Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Hamilton LRT - Financial Summary PDF

Caricato da

The Hamilton SpectatorTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Hamilton LRT - Financial Summary PDF

Caricato da

The Hamilton SpectatorCopyright:

Formati disponibili

• Hamilton LRT

• Unsolicited Proposal Discussion

• Financial Summary

Private and Confidential

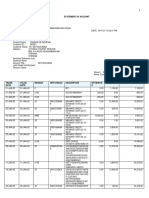

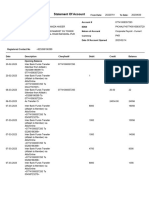

Financial Analysis – Summary

Fengate is exploring a number of scenarios to assess the economic impact to the City, citing technical

assumptions from a recent cost study and financial assumptions from recent comparable PPP precedents

Case Description

1 Base Case ▪ 85% of CapEx publicly funded; 15% privately funded (short-term bank, long-term bonds and equity)

2 Private Financing Case ▪ Project funded by private capital only (long-term bonds and equity)

3 Government Subsidy Case ▪ $2.4 billion subsidy from the provincial and federal governments funded at substantial completion

4 CIB Loan Case ▪ 1/3 of CapEx funded by a loan from the Canada Infrastructure Bank

5 Farebox Collection Case ▪ Equity investors participate in fare revenue

6 Land Development Case ▪ $250 million of development entitlements are monetized and used to fund CapEx

7 Extended Project Term ▪ Operating term is extended by an additional 10 years to 40 years

8 Combined Case ▪ Combines all assumptions under Cases 2-7 above

Private Government CIB Loan Farebox Land Extended Combined

Base Case Finance Case Subsidy Case Case Collection Development Project Term Case

1 2 3 4 5 6 7 8

(1) (2)

Net Present Value $3.5 bn $3.8 bn $3.5 bn $3.4 bn $3.6 bn $3.8 bn $3.9 bn $3.7 bn(3)

Yr. 1 Capital Payment $28.7 mm $216.3 mm $62.8 mm $192.8 mm $204.3 mm $200.4 mm $189.6 mm $43.6 mm

Yr. 1 O&M Payment $23.9 mm $23.9 mm $23.9 mm $23.9 mm $23.9 mm $23.9 mm $23.9 mm $23.9 mm

Yr. 1 Lifecycle Payment $5.3 mm $5.3 mm $5.3 mm $5.3 mm $5.3 mm $5.3 mm $5.3 mm $5.3 mm

Notes: (1) Assumes a discount rate of 4.0%. (2) NPV is $3.4 billion across the initial 30-year period. (3) NPV is $3.5 billion across the initial 30-year period. 2

Private and Confidential

Financial Analysis – Base Case 1

Case Description Sources During Construction $ mm %

▪ Assumes Project has a similar funding structure as Government Payments $2,772.5 85.0%

Hurontario LRT whereby 85% of costs are funded by public

Development Monetization - -

funds (via construction progress payments and a

substantial completion payment) and the remaining 15% is Canada Infrastructure Bank Loan - -

funded by private capital

Short-Term Debt $905.3 27.8%

▪ Short-term bank debt, long-term bond and equity capital

are used to fund capital expenditures over the five-year Repayment of Short-Term Debt ($905.3) (27.8%)

construction period Long-Term Debt $440.4 13.5%

▪ Long-term bond has an all-in interest rate of ~3.35% and Long-Term Equity $48.9 1.5%

standard PPP gearing ratio of 90%

Total $3,261.8 100.0%

▪ Assumed pre-tax equity IRR of 11.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.5 billion Construction Costs $3,019.2 92.6%

Year One Capital Payment $28.7 million Mobilization Costs $12.6 0.4%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.9%

Year One Life Cycle Payment $5.3 million Financing Costs $176.4 5.4%

SPV Costs $23.5 0.7%

Total $3,261.8 100.0%

Private and Confidential

Financial Analysis – Private Funding Case 2

Case Description Sources During Construction $ mm %

▪ Assumes Project is financed entirely by private capital (i.e. Government Subsidy - -

no progress payments from the City or the provincial

Development Monetization - -

and/or federal government during construction)

Canada Infrastructure Bank Loan - -

Short-Term Debt - -

Repayment of Short-Term Debt - -

Long-Term Debt $3,320.4 90.0%

Long-Term Equity $368.5 10.0%

Total $3,688.8 100.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.8 billion Construction Costs $3,019.2 81.8%

Year One Capital Payment $216.3 million Mobilization Costs $12.6 0.3%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.8%

Year One Life Cycle Payment $5.3 million Financing Costs $603.5 16.4%

SPV Costs $23.5 0.6%

Total $3,688.8 100.0%

Private and Confidential

Financial Analysis – Government Subsidy Case 3

Case Description Sources During Construction $ mm %

▪ Fengate understands there is an opportunity for the Project Government Subsidy $2,400.0 69.1%

to secure funding from the provincial and/or federal

Development Monetization - -

government

Canada Infrastructure Bank Loan - -

▪ Assumes $1.2 billion is received from each of the provincial

and federal governments, injected into the Project at Short-Term Debt $2,400.0 69.1%

substantial completion

Repayment of Short-Term Debt ($2,400.0) (69.1%)

▪ Funding solution includes a short-term construction facility

which is paid off by the above completion payment Long-Term Debt $964.5 27.8%

Long-Term Equity $107.0 3.1%

Total $3,471.5 100.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.5 billion Construction Costs $3,019.2 87.0%

Year One Capital Payment $62.8 million Mobilization Costs $12.6 0.4%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.9%

Year One Life Cycle Payment $5.3 million Financing Costs $386.2 11.1%

SPV Costs $23.5 0.7%

Total $3,471.5 100.0%

Private and Confidential

Financial Analysis – Canada Infrastructure Bank Loan 4

Case Description Sources During Construction $ mm %

▪ CIB is mandated to invest $35 billion into infrastructure Government Subsidy - -

projects, of which $5 billion is earmarked for public transit

Development Monetization - -

systems

Canada Infrastructure Bank Loan $1,177.0 33.3%

▪ Fengate understands CIB can only commit up to one-third

of the capital structure based on initial discussions Short-Term Debt - -

▪ Assumes CIB loan is provided at an all-in rate of 1.0% and Repayment of Short-Term Debt - -

amortized over the first 15 years of the operating period

(rate increases to 3.5% if demand risk is present) Long-Term Debt $2,002.0 56.7%

▪ In 2018, CIB provided a $1.28 billion senior secured loan Long-Term Equity $352.1 10.0%

with a 15-year term to the Réseau Express Métropolitain Total $3,531.2 100.0%

project in Montreal

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.4 billion Construction Costs $3,019.2 85.5%

Year One Capital Payment $192.8 million Mobilization Costs $12.6 0.4%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.8%

Year One Life Cycle Payment $5.3 million Financing Costs $445.9 12.6%

SPV Costs $23.5 0.7%

Total $3,531.2 100.0%

Private and Confidential

Financial Analysis – Farebox Collection Case 5

Case Description Sources During Construction $ mm %

▪ Assumes equity investors are entitled to fare revenue Government Subsidy - -

generated by the LRT, thereby reducing the City’s capital

Development Monetization - -

payments

Canada Infrastructure Bank Loan - -

▪ High-level assumptions include annual ridership of 9.2

million (held flat) and an average fare of $2.00 which Short-Term Debt - -

increases at 1.0% per year

Repayment of Short-Term Debt - -

▪ Equity IRR target increased to 14.0% to compensate

investors for taking additional demand risk Long-Term Debt $3,322.5 90.0%

Long-Term Equity $368.3 10.0%

Total $3,690.8 100.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.6 billion Construction Costs $3,019.2 81.8%

Year One Capital Payment $204.3 million Mobilization Costs $12.6 0.3%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.8%

Year One Life Cycle Payment $5.3 million Financing Costs $605.5 16.4%

SPV Costs $23.5 0.6%

Total $3,690.8 100.0%

Private and Confidential

Financial Analysis – Land Development 6

Case Description Sources During Construction $ mm %

▪ Assumes $250 million of development entitlements along Government Subsidy - -

the LRT line are monetized during the construction period

Development Monetization $250.0 6.8%

and injected into the Project at substantial completion

Canada Infrastructure Bank Loan - -

Short-Term Debt $250.0 6.8%

Repayment of Short-Term Debt ($250.0) (6.8%)

Long-Term Debt $3,075.9 83.9%

Long-Term Equity $341.3 9.3%

Total $3,667.2 100.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.8 billion Construction Costs $3,019.2 82.3%

Year One Capital Payment $200.4 million Mobilization Costs $12.6 0.3%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.8%

Year One Life Cycle Payment $5.3 million Financing Costs $581.9 15.9%

SPV Costs $23.5 0.6%

Total $3,667.2 100.0%

Private and Confidential

Financial Analysis – Extended Project Term Case 7

Case Description Sources During Construction $ mm %

▪ Assumes operating term is extended an additional 10 years Government Subsidy - -

▪ Over the initial 30-year period, the Project’s NPV is $3.4 Development Monetization - -

billion

Canada Infrastructure Bank Loan - -

Short-Term Debt - -

Repayment of Short-Term Debt - -

Long-Term Debt $3,305.3 90.0%

Long-Term Equity $367.1 10.0%

Total $3,672.4 100.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.9 billion Construction Costs $3,019.2 82.2%

Year One Capital Payment $189.6 million Mobilization Costs $12.6 0.3%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.8%

Year One Life Cycle Payment $5.3 million Financing Costs $587.1 16.0%

SPV Costs $23.5 0.6%

Total $3,672.4 100.0%

Private and Confidential

Financial Analysis – All Cases Combined 8

Case Description Sources During Construction $ mm %

▪ Takes into account all assumptions in prior cases, including Government Subsidy $2,400.0 69.4%

receipt of government subsidy, monetization of

Development Monetization $250.0 7.2%

development opportunities, equity participating in fare

revenue, CIB loan and an extended operating term Canada Infrastructure Bank Loan $728.3 21.1%

▪ Equity IRR target increased to 14.0% to compensate Short-Term Debt $2,650.0 76.6%

investors for taking additional demand risk

Repayment of Short-Term Debt ($2,650.0) (76.6%)

▪ Assumes CIB loan is provided at an all-in rate of 3.5% and

amortized over the first 15 years of the operating period Long-Term Debt - -

▪ Over the initial 30-year period, the Project’s NPV is $3.5 Long-Term Equity $81.0 2.3%

billion Total $3,459.2 100.0%

Project Economics Uses During Construction $ mm %

Net Present Value (at 4.0%) $3.7 billion Construction Costs $3,019.2 87.3%

Year One Capital Payment $43.6 million Mobilization Costs $12.6 0.4%

Year One O&M Payment $23.9 million Transaction Costs $30.0 0.9%

Year One Life Cycle Payment $5.3 million Financing Costs $373.9 10.8%

SPV Costs $23.5 0.7%

Total $3,459.2 100.0%

10

Private and Confidential

Contact Us

George Theodoropoulos CANADA

Managing Partner Toronto:

Office: 416-224-4436 77 King Street W, Suite 4230

Email: george.theodoropoulos@fengate.com Toronto, ON, M5K 1H1

Mac Bell Oakville:

Managing Director 2275 Upper Middle Road E, Suite 700

Office: 416-224-4440 Oakville, ON, L6H 0C3

Email: mac.bell@fengate.com

Jensen Clarke

UNITED STATES

Director

Office: 416-224-4452 Houston:

Email: jensen.clarke@fengate.com 708 Main Street, Suite 08-103

Houston, TX, 77002

11

Private and Confidential

Potrebbero piacerti anche

- CN Jamesville Development AppealDocumento14 pagineCN Jamesville Development AppealThe Hamilton SpectatorNessuna valutazione finora

- Fire Marshal Report From Dundas Arson MurdersDocumento11 pagineFire Marshal Report From Dundas Arson MurdersThe Hamilton SpectatorNessuna valutazione finora

- Depth Chart For Ticats RosterDocumento2 pagineDepth Chart For Ticats RosterThe Hamilton SpectatorNessuna valutazione finora

- James Kopp Court FilingDocumento19 pagineJames Kopp Court FilingThe Hamilton SpectatorNessuna valutazione finora

- Judicial ReviewDocumento12 pagineJudicial ReviewThe Hamilton SpectatorNessuna valutazione finora

- Supercrawl Festival MapDocumento1 paginaSupercrawl Festival MapThe Hamilton SpectatorNessuna valutazione finora

- Lusitania LetterDocumento6 pagineLusitania LetterThe Hamilton SpectatorNessuna valutazione finora

- McMaster Denies Request To View PNB Legal FeesDocumento2 pagineMcMaster Denies Request To View PNB Legal FeesThe Hamilton SpectatorNessuna valutazione finora

- Eastgate SquareDocumento19 pagineEastgate SquareThe Hamilton SpectatorNessuna valutazione finora

- Regional Reform Survey QuestionsDocumento1 paginaRegional Reform Survey QuestionsThe Hamilton SpectatorNessuna valutazione finora

- Letter From Province About Hamilton Urban BoundaryDocumento16 pagineLetter From Province About Hamilton Urban BoundaryThe Hamilton SpectatorNessuna valutazione finora

- Scarsin Forecast: Scenario 1 - Worst CaseDocumento3 pagineScarsin Forecast: Scenario 1 - Worst CaseThe Hamilton SpectatorNessuna valutazione finora

- Email Sent To PNB Graduate StudentsDocumento2 pagineEmail Sent To PNB Graduate StudentsThe Hamilton SpectatorNessuna valutazione finora

- Road Value For Money AuditDocumento63 pagineRoad Value For Money AuditThe Hamilton SpectatorNessuna valutazione finora

- Tex Watson LetterDocumento1 paginaTex Watson LetterThe Hamilton SpectatorNessuna valutazione finora

- Hamilton Police Discipline Decision For Paul ManningDocumento60 pagineHamilton Police Discipline Decision For Paul ManningThe Hamilton SpectatorNessuna valutazione finora

- Marge Thielke LetterDocumento1 paginaMarge Thielke LetterThe Hamilton SpectatorNessuna valutazione finora

- Heritage Green Inspection Report - May 26Documento2 pagineHeritage Green Inspection Report - May 26The Hamilton SpectatorNessuna valutazione finora

- Clint Hill LetterDocumento1 paginaClint Hill LetterThe Hamilton SpectatorNessuna valutazione finora

- Hamilton Rapid Transit Benefits ReportDocumento119 pagineHamilton Rapid Transit Benefits ReportThe Hamilton SpectatorNessuna valutazione finora

- Stadium Precinct Preliminary DesignDocumento1 paginaStadium Precinct Preliminary DesignThe Hamilton SpectatorNessuna valutazione finora

- Section 22 Order National Steel CarDocumento3 pagineSection 22 Order National Steel CarThe Hamilton SpectatorNessuna valutazione finora

- Grace Villa Inspection Report: Dec 11, 2020Documento3 pagineGrace Villa Inspection Report: Dec 11, 2020The Hamilton SpectatorNessuna valutazione finora

- Grace Villa Ministry Inspection Report Dec 22, 2020Documento3 pagineGrace Villa Ministry Inspection Report Dec 22, 2020The Hamilton SpectatorNessuna valutazione finora

- Code of Conduct Complaint Against Councillor Sam MerullaDocumento30 pagineCode of Conduct Complaint Against Councillor Sam MerullaThe Hamilton SpectatorNessuna valutazione finora

- Victim Impact PoemDocumento2 pagineVictim Impact PoemThe Hamilton SpectatorNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Structure of Financial SystemDocumento14 pagineStructure of Financial SystemRegina LintuaNessuna valutazione finora

- NRI BankingDocumento33 pagineNRI BankingKrinal Shah0% (1)

- Statement of AccountDocumento16 pagineStatement of AccountSriNessuna valutazione finora

- LECTURE NO 4 5Cs and 7Ps of CreditDocumento5 pagineLECTURE NO 4 5Cs and 7Ps of CreditJessica Miller79% (14)

- Mortgage Under Transfer of Property Act 1882Documento3 pagineMortgage Under Transfer of Property Act 188218212 NEELESH CHANDRANessuna valutazione finora

- Q#2 ACTFMKT 2021-2: Attempt HistoryDocumento6 pagineQ#2 ACTFMKT 2021-2: Attempt HistorymlaNessuna valutazione finora

- PSL35Documento2 paginePSL35musaismail8863Nessuna valutazione finora

- Know Your CustomerDocumento3 pagineKnow Your CustomerMardi RahardjoNessuna valutazione finora

- BCF+1373521 BCF+1373521 BCF+1373521 BCF+1373521 BCF+1373521Documento1 paginaBCF+1373521 BCF+1373521 BCF+1373521 BCF+1373521 BCF+1373521muhammad rizwanNessuna valutazione finora

- Liability Products: Personal Banking Segment of SBIDocumento4 pagineLiability Products: Personal Banking Segment of SBIapu20090% (2)

- A Study On Credit Management at District CoDocumento86 pagineA Study On Credit Management at District CoIMAM JAVOOR100% (2)

- Reacharge & Balance Inquiry ProcedureDocumento8 pagineReacharge & Balance Inquiry ProcedureiprashNessuna valutazione finora

- Ambit Brochure Core BankingDocumento24 pagineAmbit Brochure Core BankingSwati SamantNessuna valutazione finora

- Dispute FormDocumento1 paginaDispute Formadarsh2dayNessuna valutazione finora

- Audit of Cash and Cash EquivalentsDocumento1 paginaAudit of Cash and Cash EquivalentsEmma Mariz Garcia50% (2)

- CAMELS Ratings Lori Buerger March 2012Documento4 pagineCAMELS Ratings Lori Buerger March 2012Nael Nasir ChiraghNessuna valutazione finora

- Statement of AccountDocumento7 pagineStatement of AccountHamza CollectionNessuna valutazione finora

- CFPB English Spanish Glossary of Financial Terms! PDFDocumento77 pagineCFPB English Spanish Glossary of Financial Terms! PDFruthieNessuna valutazione finora

- Http://202.83.164.226/complaint - Attachments//2019 11 08 07 47 20 1573181240 5457837 5dc4d738aff255.3935adb9d1b58f8c PDFDocumento2 pagineHttp://202.83.164.226/complaint - Attachments//2019 11 08 07 47 20 1573181240 5457837 5dc4d738aff255.3935adb9d1b58f8c PDFNaveed KhanNessuna valutazione finora

- CIMB Islamic Bank BHD V LCL Corp BHD & AnorDocumento20 pagineCIMB Islamic Bank BHD V LCL Corp BHD & Anormuhammad amriNessuna valutazione finora

- BSCS Admission (Phase-2) Fees ChallanDocumento1 paginaBSCS Admission (Phase-2) Fees ChallanAbdullah ChohanNessuna valutazione finora

- NothingDocumento4 pagineNothingSofia Louisse C. FernandezNessuna valutazione finora

- Anaalytics FirmsDocumento6 pagineAnaalytics FirmsAmit RanaNessuna valutazione finora

- Challan 32 A PDFDocumento2 pagineChallan 32 A PDFarshad aliNessuna valutazione finora

- Payment InstructionsDocumento3 paginePayment InstructionsadiksayyuuuuNessuna valutazione finora

- Check Writing Sim 1Documento13 pagineCheck Writing Sim 1api-256424511100% (1)

- Details of Statement: Tran Id Tran Date Remarks Amount (RS.) Balance (RS.)Documento2 pagineDetails of Statement: Tran Id Tran Date Remarks Amount (RS.) Balance (RS.)Ayan DuttaNessuna valutazione finora

- Oct RakbankDocumento2 pagineOct RakbankAditya MehtaNessuna valutazione finora

- Simple InterestDocumento3 pagineSimple InterestlalaNessuna valutazione finora

- List One: Currency, Fund and Precious Metal Codes: Entity Currency Alphabetic Code Numeric Code Minor UnitDocumento7 pagineList One: Currency, Fund and Precious Metal Codes: Entity Currency Alphabetic Code Numeric Code Minor UnitWu ThaNessuna valutazione finora