Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Jaya 1

Caricato da

NoXiouSGT GamingTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Jaya 1

Caricato da

NoXiouSGT GamingCopyright:

Formati disponibili

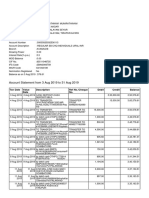

National Commission in HDFC Bank vs Anish Munjal on January 23, 2019

Facts:

Anish Munjal had a savings bank account with Centurian Bank of Punjab, which was taken over by the

HDFC Bank in May 2008. Munjal had obtained a credit card from HDFC Bank, which deducted Rs 53,043.68

from the balance in his savings bank account against his credit card dues. Aggrieved with the deduction,

Munjal approached the District Forum, which ruled in his favour. However, the bank had claimed that “the

credit card dues having not been paid, they were justified in deducting the same from the saving bank

account of the respondent.” This claim was dismissed by the District Forum. The bank then appealed

against the District Forum before the State Commission, which also ruled in favour of the customer. HDFC

Bank finally approached the NCDRC.

Contentions:

Munjal specifically stated in his complaint that he had taken credit card from HDFC Bank. The card was

last used in December 2005 and as per the demand of the bank, he had paid the amount and got the said

card cancelled.

The bank, however, said that the total amount of dues against Munjal in his credit card statement dated

5.12.2004 was Rs.9979.85, including the finance charges levied by the bank. The dues kept on increasing

on account of addition of late fee, over-limit fee and finance charges, though no fresh purchase was made

by Munjal. The bank claimed that he made purchases and made several part payments over a period of

this. The bank’s counsel told the National Commission,”However, he (Munjal) having not made full

payment of the credit card dues, the finance charges and late fee etc. continued to be added to his credit

card account and as a consequence, the said dues increased to Rs.53,043.68, till the date the said dues

were deducted from his saving bank account.”

Held:

The NCDRC noted that that Clause-6 of the terms and conditions, on which the credit card was issued,

allowed the bank to set-off dues of the cardmember from his savings account with the bank without any

notice. The commission, hence, set aside previous orders against the bank. It said, “In view of the

aforesaid clause, the petitioner bank was entitled to set off the credit card dues at any point of time,

without any notice to the complainant. Therefore, deduction of the amount of Rs.53,043.68 from the

saving bank account of the complainant was in consonance with the above referred condition stipulated

by the bank, while issuing the credit card to the complainant/respondent.”

Potrebbero piacerti anche

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (895)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (74)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- Basic Underwriting (ATG)Documento402 pagineBasic Underwriting (ATG)dwrighte1Nessuna valutazione finora

- Financial Accounting A Managerial Perspective PDFDocumento3 pagineFinancial Accounting A Managerial Perspective PDFAtaur Rahman HashmiNessuna valutazione finora

- Erffi-E ('Rrir (: FDFRTQDocumento3 pagineErffi-E ('Rrir (: FDFRTQNoXiouSGT GamingNessuna valutazione finora

- JayaDocumento2 pagineJayaNoXiouSGT GamingNessuna valutazione finora

- Algebra CATDocumento6 pagineAlgebra CATBiswajeet PandaNessuna valutazione finora

- Child Friendly Explanation of Coronavirus PDFDocumento12 pagineChild Friendly Explanation of Coronavirus PDFNawa AndrianaNessuna valutazione finora

- Adhisuchana - Regarding 5 Marks Grace Marks. - 1 PDFDocumento1 paginaAdhisuchana - Regarding 5 Marks Grace Marks. - 1 PDFNoXiouSGT GamingNessuna valutazione finora

- Freedom of TradeDocumento27 pagineFreedom of TradePranav KhandelwalNessuna valutazione finora

- Article On Section - 165 of E. Act PDFDocumento54 pagineArticle On Section - 165 of E. Act PDFNoXiouSGT GamingNessuna valutazione finora

- Jaya 2Documento1 paginaJaya 2NoXiouSGT GamingNessuna valutazione finora

- Stat BESem3 RegDocumento7 pagineStat BESem3 RegNoXiouSGT GamingNessuna valutazione finora

- Ancient Law FDocumento13 pagineAncient Law FMegh ShahNessuna valutazione finora

- Computer Science and EngineeringDocumento7 pagineComputer Science and EngineeringNoXiouSGT GamingNessuna valutazione finora

- New Doc 2020-01-27 15.37.04Documento4 pagineNew Doc 2020-01-27 15.37.04NoXiouSGT GamingNessuna valutazione finora

- FINALDocumento5 pagineFINALNoXiouSGT GamingNessuna valutazione finora

- Machine Learning 4.1 PDFDocumento347 pagineMachine Learning 4.1 PDFVaishnavi MittalNessuna valutazione finora

- Diff Between Exit (0) AndexitDocumento3 pagineDiff Between Exit (0) AndexitNoXiouSGT GamingNessuna valutazione finora

- HCSJB Fina 03022020 c0f04Documento38 pagineHCSJB Fina 03022020 c0f04NoXiouSGT GamingNessuna valutazione finora

- New Doc 2020-01-27 15.37.04 PDFDocumento4 pagineNew Doc 2020-01-27 15.37.04 PDFNoXiouSGT GamingNessuna valutazione finora

- Data StructureDocumento80 pagineData StructureNoXiouSGT GamingNessuna valutazione finora

- Syllogism 2 1Documento4 pagineSyllogism 2 1NoXiouSGT GamingNessuna valutazione finora

- Assignment 1Documento2 pagineAssignment 1NoXiouSGT GamingNessuna valutazione finora

- Adhisuchana - Regarding 5 Marks Grace Marks. - 1Documento1 paginaAdhisuchana - Regarding 5 Marks Grace Marks. - 1NoXiouSGT GamingNessuna valutazione finora

- Csvtu Syllabus Be Cse 4 SemDocumento12 pagineCsvtu Syllabus Be Cse 4 SemNikhil Gobhil0% (1)

- Invoice Karan MBDocumento1 paginaInvoice Karan MBRAHUL GUPTANessuna valutazione finora

- Invoice Karan MBDocumento1 paginaInvoice Karan MBRAHUL GUPTANessuna valutazione finora

- Invoice Karan MBDocumento1 paginaInvoice Karan MBRAHUL GUPTANessuna valutazione finora

- Bid DocumentDocumento40 pagineBid DocumentcatcpkhordhaNessuna valutazione finora

- Module 3 N.R Narayan Murthy Committee Report On CorporateDocumento4 pagineModule 3 N.R Narayan Murthy Committee Report On CorporatehitarthsarvaiyaNessuna valutazione finora

- This Study Resource Was: North South UniversityDocumento7 pagineThis Study Resource Was: North South UniversitycsolutionNessuna valutazione finora

- PDF Audit 1Documento18 paginePDF Audit 1Kali NazriNessuna valutazione finora

- Venture of Joint Nature Class NotesDocumento22 pagineVenture of Joint Nature Class NotesDbNessuna valutazione finora

- Portfolio ConstructionDocumento15 paginePortfolio ConstructionParul GuptaNessuna valutazione finora

- Certificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisDocumento19 pagineCertificate Program in Marketing & HRM: Dr. Abhijit P. PhadnisGurvinder SinghNessuna valutazione finora

- Shareholding Pattern As On June 30, 2020Documento9 pagineShareholding Pattern As On June 30, 2020Mit AdhvaryuNessuna valutazione finora

- Study On Empowerment of Women in Self Help Groups in Rural Part of ChennaiDocumento0 pagineStudy On Empowerment of Women in Self Help Groups in Rural Part of ChennaiDrKapil JainNessuna valutazione finora

- Accounting Ppe Quizzes PractoceDocumento1 paginaAccounting Ppe Quizzes PractoceMA. ANGELICA DARL DOMINGO CHAVEZNessuna valutazione finora

- Vat Bar ExamDocumento4 pagineVat Bar Examblue_blue_blue_blue_blueNessuna valutazione finora

- Ibs Penang Times Square 1 30/09/21Documento7 pagineIbs Penang Times Square 1 30/09/21Nuru JannahNessuna valutazione finora

- DLMI Annual Report - 2019 - (Part 1)Documento27 pagineDLMI Annual Report - 2019 - (Part 1)MeteorFreezeNessuna valutazione finora

- FM 1 Short Term FinancingDocumento2 pagineFM 1 Short Term FinancingCrizhae OconNessuna valutazione finora

- Chapter 12 - Capital BudgetingDocumento26 pagineChapter 12 - Capital BudgetingSamin HaqueNessuna valutazione finora

- Tutorial 7Documento2 pagineTutorial 7It's Bella RobertsonNessuna valutazione finora

- FIN081 - P2 - Q2 - Receivable Management - AnswersDocumento7 pagineFIN081 - P2 - Q2 - Receivable Management - AnswersShane QuintoNessuna valutazione finora

- Choice Multiple Questions - Docx.u1conflictDocumento4 pagineChoice Multiple Questions - Docx.u1conflictAbdulaziz S.mNessuna valutazione finora

- 1569974603267g4SdkiBXnw22cLKZ PDFDocumento4 pagine1569974603267g4SdkiBXnw22cLKZ PDFSelvarathnam MuniratnamNessuna valutazione finora

- Statement Oct 20 XXXXXXXX1430 PDFDocumento3 pagineStatement Oct 20 XXXXXXXX1430 PDFPhanikaoNessuna valutazione finora

- Franchise Relationship and Management ContractsDocumento12 pagineFranchise Relationship and Management ContractsJoana Marie Marzan CleteNessuna valutazione finora

- KOTAK BANK ProjectDocumento76 pagineKOTAK BANK ProjectNancy PatelNessuna valutazione finora

- Chapter 30 Money Growth and InflationDocumento46 pagineChapter 30 Money Growth and InflationThảo Linh Vũ NguyễnNessuna valutazione finora

- Accounting QuizDocumento14 pagineAccounting QuizMarthen YoparyNessuna valutazione finora

- Name: - Score: - Grade & Section: - DateDocumento2 pagineName: - Score: - Grade & Section: - DateAngelo DimacuhaNessuna valutazione finora

- Chapter XII Consideration For SharesDocumento12 pagineChapter XII Consideration For SharesDaphne Dianne MendozaNessuna valutazione finora

- Macy's Store Closings News ReleaseDocumento6 pagineMacy's Store Closings News ReleaseJim KinneyNessuna valutazione finora

- General Tyre Annual Report June 30 2020 1Documento112 pagineGeneral Tyre Annual Report June 30 2020 1M.TalhaNessuna valutazione finora