should come from an

accumulating working papers actuary that possesses qualifications, skills

Senior Auditor and experience

overall responsibility for completeness 5. Degree of objectivity

Manager o Objective evidence > evidence that requires

review of all wp considerable judgment to determine whether it

Partner-in-Charge is correct

may review on a selective basis before report is 6. Timeliness

signed o when it is accumulated or to the period

covered by the audit

Contains: o For ex, evidence is more reliable for balance

a. Client’s name sheet accounts when it is obtained as close as

b. Ledger account title the balance sheet date as possible. For

c. Balance sheet date for real accounts and year income statement accounts, evidence is more

covered for operating accounts reliable if there is a sample that will cover the

d. Dates and initials of preparers and reviewers trans that happened during the year such as

e. Audit procedure applied by tick marks & legend selecting sample of sales transac for each

f. Identification of docus examined or source of info mon in a year.

g. Appropriate cross referencing to other WP

AUDIT EVIDENCE AND PERSUASIVENESS

AUDIT EVIDENCE DECISIONS Audit Evidence Qualities Affecting Persuasiveness

1. Which audit procedures to use Decisions of Evidence

o audit procedure – detailed instruction that Audit Appropriateness

explains the audit evidence to be obtained procedures & - Relevance

2. What sample size to select for a given procedure timing - Reliability

o Once a procedure is selected, auditors can > Independence of provider

vary the sample size from one to all the items > Effectiveness of IC

in the population being tested > Auditor's direct knowledge

3. Which items to select from the population > Qualifications of provider

o auditor can select (a) sales transactions within > Objectivity of evidence

a particular week or month or (b) examine the - Timeliness

first 50 checks or (c) select 50 checks with the > When procedures are performed

largest amounts, or (d) select the checks > Portion of period being audited

randomly or (e) select those checks that the Sample size & Sufficiency

auditor thinks are most likely to be in error. items to select Adequate sample size

The procedures for the selection of samples Selection of proper popu items

will be discussed further in Audit Sampling

4. When to perform the procedures (timing) AUDIT DOCUMENTATION

o interim phase or year-end principal record of auditing procedures applied,

evidence obtained, and conclusions reached by

AUDIT PROGRAM the auditor in the engagement

action guide for auditors in performing the FS audit to aid the auditor in providing reasonable

lists the detailed procedures to be performed for a assurance that an adequate audit was conducted

particular FS account (e.g. cash, receivables, PPE) in accordance with auditing standards

or a transaction cycle (e.g. revenue cycle, WORKING PAPER (See page 4)

expenditure cycle)

I. Purpose of Audit Documentation

CHARACTERISTICS OF RELIABLE EVIDENCE As a basis for planning the audit

1. Independence of provider

As a tool to summarize and record the evidence

accumulated and conclusion reached therein

during the conduct of the audit.

As a basis for quality control procedures.

As a basis to comply with the auditor’s

professional responsibilities

II. Ownership of Audit Files

Auditor’s

III. Confidentiality of Audit Files

An auditor shall not disclose any confidential info

obtained in the course of a professional

engagement except w the consent of the client,

or if there is legal need to do so.

SARBANES-OXLEY ACT

requires auditors of public companies to prepare &

maintain audit working papers for a period of no

less than seven years

SEC rules require the auditor to maintain copies of

memos, correspondence, communications, other

documents and records, including electronic

records, related to the audit or review

PREPARATION OF AUDIT DOCUMENTATION

Each audit file should be properly identified

Documentation should be indexed and cross-

referenced

Completed documentation must clearly indicate the

audit work performed

It should include sufficient information

It should plainly state the conclusions reached

EFFECT OF TECHNOLOGY

Audit evidence is increasingly in electronic form

Auditors must evaluate how electronic info affects

their ability to gather evidence

Auditors use computers to read and examine

evidence

Software programs are typically Windows-based

Potrebbero piacerti anche

- Lesson 7 - Audit Evidence PDFDocumento7 pagineLesson 7 - Audit Evidence PDFAllaina Uy BerbanoNessuna valutazione finora

- CH 15 - Audit EvidenceDocumento7 pagineCH 15 - Audit EvidenceJwyneth Royce DenolanNessuna valutazione finora

- Audit Working PapersDocumento25 pagineAudit Working PapersImran MobinNessuna valutazione finora

- Jzanzig - Auditing CH 7 LectureDocumento24 pagineJzanzig - Auditing CH 7 LectureMouna MoonyNessuna valutazione finora

- Acctg 163 Review 4Documento9 pagineAcctg 163 Review 4Tressa Salarza PendangNessuna valutazione finora

- Substantive Test VsDocumento2 pagineSubstantive Test VsPrincess TolentinoNessuna valutazione finora

- Audit EvidenceDocumento5 pagineAudit Evidencecvgp1298Nessuna valutazione finora

- Audit EvidenceDocumento39 pagineAudit EvidencetasleemfcaNessuna valutazione finora

- Gathering and Evaluating Audit EvidencesDocumento21 pagineGathering and Evaluating Audit EvidencesJov E. AlcanseNessuna valutazione finora

- Audit PrelimsDocumento10 pagineAudit PrelimsMane NessyNessuna valutazione finora

- Audit EvidenceDocumento16 pagineAudit EvidenceDymphna Ann CalumpianoNessuna valutazione finora

- Module 8 - Substantive Test of Details of AccountsDocumento12 pagineModule 8 - Substantive Test of Details of AccountsMark Angelo BustosNessuna valutazione finora

- Chapter 3: Overview of Auditing Philosophy of Audit Philippine Standards On AuditingDocumento3 pagineChapter 3: Overview of Auditing Philosophy of Audit Philippine Standards On AuditingKendall JennerNessuna valutazione finora

- Audit I CH IVDocumento7 pagineAudit I CH IVAhmedNessuna valutazione finora

- Sa 501,505,510Documento17 pagineSa 501,505,510Krrish KelwaniNessuna valutazione finora

- Test of Controls: AcquisitionsDocumento7 pagineTest of Controls: AcquisitionsVan Jasper VienesNessuna valutazione finora

- Aud EvidenceDocumento14 pagineAud EvidenceJadeNessuna valutazione finora

- LS 3.20 - PSA 500 Audit EvidenceDocumento3 pagineLS 3.20 - PSA 500 Audit EvidenceSkye LeeNessuna valutazione finora

- Lesson 7 Audit EvidenceDocumento13 pagineLesson 7 Audit Evidencewambualucas74Nessuna valutazione finora

- Obtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseDocumento2 pagineObtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseTech for lifeNessuna valutazione finora

- 12 Audit EvidenceDocumento11 pagine12 Audit EvidenceMoffat MakambaNessuna valutazione finora

- Chapter 12 AnsDocumento6 pagineChapter 12 AnsDave Manalo100% (1)

- Topic # 2: Introdu Ction To Auditin GDocumento31 pagineTopic # 2: Introdu Ction To Auditin GRizza OmalinNessuna valutazione finora

- AA-Audit EvidenceDocumento15 pagineAA-Audit EvidenceRafsan JazzNessuna valutazione finora

- Auditing CHAPTER THREEDocumento9 pagineAuditing CHAPTER THREEGetachew JoriyeNessuna valutazione finora

- AT 08 PSA Audit EvidenceDocumento7 pagineAT 08 PSA Audit EvidencePrincess Mary Joy LadagaNessuna valutazione finora

- Auditing 10Documento10 pagineAuditing 10Rose Mae RubioNessuna valutazione finora

- TOPIC 2 Introduction To AuditingDocumento31 pagineTOPIC 2 Introduction To AuditingEricka Alipio AusteroNessuna valutazione finora

- B3 - Audit EvidenceDocumento8 pagineB3 - Audit EvidenceFrank AlexanderNessuna valutazione finora

- Unit 5: Audit EvidenceDocumento10 pagineUnit 5: Audit EvidenceNigussie BerhanuNessuna valutazione finora

- Procedure How Used (Examples) Assertion(s) Tested: Some Examples of How Students Should Answer Qualitative QuestionsDocumento6 pagineProcedure How Used (Examples) Assertion(s) Tested: Some Examples of How Students Should Answer Qualitative QuestionsKhairiNessuna valutazione finora

- Notes PSA 500Documento5 pagineNotes PSA 500Aang GrandeNessuna valutazione finora

- Chapter 4 - Evidential Matter and Its DocumentationDocumento14 pagineChapter 4 - Evidential Matter and Its DocumentationKristine WaliNessuna valutazione finora

- Audit Evidence by DJSDocumento9 pagineAudit Evidence by DJSImtiaz ChowdhuryNessuna valutazione finora

- Chapter 5 Audit EvidenceDocumento6 pagineChapter 5 Audit EvidencebiyaNessuna valutazione finora

- Audit Evidence and Audit ProceduresDocumento17 pagineAudit Evidence and Audit ProceduresVindhaya vasiniNessuna valutazione finora

- AT 07 Audit EvidenceDocumento6 pagineAT 07 Audit EvidenceRandy PaderesNessuna valutazione finora

- Audit Evidence and Documentation HandoutsDocumento16 pagineAudit Evidence and Documentation Handoutsumar shahzadNessuna valutazione finora

- Audit Process - Performing Substantive TestDocumento49 pagineAudit Process - Performing Substantive TestBooks and Stuffs100% (1)

- Chapter 3.auditing Concepts and ToolsDocumento18 pagineChapter 3.auditing Concepts and ToolsHussen AbdulkadirNessuna valutazione finora

- Audit CH 5pptDocumento19 pagineAudit CH 5pptsolomon adamuNessuna valutazione finora

- AT.3004-Nature and Type of Audit Evidence PDFDocumento6 pagineAT.3004-Nature and Type of Audit Evidence PDFSean SanchezNessuna valutazione finora

- AudTheo NoteDocumento2 pagineAudTheo NoteJorelyn Rose BaronNessuna valutazione finora

- AUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Documento11 pagineAUD 1.4 Audit Objectives, Procedures, Evidence and Documentation - 2022Aimee CuteNessuna valutazione finora

- Other PSAs and PAPSsDocumento7 pagineOther PSAs and PAPSsnikNessuna valutazione finora

- Aas 5 Audit EvidenceDocumento4 pagineAas 5 Audit EvidenceRishabh GuptaNessuna valutazione finora

- CH14Documento8 pagineCH14Joyce Anne GarduqueNessuna valutazione finora

- Substantive ProcedureDocumento8 pagineSubstantive ProcedureGoldaNessuna valutazione finora

- Chapter 5 Audit Evidence and DocumentatiDocumento54 pagineChapter 5 Audit Evidence and Documentatipadma adrianaNessuna valutazione finora

- Chapter Five: Audit Evidence and Edp AuditDocumento52 pagineChapter Five: Audit Evidence and Edp AuditFackallofyouNessuna valutazione finora

- Chapter 3 Audit Objectives, Procedures, Evidence, and DocumentationDocumento11 pagineChapter 3 Audit Objectives, Procedures, Evidence, and DocumentationSteffany RoqueNessuna valutazione finora

- Audit Evidence AndTestingDocumento15 pagineAudit Evidence AndTestingSigei LeonardNessuna valutazione finora

- Solution Manual Audit Arens Edisi 12 Chapter7 DikonversiDocumento23 pagineSolution Manual Audit Arens Edisi 12 Chapter7 DikonversiAndrian ArifansaNessuna valutazione finora

- De Guzman Module 7Documento9 pagineDe Guzman Module 7Ma Ruby II SantosNessuna valutazione finora

- Class Activity On Audit EvidenceDocumento5 pagineClass Activity On Audit Evidencealiza tharaniNessuna valutazione finora

- Chapter 4.2022.englishDocumento44 pagineChapter 4.2022.english26 Đỗ Kim NgọcNessuna valutazione finora

- Types and Timing of Audit ProceduresDocumento68 pagineTypes and Timing of Audit ProceduresKana Lou Cassandra Besana100% (1)

- At Evidence and DocumentationDocumento4 pagineAt Evidence and DocumentationaleachonNessuna valutazione finora

- Chapter 13 AnsDocumento4 pagineChapter 13 AnsDave ManaloNessuna valutazione finora

- CISA EXAM-Testing Concept-Knowledge of Compliance & Substantive Testing AspectsDa EverandCISA EXAM-Testing Concept-Knowledge of Compliance & Substantive Testing AspectsValutazione: 3 su 5 stelle3/5 (4)

- Marriage Laws Legal & Canonical Requirements of MarriageDocumento5 pagineMarriage Laws Legal & Canonical Requirements of MarriageAllaina Uy BerbanoNessuna valutazione finora

- Different Callings in Life: Hristian Vision of Marriage & FamilyDocumento3 pagineDifferent Callings in Life: Hristian Vision of Marriage & FamilyAllaina Uy BerbanoNessuna valutazione finora

- The Domestic Church: Home FamDocumento7 pagineThe Domestic Church: Home FamAllaina Uy BerbanoNessuna valutazione finora

- Lesson 6 - Internal Controls PDFDocumento5 pagineLesson 6 - Internal Controls PDFAllaina Uy BerbanoNessuna valutazione finora

- Lesson 5 - Audit Planning PDFDocumento4 pagineLesson 5 - Audit Planning PDFAllaina Uy BerbanoNessuna valutazione finora

- Lesson 6 - Internal ControlsDocumento5 pagineLesson 6 - Internal ControlsAllaina Uy BerbanoNessuna valutazione finora

- Corporate Social Responsibility: Milton FriedmanDocumento3 pagineCorporate Social Responsibility: Milton FriedmanAllaina Uy BerbanoNessuna valutazione finora

- Lesson 5 - Audit PlanningDocumento4 pagineLesson 5 - Audit PlanningAllaina Uy BerbanoNessuna valutazione finora

- Intro To Business Ethics: A. B. C. D. E. FDocumento2 pagineIntro To Business Ethics: A. B. C. D. E. FAllaina Uy BerbanoNessuna valutazione finora

- Product Safety & Pricing: Other Parties Adversely AffectedDocumento4 pagineProduct Safety & Pricing: Other Parties Adversely AffectedAllaina Uy BerbanoNessuna valutazione finora

- Lesson 6 - Internal Controls PDFDocumento5 pagineLesson 6 - Internal Controls PDFAllaina Uy BerbanoNessuna valutazione finora

- Lesson 6 - Internal Controls PDFDocumento5 pagineLesson 6 - Internal Controls PDFAllaina Uy BerbanoNessuna valutazione finora

- Lesson 5 - Audit Planning PDFDocumento4 pagineLesson 5 - Audit Planning PDFAllaina Uy BerbanoNessuna valutazione finora

- Lesson 5 - Audit Planning PDFDocumento4 pagineLesson 5 - Audit Planning PDFAllaina Uy BerbanoNessuna valutazione finora

- What Is A BCG Growth-Share Matrix?: Minglana, Mitch T. BSA 201Documento3 pagineWhat Is A BCG Growth-Share Matrix?: Minglana, Mitch T. BSA 201Mitch Tokong MinglanaNessuna valutazione finora

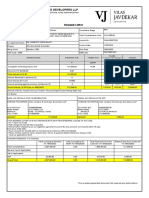

- VJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Documento1 paginaVJ - Digital Demand For O3INV-00372-23 - 20230218T031404875Hardik RavalNessuna valutazione finora

- 02012020fin RT4 PDFDocumento1 pagina02012020fin RT4 PDFPAO TPT PAO TPTNessuna valutazione finora

- 2022 Elite Lite R&R (Updated July 2022)Documento5 pagine2022 Elite Lite R&R (Updated July 2022)AdjNessuna valutazione finora

- 2316 Jan 2018 ENCS FinalDocumento2 pagine2316 Jan 2018 ENCS FinalKirsten Bairan100% (2)

- ACEFIAR Quiz No. 1Documento3 pagineACEFIAR Quiz No. 1Marriel Fate CullanoNessuna valutazione finora

- Marc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFDocumento48 pagineMarc Lavoie - Post-Keynesian Economics - New Foundations-Edward Elgar Publishing LTD (2015) - Páginas-199-246 PDFMaria Alejandra Malaver DazaNessuna valutazione finora

- Assign 2 Cash Flow Basic Sem 1 13 14Documento2 pagineAssign 2 Cash Flow Basic Sem 1 13 14Sumaiya AbedinNessuna valutazione finora

- PW Department CodesDocumento19 paginePW Department CodesanilNessuna valutazione finora

- Rent Vs Buy CalculatorDocumento10 pagineRent Vs Buy Calculatordesai ashokNessuna valutazione finora

- Review Questions: by Kailashinie ThiranagamaDocumento9 pagineReview Questions: by Kailashinie ThiranagamarkailashinieNessuna valutazione finora

- Cancellation Acord Form - CX149661-Ramon Aguilar-Aguila Trucking PDFDocumento1 paginaCancellation Acord Form - CX149661-Ramon Aguilar-Aguila Trucking PDFBryan ArenasNessuna valutazione finora

- 1059 155846588 Fab's Verified Response To Defendants Claims of ExemptionDocumento17 pagine1059 155846588 Fab's Verified Response To Defendants Claims of Exemptionlarry-612445Nessuna valutazione finora

- Act 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Documento34 pagineAct 282 Lembaga Kemajuan Wilayah Pulau Pinang Act 1983Adam Haida & CoNessuna valutazione finora

- Solution: Econ 2123, Fall 2018, Problem Set 1Documento6 pagineSolution: Econ 2123, Fall 2018, Problem Set 1Pak Ho100% (1)

- Accounts PracticleDocumento75 pagineAccounts PracticleMITESHKADAKIA60% (5)

- Sherry Hunt Case - Team CDocumento4 pagineSherry Hunt Case - Team CMariano BonillaNessuna valutazione finora

- Business Intelligence and BankingDocumento12 pagineBusiness Intelligence and BankingniklasNessuna valutazione finora

- Review Notes in Corporation Law 2023Documento13 pagineReview Notes in Corporation Law 2023Se'f BenitezNessuna valutazione finora

- Day CareDocumento21 pagineDay CareSarfraz AliNessuna valutazione finora

- Business Analysis & ValuationDocumento50 pagineBusiness Analysis & ValuationAimee EemiaNessuna valutazione finora

- deeganAFA 7e ch28 ReducedDocumento19 paginedeeganAFA 7e ch28 Reducedmail2manshaaNessuna valutazione finora

- IT Critique - Goyal 2018Documento11 pagineIT Critique - Goyal 2018Aditya GuptaNessuna valutazione finora

- Internship Report On ZahidJee Textile Mills LimitedDocumento81 pagineInternship Report On ZahidJee Textile Mills LimitedDoes it Matter?100% (11)

- Hyperin Ation in Venezuela: Research Question, Aim and GoalDocumento2 pagineHyperin Ation in Venezuela: Research Question, Aim and GoalMilica NikolicNessuna valutazione finora

- Ala in Finacct 3Documento4 pagineAla in Finacct 3VIRGIL KIT AUGUSTIN ABANILLANessuna valutazione finora

- Financial Performance of Retail Sector Companies in India-An AnalysisDocumento7 pagineFinancial Performance of Retail Sector Companies in India-An Analysisaniket jadhavNessuna valutazione finora

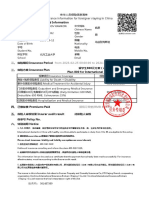

- 来华人员保险信息清单 List of insurance information for foreigner staying in ChinaDocumento1 pagina来华人员保险信息清单 List of insurance information for foreigner staying in ChinaKaneNessuna valutazione finora

- Mananquil, Julieta P. - Jeths JefrenDocumento12 pagineMananquil, Julieta P. - Jeths JefrenMarissa Bucad GomezNessuna valutazione finora

- Vanguard CostsDocumento2 pagineVanguard CostsPardeep SinghNessuna valutazione finora