Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Cambrex APIs manufacturing services financials

Caricato da

vibhor_26janDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Cambrex APIs manufacturing services financials

Caricato da

vibhor_26janCopyright:

Formati disponibili

Cambrex offers many Active Pharmaceutical Ingredient (API) products and a variety of

services specialized for custom drug development and manufacture. We provide services

such as route selection, process & analytical development, process optimization & scale-

up, safety assessments, and product formulation. Cambrex also manufactures an

extensive list of active pharmaceutical ingredients (APIs), intermediates, controlled

substances, fine chemicals, and chiral amines.

The decrease in 235 M USD is primarily due to lower volumes of an active

pharmaceutical ingredient ("API") that utilizes the Company's polymeric drug delivery

technology, lower sales of two APIs manufactured under long-term supply agreements

and lower custom development revenues, all due to the timing of orders throughout 2009.

Volumes of a feed additive for which a contract expired earlier in 2009 were also lower.

Partially offsetting these decreases were increased generic revenues resulting from

improved order patterns.

Asian competitors have increased their capabilities in drug substance manufacturing and

finished dosage form drugs in recent years. There has been a growing impact on the

volumes sold of the Company’s niche products and the presence of these competitors in

the market has resulted in downward pricing pressure on generic APIs and certain

development services for clinical phase products. Regulatory compliance and product

quality may determine the long term impact of these competitors.

Products and services are sold to a diverse group of several hundred customers, with one

customer, Gyma Laboratories of America, Inc. (“Gyma”), a distributor representing

multiple customers, accounting for 11.5% of 2009 sales. One customer, Gyma, a

distributor representing multiple customers, accounted for 11.5% of consolidated gross

sales for 2009. Two customers each account for 10% of consolidated gross sales for the

years ended December 31, 2008 and 2007. One customer, Warner Chilcott plc, with

which a long-term sales contract is in effect, account for 10.0% and 11.2% of

consolidated sales for 2008 and 2007, respectively. The second customer, Gyma,

accounted for 11.8% and 12.5% for 2008 and 2007, respectively. One product, a gastro-

intestinal API sold to multiple customers, accounted for 12.7% of 2009 sales. No one

customer accounted for more than 10% of 2009 sales of this product.

The Company spent $7,929, $7,590 and $12,157 in 2009, 2008 and 2007, respectively,

on R&D efforts.

In February 2007, the Company completed the sale of the businesses that comprised the

Bioproducts and Biopharma segments (excluding certain liabilities) to Lonza for total

cash consideration of $463,914, including working capital adjustments.

Three API facilities in Italy, Sweden, US(Iowa).

The Company experienced lower generic API sales due to competitive pricing. Sales of

controlled substances, which the Company defines as drugs falling under Schedule II of

the U.S. Drug Enforcement Agency's classification system, showed strong growth in

2009. The Company also continues to develop several new products utilizing its

proprietary polymeric drug delivery technology. Sales of a feed additive were lower as a

result of exiting the product line In 2008.

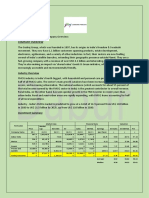

All figures in table in thousands $ :

2009 2008 2007

APIs and

pharmaceutical 212,64 220,72 220,38

intermediates $ 4 $ 2 $ 6

Other 23,633 28,896 32,188

236,27 249,61 252,57

Total $ 7 Thousand $ 8 $ 4

The following table shows gross sales to geographic area for the years ended December 31, 2009, 2008 and

2007:

2009 2008 2007

North

America $ 80,830 $ 86,631 $ 85,644

136,53 143,54 150,69

Europe 4 2 2

Asia 10,495 11,440 9,125

Other 8,418 8,005 7,113

236,27 249,61 252,57

Total $ 7 $ 8 $ 4

The Company maintained a robust pipeline of custom development projects during 2009

and its portfolio currently includes 12 products for which the Company expects to

manufacture products for its customers’ phase III clinical trials. With a broad portfolio of

products and services in the API market, the Company remains profitable and has a solid

platform for future growth.

The Company has a $200,000 revolving credit facility of which $120,800 was

outstanding at December 31, 2009. This facility expires in April of 2012. If the

Company is unable to generate sufficient cash flow or otherwise obtain funds necessary

to make required payments on the credit facility, it will be in default. This current debt

arrangement requires the Company to comply with specified financial ratios. The

Company’s ability to comply with these ratios may be affected by events beyond its

control.

All figures in table in thousands $ :

Potrebbero piacerti anche

- McDonald-Company ProfileDocumento3 pagineMcDonald-Company Profilegdpi09Nessuna valutazione finora

- Designed To: 2009 Annual ReportDocumento78 pagineDesigned To: 2009 Annual ReportAsif HaiderNessuna valutazione finora

- Aam Annual Report 2018Documento131 pagineAam Annual Report 2018shountyNessuna valutazione finora

- Market Research FinalDocumento13 pagineMarket Research Finalkjoel.ngugiNessuna valutazione finora

- LabCorp Q3 12 Press Release - FinalDocumento8 pagineLabCorp Q3 12 Press Release - FinalChang MasonNessuna valutazione finora

- Coca-Cola 2008 Financial AnalysisDocumento15 pagineCoca-Cola 2008 Financial AnalysisnintuctgNessuna valutazione finora

- CH 01Documento11 pagineCH 01Zohaib ImtiazNessuna valutazione finora

- E.I.Du Pont CaseDocumento26 pagineE.I.Du Pont CaseChip choiNessuna valutazione finora

- Strategic Management Case Study: Hailey College of Commerce University of The PunjabDocumento21 pagineStrategic Management Case Study: Hailey College of Commerce University of The PunjabRafia RiazNessuna valutazione finora

- LT Foods HDFC Research ReportDocumento14 pagineLT Foods HDFC Research ReportjayNessuna valutazione finora

- Documentos de Trabajo: SerieDocumento40 pagineDocumentos de Trabajo: SerieDarío López ZadicoffNessuna valutazione finora

- MyfileDocumento26 pagineMyfilekalsia9hotmail.com0% (1)

- Next Generation Loyalty Management Systems: Trends, Challenges, and RecommendationsDocumento24 pagineNext Generation Loyalty Management Systems: Trends, Challenges, and Recommendationskolluru hariNessuna valutazione finora

- 2023 08 07 PRA Group Reports Second Quarter 2023 ResultsDocumento6 pagine2023 08 07 PRA Group Reports Second Quarter 2023 Resultsredd.xox93Nessuna valutazione finora

- PepsiCo Strategic Plan Design PDFDocumento71 paginePepsiCo Strategic Plan Design PDFdemereNessuna valutazione finora

- 2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMDocumento54 pagine2010 - Annual - Report - Cover:Layout 1 2/5/2010 4:12 PMFoo Leung Tsz KinNessuna valutazione finora

- How Handset Leasing Impacts Telecom Industry GrowthDocumento9 pagineHow Handset Leasing Impacts Telecom Industry GrowthGerardus BanyuNessuna valutazione finora

- DynatronicsDocumento24 pagineDynatronicsFezi Afesina Haidir90% (10)

- The Financial Detective ASLIDocumento5 pagineThe Financial Detective ASLIAntonius CliffSetiawanNessuna valutazione finora

- Dabur 1Documento2 pagineDabur 1sandeep mishraNessuna valutazione finora

- Study Case Netflix'sDocumento21 pagineStudy Case Netflix'sOda RetnoNessuna valutazione finora

- Analysis DR ReddyDocumento10 pagineAnalysis DR ReddyRitik katteNessuna valutazione finora

- DR Reddy's Lab - 27-11-2019 - IC - ULJK PDFDocumento21 pagineDR Reddy's Lab - 27-11-2019 - IC - ULJK PDFP VinayakamNessuna valutazione finora

- Swot Analysis On CollgateDocumento12 pagineSwot Analysis On CollgateS.S.Rules100% (1)

- PepsiCo Segments CaseDocumento4 paginePepsiCo Segments CaseAntonio J AguilarNessuna valutazione finora

- Syndicate 1 - Financial DetectiveDocumento16 pagineSyndicate 1 - Financial DetectiveDyani Nabyla WidyaputriNessuna valutazione finora

- Best Global BrandsDocumento9 pagineBest Global BrandsfabianmgpNessuna valutazione finora

- Dabur India LTD PDFDocumento8 pagineDabur India LTD PDFBook MonkNessuna valutazione finora

- DR Reddy's LabDocumento10 pagineDR Reddy's LabTarun GuptaNessuna valutazione finora

- Can't Say It Enough: Value. Value. ValueDocumento112 pagineCan't Say It Enough: Value. Value. Valuebillroberts981Nessuna valutazione finora

- Technical Analysis of DR ReddyDocumento9 pagineTechnical Analysis of DR ReddyDante DonNessuna valutazione finora

- Faro AR 2008Documento76 pagineFaro AR 2008Rudi HasibuanNessuna valutazione finora

- Lupin LTD (3rd Largest Pharma Company of India)Documento56 pagineLupin LTD (3rd Largest Pharma Company of India)vidushikanwar67% (3)

- Synopsis P& GDocumento14 pagineSynopsis P& GmukabbasNessuna valutazione finora

- FIN526 Financial Statement Analysis Template JeffDocumento5 pagineFIN526 Financial Statement Analysis Template Jeffjeffff woodsNessuna valutazione finora

- Pedilite Industries Desk ReportDocumento21 paginePedilite Industries Desk ReportAniket YadavNessuna valutazione finora

- Strengthening Our Core: Reliance Steel & Aluminum Co. 2017 Annual ReportDocumento32 pagineStrengthening Our Core: Reliance Steel & Aluminum Co. 2017 Annual ReportShreeyaNessuna valutazione finora

- Light S.A. Corporate Presentation: Citi's 16th Annual Latin America ConferenceDocumento26 pagineLight S.A. Corporate Presentation: Citi's 16th Annual Latin America ConferenceLightRINessuna valutazione finora

- Daktronics E Dividend Policy in 2010Documento26 pagineDaktronics E Dividend Policy in 2010IBRAHIM KHANNessuna valutazione finora

- HP t5000 Product Overview Jan07Documento8 pagineHP t5000 Product Overview Jan07meharNessuna valutazione finora

- Chemicals in Canada 2007Documento29 pagineChemicals in Canada 2007Jean DuqueNessuna valutazione finora

- CH 04Documento56 pagineCH 04Hiền AnhNessuna valutazione finora

- Company A Financial Statement S$ Million Year 0 Year 1 Year 2 Total Total TotalDocumento14 pagineCompany A Financial Statement S$ Million Year 0 Year 1 Year 2 Total Total TotalAARZOO DEWANNessuna valutazione finora

- Consumer Staples & Discretionary: Worm's World View #19: Conversations With HUL DistributorsDocumento5 pagineConsumer Staples & Discretionary: Worm's World View #19: Conversations With HUL DistributorssushantNessuna valutazione finora

- Wipro Investor PPT q4 Fy 2022Documento22 pagineWipro Investor PPT q4 Fy 2022sri KarthikeyanNessuna valutazione finora

- Fluor Corporation Investor Overview: Fourth Quarter 2014Documento17 pagineFluor Corporation Investor Overview: Fourth Quarter 2014Shwe AntherNessuna valutazione finora

- Company X's financials with handset leasing plansDocumento10 pagineCompany X's financials with handset leasing plansHằng TừNessuna valutazione finora

- Two Thousand & Seven Annual ReportDocumento101 pagineTwo Thousand & Seven Annual Reportapi-3697911Nessuna valutazione finora

- Premium Research on Wockhardt LtdDocumento8 paginePremium Research on Wockhardt LtdHardik JainNessuna valutazione finora

- Topic 5 Tutorial AnswersDocumento6 pagineTopic 5 Tutorial AnswershellenijieNessuna valutazione finora

- Glacier Reports Second Quarter 2021 ResultsDocumento3 pagineGlacier Reports Second Quarter 2021 ResultsriditoppoNessuna valutazione finora

- Data AnalysisDocumento12 pagineData Analysisloic.seguin.proNessuna valutazione finora

- Assignment Financial Analysis SolvedDocumento2 pagineAssignment Financial Analysis SolvedShaimaa MuradNessuna valutazione finora

- BCG Forage Core Strategy - Telco (Task 2 Additional Data)Documento9 pagineBCG Forage Core Strategy - Telco (Task 2 Additional Data)Fadil JauhariNessuna valutazione finora

- Coca-Cola Third Quarter 2023 Full Earnings Release 10.24.23 FINALDocumento30 pagineCoca-Cola Third Quarter 2023 Full Earnings Release 10.24.23 FINALkknguyen090304Nessuna valutazione finora

- Georgetown Case Competition: ConfidentialDocumento17 pagineGeorgetown Case Competition: ConfidentialPatrick BensonNessuna valutazione finora

- Laquayas Research Paper - NetflixDocumento18 pagineLaquayas Research Paper - Netflixapi-547930687Nessuna valutazione finora

- Credit Union Revenues World Summary: Market Values & Financials by CountryDa EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityDa EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityValutazione: 4 su 5 stelle4/5 (2)

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryDa EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Vdkte: LA-9869P Schematic REV 1.0Documento52 pagineVdkte: LA-9869P Schematic REV 1.0Analia Madeled Tovar JimenezNessuna valutazione finora

- Airport Solutions Brochure Web 20170303Documento6 pagineAirport Solutions Brochure Web 20170303zhreniNessuna valutazione finora

- Todd Pace Court DocketDocumento12 pagineTodd Pace Court DocketKUTV2NewsNessuna valutazione finora

- NBA Live Mobile Lineup with Jeremy Lin, LeBron James, Dirk NowitzkiDocumento41 pagineNBA Live Mobile Lineup with Jeremy Lin, LeBron James, Dirk NowitzkiCCMbasketNessuna valutazione finora

- 4.1A. Satoshi Nakamoto and PeopleDocumento58 pagine4.1A. Satoshi Nakamoto and PeopleEman100% (1)

- Human Resource Management: Functions and ObjectivesDocumento26 pagineHuman Resource Management: Functions and ObjectivesABDUL RAZIQ REHANNessuna valutazione finora

- Murder in Paradise3Documento4 pagineMurder in Paradise3Олександр ТягурNessuna valutazione finora

- Esmf 04052017 PDFDocumento265 pagineEsmf 04052017 PDFRaju ReddyNessuna valutazione finora

- Far East Bank (FEBTC) Vs Pacilan, Jr. (465 SCRA 372)Documento9 pagineFar East Bank (FEBTC) Vs Pacilan, Jr. (465 SCRA 372)CJ N PiNessuna valutazione finora

- James M Stearns JR ResumeDocumento2 pagineJames M Stearns JR Resumeapi-281469512Nessuna valutazione finora

- CardingDocumento9 pagineCardingSheena JindalNessuna valutazione finora

- National Dairy Authority BrochureDocumento62 pagineNational Dairy Authority BrochureRIKKA JELLEANNA SUMAGANG PALASANNessuna valutazione finora

- Ecocritical Approach To Literary Text Interpretation: Neema Bagula JimmyDocumento10 pagineEcocritical Approach To Literary Text Interpretation: Neema Bagula JimmyhafizhNessuna valutazione finora

- Pension Field Verification FormDocumento1 paginaPension Field Verification FormRaj TejNessuna valutazione finora

- Medtech LawsDocumento19 pagineMedtech LawsJon Nicole DublinNessuna valutazione finora

- What Is Taekwondo?Documento14 pagineWhat Is Taekwondo?Josiah Salamanca SantiagoNessuna valutazione finora

- Introduction To Contemporary World: Alan C. Denate Maed Social Science, LPTDocumento19 pagineIntroduction To Contemporary World: Alan C. Denate Maed Social Science, LPTLorlie GolezNessuna valutazione finora

- 1940 Doreal Brotherhood PublicationsDocumento35 pagine1940 Doreal Brotherhood Publicationsfrancisco89% (9)

- Important PIC'sDocumento1 paginaImportant PIC'sAbhijit SahaNessuna valutazione finora

- Introduction To The Appian PlatformDocumento13 pagineIntroduction To The Appian PlatformbolillapalidaNessuna valutazione finora

- RA MEWP 0003 Dec 2011Documento3 pagineRA MEWP 0003 Dec 2011Anup George Thomas100% (1)

- Musical Plays: in The PhilippinesDocumento17 pagineMusical Plays: in The Philippinesgabby ilaganNessuna valutazione finora

- Buyer List For GarmentsDocumento3 pagineBuyer List For GarmentsLatha Kandasamy100% (5)

- Organizational ChartDocumento1 paginaOrganizational ChartPom tancoNessuna valutazione finora

- Group 1 - MM - Vanca Digital StrategyDocumento10 pagineGroup 1 - MM - Vanca Digital StrategyAashna Duggal100% (1)

- Phil Pharma Health Vs PfizerDocumento14 paginePhil Pharma Health Vs PfizerChristian John Dela CruzNessuna valutazione finora

- Trivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFDocumento12 pagineTrivandrum District IT Quiz Questions and Answers 2016 - IT Quiz PDFABINNessuna valutazione finora

- Rationale For Instruction: Social Studies Lesson Plan TemplateDocumento3 pagineRationale For Instruction: Social Studies Lesson Plan Templateapi-255764870Nessuna valutazione finora

- RPPSN Arbour StatementDocumento2 pagineRPPSN Arbour StatementJohnPhilpotNessuna valutazione finora

- Versova Koliwada': Introd U C T I OnDocumento4 pagineVersova Koliwada': Introd U C T I OnNikunj Dwivedi100% (1)