Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

What Is Income Tax

Caricato da

Darlene SarcinoCopyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

What Is Income Tax

Caricato da

Darlene SarcinoCopyright:

Formati disponibili

What Is Income Tax?

Income tax is a type of tax that governments impose on income generated by

businesses and individuals within their jurisdiction. By law, taxpayers must file an

income tax return annually to determine their tax obligations. 1 2 Income taxes are a

source of revenue for governments. They are used to fund public services, pay

government obligations, and provide goods for citizens.

How Income Tax Works

Most countries employ a progressive income tax system in which higher-income

earners pay a higher tax rate compared to their lower-income counterparts. 4 The U.S.

imposed the nation's first income tax in 1862 to help finance the Civil War. After the war,

the tax was repealed; it was reinstated during the early 20th century. 5

In the U.S., the Internal Revenue Service (IRS) collects taxes and enforces tax law.6

The IRS employs a complex set of rules and regulations regarding reportable and

taxable income, deductions, credits, et al. 7 The agency collects taxes on all forms of

income, such as wages, salaries, commissions, investments, and business earnings. 8

The personal income tax the government collects can help fund government programs

and services, such as Social Security, national security, schools, and roads. 9

Types of Income Tax

Individual Income Tax

Individual income tax is also referred to as personal income tax. This type of income tax

is levied on an individual's wages, salaries, and other types of income. This tax is

usually a tax the state imposes. Because of exemptions, deductions, and credits, most

individuals do not pay taxes on all of their income. 1 0

The IRS offers a series of income tax deductions and tax credits that taxpayers can

make use of to reduce their taxable income. While a deduction can lower your taxable

income and the tax rate that is used to calculate your tax, a tax credit reduces your

income tax by giving you a larger refund of your withholding.

The IRS offers tax deductions for healthcare expenses, investments, and certain

education expenses. For example, if a taxpayer earns $100,000 in income and qualifies

for $20,000 in deductions, the taxable income reduces to $80,000 ($100,000 - $20,000

= $80,000).

Tax credits exist to help reduce the taxpayer's tax obligation or amount owed. They

were created primarily for those in middle-income and low-income households. To

illustrate, if an individual owes $20,000 in taxes but qualifies for $4,500 in credits, their

tax obligation reduces to $15,500 ($20,000 - $4,500= $15,500). 1 1

Business Income Taxes

Businesses also pay income taxes on their earnings; the IRS taxes income from

corporations, partnerships, self-employed contractors, and small businesses. 1 2

Depending on the business structure, either the corporation, its owners, or shareholders

report their business income and then deduct their operating and capital

expenses. Generally, the difference between their business income and their operating

and capital expenses is considered their taxable business income. 1 3 1 4

State and Local Income Tax

Most U.S. states also levy personal income taxes. As of 2020, there are seven states

with no income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington, and

Wyoming. In addition, two other states–New Hampshire and Tennessee–do not tax

earned income; however, they do tax investment income and interest.

However, both of these states are set to eliminate those taxes on investment income

and interest, and it is projected that the number of states in the U.S. with no income tax

will reach nine in 2025.

For taxpayers, it may not necessarily be cheaper to live in a state that does not levy

income taxes. This is because states often make up the lost revenue with other taxes or

reduced services. In addition, there are other factors that determine the affordability of

living in a state, including healthcare, cost of living, and job opportunities.

Potrebbero piacerti anche

- What Is The Difference Between An Adjunct Account and A Contra AccountDocumento1 paginaWhat Is The Difference Between An Adjunct Account and A Contra AccountDarlene SarcinoNessuna valutazione finora

- What Is The Solvency RatioDocumento2 pagineWhat Is The Solvency RatioDarlene SarcinoNessuna valutazione finora

- What Is Return On InvestmentDocumento3 pagineWhat Is Return On InvestmentDarlene SarcinoNessuna valutazione finora

- What Is Return On AssetsDocumento2 pagineWhat Is Return On AssetsDarlene SarcinoNessuna valutazione finora

- What Is The Difference Between Notes Payable and Accounts PayableDocumento2 pagineWhat Is The Difference Between Notes Payable and Accounts PayableDarlene SarcinoNessuna valutazione finora

- What Is Inventory TurnoverDocumento2 pagineWhat Is Inventory TurnoverDarlene SarcinoNessuna valutazione finora

- What Is Ratio AnalysisDocumento2 pagineWhat Is Ratio AnalysisDarlene SarcinoNessuna valutazione finora

- What Is Accounts ReceivableDocumento2 pagineWhat Is Accounts ReceivableDarlene SarcinoNessuna valutazione finora

- What Is Equity AccountingDocumento2 pagineWhat Is Equity AccountingDarlene SarcinoNessuna valutazione finora

- What Is Working Capital TurnoverDocumento2 pagineWhat Is Working Capital TurnoverDarlene SarcinoNessuna valutazione finora

- What Is Property, Plant, and Equipment - PP&E?: EquityDocumento2 pagineWhat Is Property, Plant, and Equipment - PP&E?: EquityDarlene SarcinoNessuna valutazione finora

- What Is An Asset?: Economic ValueDocumento2 pagineWhat Is An Asset?: Economic ValueDarlene SarcinoNessuna valutazione finora

- Market Prospect RatiosDocumento4 pagineMarket Prospect RatiosDarlene SarcinoNessuna valutazione finora

- What Do Efficiency Ratios MeasureDocumento2 pagineWhat Do Efficiency Ratios MeasureDarlene SarcinoNessuna valutazione finora

- What Is Accounts Payable (AP) ?: General LedgerDocumento3 pagineWhat Is Accounts Payable (AP) ?: General LedgerDarlene SarcinoNessuna valutazione finora

- What Is Accounts Receivable TurnoverDocumento4 pagineWhat Is Accounts Receivable TurnoverDarlene SarcinoNessuna valutazione finora

- What Is A StockDocumento2 pagineWhat Is A StockDarlene SarcinoNessuna valutazione finora

- What Is A Liability?: Right Side Balance Sheet Accounts PayableDocumento3 pagineWhat Is A Liability?: Right Side Balance Sheet Accounts PayableDarlene SarcinoNessuna valutazione finora

- What Is A PatentDocumento2 pagineWhat Is A PatentDarlene SarcinoNessuna valutazione finora

- What Is A Coverage RatioDocumento2 pagineWhat Is A Coverage RatioDarlene SarcinoNessuna valutazione finora

- What Are Profitability RatiosDocumento2 pagineWhat Are Profitability RatiosDarlene SarcinoNessuna valutazione finora

- What Are Notes ReceivableDocumento2 pagineWhat Are Notes ReceivableDarlene SarcinoNessuna valutazione finora

- What Are Liquidity RatiosDocumento2 pagineWhat Are Liquidity RatiosDarlene SarcinoNessuna valutazione finora

- Test Sample 3 Law On SalesDocumento10 pagineTest Sample 3 Law On SalesDarlene SarcinoNessuna valutazione finora

- What Are Bonds PayableDocumento1 paginaWhat Are Bonds PayableDarlene SarcinoNessuna valutazione finora

- What Is A PartnershipDocumento2 pagineWhat Is A PartnershipDarlene SarcinoNessuna valutazione finora

- Actual Cost Accounting Records Variances: Standard Costing OverviewDocumento3 pagineActual Cost Accounting Records Variances: Standard Costing OverviewDarlene SarcinoNessuna valutazione finora

- Test Sample 2 Law (Oblicon)Documento15 pagineTest Sample 2 Law (Oblicon)Darlene SarcinoNessuna valutazione finora

- Applied Auditing: Chapter 5 Cash and Accrual BasisDocumento5 pagineApplied Auditing: Chapter 5 Cash and Accrual BasisDarlene SarcinoNessuna valutazione finora

- Financial Accounting and Reporting NotesDocumento6 pagineFinancial Accounting and Reporting NotesDarlene SarcinoNessuna valutazione finora

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Iffco at A GlanceDocumento74 pagineIffco at A Glancelokesharya1Nessuna valutazione finora

- HUL CaseDocumento1 paginaHUL CaseChiragNarulaNessuna valutazione finora

- Full Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter ChapterDocumento23 pagineFull Operations Management 6Th Edition Test Bank Nigel Slack PDF Docx Full Chapter Chaptersuavefiltermyr62100% (28)

- Agency Program Coordinator GuideDocumento42 pagineAgency Program Coordinator Guidenate mcgradyNessuna valutazione finora

- Business Ethics - Module 1Documento16 pagineBusiness Ethics - Module 1Rekha Madhu100% (1)

- CHAPTER 10. Corporation TaxDocumento55 pagineCHAPTER 10. Corporation TaxAmanda RuseirNessuna valutazione finora

- University of Pune: Revised With Effect From June 2013Documento162 pagineUniversity of Pune: Revised With Effect From June 2013Deepak PaulNessuna valutazione finora

- Production Logistics and Human-Computer Interaction - State-Of-The-Art, Challenges and Requirements For The FutureDocumento19 pagineProduction Logistics and Human-Computer Interaction - State-Of-The-Art, Challenges and Requirements For The FutureBladimir MendezNessuna valutazione finora

- DDA Status-Dwarka ExpresswayDocumento11 pagineDDA Status-Dwarka ExpresswayAshok SharmaNessuna valutazione finora

- 21 - Procure 2 Pay Cycle in Oracle Apps R12Documento22 pagine21 - Procure 2 Pay Cycle in Oracle Apps R12Bala SubramanyamNessuna valutazione finora

- R3 PT Canggu International-1 PDFDocumento2 pagineR3 PT Canggu International-1 PDFkarina MEPNessuna valutazione finora

- Sbaa1504 - Business Policy and Strategy - Unit Ii - PPT (3) 2Documento55 pagineSbaa1504 - Business Policy and Strategy - Unit Ii - PPT (3) 2abcdNessuna valutazione finora

- Resume - Jatin Kumar NagarDocumento1 paginaResume - Jatin Kumar NagarVinayNessuna valutazione finora

- Lozada - NVIDIA SWOT AnalysisDocumento2 pagineLozada - NVIDIA SWOT AnalysisKyrelle Mae LozadaNessuna valutazione finora

- List of Payment Purpose Code KRDocumento10 pagineList of Payment Purpose Code KRあいうえおかきくけこNessuna valutazione finora

- SoftexcodesDocumento12 pagineSoftexcodesGuru MoorthiNessuna valutazione finora

- Amena Akter Mim 1620741630 - SCM 320 Individual Assignment 1Documento10 pagineAmena Akter Mim 1620741630 - SCM 320 Individual Assignment 1amena aktar MimNessuna valutazione finora

- Mass Media and Society PPT (Grp. 1)Documento25 pagineMass Media and Society PPT (Grp. 1)JeNnifer ManuelNessuna valutazione finora

- Surendra Gupta Refuse To Pay NSELDocumento2 pagineSurendra Gupta Refuse To Pay NSELBhoomiPatelNessuna valutazione finora

- Ihab Yacoub - Resume - JoDocumento5 pagineIhab Yacoub - Resume - JoMuthanna AladwanNessuna valutazione finora

- Tindak Lanjut DiklatDocumento15 pagineTindak Lanjut Diklatdian kNessuna valutazione finora

- Od 330390050476522100Documento3 pagineOd 330390050476522100rjvNessuna valutazione finora

- Productivity - NotesDocumento16 pagineProductivity - Notesjac bnvstaNessuna valutazione finora

- What Is ChangeDocumento3 pagineWhat Is ChangeCalonneFrNessuna valutazione finora

- Corporate Governance Complete ProjectDocumento21 pagineCorporate Governance Complete ProjectEswar Stark100% (1)

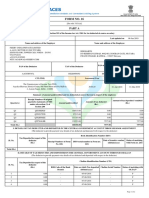

- Form16 Fiserv 2018-19Documento8 pagineForm16 Fiserv 2018-19SiddharthNessuna valutazione finora

- Corporate Crime Project FinalDocumento32 pagineCorporate Crime Project Finalankita100% (1)

- Solution Manual For Principles of Corporate Finance 12th Edition by BrealeyDocumento3 pagineSolution Manual For Principles of Corporate Finance 12th Edition by BrealeyNgân HàNessuna valutazione finora

- Principles of Accounting 11th Edition Needles Test BankDocumento49 paginePrinciples of Accounting 11th Edition Needles Test Bankjosephroyszexgqbdct100% (10)

- MGT602 Final Subjective by USMAN ATTARIDocumento12 pagineMGT602 Final Subjective by USMAN ATTARImaryamNessuna valutazione finora