Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Omnicom - 1-Page Appraisal

Caricato da

Andy Park0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni1 paginaQuick look at Omnicom

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoQuick look at Omnicom

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni1 paginaOmnicom - 1-Page Appraisal

Caricato da

Andy ParkQuick look at Omnicom

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 1

1.

Omnicom (OMC) 1-Page Appraisal

Omnicom is a global holding company which is among the five largest advertising agencies in

the world. While its main focus is Advertising, which accounts for roughly half of the business

(56% of revenue, 10-K 2019), they are also involved in Customer Relations Management (26%),

Public Relations (9%), as well as Healthcare Advertisement (7.5%).

As a result of the COVID-19 crisis, the advertising industry took a large hit in terms of valuation,

and is expected to see even more in terms of performance for the rest of 2020, followed by a

gradual recovery.

Yet their results for Q1 2020, were fairly surprising for me as they were relatively unchanged

when compared YoY to Q1 2019. Revenue was down -1% from 3,468m to 3,406m and Net

Income down only -1.9%, hardly the end of the world. (Of course, as the year continues, I do

expect that the effects of COVID will manifest more clearly in their financials, but perhaps not

as severe as the market estimates.)

Omnicom, with its size and low capital requirements, makes for a great business, having

maintained a Pre-Tax ROIC of ~20% over the past 10 years.

Their largest customer makes up only 3% of their total revenue, and their

next 100 largest clients represent approximately 51% of revenue,

eliminating large customer risk. Their clientele is diversified throughout

multiple industries as well, as shown by the tiny right graph (Q1 2020

Presentation)

In the scenario that Omnicom is able to return to historical median

multiples, there is a sizeable margin of safety at current prices, for this solid business.

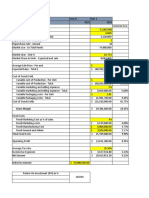

Current Hist.

Curren Industr Median

t OMC y (OMC) Implied EV Equity Value Imp. V/Share

Sales 14,891.70 1.10 1.06 1.33 19,805.96 16,167.36 $ 75.45

EBIT $ 2,193.90 7.47 9.79 8.98 19,701.22 16,062.62 $ 74.96

EBITDA 2,295.30 7.14 6.25 10.24 23,503.87 19,865.27 $ 92.71

Net Debt 3,638.60 $ 81.04

S/O 214.28 Current Price $ 56.33

Margin of

Safety 30.5%

Also, using a DCF with the assumption revenue drops 25% in 2020, with steady recovery for the next 5 years, a 3%

terminal growth rate, and a 10% Levered Free Cash Flow Margin, that the implied share price was still ~$70, a 23%

upside to today’s prices. This would mean that this stock is undervalued by even the street’s own guess-timates!

Potrebbero piacerti anche

- Realigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationDocumento8 pagineRealigning Estimate On Stronger Than Expected Mass Market: Bloomberry Resorts CorporationJajahinaNessuna valutazione finora

- Earnings Analysis - Bloomberry Resorts CorporationDocumento8 pagineEarnings Analysis - Bloomberry Resorts CorporationgwapongkabayoNessuna valutazione finora

- BLOOM Resorts raises FV on strong 4Q16 performanceDocumento5 pagineBLOOM Resorts raises FV on strong 4Q16 performanceJajahinaNessuna valutazione finora

- Manila Water 9M16 earnings up 5.8% on higher contributions from subsidiariesDocumento4 pagineManila Water 9M16 earnings up 5.8% on higher contributions from subsidiariesJajahinaNessuna valutazione finora

- Reducing FV Estimate On A More Conservative Outlook: Bloomberry Resorts CorporationDocumento10 pagineReducing FV Estimate On A More Conservative Outlook: Bloomberry Resorts CorporationJajahinaNessuna valutazione finora

- 3Q18 Earnings Improve Sequentially But A Sustainable Recovery Is Still UnsureDocumento8 pagine3Q18 Earnings Improve Sequentially But A Sustainable Recovery Is Still Unsureherrewt rewterwNessuna valutazione finora

- 9M21 Profit in Line With Estimates, Outlook Improves: Ayala Land IncDocumento8 pagine9M21 Profit in Line With Estimates, Outlook Improves: Ayala Land IncJajahinaNessuna valutazione finora

- Part 4 - Group8Documento9 paginePart 4 - Group8parmeet kaurNessuna valutazione finora

- 1Q19 Earnings Beat Estimates On Lower-Than-Expected Opex: Cebu Air, IncDocumento8 pagine1Q19 Earnings Beat Estimates On Lower-Than-Expected Opex: Cebu Air, IncMaloxeNessuna valutazione finora

- 2Q Profits Up 24% On Strong Sales and Opex Savings: Puregold Price Club, IncDocumento7 pagine2Q Profits Up 24% On Strong Sales and Opex Savings: Puregold Price Club, Incacd1355Nessuna valutazione finora

- Growth of The Textile and Apparel Industry Sector 2011 - 2021Documento6 pagineGrowth of The Textile and Apparel Industry Sector 2011 - 2021Kenny FamelikaNessuna valutazione finora

- Ir q4 2022 Full AnnouncementDocumento28 pagineIr q4 2022 Full AnnouncementtraphecafeNessuna valutazione finora

- DNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncDocumento9 pagineDNL 1Q21 Earnings Grow 35% Y/y, Ahead of Estimates: D&L Industries, IncJajahinaNessuna valutazione finora

- PGOLD Sees A Slower Performance in 2H20: Puregold Price Club, IncDocumento7 paginePGOLD Sees A Slower Performance in 2H20: Puregold Price Club, IncJNessuna valutazione finora

- Uber's Potential in Global Mobility Services MarketDocumento36 pagineUber's Potential in Global Mobility Services MarketSergio OlarteNessuna valutazione finora

- Finacial Growth - Assignment #1Documento4 pagineFinacial Growth - Assignment #1kattremblay17Nessuna valutazione finora

- 3Q20 Net Loss Amounts To Php1.6Bil in Line With COL EstimatesDocumento9 pagine3Q20 Net Loss Amounts To Php1.6Bil in Line With COL EstimatesJNessuna valutazione finora

- 9M16 Earnings in Line: Share DataDocumento4 pagine9M16 Earnings in Line: Share DataJajahinaNessuna valutazione finora

- Restated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncDocumento4 pagineRestated Earnings Largely Driven by Non-Cash Expenses: 2GO Group, IncJNessuna valutazione finora

- Nickel StudyDocumento7 pagineNickel StudyILSEN N. DAETNessuna valutazione finora

- Albermarle Financial ModelDocumento38 pagineAlbermarle Financial ModelParas AroraNessuna valutazione finora

- Sustained Improvement in 4Q20, in Line With Expectations: D&L Industries, IncDocumento8 pagineSustained Improvement in 4Q20, in Line With Expectations: D&L Industries, IncJazper ComiaNessuna valutazione finora

- Metro Pacific Inv. Corp: A No Surprise Quarter: Earnings AnalysisDocumento3 pagineMetro Pacific Inv. Corp: A No Surprise Quarter: Earnings AnalysisJNessuna valutazione finora

- Itc Clsa Oct2020Documento100 pagineItc Clsa Oct2020ksatishbabuNessuna valutazione finora

- CNPF sustains growth momentum in 3Q21 with 23.5% rise in profitsDocumento8 pagineCNPF sustains growth momentum in 3Q21 with 23.5% rise in profitsJajahinaNessuna valutazione finora

- VLL RENTAL ESTIMATE RAISED, SALES FORECAST CUTDocumento4 pagineVLL RENTAL ESTIMATE RAISED, SALES FORECAST CUTJajahinaNessuna valutazione finora

- Target Corporation - Simple Operating Model: General AssumptionsDocumento6 pagineTarget Corporation - Simple Operating Model: General AssumptionsoussemNessuna valutazione finora

- V Guard Industries Q3 FY22 Results PresentationDocumento17 pagineV Guard Industries Q3 FY22 Results PresentationRATHINessuna valutazione finora

- PC2020 Mid Year ReportDocumento9 paginePC2020 Mid Year ReportKW SoldsNessuna valutazione finora

- Federal Bank - Q1FY22 Result Update - 26072021 - 26-07-2021 - 11Documento8 pagineFederal Bank - Q1FY22 Result Update - 26072021 - 26-07-2021 - 11Tejas ShahNessuna valutazione finora

- 1Q21 Net Income Above Expectation: Semirara Mining CorporationDocumento8 pagine1Q21 Net Income Above Expectation: Semirara Mining CorporationJajahinaNessuna valutazione finora

- BMP Bav ValuationDocumento4 pagineBMP Bav ValuationThu ThuNessuna valutazione finora

- Business Policy Lululemon S09910604Documento3 pagineBusiness Policy Lululemon S09910604Dave Revinder LoekmanhadiNessuna valutazione finora

- Downgraded To HOLD As Recovery Stalls: Bloomberry Resorts CorporationDocumento8 pagineDowngraded To HOLD As Recovery Stalls: Bloomberry Resorts CorporationJajahinaNessuna valutazione finora

- Morocco: 2022 Annual Research: Key HighlightsDocumento2 pagineMorocco: 2022 Annual Research: Key HighlightsJohn WayneNessuna valutazione finora

- Handsome (020000) 20060217Documento4 pagineHandsome (020000) 20060217Imad ElharrakNessuna valutazione finora

- Ptba Ij - 2016Documento4 paginePtba Ij - 2016yasinta faridaNessuna valutazione finora

- Tech Mahindra Valuation Report FY21 Equity Inv CIA3Documento5 pagineTech Mahindra Valuation Report FY21 Equity Inv CIA3safwan hosainNessuna valutazione finora

- Profits Pulled Down by COVID-19 Pandemic: Cosco Capital, IncDocumento7 pagineProfits Pulled Down by COVID-19 Pandemic: Cosco Capital, Incacd1355Nessuna valutazione finora

- Manual input of data next to yellow cellsDocumento61 pagineManual input of data next to yellow cellsbysqqqdxNessuna valutazione finora

- TSX Mty or Us Otc Mtyff - Passive WatchDocumento8 pagineTSX Mty or Us Otc Mtyff - Passive WatchwmthomsonNessuna valutazione finora

- Gross MarginDocumento2 pagineGross MarginEDxColdBloodedNessuna valutazione finora

- Final Paper - Sample 1Documento13 pagineFinal Paper - Sample 1Abdo Mohammed AbdoNessuna valutazione finora

- GZ R&F’s FY20 core profit -52%yoy to Rmb4.3bnDocumento2 pagineGZ R&F’s FY20 core profit -52%yoy to Rmb4.3bnneil5mNessuna valutazione finora

- Evaluating Reliance's Dividend Policy and ValuationDocumento11 pagineEvaluating Reliance's Dividend Policy and ValuationYash Aggarwal BD20073Nessuna valutazione finora

- Shriram Transport Q1 FY20 PresentationDocumento18 pagineShriram Transport Q1 FY20 PresentationVenkata Reddy KNessuna valutazione finora

- Financial Analysis of P & GDocumento25 pagineFinancial Analysis of P & Ghitesh_mahajan_3Nessuna valutazione finora

- Earnings Release 3Q22 1Documento12 pagineEarnings Release 3Q22 1Yousif Zaki 3Nessuna valutazione finora

- Treasury Weekly Report W-33-1Documento2 pagineTreasury Weekly Report W-33-1shyamalNessuna valutazione finora

- CT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Documento11 pagineCT CLSA - Hayleys Fabric (MGT) 3Q21 Results Update - 22 February 2021Imran ansariNessuna valutazione finora

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocumento8 pagineZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21Nessuna valutazione finora

- The Warren Buffett Spreadsheet v16 - PreviewDocumento589 pagineThe Warren Buffett Spreadsheet v16 - PreviewNikhil SharmaNessuna valutazione finora

- Automobile Industry UpdateDocumento14 pagineAutomobile Industry UpdateMOHD SHARIQUE ZAMANessuna valutazione finora

- Get the Full Version of Stock Analysis SoftwareDocumento6 pagineGet the Full Version of Stock Analysis SoftwaresumanNessuna valutazione finora

- SMPH 1Q21 Profit Up 78% Q/Q But Outlook Remains UncertainDocumento9 pagineSMPH 1Q21 Profit Up 78% Q/Q But Outlook Remains UncertainJajahinaNessuna valutazione finora

- Top 5 MidcapDocumento20 pagineTop 5 MidcapABHISHEK YADAVNessuna valutazione finora

- MEG Maintain BUY on Valuations Despite Weaker OutlookDocumento5 pagineMEG Maintain BUY on Valuations Despite Weaker OutlookArwin MarianoNessuna valutazione finora

- Aktias Interim Report Q3-2023Documento53 pagineAktias Interim Report Q3-2023AnnabelNessuna valutazione finora

- Zorbas ExcelDocumento23 pagineZorbas ExcelRoderick Jackson Jr100% (5)

- Problems and Possibilities of the Us EconomyDa EverandProblems and Possibilities of the Us EconomyNessuna valutazione finora

- Highlights:: DCB Bank Announces Third Quarter FY 2022 ResultsDocumento7 pagineHighlights:: DCB Bank Announces Third Quarter FY 2022 ResultsanandNessuna valutazione finora

- Top 6 Best Accounting and Auditing Firms in The PhilippinesDocumento4 pagineTop 6 Best Accounting and Auditing Firms in The Philippineschelsea kayle licomes fuentesNessuna valutazione finora

- Basic Foreclosure Litigation Defense ManualDocumento155 pagineBasic Foreclosure Litigation Defense ManualDiane Stern100% (2)

- Week 03 - Bank ReconciliationDocumento6 pagineWeek 03 - Bank ReconciliationPj ManezNessuna valutazione finora

- Articles of IncorporationDocumento4 pagineArticles of IncorporationRuel FernandezNessuna valutazione finora

- Accounting 12 Chapter 8Documento30 pagineAccounting 12 Chapter 8cecilia capiliNessuna valutazione finora

- Sustainable Banking: A Systematic Review of Concepts and MeasurementsDocumento39 pagineSustainable Banking: A Systematic Review of Concepts and Measurementsثقتي بك ياربNessuna valutazione finora

- Christopher P. Mittleman's LetterDocumento5 pagineChristopher P. Mittleman's LetterDealBook100% (2)

- Biz Cafe Operations Excel - Assignment - UIDDocumento3 pagineBiz Cafe Operations Excel - Assignment - UIDJenna AgeebNessuna valutazione finora

- Implementing Your Business PlanDocumento10 pagineImplementing Your Business PlanGian Carlo Devera71% (7)

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDocumento4 pagineDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000Nessuna valutazione finora

- Reinsurance Contract Nature and Original Insured InterestDocumento2 pagineReinsurance Contract Nature and Original Insured InterestFlorena CayundaNessuna valutazione finora

- Dnata Campus To Corporate ProgramDocumento28 pagineDnata Campus To Corporate ProgramAmit Kushwaha100% (1)

- Garima Axis Bank SDocumento3 pagineGarima Axis Bank SSajan Sharma100% (1)

- Tech UnicornsDocumento16 pagineTech UnicornsSatishNessuna valutazione finora

- Final Assessment S1, 2021Documento5 pagineFinal Assessment S1, 2021Dilrukshi WanasingheNessuna valutazione finora

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Documento35 pagineWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nNessuna valutazione finora

- Itr-3 Coi - F.Y 2021-22 - Ayush BhosleDocumento6 pagineItr-3 Coi - F.Y 2021-22 - Ayush Bhosledarshil thakkerNessuna valutazione finora

- Application For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1Documento3 pagineApplication For Opening An Account Under ''Sukanya Samriddhi Account'' FORM-1shobsundar1Nessuna valutazione finora

- Bata & AB BankDocumento8 pagineBata & AB BankSaqeef RayhanNessuna valutazione finora

- Landbank RequirementsDocumento3 pagineLandbank Requirementsgee gambol50% (4)

- Textbook PDFDocumento367 pagineTextbook PDFRiaNessuna valutazione finora

- Total Compensation Framework Template (Annex A)Documento2 pagineTotal Compensation Framework Template (Annex A)Noreen Boots Gocon-GragasinNessuna valutazione finora

- The Payment of Bonus Act, 1965Documento15 pagineThe Payment of Bonus Act, 1965Raman GhaiNessuna valutazione finora

- Abacus v. AmpilDocumento11 pagineAbacus v. AmpilNylaNessuna valutazione finora

- Solution 1Documento5 pagineSolution 1frq qqrNessuna valutazione finora

- Microequities Deep Value Microcap Fund IMDocumento28 pagineMicroequities Deep Value Microcap Fund IMMicroequities Pty LtdNessuna valutazione finora

- DR Stanisław Kubielas: International FinanceDocumento4 pagineDR Stanisław Kubielas: International FinanceGorana Goga RadisicNessuna valutazione finora

- CIMA F1 Financial Operations KitDocumento433 pagineCIMA F1 Financial Operations KitAnonymous 5z7ZOp67% (3)

- Balance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of AccountsDocumento27 pagineBalance Sheet Accounts Income Statement Accounts: APPENDIX A: Company Chart of Accountsrisc1Nessuna valutazione finora