Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

USA UAE: IRMA/ PRM39/ FTA Class Quiz (11.03.2020) : Answer Key

Caricato da

Ruchi Shinde0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni2 pagineFta Irma Quiz1 Key

Titolo originale

Fta Irma Quiz1 Key

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoFta Irma Quiz1 Key

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

34 visualizzazioni2 pagineUSA UAE: IRMA/ PRM39/ FTA Class Quiz (11.03.2020) : Answer Key

Caricato da

Ruchi ShindeFta Irma Quiz1 Key

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

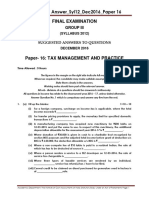

IRMA/PRM39/FTA/QUIZ-01

IRMA/ PRM39/ FTA Class Quiz (11.03.2020): Answer Key

Total Marks: 20 (10Q x 2 = 20)

Q1: The OECD country which has not adopted

VAT/ GST is ___________ (France/ UK/ USA),

while the latest GST/ VAT implementing country

is ________________ (Malaysia/ UAE/ India).

Q6: IGST, equal to sum total of CGST and

Q2: Which statements are correct in relation SGST, is levied on

to VAT/GST in India (√ Pl.) – (a) Intra-State supplies & Exports

(a) It is destination based tax on (b) Inter-State supplies & Imports √

consumption √ (c) Online Internet data traffic

(b) It is applicable only to B2B and not (d) Only Imports & Exports

B2C

(c) It is levied by local government bodies Q7: The letter of Credit (LC) is the part of

(d) Exports are zero rated √ ____________ (two/ three/ four) independent

contracts in relation to international trade. For

Q3: Match the following: LC, which is the __________ (first/ second/

A. Customs Act (i) 1975 >> third) contract in the sequence, the Global

[B] Banking system, since _____________ (2005/

B. Customs Tariff Act (ii) 2017 >> 2007/ 2010) follows the U. C. P. D. C.

[D] ____________ (400/ 600/ 900) of I. C. C.

C. SEZ Act (iii) 1962 >>

[A] Q8: One test of goods or not being goods

D. CGST Act (iv) 2005 >> [ C (service) is whether it is tangible in nature or

] not. To determine it in finality what other

factors one need to consider? (√ Pl.) –

Q4: Mr. Ravi, a GSTIN registration holder,

has a potato wafers start-up in a rural taluka. (a) Transfer of Title

He buys potatoes from various agriculturists, (b) Ownership

who are not registered under GST. To avail (c) Right to use

credits of tax he should pay GST on reverse (d) All of above √

charge basis on the supplies received from (e) None of above

unregistered agriculturists. The statement is-

(a) True √ Q9: If import prices are given in FOB terms,

(b) Partly true one must add ________________ (Actual,

(c) False 20% of FOB, 20% of actual) Freight and

____________ (Actual, 1.125% of Actual,

Q5: State True or False: 1.125% of FOB) Insurance, to arrive at CIF

(a) The Supplies to SEZ are treated as price for Custom purpose valuation.

exports by domestic company [ T ]

Q10: In the GST Council the votes of the

(b) The Windows software sold on a pen Centre has __________________ (1/3, 1/2,

drive is service [ F ] 2/3, 3/4) weights, while that of States is

(c) The IGM relates to Exports, while the ________________ (1/3, 1/2, 2/3, 3/4) and

EGM relates to Imports [ F ] the quorum consist of _________________

(1/3, 1/2, 2/3, 3/4) members while to take a

(d) To calculate IGST on imports, the

decision ____________ (1/3, 1/2, 2/3, 3/4) of

value includes customs duties [

the weighted vote must be in the support.

T ]

FTA20/IRMA/Quiz1/03-20/ Key

<The quiz-Key: Correct Answers Underlined and in Red Font>

Potrebbero piacerti anche

- GovTech Maturity Index: The State of Public Sector Digital TransformationDa EverandGovTech Maturity Index: The State of Public Sector Digital TransformationNessuna valutazione finora

- GST Question BankDocumento6 pagineGST Question Bankrohithsarmanagaraju01Nessuna valutazione finora

- IcstDocumento5 pagineIcstMukeshbhai ShahNessuna valutazione finora

- Form Vat - IiiDocumento4 pagineForm Vat - IiihrsolutionNessuna valutazione finora

- GST MULTIPLE CHOICEDocumento20 pagineGST MULTIPLE CHOICETax NatureNessuna valutazione finora

- Goods and Services Tax: Multiple Choice QuestionsDocumento20 pagineGoods and Services Tax: Multiple Choice QuestionsDhruti AthaNessuna valutazione finora

- Applied Indirect TaxationDocumento23 pagineApplied Indirect TaxationMehak KaushikkNessuna valutazione finora

- GST - MCQ by VGDocumento18 pagineGST - MCQ by VGIS WING APNessuna valutazione finora

- GSTDocumento13 pagineGSTpriyababu4701Nessuna valutazione finora

- Answers to GST QuestionsDocumento20 pagineAnswers to GST QuestionsVVR &CoNessuna valutazione finora

- GST MCQDocumento73 pagineGST MCQtongocharliNessuna valutazione finora

- GST MCQ 1Documento7 pagineGST MCQ 1avinashNessuna valutazione finora

- Price Schedule GoodsDocumento6 paginePrice Schedule GoodsDangi DilleeRamNessuna valutazione finora

- GST Multiple Choice QuestionsDocumento57 pagineGST Multiple Choice QuestionsTanvi DevaleNessuna valutazione finora

- MTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationDocumento6 pagineMTP - Intermediate - Syllabus 2016 - Dec 2019 - Set 1: Paper 11-Indirect TaxationvijaykumartaxNessuna valutazione finora

- ProceduresDocumento89 pagineProceduresmayur_jadav54Nessuna valutazione finora

- GST QuestionnaireDocumento2 pagineGST QuestionnaireIshan MehtaNessuna valutazione finora

- DT Full MCQ BookDocumento209 pagineDT Full MCQ BookPanth BaggaNessuna valutazione finora

- Slip 2 (AD/MA 1/1999) Exchange Control Software Export Declaration (Softex) FormDocumento4 pagineSlip 2 (AD/MA 1/1999) Exchange Control Software Export Declaration (Softex) FormRixinayNessuna valutazione finora

- Suggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate ExaminationDocumento14 pagineSuggested Answer - Syl12 - Dec2015 - Paper 11: Intermediate Examinationseenu pNessuna valutazione finora

- 356-Bba 603N - (A)Documento24 pagine356-Bba 603N - (A)Vikas PatelNessuna valutazione finora

- Itctp 2022Documento4 pagineItctp 2022Muskaan ShawNessuna valutazione finora

- MTP-QP-Dec2022-Intermediate Examination- Syllabus2016-P11-S1: Paper 11- Indirect TaxationDocumento7 pagineMTP-QP-Dec2022-Intermediate Examination- Syllabus2016-P11-S1: Paper 11- Indirect TaxationRehan RahmanNessuna valutazione finora

- CS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFDocumento5 pagineCS EXECUTIVE GST MOCK TEST PAPER 6 WITH ANSWER by CA VIVEK GABA PDFRadhika ChopraNessuna valutazione finora

- Annexes A G Road Clearing ValidationDocumento11 pagineAnnexes A G Road Clearing ValidationJoemar SalmoroNessuna valutazione finora

- P16 - Syl2012 CostDocumento16 pagineP16 - Syl2012 CostheerunheroNessuna valutazione finora

- Direct Taxation Paper SolutionDocumento16 pagineDirect Taxation Paper SolutionRama KrishnaNessuna valutazione finora

- Full Syllabus GST Test - 1 Without AnswersDocumento19 pagineFull Syllabus GST Test - 1 Without Answersrajbhanushali3981Nessuna valutazione finora

- Exchange Control Software Export Declaration (Softex) FormDocumento4 pagineExchange Control Software Export Declaration (Softex) FormRixinayNessuna valutazione finora

- GST PRACTICE SET - 6th EDITION - SET JDocumento6 pagineGST PRACTICE SET - 6th EDITION - SET JGANESH KUNJAPPA POOJARINessuna valutazione finora

- Softex FormDocumento4 pagineSoftex Formrajkumarjain10Nessuna valutazione finora

- GST MCQDocumento22 pagineGST MCQG Prasana KumarNessuna valutazione finora

- Tax MCQ 5Documento17 pagineTax MCQ 5siddhant.gupta.delhiNessuna valutazione finora

- Mcqs On DrfinitionsDocumento9 pagineMcqs On DrfinitionsNudrat niazNessuna valutazione finora

- CBIC Regulation-6 Exam QuestionsDocumento21 pagineCBIC Regulation-6 Exam QuestionsImport Export ConsultancyNessuna valutazione finora

- Changes in ITC Reporting in GSTR - 3BDocumento6 pagineChanges in ITC Reporting in GSTR - 3BKirtan Ramesh JethvaNessuna valutazione finora

- Paper 18Documento5 paginePaper 18VijayaNessuna valutazione finora

- 1 - PRELIMINARY-Q - As - AFTER SESSION 4Documento6 pagine1 - PRELIMINARY-Q - As - AFTER SESSION 4Mighty SinghNessuna valutazione finora

- Ca Inter Indirect Tax MCQDocumento85 pagineCa Inter Indirect Tax MCQVikramNessuna valutazione finora

- Intermediate Examination: Suggested Answers To QuestionsDocumento13 pagineIntermediate Examination: Suggested Answers To Questionsnarendra225Nessuna valutazione finora

- CA FINAL INDIRECT TAX LAWS MCQ PRACTICEDocumento4 pagineCA FINAL INDIRECT TAX LAWS MCQ PRACTICEJignesh NagarNessuna valutazione finora

- Manoj Batra 120 MCQDocumento14 pagineManoj Batra 120 MCQAjay BalachandranNessuna valutazione finora

- MCQ's IDTDocumento45 pagineMCQ's IDTangadsharmaNessuna valutazione finora

- Paper11_Set1Documento8 paginePaper11_Set1mvsvvksNessuna valutazione finora

- CS Tax Question CsDocumento16 pagineCS Tax Question Csgopika mundraNessuna valutazione finora

- CA Final IDT A MTP 1 May 2024 Castudynotes ComDocumento13 pagineCA Final IDT A MTP 1 May 2024 Castudynotes Comamanjain254Nessuna valutazione finora

- Financial Accounting and Auditing X - Costing (SEM VI)Documento24 pagineFinancial Accounting and Auditing X - Costing (SEM VI)721DEEPIKA SOYANessuna valutazione finora

- GST & Charge of GST PaperDocumento3 pagineGST & Charge of GST PaperDevendra AryaNessuna valutazione finora

- Igst Itc 11112022Documento18 pagineIgst Itc 11112022hrtclients1Nessuna valutazione finora

- GST MCQS - 2 Without AnswerDocumento9 pagineGST MCQS - 2 Without AnswerSpidy MacNessuna valutazione finora

- Model Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsDocumento25 pagineModel Question Paper - IGST Act.: (2 Marks Each) Multiple Choice QuestionsShyam Prasad100% (1)

- GST MCQS - 4 Without AnswerDocumento6 pagineGST MCQS - 4 Without AnswerSpidy MacNessuna valutazione finora

- TYBCom-Sem-VI-Indirect Taxes-GST MCQsDocumento10 pagineTYBCom-Sem-VI-Indirect Taxes-GST MCQsMâyúř PäťîĺNessuna valutazione finora

- Intermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)Documento12 pagineIntermediate Examination Syllabus 2016 Paper 11: Indirect Taxation (ITX)AnjaliNessuna valutazione finora

- Direct Tax Laws & International Taxation Mock Test Paper SeriesDocumento11 pagineDirect Tax Laws & International Taxation Mock Test Paper SeriesDeepsikha maitiNessuna valutazione finora

- Form GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BDocumento6 pagineForm GSTR-3B System Generated Summary: Section I: Auto-Populated Details of Table 3.1,3.2 and 4 of FORM GSTR-3BMUJAHIDUL ISLAM SHAIKHNessuna valutazione finora

- Paper Set1Documento8 paginePaper Set1AVS InfraNessuna valutazione finora

- R2.TAXM - .L Question CMA June 2021 Exam.Documento7 pagineR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNessuna valutazione finora

- 4 Law of TaxationDocumento21 pagine4 Law of TaxationssNessuna valutazione finora

- Basic Concepts MCQs by CA Pranav ChandakDocumento11 pagineBasic Concepts MCQs by CA Pranav ChandakJoginder shahNessuna valutazione finora

- QF Jute Spinning SardarDocumento27 pagineQF Jute Spinning SardarRuchi ShindeNessuna valutazione finora

- Jute Weft Widingoperator TSC Q0304Documento48 pagineJute Weft Widingoperator TSC Q0304Ruchi ShindeNessuna valutazione finora

- Letter of CreditDocumento14 pagineLetter of CreditRuchi ShindeNessuna valutazione finora

- USA UAE: IRMA/ PRM39/ FTA Class Quiz (11.03.2020) : Answer KeyDocumento2 pagineUSA UAE: IRMA/ PRM39/ FTA Class Quiz (11.03.2020) : Answer KeyRuchi ShindeNessuna valutazione finora

- FTA Quiz 1Documento3 pagineFTA Quiz 1Ruchi ShindeNessuna valutazione finora

- CBSE Class 12 Economics Revision Notes Indian Economy on the Eve of IndependenceDocumento2 pagineCBSE Class 12 Economics Revision Notes Indian Economy on the Eve of IndependenceAryan ph vlogsNessuna valutazione finora

- Assignment GE MckinseyDocumento2 pagineAssignment GE MckinseyBhavana Watwani100% (1)

- Alat Pemotong Tahu (Jurnal)Documento26 pagineAlat Pemotong Tahu (Jurnal)Aldi EmNessuna valutazione finora

- Article 1232-1235Documento3 pagineArticle 1232-1235Dianna Rose Vico100% (1)

- RECOGNISED PROFESSIONAL BODIES CONTACT DETAILSDocumento17 pagineRECOGNISED PROFESSIONAL BODIES CONTACT DETAILSGD SinghNessuna valutazione finora

- Investment PolicyDocumento16 pagineInvestment PolicyNonoNessuna valutazione finora

- Annual Income Statement Report Name: Laporan Laba Rugi / Nama / Ery Abd Nasir PelupessyDocumento2 pagineAnnual Income Statement Report Name: Laporan Laba Rugi / Nama / Ery Abd Nasir PelupessyErry Abdul Nasir PelupessyNessuna valutazione finora

- A Study On Financial Analysis at Basaveshwar Urban Co-Operative Credit SocietyDocumento79 pagineA Study On Financial Analysis at Basaveshwar Urban Co-Operative Credit Society20PMHS005 - Diptasree DebbarmaNessuna valutazione finora

- Fraudulent TransferDocumento3 pagineFraudulent TransferSeenu SeenuNessuna valutazione finora

- Krugman - The Myth of AsiaDocumento13 pagineKrugman - The Myth of AsiaUmberto TabalappiNessuna valutazione finora

- Info@ks-Legal - In: Rating/Loan Eligibility Across The IndustryDocumento2 pagineInfo@ks-Legal - In: Rating/Loan Eligibility Across The IndustryChinmoy DeNessuna valutazione finora

- Aca Brother Contract of Lease - Doc2Documento6 pagineAca Brother Contract of Lease - Doc2Janice Gail BartolomeNessuna valutazione finora

- Women EntrepreneursDocumento25 pagineWomen Entrepreneursnoufalnaheemkk786Nessuna valutazione finora

- FESCO July BILLDocumento2 pagineFESCO July BILLacademic.kashifNessuna valutazione finora

- Economic Integration: Trade Creation and Diversion EffectsDocumento40 pagineEconomic Integration: Trade Creation and Diversion EffectsAdam GamblinNessuna valutazione finora

- THE LABORATORY QUALITY MANUAL TempDocumento37 pagineTHE LABORATORY QUALITY MANUAL Tempkavaim001Nessuna valutazione finora

- Understanding Market EquilibriumDocumento22 pagineUnderstanding Market EquilibriumTw YulianiNessuna valutazione finora

- HISTORIC BOND PRICE LISTDocumento4 pagineHISTORIC BOND PRICE LISTGustavo RedondoNessuna valutazione finora

- Birth of The CISG - Its Applicability and NatureDocumento12 pagineBirth of The CISG - Its Applicability and NatureAshi JainNessuna valutazione finora

- Global Management Intel CaseDocumento2 pagineGlobal Management Intel Caseapi-705719715Nessuna valutazione finora

- Tax Invoice for R K Steels YadgirDocumento1 paginaTax Invoice for R K Steels Yadgirsudheer kulkarniNessuna valutazione finora

- Quote To Afina Sistemas Informaticos Ltda 3017385Documento1 paginaQuote To Afina Sistemas Informaticos Ltda 3017385Rubén CastañoNessuna valutazione finora

- LeaseDocumento7 pagineLeaseSeenu SeenuNessuna valutazione finora

- Advantages of GlobalizationDocumento8 pagineAdvantages of GlobalizationKen Star100% (1)

- Interest Rates On Deposits: Nri Deposits : Non-Resident External (Nre) Deposits - Less Than 5 Crores W.E.F 03/09/2021Documento3 pagineInterest Rates On Deposits: Nri Deposits : Non-Resident External (Nre) Deposits - Less Than 5 Crores W.E.F 03/09/2021Deepak GoyalNessuna valutazione finora

- ManscieDocumento10 pagineManscieNicole Tonog AretañoNessuna valutazione finora

- Advanced Marketing Management: Case Study: Culinarian Cookware: Pondering Price PromotionDocumento3 pagineAdvanced Marketing Management: Case Study: Culinarian Cookware: Pondering Price PromotionKRISHNA YELDINessuna valutazione finora

- Cambridge IGCSE™: Accounting 0452/22 March 2021Documento19 pagineCambridge IGCSE™: Accounting 0452/22 March 2021Farrukhsg50% (2)

- Data AnalyticDocumento26 pagineData AnalyticVipul NimbolkarNessuna valutazione finora

- MAS 8 Short-Term Budgeting and Forecasting FOR UPLOADDocumento10 pagineMAS 8 Short-Term Budgeting and Forecasting FOR UPLOADJD SolañaNessuna valutazione finora