Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

CHP 13 Testbank 2

Caricato da

judy0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

137 visualizzazioni15 pagineTitolo originale

chp 13 testbank 2.docx

Copyright

© © All Rights Reserved

Formati disponibili

DOCX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

137 visualizzazioni15 pagineCHP 13 Testbank 2

Caricato da

judyCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato DOCX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 15

1.

A debenture bond issued by a corporation

a. is unsecured.

b. may be converted into other securities of the corporation for a specified time after

issuance.

c. matures in installments

d. is secured by stocks and bonds of other corporations.

2. What is the term used for bonds that pay no interest unless the issuing company is profitable?

a. Debenture bonds

b. Collateral trust bonds

c. Revenue bonds

d. Income bonds

3. On August 31, Jackson Enterprises issued bonds with a par value of $750,000 and a stated

interest rate of 8%. Interest is payable semiannually on June 30 and December 31. If the

proceeds from the issue amounted to $760,000, the bonds were likely

a. sold at a premium.

b. sold at a higher effective interest rate.

c. sold at a discount.

d. issued at par plus accrued interest.

4. Bowser Clothing sold $350,000 in 10-year bonds at an interest rate of 8 percent. The market

rate for similar bonds is 9 percent. Bowser decides to pay interest annually. Assume that the

PVF-OA10, 8% = 6.71008, PVF-OA10, 9% = 6.41766, PVF10, 8% = 0.46319, and PVF10, 9% =

0.42241. Based on this, Bowser sold the bonds for ________ of par.

a. 100%

b. 95.9%

c. 102.6%

d. 93.6%

5. Hinds Enterprises issued bonds at a premium. They traditionally use the effective interest

method of amortization. Therefore, you would expect the earlier years of the bonds to have an

interest expense that is

a. less than if the straight line method were used.

b. greater than if the straight-line method were used.

c. the same as if the straight-line method were used.

d. greater than the amount of the interest payments.

6. How should a bond premium be reported on a statement of financial position?

a. At the present value of the future reduction in bond interest expense due to the

premium.

b. As a deferred credit.

c. As a direct addition to the face amount of the bond.

d. Along with other premium accounts such as those resulting from share transactions.

7. When considering discounts or premiums applied to a bond issue, which of the following

statements is correct?

a. The difference between the effective rate of interest and the market rate of interest is

the reason discounts and premiums arise.

b. The terms "discount" and "premium" are the same as loss and gain, respectively, to

both buyer and seller.

c. The interest expense to the seller of bonds issued at a premium will be less than the

total interest payments.

d. When bonds are issued at a discount, the seller has an advantage in that interest

payments are based upon an amount less than face value.

8. How are commissions, legal fees, and printing fees associated with a bond issue accounted for?

a. By adjusting the bonds’ initial carrying value.

b. By adding them to any discount on bonds or subtracting them from any premium on

bonds when the bonds are sold.

c. By charging them to an expense account in the year the bonds are originally dated,

whether or not they are sold in that year.

d. By charging them to an expense account in the year the bonds are actually sold.

9. Bond issue costs, premiums, and discounts associated with bonds that are held to maturity

a. should be used to calculate the gain or loss resulting from the maturity of the bonds.

b. will be fully amortized as their amortization period is designed to coincide with the life

of the bond issue.

c. should be written off directly to a bond retirement account as the bond will be

redeemed.

d. are carried forward and written off in the same manner as that used prior to the

maturity date.

10. The difference between the reacquisition price and the net carrying amount on the books

should be __________ when debt is extinguished before its maturity date through a refunding

transaction.

a. treated as a prior period adjustment

b. recognized currently in income as a loss or gain

c. amortized over the life of the new issue

d. amortized over the remaining original life of the extinguished issue

11. On January 1, 2012, Morley Electronics issued bonds with a par value of $1,350,000 at 95, due in

10 years. The bond discount was amortized using the straight-line method. On January 1, 2017,

Morley called the entire issue at 102. Calculate Morley’s loss or gain on redemption.

a. $89,500 gain

b. $67,500 loss

c. $60,750 loss

d. $44,750 gain

12. The present value of a zero-interest-bearing note given for property, goods, or services should

be measured by

a. the fair value of the property, goods, or services or by an amount that reasonably

approximates the fair value of the note.

b. the book value of the property on the seller’s books the interest rate on similar notes

being offered in the market place for similar property, goods, or services.

c. using a negotiated interest rate between the issuer of the note and the owner of the

property, goods, or services to discount the note.

d. using the prime interest rate to discount the note.

13. When property with an indeterminable fair market value is exchanged for a debt instrument

with no ready market,

a. the present value of the debt instrument must be approximated using an imputed

interest rate.

b. it should not be recorded on the books of either party until the fair market value of the

property becomes evident.

c. the directors of both entities involved in the transaction should negotiate a value to be

assigned to the property.

d. the board of directors of the entity receiving the property should estimate a value for

the property that will serve as a basis for the transaction.

14. Marion Company issued a $350,000, zero-interest-bearing, 5-year note in exchange for land

with a fair market value of $287,000 from Palma Real Estate. If the present value of the note at

an appropriate rate of interest is $287,000, Palma Real Estate should record a

a. note payable in the amount of $287,000.

b. note receivable in the amount of $287,000.

c. note receivable in the amount of $350,000.

d. gain on the sale of land.

15. Brownlee Enterprises calculates the value of their bonds based on the fair value option. If the

market interest rate declines, the value of Brownlee’s bonds is likely to

a. stay the same.

b. be the same as the bond’s face value.

c. increase.

d. decrease.

16. All of the following are valid reasons to form a special-purpose entity EXCEPT

a. the new entity borrows money to finance a project and repays the debt from the

proceeds received from the project.

b. two or more entities form a new entity to construct an operating plant that will be used

by both parties.

c. the special-purpose entity is formed to remove risk from the company’s own financial

statements.

d. the special purpose entity segregates certain specific company assets from others.

17. A company that enters into off-balance sheet financing (Select all that apply.)

a. is in violation of generally accepted accounting principles.

b. may be attempting to conceal the debt from shareholders by having no information

about the debt included in the balance sheet.

c. wishes to confine all information related to the debt to the income statement and the

statement of cash flow.

d. can enhance the quality of its financial position and perhaps permit credit to be

obtained more readily and at less cost.

18. Farrar Cakes disclosed total liabilities of $5,400,000, total assets of $8,000,000, interest expense

of $400,000, income taxes of $600,000, and net income of $1,000,000 in their 2016 Annual

Report. Based on this, Farrar Cakes’ times interest earned ratio is

a. 10.

b. 5.

c. 2.5.

d. 8.

19. How should long-term debt be reported if it matures within one year and the company has

arranged, before its current year-end, to convert the debt into shares?

a. As noncurrent.

b. As a current liability.

c. As non-current and accompanied with a note explaining the method to be used in its

liquidation.

d. In a special section between liabilities and shareholders' equity.

20. Complex financial instruments make the distinction between debt and equity

a. harder to define.

b. easier to define.

c. less important.

d. irrelevant.

21. Which of the following conditions must be present for a debt refinancing to be treated as a

settlement?

a. The discounted present value of the cash flows under the new terms must be at least

10% greater or less than those under the old terms.

b. The discounted present value of the cash flows under the new terms must be at least

10% less than those under the old terms.

c. The discounted present value of the cash flows under the new terms must be at least

5% less than those under the old terms.

d. The discounted present value of the cash flows under the new terms must be at least

5% greater or less than those under the old terms.

22. Which of the following is a required disclosure with respect to liabilities?

a. payment terms for trade accounts payable

b. who the creditors are and how much is owed to each

c. details of assets pledged as collateral

d. future payments and maturity amounts for each of the next ten years

23. Which of the following is not a required disclosure with respect to liabilities?

a. future payments and maturity amounts for each of the next five years

b. maturity dates and interest rates for each outstanding bond issue

c. payment terms for trade accounts payable

d. details of assets pledged as collateral

24. What problem might the existence of a debt covenant pose to accountants and analysts?

a. The debtor might use overly conservative accounting in order to meet the condition

imposed by the covenant.

b. The creditor might use overly aggressive accounting in order to meet the condition

imposed by the covenant.

c. The creditor might use overly conservative accounting in order to meet the condition

imposed by the covenant.

d. The debtor might use overly aggressive accounting in order to meet the condition

imposed by the covenant.

25. The numerator of the times interest earned ratio is

a. net income before income tax.

b. net income before interest and income tax.

c. net income before interest.

d. net income before interest, income tax, and depreciation (EBITDA).

26. Which of the following would be considered positive indicators of a company’s financial health?

a. a low debt to total assets ratio and a high interest coverage ratio

b. a high debt to total assets ratio and a high interest coverage ratio

c. a low debt to total assets ratio and a low interest coverage ratio

d. a high debt to total assets ratio and a low interest coverage ratio

27. Which of the following statements is true?

a. Refinanced long-term debt may be reported as long-term rather than current if the

refinancing has been completed before the date of the financial statements, according

to IFRS and ASPE.

b. Refinanced long-term debt may be reported as long-term rather than current if the

refinancing has been completed before the issue of the financial statements, according

to IFRS and ASPE.

c. Refinanced long-term debt may be reported as long-term rather than current if the

refinancing has been completed before the date of the financial statements, according

to IFRS; and before the date of the issue of the financial statements, according to ASPE.

d. Refinanced long-term debt may be reported as long-term rather than current if the

refinancing has been completed before the date of the financial statements, according

to ASPE; and before the date of the issue of the financial statements, according to IFRS.

28. Which of the following statements is correct?

a. Both IFRS and ASPE require the effective interest method to be used to amortize bond

premiums and discounts.

b. ASPE requires the effective interest method to be used to amortize bond premiums and

discounts; IFRS permits either the effective interest method or the straight-line method.

c. IFRS requires the effective interest method to be used to amortize bond premiums and

discounts; ASPE permits either the effective interest method or the straight-line

method.

d. Both IFRS and ASPE permit either the effective interest method or the straight-line

method to be used to amortize bond premiums and discounts.

29. Which of the following would be considered a collateral trust bond?

a. a corporate bond that is backed with inventory of raw goods and/or finished materials

b. a corporate bond that is backed by a claim on real estate

c. a corporate bond that is backed with shares in another corporation

d. a corporate bond that is backed by one or more commodities

30. Gains and losses due to credit risk on fair-valued liabilities are booked to other comprehensive

income under which standard(s)?

a. neither ASPE nor IFRS

b. IFRS only

c. ASPE and IFRS

d. ASPE only

31. Which of the following statements is correct?

a. Only ASPE provides specific guidance on measuring transactions between related

parties.

b. Neither ASPE nor IFRS provide specific guidance on measuring transactions between

related parties.

c. Both ASPE and IFRS provide specific guidance on measuring transactions between

related parties.

d. Only IFRS provides specific guidance on measuring transactions between related parties.

32. Gains and losses due to credit risk on fair-valued liabilities are booked to other comprehensive

income under IFRS 9.

a. True

b. False

33. Gains and losses due to credit risk on fair-valued liabilities are booked to income

under IFRS 9.

a. Net

b. Other comprehensive

34. Gains and losses due to credit risk on fair-valued liabilities are booked to income

under ASPE.

a. Net

b. Other comprehensive

35. Only provides specific guidance on measuring transactions between related

parties.

a. ASPE

b. IFRS

36. Only provides specific guidance on measuring transactions between related

parties.

a. ASPE

b. IFRS

37. Only ASPE provides specific guidance on measuring transactions between related parties.

a. True

b. False

38. Long-term debt should be reported as current on the statement of financial position if a

company plans to retire the debt from a bond retirement fund which exists at or before the

current year-end.

a. True

b. False

39. Companies that wish to justify not reporting certain obligations on their financial statements

might argue that the recognition criteria in the accounting are imprecise.

a. Conceptual framework

b. Standard

40. Gilley Resources reported the following account balances on their December 31,

2017 adjusted trial balance:

How much should they report for long-term liabilities?

a. $2,865,000

b. $2,950,000

c. $2,965,000

d. $2,850,000

41. Under which of the following scenarios would a company likely report a

noncurrent liability as a current liability on their statement of financial position?

a. if they plan to call bonds by using money from a bond retirement fund in

the next three months

b. if they plan to pay off a five-year loan with cash in the first half of the next

fiscal period

c. if they plan to convert bonds to shares within the next year

d. if they plan to pay off a loan by issuing bonds in the next month

42. Knoll Resources has the following included in their liabilities:

1. Six-year, $360,000 loan at 4% interest, payable at $60,000/year plus interest,

obtained in 2012

2. 10-year term bond with $1,000,000 par value at 8% interest, issued in 2007

3. 20-year term bond with $2,500,000 par value at 12% interest, issued in 2009

4. 15-year, $6 million loan at 7.5% interest, payable at $400,000/year plus interest,

obtained in 2008

How much of these liabilities, excluding interest will they list under current liabilities at

12/31/16?

a. $1,460,000

b. $899,800

c. $685,000

d. $1,674,800

43. Companies that wish to justify not reporting certain obligations on their financial

statements might argue that

a. the use of judgement allows them to report whatever they choose.

b. an obligation that may never have to be repaid does not, in fact, exist.

c. the recognition criteria in the accounting conceptual framework are

imprecise.

d. including obligations of subsidiaries and associates would confuse

readers.

44. Companies that wish to justify not reporting certain obligations on their financial

statements might argue that the recognition criteria in the accounting

conceptual framework are imprecise.

a. True

b. False

45. An investor is interested in purchasing a bond, but he is not sure how long he

will want to hold it. As a result, the investor wants the process of selling this

bond to be as quick and easy as possible. Which type of bond should this

investor avoid when making his purchase?

a. bearer bond

b. registered bond

c. convertible bond

d. coupon bond

46. Which of the following provisions would you most expect to see in the indenture

for a convertible bond?

a. “Upon maturity, this bond may be redeemed for either cash or five

barrels of crude oil.”

b. “At any time in the next 10 years, the corporation may compel the holder

of this bond to redeem it for cash.”

c. “At any time in the next five years, this bond may be redeemed for 30

common shares.”

d. “All interest payments for this bond will be provided at the time of the

bond’s maturity.”

47. Tenor Technologies is planning to conduct a bond issue via firm underwriting.

This choice of underwriting methods suggests that Tenor

a. plans to sell the bonds directly to one large institution.

b. wants to be guaranteed a certain amount from the sale of its bonds.

c. is comfortable with the possibility of raising less money than expected

should investor interest in the bond fluctuate.

d. does not want to rely upon the services of an investment bank.

48. A large firm has just reduced the amount of debt in its capital structure. Given

this change, individuals who hold any bonds issued by the firm at

increased risk of incurring a loss on the bonds.

a. Are

b. Are Not

49. A collateral trust bond would be classified as a debenture bond.

a. True

b. False

50. You have just purchased a corporate bond with a maturity date of January 1,

2025. Despite the stated maturity, you know that the bond may be retired prior

to that date. What type of bond did you purchase?

a. serial bond

b. bearer bond

c. debenture bond

d. callable bond

51. Of the following terms, which refers to a bond that matures in installments?

a. Bearer bond

b. Term bond

c. Serial bond

d. Callable bond

52. With firm underwriting, the investment bank that sells a company’s bonds

guarantees that the company will receive a specific amount from the sale.

a. True

b. False

53. If a bond’s issuer has the right to retire the bond prior to its maturity date, that

bond would be classified as a

a. debenture bond.

b. retirable bond.

c. convertible bond.

d. callable bond.

54. Which of the following terms refers to a bond that does not pay interest unless

the issuing company is profitable?

a. Revenue bond

b. Collateral trust bond

c. Income bond

d. Debenture bond

55. If the name of a bond’s owner is not recorded with the issuing corporation, then

that bond would be classified as a

a. bearer bond.

b. term bond.

c. debenture bond.

d. secured bond.

56. Of the following choices, which would NOT be considered a long-term liability?

a. pension liabilities

b. bonds payable

c. utility bills

d. mortgages payable

57. Which of the following terms refers to a bond that is unsecured as to principal?

a. Callable bond

b. Debenture bond

c. Mortgage bond

d. Indenture bond

58. What is the name for the document that sets forth the covenants and

restrictions protecting both the issuer and the purchasers of a bond?

a. Bond debenture

b. Bond coupon

c. Registered bond

d. Bond indenture

59. Bonds that are not backed by collateral are called unsecured bonds.

a. True

b. False

60. The process of transferring a coupon bond is complicated than the

process of transferring a registered bond.

a. More

b. Less

61. A bond indenture contains the following provision: “At any time in the first 10

years after this bond’s issuance, the bearer may redeem the bond for 30

common shares in the issuing corporation”. This provision suggests that the

bond should be classified as a ________ bond.

a. Bearer

b. Callable

c. Convertible

d. commodity-backed

62. When shopping for corporate bonds on the open market, you would expect the

majority of available bonds to have a face value of

a. $10,000.

b. $100.

c. $1,000.

d. $100,000.

63. Crandall Industries recently conducted a bond issue. The company backed these

bonds with bonds issued by six other large corporations. Given this information,

Crandall’s newly issued bonds should be classified as ________ bonds.

a. Convertible

b. double-backed

c. serial

d. collateral trust

64. You have just purchased a corporate bond with a maturity date of January 1,

2025. Despite the stated maturity, you know that the bond may be retired prior

to that date. What type of bond did you purchase?

a. The firm must seek approval from all parties who hold any of its long-

term debt.

b. The firm’s existing bondholders must approve the new bond issue.

c. The firm’s shareholders must approve the new bond issue.

d. The firm must seek approval from all parties who hold any of its short-

term debt.

65. Gomez Manufacturing is preparing to conduct a bond issue and has decided to

go with best-efforts underwriting. This decision suggests that Gomez

a. does not want to rely upon the services of an investment bank.

b. does not want to pay a commission on the proceeds of the sale.

c. wants to be guaranteed a certain amount from the sale of its bonds.

d. feels there is enough investor interest in the bond that the firm will be

able to raise at least as much money as it needs.

66. Weston Incorporated needs to raise $25 million for long-term use. The firm

prefers that this amount be split into investing units of at least $500,000 or

more. Given this preference, Weston a good candidate for a bond

issue.

a. Is

b. Is Not

67. Foster Industries has just announced that it will conduct a bond issue in the

coming months. This announcement suggests that Foster needs to borrow a

________ amount of money for the ________ term.

a. large; short

b. large; long

c. small; short

d. small; long

68. The process of transferring a coupon bond is

a. they may be forced to redeem the bonds prior to their stated maturity

date.

b. the interest paid on these bonds comes directly from specified revenue

sources.

c. these bonds will not mature on a single date.

d. they may not always receive interest payments.

69. When investors purchase callable bonds, they do so with the knowledge that

they

a. may be forced to redeem the bond for a particular commodity.

b. will have the option to redeem the bond in exchange for stock in the

issuing corporation.

c. may be compelled to redeem the bond earlier than they would like.

d. will receive their total interest payoff at maturity.

70. Which of the following terms refers to a bond that is issued in the name of its

owner?

a. Convertible bond

b. Income bond

c. Bearer bond

d. Registered bond

71. In most cases, companies make annual bond interest payments, even though

the interest rate is usually expressed as a semiannual rate.

a. True

b. False

72. Your friend Penny is interested in investing in corporate bonds, but she is not

sure what type of bond is the best choice for her. She tells you that she is

especially interested in buying a bond that has a relatively low level of risk and

offers a steady income stream. Which of the following pieces of advice would be

most appropriate for you to provide?

a. “I would recommend avoiding term bonds. Because these bonds all

mature on a single date, you will not receive any interest payments until

that maturity date is reached.”

b. “Any type of debenture bond should be a solid choice. These bonds are

backed by collateral, which means your risk of loss is low or even

nonexistent.”

c. “Given your desire for a steady income stream, you will want to avoid

deep-discount bonds, even if their price makes them seem like an

appealing option.”

d. “I think an income bond is the best choice for you, because with this type

of bond, the issuing corporation must pay you a set amount of money

every year until the bond reaches maturity.”

73. Over the past year, Piazza Products has seen a moderate drop in sales, which

has led to a 15% decline in the value of the firm’s common shares. Given this

drop in sales and stock price, Piazza’s bondholders are at

a. increased risk of loss, because Piazza will have less sales revenue and

therefore less money available to pay back its obligation to its

bondholders.

b. minimal risk of loss, because the firm has not taken on additional debt in

its capital structure

c. increased risk of loss, because investor interest in Piazza’s bonds has

likely fallen in much the same way as it has fallen for the firm’s shares.

d. minimal risk of loss, because government regulations prevent firms from

defaulting on their obligation to their bondholders.

74. After a firm issues bonds, it will typically owe relatively ________ amounts of

money to a relatively ________ number of investors.

a. small; large

b. small; small

c. large; large

d. large; small

75. An investor has just purchased a corporate bond, even though she understands

that she may not always receive interest payments on the bond. This suggests

that the bond is most likely a(n) bond.

a. Income

b. Revenue

76. Which of the following corporate bonds would least likely be available for

purchase?

a. a bond with a $10,000 face value

b. a bond with a $100 face value

c. a bond with a $1,000 face value

d. a bond with a $1,500 face value

77. In which of the following scenarios would a firm most likely decide to conduct a

bond issue?

a. The firm’s shareholders are unwilling to authorize the firm to take on

more long-term debt.

b. The firm needs to borrow an amount that is too large for a single bank to

supply.

c. The firm needs to borrow an amount that is less than $1 million.

d. The firm predicts a one-year drop in income and wants extra funds on

hand to cover the anticipated shortfall.

78. Which of the following statements is accurate with regard to corporate bond

issues?

a. A bond’s indenture rarely states the amount authorized to be issued.

b. Typically, corporate bonds have various covenants that protect the

lenders but not the borrowers.

c. When a corporation issues bonds, it increases its level of short-term debt.

d. In most cases, a corporation’s board of directors and shareholders must

approve a new bond issue.

79. Your friend Juan tells you that he has run across what he believes to be a

fantastic investment opportunity. Specifically, he has learned that XYZ

Corporation is planning a deep-discount debenture bond issue in the coming

months. The low price of this bond appeals to Juan, especially in light of the

bond’s high face value and above-average interest rate. Juan asks your advice on

whether he should purchase one of these bonds. Which of the following

represents your best response?

a. “The low price of this bond reflects the fact that XYZ may call in the bond

at any time. Before buying the bond, consider how comfortable you are

with the possibility that you may have to surrender the bond before its

maturity date.”

b. “Although the low price is tempting, you should think about possible

changes in the price of the commodity linked to this bond. If the price of

the commodity falls between now and the bond’s maturity date, you may

lose money on your investment.”

c. “Your decision depends on whether you want this bond to provide an

income stream prior to its maturity date. If you are interested in receiving

regular cash flows, this bond is not your best choice.”

d. “This seems like a smart choice to me, too. Given that the loan is secured

by collateral, you are sure to realize some level of return on your

investment, even if XYZ suffers financial losses between now and the

bond’s maturity date.”

80. Monroe Manufacturing was recently the subject of a leveraged buyout led by the

firm’s upper management. As a result of the buyout, the amount of debt in

Monroe’s capital structure rose by 25%. Prior to the buyout, Monroe’s bonds had

a solid rating and its shares were considered a safe investment. How would

Monroe’s existing investors most likely be affected by the firm’s leveraged

buyout?

a. Only the firm’s bondholders would be at increased risk of loss.

b. Both the firm’s shareholders and its bondholders would be at increased

risk of loss.

c. Neither the firm’s bondholders nor its shareholders would be at

increased risk of loss.

d. Only the firm’s shareholders would be at increased risk of loss.

81. If the name of a bond’s owner is not recorded with the issuing corporation, then

that bond would be classified as a

a. bearer bond.

b. debenture bond.

c. term bond.

d. secured bond.

82. What is the name for the document that sets forth the covenants and

restrictions protecting both the issuer and the purchasers of a bond?

a. Registered bond

b. Bond debenture

c. Bond coupon

d. Bond indenture

83. Which of the following terms refers to a bond that does not pay interest unless

the issuing company is profitable?

a. Income bond

b. Revenue bond

c. Collateral trust bond

d. Debenture bond

84. If a bond’s issuer has the right to retire the bond prior to its maturity date, that

bond would be classified as a

a. debenture bond.

b. convertible bond.

c. retirable bond.

d. callable bond.

85. Which of the following terms refers to a bond that is unsecured as to principal?

a. Debenture bond

b. Indenture bond

c. Callable bond

d. Mortgage bond

86. Of the following terms, which refers to a bond that matures in installments?

a. Bearer bond

b. Callable bond

c. Serial bond

d. Term bond

87. Pension liabilities be classified as long-term debt.

a. Should

b. Should Not

88. A large firm has just reduced the amount of debt in its capital structure. Given

this change, individuals who hold any bonds issued by the firm at

increased risk of incurring a loss on the bonds.

a. Are

b. Are Not

89. With firm underwriting, the investment bank that sells a company’s bonds

guarantees that the company will receive a specific amount from the sale.

a. True

b. False

90.

Potrebbero piacerti anche

- Management Reporting A Complete Guide - 2019 EditionDa EverandManagement Reporting A Complete Guide - 2019 EditionNessuna valutazione finora

- ACC 430 Chapter 10Documento20 pagineACC 430 Chapter 10vikkiNessuna valutazione finora

- Equity Financing A Complete Guide - 2020 EditionDa EverandEquity Financing A Complete Guide - 2020 EditionNessuna valutazione finora

- Accounting Information SystemDocumento24 pagineAccounting Information Systembea6089Nessuna valutazione finora

- Asset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionDa EverandAsset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionValutazione: 4 su 5 stelle4/5 (13)

- Chapter 11 TaxDocumento21 pagineChapter 11 TaxMatt HratkoNessuna valutazione finora

- Controlling Payroll Cost - Critical Disciplines for Club ProfitabilityDa EverandControlling Payroll Cost - Critical Disciplines for Club ProfitabilityNessuna valutazione finora

- Chapter 5, Long Term Financing, RevisedDocumento9 pagineChapter 5, Long Term Financing, RevisedAndualem ZenebeNessuna valutazione finora

- Electronic funds transfer A Clear and Concise ReferenceDa EverandElectronic funds transfer A Clear and Concise ReferenceNessuna valutazione finora

- Chapter 7 Bond MarketsDocumento15 pagineChapter 7 Bond MarketsDianne BallonNessuna valutazione finora

- Public Sector AccountingDocumento9 paginePublic Sector AccountingBekanaNessuna valutazione finora

- Chapter 2 Property Acquisition and Cost Recovery: Taxation of Business Entities, 11e (Spilker)Documento17 pagineChapter 2 Property Acquisition and Cost Recovery: Taxation of Business Entities, 11e (Spilker)yea okayNessuna valutazione finora

- The Role of Managerial FinanceDocumento23 pagineThe Role of Managerial FinanceLee TeukNessuna valutazione finora

- Accounting For Branches and Combined FSDocumento112 pagineAccounting For Branches and Combined FSEcka Tubay100% (1)

- IAS 39 - Financial InstrumentsDocumento5 pagineIAS 39 - Financial InstrumentsSt Dalfour CebuNessuna valutazione finora

- (201001 - 201020) Afar - Partnership Formation (PPT Version)Documento41 pagine(201001 - 201020) Afar - Partnership Formation (PPT Version)Mau Dela CruzNessuna valutazione finora

- REVIEWERDocumento10 pagineREVIEWERRhyna Vergara SumaoyNessuna valutazione finora

- Intermediate Accounting 5EDocumento44 pagineIntermediate Accounting 5Ejahanzeb90100% (1)

- Test Bank Chapter 11Documento25 pagineTest Bank Chapter 11leelee0302Nessuna valutazione finora

- Payout Policy Elements of Payout PolicyDocumento6 paginePayout Policy Elements of Payout PolicyMarlon A. RodriguezNessuna valutazione finora

- Chapter 4Documento45 pagineChapter 42222mahmood50% (2)

- Bird in TH Hand TheoryDocumento1 paginaBird in TH Hand TheorySharma Gokhool100% (3)

- Week 3 Answers To Questions Final DFTDocumento10 pagineWeek 3 Answers To Questions Final DFTGabriel Aaron Dionne0% (1)

- Chapter 4 - Review Questions Accounting Information SystemDocumento2 pagineChapter 4 - Review Questions Accounting Information SystemBeny MoldogoNessuna valutazione finora

- The Afn FormulaDocumento1 paginaThe Afn Formulasplendidhcc100% (2)

- Govacc AccountsDocumento88 pagineGovacc AccountsEunice Rae De GuzmanNessuna valutazione finora

- Chapter 7Documento27 pagineChapter 7phillipNessuna valutazione finora

- CHAP 1.the Demand For Audit and Other Assurance ServicesDocumento11 pagineCHAP 1.the Demand For Audit and Other Assurance ServicesNoroNessuna valutazione finora

- Practice Quiz NonFinlLiabDocumento15 paginePractice Quiz NonFinlLiabIsabelle GuillenaNessuna valutazione finora

- Test Bank Ch6 ACCTDocumento89 pagineTest Bank Ch6 ACCTMajed100% (1)

- Multiple Choice QuestionsDocumento9 pagineMultiple Choice QuestionsMiguel Cortez100% (1)

- MAS Monitoring ExamDocumento12 pagineMAS Monitoring ExamPrincess Claris Araucto0% (1)

- Income Based ValuationDocumento25 pagineIncome Based ValuationApril Joy ObedozaNessuna valutazione finora

- Mergers and Acquisitions: Multiple Choice: ConceptualDocumento2 pagineMergers and Acquisitions: Multiple Choice: ConceptualKristel SumabatNessuna valutazione finora

- PWC 1Documento20 paginePWC 1Clyde RamosNessuna valutazione finora

- Questionnaire: Act112 - Intermediate Accounting IDocumento20 pagineQuestionnaire: Act112 - Intermediate Accounting IMichaelNessuna valutazione finora

- Accounting 203 Chapter 13 TestDocumento3 pagineAccounting 203 Chapter 13 TestAnbang XiaoNessuna valutazione finora

- CRC AceDocumento3 pagineCRC AceNaSheengNessuna valutazione finora

- Financial Accounting Chapter 5 QuizDocumento6 pagineFinancial Accounting Chapter 5 QuizZenni T XinNessuna valutazione finora

- FM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFDocumento28 pagineFM CH 1natureoffinancialmanagement 120704104928 Phpapp01 PDFvasantharao100% (1)

- Gross IncomeDocumento7 pagineGross Incomeceline marasiganNessuna valutazione finora

- Chapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroDocumento7 pagineChapter 08-Risk and Rates of Return: Cengage Learning Testing, Powered by CogneroqueenbeeastNessuna valutazione finora

- Liabilities: Problem 1Documento3 pagineLiabilities: Problem 1Frederick Abella0% (1)

- ACCT 201 Exam 1Documento16 pagineACCT 201 Exam 1Steve ZaluchaNessuna valutazione finora

- CH 6Documento40 pagineCH 6yosefnaserNessuna valutazione finora

- Ae 123 Management ScienceDocumento7 pagineAe 123 Management ScienceMa MaNessuna valutazione finora

- The Features of Long Term DebtsDocumento56 pagineThe Features of Long Term DebtsMicah Ramayka100% (3)

- Testbank Ch01 02 REV Acc STD PDFDocumento7 pagineTestbank Ch01 02 REV Acc STD PDFheldiNessuna valutazione finora

- Qualifying Exam Reviewer - ObliconDocumento10 pagineQualifying Exam Reviewer - ObliconFeeNessuna valutazione finora

- 004 +Self+Test,+Financial+ForecastingDocumento15 pagine004 +Self+Test,+Financial+ForecastingMatel Franklin AnastaNessuna valutazione finora

- C. Update Valid Vendor File: Multiple-Choice Questions 1Documento8 pagineC. Update Valid Vendor File: Multiple-Choice Questions 1DymeNessuna valutazione finora

- Accounting GeniusDocumento9 pagineAccounting Geniusryan angelica allanicNessuna valutazione finora

- Toa - Preboard - May 2016Documento11 pagineToa - Preboard - May 2016Kenneth Bryan Tegerero Tegio100% (1)

- CHAPTER 11 Compensation IncomeDocumento15 pagineCHAPTER 11 Compensation IncomeGIRLNessuna valutazione finora

- Chapter 4 Question ReviewDocumento11 pagineChapter 4 Question ReviewNayan SahaNessuna valutazione finora

- Afar8721 8722 Npo PDFDocumento3 pagineAfar8721 8722 Npo PDFSid TuazonNessuna valutazione finora

- Partnership: (Definition, Nature, Formation) Lucille Myschkin Flores, MBADocumento38 paginePartnership: (Definition, Nature, Formation) Lucille Myschkin Flores, MBAYbonne BatleNessuna valutazione finora

- Test Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisDocumento126 pagineTest Bank Accounting 25th Editon Warren Chapter 17 Financial Statement AnalysisJessa De GuzmanNessuna valutazione finora

- Intermediate Accounting 14eDocumento50 pagineIntermediate Accounting 14eMiguel Cortez100% (1)

- Quiz Chapter 7Documento2 pagineQuiz Chapter 7PauNessuna valutazione finora

- Comparative Investment ReportDocumento8 pagineComparative Investment ReportNelby Actub MacalaguingNessuna valutazione finora

- Long Term Career GoalsDocumento3 pagineLong Term Career GoalsXylinNessuna valutazione finora

- Bba PDFDocumento50 pagineBba PDFLakhan KumarNessuna valutazione finora

- Beams AdvAcc11 ChapterDocumento21 pagineBeams AdvAcc11 Chaptermd salehinNessuna valutazione finora

- Format For BQDocumento2 pagineFormat For BQAfroj ShaikhNessuna valutazione finora

- Benihana of Tokyo Case AnalysisDocumento2 pagineBenihana of Tokyo Case AnalysisJayr Padillo33% (3)

- Brand Management Secondary AssociationDocumento17 pagineBrand Management Secondary AssociationTanveer H. RayveeNessuna valutazione finora

- Agnes Hanson's ResumeDocumento1 paginaAgnes Hanson's ResumeAgnes HansonNessuna valutazione finora

- PAYE-GEN-01-G02 - Guide For Employers in Respect of Fringe Benefits - External GuideDocumento25 paginePAYE-GEN-01-G02 - Guide For Employers in Respect of Fringe Benefits - External Guidelixocan100% (1)

- Finweek English Edition - March 7 2019Documento48 pagineFinweek English Edition - March 7 2019fun timeNessuna valutazione finora

- A Study On Market Anomalies in Indian Stock Market IDocumento10 pagineA Study On Market Anomalies in Indian Stock Market ISrinu BonuNessuna valutazione finora

- Bibliography Financial CrisisDocumento41 pagineBibliography Financial CrisisaflagsonNessuna valutazione finora

- Oman - Corporate SummaryDocumento12 pagineOman - Corporate SummarymujeebmuscatNessuna valutazione finora

- RIFD at The Metro GroupDocumento8 pagineRIFD at The Metro GroupSoumya BarmanNessuna valutazione finora

- Cls Casuallens Whitepaper v4Documento3 pagineCls Casuallens Whitepaper v4geaninetwiceNessuna valutazione finora

- Chapter 13 Human Resource ManagementDocumento37 pagineChapter 13 Human Resource ManagementKashif Ullah KhanNessuna valutazione finora

- Nature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawDocumento6 pagineNature and Source of Local Taxing Power: Grant of Local Taxing Power Under Existing LawFranco David BaratetaNessuna valutazione finora

- Case Study WilkersonDocumento2 pagineCase Study WilkersonHIMANSHU AGRAWALNessuna valutazione finora

- Hindalco Annual Report FY2007Documento135 pagineHindalco Annual Report FY2007hennadNessuna valutazione finora

- Introduction To Financial Accounting 1a NotesDocumento52 pagineIntroduction To Financial Accounting 1a NotesNever DoviNessuna valutazione finora

- Indonesian Physician's CompetencyDocumento34 pagineIndonesian Physician's CompetencyAdecha DotNessuna valutazione finora

- Lecture 6 and 7 Project Finance Model 1Documento61 pagineLecture 6 and 7 Project Finance Model 1w_fibNessuna valutazione finora

- Nigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDocumento3 pagineNigeria Civil Aviation Policy (NCAP) 2013: Tampering With NCAA's Safety & Economic RegulationDung Rwang PamNessuna valutazione finora

- Regional Trade Integration in SEE Benefits and ChallengesDocumento178 pagineRegional Trade Integration in SEE Benefits and ChallengesRakip MaloskiNessuna valutazione finora

- EOU FAQsDocumento6 pagineEOU FAQsSri KanthNessuna valutazione finora

- VP Human Resources Global Operations in Boston MA Resume Richard HunterDocumento3 pagineVP Human Resources Global Operations in Boston MA Resume Richard HunterRichardHunterNessuna valutazione finora

- Learn Socialism Collection - Full Size PDFDocumento107 pagineLearn Socialism Collection - Full Size PDFRobert RodriguezNessuna valutazione finora

- LIST OF YGC and AYALA COMPANIESDocumento3 pagineLIST OF YGC and AYALA COMPANIESJibber JabberNessuna valutazione finora

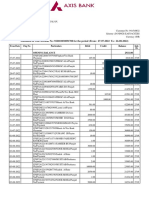

- Acct Statement XX1708 26082022Documento4 pagineAcct Statement XX1708 26082022Firoz KhanNessuna valutazione finora

- Bay' Al-TawarruqDocumento12 pagineBay' Al-TawarruqMahyuddin Khalid67% (3)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNDa Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNValutazione: 4.5 su 5 stelle4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisDa EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisValutazione: 5 su 5 stelle5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 3.5 su 5 stelle3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaDa EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaValutazione: 4.5 su 5 stelle4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successDa EverandReady, Set, Growth hack:: A beginners guide to growth hacking successValutazione: 4.5 su 5 stelle4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyDa EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyValutazione: 3 su 5 stelle3/5 (1)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamDa EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNessuna valutazione finora

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthDa EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthValutazione: 4 su 5 stelle4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNessuna valutazione finora

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingDa EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingValutazione: 4.5 su 5 stelle4.5/5 (17)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursDa EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursValutazione: 5 su 5 stelle5/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialDa EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialValutazione: 4.5 su 5 stelle4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsDa EverandCreating Shareholder Value: A Guide For Managers And InvestorsValutazione: 4.5 su 5 stelle4.5/5 (8)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsDa EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNessuna valutazione finora

- Product-Led Growth: How to Build a Product That Sells ItselfDa EverandProduct-Led Growth: How to Build a Product That Sells ItselfValutazione: 5 su 5 stelle5/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsDa EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsValutazione: 4.5 su 5 stelle4.5/5 (21)

- Value: The Four Cornerstones of Corporate FinanceDa EverandValue: The Four Cornerstones of Corporate FinanceValutazione: 4.5 su 5 stelle4.5/5 (18)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondDa EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondNessuna valutazione finora

- Mind over Money: The Psychology of Money and How to Use It BetterDa EverandMind over Money: The Psychology of Money and How to Use It BetterValutazione: 4 su 5 stelle4/5 (24)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursDa EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursValutazione: 4.5 su 5 stelle4.5/5 (8)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Da EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Valutazione: 4 su 5 stelle4/5 (5)

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsDa EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsValutazione: 5 su 5 stelle5/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismDa EverandThe Value of a Whale: On the Illusions of Green CapitalismValutazione: 5 su 5 stelle5/5 (2)