Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Meaning, Types & Merits/Demerits of Direct & Indirect Taxes

Caricato da

SaurabhTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Meaning, Types & Merits/Demerits of Direct & Indirect Taxes

Caricato da

SaurabhCopyright:

Formati disponibili

Meaning of a tax :- A tax is a compulsory payment to government without expectation of direct

benefits to the tax payer. For example taxes on income, wealth, imports, exports etc.

Types of taxes :- There are two types of taxes : (i) Direct Tax and (ii) Indirect Tax.

Direct Tax

If the liability to pay a tax and its burden falls on the same person, it is termed as direct tax. Burden of a

direct tax cannot be shifted to other persons. Examples of direct taxes are income tax, corporation tax,

wealth tax, expenditure tax, estate duties etc.

Indirect tax

If the liability to pay a tax and its burden can be on different persons, it is called indirect tax. Thus, the

burden of an indirect tax can be shifted on other persons. Examples are sales tax, excise duties, custom

duties, entertainment tax etc.

Merits of Direct Taxes:

(i) They are imposed according to the ability of the person to pay. Therefore these taxes are

considered progressive.

(ii) The revenue is income elastic; because of the progressive character revenue will increase faster

than the increase in income .

(iii) These taxes create better civic consciousness because the person paying knows clearly how

much he has paid. This incidentally fulfils the objective of certainty.

(iv) They best serve the purpose of transference of income from the rich to the poor, through

provision of amenities to the poor or even direct monetary help like old age pensions.

Demerits of Direct Taxes :

(i) The ability to pay is difficult to determine; only a rough idea can be formed.

(ii) Because of undeclared sources of income or evasion, the actual payment may not be strictly

according to the ability to pay. It is also sometimes said that direct taxes are taxes on the

honesty of the person.

(iii) Such taxes necessitate proper maintenance of accounts which some of the tax payers may not

be able to do.

(iv) The assessment procedure is also cumbersome requiring expert assistance of tax advisers. The

direct tax system is often very complicated.

Merits of Indirect Taxes

(i) The most important merit is convenience in assessment and a relative difficulty in evasion.

(ii) Since the tax is included in the price, the consumer may not even realise that he is paying a tax.

The amount of tax on each item is often so small as really not to hurt the tax payer.

(iii) Even these taxes may not be really regressive if they are levied on ad valorem basis or on the

basis of value. The rates may also be differential-higher for luxury articles and lower for

necessaries; the latter are sometimes fully exempt.

(iv) Such taxes are difficult to evade. Unless the producers resort to manipulation of accounts or

smuggling, it is difficult to evade the excise duty. In case of customs duties, articles are taxed the

moment they enter the country. However, it is difficult to make a similar claim in respect of

sales tax.

(v) Indirect taxes on drinks, narcotics and tobacco, serve a social purpose by discouraging their

consumption.

Demerits of Indirect Taxes:

(i) These taxes are often criticised for their regressive character. Taxes on necessaries of life will

certainly mean taxing the poor and that will mean taxing the rich and the poor alike.

(ii) Also it is contended that these taxes do not create social consciousness because they are often

not felt by tax payers.

(iii) Government is not certain about the proceeds of these taxes.

(iv) The burden of indirect taxes can be shifted forward or backward. In most of the cases, the

consumers have to bear the ultimate burden of indirect taxes.

(v) These taxes can also be evaded by such methods as smuggling, falsification of accounts

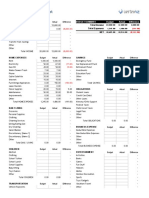

Distinction between direct and indirect tax

1. In case of direct tax, burden cannot be 1. In case of indirect tax burden can be

shifted on others. shifted to others.

2. Direct taxes are progressive in nature. 2. Indirect taxes are not progressive in

nature.

3. Indirect taxes can be avoided if a person

3. Direct taxes are compulsory payments does not purchase the commodity on

and cannot be avoided. which a case is imposed.

4. Examples of direct taxes are wealth tax, 4. Examples of indirect taxes are sales tax,

income tax and corporation tax. excise duty, customs duty etc.

Potrebbero piacerti anche

- Stop ForeclosureDocumento7 pagineStop ForeclosureRicharnellia-RichieRichBattiest-Collins0% (1)

- How To Make Money With Direct MailDocumento4 pagineHow To Make Money With Direct Maildirectmailsecrets100% (1)

- Preparation of Financial Statement For A Sole TraderDocumento8 paginePreparation of Financial Statement For A Sole TraderDebbie DebzNessuna valutazione finora

- Temple ArchitectureDocumento107 pagineTemple ArchitectureSaurabhNessuna valutazione finora

- Temple ArchitectureDocumento107 pagineTemple ArchitectureSaurabhNessuna valutazione finora

- Cooper Industries' Potential Acquisition of Nicholson File CompanyDocumento12 pagineCooper Industries' Potential Acquisition of Nicholson File CompanyLutful Kabir71% (7)

- Taxation Law 1 Compiled QuestionsDocumento4 pagineTaxation Law 1 Compiled QuestionsTiffany HuntNessuna valutazione finora

- Government Accounting ExamDocumento4 pagineGovernment Accounting ExamAllen GonzagaNessuna valutazione finora

- SBI Noc Format (Builder)Documento2 pagineSBI Noc Format (Builder)desibanda73100% (3)

- Essentials of Life Insurance ProductsDocumento113 pagineEssentials of Life Insurance ProductsApril ShowersNessuna valutazione finora

- Taxation Law ExplainedDocumento33 pagineTaxation Law ExplainedDavid100% (2)

- TAXATION PRINCIPLESDocumento20 pagineTAXATION PRINCIPLESSony Axle100% (11)

- Indirect Taxes 1,2,3Documento34 pagineIndirect Taxes 1,2,3Welcome 1995Nessuna valutazione finora

- Direct Tax and Indirect TaxDocumento2 pagineDirect Tax and Indirect TaxmykinsonNessuna valutazione finora

- Account Titles Unadjusted Trial Adjustments Balance Dr. Cr. DRDocumento6 pagineAccount Titles Unadjusted Trial Adjustments Balance Dr. Cr. DRJohn Gabriel BondoyNessuna valutazione finora

- Principles and Practice of Taxation Lecture Notes PDFDocumento20 paginePrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- Advantages of Direct TaxesDocumento3 pagineAdvantages of Direct TaxesIryna HoncharukNessuna valutazione finora

- TaxtypesDocumento19 pagineTaxtypesShrutiNessuna valutazione finora

- Notes - Residential Status Module 1Documento30 pagineNotes - Residential Status Module 1Sajan N ThomasNessuna valutazione finora

- LESSON 15 - TaxationDocumento4 pagineLESSON 15 - TaxationChirag HablaniNessuna valutazione finora

- A. Direct TaxDocumento4 pagineA. Direct TaxbharatNessuna valutazione finora

- Direct and Indirect Tax Merits and Demerits EconomicsDocumento6 pagineDirect and Indirect Tax Merits and Demerits EconomicsLalaNessuna valutazione finora

- Types of TaxationDocumento4 pagineTypes of TaxationfarahNessuna valutazione finora

- Indirect Taxes 1,2,3Documento33 pagineIndirect Taxes 1,2,3Welcome 1995Nessuna valutazione finora

- (Ecolebooks - Com) COMMERCE A LEVEL (FORM SIX) NOTES - TAXATIONDocumento14 pagine(Ecolebooks - Com) COMMERCE A LEVEL (FORM SIX) NOTES - TAXATIONMhiz MercyNessuna valutazione finora

- Unit - I TAX HistoryDocumento4 pagineUnit - I TAX HistoryWelcome 1995Nessuna valutazione finora

- Advantages and Disadvantages of TaxDocumento3 pagineAdvantages and Disadvantages of TaxR.N. RautNessuna valutazione finora

- Merits of Direct TaxesDocumento2 pagineMerits of Direct TaxesJack SonNessuna valutazione finora

- Basic Concepts of Income Tax - Direct vs Indirect TaxesDocumento33 pagineBasic Concepts of Income Tax - Direct vs Indirect TaxesDhananjay KumarNessuna valutazione finora

- Types of Taxes ExplainedDocumento10 pagineTypes of Taxes ExplainedmanjushreeNessuna valutazione finora

- Taxation LawDocumento38 pagineTaxation Lawmrfreak2023Nessuna valutazione finora

- Notes EconmicsDocumento18 pagineNotes EconmicsSubham PareekNessuna valutazione finora

- Difference between direct and indirect taxes explained in 40 charactersDocumento5 pagineDifference between direct and indirect taxes explained in 40 charactersRaytone Tonnie MainaNessuna valutazione finora

- Indirect tax definitionDocumento9 pagineIndirect tax definitionSuhas SalehittalNessuna valutazione finora

- Taxation LawDocumento94 pagineTaxation LawspandanaNessuna valutazione finora

- Answers For TaxationDocumento8 pagineAnswers For Taxationshruti sharmaNessuna valutazione finora

- Role of TaxationDocumento13 pagineRole of TaxationHassaanAteeqNessuna valutazione finora

- Advantages and Disadvantages of TaxationDocumento20 pagineAdvantages and Disadvantages of TaxationNimraa NoorNessuna valutazione finora

- Topic: Page NoDocumento21 pagineTopic: Page NoAcchu BajajNessuna valutazione finora

- Direct & Indirect Taxes and Sources of Revenue: Free E-BookDocumento9 pagineDirect & Indirect Taxes and Sources of Revenue: Free E-BooknehaNessuna valutazione finora

- Unit VIII (Public Finance)Documento12 pagineUnit VIII (Public Finance)darun17076Nessuna valutazione finora

- Q1. Define Tax and Explain The Important Characteristics of TaxDocumento37 pagineQ1. Define Tax and Explain The Important Characteristics of TaxSuryanarayana Murthy YamijalaNessuna valutazione finora

- Group 3 ReportingDocumento26 pagineGroup 3 ReportingBalontong, Marven Ceasar V.Nessuna valutazione finora

- Tax Direct Indire Adv Dis IndiaDocumento4 pagineTax Direct Indire Adv Dis IndiaRuhul AminNessuna valutazione finora

- Institute-University School of Business Department of CommerceDocumento21 pagineInstitute-University School of Business Department of Commercebhavu aryaNessuna valutazione finora

- Introduction To Income TaxDocumento13 pagineIntroduction To Income TaxPradeep RaghavanNessuna valutazione finora

- Direct Tax Capital GainsDocumento95 pagineDirect Tax Capital Gainskaran chawareNessuna valutazione finora

- Chapter 1Documento6 pagineChapter 1suhanivirdiNessuna valutazione finora

- TAXATION SYSTEM OF PAKISTANDocumento31 pagineTAXATION SYSTEM OF PAKISTANMalick Sajid Ali IlladiiNessuna valutazione finora

- Analysis of Advantages and Disadvantages of Indirect Taxes in IndiaDocumento10 pagineAnalysis of Advantages and Disadvantages of Indirect Taxes in IndiaRaGa JoThi0% (1)

- Difference Between Direct and Indirect TaxDocumento1 paginaDifference Between Direct and Indirect TaxSushovan RoyNessuna valutazione finora

- Reading Comprehension01Documento2 pagineReading Comprehension01SumitNessuna valutazione finora

- Table of ContentDocumento37 pagineTable of ContentEmmaNessuna valutazione finora

- HRD 104 - Qs II Topic Three (Taxation) Notes-1-1Documento10 pagineHRD 104 - Qs II Topic Three (Taxation) Notes-1-1Fidel FlavinNessuna valutazione finora

- Chapter 1 Introduction To Income Tax Act PDFDocumento66 pagineChapter 1 Introduction To Income Tax Act PDFRISHI SHAHNessuna valutazione finora

- What Are The Indirect TaxesDocumento3 pagineWhat Are The Indirect Taxesatmiya2010Nessuna valutazione finora

- Null 3Documento37 pagineNull 3GeofreyNessuna valutazione finora

- Indirecttaxes 141021115023 Conversion Gate01Documento28 pagineIndirecttaxes 141021115023 Conversion Gate01Mr. MOHAMMED AVVAD MECHANICALNessuna valutazione finora

- Government Microeconomic Intervention Pt.2Documento9 pagineGovernment Microeconomic Intervention Pt.2Yashjeet Gurung RCS KJNessuna valutazione finora

- CLASSIFICATION OF TAXDocumento2 pagineCLASSIFICATION OF TAXjonniebix9Nessuna valutazione finora

- Difference Between Direct & Indirect TaxesDocumento3 pagineDifference Between Direct & Indirect TaxesLMRP2 LMRP2Nessuna valutazione finora

- Definition of Taxation and Its Key ConceptsDocumento16 pagineDefinition of Taxation and Its Key ConceptsMd. Rayhanul IslamNessuna valutazione finora

- TAXATION LAW Final NotesDocumento95 pagineTAXATION LAW Final NotesTushita SonkarNessuna valutazione finora

- Taxation: Presented By: Manoj B.K Roll No.: 09Documento20 pagineTaxation: Presented By: Manoj B.K Roll No.: 09Sailesh PathakNessuna valutazione finora

- Conceptual Framework of TaxDocumento9 pagineConceptual Framework of Taxdpak bhusalNessuna valutazione finora

- Of Direct Benefit in Return To The Tax Payer". Hence, Taxes Have Following FeaturesDocumento3 pagineOf Direct Benefit in Return To The Tax Payer". Hence, Taxes Have Following FeaturesSanjay KarkiNessuna valutazione finora

- Direct Tax Vs Indirect TaxDocumento7 pagineDirect Tax Vs Indirect Taxsamuel debebeNessuna valutazione finora

- Citn New Professional Syllabus - Indirect TaxationDocumento95 pagineCitn New Professional Syllabus - Indirect TaxationtwweettybirdNessuna valutazione finora

- Lecture 1Documento10 pagineLecture 1Masitala PhiriNessuna valutazione finora

- DT Word 21Documento10 pagineDT Word 21Kirti ParkNessuna valutazione finora

- Rural and Urban CommunitiesDocumento3 pagineRural and Urban CommunitiesSaurabhNessuna valutazione finora

- Early Medieval and RomanasqueDocumento26 pagineEarly Medieval and RomanasqueSaurabhNessuna valutazione finora

- Planning&Expansion of Hospital Building PDFDocumento9 paginePlanning&Expansion of Hospital Building PDFdemullu reddiNessuna valutazione finora

- Sustainable DevelopmentDocumento4 pagineSustainable DevelopmentSaurabhNessuna valutazione finora

- ByzantineDocumento12 pagineByzantineSaurabhNessuna valutazione finora

- FORMS OF MARKET STRUCTURESDocumento4 pagineFORMS OF MARKET STRUCTURESSaurabhNessuna valutazione finora

- Understanding Social InstitutionsDocumento2 pagineUnderstanding Social InstitutionsSaurabhNessuna valutazione finora

- Social StratificationDocumento2 pagineSocial StratificationSaurabhNessuna valutazione finora

- SUPPLY: WHAT IS IT AND WHAT DETERMINES ITDocumento4 pagineSUPPLY: WHAT IS IT AND WHAT DETERMINES ITSaurabhNessuna valutazione finora

- Chapter-3 Egypt: Eighteenth Dynasty Painting From The Tomb of Theban Governor Ramose in Deir El-MadinahDocumento15 pagineChapter-3 Egypt: Eighteenth Dynasty Painting From The Tomb of Theban Governor Ramose in Deir El-MadinahSaurabhNessuna valutazione finora

- The Importance of Sustainability in Architecture and EconomyDocumento4 pagineThe Importance of Sustainability in Architecture and EconomySaurabhNessuna valutazione finora

- Sri LankaDocumento27 pagineSri LankaSaurabhNessuna valutazione finora

- The Position of Urbanization in IndiaDocumento4 pagineThe Position of Urbanization in IndiaSaurabhNessuna valutazione finora

- Egyptian ArchDocumento34 pagineEgyptian ArchSaurabhNessuna valutazione finora

- West Asian Architecture: Ziggurats and the Hanging GardensDocumento33 pagineWest Asian Architecture: Ziggurats and the Hanging GardensSaurabh100% (1)

- RomeDocumento9 pagineRomeSaurabhNessuna valutazione finora

- IVC, Vedic, BuddhistDocumento71 pagineIVC, Vedic, BuddhistSaurabhNessuna valutazione finora

- Types of Society: Tribal, Agrarian and Industrial SocietyDocumento7 pagineTypes of Society: Tribal, Agrarian and Industrial SocietySaurabhNessuna valutazione finora

- 3AR2: History of Architecture-IDocumento71 pagine3AR2: History of Architecture-ISaurabhNessuna valutazione finora

- Physical Tests Reveal Stone StrengthDocumento8 paginePhysical Tests Reveal Stone StrengthSaurabhNessuna valutazione finora

- Building StonesDocumento26 pagineBuilding StonesSaurabhNessuna valutazione finora

- Arrears Relief Calculator For W.B.govt Employees 2Documento4 pagineArrears Relief Calculator For W.B.govt Employees 2Rana BiswasNessuna valutazione finora

- Amma I Loove UDocumento97 pagineAmma I Loove UDeepesh Fal DessaiNessuna valutazione finora

- Income Tax Department Income Tax Department: Non-Filing of Return Non-Filing of ReturnDocumento1 paginaIncome Tax Department Income Tax Department: Non-Filing of Return Non-Filing of ReturnSarvesh SamantNessuna valutazione finora

- Pigmy DepositDocumento2 paginePigmy DepositVirendra PatilNessuna valutazione finora

- Kiruba ProDocumento3 pagineKiruba ProMOORTHI FINANCIAL SERVICESNessuna valutazione finora

- Big Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4Documento3 pagineBig Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4rida zulquarnainNessuna valutazione finora

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocumento3 pagineFixedline and Broadband Services: Your Account Summary This Month'S ChargesAkshatNessuna valutazione finora

- UCSB MapDocumento1 paginaUCSB MapXiaoyan WangNessuna valutazione finora

- Analyze financial statements with ratiosDocumento13 pagineAnalyze financial statements with ratiosDiwakar SrivastavaNessuna valutazione finora

- Working of Depositary System 110820104758 Phpapp02Documento76 pagineWorking of Depositary System 110820104758 Phpapp02harsh royNessuna valutazione finora

- Startup Annual Compliance ChecklistDocumento6 pagineStartup Annual Compliance ChecklistKrishnendu BhattacharyyaNessuna valutazione finora

- About Your Intermediary (Insurance Brokerage)Documento3 pagineAbout Your Intermediary (Insurance Brokerage)JabuNessuna valutazione finora

- Institute of Space Technology Functional RequirementsDocumento62 pagineInstitute of Space Technology Functional RequirementsMaheen AhmedNessuna valutazione finora

- Unit-5 Legal Aspects of Purchasing Management: An IntroductionDocumento25 pagineUnit-5 Legal Aspects of Purchasing Management: An IntroductionAnuj SinghNessuna valutazione finora

- Real Estate Finance Midterm SolutionsDocumento7 pagineReal Estate Finance Midterm SolutionsJiayu JinNessuna valutazione finora

- Importance and Usefulness of Financial StatementsDocumento3 pagineImportance and Usefulness of Financial Statementsvishal vadadoriya67% (3)

- 3) Banking and Financial ServicesDocumento20 pagine3) Banking and Financial ServicesAMIN BUHARI ABDUL KHADERNessuna valutazione finora

- Monthly Household Budget: IncomeDocumento6 pagineMonthly Household Budget: IncomeMayur NarkarNessuna valutazione finora

- Akl2 SEGMENT AND INTERIM FINANCIAL REPORTING (8-9) .Documento27 pagineAkl2 SEGMENT AND INTERIM FINANCIAL REPORTING (8-9) .Nanda Latifa PutriNessuna valutazione finora

- Tax Study Material PDFDocumento151 pagineTax Study Material PDFROHITH R MENONNessuna valutazione finora

- Taxation Powers and Principles ExplainedDocumento19 pagineTaxation Powers and Principles ExplainedRia GayleNessuna valutazione finora