Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

FAR.2853 - Small Entities PDF

Caricato da

stephen poncianoDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

FAR.2853 - Small Entities PDF

Caricato da

stephen poncianoCopyright:

Formati disponibili

Since 1977

FAR OCAMPO/CABARLES/SOLIMAN/OCAMPO

FAR.2853 - Small Entities (SEs) MAY 2020

DISCUSSION PROBLEMS

1. The Securities and Exchange Commission (SEC) has b. A small entity which is a subsidiary of a foreign

issued SEC Memorandum Circular No. 05 (2018) parent company which will be moving towards

adopting, as part of its financial reporting rules and IFRS or IFRS for SMEs pursuant to the foreign

regulations, the Philippine Financial Reporting country’s published convergence plan.

Standards For Small Entities (PFRS for SEs). This is in c. A small entity, either as a significant joint venture

line with the corporate regulator’s or associate, is part of a group that is reporting

a. Run After Tax Evaders initiatives under full PFRS or PFRS for SMEs.

b. Public Private Partnership initiatives d. A small entity which has a short term projection

c. Build Build Build initiatives that show that it will breach the quantitative

d. Ease of Doing Business initiatives thresholds set in the criteria for a small entity.

The breach is not expected to be significant and

2. In accordance with SEC Memorandum Circular No. 5 continuing.

Series of 2018, small entities are those that:

I. Have total assets of between P3M to P100M or 8. Which of the following small entities may apply the full

total liabilities of between P3M to P100M PFRS or PFRS for SMEs?

II. Are not required to file financial statements under a. A small entity which is a branch office or regional

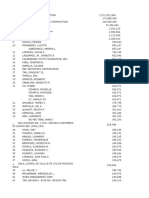

Part II of SRC Rule 68 operating headquarter of a foreign company

III. Are not in the process of filing their financial reporting under the full IFRS or IFRS for SMEs.

statements for the purpose of issuing any class of b. A small entity which has been preparing financial

instruments in a public market statements using full PFRS or PFRS for SMEs and

IV. Are not holders of secondary licenses issued by has decided to liquidate.

regulatory agencies c. Both a and b.

d. Neither a nor b.

a. I, II, III and IV c. I and IV only

b. I, II and III only d. I only

9. In relation to the change in financial reporting

framework of a small entity, the determination of what

3. The following are common characteristics of medium-

is “significant and continuing” shall be based on

sized, small and micro entities, except

management’s judgment taking into consideration

a. Are not required to file financial statements under

relevant qualitative and quantitative factors. As a

Part II of SRC Rule 68

general rule, what would be considered as significant?

b. Are not in the process of filing their financial

a. 20% or more of the consolidated total assets.

statements for the purpose of issuing any class of

b. 20% or more of the consolidated total liabilities.

instruments in a public market

c. Either a or b.

c. Are not holders of secondary licenses issued by

d. Neither a nor b.

regulatory agencies

d. Are not public utilities

10. If a small entity that uses the PFRS for SEs in a current

year breaches the floor or ceiling of the size criteria at

4. An entity with total assets of below P3 million is

the end of that current year, and the event that caused

considered as

the change is not considered “significant and

a. Large entity c. Small entity

continuing”, the entity

b. Medium-sized entity d. Micro entity

a. Should transition to the applicable financial

reporting framework in the next accounting period.

5. Which of the following entity shall apply the PFRS for

b. Should transition to the applicable financial

SEs?

reporting framework in the current accounting

a. Finance company

period.

b. Insurance company

c. Should transition to the applicable financial

c. Securities brokers/dealers

reporting framework from the previous accounting

d. A non-publicly accountable entity with total

period.

liabilities of P3 million.

d. Can continue to use the same financial reporting

framework it currently uses.

6. Small entities who have operations or investments that

are based or conducted in a different country with a

11. The PFRS for SEs was developed in response to

different functional currency should apply

feedback of small entities that PFRS for SMEs is too

a. Full PFRS c. PFRS for SEs

complex to apply. The PFRS for SEs allows small

b. PFRS for SMEs d. Either a or b

entities to comply with the financial reporting

requirements without undue cost or burden by

7. The following SMEs shall be exempt from the

I. Reducing choices for accounting treatment

mandatory adoption of the PFRS for SEs and may

II. Eliminating topics that are not generally relevant to

instead apply, as appropriate, the full PFRS or the

small entities

PFRS for SMEs, except

III. Simplifying methods for recognition and

a. A small entity which is a subsidiary of a parent

measurement

company reporting under the full PFRS or PFRS for

IV. Reducing disclosure requirements

SMEs.

Page 1 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

a. I, II, III and IV c. I and III only a. Cash

b. I, II and III only d. I only b. Trade receivables and payables

c. Loans receivable and payable

12. Simplifications introduced by PFRS for SEs include d. Investments in convertible preference shares

a. Entities are given a policy choice of not recognizing

deferred taxes in the financial statements. 20. In accordance with Section 6 of PFRS for SEs, a

b. Prior period adjustments are just captured in the financial asset or liability is measured initially at

opening balance of the current year, but with a. Transaction price, including transaction costs

appropriate disclosures. b. Transaction price, excluding transaction costs

c. For defined benefit plans, an entity is required to c. Fair value, including transaction costs

use the accrual approach in calculating benefit d. Fair value, excluding transaction costs

obligations in accordance with Republic Act (RA)

7641, The Philippine Retirement Pay Law, or 21. In accordance with Section 6 of PFRS for SEs,

company policy (if superior than RA 7641). investments in shares that are traded in an active

d. All of these. market shall be measured subsequently at

a. Cost c. Lower of a or b

13. Which the following topics in PFRS for SMEs apply to b. Fair value d. Amortized cost

small entities?

a. Finance leases c. Hedge accounting 22. In accordance with Section 7 of PFRS for SEs, a

b. Onerous contracts d. None of these financial asset or liability is measured initially at

a. Transaction price, including transaction costs

14. Items of other comprehensive income of small entities b. Transaction price, excluding transaction costs

include c. Fair value, including transaction costs

I. Some gains and losses arising on translating the d. Fair value, excluding transaction costs

financial statements of a foreign operation.

II. Some actuarial gains and losses. 23. In accordance with Section 7 of PFRS for SEs, financial

III. Changes in revaluation surplus. instruments within the scope of the section shall be

IV. Some changes in fair values of hedging measured subsequently at

instruments. a. Cost

b. Amortized cost

a. I, II, III and IV c. II and IV only

c. Fair value though profit or loss

b. II, III and IV only d. None of them

d. Fair value through other comprehensive income

15. Section 2 of PFRS for SEs Concepts and Pervasive

24. In accordance with Section 8 of PFRS for SEs,

Principles provides guidance on

Inventories are required to be measured at the

I. Objective of financial statements

a. Lower of cost and net realizable value.

II. Information provided by the financial statements

b. Lower of cost and estimated selling price less costs

III. Recognition of the elements of financial statements

to complete and sell.

IV. Use of accrual basis

c. Lower cost or market value.

V. Fair value of an asset

d. Lower of cost and fair value less costs to sell.

VI. Offsetting of the elements of financial statements

a. I, II, III, IV, V and VI c. I, III and VI only 25. In accordance with PFRS for SEs, ‘market value’ is

b. I, II, III, IV and VI only d. I and III only a. The amount for which an asset could be

exchanged, a liability settled or an equity

16. In accordance with Section 3 of PFRS for SEs, which of instrument granted could be exchanged, between

the following financial statements is not applicable to a knowledgeable, willing parties in an arm’s length

small entity? transaction.

a. Statement of financial position b. The amount obtainable from the sale of an asset or

b. Statement of comprehensive income cash-generating unit in an arm’s length transaction

c. Statement of changes in equity between knowledgeable, willing parties, less the

d. Statement of cash flows costs of disposal.

c. The price paid to acquire the asset.

17. In accordance with Section 4 of PFRS for SEs, an entity d. The probable selling price to willing buyers as of

shall account for all its investments in subsidiaries reporting date.

using

I. Cost model 26. In accordance with Section 9 of PFRS for SEs, an

II. Equity method investor shall account for all its investments in

III. Fair value model associates using

IV. Consolidation method I. Cost less impairment model

II. Equity method

a. I, II, III or IV c. II or IV only III. Fair value model

b. I or II only d. IV only

a. I, II or III c. I only

18. In accordance with Section 5 of PFRS for SEs, which of b. I or II only d. II or III only

the following requires restatement of comparative

information? 27. In accordance with Section 10 of the PFRS for SEs, a

a. Change in accounting estimates venturer shall account for all its investment in ventures

b. Change in accounting policies using

c. Correction of prior period errors I. Cost model

d. None of these II. Equity method

III. Fair value model

19. In accordance with Section 6 of PFRS for SEs, basic

a. I, II or III c. I only

financial instruments exclude

b. I or II only d. II or III only

Page 2 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

28. Which statement is correct regarding measurement b. Fair value of the goods or services received, unless

after recognition of investment property in accordance that fair value cannot be estimated reliably.

with Section 11 of PFRS for SEs? c. Fair value of the equity instruments granted, if fair

a. An entity is required to use the cost model. value of the goods or services received cannot be

b. An entity has a choice to use either the cost model estimated reliably.

or the fair value model. d. Par value of equity instruments granted.

c. Investment property whose fair value cannot be

measured reliably without undue cost or effort 35. In accordance with Section 22 of PFRS for SEs, for

shall be measured using the cost-depreciation- defined benefit plans, an entity is required to

impairment model. a. Calculate the expected liability as of reporting date

d. Investment property whose fair value can be using the current salary of the entitled employees

measured reliably without undue cost or effort and the employees' years of service, without

shall be measured at fair value at each reporting consideration of future changes in salary rates and

date with changes in fair value recognized in profit service periods.

or loss. b. See each period of service as giving rise to an

additional unit of benefit entitlement and measure

29. Which statement is correct regarding measurement each unit of benefit entitlement separately to build

after recognition of property, plant and equipment up the final obligation.

(PPE) in accordance with Section 12 of PFRS for SEs? c. Either a or b.

a. An entity is required to use the cost model. d. Neither a nor b.

b. An entity has a choice to use either the cost model

or the fair value model. 36. Which statement is correct regarding measurement of

c. PPE whose fair value cannot be measured reliably biological assets in accordance with Section 27 of PFRS

without undue cost or effort shall be measured for SEs?

using the cost-depreciation- impairment model. a. An entity is required to use the current market

d. PPE whose fair value can be measured reliably price model.

without undue cost or effort shall be measured at b. An entity has a choice to use either the current

fair value at each reporting date with changes in market price model or the cost model.

fair value recognized in profit or loss. c. Biological assets whose fair value cannot be

measured reliably without undue cost or effort

30. PFRS for SEs is similar to PFRS for SMEs in relation to shall be measured using the cost-depreciation-

accounting for impairment model.

a. Investment property d. Biological assets whose fair value can be measured

b. Property, plant and equipment reliably without undue cost or effort shall be

c. Intangible assets measured at their current market price or the

d. Leases probable selling price to willing buyers at each

reporting date with changes in current market

31. Section 16 of PFRS for SEs applies to price recognized in profit or loss.

a. Executory contracts

b. Provision for depreciation, impairment of assets 37. In accordance with Section 28 of PFRS for SEs, an

and uncollectible receivables entity shall account for a non-monetary government

c. Contingent assets and contingent liabilities grant by

d. None of these a. Not recognizing the non-monetary grant.

b. Recognizing the non-monetary grant at fair value.

32. PFRS for SEs is similar to PFRS for SMEs in relation to c. Either a or b.

accounting for d. Neither a nor b.

a. Equity c. Borrowing costs

b. Revenue d. All of these 38. In accordance with Section 29 of PFRS for SEs, an

entity can be a first-time adopter of PFRS for SEs

33. Section 18 of PFRS for SEs applies to accounting for a. Only once c. Only thrice

revenue arising from b. Only twice d. Without limit

I. Sale of goods

II. Rendering of services 39. The trial balance of Entity S (a small entity) included

III. Construction contracts in which the entity is the the following assets:

contractor Cash P 500,000

IV. Deposits or receivables yielding interest Accounts receivable 3,000,000

V. Dividends from investments in shares of stock that Inventories (at cost) 5,100,000

are not accounted for using the equity method Investment in shares (at cost) 900,000

a. I, II, III, IV and V c. I and II only Property, plant and equipment 8,000,000

b. I, II and III only d. I only Additional information:

• The probable selling price of inventories to willing

34. In accordance with Section 20 of PFRS for SEs, for buyers as of reporting date is P5,000,000.

equity-settled share-based payment transactions, an • The shares held as investment are traded in an

entity shall measure the goods or services received, active market. Fair value as of reporting date is

and the corresponding increase in equity, with P950,000.

reference to the

a. Net asset value of the equity instruments granted. In accordance with the PFRS for Small Entities, Entity

Net asset value is derived by dividing the total S should report total assets of

assets of the entity less any liabilities, by the a. P17,400,000 c. P17,500,000

number of shares outstanding at measurement b. P17,450,000 d. P17,550,000

date.

- now do the DIY drill -

Page 3 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

DO-IT-YOURSELF (DIY) DRILL

1. In accordance with SEC Memorandum Circular No. 5 8. Which of the following is not peculiar to small entities?

Series of 2018, small entities are those that are: a. Measurement of inventories at the lower cost or

a. Required to file financial statements under Part II market value.

of SRC Rule 68 b. Measurement of property, plant and equipment

b. In the process of filing their financial statements using fair value model.

for the purpose of issuing any class of instruments c. Measurement of equity-settled share-based

in a public market payment transactions at net asset value of the

c. Holders of secondary licenses issued by regulatory equity instruments granted.

agencies d. None of these.

d. None of these

9. A small entity may report which of the following in its

2. An entity that is required to file financial statements statement of financial position?

under Part II of SRC Rule 68 shall use as its financial a. Finance lease liability

reporting framework b. Provision for onerous contract

a. Full PFRS c. PFRS for SEs c. Deferred tax liability

b. PFRS for SMEs d. Income tax basis d. None of these

3. An entity that is in the process of filing their financial 10. In accordance with Section 23 of PFRS for SEs, an

statements for the purpose of issuing any class of entity shall account for income taxes using

instruments in a public market shall use as its financial a. The taxes payable method

reporting framework b. The deferred income taxes method

a. Full PFRS c. PFRS for SEs c. Either a or b

b. PFRS for SMEs d. Income tax basis d. Neither a nor b

4. An entity that is a holder of secondary license issued 11. Which of the following applies to small entities?

by a regulatory agency shall use as its financial a. Revaluation of assets

reporting framework b. Actuarial gains and losses

a. Full PFRS c. PFRS for SEs c. Reclassification adjustments

b. PFRS for SMEs d. Income tax basis d. None of these

5. Which of the following entity shall apply the PFRS for 12. In accordance with Section 6 of PFRS for SEs,

SEs? investments in shares that are not traded in an active

a. Bank c. Mutual fund market shall be measured subsequently at

b. Investment house d. None of these a. Cost less impairment

b. Fair value

6. An entity with total assets of P3 million and total c. Lower of a or b

liabilities of P2.5 million shall use as its financial d. Amortized cost

reporting framework

a. PFRS for SMEs c. Income tax basis 13. Which of the following Specialized Activities of SMEs

b. PFRS for SEs d. Either b or c apply to small entities?

a. Service concession arrangements

7. Which of the following is not a simplification introduced b. Extractive activities

by the PFRS for SEs? c. Agriculture

a. Inventories are to be subsequently valued at the d. None of these

lower of cost and market value.

b. Investment properties can be carried either at cost

or at fair value, depending on the policy choice

made by the entity.

c. Biological assets can be carried either at cost or at

current market price, depending on the policy

choice made by the entity.

d. For equity-settled share-based payment

transactions, an entity shall measure the goods or

services received, and the corresponding increase

in equity, with reference to the par value of the

equity instruments granted. - done -

Page 4 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

LECTURE NOTES

PFRS for Small Entities Section by Section Summary 6. A small entity which has been preparing financial

statements using PFRS or PFRS for SMEs and has

Preface decided to liquidate; and

Some of the key simplifications introduced by the PFRS for 7. Such other cases that the Commission may consider

Small Entities are as follows: as valid exceptions from the mandatory adoption of

• Inventories are to be subsequently valued at the PFRS for SMEs.

lower of cost and market value,

• Investment properties can be carried either at cost or Section 2 – Concepts and Pervasive Principles

at fair value, depending on the policy choice made by • Objective of SEs' financial statements: To provide

the entity. information about financial position, performance, cash

• There is no concept of "finance lease". flows

• There is no accounting for onerous contracts. • Basic recognition concept – An item that meets the

• For equity-settled share-based payment transactions, definition of an asset, liability, income, or expense is

an entity shall measure the goods or services recognised in the financial statements if:

received, and the corresponding increase in equity, o it is probable that future benefits associated with

with reference to the net asset value of the equity the item will flow to or from the entity, and

instruments granted. Net asset value is derived by o the item has a cost or value that can be measured

dividing the total assets of the entity less any reliably

liabilities, by the number of shares outstanding at • Measurement requirements are generally set out in the

measurement date. individual sections. However guidance on fair value

• For defined benefit plans, an entity is required to use relevant to several sections is included in this section.

the accrual approach in calculating benefit obligations • Offsetting of assets and liabilities or of income and

in accordance with Republic Act (RA) 7641, The expenses is prohibited unless expressly required or

Philippine Retirement Pay Law, or company policy (if permitted

superior than RA 7641). Accrual approach is applied

by calculating the expected liability as of reporting Section 3 – Financial Statement Presentation

date using the current salary of the entitled Components of financial statements

employees and the employees' years of service, 1. A statement of financial position

without consideration of future changes in salary rates 2. A statement of income

and service periods. 3. A statement of changes in equity

• Entities are given a policy choice of not recognizing 4. A statement of cash flows

deferred taxes in the financial statements. 5. Notes to financial statements

• Biological assets can be carried either at cost or at

current market price, depending on the policy choice Statements of income and changes in equity can be

made by the entity. combined if the only changes to equity arise from profit or

• Prior period adjustments are just captured in the loss, payment of dividends, corrections of prior period

opening balance of the current year, but with errors, and changes in accounting policy.

appropriate disclosures.

Disclosures

Section 1 – Scope Disclosure of information about key sources of

PFRS for SEs is intended for use by small entities as estimation uncertainty and judgments NOT

defined by the Philippine SEC. mandatory.

Entities who have operations or investments that are Section 4 – Subsidiaries

based or conducted in a different country with a different The section covers:

functional currency shall not apply PFRS for SEs and • accounting policies available for a parent company

should instead apply the full PFRS or PFRS for SMEs. with investment in a subsidiary;

• procedures for preparing consolidated financial

Exemption from mandatory adoption of the PFRS for Small statements; and

entities and may instead apply, as appropriate, the full • guidance on separate financial statements.

PFRS or PFRS for SMEs:

1. A small entity which is a subsidiary of a parent Accounting policy choice to:

company reporting under the PFRS or PFRS for SMEs; a) consolidate its subsidiaries; or

2. A small entity which is a subsidiary of a foreign parent b) account for its subsidiaries using the equity

company which will be moving towards IFRS or IFRS method as described in Section 9 - Investments

for SMEs pursuant to the foreign country’s published in Associates.

convergence plan;

3. A small entity, either as a significant joint venture or Separate financial statements refers to:

associate, is part of a group that is reporting under a) An investor’s financial statements that are presented

the PFRS or PFRS for SMEs; in addition to consolidated financial statements; or

4. A small entity which is a branch office or regional b) An investor’s financial statements that are presented

operating headquarter of a foreign company reporting as the company’s only financial statements because it

under the IFRS or IFRS for SMEs; has taken an exemption from consolidation or from

5. A small entity which has a short term projection that applying the equity method

show that it will breach the quantitative thresholds set

in the criteria for a small entity. The breach is Accounting policy election for investments in

expected to be significant and continuing due to its subsidiaries in separate financial statements:

long-term effect on the company’s asset or liability a) at cost less impairment, or

size; b) at equity method (using the procedures in

Section 9 - Investments in Associates).

Page 5 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

Any entity should provide the following disclosures: Change in estimate

• method used to account for its subsidiaries. • nature and amount of a change in an accounting

• listing and description of all subsidiaries, including estimate that has an effect in the current period

their names, carrying amounts, and the proportion of

ownership interests held in each subsidiary. Section 6 – Basic Financial Instruments

• any difference in the reporting date of the financial Covers:

statements of the parent and its subsidiaries a) cash;

b) the following receivables and payables subject to

In addition to a - c above, an entity that chose the certain requirements:

equity method should disclose separately any i. bank deposits;

dividends received from the subsidiaries and its ii. trade receivables and payables;

share of the profit or loss of such subsidiaries. iii. loans receivable and payable;

iv. notes receivable and payable; and

Section 5 – Accounting Policies, Estimates and Errors c) investments in non-convertible preference shares and

Selection of accounting policies and use of other guidance non-puttable ordinary shares.

When PFRS for Small Entities does not address a

transaction, other event or condition, management uses its Initial measurement

judgment in developing and applying an accounting policy Transaction price (including transaction costs) unless the

that results in information that is relevant and reliable. arrangement constitutes a financing transaction, in which

case, the financial asset or financial liability at the present

If there is no relevant guidance, management considers

value of the future payments discounted at a market rate

the following sources, in descending order:

of interest for a similar debt instrument.

a) the requirements and guidance of PFRS for Small

Entities dealing with similar and related issues, and

Subsequent measurement

b) the definitions, recognition criteria and measurement

• Debt instruments are measured at amortized cost

concepts for assets, liabilities, income and expenses

using the effective interest method

and the pervasive principles in Section 2.

• Investments in shares shall be carried at cost

Management may also consider the requirements and less impairment, unless the investment in

guidance in PFRS for Small and Medium-sized Entities shares are traded in an active market, which

(PFRS for SMEs) dealing with similar and related issues. shall be measured at the lower of cost or fair

value, with changes in fair value recognized in

Change in accounting policies profit or loss.

An entity shall account for changes in accounting

policy as follows: Impairment of financial assets measured at cost or

a) Applied to the carrying amounts of assets and amortized cost

liabilities at the beginning of the current period. • An entity shall recognize impairment loss if there is

Any cumulative effect shall be recognized as an objective evidence of impairment

adjustment to the opening balance of retained • Impairment loss is the difference between the asset’s

earnings (or other component of equity, as carrying amount and the present value of cash flows

appropriate) of the current period. (for assets measured at amortized cost) or best

b) Comparative information shall not be restated. estimate of selling price (for assets measured at cost).

Changes in accounting estimates Derecognition of financial asset

Changes in accounting estimates are recognized Financial asset is derecognized when:

prospectively by including the effects in profit or loss in the • the contractual rights to the cash flows from the

period that is affected. financial asset expire or are settled; or

• the entity transfers to another party substantially all

If the change in estimates gives rise to changes in assets, of the risks and rewards of ownership of the financial

liabilities or equity, it is recognized by adjusting the asset.

carrying amount of the related asset, liability or equity in

the period of change. Derecognition of financial liability

Financial liability is derecognized when it is extinguished -

Correction of errors i.e., when the obligation specified in the contract is

An entity shall correct material prior period errors as discharged, is cancelled or has expired.

follows:

• No restatement of comparatives Section 7 – Other Financial Instruments

• Adjustments are recognized against opening

balance of current year retained earnings (or Initial measurement

other component of equity) At fair value, which is normally the transaction price.

Disclosures Subsequent measurement

Change in accounting policy/correction of error • Fair value with changes in fair value recognized in

• the nature of the change or prior period error profit or loss.

and the amount of adjustments to the carrying • Equity instruments that are not publicly traded and

amounts of assets and liabilities at the whose fair value cannot be measured reliably are

beginning of the current period and any measured at cost less impairment.

cumulative effect recognized as an adjustment • Hedge of variable interest rate risk of a recognized

to the opening balance of equity; financial instrument, foreign exchange risk or

• in the notes, for each financial statement line commodity price risk in a firm commitment or highly

item affected in the prior period, the amount of probable forecast transaction - effective portion

the necessary adjustment and the adjusted recognized in hedging reserve (equity account)

amount had the new accounting policy or while ineffective portion is recognized in profit

correction been applied in the prior period. or loss.

Page 6 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

Derecognition Section 10 – Joint Arrangements

Similar with basic financial instruments. Classification

Classified either as (a) joint venture; or (b) joint

Section 8 – Inventories operations, depending on the rights and obligations of the

Measurement parties to the arrangement

Initially measured at cost (cost of purchase, cost of

conversion, and other directly attributable costs) Joint operations

Investor account for rights and obligations by recognizing

Cost formulas its own assets, liabilities, revenue, and expenses, as well

The cost of inventories, other than those measured using as its share of assets, liabilities, revenue, expenses,

specific identification, by using the first-in, first-out (FIFO) held/earned/incurred jointly from the joint operation.

or weighted average cost formula. Last-in, first-out

method (LIFO) is not permitted. Joint venture - measurement

Option to apply:

Subsequent measurement • Cost model; or

Lower of cost or market value • Equity method

Disclosures Transactions between a venturer and a joint venture

An entity shall disclose the following: Gains and losses on contribution or sales of assets to a

• the accounting policies adopted in measuring joint venture are recognized only on the portion

inventories, including the cost formula used; attributable to the interests of the other venturers

• the total carrying amount of inventories and the provided the assets are retained by the joint venture and

carrying amount in classifications appropriate to the significant risks and rewards of ownership have been

entity; transferred.

• the amount of inventories recognized as an expense

during the period; Disclosures

• impairment losses recognized or reversed in profit or • Name and type of joint arrangement; principal place

loss in accordance with Section 21 - Impairment of of business, ownership interest

Assets; and • For joint venture - accounting policy elected, carrying

• the total carrying amount of inventories pledged as amount, fair value of investment if equity method is

security for liabilities. used and there are published price quotations,

amount of dividends recognized in income if cost

Section 9 – Investments in Associates method is used

Measurement

Option to apply: Section 11 – Investment Property

• Cost model; or Recognition and measurement

• Equity method Initially measured at cost. The cost of a purchased

investment property comprises its purchase price and any

Cost model

directly attributable expenditures.

Measured at cost less any accumulated impairment losses.

All dividends are recognized in the income statement.

Subsequent measurement, option to apply:

Equity method • Cost model

An associate is initially recognized at the transaction price • Fair value Model

(including transaction costs) and is subsequently adjusted

to reflect the investor’s share of the profit or loss of the Cost model

associate. Investment properties are carried at cost less accumulated

depreciation and any accumulated impairment losses.

Distributions received from the associate reduce the

carrying amount of the investment. Fair value model

Changes in fair value is recognized in profit or loss.

Notional purchase price allocation If a reliable measure of fair value is no longer available

On acquisition, an investor shall account for any difference without undue cost or effort, it will be accounted for under

between the cost of acquisition and the investor’s share of the cost model. Carrying amount at date of change

the fair values of the net identifiable assets of the becomes the cost.

associate.

Equity pick-up shall be adjusted for additional depreciation Transfers

or amortization of the associate’s depreciable or Transfer to or from investment properties applies when the

amortizable assets (including goodwill) on the basis of property meets or ceases to meet the definition of an

difference between fair value and carrying amount on investment property.

acquisition date.

Disclosures

Disclosures • Under cost model, depreciation method, useful lives,

• Name of the associate; principal place of business; gross carrying amount and accumulated depreciation,

ownership interest, accounting policy, and carrying reconciliation of the carrying amount;

amount • Under fair value model, whether independent valuer

• If accounting policy is cost method - amount of was involved, method and significant assumptions

dividends and other distributions recognized as used in valuation, reconciliation of carrying amount;

income and

• If accounting policy is equity method - share of profit • Existence and carrying amount of property with

or loss, and fair value of investment if there are restricted title or was used as a security.

published price quotations.

Page 7 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

Section 12 – Property, Plant and Equipment Section 14 – Business Combinations and Goodwill

Measurement Accounting

Initially measured at cost which includes: All business combinations shall be accounted for by

• Purchase price applying the purchase method.

• Any directly attributable costs to bring the asset to the

Goodwill

location and condition necessary for it to be capable of

After initial recognition, the acquirer shall measure

operating in the manner intended by management.

goodwill acquired in a business combination at cost less

accumulated amortization and accumulated impairment

Subsequent measurement, option to apply:

losses.

• Cost model

• Fair value Model An entity shall amortize goodwill on a systematic basis

over its useful life. The life shall be determined based on

Depreciable amount and depreciation period management’s best estimate but shall not exceed ten (10)

The depreciable amount is allocated over its useful life. years.

Change in residual value or useful life is accounted for as a

change in estimate Disclosures

Disclosure requirements under paragraph 288-289 apply.

Depreciation method

• The depreciation method is reviewed if there is an Section 15 – Leases

indication that there has been a significant change Classification

since the last annual reporting date. No distinction between finance and operating lease.

• Change in the depreciation method is accounted for as

Measurement

a change in estimate.

All receipts/payments are recognized as

income/expense as earned/incurred .

Fair value model

• Changes in fair value is recognized in profit or loss.

Section 16 – Provisions and Contingencies

• If a reliable measure of fair value is no longer

available without undue cost or effort, it will be Initial recognition

accounted for under the cost model. Carrying amount An entity shall recognize a provision only when:

at date of change becomes the cost. a) the entity has an obligation at the reporting date as a

result of a past event;

Derecognition b) it is probable (i.e., more likely than not) that the

• Derecognize on disposal or when no future economic entity will be required to transfer economic benefits in

benefits are expected from its use or disposal. settlement; and

c) the amount of the obligation can be estimated reliably

Disclosures A contingent liability is either a possible but uncertain

• Under cost model, depreciation method, useful lives, obligation or a present obligation that is not recognized

gross carrying amount and accumulated depreciation, because it fails to meet one or both of the conditions b or c

reconciliation of the carrying amount; above.

• Under fair value model, whether independent

valuer was involved, method and significant Measurement

assumptions used in valuation, reconciliation of An entity shall measure a provision at the best estimate of

carrying amount; and the amount required to settle the obligation at the

• Existence and carrying amount of property with reporting date.

restricted title or was used as a security.

Disclosures

Provisions

Section 13 – Intangible Assets Other than Goodwill

• Reconciliation of the account; description of the

Recognition and measurement nature of obligation and expected amount/timing of

Initially measured at cost and subsequently accounted for payment; indication of uncertainties about the timing

a cost model. and amount; expected reimbursements.

Contingent liabilities (if not remote)

Useful life • Description of nature of the contingent liability; if

Useful life is considered finite. practicable, an estimate of financial effect, and

possibility of reimbursement.

If an entity is unable to make a reliable estimate of the

Contingent assets (if probable)

useful life of an intangible asset, the life shall be

• Description of nature of contingent asset and if

determined based on management’s best estimate but

practicable, estimate of financial effect.

shall not exceed ten (10) years.

Section 17 – Equity

Classification

Intangibles acquired through business combination must Recognition and measurement

be identified and accounted for by: • An entity shall measure the equity instruments at the

(a) separately recognizing the intangible asset as an amount of cash received.

identifiable asset; or • If payment is deferred and the time value of money is

(b) subsuming into goodwill material, the initial measurement shall be on a

present value basis.

Disclosures • If the equity instruments are exchanged for resources

• Depreciation method, useful lives, gross carrying other than cash, the equity instruments shall be

amount and accumulated depreciation, reconciliation recognized at the fair value of those resources.

of the carrying amount; line item in the income • An entity shall account for the transaction costs (i.e.,

statement where amortization was included; and incremental costs that are directly attributable to the

• Existence and carrying amount of asset with restricted issue) as a deduction from equity, net of any related

title or was used as a security. income tax benefit.

Page 8 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

Distribution to owners Section 21 – Impairment of Assets

• An entity shall reduce equity for the amount of General principles

distributions to its owners (holders of its equity If the recoverable amount of an asset is less than its

instruments), net of any related income tax benefits. carrying amount, impairment loss be recognized to reduce

the carrying amount of the asset to its recoverable

Section 18 – Revenue amount.

Recognition

The revenue section captures all revenue transactions from Measuring recoverable amount

the following transactions or events: The recoverable amount of an asset or a cash-generating

• Sale of goods. unit is the higher of its fair value less costs to sell and its

• Rendering of services; value in use.

• Construction contracts;

• Deposits or receivables yielding interest; and Fair value less costs to sell is the amount obtainable from

• dividends from investments in shares of stock that are the sale of an asset in an arm’s length transaction between

not accounted for using the equity method. knowledgeable, willing parties, less the costs of disposal.

Value in use is the present value of the future cash flows

Revenue recognition criteria for each of these categories

expected to be derived from an asset (or cash-generating

include the probability that the economic benefits

unit).

associated with the transaction will flow to the entity and

that the revenue and costs can be measured reliably.

Recognition of impairment loss

Additional recognition criteria apply within each broad

An entity shall recognize an impairment loss immediately

category.

in profit or loss.

Measurement

Measurement of revenue at the fair value of the Disclosures

consideration received or receivable is required. Amount of impairment loss recognized in profit or loss

during the period and the line item in the statement of

Disclosures income in which the impairment loss is included for each

• Accounting policies, including method to determine asset that was tested for impairment.

the stage of completion for transactions involving

rendering of services Section 22 – Employee Benefits

• Amount of revenue for each category (sale of goods,

rendering of services, interest, commissions) Measurement (post-employment benefit plan)

• For construction contracts - amount and method used Accrual method in calculating benefit obligations in

to determine contract revenue, methods used to accordance to RA7641 or company policy (if superior

determine percentage of completion, gross amount than RA7641). No consideration of changes in

due from/to customers. future salary rates and service periods

No recognition of actuarial gains/losses.

Section 19 – Borrowing Costs

Disclosures (post-employment benefit plan)

Recognition

Amount recognized in profit or loss as an expense for post-

All borrowing costs as an expense in profit or loss in the

employment benefit plans, the amount of its obligation,

period in which they are incurred.

and the extent of funding at the reporting date.

Disclosures

Disclosure requirements for financial liabilities apply. Section 23 – Income Tax

Recognition

Section 20 – Share-based Payment Policy choice to account for income taxes using

Recognition and measurement either

All transactions involving share-based payment are a) The taxes payable method, in which an entity shall

recognized as expenses or assets over any vesting period. recognize a current tax liability for tax payable on

taxable profit for the current and past periods

Distinguishes between cash-settled and equity-settled b) The deferred income taxes method, in which, the

arrangements. current and future tax consequences of transactions

For equity-settled awards, the value of goods or and other events are recognized.

services acquired must be recognized with reference

to the net asset value (total assets less liabilities Measurement of deferred tax

divided by outstanding shares) of the entity. Deferred tax assets/liabilities are measured using the tax

rates and laws that have been enacted or substantively

Disclosures enacted by the reporting date.

• Description, including terms and conditions, of each

share-based arrangement; An entity shall not discount deferred tax assets and

• Number and weighted-average prices of each group of liabilities

options outstanding, granted, forfeited, exercised,

expired, outstanding, and exercisable; The carrying amount of a deferred tax asset shall be

• For cash settled - information about how the liability reviewed at the end of each reporting period. An entity

was measured; shall reduce the carrying amount of a deferred tax asset to

• Information about modifications in share-based the extent that it is no longer probable that sufficient

arrangement, if any; taxable profit will be available.

• For Group-settled share-based plan - whether

expense is based on reasonable allocation and basis Presentation

for allocation; Tax expense (income) are recognized n profit or loss or

• Financial effect of share-based plans, including equity as the transaction or other event that resulted in

expense and liabilities arising thereof. the tax expense (income)

Page 9 of 10 www.prtc.com.ph FAR.2853

EXCEL PROFESSIONAL SERVICES, INC.

Current/non-current distinction Section 27 – Biological Assets

Deferred tax assets (liabilities) should be classified as as Recognition

non-current assets (liabilities). An entity shall recognize a biological asset or agricultural

produce when, and only when:

Disclosures (a) the entity controls the asset as a result of past

Disclosure requirements applicable for current taxes events;

payable and deferred income tax method are enumerated (b) it is probable that future economic benefits associated

in paragraph 425 to 428. with the asset will flow to the entity; and

(c) the fair value or cost of the asset can be measured

Section 24 – Foreign Currency Translation reliably without undue cost or effort.

Reporting foreign currency transactions in the functional

currency Measurement

An entity shall recognize, in profit or loss in the period in Policy choice:

which they arise: (a) Cost model

• exchange differences arising on the settlement of (b) Current market price model (current market

monetary items; or price or the probable selling price)

• on translating monetary items at closing rates

Disclosures

Presentation currency Cost model

An entity shall translate its items of income and expense • a description of each class of its biological assets

and financial position into the presentation currency • the depreciation method used

• the useful lives or the depreciation rates used.

Disclosures • the gross carrying amount and the accumulated

The amount of an exchange gain or loss included in net depreciation at the beginning and end of the period.

income should be disclosed

Current market price model

Section 25 – Events After the End of the Reporting • a description of each class of its biological assets.

Period • the methods and significant assumptions applied in

• Adjust financial statements to reflect adjusting events determining the current market price

– events after the balance sheet date that provide • a reconciliation of changes in the carrying amount of

further evidence of conditions that existed at the end biological assets

of the reporting period.

• Do not adjust for non-adjusting events – events or Section 28 – Government Grants

conditions that arose after the end of the reporting Recognition and classification

period. For these, the entity must disclose the nature Distinguishes between monetary and non-monetary

of event and an estimate of its financial effect. grants

• If an entity declares dividends after the reporting

period, the entity shall not recognise those dividends Accounting policy option for non-monetary grants:

as a liability at the end of the reporting period. That is • no recognition; or

a non-adjusting event. • at fair value

Section 26 – Related Party Disclosures Disclosures

• Disclose parent-subsidiary relationships, including the Monetary grants

name of the parent and (if any) the ultimate • the nature and amounts of government grants

controlling party. • unfulfilled conditions and other contingencies attaching

• Disclose key management personnel compensation in to grants

total for all key management. Non-monetary grants

• Disclose the following for transactions between related • nature of the government grant and any

parties: unfulfilled conditions or contingencies

o Nature of the relationship • where fair value measurement is elected or fair

o Information about the transactions and value is voluntarily disclosed, valuation hierarchy

outstanding balances necessary to understand the must be applied and the financial statements

potential impact on the financial statements must describe how fair values were derived.

o Amount of the transaction

o Provisions for uncollectible receivables Section 29 – Transition to the Framework

o Any expense recognised during the period in • Apply PFRS for Small Entities to all recognized assets

respect of an amount owed by a related party and liabilities for current and comparative period

• An entity shall make the disclosures required by (restatement is required).

paragraph 453 separately for each of the following • Disclosure requirements include:

categories: • a description of the nature of each account affected

a) entities with control, joint control or significant with the change in accounting policy

influence over the entity; • reconciliations of its equity and profit or loss (previous

b) entities over which the entity has control, joint framework vs. PFRS for Small Entities)

control or significant influence; • Effective January 1, 2019, with early adoption

c) key management personnel of the entity or its permitted.

parent (in the aggregate); and

d) other related parties. J - end of FAR.2853 - J

Page 10 of 10 www.prtc.com.ph FAR.2853

Potrebbero piacerti anche

- Operational Auditing A Complete Guide - 2021 EditionDa EverandOperational Auditing A Complete Guide - 2021 EditionNessuna valutazione finora

- Small & Medium-Sized Entities (Smes)Documento8 pagineSmall & Medium-Sized Entities (Smes)Levi Emmanuel Veloso BravoNessuna valutazione finora

- Theory of Accounts With Answers PDFDocumento9 pagineTheory of Accounts With Answers PDFRodNessuna valutazione finora

- Toa Cpa ReviewDocumento10 pagineToa Cpa ReviewKim ZamoraNessuna valutazione finora

- Afar 106 - Home Office and Branch Accounting PDFDocumento3 pagineAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNessuna valutazione finora

- The Review Schooj. of AccountancyDocumento17 pagineThe Review Schooj. of AccountancyYukiNessuna valutazione finora

- Absorption and Variable Costing Act3Documento2 pagineAbsorption and Variable Costing Act3Gill Riguera100% (1)

- TOA - Mock Compre - AnswersDocumento12 pagineTOA - Mock Compre - AnswersChrissa Marie VienteNessuna valutazione finora

- MQC - Quiz On Segment, Cash To Accrual, Single and CorrectionDocumento10 pagineMQC - Quiz On Segment, Cash To Accrual, Single and CorrectionLenie Lyn Pasion Torres0% (1)

- Home Office Branch and Agency Accounting QuestionsDocumento32 pagineHome Office Branch and Agency Accounting QuestionsMichaela Quimson100% (1)

- Palmones, Jayhan Grace M. QuizDocumento6 paginePalmones, Jayhan Grace M. QuizjayhandarwinNessuna valutazione finora

- Adv 1 - Dept 2010Documento16 pagineAdv 1 - Dept 2010Aldrin100% (1)

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDocumento10 pagineQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyNessuna valutazione finora

- REVIEWer Take Home QuizDocumento3 pagineREVIEWer Take Home QuizNeirish fainsan0% (1)

- Expenditures On The Project Were As Follows:: Problem 3Documento3 pagineExpenditures On The Project Were As Follows:: Problem 3Par Cor100% (2)

- P1.17 - Equity InvestmentsDocumento10 pagineP1.17 - Equity InvestmentsAlmirah's iCPA ReviewNessuna valutazione finora

- MGT Adv Serv 09.2019Documento11 pagineMGT Adv Serv 09.2019Weddie Mae VillarizaNessuna valutazione finora

- Hoba 2019 QuizDocumento10 pagineHoba 2019 QuizJo Montes0% (1)

- NAME: Joven, Al Vincent M. Acc316/413: Assigned Quiz 1Documento2 pagineNAME: Joven, Al Vincent M. Acc316/413: Assigned Quiz 1beeeeeeNessuna valutazione finora

- AFAR 01 Partnership AccountingDocumento6 pagineAFAR 01 Partnership AccountingAriel DimalantaNessuna valutazione finora

- Quiz 2 - Corp Liqui and Installment SalesDocumento8 pagineQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNessuna valutazione finora

- Lecture Notes: Afar - Not For Profit OrganizationsDocumento5 pagineLecture Notes: Afar - Not For Profit OrganizationsJem Valmonte100% (1)

- Module 13 - BusCom - Forex. - StudentsDocumento13 pagineModule 13 - BusCom - Forex. - StudentsLuisito CorreaNessuna valutazione finora

- Mcqs Audit PRTC2Documento16 pagineMcqs Audit PRTC2PatOcampoNessuna valutazione finora

- AttachmentDocumento14 pagineAttachmentAngelo Jose BalalongNessuna valutazione finora

- Afar ToaDocumento22 pagineAfar ToaVanessa Anne Acuña DavisNessuna valutazione finora

- Q - Process Further Scarce ResourceDocumento2 pagineQ - Process Further Scarce ResourceIrahq Yarte TorrejosNessuna valutazione finora

- Resa Toa 1205 PreweekDocumento38 pagineResa Toa 1205 PreweekLlyod Francis Laylay100% (1)

- 009 Cash Basis Accrual BasisDocumento4 pagine009 Cash Basis Accrual BasisRosanna Romanca50% (2)

- AP.2904 - Cash and Cash Equivalents.Documento7 pagineAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- Mindanao State University College of Business Administration and Accountancy Marawi CityDocumento7 pagineMindanao State University College of Business Administration and Accountancy Marawi CityHasmin Saripada AmpatuaNessuna valutazione finora

- 1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsDocumento181 pagine1.0 Notes Cash and Cash Equivalents 1.0 Notes Cash and Cash EquivalentsLawrence YusiNessuna valutazione finora

- Applied Auditing Quiz #1 (Diagnostic Exam)Documento7 pagineApplied Auditing Quiz #1 (Diagnostic Exam)ephraimNessuna valutazione finora

- Chapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementDocumento33 pagineChapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementYukiNessuna valutazione finora

- Mas Test Bank QuestionDocumento3 pagineMas Test Bank QuestionEricka CalaNessuna valutazione finora

- AfarDocumento18 pagineAfarFleo GardivoNessuna valutazione finora

- Chapter 5 Audit of InventoryDocumento10 pagineChapter 5 Audit of InventoryMarkie GrabilloNessuna valutazione finora

- Lecture Notes: Afar de Leon/De Leon/De Leon/Tan 2901-Partnerships Batch: October 2020Documento12 pagineLecture Notes: Afar de Leon/De Leon/De Leon/Tan 2901-Partnerships Batch: October 2020RAVEN REI GARCIANessuna valutazione finora

- 7 CPA Board SubjectsDocumento19 pagine7 CPA Board SubjectsNovie Marie Balbin AnitNessuna valutazione finora

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocumento9 pagineApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNessuna valutazione finora

- PUP Home Branch AccountingDocumento7 paginePUP Home Branch AccountingRodNessuna valutazione finora

- 2402 Corporate LiquidationDocumento7 pagine2402 Corporate LiquidationFernando III PerezNessuna valutazione finora

- RewDocumento69 pagineRewMargenete Casiano100% (2)

- Aud ThEORY 2nd PreboardDocumento11 pagineAud ThEORY 2nd PreboardJeric TorionNessuna valutazione finora

- At Quizzer 14 - Reporting IssuesDocumento18 pagineAt Quizzer 14 - Reporting IssuesRachel Leachon50% (2)

- Audit of CashDocumento9 pagineAudit of CashRizzel SubaNessuna valutazione finora

- Business Combi TsetDocumento28 pagineBusiness Combi Tsetsamuel debebeNessuna valutazione finora

- Auditing The Revenue Receipt Cycle QuizDocumento2 pagineAuditing The Revenue Receipt Cycle Quizgaler LedesmaNessuna valutazione finora

- 03 Gross Profit AnalysisDocumento5 pagine03 Gross Profit AnalysisJunZon VelascoNessuna valutazione finora

- (At) 01 - Preface, Framework, EtcDocumento8 pagine(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNessuna valutazione finora

- CPAR AT - Philippine Accountancy Act of 2004Documento4 pagineCPAR AT - Philippine Accountancy Act of 2004John Carlo CruzNessuna valutazione finora

- AP 08 Substantive Audit Tests of EquityDocumento2 pagineAP 08 Substantive Audit Tests of EquityJobby JaranillaNessuna valutazione finora

- FAR Test BankDocumento24 pagineFAR Test BankMaryjel17Nessuna valutazione finora

- FEU HO1 Audit of Inventories 2017 PDFDocumento4 pagineFEU HO1 Audit of Inventories 2017 PDFJoshuaNessuna valutazione finora

- 08 InvestmentquestfinalDocumento13 pagine08 InvestmentquestfinalAnonymous l13WpzNessuna valutazione finora

- 00 - Practical Accounting 2 PDFDocumento7 pagine00 - Practical Accounting 2 PDFTricia Mae De Ocera0% (1)

- 5rd Batch - P2 Final Pre-Boards - Wid ANSWERDocumento11 pagine5rd Batch - P2 Final Pre-Boards - Wid ANSWERKim Cristian MaañoNessuna valutazione finora

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocumento3 pagineDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNessuna valutazione finora

- FAR.2852 - Medium Sized Entities PDFDocumento16 pagineFAR.2852 - Medium Sized Entities PDFPhoeza Espinosa VillanuevaNessuna valutazione finora

- Acctg303 FinalsDocumento2 pagineAcctg303 FinalsÌÐølJåyskëiUvNessuna valutazione finora

- The Mile Gully To Greenvale RoadDocumento32 pagineThe Mile Gully To Greenvale RoadShane KingNessuna valutazione finora

- ICICI Prudential Equity & Debt FundDocumento3 pagineICICI Prudential Equity & Debt FundSabyasachi ChatterjeeNessuna valutazione finora

- Lecture 4 Handouts - PCFM - Fall 2021 01102022 124433pmDocumento18 pagineLecture 4 Handouts - PCFM - Fall 2021 01102022 124433pmKennie's FashionityNessuna valutazione finora

- Cfas 19 Pas 41 Biological AssetsDocumento3 pagineCfas 19 Pas 41 Biological Assetsnash lastNessuna valutazione finora

- Financial Feasibility Study 2020/2021: Theoretical PartDocumento17 pagineFinancial Feasibility Study 2020/2021: Theoretical Partislam hamdyNessuna valutazione finora

- FINMAN 104 Module IDocumento34 pagineFINMAN 104 Module IAlma Teresa NipaNessuna valutazione finora

- Sample Synopsis PDFDocumento10 pagineSample Synopsis PDFSrinivas CnaNessuna valutazione finora

- Bit - Financial StatementsDocumento10 pagineBit - Financial StatementsAldrin ZolinaNessuna valutazione finora

- Perez, Christian Andrew F. Strategic Management PaperDocumento29 paginePerez, Christian Andrew F. Strategic Management PaperChristian PerezNessuna valutazione finora

- The Richard Branson Interview Part 1 - KeyDocumento6 pagineThe Richard Branson Interview Part 1 - Keyelianasilva100% (1)

- SemiDocumento252 pagineSemiGNessuna valutazione finora

- Brown, Walter W. or Annabelle P. BrownDocumento20 pagineBrown, Walter W. or Annabelle P. BrownJan Ellard CruzNessuna valutazione finora

- Questions Old 2066 & 2068 NTC Level - 7 (Elx & Comm)Documento4 pagineQuestions Old 2066 & 2068 NTC Level - 7 (Elx & Comm)Prashant McFc AdhikaryNessuna valutazione finora

- Financial Ratio AnalysisDocumento2 pagineFinancial Ratio Analysismaterials4studyNessuna valutazione finora

- Talisman Centre Annual Report 03: - Jgfujnf - FNCFSTDocumento28 pagineTalisman Centre Annual Report 03: - Jgfujnf - FNCFSTTalisman CentreNessuna valutazione finora

- Pertemuan Asistensi 8 (Performance Measurement)Documento2 paginePertemuan Asistensi 8 (Performance Measurement)Sholkhi ArdiansyahNessuna valutazione finora

- Kotak's 811 Banking App - Digital Customer On-Boarding For The First Time in IndiaDocumento9 pagineKotak's 811 Banking App - Digital Customer On-Boarding For The First Time in IndiajeetNessuna valutazione finora

- Bharat ElectronicsDocumento12 pagineBharat Electronicsnafis20Nessuna valutazione finora

- CP RedeemedDocumento171 pagineCP RedeemedkinananthaNessuna valutazione finora

- Government Accountability Office - Ensuring Income Throughout Retirement Requires Difficult ChoicesDocumento79 pagineGovernment Accountability Office - Ensuring Income Throughout Retirement Requires Difficult ChoicesEphraim DavisNessuna valutazione finora

- ACCA Marking Insight Mock Exam 2018 - Annotated Example Answer CDocumento10 pagineACCA Marking Insight Mock Exam 2018 - Annotated Example Answer CQasim RaoNessuna valutazione finora

- Heavy OilDocumento6 pagineHeavy Oilsnikraftar1406Nessuna valutazione finora

- Heloc Booklet (CFPB)Documento19 pagineHeloc Booklet (CFPB)SweetysNessuna valutazione finora

- Air Thread Case FinalDocumento49 pagineAir Thread Case FinalJonathan GranowitzNessuna valutazione finora

- CadburyDocumento19 pagineCadburylynette rego100% (1)

- Case Notes - Topic 7Documento2 pagineCase Notes - Topic 7meiling_1993Nessuna valutazione finora

- Annual Report 2019Documento304 pagineAnnual Report 2019fahadNessuna valutazione finora

- BCG MatrixDocumento19 pagineBCG MatrixRishab MehtaNessuna valutazione finora

- ForbesDocumento140 pagineForbesobee1234Nessuna valutazione finora

- Sales Management: 1 Compiled by T S Dawar - Sales Management Lecture 7 & 8Documento21 pagineSales Management: 1 Compiled by T S Dawar - Sales Management Lecture 7 & 8sagartolaneyNessuna valutazione finora

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Da EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Valutazione: 4 su 5 stelle4/5 (33)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsDa EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsValutazione: 5 su 5 stelle5/5 (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InDa EverandGetting to Yes: How to Negotiate Agreement Without Giving InValutazione: 4 su 5 stelle4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Da EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Valutazione: 4.5 su 5 stelle4.5/5 (13)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDa EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindValutazione: 5 su 5 stelle5/5 (231)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDa EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNessuna valutazione finora

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDa EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItValutazione: 5 su 5 stelle5/5 (13)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Da EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Valutazione: 4.5 su 5 stelle4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)Da EverandFinance Basics (HBR 20-Minute Manager Series)Valutazione: 4.5 su 5 stelle4.5/5 (32)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDa EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsValutazione: 4 su 5 stelle4/5 (7)

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessDa EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessValutazione: 4.5 su 5 stelle4.5/5 (28)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookDa EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookValutazione: 5 su 5 stelle5/5 (4)

- Financial Accounting For Dummies: 2nd EditionDa EverandFinancial Accounting For Dummies: 2nd EditionValutazione: 5 su 5 stelle5/5 (10)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Da EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Valutazione: 4.5 su 5 stelle4.5/5 (5)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeDa EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeValutazione: 4 su 5 stelle4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCDa EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCValutazione: 5 su 5 stelle5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDa EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNessuna valutazione finora

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDa EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNessuna valutazione finora

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyDa EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyValutazione: 4.5 su 5 stelle4.5/5 (37)

- Controllership: The Work of the Managerial AccountantDa EverandControllership: The Work of the Managerial AccountantNessuna valutazione finora

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDa EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantValutazione: 4.5 su 5 stelle4.5/5 (146)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingDa EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingValutazione: 4.5 su 5 stelle4.5/5 (760)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditDa EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditValutazione: 5 su 5 stelle5/5 (1)