Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc Below

Caricato da

Gaurav Singh RathoreTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc Below

Caricato da

Gaurav Singh RathoreCopyright:

Formati disponibili

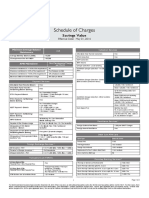

IndusInd Bank Ltd.

SCHEDULE OF SERVICE CHARGES

Balance Requirement IndusStox 3in1

Minimum Balance (Average Monthly/ Quarterly Requirement) Zero Balance, subject to trading account being active

Charges for Balance Non Maintenance NIL

Remittance Facilities through Own Bank

Demand Draft or Pay Order - Issuance Free one draft per day upto Rs. 25,000/-; above this Rs. 2.5/- per Rs. 1,000 /-, Minimum of Rs. 50/- & Maximum of

Rs. 5,000/- per instrument

DD/ PO Cancellation/ Duplicate Instrument Issuance Rs. 100/- per instrument

DD/ PO Revalidation Rs. 50/- per instrument

Visa Credit Card Payment through ATM/Net Banking Free

IMPS / NEFT - Outward - w.e.f 1st July'19 No Charges @ Branch/Mobile Banking/Net Banking/Alexa/Whatsapp Banking

RTGS - Outward - w.e.f 1st July'19 No Charges @ Branch/Mobile Banking/Net Banking/Alexa/Whatsapp Banking

Remittance Facilities through Other Bank

DD - Issuance Through Correspondent Bank- Rs. 3/- per Rs. 1,000/-; Minimum of Rs. 50/- and Maximum of Rs. 5,000/- per

instrument

Through Non- Correspondent Bank- At Actuals

DD - Cancellation Rs. 100/- per instrument

DD - Revalidation Rs. 50/- per instrument

Foreign Exchange Remittance

Inward Remittances (a) 0.12% of the gross amount of currency exchanged for an amount up to Rs.1,00,000/-, subject to the

minimum amount of Rs.30/-;

(b) Rs.120/- and 0.06% of the gross amount of currency exchanged for an amount exceeding Rs. 1,00,000/-

and up to Rs.10,00,000/-;

(c) Rs.660/- and 0.012% of the gross amount of currency exchanged for an amount exceeding Rs.10,00,000/-,

subject to maximum amount of Rs.6000/

FIRC (Foreign Inward Remittance Certificate) Issuance Rs. 100/-

Non-Trade Remittance Rs. 250/- in addtion to SWIFT charges

SWIFT/ Wire Transfer Rs. 500/-

FCY (Foreign Currency) Draft /DD issuance Rs. 350/-

FCY (Foreign Currency) Cheque Collection 0.25% on the cheque collection, Minimum of Rs. 25/-

Cheque Collection

Local Clearing Free

Outstation Clearing through Own Bank Free

Outstation Clearing through Correspondent Bank Upto and including 5,000: Rs. 25; Above 5,000 and upto and including 10,000: Rs. 50; Above 10,000 and upto

100,000: Rs. 100; Above 100,000: Rs. 150

Return of Cheque/s - Local Only for Financial Reasons

Local Inward Clearing: -

First cheque return in a quarter - Rs.350/-. From second cheque return in the same quarter - Rs.500/- per return

Local Outward Clearing: -

SB A/c – Rs. 50/- per cheque

Return of Cheque/s - Outstation - through Own Bank Collection charges subject to a minimum of Rs. 100/- plus actual out of pocket expenses

Return of Cheque/s - Outstation - through Another Bank Collection charges subject to a minimum of Rs. 100/- plus actual out of pocket expenses

Return of Cheque/s - Outstation Cheques Received in Inward Rs. 100/- plus out of pocket expenses.

Collection

Cards

ATM

Card Annual / Renewal Fee. (Issuance of ATM card will not be Not Applicable

done)

Debit Card

Card Issuance/Renewal/Reissuance Fee Titanium Chip Card: Rs. 249/- p.a#

For upgrading to premium debit cards, please refer premium debit cards SoC below -

As per regulatory directive -Effective 01.09.2015 new debit cards

issued will be chip variant only http://indusind.com/content/dam/indusind/PDF/schedule-of-benefits-n-charges-premium-debitcard.pdf

Card Replacement Fee Rs. 249 + taxes

Issuance of Duplicate PIN Rs. 20/-

Non-cash transactions - Own ATMs (IndusInd Bank) Free

Cash Withdrawals - Own ATMs (IndusInd Bank) Free

Non-cash transactions - Other Bank ATMs in India 5* Free Cash or Non-cash transactions (Balance Enquiry, PIN Change and Mini Statement) per month. Beyond

5 transactions, all Non-cash transactions would be charged at Rs. 10/- per transaction

* 3 in metro citie

Cash Withdrawals - Other Bank ATMs in India 5* Free Cash or Non-cash transactions (Balance Enquiry, PIN Change and Mini Statement) per month. Beyond

5 transactions, all Cash withdrawals would be charged at Rs. 20/- per transaction

* 3 in metro cities

Cash Withdrawals - Other Bank ATMs outside India Outside India: Rs. 125/- for Cash Withdrawal

Exchange rate mark up on Foreign Currency Debit card Classic/ Gold/Titanium card - 3.5%

transaction Platinum -2%

ATM transaction decline fee : Transactions declined at other Rs.20/- per transaction

bank ATMs due to insufficient funds

Daily Cash Withdrawal Limit Titanium Card : Rs 50,000

Daily POS Limit Titanium Card : Rs 100,000

Other Savings Bank Account Facilities

Account Statement Free Monthly E-Statement.

Monthly/Quaterly Phyiscal statement : Collect from Home Branch- Free,

Quarterly physical Statement: Delivery Charge :Rs 15/- per quarter.

Statement Adhoc request (Physical) : From Contact centre/PhoneBanking/ATM - Delivery Fee of : Rs 50

Issuance of Duplicate/Additional Statement Statement period Less than 90 days as on date of issuance - FREE Beyond 90 days - 100/-

Issuance of Loose Cheque Leaves (w.e.f Rs 3.5/Leaf***

1st Aug'19)

Issuance of Duplicate Pass Book Free

Internal Transfer / ECS Return (Insufficient Balance) First ECS return in a quarter - Rs.350/-. From second ECS return in the same quarter - Rs.500/- per return

Miscellaneous

Mobile Alerts Free Transaction Alerts

Balance Notification Balance Notification Service will be charged at Rs 30/- per quarter

Balance Certificate Limit Accounts - Rs. 25/-

Other Accounts - Rs. 100/-

Interest Certificate Rs. 100/-

Standing Order/Balance Order/Instructions Free

Enquiry relating to Old Records Rs. 100/- per enquiry

Account Closure No Charge if A/C closed within 14 days .

Charge of Rs. 200/-, or balance in the A/c whichever is lower, if account is closed post 14 days and within 6

months

Photo Attestation Free

Signature Attestation Rs. 50/- per signature

Cheque Stop Payment Rs. 100/- per instruction

Rs. 150/- for range of instruction in single mandate

Inactive Account (>12 Months) Rs. 200/- per quarter

Phone Banking (@Contact Center) Free

Cheque Books

Issuance of Cheque Books 2 Cheque Book per quarter (30 leaves) free. For additional cheque leaves - Rs. 3.5/- per leaf***

Charges on Cash Withdrawal/Deposits at Branch/es

Cash withdrawal at any Indusind branch in India Free

Third Party Cash withdrawal at non home Indusind branch in Free Limit of Rs.50,000/- per month; Above free limit, Rs.2.5/- per Rs.1000/- subject to minimum of Rs 100

India

Cash Deposit at any Indusind Branch location Free Limit of Rs.2,00,000/- per month. Above free limit, Rs.2.5/- per Rs.1000/- subject to minimum of Rs 100

Note :- Subject to trading account being active

Door Step Banking

Cashier's Cheque/Demand Drafts Delivery Free

Cheque Pickup 1 request free per day ; Minimum cheque consolidated value Rs. 10,000/-

Cash Delivery Minimum value of Rs.10,000/- & Maximum Rs.1 Lac @ Rs.50/- per request

Cash Pick-Up Minimum value of Rs. 10,000/- & Maximum Rs.1 Lac @ Rs.130/- per request

1. All charges indicated above are exclusive of Taxes (as per Government rules)

2. Doorstep Banking is available at select branches only.

3. Bank reserves the right to assess charges on transactions which are not covered by this schedule and to

amend with prior notice the terms and conditions governing such services mentioned above and rates

stated in this schedule.

4. Any changes in the charge tariff will be applied after a notice of atleast 30 days.

*** Available only after updating signature in Bank's records

#

Issuance fee is waived for a limited period basis funding of IndusStox Saving Account through own account

Potrebbero piacerti anche

- Pca 14 6Documento2 paginePca 14 6Arora MathewNessuna valutazione finora

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Documento2 pagineMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNessuna valutazione finora

- From Kotak WebsiteDocumento20 pagineFrom Kotak WebsiteHimadri Shekhar VermaNessuna valutazione finora

- Banking Operations - Bank of IndiaDocumento21 pagineBanking Operations - Bank of IndiaEkta singhNessuna valutazione finora

- SOC Indus Multiplier MaxDocumento4 pagineSOC Indus Multiplier Maxmanoj baroka0% (1)

- Services ProvidedDocumento15 pagineServices ProvidedParul AroraNessuna valutazione finora

- RBI SBI Demand Draft Exchange RatesDocumento11 pagineRBI SBI Demand Draft Exchange RatesJithin VijayanNessuna valutazione finora

- Common Service ChargesDocumento3 pagineCommon Service ChargesatharvxunoNessuna valutazione finora

- Service Charges Annexure-A Revised 18-7-11Documento28 pagineService Charges Annexure-A Revised 18-7-11Dhaliwal JassieNessuna valutazione finora

- Preferred AccountDocumento2 paginePreferred AccountaurummaangxinchenNessuna valutazione finora

- Broking Idirect Linked Savings AccountDocumento7 pagineBroking Idirect Linked Savings Accounttrue chartNessuna valutazione finora

- NeekiDocumento2 pagineNeekiRamNessuna valutazione finora

- Sr. Particulars Charges Applicable To Savings Accounts Wef 23rdDocumento7 pagineSr. Particulars Charges Applicable To Savings Accounts Wef 23rdSantosh NairNessuna valutazione finora

- Account Tariff Structure Basic Savings AccountDocumento1 paginaAccount Tariff Structure Basic Savings Accountgaddipati_ramuNessuna valutazione finora

- PK 4Documento15 paginePK 4Instagram OfficeNessuna valutazione finora

- Basic Saving Account With Complete KYCDocumento2 pagineBasic Saving Account With Complete KYCVarsha100% (1)

- Soc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFDocumento2 pagineSoc Edge Business Prime Business Exclusive Business Wef 1st April23 PDFJella RamakrishnaNessuna valutazione finora

- PK Saadiq EnglishDocumento53 paginePK Saadiq EnglishZeeshan AshrafNessuna valutazione finora

- Being MeDocumento2 pagineBeing Metharun venkatNessuna valutazione finora

- Schedule of Charges Yes Bank 6Documento2 pagineSchedule of Charges Yes Bank 6Sayantika MondalNessuna valutazione finora

- KFS Current ACDocumento23 pagineKFS Current ACFakharNessuna valutazione finora

- "Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Documento2 pagine"Being Me" Savings Account (January 01,2021) : Issuance Fee (Personalised Debit Card) Rs.150Sweta MistryNessuna valutazione finora

- Service Charges As Per Rbi GuidelinesDocumento10 pagineService Charges As Per Rbi Guidelineskrunal3726Nessuna valutazione finora

- Core Bundled Savings AccountDocumento2 pagineCore Bundled Savings AccountSweta MistryNessuna valutazione finora

- Schedule of ChargesDocumento14 pagineSchedule of ChargeskrishmasethiNessuna valutazione finora

- Islamic SOC Jan June 2013 FinalDocumento16 pagineIslamic SOC Jan June 2013 Finalfaisal_ahsan7919Nessuna valutazione finora

- Being MeDocumento2 pagineBeing MeVarshaNessuna valutazione finora

- Jubilee Plus Savings Account: (January 01,2020)Documento2 pagineJubilee Plus Savings Account: (January 01,2020)Ruthvik TMNessuna valutazione finora

- Basic Savings Bank Deposit Account SocsDocumento6 pagineBasic Savings Bank Deposit Account Socstrue chartNessuna valutazione finora

- (1.) Service Charges To Maintain A Ledger Accounts: P A G eDocumento17 pagine(1.) Service Charges To Maintain A Ledger Accounts: P A G eshaantnuNessuna valutazione finora

- Core Savings AccountDocumento2 pagineCore Savings AccountVarshaNessuna valutazione finora

- Regular Saving AccountDocumento92 pagineRegular Saving AccountSimu MatharuNessuna valutazione finora

- AnnexA-SoC Comfort01062014Documento4 pagineAnnexA-SoC Comfort01062014satyabrataNessuna valutazione finora

- ICICI Bank Current Account ChargesDocumento3 pagineICICI Bank Current Account Chargesashishtiwari92100% (1)

- Senior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountDocumento13 pagineSenior Citizen Saving Account: As A Senior Citizen, You Can Enjoy A Host of Benefits On Your AccountRohan MohantyNessuna valutazione finora

- Super Savings Account: Common Service ChargesDocumento2 pagineSuper Savings Account: Common Service ChargesSantosh ThakurNessuna valutazione finora

- Service Charges 15-03-2011Documento13 pagineService Charges 15-03-2011AnandshingviNessuna valutazione finora

- ICICI Bank Service ChargesDocumento7 pagineICICI Bank Service ChargesRanjith MeelaNessuna valutazione finora

- Axis Bank Service ChargesDocumento4 pagineAxis Bank Service ChargesRanjith MeelaNessuna valutazione finora

- Schedule of Charges Deutsche Bank 4Documento3 pagineSchedule of Charges Deutsche Bank 4Sayantika MondalNessuna valutazione finora

- Rca SocDocumento3 pagineRca SocKrishna Kiran VyasNessuna valutazione finora

- Nri Schedule of ChargesDocumento4 pagineNri Schedule of ChargesRishiNessuna valutazione finora

- Schedule of Charges: Savings ValueDocumento2 pagineSchedule of Charges: Savings ValueNavjot SinghNessuna valutazione finora

- Particulars Revised SBTRS Charges W.E.F. July 1, 2020Documento2 pagineParticulars Revised SBTRS Charges W.E.F. July 1, 2020Parikshit ShomeNessuna valutazione finora

- Effective From 1st April, 2020Documento2 pagineEffective From 1st April, 2020SundarNessuna valutazione finora

- Terms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMDocumento6 pagineTerms & Conditions: SOC Brochure: Size (Close) 92 X 185 MMArnab Nandi100% (1)

- Super Savings NewDocumento2 pagineSuper Savings NewwinnermeNessuna valutazione finora

- Casil Soc 01 07 23Documento2 pagineCasil Soc 01 07 23rishisiliveri95Nessuna valutazione finora

- Schedule of Charges - Retail (India)Documento2 pagineSchedule of Charges - Retail (India)John PeterNessuna valutazione finora

- 150722-Revision in Service Charges Updated As On 30062022Documento21 pagine150722-Revision in Service Charges Updated As On 30062022Vinoth KumarNessuna valutazione finora

- Mojo Platinum Credit Card: INR 1000 INR 1000Documento4 pagineMojo Platinum Credit Card: INR 1000 INR 1000Saksham Goel100% (2)

- Schedule of Charges Deutsche Bank 3Documento3 pagineSchedule of Charges Deutsche Bank 3Sayantika MondalNessuna valutazione finora

- KioskDocumento21 pagineKioskgollamandalaappaiahNessuna valutazione finora

- Core Savings Account - IDBIDocumento2 pagineCore Savings Account - IDBIprasanNessuna valutazione finora

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDocumento1 paginaCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNessuna valutazione finora

- Ready Line SOC Jan June 2024Documento1 paginaReady Line SOC Jan June 2024umarNessuna valutazione finora

- NRENROBeingMeaccountApril 012019Documento2 pagineNRENROBeingMeaccountApril 012019KxhsujsnsNessuna valutazione finora

- Au Digital Savings AccountDocumento5 pagineAu Digital Savings AccountQuaint ZoneNessuna valutazione finora

- WebsitepublicationDocumento8 pagineWebsitepublicationgifak51155Nessuna valutazione finora

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaDa EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNessuna valutazione finora

- Lab Results 40245121Documento1 paginaLab Results 40245121Gaurav Singh RathoreNessuna valutazione finora

- Lab Results 46927339Documento1 paginaLab Results 46927339Gaurav Singh RathoreNessuna valutazione finora

- Assi03032020 PDFDocumento57 pagineAssi03032020 PDFtushar goyalNessuna valutazione finora

- Common Recruitment Process For Recruitment of Clerks in Participating Organisations (Crp-clerks-Viii)Documento2 pagineCommon Recruitment Process For Recruitment of Clerks in Participating Organisations (Crp-clerks-Viii)krshna jainNessuna valutazione finora

- University of Allahabad: Admit Card For Examination 2019Documento1 paginaUniversity of Allahabad: Admit Card For Examination 2019Gaurav Singh RathoreNessuna valutazione finora

- Lab Results 50245121Documento1 paginaLab Results 50245121Gaurav Singh RathoreNessuna valutazione finora

- Notice Regarding Calendar of Examinations - 17092020Documento1 paginaNotice Regarding Calendar of Examinations - 17092020Gaurav Singh RathoreNessuna valutazione finora

- Important Notice: For The Remaining Candidates of Combined Higher Secondary (10+2) Level Examination (CHSLE) 2019Documento2 pagineImportant Notice: For The Remaining Candidates of Combined Higher Secondary (10+2) Level Examination (CHSLE) 2019chandrahasNessuna valutazione finora

- Social Media Rules and Regulations For University of Allahabad The Social Media CommitteeDocumento3 pagineSocial Media Rules and Regulations For University of Allahabad The Social Media CommitteeGaurav Singh RathoreNessuna valutazione finora

- 09 Chapter2Documento38 pagine09 Chapter2Gaurav Singh RathoreNessuna valutazione finora

- Farmers (Empowerment and Protection) Agreement On Price Assurance and Farm Service Act, 2020Documento8 pagineFarmers (Empowerment and Protection) Agreement On Price Assurance and Farm Service Act, 2020AKHIL H KRISHNANNessuna valutazione finora

- Farmers Produce Trade Commerce Promotion Facilitation Act2020Documento8 pagineFarmers Produce Trade Commerce Promotion Facilitation Act2020dinesh hegdeNessuna valutazione finora

- Supply Chain Managementbijdrage Jackvander Vorstv 10Documento20 pagineSupply Chain Managementbijdrage Jackvander Vorstv 10Chandr IthaNessuna valutazione finora

- Marketing Management (206) MBA Semester - II Examination - 2016 Maximum Marks 75Documento2 pagineMarketing Management (206) MBA Semester - II Examination - 2016 Maximum Marks 75Gaurav Singh RathoreNessuna valutazione finora

- SSC 2019 Marks PDFDocumento1 paginaSSC 2019 Marks PDFGaurav Singh RathoreNessuna valutazione finora

- Aadhaar JudgmentDocumento1.448 pagineAadhaar JudgmentThe WireNessuna valutazione finora

- Ordinance Aadhaar Amendment 07032019 PDFDocumento12 pagineOrdinance Aadhaar Amendment 07032019 PDFGaurav Singh RathoreNessuna valutazione finora

- DetailedAdvertisement PDFDocumento14 pagineDetailedAdvertisement PDFAnamika SharmaNessuna valutazione finora

- Fci Recruitment PDFDocumento44 pagineFci Recruitment PDFAbhishek GhatakNessuna valutazione finora

- Earth - Interior + Eh - Latitudes & Longitudes PDFDocumento14 pagineEarth - Interior + Eh - Latitudes & Longitudes PDFGaurav Singh RathoreNessuna valutazione finora

- LIST - 3 - Other Than NR - 01072020Documento761 pagineLIST - 3 - Other Than NR - 01072020Om Narayan TiwariNessuna valutazione finora

- 09 Chapter2Documento38 pagine09 Chapter2Gaurav Singh RathoreNessuna valutazione finora

- Stat GKDocumento13 pagineStat GKdjNessuna valutazione finora

- PDF Cibil Report PDFDocumento8 paginePDF Cibil Report PDFMargub SubhaniNessuna valutazione finora

- 4Documento14 pagine4Netflix FamiliaNessuna valutazione finora

- 5-3-Buyer and Seller EntriesDocumento3 pagine5-3-Buyer and Seller EntriesRaymond BarbosaNessuna valutazione finora

- The 4th Edition of The IETS Manual Is Available in CD Format, Contains 3 Versions, English, French and SpanishDocumento1 paginaThe 4th Edition of The IETS Manual Is Available in CD Format, Contains 3 Versions, English, French and SpanishPedro Cisneros SorrozaNessuna valutazione finora

- SBSA Statement 2023-02-02Documento3 pagineSBSA Statement 2023-02-02Melissa Albertyn-BrowneNessuna valutazione finora

- Chris Hauser Remittance Letter ExampleDocumento4 pagineChris Hauser Remittance Letter ExampleRoberto Monterrosa100% (40)

- SIP Report PDFDocumento66 pagineSIP Report PDFNagma ParmarNessuna valutazione finora

- Hotel Reservation Form: 1. Personal InformationDocumento7 pagineHotel Reservation Form: 1. Personal InformationANGELOJERLEN TANNessuna valutazione finora

- DiCeglie052521Invite (30959)Documento2 pagineDiCeglie052521Invite (30959)Jacob OglesNessuna valutazione finora

- Gerald N. Roman Bsba FM 2-C Financial Analysis and ReportingDocumento3 pagineGerald N. Roman Bsba FM 2-C Financial Analysis and ReportingGerald Noveda RomanNessuna valutazione finora

- Important Facts About PM Svanidhi For UpscDocumento2 pagineImportant Facts About PM Svanidhi For UpscMdshajiNessuna valutazione finora

- Book NQN KeyDocumento86 pagineBook NQN KeyQuỳnh Trần Thị DiễmNessuna valutazione finora

- Chapter 3 Basic AccountingDocumento35 pagineChapter 3 Basic AccountingDeanna LuiseNessuna valutazione finora

- Equivalents: Cash Basic ProblemsDocumento21 pagineEquivalents: Cash Basic ProblemsAndrea FontiverosNessuna valutazione finora

- Final ProjectDocumento77 pagineFinal ProjectbccmehtaNessuna valutazione finora

- Rajshree Patil 10Documento84 pagineRajshree Patil 1004- SIDDHI PATILNessuna valutazione finora

- First Long Quiz For The Second QuarterDocumento7 pagineFirst Long Quiz For The Second QuarterReiah RongavillaNessuna valutazione finora

- JPMCStatementDocumento4 pagineJPMCStatementesteysi775Nessuna valutazione finora

- Credit Reports HomeworkDocumento4 pagineCredit Reports Homeworkafeurbmvo100% (1)

- BTLPDocumento282 pagineBTLPSanjeev Kumar JainNessuna valutazione finora

- Fariya Baig - Retail Management Assignment 4Documento3 pagineFariya Baig - Retail Management Assignment 4fariya baigNessuna valutazione finora

- Hotel BookingDocumento6 pagineHotel BookingIRSHATH MOHAMED ISMAILNessuna valutazione finora

- Cash Book & BRSDocumento9 pagineCash Book & BRSRahul NegiNessuna valutazione finora

- Audit of Cash - Exercise 2 (Solution)Documento5 pagineAudit of Cash - Exercise 2 (Solution)Aby ReedNessuna valutazione finora

- IDFCFIRSTBankstatement AnjaliDocumento4 pagineIDFCFIRSTBankstatement Anjalithink moveNessuna valutazione finora

- REVISION AccountingDocumento13 pagineREVISION Accountingiquidbae1Nessuna valutazione finora

- FinalONLINE TRANSACTION INDEXDocumento2 pagineFinalONLINE TRANSACTION INDEXLaraya, Roy MatthewNessuna valutazione finora

- Bank Account Statement: Summary For Routing AccountDocumento3 pagineBank Account Statement: Summary For Routing AccountSolomon100% (1)

- Statement of AccountDocumento3 pagineStatement of AccountJohar Safana50% (4)

- American Express Issued CardsDocumento1 paginaAmerican Express Issued CardsFarisNessuna valutazione finora