Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

10 Ways To Protect Your Company From Expense Fraud V2 PDF

Caricato da

Ndumiso Shoko0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

19 visualizzazioni1 paginaTitolo originale

10-Ways-to-Protect-Your-Company-From-Expense-Fraud-V2.pdf

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

19 visualizzazioni1 pagina10 Ways To Protect Your Company From Expense Fraud V2 PDF

Caricato da

Ndumiso ShokoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

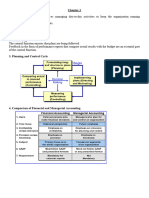

10 Ways to Protect Your Company

From Expense Fraud

Expense fraud costs US companies $1 billion per year and most cases last a total of two years

before being detected. Employ strong prevention and detection strategies to keep your

organization safe from this common form of fraud.

$ $ $ 6. Issue corporate credit cards to

employees who travel frequently. Send all

statements to the accounting department and

1. Have a company expense policy. ensure that only business-related expenses are

Distribute the policy to all employees and ensure charged to corporate credit cards.

they have read and understood it. Include

information on how the company handles

breaches of the policy and fraudulent expense 7. Discipline employees who violate

reimbursement claims.

the expense policy to ensure everyone

knows that the company takes compliance

2. Implement controls at the seriously. Don’t make “special” cases for

executives and upper management. Everyone

submission stage that apply to every expense should be following the same rules.

claim. Executives and upper management are the

most frequent perpetrators of expense fraud, so

controls must apply to them too.

8. Provide training to everyone involved

in approving expense reimbursements and

refresh training regularly to keep the accounting

3. Empower approvers to question department up to date on policy changes and new

employees about their expense claims to show types of violations.

employees that submissions are reviewed and

checked. Deny any expenses that don’t fall within

the guidelines of the company expense policy. 9. Consider software for managing

expenses. Eliminating the manual aspect

4. Implement a secondary control. of reviewing expenses will save time, reduce

Conduct monthly analysis on average amounts mistakes and help generate valuable data for

of employee claims, by claim type and by total comparison and analysis, allowing you to run

amounts claimed to spot trends and identify areas reports that flag suspicious transactions.

that need attention.

10. Embed compliance into the

5. Conduct regular audits of company culture by ensuring the leadership

reimbursements to ensure the company team demonstrates their commitment to the

policy is being followed by all employees. Inform expense policy. When managers and executives

employees of discrepancies and minor violations to follow the rules, employees will do the same.

warn them that their expenses are being monitored.

For more information on i-Sight’s products and services feel free to contact

us at 1-800-465-6089, info@i-sight.com or visit our website i-sight.com

Potrebbero piacerti anche

- How to Audit Your Account without Hiring an AuditorDa EverandHow to Audit Your Account without Hiring an AuditorNessuna valutazione finora

- Improving Cash and Working Capital ManagementDocumento4 pagineImproving Cash and Working Capital ManagementAnonymous iMq2HDvVqNessuna valutazione finora

- THEORYDocumento6 pagineTHEORYsuduh09Nessuna valutazione finora

- MODULE 3 PPT Managerial Accounting As A CareerDocumento27 pagineMODULE 3 PPT Managerial Accounting As A CareerAnnabel SenitaNessuna valutazione finora

- Cost FINALDocumento62 pagineCost FINALthangarajbala123Nessuna valutazione finora

- Management FeasibilityDocumento4 pagineManagement FeasibilityHoney Grace T. PanesNessuna valutazione finora

- Auditing Theory Ch1-Guide Questions With AnswerDocumento8 pagineAuditing Theory Ch1-Guide Questions With AnswerElaineNessuna valutazione finora

- Risk Management PolicyDocumento9 pagineRisk Management PolicyPanganayi JamesNessuna valutazione finora

- Ethics in Accounting and Finance: © The Institute of Chartered Accountants of IndiaDocumento8 pagineEthics in Accounting and Finance: © The Institute of Chartered Accountants of IndiaSushant SaxenaNessuna valutazione finora

- ACCOUNTING PRINCIPLES AND PRACTICES in INSURANCE COMPANIESDocumento4 pagineACCOUNTING PRINCIPLES AND PRACTICES in INSURANCE COMPANIESSifat TarannumNessuna valutazione finora

- FRAUD RISK Point 4-6Documento6 pagineFRAUD RISK Point 4-6Nada An-NaurahNessuna valutazione finora

- Catamura, Mark Louie Bsba 4c - Lesson 1 - ActivityDocumento5 pagineCatamura, Mark Louie Bsba 4c - Lesson 1 - ActivityMark Louie Catamura100% (1)

- EY Ban - A Wake-Up Call For Auditors EverywhereDocumento2 pagineEY Ban - A Wake-Up Call For Auditors EverywherevisshelpNessuna valutazione finora

- Solution Assuranceand Audit Practice May 2009Documento9 pagineSolution Assuranceand Audit Practice May 2009samuel_dwumfourNessuna valutazione finora

- FSA&V Case StudyDocumento10 pagineFSA&V Case StudyAl Qur'anNessuna valutazione finora

- Topic 1 Cost Accounting CostDocumento3 pagineTopic 1 Cost Accounting CostCarry KelvinsNessuna valutazione finora

- Cost AuditDocumento4 pagineCost AuditDivya RaoNessuna valutazione finora

- Wenjun Herminado QuizzzzzDocumento3 pagineWenjun Herminado QuizzzzzWenjunNessuna valutazione finora

- Enterpreneurship Chapter-7 GrowthDocumento12 pagineEnterpreneurship Chapter-7 GrowthBantamkak FikaduNessuna valutazione finora

- Accounts Receivable: Special JargonDocumento9 pagineAccounts Receivable: Special Jargonrashmikant vyasNessuna valutazione finora

- Topic OneDocumento15 pagineTopic OnechelseaNessuna valutazione finora

- Business Plan Financial Plan A. Financial Projections Sources of Funds The BusinessDocumento7 pagineBusiness Plan Financial Plan A. Financial Projections Sources of Funds The BusinessPM WritersNessuna valutazione finora

- Introduction of FMDocumento11 pagineIntroduction of FMsonika7Nessuna valutazione finora

- Bea Angelee Arellano REM 1. What Is Accounting? Accounting Is How Finances Are Tracked by An Individual orDocumento4 pagineBea Angelee Arellano REM 1. What Is Accounting? Accounting Is How Finances Are Tracked by An Individual orBea ArellanoNessuna valutazione finora

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocumento72 pagineSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNessuna valutazione finora

- Cost Accounting Needs To Identify The Different Types of ExpensesDocumento3 pagineCost Accounting Needs To Identify The Different Types of ExpensesRupali SinghNessuna valutazione finora

- Auditing Unit 2 NotesDocumento23 pagineAuditing Unit 2 NotesMahaktaj BashaNessuna valutazione finora

- Accounting Ethics PDFDocumento6 pagineAccounting Ethics PDFSunday OcheNessuna valutazione finora

- CORPORATE FINANCE Mba 2nd NotesDocumento100 pagineCORPORATE FINANCE Mba 2nd Noteskunal roxNessuna valutazione finora

- Chapter 01 Overview of Cost Management and StrategyDocumento3 pagineChapter 01 Overview of Cost Management and StrategySeventeen HomeNessuna valutazione finora

- C3 Ethics, Fraud, and Internal ControlDocumento12 pagineC3 Ethics, Fraud, and Internal ControlLee SuarezNessuna valutazione finora

- Unit 1-IntroductionDocumento13 pagineUnit 1-Introductionavinal malikNessuna valutazione finora

- 7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesDocumento9 pagine7.1.1 Record Keeping: It Is Necessary To Have Good Records For Effective Control and For Tax PurposesTarekegnNessuna valutazione finora

- Management AccountingDocumento18 pagineManagement AccountingFiyadNessuna valutazione finora

- Chapter 5 Principls and ConceptsDocumento10 pagineChapter 5 Principls and ConceptsawlachewNessuna valutazione finora

- Performance AssessmentDocumento66 paginePerformance Assessmentshaikhsadiya282Nessuna valutazione finora

- Business FinanceDocumento91 pagineBusiness FinanceIStienei B. EdNessuna valutazione finora

- Technical University of Mombasa School of Business Department of Accounting and Finance Bachelor of CommerceDocumento7 pagineTechnical University of Mombasa School of Business Department of Accounting and Finance Bachelor of CommerceSalimNessuna valutazione finora

- Cost AccountingDocumento12 pagineCost AccountingMeenakshi SeerviNessuna valutazione finora

- Cost & Management AccountingDocumento6 pagineCost & Management Accountingshivam goyalNessuna valutazione finora

- 1 - Cost Accounting ConceptsDocumento40 pagine1 - Cost Accounting ConceptsCharisse Ahnne TosloladoNessuna valutazione finora

- Diagnosis To Find Out Reason For Sickness in SME by Amritraj D BangeraDocumento6 pagineDiagnosis To Find Out Reason For Sickness in SME by Amritraj D BangeraAmritraj D.BangeraNessuna valutazione finora

- Notes To Mid 1Documento24 pagineNotes To Mid 1Ismam Ahmed ApurbaNessuna valutazione finora

- Assignment-1: Compliance RequirementsDocumento26 pagineAssignment-1: Compliance RequirementsDivya JoshiNessuna valutazione finora

- Mock Examination Answers Auditing and Assurance November 22 2022Documento17 pagineMock Examination Answers Auditing and Assurance November 22 2022magdawaks46Nessuna valutazione finora

- AuditingDocumento11 pagineAuditingkassahungedefaye312Nessuna valutazione finora

- Business Finance Week 3 4Documento10 pagineBusiness Finance Week 3 4Camille CornelioNessuna valutazione finora

- Advanced Accounting TheoriesDocumento3 pagineAdvanced Accounting TheoriesLizie100% (1)

- Auditng CIA-1Documento5 pagineAuditng CIA-1Hitesh ohlyanNessuna valutazione finora

- Assessment 3 - Written ReportDocumento9 pagineAssessment 3 - Written Reportmuhammad raqibNessuna valutazione finora

- MGT 209 - CH 13 NotesDocumento6 pagineMGT 209 - CH 13 NotesAmiel Christian MendozaNessuna valutazione finora

- Assig 2Documento29 pagineAssig 2vinayNessuna valutazione finora

- Overview of Cost AccountingDocumento21 pagineOverview of Cost AccountingVinayNessuna valutazione finora

- Auditing II Ude200062 Tuto 2Documento2 pagineAuditing II Ude200062 Tuto 2nadiiny maniNessuna valutazione finora

- Arens Auditing16e SM 01Documento14 pagineArens Auditing16e SM 01Mohd KdNessuna valutazione finora

- Course Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The CourseDocumento29 pagineCourse Code - 102 Course Title-Accounting For Business Decisions 2. Learning Objectives of The Courseavinash singhNessuna valutazione finora

- Cost Accounting-Task No. 1Documento11 pagineCost Accounting-Task No. 1Aguilar Desirie P.Nessuna valutazione finora

- Cost AccountingDocumento117 pagineCost AccountingSIKANDARR GAMING YTNessuna valutazione finora

- First HomeworkDocumento6 pagineFirst HomeworkDanaNessuna valutazione finora

- Auditors LiabilityDocumento36 pagineAuditors LiabilityVaibhav BanjanNessuna valutazione finora

- IESBA-Code of EthicsDocumento1 paginaIESBA-Code of EthicsAlHusseinAlShukairiNessuna valutazione finora

- UCT 04 DepositsDocumento2 pagineUCT 04 DepositsNopetyNessuna valutazione finora

- JLD 32103 Introduction To Risk Management and InsuranceDocumento3 pagineJLD 32103 Introduction To Risk Management and InsurancehafidzNessuna valutazione finora

- TDS Grossing Up Agreement To Gross Up Available - Sergi TransformersDocumento6 pagineTDS Grossing Up Agreement To Gross Up Available - Sergi TransformersGOKUL BALAJINessuna valutazione finora

- Steel Tech. v. 808 HI-DR8 - ComplaintDocumento17 pagineSteel Tech. v. 808 HI-DR8 - ComplaintSarah BursteinNessuna valutazione finora

- Jobs-865-Advertisement STA PDFDocumento4 pagineJobs-865-Advertisement STA PDFShalin NairNessuna valutazione finora

- 23-1 ShackleDocumento2 pagine23-1 ShackleAkhilNessuna valutazione finora

- Essay 2Documento6 pagineEssay 2api-249962833Nessuna valutazione finora

- Importance of Product Knowledge: STC ChennaimetroDocumento20 pagineImportance of Product Knowledge: STC ChennaimetrotsrajanNessuna valutazione finora

- 2 G.R. No. 178288 - Spouses Fortaleza v. Spouses LapitanDocumento3 pagine2 G.R. No. 178288 - Spouses Fortaleza v. Spouses LapitanAndelueaNessuna valutazione finora

- General Instructions On How To Accomplish The Online Practical ExercisesDocumento4 pagineGeneral Instructions On How To Accomplish The Online Practical ExercisesManz ManzNessuna valutazione finora

- Ordoño V. Daquigan FactsDocumento2 pagineOrdoño V. Daquigan Factsrodel vallartaNessuna valutazione finora

- 24 - People v. Dela Torre-YadaoDocumento13 pagine24 - People v. Dela Torre-YadaoMargaux RamirezNessuna valutazione finora

- Human Development Index: Origins Dimensions and CalculationDocumento11 pagineHuman Development Index: Origins Dimensions and CalculationSanthosh PNessuna valutazione finora

- Information On Community Leader ElectionsDocumento152 pagineInformation On Community Leader ElectionsiphonemiqNessuna valutazione finora

- Cooperatives Perspectives in TanzaniaDocumento10 pagineCooperatives Perspectives in TanzaniaMichael NyaongoNessuna valutazione finora

- Dhs Policy Directive 047-01-007 Handbook For Safeguarding Sensitive PII 12-4-2017Documento20 pagineDhs Policy Directive 047-01-007 Handbook For Safeguarding Sensitive PII 12-4-2017jujachaves silvaNessuna valutazione finora

- Mitsubishi Electric Corporation V Westcode IncDocumento5 pagineMitsubishi Electric Corporation V Westcode IncLespassosNessuna valutazione finora

- HON. KIM S. JACINTO-HENARES, in Her Official Capacity As COMMISSIONER OF THE BUREAU OF INTERNAL REVENUE, PetitionerDocumento3 pagineHON. KIM S. JACINTO-HENARES, in Her Official Capacity As COMMISSIONER OF THE BUREAU OF INTERNAL REVENUE, PetitionerRochelle Othin Odsinada MarquesesNessuna valutazione finora

- Result MSC Nursing PDFDocumento7 pagineResult MSC Nursing PDFvkNessuna valutazione finora

- Fenimore CaseDocumento2 pagineFenimore CaseFlor GeldresNessuna valutazione finora

- Sample Minutes of The MeetingDocumento3 pagineSample Minutes of The MeetingZee KimNessuna valutazione finora

- Ocampo VS CoaDocumento9 pagineOcampo VS CoaRomy Ian Lim0% (1)

- FransaDocumento2 pagineFransaElena DafinaNessuna valutazione finora

- Invoice PDFDocumento1 paginaInvoice PDFShreya AgarwalNessuna valutazione finora

- Affidavit of Cancellation - DtiDocumento1 paginaAffidavit of Cancellation - Dtid-fbuser-5418440081% (21)

- Darex GL 1231-04 - enDocumento2 pagineDarex GL 1231-04 - enDiego GómezNessuna valutazione finora

- Spy The Lie Former CIA Officers Teach You How To Detect DeceptionDocumento11 pagineSpy The Lie Former CIA Officers Teach You How To Detect DeceptionMacmillan Publishers14% (14)

- How To Delete Groupme Chats - Google SearchDocumento1 paginaHow To Delete Groupme Chats - Google SearchLuis RiveraNessuna valutazione finora

- Ufgs 01 45 00.10 20Documento14 pagineUfgs 01 45 00.10 20jackcan501Nessuna valutazione finora