Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Recinto, Rommel T1 Summary

Caricato da

michelleCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Recinto, Rommel T1 Summary

Caricato da

michelleCopyright:

Formati disponibili

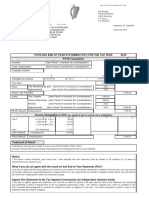

Recinto, Rommel SIN: 302 329 149 Printed: 2020/05/19 21:30

T1Summary

2019 Tax Return Summary

Taxpayer personal information Spousal information

SIN 302 329 149 SIN ___ ___ ___

Name Recinto, Rommel Name

Care of Birthdate

Street address 87 Cedardale Hill SW Apt # Filing

P.O. Box, R.R.

Province of residence on 2019/12/31 Alberta

City Calgary

EFILE this return? X Yes No

Province AB

Is return discounted? Yes X No

Postal code T2W 5A6

Use preparer address for: Nothing

Home phone (___) ___-____

Birthdate 1973-09-29

Marital status Separated

Total income

Employment income (box 14 on all T4 slips) 10100 43,640 88

RRSP income (from all T4RSP slips) 12900 3,850 00

Self-employment income

Business income Gross 13499 1,281 49 Net 13500

Total income 15000 47,490 88 47,490 88

Net income

Annual union, professional, or like dues (box 44 on T4 slips, or from receipts) 21200 33 30

Deduction for CPP or QPP enhanced contributions on employment income

(Complete Schedule 8 or get and complete Form RC381, whichever applies.) 22215 57 25

Add lines 20700 to 22400, 22900, 23100 and 23200. 23300 90 55 90 55

Net income 23600 47,400 33

Taxable income

Taxable income 26000 47,400 33

Non-refundable tax credits

Basic personal amount claim $12,069 30000 12,069 00

CPP or QPP contributions through employment (maximum $2,748.90) 30800 1,889 26

Employment Insurance premiums from box 18 on all T4 slips (maximum $860.22) 31200 706 89

Canada employment amount (see the guide) (maximum $1,222) 31260 1,222 00

Add lines 1 to 26 33500 15,887 15

Multiply the amount on line 26 by 15% = 33800 2,383 07

Total federal non-refundable tax credits: 27 and 28. 35000 2,383 07

Refund or Balance owing

Net federal tax. 42000 4,726 98

Provincial or territorial tax 42800 2,543 51

Total payable 43500 7,270 49

Total income tax deducted (from all information slips) 43700 6,715 14

Climate action incentive (Complete Schedule 14) 45110 444 00

Total credits 48200 7,159 14 7,159 14

Total payable minus total credits 111 35

Balance owing 48500 111 35

2020 Estimated

GST/HST credit Annual 6 00 Quarterly

RRSP contribution limit 15,586 00

Page 1 of 1

Potrebbero piacerti anche

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- 1111Documento2 pagine1111Karan JangidNessuna valutazione finora

- Sample Notice of Assessment Oct 2020 (NOA)Documento2 pagineSample Notice of Assessment Oct 2020 (NOA)splouffevachonNessuna valutazione finora

- Itr 1 FormatDocumento3 pagineItr 1 FormatPawanNessuna valutazione finora

- Sri. v. Siva Kumar 31.03.2021Documento2 pagineSri. v. Siva Kumar 31.03.2021Saravana SaruNessuna valutazione finora

- COI AY 22-23 Narinder BhatiaDocumento4 pagineCOI AY 22-23 Narinder BhatiaAshwani KumarNessuna valutazione finora

- Amit Kumar Mudgal ComputationDocumento4 pagineAmit Kumar Mudgal ComputationSHELESH GARGNessuna valutazione finora

- AY2021-22 ANISETTY SINDHU-EFPPS3410N-ComputationDocumento3 pagineAY2021-22 ANISETTY SINDHU-EFPPS3410N-Computationforty oneNessuna valutazione finora

- Computation of Total Income Income From Business or Profession (Chapter IV D) 385000Documento3 pagineComputation of Total Income Income From Business or Profession (Chapter IV D) 385000Rohit kandpalNessuna valutazione finora

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Documento1 paginaTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNessuna valutazione finora

- AY2020-21 NARASIMHAMOORTHY RANGAIAH LAKKUPA-AFOPN5099M-ComputationDocumento4 pagineAY2020-21 NARASIMHAMOORTHY RANGAIAH LAKKUPA-AFOPN5099M-ComputationNarasimhamoorthy L RNessuna valutazione finora

- Notice of Reassessment 2021 05 31 09 31 59 847068Documento4 pagineNotice of Reassessment 2021 05 31 09 31 59 847068api-676582318Nessuna valutazione finora

- UnknownDocumento1 paginaUnknownAjit KumarNessuna valutazione finora

- Attachment UnlockedDocumento3 pagineAttachment Unlockedmbhalani1207Nessuna valutazione finora

- 1701qjuly2008 (ENCS) q22019Documento5 pagine1701qjuly2008 (ENCS) q22019Andrew AndalNessuna valutazione finora

- UnknownDocumento1 paginaUnknownNISHCHAL AGARWALNessuna valutazione finora

- Deepak ComputationDocumento3 pagineDeepak ComputationRavi YadavNessuna valutazione finora

- Draft Computation SheetDocumento3 pagineDraft Computation Sheettax advisorNessuna valutazione finora

- Notice of Assessment 2021 05 07 05 37 16 132636Documento4 pagineNotice of Assessment 2021 05 07 05 37 16 132636bibicolibri1961Nessuna valutazione finora

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocumento2 pagineIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNessuna valutazione finora

- Employee Details Payment & Leave Details: Arrears Current AmountDocumento1 paginaEmployee Details Payment & Leave Details: Arrears Current AmountAshok KumarNessuna valutazione finora

- Sal Slip Feb 2019Documento1 paginaSal Slip Feb 2019pankajNessuna valutazione finora

- Paystub 202311Documento1 paginaPaystub 202311Gss ChaitanyaNessuna valutazione finora

- Shri Amit Santwani Ji Computitaon 2023-24Documento2 pagineShri Amit Santwani Ji Computitaon 2023-24bhupeshkaushik61Nessuna valutazione finora

- Notice of Assessment 2021 03 11 12 47 30 085217Documento4 pagineNotice of Assessment 2021 03 11 12 47 30 085217gilli billiNessuna valutazione finora

- Sa302 2021Documento1 paginaSa302 2021Umt KayaNessuna valutazione finora

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocumento6 pagineItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNessuna valutazione finora

- Computation of Total Income Income From Business or Profession (Chapter IV D) 300000Documento4 pagineComputation of Total Income Income From Business or Profession (Chapter IV D) 300000ramanNessuna valutazione finora

- Ageeta AY 2018-2019: Computation of Income (ITR4)Documento50 pagineAgeeta AY 2018-2019: Computation of Income (ITR4)pmcmbharat264Nessuna valutazione finora

- Compu PDFDocumento4 pagineCompu PDFMihir ThakkarNessuna valutazione finora

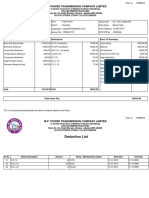

- M.P. Power Transmission Company LimitedDocumento2 pagineM.P. Power Transmission Company LimitedKanhaiya SharmaNessuna valutazione finora

- Employee Details Payment & Leave Details: Arrears Current AmountDocumento1 paginaEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNessuna valutazione finora

- R K S Infra Computation 2022Documento4 pagineR K S Infra Computation 2022birpal singhNessuna valutazione finora

- NON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationDocumento2 pagineNON MEDICLAIM AY2024-25 SARBANI BORA-BDPPB0721G-ComputationlaskarmohinNessuna valutazione finora

- Direct Tax Solution PDFDocumento8 pagineDirect Tax Solution PDFGaurav SoniNessuna valutazione finora

- Pay Slip of August 2023Documento1 paginaPay Slip of August 2023alim.siddiquiNessuna valutazione finora

- Documents 0Documento3 pagineDocuments 0rajindermechNessuna valutazione finora

- Com 23Documento3 pagineCom 23TAX INDIANessuna valutazione finora

- Computation FY 18-19 PDFDocumento6 pagineComputation FY 18-19 PDFRuch JainNessuna valutazione finora

- GgjdfhijfrbjcDocumento3 pagineGgjdfhijfrbjcdmqktchxphNessuna valutazione finora

- Ilovepdf MergedDocumento7 pagineIlovepdf MergedRavi ChristoNessuna valutazione finora

- COMPUTATIONDocumento4 pagineCOMPUTATIONkambojnaresh693Nessuna valutazione finora

- SalarySlip 8484236Documento1 paginaSalarySlip 8484236Vikram MaanNessuna valutazione finora

- Employee Details Payment & Leave Details: Arrears Current AmountDocumento1 paginaEmployee Details Payment & Leave Details: Arrears Current Amountabhilash eNessuna valutazione finora

- 2022 AssessmentDocumento1 pagina2022 AssessmentDimoNessuna valutazione finora

- Paystub 02.28.2019 PDFDocumento1 paginaPaystub 02.28.2019 PDFAnonymous dDiu2yq2KNessuna valutazione finora

- Pps No: 1880834ia: Ššpdfnamešš 1188083400007 - 1 Gfdid-Entitydfg1880834Iagfdid-EntitydfgDocumento4 paginePps No: 1880834ia: Ššpdfnamešš 1188083400007 - 1 Gfdid-Entitydfg1880834Iagfdid-EntitydfgDavid WilliamsNessuna valutazione finora

- Notice of Assessment 2021 03 22 15 36 05 837221Documento4 pagineNotice of Assessment 2021 03 22 15 36 05 837221Joseph HudsonNessuna valutazione finora

- COI Narinder Bhatia 22-23Documento5 pagineCOI Narinder Bhatia 22-23Ashwani KumarNessuna valutazione finora

- UnknownDocumento2 pagineUnknownSudip MondalNessuna valutazione finora

- EPF Universal Account Number: 100618268345 LIC ID / Policy IDDocumento1 paginaEPF Universal Account Number: 100618268345 LIC ID / Policy IDHoly ReaperNessuna valutazione finora

- NitishDocumento1 paginaNitishkaushikdutta176Nessuna valutazione finora

- Notice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Documento4 pagineNotice - of - Assessment - 2022 - 04 - 07 - 11 - 48 - 30 - 067197 2Therese FadelNessuna valutazione finora

- UntitledDocumento3 pagineUntitledVAIBHAV ARORANessuna valutazione finora

- Compu TationDocumento3 pagineCompu TationAbhilash M NairNessuna valutazione finora

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocumento2 pagineIncome From Salaries: Rs. Rs. Rs. SCH - Nosrinivas maguluriNessuna valutazione finora

- Notice of Assessment 2021 03 18 13 33 09 783841Documento4 pagineNotice of Assessment 2021 03 18 13 33 09 783841Maria Fe CeleciosNessuna valutazione finora

- February 2023Documento1 paginaFebruary 2023Pradeep Kumar malikNessuna valutazione finora

- Comp 21Documento6 pagineComp 21aprna SharmaNessuna valutazione finora

- Low Cost Food April 2011Documento2 pagineLow Cost Food April 2011michelleNessuna valutazione finora

- Stardock WindowBlinds 10Documento2 pagineStardock WindowBlinds 10michelleNessuna valutazione finora

- Cable/Satellite Dish/TV RequestDocumento2 pagineCable/Satellite Dish/TV RequestmichelleNessuna valutazione finora

- Tests - Fall 2019 - Safety Orientation (SAFE-160-EET) - SAITDocumento1 paginaTests - Fall 2019 - Safety Orientation (SAFE-160-EET) - SAITmichelleNessuna valutazione finora

- Anti Ransome Ware Hitmanpro - Alert 3.1.10 Build 373 FullDocumento2 pagineAnti Ransome Ware Hitmanpro - Alert 3.1.10 Build 373 FullmichelleNessuna valutazione finora

- Street Types & Abbreviations: Street Type Street TypeDocumento1 paginaStreet Types & Abbreviations: Street Type Street TypemichelleNessuna valutazione finora

- Vocabulary Terms: Presented By: Mr. Virgo Clemente LopezDocumento54 pagineVocabulary Terms: Presented By: Mr. Virgo Clemente LopezmichelleNessuna valutazione finora

- Fiber Reinforced Polymer Guidelines (FRPG) : Florida Department of TransportationDocumento18 pagineFiber Reinforced Polymer Guidelines (FRPG) : Florida Department of TransportationmichelleNessuna valutazione finora

- Roof Ok - Check For Any Repairs That May Be Necessary: 3 Alberta CVDocumento3 pagineRoof Ok - Check For Any Repairs That May Be Necessary: 3 Alberta CVmichelle100% (1)

- Technical Report On Step by Step Configuration of Free To Air Satellite in West Africa in Ku BandDocumento5 pagineTechnical Report On Step by Step Configuration of Free To Air Satellite in West Africa in Ku BandmichelleNessuna valutazione finora

- A5 Reid Owners - Manual Digital PDFDocumento24 pagineA5 Reid Owners - Manual Digital PDFmichelleNessuna valutazione finora

- METERCOR Faq-Meter-ReadingDocumento3 pagineMETERCOR Faq-Meter-ReadingmichelleNessuna valutazione finora

- Thinset & Grout Coverage InfoDocumento2 pagineThinset & Grout Coverage InfomichelleNessuna valutazione finora

- PinterestDocumento3 paginePinterestmichelleNessuna valutazione finora

- Lecture 1. Getting Started: Objectives Requirements & Grading Policy Other InformationDocumento19 pagineLecture 1. Getting Started: Objectives Requirements & Grading Policy Other InformationmichelleNessuna valutazione finora

- Chap 6 - Karen HorneyDocumento95 pagineChap 6 - Karen HorneyDiana San JuanNessuna valutazione finora

- Campus Sexual Violence - Statistics - RAINNDocumento6 pagineCampus Sexual Violence - Statistics - RAINNJulisa FernandezNessuna valutazione finora

- Chapter 8 - Lipids and Proteins Are Associated in Biological Membranes - Part 1Documento44 pagineChapter 8 - Lipids and Proteins Are Associated in Biological Membranes - Part 1Tommy RamazzottoNessuna valutazione finora

- Dissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoDocumento44 pagineDissertation On: To Asses The Impact of Organizational Retention Strategies On Employee Turnover: A Case of TescoAhnafTahmidNessuna valutazione finora

- Boeco BM-800 - User ManualDocumento21 pagineBoeco BM-800 - User ManualJuan Carlos CrespoNessuna valutazione finora

- E10b MERCHANT NAVY CODE OF CONDUCTDocumento1 paginaE10b MERCHANT NAVY CODE OF CONDUCTssabih75Nessuna valutazione finora

- Chapter FourDocumento9 pagineChapter FourSayp dNessuna valutazione finora

- c3175492 Pavan Kumarvasudha Signed OfferletterDocumento6 paginec3175492 Pavan Kumarvasudha Signed OfferletterPavan Kumar Vasudha100% (1)

- L04-課文單片填空 (題目) (Day of the Dead)Documento3 pagineL04-課文單片填空 (題目) (Day of the Dead)1020239korrnellNessuna valutazione finora

- Derivative Investment!Documento24 pagineDerivative Investment!Asif Riaz100% (2)

- He 3 Basic Types of Descriptive Research MethodsDocumento2 pagineHe 3 Basic Types of Descriptive Research MethodsRahul SarinNessuna valutazione finora

- 99 AutomaticDocumento6 pagine99 AutomaticDustin BrownNessuna valutazione finora

- 24.2 The Core Assumptions of MindfulnessDocumento9 pagine24.2 The Core Assumptions of Mindfulnessale alvarezNessuna valutazione finora

- IB Final ShellDocumento25 pagineIB Final ShellsnehakopadeNessuna valutazione finora

- Metabolism of Carbohydrates and LipidsDocumento7 pagineMetabolism of Carbohydrates and LipidsKhazel CasimiroNessuna valutazione finora

- Radproduction Chapter 2-9Documento276 pagineRadproduction Chapter 2-9Christian DioNessuna valutazione finora

- Form 28 Attendence RegisterDocumento1 paginaForm 28 Attendence RegisterSanjeet SinghNessuna valutazione finora

- Unit-7 (EVS)Documento32 pagineUnit-7 (EVS)g6614134Nessuna valutazione finora

- Wilo Water PumpDocumento16 pagineWilo Water PumpThit SarNessuna valutazione finora

- Prof. Madhavan - Ancient Wisdom of HealthDocumento25 pagineProf. Madhavan - Ancient Wisdom of HealthProf. Madhavan100% (2)

- Dryer Regenerative Blower Purge DBP 02250195 405 R00 PDFDocumento84 pagineDryer Regenerative Blower Purge DBP 02250195 405 R00 PDFjennyNessuna valutazione finora

- People of The Philippines V. Crispin Payopay GR No. 141140 2003/07/2001 FactsDocumento5 paginePeople of The Philippines V. Crispin Payopay GR No. 141140 2003/07/2001 FactsAb CastilNessuna valutazione finora

- Adult Module 1 - Five Healthy Habits Handout (English) PDFDocumento2 pagineAdult Module 1 - Five Healthy Habits Handout (English) PDFKennedy FadriquelanNessuna valutazione finora

- Operational Safety and Health Procedures, Practices and RegulationsDocumento20 pagineOperational Safety and Health Procedures, Practices and RegulationsDionisa ErnacioNessuna valutazione finora

- 10 Chapter 3 Occupancy Classification AnDocumento10 pagine10 Chapter 3 Occupancy Classification AnMatt BaronNessuna valutazione finora

- Plumbing Breakup M 01Documento29 paginePlumbing Breakup M 01Nicholas SmithNessuna valutazione finora

- General Session Two - Work Life BalanceDocumento35 pagineGeneral Session Two - Work Life BalanceHiba AfandiNessuna valutazione finora

- An Energy Saving Guide For Plastic Injection Molding MachinesDocumento16 pagineAn Energy Saving Guide For Plastic Injection Molding MachinesStefania LadinoNessuna valutazione finora

- A Conceptual Framework For Characterizing M - 2019 - International Journal of MiDocumento7 pagineA Conceptual Framework For Characterizing M - 2019 - International Journal of MiKENNY BRANDON MAWODZWANessuna valutazione finora

- Challenger 350 Recommended Operating Procedures and TechniquesDocumento104 pagineChallenger 350 Recommended Operating Procedures and Techniquessebatsea100% (1)