Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Tax

Caricato da

SUNYYR0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

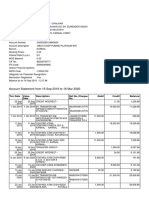

79 visualizzazioni1 paginaThis document is a challan receipt for an income tax payment of Rs. 16,210 made by GURXXXXK SINGH for the 2018-19 assessment year. The payment was for income tax other than companies (code 0021) and was a self-assessment tax payment (code 300). It was successfully paid through internet banking using an ICICI bank account on August 29, 2018.

Descrizione originale:

direct taxes

Titolo originale

tax

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document is a challan receipt for an income tax payment of Rs. 16,210 made by GURXXXXK SINGH for the 2018-19 assessment year. The payment was for income tax other than companies (code 0021) and was a self-assessment tax payment (code 300). It was successfully paid through internet banking using an ICICI bank account on August 29, 2018.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

79 visualizzazioni1 paginaTax

Caricato da

SUNYYRThis document is a challan receipt for an income tax payment of Rs. 16,210 made by GURXXXXK SINGH for the 2018-19 assessment year. The payment was for income tax other than companies (code 0021) and was a self-assessment tax payment (code 300). It was successfully paid through internet banking using an ICICI bank account on August 29, 2018.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

Challan No.

/ITNS Tax Applicable Assessment Year

280 (0020) INCOME TAX ON COMPANIES (CORPORATION TAX) 2018-19

(0021) INCOME TAX OTHER THAN COMPANIES ✔

PAN: AXTPS5216J

Full Name : GURXXXXK SINGH

Complete Address with City & State : ITR, , 16210, , UDHAMPRU, JAMMU & KASHMIR, 194001

Tel. No. :

Type of Payment :

(100) Advance Tax (102) Surtax

(300) Self Assessment Tax ✔ (106) Profits of Domestic Companies

(400) Tax on Regular Assessment (800) TDS on Sale of Property

(107) Tax on Distributed Income to Unit Holders

Details of Payment FOR USE IN RECEIVING BANK

Amount (in Rs. only) Debit to A/c / Cheque credited on

Income Tax 16210 29-08-2018(DD-MM-YYYY)

Surcharge 0 Payment Status : Successful

Education Cess 0 Bank Reference No.: 22109495

Interest 0

SPACE FOR BANK SEAL

Penalty Code

Penalty 0 ICICI Bank

Others 0 Uttam Nagar, New Delhi

Total 16210 CIN

Total (in words) Rupees Sixteen Thousand BSR Code 6390340

Two Hundred Ten and Tender Date 290818

Paise Zero Only.

Challan Serial No. 02637

Crores Lakhs Thousands Hundreds Tens Units

Zero Zero Sixteen Two One Zero Rs. 16210

Debit to A/c 016301537085 Tax payer remarks. : ---

Date 29-08-2018

Drawn on Internet Banking Payment

through ICICI Bank

Taxpayers Counterfoil Payment Status : Successful

PAN: AXTPS5216J Bank Reference 22109495

No.:

Received From : GURXXXXK SINGH

Paid in Cash / Debit to A/c / 016301537085 SPACE FOR BANK SEAL

Cheque No :

For Rs. : 16210 ICICI Bank

Rs (in words) : Rupees Sixteen Thousand Two Uttam Nagar, New Delhi

Hundred Ten and Paise Zero Only. CIN

Drawn on: Internet Banking Payment through BSR Code 6390340

ICICI Bank

Tender Date 290818

On Account of : (0021)Other than Companies Tax

Challan Serial No. 02637

Type of Payment (300)Self Assessment Tax

For the Assessment Year : 2018-19 Rs. 16210

Potrebbero piacerti anche

- TDS Challan 06-05-18Documento1 paginaTDS Challan 06-05-18sandipgargNessuna valutazione finora

- Contoh Soal SAP 010 - Financial Accounting (Batch 1&2)Documento19 pagineContoh Soal SAP 010 - Financial Accounting (Batch 1&2)Jhoni100% (3)

- FM II Assignment 19 19Documento1 paginaFM II Assignment 19 19RaaziaNessuna valutazione finora

- TDS ChalanDocumento1 paginaTDS ChalanRAKHAL BAIRAGINessuna valutazione finora

- DirectTaxReport Challan 1 Cp203Documento1 paginaDirectTaxReport Challan 1 Cp203Madhyam JeswaniNessuna valutazione finora

- Direct Taxes 639034001021902385Documento1 paginaDirect Taxes 639034001021902385Raghava KruthiventiNessuna valutazione finora

- Blrp25916c 639034031072221993 Itns281 31072022 Plaxxxxsters Moulding Private LimitedDocumento1 paginaBlrp25916c 639034031072221993 Itns281 31072022 Plaxxxxsters Moulding Private LimitedAMIE ELCIT JOSE 20212065Nessuna valutazione finora

- Direct Tax ReportDocumento1 paginaDirect Tax Reportgiri00767098Nessuna valutazione finora

- #A#c#0#47m - 639034022092104544 - Itns280 - 22092021 - Aveva Information Technology India Private LimitedDocumento1 pagina#A#c#0#47m - 639034022092104544 - Itns280 - 22092021 - Aveva Information Technology India Private LimitedVinayak DhotreNessuna valutazione finora

- View Tax Payment Details: Reference Number: 29973456Documento2 pagineView Tax Payment Details: Reference Number: 29973456arjuntyagi22Nessuna valutazione finora

- UntitledDocumento1 paginaUntitledw sNessuna valutazione finora

- View Tax Payment Details: Reference Number: 29973328Documento1 paginaView Tax Payment Details: Reference Number: 29973328arjuntyagi22Nessuna valutazione finora

- Mrts18865a - 639034006082151575 - Itns281 - 06082021 - Sigxxxxre OverseasDocumento1 paginaMrts18865a - 639034006082151575 - Itns281 - 06082021 - Sigxxxxre OverseasCA Akash AgrawalNessuna valutazione finora

- CBDTChallanForm18 10 2022Documento1 paginaCBDTChallanForm18 10 2022gurdyal672Nessuna valutazione finora

- TDS ChalanDocumento1 paginaTDS ChalanRAKHAL BAIRAGINessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNessuna valutazione finora

- #U#a#5#45g - 639034028042233809 - Itns281 - 28042022 - Aveva Information Technology India PVT LTDDocumento1 pagina#U#a#5#45g - 639034028042233809 - Itns281 - 28042022 - Aveva Information Technology India PVT LTDVinayak DhotreNessuna valutazione finora

- Uk Knitting ChallanDocumento1 paginaUk Knitting Challankavinkandasamy95Nessuna valutazione finora

- Tax Invoice - MEAL CARD: For Sodexo SVC India Private Lim ItedDocumento1 paginaTax Invoice - MEAL CARD: For Sodexo SVC India Private Lim ItedElakkiyaNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaAkhil ThannikalNessuna valutazione finora

- CBDTChallanForm25 06 2022Documento1 paginaCBDTChallanForm25 06 2022Shivaani ManoharanNessuna valutazione finora

- Direct Tax Challan Report: Save PrintDocumento2 pagineDirect Tax Challan Report: Save PrintRavi JujjavarapuNessuna valutazione finora

- Computation 23-24 Buta Singh.Documento2 pagineComputation 23-24 Buta Singh.Sharn RamgarhiaNessuna valutazione finora

- CBDT E-Receipt For E-Tax PaymentDocumento1 paginaCBDT E-Receipt For E-Tax PaymentPWD HIGHWAYNessuna valutazione finora

- CBDT Challan - Ay 2017-18Documento1 paginaCBDT Challan - Ay 2017-18SATEESH SIRAPURAPUNessuna valutazione finora

- CBDTSMChallanForm02 09 2022Documento1 paginaCBDTSMChallanForm02 09 2022asok maitiNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaAshwani TiwariNessuna valutazione finora

- Income Tax Challan 280Documento2 pagineIncome Tax Challan 280RamarNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaKumar MNessuna valutazione finora

- Direct Taxes 639034004081721340Documento1 paginaDirect Taxes 639034004081721340AshishNessuna valutazione finora

- CBDTChallanForm01 09 2022Documento1 paginaCBDTChallanForm01 09 2022Aruna Kumari GorantlaNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaPV REDDY AssociatesNessuna valutazione finora

- Tax Invoice - MEAL CARD: For Sodexo SVC India Private Lim ItedDocumento1 paginaTax Invoice - MEAL CARD: For Sodexo SVC India Private Lim ItedElakkiyaNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of Indiaharish9Nessuna valutazione finora

- BNGPS7366P 23072000246934ICIC DTAX 20072023 TaxPayerDocumento1 paginaBNGPS7366P 23072000246934ICIC DTAX 20072023 TaxPayerAshok KumarNessuna valutazione finora

- Medipath TDS 1st Oct 22Documento1 paginaMedipath TDS 1st Oct 22asok maitiNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaPradipta MondalNessuna valutazione finora

- Income Tax Department: Challan ReceiptDocumento1 paginaIncome Tax Department: Challan Receiptchatore's ChaatNessuna valutazione finora

- Sushma Tax Receipt 2021-22Documento2 pagineSushma Tax Receipt 2021-22Shreedhar MurthyNessuna valutazione finora

- Ajio 1677826206309Documento1 paginaAjio 1677826206309Sakshi SinghNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNessuna valutazione finora

- 23042000194169SBIN ChallanReceiptDocumento1 pagina23042000194169SBIN ChallanReceiptTamarala SrimanNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaInspiring IndiaNessuna valutazione finora

- Tax Invoice: Original For RecipientDocumento3 pagineTax Invoice: Original For RecipientMridupaban DuttaNessuna valutazione finora

- Saroj ComputationDocumento2 pagineSaroj ComputationFuture Money Easy Services Pvt. LtdNessuna valutazione finora

- Ho 94H NC June 22Documento2 pagineHo 94H NC June 22Rupeshkumar JhaNessuna valutazione finora

- CII InvoiceDocumento1 paginaCII InvoicesambasivaNessuna valutazione finora

- 23031900315268CBIN ChallanReceiptDocumento1 pagina23031900315268CBIN ChallanReceiptAMIRUL HAQUENessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaGaurav AgarwalNessuna valutazione finora

- 23031500648647ICIC ChallanReceiptDocumento1 pagina23031500648647ICIC ChallanReceiptUpendra BardhanNessuna valutazione finora

- LIC Receipt Jeevan AnandDocumento1 paginaLIC Receipt Jeevan AnandChandra ShekarNessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaMULTI PURPOSENessuna valutazione finora

- Markazu UloomDocumento1 paginaMarkazu UloomYoonus VallatNessuna valutazione finora

- AJPL1302Documento1 paginaAJPL1302shrungar.ornament1Nessuna valutazione finora

- Tax Payer Counterfoil: State Bank of IndiaDocumento1 paginaTax Payer Counterfoil: State Bank of IndiaMansi JainNessuna valutazione finora

- ChallanFormDocumento1 paginaChallanFormvinodvadageri367Nessuna valutazione finora

- 23030600027268KKBK ChallanReceiptDocumento1 pagina23030600027268KKBK ChallanReceiptNAVYUG SR. SEC. SCHOOL PESHWA ROADNessuna valutazione finora

- FASTag - Statement10287302636201802218131871Documento2 pagineFASTag - Statement10287302636201802218131871அன்புடன் அஸ்வின்Nessuna valutazione finora

- HDS231934Documento1 paginaHDS231934Prabhakar DasariNessuna valutazione finora

- 23051600137773HDFC ChallanReceiptDocumento1 pagina23051600137773HDFC ChallanReceiptalkabhor02Nessuna valutazione finora

- CMNPM9413J PDFDocumento1 paginaCMNPM9413J PDFPradipta MondalNessuna valutazione finora

- E-Upload Military Engineer ServiceDocumento1 paginaE-Upload Military Engineer ServiceSUNYYRNessuna valutazione finora

- E-Upload Military Engineer ServiceDocumento1 paginaE-Upload Military Engineer ServiceSUNYYRNessuna valutazione finora

- E-Upload Military Engineer ServiceDocumento1 paginaE-Upload Military Engineer ServiceSUNYYRNessuna valutazione finora

- CA No. CWE/U (N) - 15/2021-22 Serial Page No: 10: Appendix A' Notice Inviting E-Tender (Military Engineer Services)Documento11 pagineCA No. CWE/U (N) - 15/2021-22 Serial Page No: 10: Appendix A' Notice Inviting E-Tender (Military Engineer Services)SUNYYRNessuna valutazione finora

- E-Upload Military Engineer ServiceDocumento1 paginaE-Upload Military Engineer ServiceSUNYYRNessuna valutazione finora

- New Doc 2020-09-18 09.57.14 - 1Documento1 paginaNew Doc 2020-09-18 09.57.14 - 1SUNYYRNessuna valutazione finora

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Documento4 pagineForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961SUNYYRNessuna valutazione finora

- Schedule 'A' Part - I (Buildings/ Structures)Documento16 pagineSchedule 'A' Part - I (Buildings/ Structures)SUNYYRNessuna valutazione finora

- Ce Northern Command: Mes Org & Offrs' Est Sanction: 2016-17Documento27 pagineCe Northern Command: Mes Org & Offrs' Est Sanction: 2016-17SUNYYRNessuna valutazione finora

- Minutes of MeetingDocumento5 pagineMinutes of MeetingSUNYYRNessuna valutazione finora

- Account Statement From 16 Sep 2019 To 16 Mar 2020Documento2 pagineAccount Statement From 16 Sep 2019 To 16 Mar 2020SUNYYRNessuna valutazione finora

- Account Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceDocumento2 pagineAccount Statement: Date Value Date Description Cheque Deposit Withdrawal BalanceSUNYYRNessuna valutazione finora

- Student CS CHANDIGARH6429023 PDFDocumento2 pagineStudent CS CHANDIGARH6429023 PDFSUNYYRNessuna valutazione finora

- General and Special Condition of ContractsDocumento5 pagineGeneral and Special Condition of ContractsSUNYYRNessuna valutazione finora

- General and Special Condition of ContractsDocumento5 pagineGeneral and Special Condition of ContractsSUNYYRNessuna valutazione finora

- Bdagarwal Constructions M/s Arihant Builders Sood Enterprises Sudhir Sharma Associates PK Constructions V R & Company J.D.BuildersDocumento1 paginaBdagarwal Constructions M/s Arihant Builders Sood Enterprises Sudhir Sharma Associates PK Constructions V R & Company J.D.BuildersSUNYYRNessuna valutazione finora

- Tendernotice 1 PDFDocumento3 pagineTendernotice 1 PDFSUNYYRNessuna valutazione finora

- Assignment On Cooperative FederalismDocumento4 pagineAssignment On Cooperative FederalismSUNYYR100% (1)

- Ashoka Empire EssayDocumento7 pagineAshoka Empire EssaySUNYYRNessuna valutazione finora

- Org - Role of BsoDocumento12 pagineOrg - Role of BsoSUNYYRNessuna valutazione finora

- Sewage Collection and DisposalDocumento92 pagineSewage Collection and DisposalSUNYYRNessuna valutazione finora

- An Inconvenient Truth REVIEWDocumento4 pagineAn Inconvenient Truth REVIEWSUNYYRNessuna valutazione finora

- Performance Appraisal: Self Evaluation Phrases-1Documento6 paginePerformance Appraisal: Self Evaluation Phrases-1SUNYYRNessuna valutazione finora

- Basic Accounting RatiosDocumento47 pagineBasic Accounting RatiosSUNYYRNessuna valutazione finora

- CME Letter Delhi Accomodation FinalDocumento3 pagineCME Letter Delhi Accomodation FinalSUNYYRNessuna valutazione finora

- India's Nuclear Policy: Strategic ImplicationsDocumento2 pagineIndia's Nuclear Policy: Strategic ImplicationsSUNYYRNessuna valutazione finora

- SewerageDocumento59 pagineSewerageSUNYYRNessuna valutazione finora

- Monzo Bank Statement 2021 10 15-2021 10 15 4582Documento3 pagineMonzo Bank Statement 2021 10 15-2021 10 15 4582Myt WovenNessuna valutazione finora

- Ex10 - Working Capital Management With SolutionDocumento9 pagineEx10 - Working Capital Management With SolutionJonas Mondala80% (5)

- Inflation DissertationDocumento59 pagineInflation Dissertationbaguma100% (1)

- Century Paper and Board Mills Limited - Case StudyDocumento23 pagineCentury Paper and Board Mills Limited - Case StudyJuvairiaNessuna valutazione finora

- P1 Investment Appraisal MethodsDocumento3 pagineP1 Investment Appraisal MethodsSadeep Madhushan0% (1)

- Substation Tender DocumentDocumento97 pagineSubstation Tender DocumentthibinNessuna valutazione finora

- Chapter 2 Macro SolutionDocumento11 pagineChapter 2 Macro Solutionsaurabhsaurs100% (1)

- SOLENNE Temporary Sales InvoiceDocumento1 paginaSOLENNE Temporary Sales InvoiceMark Anthony CasupangNessuna valutazione finora

- Final Word-Over The Counter Exchange of IndiaDocumento14 pagineFinal Word-Over The Counter Exchange of IndiaVidita VanageNessuna valutazione finora

- Momo Statement ReportDocumento2 pagineMomo Statement ReportHolybabyNessuna valutazione finora

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocumento6 pagineThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureSachinNessuna valutazione finora

- SET 2 TCAA 2021 DepEd Forms Above P500K and Autonomous v1.0Documento14 pagineSET 2 TCAA 2021 DepEd Forms Above P500K and Autonomous v1.0Aynrand SalvadorNessuna valutazione finora

- Pfau Sustainable Withdrawal Rates WhitepaperDocumento14 paginePfau Sustainable Withdrawal Rates WhitepaperJohn Koh100% (1)

- Group 8 - Final Report - Mutual Funds in VietnamDocumento18 pagineGroup 8 - Final Report - Mutual Funds in VietnamNguyễn Thuỳ DungNessuna valutazione finora

- Adnan ThesisDocumento51 pagineAdnan ThesisMohammad Naveed Hashmi100% (1)

- Soal Pas Myob Kelas Xii GanjilDocumento4 pagineSoal Pas Myob Kelas Xii GanjilLank BpNessuna valutazione finora

- Financial Management-Kings 2012Documento2 pagineFinancial Management-Kings 2012Suman KCNessuna valutazione finora

- Chapter 10Documento16 pagineChapter 10Charlene LeynesNessuna valutazione finora

- Convertibility of RupeeDocumento14 pagineConvertibility of RupeeArun MishraNessuna valutazione finora

- Dtaa AnnexureDocumento4 pagineDtaa AnnexureAkansha SharmaNessuna valutazione finora

- Financial Management For ArchitectsDocumento10 pagineFinancial Management For ArchitectsARD SevenNessuna valutazione finora

- MMT and Its CritiquesDocumento10 pagineMMT and Its CritiquestymoigneeNessuna valutazione finora

- Draft Version - Article On Cross Collateralization-C1Documento6 pagineDraft Version - Article On Cross Collateralization-C1Rohit Anand DasNessuna valutazione finora

- The Revenue CycleDocumento36 pagineThe Revenue CycleGerlyn Dasalla ClaorNessuna valutazione finora

- Citibank Research PaperDocumento5 pagineCitibank Research Paperzwyzywzjf100% (1)

- Literature ReviewDocumento3 pagineLiterature Reviewkalaswami50% (2)

- LBO Case Study 1Documento2 pagineLBO Case Study 1Zexi WUNessuna valutazione finora

- Ratio Analysis of Banking Reports (HBL, UBL, MCB Etc)Documento42 pagineRatio Analysis of Banking Reports (HBL, UBL, MCB Etc)Fahad Khan80% (20)