Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

March 2005 Q. P. JR

Caricato da

M JEEVARATHNAM NAIDUTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

March 2005 Q. P. JR

Caricato da

M JEEVARATHNAM NAIDUCopyright:

Formati disponibili

Accountancy – I 1

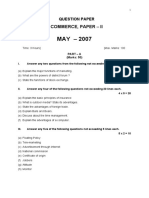

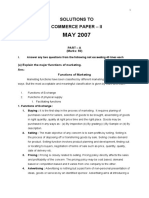

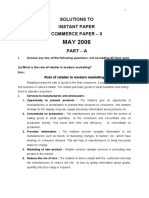

QUESTION PAPER

COMMERCE PAPER – I

MARCH – 2005

Time: 3 Hours] [Max. Marks: 100

PART – A

(Marks: 50)

I. Answer any TWO of the following questions not exceeding 40 lines.

2 X 10 = 20

(a) Define a Co-operative society and state the principles and characteristics of Co-

operative societies with examples.

(b) Distinguish between a private company and a public company.

(c) Explain the functions of Reserve Bank of India (RBI)

II. Answer any FOUR of the following questions not exceeding 20 lines.

4 X 5 = 20

(a) Define trade and explain the different types of trades with relevant examples.

(b) Discuss the rights, duties and liabilities of partners.

(c) What are the problems of Public Enterprises?

(d) What factors are to be considered in the selection of a communication system?

(e) Explain redeemable preference shares.

(f) Explain the merits of debentures as a source of finance.

III. Answer any FIVE of the following questions not exceeding 5 lines each.

5 X 2 = 10

(a) Define commerce.

(b) Minor partner.

(c) Articles of Association

(d) Minimum Subscription.

(e) Define Public Enterprises.

Accountancy – I 2

(f) Indexing

(g) Limitations of Institutional Finance.

(h) NABARD

PART – B

(Marks: 50)

IV. Answer any TWO of the following questions.

2 X 5 = 10

(a) Define accountancy and explain its function.

(b) Explain the rules/principles of debit and credit of different

accounts with examples.

(c) Prepare Venkatesh a/c up to 31-12-2003 in the books of

Vandana Stores and find out whether he is a debtor or

creditor.

2003 Rs.

Dec 4 Sold goods to Venkatesh 5,000

7 Cash received from Venkatesh 4,000

12 Returned goods by Venkatesh 200

17 Purchased goods from Venkatesh 2,000

19 Received cash from Venkatesh 1,000

21 Goods returned from Venkatesh 1,000

24 Venkatesh purchased goods from Vandana Stores 1,500

28 Venkatesh bought goods for cash 800

(d) Record the following transactions in the purchase book.

2004 Rs.

Mar 1 Goods purchased from Krishna 5,000

4 Purchased goods from Pal for cash 2,000

6 Goods purchased form Choudary 1,000

8 Goods purchased from Prasad 500

12 Goods purchased from Naveen brothers 15,000

21 Goods purchased from Upendra 2,500

V. Answer any ONE of the following questions:

1 X 10 = 10

(a) Prepare triple column Cash Book from the following:

2004 Particulars Rs.

June 1 Cash in hand 8,000

Cash at Bank 5,800

4 Cash sales 3,200

6 Issued a cheque to ‘B’ 2,950

Discount 50

7 Received cash from ‘R’ 1,200

Accountancy – I 3

Cheque 2,500

Discount 100

12 Cash withdrawn from bank for office use 800

20 Paid salaries by cheque 1,000

(b) Prepare bank Reconciliation Statement of Maruthi as on 31-12-2003.

(b) Overdraft as per cash book as on 31-12-2003 Rs.6, 000

(ii) Interest on overdraft Rs.200. Bank charges, Rs.50 debited in the passbook only.

(iii) Cheques issued but not cashed before 31-12-2003 are Rs.1, 500

(iv) Cheques paid in bank, but not collected before 31-12-2003 are Rs.1, 800

(v) Interest on Govt. Securities collected and credited in the passbook only Rs.2,

000.

VI. Answer any FIVE of the following questions.

5 x 2 = 10

(a) Consistency.

(b) Single entry system

(c) Define ledger.

(d) Credit Note

(e) Contra entry

(f) Explain the two causes for showing differences between the balances of Cash

Book and Pass Book

(g) Write Journal entries

2003 Rs.

Mar 9 Started business 10,000

11 Cash Sales 2,000

13 Purchases 1,500

14 Sold plant and machinery 3,000

(h) Prepare Trial Balance on 31-12-2003

Cash on hand 10,000

Cash at Bank 35,000

Salaries 2,000

Purchases 2,00,000

Sales 2,25,000

Stock 20,000

Buildings 20,000

Bills payable 5,000

Bills receivable 5,000

Capital 62,000

Accountancy – I 4

VII. Answer the following questions.

1 X 20 = 20

From the following trial balance as on 31-12-2003 prepare Trading, Profit and Loss

a/c and Balance Sheet.

Trial Balance

Debit balance Rs. Credit Balance Rs.

Salaries 6,000 Capital 25,000

Purchases 26,000 Sales 47,000

Trade Expenses 1,000 Discount 200

Wages 7,800 Creditors 21,000

Carriage 400 Bills payable 6,800

Office expenses 500

Commission 600

Bad debts 1,200

Debtors 30,000

Furniture 3,000

Machinery 10,000

Insurance 400

Bills receivable 2,000

Opening Stock 7,000

Cash in hand 500

Cash in bank 3,600

1,00,000 1,00,000

Adjustments:

(a) Closing Stock Rs.11, 000

(b) Outstanding wages Rs.2, 000

(c) Prepaid Insurance Rs.50

(d) Provide bad debts reserve at 5%

(e) Depreciation on machinery and furniture by 5%.

*********

Potrebbero piacerti anche

- March 2006 Q.P. JURDocumento4 pagineMarch 2006 Q.P. JURM JEEVARATHNAM NAIDUNessuna valutazione finora

- March, 2007 JRDocumento4 pagineMarch, 2007 JRM JEEVARATHNAM NAIDUNessuna valutazione finora

- May, 2007Documento6 pagineMay, 2007M JEEVARATHNAM NAIDUNessuna valutazione finora

- June, 2004 Q.P JRDocumento4 pagineJune, 2004 Q.P JRM JEEVARATHNAM NAIDUNessuna valutazione finora

- I. Answer Any TWO of The Following Questions. 2 X 5 10Documento3 pagineI. Answer Any TWO of The Following Questions. 2 X 5 10M JEEVARATHNAM NAIDUNessuna valutazione finora

- Hsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIDocumento27 pagineHsslive Xi Acc Prvs QN Ans 4 Recording of Transaction IIMuhammed Rasil NaseerNessuna valutazione finora

- CBSE CLASS 11 ACCOUNTANCY SAMPLE PAPER SET-1 (QUESTIONSDocumento6 pagineCBSE CLASS 11 ACCOUNTANCY SAMPLE PAPER SET-1 (QUESTIONSNishtha 3153Nessuna valutazione finora

- 3 - Recording of Transaction IDocumento13 pagine3 - Recording of Transaction IMai SalehNessuna valutazione finora

- March, 2007 QuestionssDocumento4 pagineMarch, 2007 QuestionssM JEEVARATHNAM NAIDUNessuna valutazione finora

- (C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10Documento3 pagine(C) Prepare Suman Account With The Following Transactions:: I. Answer Any Two of The Following: 2 X 5 10M JEEVARATHNAM NAIDUNessuna valutazione finora

- Commerce First YearDocumento7 pagineCommerce First Yearravulapallysona93Nessuna valutazione finora

- Financial Accounting Unit 1Documento7 pagineFinancial Accounting Unit 1MOAAZ AHMEDNessuna valutazione finora

- Vijayam Junior College Commerce Exam QuestionsDocumento2 pagineVijayam Junior College Commerce Exam QuestionsM JEEVARATHNAM NAIDUNessuna valutazione finora

- May. 2007 Q.P.Documento4 pagineMay. 2007 Q.P.M JEEVARATHNAM NAIDUNessuna valutazione finora

- Inter May, 2008Documento4 pagineInter May, 2008M JEEVARATHNAM NAIDUNessuna valutazione finora

- Business Accounting 2019-1Documento4 pagineBusiness Accounting 2019-1justin joyNessuna valutazione finora

- Financial Accounting First Midterm Test Ii BcaDocumento2 pagineFinancial Accounting First Midterm Test Ii BcasuryaNessuna valutazione finora

- Accountancy Model QP I Puc 2023-24 PDFDocumento7 pagineAccountancy Model QP I Puc 2023-24 PDFsyedsaadss008Nessuna valutazione finora

- 3562 Question PaperDocumento3 pagine3562 Question PaperKimberly MataruseNessuna valutazione finora

- Commerce-II ModelpaperDocumento3 pagineCommerce-II ModelpaperDeepak AjjuNessuna valutazione finora

- Financial Account CIA 1 QPDocumento1 paginaFinancial Account CIA 1 QPPadmaja NaiduNessuna valutazione finora

- Question Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowDocumento16 pagineQuestion Paper Accounting (3702) : January 2004: Answer Any Two From The Four Questions Given BelowRaveendra KJNessuna valutazione finora

- COMMERCE PAPER EXAMDocumento4 pagineCOMMERCE PAPER EXAMM JEEVARATHNAM NAIDUNessuna valutazione finora

- 202AF13A Financial AccountingDocumento14 pagine202AF13A Financial AccountingkalpanaNessuna valutazione finora

- 2015 Accountancy Question PaperDocumento4 pagine2015 Accountancy Question PaperJoginder SinghNessuna valutazione finora

- NCERT solutions, CBSE sample papers, notes for classes 6 to 12Documento4 pagineNCERT solutions, CBSE sample papers, notes for classes 6 to 12NameNessuna valutazione finora

- Humanities I and II Year MQPDocumento108 pagineHumanities I and II Year MQPKishore VNessuna valutazione finora

- Vidya Mandir Public School Accountancy QuestionsDocumento4 pagineVidya Mandir Public School Accountancy QuestionsPatanjal kumarNessuna valutazione finora

- BCA & BSC (CS) Bussines Accounting I Internal QuestionDocumento3 pagineBCA & BSC (CS) Bussines Accounting I Internal QuestionVignesh GopalNessuna valutazione finora

- Problems On Journal, Ledger and Accounting EquationDocumento11 pagineProblems On Journal, Ledger and Accounting EquationGopiNessuna valutazione finora

- Accountancy 17Documento12 pagineAccountancy 17Manav GargNessuna valutazione finora

- Time: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoDocumento4 pagineTime: 3 Hours Total Marks: 100: Printed Pages: 03 Sub Code: KMB103 Paper Id: 270103 Roll NoAbhishek ChaubeyNessuna valutazione finora

- Acc 22 PaperDocumento15 pagineAcc 22 Papersyedsaadss008Nessuna valutazione finora

- Accountancy notes cover key conceptsDocumento5 pagineAccountancy notes cover key conceptsKartik DhilwalNessuna valutazione finora

- Bba 1 Sem Business Accounting 21102401 Oct 2021Documento4 pagineBba 1 Sem Business Accounting 21102401 Oct 2021lizabnamazliaNessuna valutazione finora

- Part - A: (Financial Accounting - I)Documento16 paginePart - A: (Financial Accounting - I)Adit Bohra VIII BNessuna valutazione finora

- Jr. Commerce PDF - Set-2Documento5 pagineJr. Commerce PDF - Set-2YF YFNessuna valutazione finora

- May, 2005 Q.P.Documento4 pagineMay, 2005 Q.P.M JEEVARATHNAM NAIDUNessuna valutazione finora

- Inter-II QP 2008Documento4 pagineInter-II QP 2008M JEEVARATHNAM NAIDUNessuna valutazione finora

- ACCOUNTANCY CLASS XI QUESTION PAPER 2023-24 FinalDocumento2 pagineACCOUNTANCY CLASS XI QUESTION PAPER 2023-24 Finalashmitamor10Nessuna valutazione finora

- Accounting CatDocumento3 pagineAccounting Catalanorules001Nessuna valutazione finora

- Assignment - DCM1103 - Fundamentals of Acccounting IDocumento3 pagineAssignment - DCM1103 - Fundamentals of Acccounting Itaniya thakurNessuna valutazione finora

- Accounts Prelim Paper 28-11-23Documento4 pagineAccounts Prelim Paper 28-11-23roshanchoudhary4350Nessuna valutazione finora

- Financial Accounting and Analysis-KMBN103Documento2 pagineFinancial Accounting and Analysis-KMBN103dhruv.chaudhary0722Nessuna valutazione finora

- March, 2004, Q.P.Documento4 pagineMarch, 2004, Q.P.M JEEVARATHNAM NAIDUNessuna valutazione finora

- Faculty of Commerce: Code No. 10001Documento4 pagineFaculty of Commerce: Code No. 10001Madasu BalnarsimhaNessuna valutazione finora

- Cash Book Solutions for Class 11 Accountancy Chapter 11Documento51 pagineCash Book Solutions for Class 11 Accountancy Chapter 11jigyasuNessuna valutazione finora

- AccountancyDocumento8 pagineAccountancyAnkit KumarNessuna valutazione finora

- JR Mec Iii Term 06-12-18Documento4 pagineJR Mec Iii Term 06-12-18M JEEVARATHNAM NAIDUNessuna valutazione finora

- 1bba FOA Prep QPDocumento2 pagine1bba FOA Prep QPSuhail AhmedNessuna valutazione finora

- FR2 Past Papers 24 AttemptsDocumento107 pagineFR2 Past Papers 24 AttemptsAbdullah FarooqiNessuna valutazione finora

- Acc Mba Int - 1 Dec 2022Documento3 pagineAcc Mba Int - 1 Dec 2022Hema LathaNessuna valutazione finora

- Foundation Course Examination: Suggested Answers To QuestionsDocumento20 pagineFoundation Course Examination: Suggested Answers To Questionstapwater722Nessuna valutazione finora

- Class 11 Cbse Assighnment (New)Documento3 pagineClass 11 Cbse Assighnment (New)carrotunchainedNessuna valutazione finora

- Cashew ProblemDocumento2 pagineCashew ProblemJoyNessuna valutazione finora

- Instant Paper Commerce Paper - IiDocumento3 pagineInstant Paper Commerce Paper - IiM JEEVARATHNAM NAIDUNessuna valutazione finora

- Sem 2 - End Sem PapersDocumento23 pagineSem 2 - End Sem Paperslalith sasankaNessuna valutazione finora

- Xi Annual NewDocumento5 pagineXi Annual NewPragadeshwar KarthikeyanNessuna valutazione finora

- Accountancy Master Test 4 PDFDocumento5 pagineAccountancy Master Test 4 PDFRaghav PrajapatiNessuna valutazione finora

- Cash & Investment Management for Nonprofit OrganizationsDa EverandCash & Investment Management for Nonprofit OrganizationsNessuna valutazione finora

- Private Sector Definition and RoleDocumento4 paginePrivate Sector Definition and RoleM JEEVARATHNAM NAIDUNessuna valutazione finora

- Public SectorDocumento12 paginePublic SectorM JEEVARATHNAM NAIDUNessuna valutazione finora

- Multinational Corporations (MNC'S) : Meaning and DefinitionDocumento5 pagineMultinational Corporations (MNC'S) : Meaning and DefinitionM JEEVARATHNAM NAIDUNessuna valutazione finora

- March, 2004 AnswersDocumento22 pagineMarch, 2004 AnswersM JEEVARATHNAM NAIDUNessuna valutazione finora

- May, 2005 AnswersDocumento21 pagineMay, 2005 AnswersM JEEVARATHNAM NAIDUNessuna valutazione finora

- May, 2007 AnswersDocumento20 pagineMay, 2007 AnswersM JEEVARATHNAM NAIDUNessuna valutazione finora

- May, 2006 AnswerDocumento17 pagineMay, 2006 AnswerM JEEVARATHNAM NAIDUNessuna valutazione finora

- March, 2007 AnswersDocumento18 pagineMarch, 2007 AnswersM JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Mec Pre Final 2Documento1 paginaJR Mec Pre Final 2M JEEVARATHNAM NAIDUNessuna valutazione finora

- CD Contents: S.No. Particulars PagesDocumento2 pagineCD Contents: S.No. Particulars PagesM JEEVARATHNAM NAIDUNessuna valutazione finora

- March, 2005 AnswersDocumento25 pagineMarch, 2005 AnswersM JEEVARATHNAM NAIDUNessuna valutazione finora

- Liabilities Amount Rs. Assets Amount RsDocumento2 pagineLiabilities Amount Rs. Assets Amount RsM JEEVARATHNAM NAIDUNessuna valutazione finora

- June, 2004 AnswersDocumento18 pagineJune, 2004 AnswersM JEEVARATHNAM NAIDUNessuna valutazione finora

- March, 2006 AnswerDocumento23 pagineMarch, 2006 AnswerM JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College Commerce Exam QuestionsDocumento2 pagineVijayam Junior College Commerce Exam QuestionsM JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Mec Iii Term 06-12-18Documento4 pagineJR Mec Iii Term 06-12-18M JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Mec Monthly 18-9-17Documento1 paginaJR Mec Monthly 18-9-17M JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsDocumento1 paginaVijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsM JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsDocumento1 paginaVijayam Junior College Chittoor Junior MEC Monthly Test Business Organization FormsM JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College terminal exam questionsDocumento2 pagineVijayam Junior College terminal exam questionsM JEEVARATHNAM NAIDUNessuna valutazione finora

- SUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100Documento3 pagineSUB: COMMERCE-I TERMINAL EXAM Date: 18.08.2018 Marks: 100M JEEVARATHNAM NAIDUNessuna valutazione finora

- I Yr Monthly 24-10-16Documento1 paginaI Yr Monthly 24-10-16M JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Mec Pre Final 2Documento1 paginaJR Mec Pre Final 2M JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College::Chittoor I: Year Mec Ii Terminal ExaminatiuonDocumento2 pagineVijayam Junior College::Chittoor I: Year Mec Ii Terminal ExaminatiuonM JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Documento1 paginaVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Commerce Weekly Three Column Cash BookDocumento3 pagineJR Commerce Weekly Three Column Cash BookM JEEVARATHNAM NAIDUNessuna valutazione finora

- Vijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10Documento1 paginaVijayam Junior College:: Chittoor: Iii Answer The Following. 1X10 10M JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Commerce Weekly Three Column Cash BookDocumento3 pagineJR Commerce Weekly Three Column Cash BookM JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Mec Monthly Test 15-07-19Documento2 pagineJR Mec Monthly Test 15-07-19M JEEVARATHNAM NAIDUNessuna valutazione finora

- JR Mec Monthly 30.10.18Documento2 pagineJR Mec Monthly 30.10.18M JEEVARATHNAM NAIDUNessuna valutazione finora

- Improving Network Quality Through RTPO 2.0 InitiativesDocumento21 pagineImproving Network Quality Through RTPO 2.0 InitiativesArgya HarishNessuna valutazione finora

- Advance NewsletterDocumento14 pagineAdvance Newsletterapi-206881299Nessuna valutazione finora

- Pakistan Relations With EnglandDocumento4 paginePakistan Relations With Englandpoma7218Nessuna valutazione finora

- Pulau Besar Island Off Malacca CoastDocumento5 paginePulau Besar Island Off Malacca CoastLucy TyasNessuna valutazione finora

- Relocation Guide Version 5.6 - New BrandingDocumento29 pagineRelocation Guide Version 5.6 - New BrandingEndika AbiaNessuna valutazione finora

- Emulsifier Solutions: Targeted Applications. Established SuccessDocumento32 pagineEmulsifier Solutions: Targeted Applications. Established SuccessSen D' Favian100% (1)

- Expressing Interest in NIBAV LiftsDocumento9 pagineExpressing Interest in NIBAV LiftsSetiawan RustandiNessuna valutazione finora

- Affidavit in Support of ComplaintDocumento3 pagineAffidavit in Support of ComplaintTrevor DrewNessuna valutazione finora

- Pearce v. FBI Agent Doe 5th Circuit Unpublished DecisionDocumento6 paginePearce v. FBI Agent Doe 5th Circuit Unpublished DecisionWashington Free BeaconNessuna valutazione finora

- 2 - Brief Report On Logistics Workforce 2019Documento39 pagine2 - Brief Report On Logistics Workforce 2019mohammadNessuna valutazione finora

- Chapter 3 Views in ASP - NET CoreDocumento23 pagineChapter 3 Views in ASP - NET Coremohammadabusaleh628Nessuna valutazione finora

- Vda. de Villanueva vs. JuicoDocumento3 pagineVda. de Villanueva vs. JuicoLucas Gabriel Johnson100% (1)

- Role of Commercial Banks in Developing The Economy of PakistanDocumento40 pagineRole of Commercial Banks in Developing The Economy of PakistanIshtiaq Ahmed84% (25)

- Converting WSFU To GPMDocumento6 pagineConverting WSFU To GPMDjoko SuprabowoNessuna valutazione finora

- Tata MotorsDocumento13 pagineTata MotorsAshwin Sood100% (3)

- Jabiru Inc S Senior Management Recently Obtained A New Decision Support DatabaseDocumento1 paginaJabiru Inc S Senior Management Recently Obtained A New Decision Support DatabaseDoreenNessuna valutazione finora

- This Study Resource Was: Artur Vartanyan Supply Chain and Operations Management MGMT25000D Tesla Motors, IncDocumento9 pagineThis Study Resource Was: Artur Vartanyan Supply Chain and Operations Management MGMT25000D Tesla Motors, IncNguyễn Như QuỳnhNessuna valutazione finora

- Equity Research: Fundamental Analysis For Long Term InvestmentDocumento5 pagineEquity Research: Fundamental Analysis For Long Term Investmentharish kumarNessuna valutazione finora

- Uuee 17-2020Documento135 pagineUuee 17-2020Tweed3ANessuna valutazione finora

- (Guidebook) International Businessplan Competition 2023Documento14 pagine(Guidebook) International Businessplan Competition 2023Scubby dubbyNessuna valutazione finora

- Concepts in Enterprise Resource Planning: Chapter Six Human Resources Processes With ERPDocumento39 pagineConcepts in Enterprise Resource Planning: Chapter Six Human Resources Processes With ERPasadnawazNessuna valutazione finora

- Valuing Common and Preferred SharesDocumento31 pagineValuing Common and Preferred SharesAdam Mo AliNessuna valutazione finora

- Bank AlfalahDocumento62 pagineBank AlfalahMuhammed Siddiq KhanNessuna valutazione finora

- Delivering Large-Scale IT Projects On Time, On Budget, and On ValueDocumento5 pagineDelivering Large-Scale IT Projects On Time, On Budget, and On ValueMirel IonutNessuna valutazione finora

- Export Promoting InstitutesDocumento21 pagineExport Promoting InstitutesVikaskundu28100% (1)

- US20170335223A1Documento18 pagineUS20170335223A1hugo vignoloNessuna valutazione finora

- Science Room Rules Teaching PlanDocumento1 paginaScience Room Rules Teaching PlanraqibsheenaNessuna valutazione finora

- Schedule of BPSC Teacher - S 6 Day - SDocumento1 paginaSchedule of BPSC Teacher - S 6 Day - SNarendraNessuna valutazione finora

- The Power Elite and The Secret Nazi PlanDocumento80 pagineThe Power Elite and The Secret Nazi Planpfoxworth67% (3)

- Djiwandono, Indonesian Financial Crisis After Ten Years: Some Notes On Lessons Learned and ProspectsDocumento12 pagineDjiwandono, Indonesian Financial Crisis After Ten Years: Some Notes On Lessons Learned and ProspectsMuhammad Arief Billah100% (1)