Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

REYNOSO MBBA507 Final Assessment

Caricato da

Gianne Denise ReynosoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

REYNOSO MBBA507 Final Assessment

Caricato da

Gianne Denise ReynosoCopyright:

Formati disponibili

Name _Gianne Denise C. Reynoso_________________ Date of Submission: May 9, 2020, Sat.

Course: MBBA507 – Financial Management Academic Year: 2nd semester, 2019-2020

Faculty: Christian John P. Formaran, CPA, MBA Final Assessment/Exam

General Instruction:

Use this template to submit your answers to the following questions below

Answers should be in PDF format, Font = Arial, Font size = 12, Single spacing, Long Bond

Page Size, Justified alignment.

Send your answers to our UB LMS and to my email (as back-up) - cjpformaran@gmail.com

Use this format name upon submission - surname_MBBA507_Final Assessment

FINAL ASSESSMENT

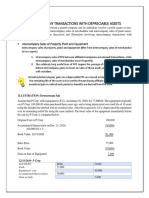

COMPREHENSIVE PROBLEM 1: Working Capital

Questions (a) to (g) refer to Kho Bid Manufacturing Company. Use the following information to solve

for (a) and (b)

KHO BID MANUFACTURING COMPANY

Pro-Forma Statement of Financial Position

As of December 31, 2019

Cash P20,000 Current Liabilities (10%) P200,000

Marketable securities 30,000 Long-term Liabilities (15%) 300,000

Accounts receivable 150,000 Total Liabilities P500,000

Inventory 200,000

Total Current Assets P400,000

Net Fixed Assets P600,000 Stockholders’ equity P500,000

TOTAL ASSETS P1,000,000 TOTA LIAB. & EQUITY P1,000,000

During 2019, firm’s earnings before interest and taxes were 20% of P800,000 in sales. The income

tax rate is 34%.

Required:

a. Determine the level of working capital, net working capital and current ratio.

b. Calculate the return on equity.

Use the following information about Kho Bid Manufacturing Company to solve for (c) and (d).

Kho Bid Manufacturing Company decides to examine its working capital policy. In addition to its

current strategy of maintaining current assets at 50% of sales, the company is considering two other

strategies based on current assets at 30% or 70% of next year’s sales. Projected net sales and fixed

assets for next year are P1,000,000 and P600,000, respectively. The company plans to maintain its

existing capital structure of 50% debt and 50% equity. Current liabilities are to be 40% of projected

total liabilities.

Required:

c. Calculate the company’s net working capital and current ratio under each of the three strategies.

d. Explain what effect these strategies would have on the company’s liquidity.

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

Refer to (b) and the following information about the Kho Bid Manufacturing Company to solve for €

and (f).

Kho Bid expects its earnings before interest and taxes in 2020 to be 18% of P1,000,000 in sales.

Interest rates are projected to remain at 10% for short-term debt and 15% for long-term debt. The

firm’s tax rate will be 34%.

Required:

e. What is the company’s rate of return on equity for each of the three strategies?

f. Describe the relationship between the company’s liquidity and profitability.

Use the following information about Kho Bid Manufacturing Company to solve for (g).

Kho Bid Manufacturing Company wants to determine the impact of changing the financing mix when

using an aggressive current asset strategy of having current assets at 30% of sales. Earnings before

interest and taxes are expected to be P180,000. Short-term interest rates are 10% and long-term

rates are 15%. The firm’s tax rate is 34%. The company wants to maintain a mix of 50% debt and

50% equity under restricted, compromise and flexible financing strategies as shown below:

KHO BID MANUFACTURING COMPANY

Pro-Forma Statement of Financial Position

As of December 31, 2020

ASSETS Restricted Compromise Flexible

Current Assets P300,000 P300,000 P300,000

Fixed Assets 600,000 600,000 600,000

TOTAL ASSETS P900,000 P900,000 P900,000

LIABILITIES AND STOCKHOLDER’S EQUITY

Current Liabilities (10%) P100,000 P300,000 P450,000

Long-term Liabilities (15%) 350,000 150,000 -

Total Liabilities P450,000 P450,000 P450,000

Stockholders’ equity 450,000 450,000 450,000

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY P900,000 P900,000 P900,000

Required:

g. Show the expected return on equity, net working capital and current ratio for each proposed

strategy.

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

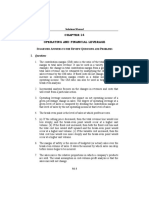

COMPREHENSIVE PROBLEM 2: Capital Budgeting

A. UB Company plans to replace a production machine that ·was acquired several years ago. The

old machine's acquisition cost was P450,000, with salvage value of P 50,000. The machine being

considered is worth P 800,000 and the supplier is willing to accept the old machine at a trade-in

value of P60,000. Should the company decide not to acquire the new machine, it needs to repair the

old one at a cost of P 200,000. Tax-wise, the trade-in transaction will not have any implication but

the cost to repair is tax-deductible. The effective corporate tax rate is 35%.

For purposes of capital budgeting, the net investment in the new machine is

____________________ (Show your solution).

B. Thelma Industries is considering an expansion. The necessary equipment would be purchased for

P9 million, and the expansion would require an additional P3 million investment in net operating

working capital. The tax rate is 40%.

a. What is the initial investment outlay? __________________. (Show your solution)

b. The company spent and expensed P50,000 on research related to the projected last year.

Would this change your answer? Explain.

c. The company plans to use a building that it owns to house the project. The building could

be sold for P1 million after taxes and real estate commissions. How would that fact affect your

answer?

C. You are the financial manager of Romualdez Manufacturing Company (a large and highly

profitable manufacturing company). You are currently evaluating a project proposal involving the

production of new product line. The proposed project will have a 3-year life and will require the

purchase of new capital equipment with a total purchase price of P2,000,000. In addition, the project

will require an initial investment of P250,000 in supplies and spare parts for the equipment, with 60%

of this amount financed with trade credit. The new product line is expected to increase cash sales by

P800,000 per year and increase cash operating expenses by P350,000 per year. The new

equipment will have a 5-year life. At the end of three years, you expect to terminate the project,

liquidate the supplies and parts and sell the equipment for P100,000. Assume that the marginal tax

rate is 34%.

Based on the information given above, determine the following (Show your computation):

a. What is the net investment cash outflow for this project? _______________.

b. What is the operating cash flow for the 1st year of the project’s life? _______________.

c. What is the operating cash flow for the 2 nd year of the project’s life? _______________.

d. What is the operating cash flow for the 3rd year of the project’s life? _______________.

e. What is the tax effect of selling the equipment at the end of the 3 rd year? ____________.

f. What is the project-disposal cash flow (not including the annual operating cash flow)?

________________________.

D. Nicole Air Services is now in the final year of a project. The equipment originally cost P250 million,

of which 80% has been depreciated. Nicole can sell the use equipment today for P5 million and its

tax rate is 40%. What is the equipment’s after-tax salvage value? ________________. (Show your

computation):

- NOTHING FOLLOWS –

“IF YOU DO, DON’T DOUBT. IF YOU DOUBT, DON’T DO.”

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

Answers:

Comprehensive Problem 1

a. Working Capital = P400,000

Net Working Capital = P400,000 - P 200,000 = P200,000

Current Ratio = P 400,000 / P 200,000 = 2 times

b. Net Sales 800,000.00

EBIT (20% of sales) 160,000.00

Less: Interest Expense

Current Liab (10%) 20,000.00

Non-Current Liab (15%) 45,000.00

Earnings before tax 95,000.00

Less Income tax 34% 32,300.00

Net Income 62,700.00

Return on Equity (P 62,700 /P 500,000) = 12.54%

c.

Strategies

Current Assets as a Percent of Sales

30% 50% 70%

Current assets (CA) ₱300,000 ₱500,000 ₱700,000

Fixed assets 600,000 600,000 600,000

Total assets ₱900,000 ₱1,100,000 ₱1,300,000

Current liabilities (CL) ₱180,000 ₱220,000 ₱260,000

Long-term liabilities 270,000 330,000 390,000

Total liabilities ₱450,000 ₱550,000 ₱650,000

Stockholders’ equity 450,000 550,000 650,000

Total liabilities and equity ₱900,000 ₱1,100,000 ₱1,300,000

Net working capital (CA – CL) ₱120,000 ₱280,000 ₱440,000

Current ratio (CA/CL) 1.67 times 2.27 times 2.69 times

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

d. The company’s liquidity position, measured by the amount of net working capital and

current ration, improves when current asset as percentage of sales goes higher.

e. The company’s rate of return on equity for each of the three strategies is shown below:

Strategies

Current Assets as a Percent of Sales

30% 50% 70%

Net sales ₱1,000,000 ₱1,000,000 ₱1,000,000

EBIT (18% of sales) 180,000 180,000 180,000

Interest expense

Short-term debt

18,000 22,000 26,000

(10%)

Long-term debt (15%) 40,500 49,500 58,500

Earnings before taxes

121,500 108,500 95,500

(EBT)

Income taxes (34%) 41,310 36,890 32,470

Net income ₱80,190 ₱71,610 ₱63,030

Return on equity

17.82% 13.02% 9.70%

(NI/SE)

f. The company’s profitability decrease as liquidity increases. As shown in the answers

given above, the firm’s liquidity (current ratio) is highest at 2.69 times but profitability (ROE)

is the lowest with only 9.70% when current assets are 70% of sales.

g.

Financing- Mix Strategies

Restricted Compromise Flexible

EBIT ₱180,000 ₱180,000 ₱180,000

Interest expenses

Short-term (10%) 10,000 30,000 45,000

Long-term (15%) 52,500 22,500

-

Earnings before taxes (EBT) 117,500 127,500 135,000

Income taxes (34%) 39,950 43,350 45,900

Net income ₱77,550 ₱84,150 ₱89,100

Return on equity (NI/SE) 17.23% 18.70% 19.80%

Net working capital (CA – CL) ₱200,000 (P 150,000)

-

Current ratio (CA/CL) 3.0 times 1.0 times 0.67 times

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

Comprehensive Problem No. 2

A. UB Company

Purchase Price of new machine P 800,000

Less: Proceeds from sale of old machine 60,000

Avoidable Cost of repairs (net of tax)

(200,000 x 65%) 130,000 (190,000)

Net Cost of Investment P 610,000

B. Thelma Industries

a. Purchase price of necessary equipment P 9,000,000

Additional investment in net working capital 3,000,000

Initial Investment Outlay P 12,000,000

b. No I will not change my answer, the P 50,000 spent on research related to the project is

considered sunk cost, and do not affect the decision-making.

c. It will add 1 Million to the initial investment outlay. The possible after-tax sales price must

be charged against the project as a cost since the potential sale of the building represents

an opportunity cost of conducting the project in that building.

C. Romualdez Manufacturing Company

a. Purchase price 2,000,000.00

Initial Cash investment 100,000.00

Net Investment cash outflow 2,100,000.00

b.

Cash Sales 800,000.00

Less : Cash Operating Expense 350,000.00

Depreciation Expense 400,000.00

Net Income before Tax 50,000.00

less: Income Tax (34%) 17,000.00

Net Income 33,000.00

Add: Depreciation 400,000.00

Net Operating Cash flows 433,000.00

c.

Cash Sales 1,600,000.00

Less : Cash Operating Expense 700,000.00

Depreciation Expense 400,000.00

Net Income before Tax 500,000.00

less: Income Tax (34%) 170,000.00

Net Income 330,000.00

Add: Depreciation 400,000.00

Net Operating Cash flows 730,000.00

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

d.

Cash Sales 2,400,000.00

Less : Cash Operating Expense 1,050,000.00

Depreciation Expense 400,000.00

Loss on sale of Equipment 700,000.00

Net Income before Tax 250,000.00

less: Income Tax (34%) 85,000.00

Net Income 165,000.00

Add: Non-Cash Expenses

Depreciation Expense 400,000.00

Loss on sale of Equipment 700,000.00

Net Cash flows 1,265,000.00

e.

Proceeds from sale of equipment 100,000.00

Cost of Equipment 2,000,000.00

less Accumulated Depreciation 1,200,000.00

Net Book Value 800,000.00

Loss on Sale of Equipment (700,000.00)

Tax Rate 34%

Tax savings due to loss on sale of equipment 238,000.00

f.

Actual Proceeds received from Disposal 100,000.00

Tax savings due to loss on sale of equipment 238,000.00

After Tax Proceeds from Disposal 338,000.00

Change in Working Capital -

Project Disposal Cash flow 338,000.00

D. Nicole Air Services

Equipment's original cost 250,000,000.00

Depreciation (80%) 200,000,000.00

Book Value 50,000,000.00

less : Proceeds from sale of

equipment 5,000,000.00

Loss on Sale (45,000,000.00)

Tax Rate 40%

Tax Savings on loss 18,000,000.00

Add: Proceeds from sale of

equipment 5,000,000.00

At net salvage value 23,000,000.00

Campuses: Hilltop | MH del Pilar | Pallocan East | Pallocan West | Lipa

Telephone Numbers: +63 43 723 1446 | 980 0041

Website: www.ub.edu.ph

Potrebbero piacerti anche

- 05.02 - ProblemSolvingChapter16.docx-2Documento5 pagine05.02 - ProblemSolvingChapter16.docx-2Murien Lim100% (1)

- Chapter 28 - AnswerDocumento6 pagineChapter 28 - Answerwynellamae100% (1)

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocumento5 pagineSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNessuna valutazione finora

- Intercompany Sale of Depreciable AssetsDocumento2 pagineIntercompany Sale of Depreciable AssetsTriechia LaudNessuna valutazione finora

- Consolidation at Acquisition DateDocumento29 pagineConsolidation at Acquisition DateLee DokyeomNessuna valutazione finora

- Assign 9 Chapter 12 Cash and Marketable Securities Cabrera 2019-2020Documento5 pagineAssign 9 Chapter 12 Cash and Marketable Securities Cabrera 2019-2020mhikeedelantar100% (1)

- CHAPTER 14 - AnswerDocumento17 pagineCHAPTER 14 - Answernash0% (2)

- Chapter 20 - AnswerDocumento12 pagineChapter 20 - Answerwynellamae100% (3)

- Chapter 10Documento9 pagineChapter 10Patrick Earl T. PintacNessuna valutazione finora

- Solutions Manual Chapter 26 Dividends, Share Repurchases and PayoutsDocumento21 pagineSolutions Manual Chapter 26 Dividends, Share Repurchases and Payoutsnash67% (3)

- Chapter 11 - Fringe Benefits PDFDocumento12 pagineChapter 11 - Fringe Benefits PDFJohn RavenNessuna valutazione finora

- Financial Management 16th Edition Chapter 7Documento32 pagineFinancial Management 16th Edition Chapter 7drcoolzNessuna valutazione finora

- Saint Joseph College of Sindangan Incorporated College of AccountancyDocumento18 pagineSaint Joseph College of Sindangan Incorporated College of AccountancyRendall Craig Refugio0% (1)

- REVIEWER-NI-LOVE HeheDocumento6 pagineREVIEWER-NI-LOVE HeheSteph GonzagaNessuna valutazione finora

- Compound Financial InstrumentDocumento6 pagineCompound Financial InstrumentBeverlene BatiNessuna valutazione finora

- Capital Budgeting QuizDocumento3 pagineCapital Budgeting QuizJen Zabala100% (1)

- Total Liabilities Total AssetsDocumento4 pagineTotal Liabilities Total AssetsAngelica CondenoNessuna valutazione finora

- Homework: Working Capital Management 2021coardbulji: ActivityDocumento3 pagineHomework: Working Capital Management 2021coardbulji: ActivityMa Teresa B. CerezoNessuna valutazione finora

- Why Is There A Need To Understand How Monetary Policy Is Conducted by The Central Banks WorldwideDocumento2 pagineWhy Is There A Need To Understand How Monetary Policy Is Conducted by The Central Banks WorldwideelaineNessuna valutazione finora

- FinAcc3 Chap4Documento9 pagineFinAcc3 Chap4Iyah AmranNessuna valutazione finora

- CHAPTER 30 - AnswerDocumento3 pagineCHAPTER 30 - Answernash100% (1)

- Assessing Long-Term Debt, Equity and Capital Structure: S A R Q P I. QuestionsDocumento9 pagineAssessing Long-Term Debt, Equity and Capital Structure: S A R Q P I. QuestionsJp CombisNessuna valutazione finora

- Chapter 16 - AnswerDocumento8 pagineChapter 16 - Answerwynellamae100% (2)

- Chapter 18 - AnswerDocumento9 pagineChapter 18 - Answerwynellamae0% (2)

- Transfer and Business Tax 2014 Ballada PDFDocumento26 pagineTransfer and Business Tax 2014 Ballada PDFCamzwell Kleinne HalyieNessuna valutazione finora

- Solutions Manual Chapter 25 Sources of Long-Term FinancingDocumento10 pagineSolutions Manual Chapter 25 Sources of Long-Term FinancingReanne Claudine Laguna71% (7)

- Midterm Quiz # 1 (Chapters 1 To 3) - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDocumento18 pagineMidterm Quiz # 1 (Chapters 1 To 3) - ACCOUNTING FOR GOVERNMENT AND NON - PROFIT ORGANIZATIONSDonise Ronadel SantosNessuna valutazione finora

- Cvpprac ExamDocumento4 pagineCvpprac ExamGwy PagdilaoNessuna valutazione finora

- CVP AnalysisDocumento24 pagineCVP AnalysisKim Cherry BulanNessuna valutazione finora

- Chapter 6 - Investments in Financial InstrumentsDocumento5 pagineChapter 6 - Investments in Financial InstrumentsMcy CaniedoNessuna valutazione finora

- TAX 302 Business Transfer Taxes AssignmentDocumento6 pagineTAX 302 Business Transfer Taxes AssignmentBenzon Agojo OndovillaNessuna valutazione finora

- Chapter 17 - Short-Term Credit For Financiang Current AssetsDocumento12 pagineChapter 17 - Short-Term Credit For Financiang Current Assetslou-92450% (4)

- Chapter 16 AmponganDocumento2 pagineChapter 16 AmponganLaine Ricafort100% (2)

- PAS37 ProbsDocumento4 paginePAS37 ProbsAngelicaNessuna valutazione finora

- Problem II A. 1. A. P87,725Documento5 pagineProblem II A. 1. A. P87,725MckenzieNessuna valutazione finora

- Partnership FormationDocumento13 paginePartnership FormationGround ZeroNessuna valutazione finora

- Investment in AssetsDocumento21 pagineInvestment in AssetsAlthon JayNessuna valutazione finora

- Continue Operations or Shut DownDocumento2 pagineContinue Operations or Shut DownDivina Secretario0% (1)

- Answers - V2Chapter 3 2012 PDFDocumento17 pagineAnswers - V2Chapter 3 2012 PDFkea paduaNessuna valutazione finora

- MAS Mockboard ExaminationDocumento8 pagineMAS Mockboard ExaminationAngelica EstolatanNessuna valutazione finora

- Management Advisory Services: ConceptualDocumento5 pagineManagement Advisory Services: ConceptualYeji BabeNessuna valutazione finora

- Self Practice Cost AccountingDocumento17 pagineSelf Practice Cost AccountingLara Alyssa GarboNessuna valutazione finora

- MGT Adv Serv 09.2019Documento11 pagineMGT Adv Serv 09.2019Weddie Mae VillarizaNessuna valutazione finora

- AC15 Quiz 2Documento6 pagineAC15 Quiz 2Kristine Esplana Toralde100% (1)

- Take Home QuizDocumento5 pagineTake Home QuizMA ValdezNessuna valutazione finora

- Assignment 1Documento2 pagineAssignment 1Mitch wongNessuna valutazione finora

- Reviewer in Financial MarketDocumento6 pagineReviewer in Financial MarketPheobelyn EndingNessuna valutazione finora

- Endterm ExamDocumento6 pagineEndterm ExamMasTer PanDaNessuna valutazione finora

- TERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Documento3 pagineTERMINAL OUTPUT FOR THE FINAL TERM (2ND SY 2018-2019Millen Austria0% (1)

- Ma1 Sfe KaDocumento6 pagineMa1 Sfe KaMarc MagbalonNessuna valutazione finora

- FINMGT 1 Final Exam Questions for BSMA StudentsDocumento9 pagineFINMGT 1 Final Exam Questions for BSMA StudentsMiconNessuna valutazione finora

- Capital Budgeting Quiz AnalysisDocumento12 pagineCapital Budgeting Quiz AnalysisPatriciaNessuna valutazione finora

- Multiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetDocumento10 pagineMultiple Choice: Shade The Box Corresponding To Your Answer On The Answer SheetRhad Estoque0% (1)

- Final Exam Questions on Financial ManagementDocumento3 pagineFinal Exam Questions on Financial ManagementAnaSolitoNessuna valutazione finora

- Chapters-1-10-Exam-Problem (2) Answer JessaDocumento6 pagineChapters-1-10-Exam-Problem (2) Answer JessaLynssej BarbonNessuna valutazione finora

- Universal College of Parañaque: Working Capital ManagementDocumento23 pagineUniversal College of Parañaque: Working Capital ManagementEmelita ManlangitNessuna valutazione finora

- Part 1: Financial ForecastingDocumento8 paginePart 1: Financial ForecastingJustine CruzNessuna valutazione finora

- BBDocumento3 pagineBBJoshua WacanganNessuna valutazione finora

- Management Advisory ServicesDocumento18 pagineManagement Advisory ServicesAldrin Arcilla Simeon0% (1)

- Philippine Taxation Questions GuideDocumento36 paginePhilippine Taxation Questions GuideShaira BugayongNessuna valutazione finora

- Income Statement Format and PresentationDocumento52 pagineIncome Statement Format and PresentationIvern BautistaNessuna valutazione finora

- Capital Budgeting: R.KasilingamDocumento71 pagineCapital Budgeting: R.Kasilingamvijayadarshini vNessuna valutazione finora

- 7Documento28 pagine7Alex liao0% (1)

- Accounting SolutionsDocumento11 pagineAccounting SolutionsKrittima Parn SuwanphorungNessuna valutazione finora

- CFAS Reviewer - Module 4Documento14 pagineCFAS Reviewer - Module 4Lizette Janiya SumantingNessuna valutazione finora

- PR P4-5a 29 November 2016Documento8 paginePR P4-5a 29 November 2016Amiratul Ratna Putri50% (2)

- FINANCIAL MANAGEMENT full module (1) (1)Documento72 pagineFINANCIAL MANAGEMENT full module (1) (1)negamedhane58Nessuna valutazione finora

- LUMS ACCT 100 Financial AccountingDocumento7 pagineLUMS ACCT 100 Financial AccountingZulfeqar HaiderNessuna valutazione finora

- What Is Ratio AnalysisDocumento19 pagineWhat Is Ratio AnalysisMarie Frances Sayson100% (1)

- Principles of Property ValuationDocumento8 paginePrinciples of Property ValuationcivilsadiqNessuna valutazione finora

- Calculating Cost of Capital for Capital Budgeting DecisionsDocumento2 pagineCalculating Cost of Capital for Capital Budgeting DecisionsAnonymous wSXoP5aaNessuna valutazione finora

- NCA Held For Sale and Disc Operation-DiscussionDocumento3 pagineNCA Held For Sale and Disc Operation-DiscussionJennifer ArcadioNessuna valutazione finora

- Asset September 2018Documento352 pagineAsset September 2018Megawati NajamuddinNessuna valutazione finora

- Result Presentation For March 31, 2016 (Result)Documento19 pagineResult Presentation For March 31, 2016 (Result)Shyam SunderNessuna valutazione finora

- Corporate Finance Core Principles and Applications 4th Edition Ross Solutions ManualDocumento14 pagineCorporate Finance Core Principles and Applications 4th Edition Ross Solutions Manualphungkhainwa7ow100% (28)

- Practice of Cost Volume Profit Breakeven AnalysisDocumento4 paginePractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- Key Uni 1 Activities Lessons 2 3Documento20 pagineKey Uni 1 Activities Lessons 2 3Leslie Mae Vargas ZafeNessuna valutazione finora

- Cost Volume Profit AnalysisDocumento45 pagineCost Volume Profit AnalysisRodel Carreon Candelaria0% (1)

- For December 31Documento4 pagineFor December 31Bopha vongNessuna valutazione finora

- Asset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White PaperDocumento7 pagineAsset Revaluation or Impairment Understanding The Accounting For Fixed Assets in Release 12 White Papervarachartered283Nessuna valutazione finora

- Cashflow Analsis: Tony Deepa PankajDocumento20 pagineCashflow Analsis: Tony Deepa PankajDeepaNessuna valutazione finora

- Inventory MethodsDocumento21 pagineInventory MethodsJaspreet GillNessuna valutazione finora

- Ultimate Accounting Guide SheetDocumento1 paginaUltimate Accounting Guide SheetMD. Monzurul Karim Shanchay67% (6)

- WelcomeDocumento44 pagineWelcomeRakib HasanNessuna valutazione finora

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Documento8 pagineCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Performance Measurement: OutlineDocumento17 paginePerformance Measurement: OutlineLưu Hồng Hạnh 4KT-20ACNNessuna valutazione finora

- Advanced aCCOUNTING 2 SOLMAN PDFDocumento418 pagineAdvanced aCCOUNTING 2 SOLMAN PDF杉山未来100% (1)

- Company Report: Thomas B. Thriges FundDocumento4 pagineCompany Report: Thomas B. Thriges FundJack58Nessuna valutazione finora

- Cogent Analytics M&A ManualDocumento19 pagineCogent Analytics M&A Manualvan070100% (1)

- Analyze Company Liquidity and Working CapitalDocumento42 pagineAnalyze Company Liquidity and Working CapitalFrans Willdansya FitranyNessuna valutazione finora