Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Law Relating To Banking May 2010 Main Paper

Caricato da

Basilio MaliwangaTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Law Relating To Banking May 2010 Main Paper

Caricato da

Basilio MaliwangaCopyright:

Formati disponibili

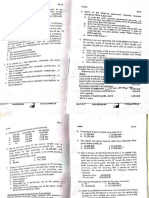

INSTITUTE OF BANKERS IN MALAWI

DIPLOMA IN BANKING EXAMINATION

SUBJECT: LAW RELATING TO BANKING (IOBM – D216)

Date: Tuesday, 4th May 2010

Time Allocated: 3 hours (08:00 – 11:0 am)

INSTRUCTIONS TO CANDIDATES

1 This paper consists of TWO Sections, A and B.

2 Section A consists of 4 questions, each question carries 15 marks.

Answer ALL questions.

3 Section B consists of 4 questions, each question carries 20 marks. Answer

ANY TWO questions.

4 You will be allowed 10 minutes to go through the paper before the start of the

examination, you may write on this paper but not in the answer book.

5 Begin each answer on a new page.

6 Please write your examination number on each answer book used.

7 DO NOT open this question paper until instructed to do so.

SECTION A (60 MARKS)

Answer ALL questions from this section.

QUESTION 1

(a) The Banking Act (Cap. 44:01) of the Laws of Malawi under section 2 (1) defines

a ‘bank” as a person who conducts banking business in Malawi, including the

acceptance of funds withdrawable by cheque or transferable by other means.

However, the Banking Act does not define a “customer”. Explain what makes a

person a bank’s customer in banking law terms. (4 marks)

(b) A banker-customer relationship may take several instances (characteristics).

With illustrations, give three of the forms of banker-customer relationship.

(6 marks)

(c) The opening of an account by a customer with a bank involves a contractual

relationship with rights and obligations both for the bank and the customer.

What are five of the duties that a bank owes its customer? (5 marks)

(Total 15 marks)

QUESTION 2

(a) The Reserve Bank of Malawi in conjunction with the Minister of Finance is

given the mandate to regulate the exchange control regime in Malawi. In this

regard, the Reserve Bank of Malawi has established regulations with a view to

ensuring stability in the foreign exchange market. Give any twelve restrictions

that have been imposed by the Exchange Control Regulations. (12 marks)

(b) In terms of section 3 (d) of the Reserve Bank of Malawi Act (Cap. 44:02) of the

Laws of Malawi, one of the principal objectives of the Reserve Bank of Malawi

is to carry out monetary policies. Describe three of the aims of monetary

policies. (3 marks)

(Total 15 marks)

A qualification examined by the Institute of Bankers in Malawi 2

QUESTION 4

(a) In banking, a customer may give a third party to the banking contract his power

of attorney to operate his bank account. The power of attorney may be special

or specific (to operate the bank account or other specific powers like the sale of

property) or general (which may give the holder authority to act on the

customer’s behalf for many activities including banking). A power of attorney

arrangement creates some duties on the part of the attorney. Mention five of

the duties that are imposed by law on the holder of a power of attorney.

(5 marks)

(b) Just as a person can give a power of Attorney, can also cancel it by revocation.

However, Power of Attorney revocation may also result automatically from

various events. List five instances in which a power of attorney can be revoked.

(5 marks)

(c) Under section 75 Bills of Exchange Act (cap. 48:02) of the Laws of Malawi a

bank's duty to pay a cheque is ended by a countermand. Explain five of the

prerequisites of an effective countermand. (5 marks)

(Total 15 marks)

QUESTION 4

With illustrations, discuss circumstances under which money mistakenly paid into the

customer’s account by the bank can be rightfully claimed by the said customer and

under which the bank may be estopped from asserting its claim to recover the said

money. (15 marks)

(Total 15 marks)

A qualification examined by the Institute of Bankers in Malawi 3

SECTION B (40 MARKS)

Answer ANY TWO questions from this section.

QUESTION 5

(a) Mr. Chipande, an illiterate wealthy man in town and Mrs. Phiri, a chartered

accountant, with a view to share profits form a partnership called Deposit

Investments. In terms of their partnership deed, Deposit Investments will be

managed by Mrs Phiri only at executive level owing to Mr. Chipande’s illiteracy.

Deposit Investments capital has now grown to Malawi Kwacha equivalent of

US$ 600,000.00 and Deposit Investments now wants to get a banking licence.

Advise Deposit Investments on the law governing acquisition of banking

licences in Malawi. (15 marks)

(b) The banker-customer relationship may be terminated voluntarily by either of the

parties. However, there also instances when the bank-customer may be

terminated by operation of law. Briefly explain three instances in which the

banker-customer relationship is terminated by operation of law. (5 marks)

(Total 20 marks)

QUESTION 6

(a) Mrs. Gama, a non-trading individual, delivered to her bank, Uptown Bank, a

MK10,000,000.00 cheque payable to her for credit of the proceeds to her

account. By mistake the proceeds were credited by Uptown Bank to another

customer’s account. After a few days, Mrs. Gama’s own cheque of

MK50,000.00 drawn on her account in payment of rent due to her landlord was

presented by her landlord for payment and dishonoured as there were in

sufficient funds in Mrs. Gama’s account. The landlord insisted that in future

Mrs. Gama must pay her rent to him in cash. Mrs Gama wants to sue the

Uptown Bank to Claim substantial damages. Discuss the issue of liability as

between Mrs Gama and the Bank. (10 marks)

(b) Mr. Lingawombe terminated the authority of Mr. Tidyeretu to act as Mr.

Lingawombe’s agent. However, after the said termination of agency, Mr.

A qualification examined by the Institute of Bankers in Malawi 4

Lingawombe suspected that Mr. Tidyeretu had subsequently paid into his (Mr.

Tidyeretu’s) own bank account a cheque received by Mr. Tidyeretu in his

capacity as an agent of Mr. Lingawombe. Accordingly, Mr. Lingawombe

persuaded the bank inspector to allow him to a statement of the account.

Discuss the rights of the parties. (10 marks)

(Total 20 marks)

QUESTION 7

City Jewelries Ltd received a consignment of rare diamond. Fearing for the safety of

the diamond, City Jewelries Ltd deposited the diamond with their bank for

safekeeping. One morning a cleaner who was given access to clean the custody

room stole the diamond. City Jewelries Ltd wants sue the bank and the said City

Jewelries Ltd have now approached you for advice. Discuss the issue of liability.

(Total 20 marks)

QUESTION 8

Discuss any five grounds on which the Reserve Bank of Malawi may revoke a

banking licence and give rationale behind these grounds.

(Total 20 marks)

END OF THE EXAMINATION PAPER

A qualification examined by the Institute of Bankers in Malawi 5

Potrebbero piacerti anche

- Law Relating To Banking - Nov 2013Documento4 pagineLaw Relating To Banking - Nov 2013Basilio MaliwangaNessuna valutazione finora

- Law Relating To Banking May 2014Documento4 pagineLaw Relating To Banking May 2014Basilio MaliwangaNessuna valutazione finora

- Advanced Banking Law MAY 2014 PAPERDocumento4 pagineAdvanced Banking Law MAY 2014 PAPERBasilio MaliwangaNessuna valutazione finora

- Law Relating To Banking November 2015Documento4 pagineLaw Relating To Banking November 2015Basilio MaliwangaNessuna valutazione finora

- Advanced Banking Law May 2013 ExamsDocumento5 pagineAdvanced Banking Law May 2013 ExamsBasilio MaliwangaNessuna valutazione finora

- Advanced Banking Law - November 2014Documento4 pagineAdvanced Banking Law - November 2014Basilio MaliwangaNessuna valutazione finora

- Law Relating To Banking Nov 2014Documento4 pagineLaw Relating To Banking Nov 2014Basilio MaliwangaNessuna valutazione finora

- Advanced Banking Law - May 2015Documento4 pagineAdvanced Banking Law - May 2015Basilio MaliwangaNessuna valutazione finora

- Banking LawDocumento3 pagineBanking LawtrizahNessuna valutazione finora

- Advanced Banking Law Nov 2016Documento4 pagineAdvanced Banking Law Nov 2016Basilio MaliwangaNessuna valutazione finora

- Law Relating To Banking May 2015Documento5 pagineLaw Relating To Banking May 2015Basilio MaliwangaNessuna valutazione finora

- Answers To Quiz No 16Documento4 pagineAnswers To Quiz No 16Your Public ProfileNessuna valutazione finora

- Advanced Banking Law Nov 2010 Main PaperDocumento4 pagineAdvanced Banking Law Nov 2010 Main PaperBasilio MaliwangaNessuna valutazione finora

- Advanced Banking Law May 2010 Main PaperDocumento3 pagineAdvanced Banking Law May 2010 Main PaperBasilio MaliwangaNessuna valutazione finora

- Bar Exam Questions in Banking LawsDocumento54 pagineBar Exam Questions in Banking LawsKayzer SabaNessuna valutazione finora

- Law Relating To Banking Nov 2014 SolutionsDocumento8 pagineLaw Relating To Banking Nov 2014 SolutionsBasilio MaliwangaNessuna valutazione finora

- International Trade Finance - May 2015Documento6 pagineInternational Trade Finance - May 2015Basilio MaliwangaNessuna valutazione finora

- Credit Risk Assessment 1 - May 2015Documento6 pagineCredit Risk Assessment 1 - May 2015Basilio MaliwangaNessuna valutazione finora

- Advanced Banking Law May 2016Documento3 pagineAdvanced Banking Law May 2016Basilio MaliwangaNessuna valutazione finora

- Jea R. Sumalinog BS Legal Management: Gregorio - Leynes@mlqu - Edu.phDocumento7 pagineJea R. Sumalinog BS Legal Management: Gregorio - Leynes@mlqu - Edu.phJea SumalinogNessuna valutazione finora

- International Trade Finance November 2014Documento5 pagineInternational Trade Finance November 2014Basilio MaliwangaNessuna valutazione finora

- 2009 Bar QuestionsDocumento3 pagine2009 Bar QuestionskylebollozosNessuna valutazione finora

- Lecture 2 (Banking)Documento108 pagineLecture 2 (Banking)miles1280100% (1)

- 2018-JAIBB LPB NovDocumento3 pagine2018-JAIBB LPB NovMashiur RahmanNessuna valutazione finora

- MA0037Documento2 pagineMA0037Smu DocNessuna valutazione finora

- CM-Final-EMBA-15th BatchDocumento2 pagineCM-Final-EMBA-15th BatchMmonower HosenNessuna valutazione finora

- Banking - Bar QuestionsDocumento11 pagineBanking - Bar QuestionsGenelle Mae MadrigalNessuna valutazione finora

- Banking and AMLADocumento26 pagineBanking and AMLAMosarah AltNessuna valutazione finora

- Banking Law NotesDocumento3 pagineBanking Law NoteserickekutuNessuna valutazione finora

- Bar Examination 2010Documento9 pagineBar Examination 2010grapicartist phNessuna valutazione finora

- Can Banks Owe A Duty of Care To Non-Customers? - Yes, Says Court of Appeal in Koperasi Sahabat V RHB Investment Bank (2022) 6 MLJ 722Documento2 pagineCan Banks Owe A Duty of Care To Non-Customers? - Yes, Says Court of Appeal in Koperasi Sahabat V RHB Investment Bank (2022) 6 MLJ 722ngweien.nwe.nweNessuna valutazione finora

- BF 130Documento4 pagineBF 130Dixie CheeloNessuna valutazione finora

- 2007-2010 Banking Bar QuestionsDocumento4 pagine2007-2010 Banking Bar QuestionsNorhalisa Naga SalicNessuna valutazione finora

- Credit Risk Assessment 1 May 2011Documento5 pagineCredit Risk Assessment 1 May 2011Basilio MaliwangaNessuna valutazione finora

- Commlaw Quiz1 PDFDocumento2 pagineCommlaw Quiz1 PDFMa. Danice Angela Balde-BarcomaNessuna valutazione finora

- Firm C7 Workshop One (Banking)Documento22 pagineFirm C7 Workshop One (Banking)MUBANGIZI ABBYNessuna valutazione finora

- Banking Law Unit 2Documento36 pagineBanking Law Unit 2RHEA VIJU SAMUEL 1850355Nessuna valutazione finora

- International Trade Finance May 2010 Main PaperDocumento9 pagineInternational Trade Finance May 2010 Main PaperBasilio MaliwangaNessuna valutazione finora

- International Trade Finance Nov 2011 Main PaperDocumento6 pagineInternational Trade Finance Nov 2011 Main PaperBasilio MaliwangaNessuna valutazione finora

- Answers To Bar Questions in Banking 2003 To 1990Documento10 pagineAnswers To Bar Questions in Banking 2003 To 1990Maricar Corina CanayaNessuna valutazione finora

- International Trade Finance Nov 2010 Main PaperDocumento6 pagineInternational Trade Finance Nov 2010 Main PaperBasilio MaliwangaNessuna valutazione finora

- Chapter # 5: DepartmentalizationDocumento24 pagineChapter # 5: Departmentalizationanon_248950009Nessuna valutazione finora

- Credit Risk Assessment 1 - November 2015Documento8 pagineCredit Risk Assessment 1 - November 2015Basilio MaliwangaNessuna valutazione finora

- Bar Q&A For Banking Law: Bank Deposits Are Funds Obtained by A Bank From TheDocumento4 pagineBar Q&A For Banking Law: Bank Deposits Are Funds Obtained by A Bank From TheDon TiansayNessuna valutazione finora

- AB Legal Banking For BOB Clerical To Officer Promotion Exam PDFDocumento37 pagineAB Legal Banking For BOB Clerical To Officer Promotion Exam PDFNarayanan RajagopalNessuna valutazione finora

- 2013 Legal Framework of Banking BusinessDocumento143 pagine2013 Legal Framework of Banking BusinessdreaNessuna valutazione finora

- Commercial Law 2016 Bar Exams by Professor LoanzonDocumento43 pagineCommercial Law 2016 Bar Exams by Professor LoanzonLloyd ReyesNessuna valutazione finora

- Money CreationDocumento28 pagineMoney Creationathirah jamaludinNessuna valutazione finora

- Chapter 1 General BankingDocumento223 pagineChapter 1 General BankingPushpa Kumari singhNessuna valutazione finora

- Forgery QUESTION: (BAR 2009)Documento2 pagineForgery QUESTION: (BAR 2009)Crystal Gale DSNessuna valutazione finora

- JAIIB Paper 3 Module A Regulations and Compliance PDFDocumento28 pagineJAIIB Paper 3 Module A Regulations and Compliance PDFstudy studyNessuna valutazione finora

- JAIIB Principles and Practices of Banking Q & ADocumento13 pagineJAIIB Principles and Practices of Banking Q & ARahul FouzdarNessuna valutazione finora

- 2 LawsRelatingDocumento1 pagina2 LawsRelatinghirazahid56Nessuna valutazione finora

- FIRM A2-WORKSHOP 1-Corporate & Commercial Practice-Term 3-Week 2Documento43 pagineFIRM A2-WORKSHOP 1-Corporate & Commercial Practice-Term 3-Week 2MUBANGIZI ABBYNessuna valutazione finora

- International Trade Finance Stella - Nov 2016Documento4 pagineInternational Trade Finance Stella - Nov 2016Basilio MaliwangaNessuna valutazione finora

- Conservatorship and Receivership DigestDocumento14 pagineConservatorship and Receivership Digestmelaniem_1Nessuna valutazione finora

- Banking Laws Bar Qs CompiledDocumento16 pagineBanking Laws Bar Qs CompiledMing YaoNessuna valutazione finora

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaDa EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNessuna valutazione finora

- Building A Successful Marriage - Bishop David OyedepoDocumento117 pagineBuilding A Successful Marriage - Bishop David Oyedepoemmanueloduor83% (12)

- Boy Meets Girl - Say Hello To Courtship - 180532 PDFDocumento570 pagineBoy Meets Girl - Say Hello To Courtship - 180532 PDFNash Perez100% (1)

- 555 Difficult Bible Questions AnsweredDocumento665 pagine555 Difficult Bible Questions Answeredfer753100% (4)

- Angels On Assignment - GOD's Rel - Perry StoneDocumento176 pagineAngels On Assignment - GOD's Rel - Perry StoneBasilio MaliwangaNessuna valutazione finora

- 101 Weapons of Spiritual Warfar - D. K. Olukoya-1Documento557 pagine101 Weapons of Spiritual Warfar - D. K. Olukoya-1Basilio Maliwanga100% (16)

- Breakthrough! Develop The 7 HabitsDocumento182 pagineBreakthrough! Develop The 7 HabitsBasilio MaliwangaNessuna valutazione finora

- Englisch Schwer Letter-Of-Motivation Audio-1Documento2 pagineEnglisch Schwer Letter-Of-Motivation Audio-1Basilio MaliwangaNessuna valutazione finora

- A Closer Talk With God - Prayers - Kim TrujilloDocumento70 pagineA Closer Talk With God - Prayers - Kim TrujilloBasilio MaliwangaNessuna valutazione finora

- Your Spiritual Weapons and How - Terry LawDocumento64 pagineYour Spiritual Weapons and How - Terry LawBasilio MaliwangaNessuna valutazione finora

- How To Draw Comics ComicDocumento34 pagineHow To Draw Comics ComicGweedoFukin Weedo91% (11)

- 7 QUALITIES WISE MEN WANT Kingsley OkonkwoDocumento60 pagine7 QUALITIES WISE MEN WANT Kingsley OkonkwoNdip Smith100% (5)

- Handbook of DrawingDocumento302 pagineHandbook of DrawingTucc195% (22)

- You're Supposed To Be Wealthy HowDocumento231 pagineYou're Supposed To Be Wealthy HowBasilio Maliwanga100% (1)

- Drawing Basics - 26 Free Beginner Drawing Techniques PDFDocumento14 pagineDrawing Basics - 26 Free Beginner Drawing Techniques PDFDavid FonsecaNessuna valutazione finora

- (Ebook - PDF - Graphic Design) - Learn How To DrawDocumento133 pagine(Ebook - PDF - Graphic Design) - Learn How To DrawBalachandran NavaratnasamyNessuna valutazione finora

- Colored Pencil Step by StepDocumento64 pagineColored Pencil Step by StepAndre Beaureau70% (37)

- The New Drawing On The Right Side of The BrainDocumento314 pagineThe New Drawing On The Right Side of The BrainBasilio MaliwangaNessuna valutazione finora

- Red de Artistas Tecnicas Shadow PDFDocumento33 pagineRed de Artistas Tecnicas Shadow PDFpilar ortizNessuna valutazione finora

- 01 Helping Your Child Become A Reader ReaderDocumento54 pagine01 Helping Your Child Become A Reader Readerapi-309082881Nessuna valutazione finora

- Colored Pencil Step by StepDocumento64 pagineColored Pencil Step by StepAndre Beaureau70% (37)

- Lets Draw EquipmentDocumento13 pagineLets Draw EquipmentAugustoEscobar RivasNessuna valutazione finora

- CFR Exam GuideDocumento32 pagineCFR Exam GuideNkopane MonahengNessuna valutazione finora

- (Ebook - PDF - Graphic Design) - Learn How To DrawDocumento133 pagine(Ebook - PDF - Graphic Design) - Learn How To DrawBalachandran NavaratnasamyNessuna valutazione finora

- CFR Exam GuideDocumento32 pagineCFR Exam GuideNkopane MonahengNessuna valutazione finora

- WealthDocumento40 pagineWealthapi-310517163Nessuna valutazione finora

- Description: Tags: SucceedDocumento48 pagineDescription: Tags: Succeedanon-439343Nessuna valutazione finora

- Description: Tags: CitizenDocumento43 pagineDescription: Tags: Citizenanon-313818Nessuna valutazione finora

- Are Your Finances Ready For A Stressful Life Event?: Also InsideDocumento8 pagineAre Your Finances Ready For A Stressful Life Event?: Also InsideBasilio MaliwangaNessuna valutazione finora

- Finance: PersonalDocumento44 pagineFinance: PersonalBasilio MaliwangaNessuna valutazione finora

- Sec Questions Investors Should AskDocumento20 pagineSec Questions Investors Should Askhaha2012Nessuna valutazione finora

- The List of Official United States National SymbolsDocumento3 pagineThe List of Official United States National SymbolsВікторія АтаманюкNessuna valutazione finora

- Composition Notes Essay C1 and C2Documento7 pagineComposition Notes Essay C1 and C2Γιάννης ΜατσαμάκηςNessuna valutazione finora

- Essential Real AnalysisDocumento459 pagineEssential Real AnalysisPranay Goswami100% (2)

- Painter Gary Woo - Oct 19 Talk by Yolanda Garfias WooDocumento2 paginePainter Gary Woo - Oct 19 Talk by Yolanda Garfias WooChinese Historical Society of America MuseumNessuna valutazione finora

- System of Units: Si Units and English UnitsDocumento7 pagineSystem of Units: Si Units and English UnitsJp ValdezNessuna valutazione finora

- Sony Ht-ct390 Startup ManualDocumento1 paginaSony Ht-ct390 Startup Manualalfred kosasihNessuna valutazione finora

- Prosthetic Aspects of Dental Implants - IIDocumento73 pagineProsthetic Aspects of Dental Implants - IIKomal TalrejaNessuna valutazione finora

- Auditing The Purchasing Process: Mcgraw-Hill/IrwinDocumento18 pagineAuditing The Purchasing Process: Mcgraw-Hill/IrwinFaruk H. IrmakNessuna valutazione finora

- Fabled 6Documento75 pagineFabled 6joaamNessuna valutazione finora

- Project Presentation (142311004) FinalDocumento60 pagineProject Presentation (142311004) FinalSaad AhammadNessuna valutazione finora

- A Day in The Life of A Scrum MasterDocumento4 pagineA Day in The Life of A Scrum MasterZahid MehmoodNessuna valutazione finora

- NLP - Neuro-Linguistic Programming Free Theory Training Guide, NLP Definitions and PrinciplesDocumento11 pagineNLP - Neuro-Linguistic Programming Free Theory Training Guide, NLP Definitions and PrinciplesyacapinburgosNessuna valutazione finora

- Distribution Optimization With The Transportation Method: Risna Kartika, Nuryanti Taufik, Marlina Nur LestariDocumento9 pagineDistribution Optimization With The Transportation Method: Risna Kartika, Nuryanti Taufik, Marlina Nur Lestariferdyanta_sitepuNessuna valutazione finora

- RONIN Hold The BridgeDocumento3 pagineRONIN Hold The BridgekamaeqNessuna valutazione finora

- MoncadaDocumento3 pagineMoncadaKimiko SyNessuna valutazione finora

- Chicago Citation and DocumentDocumento8 pagineChicago Citation and DocumentkdemarchiaNessuna valutazione finora

- CHAPTER 15 Rizal's Second Journey To ParisDocumento11 pagineCHAPTER 15 Rizal's Second Journey To ParisVal Vincent M. LosariaNessuna valutazione finora

- (Susan Harris-Hümmert) Evaluating Evaluators An (BookFi)Documento299 pagine(Susan Harris-Hümmert) Evaluating Evaluators An (BookFi)Muhammad FitrahullahNessuna valutazione finora

- Highway MidtermsDocumento108 pagineHighway MidtermsAnghelo AlyenaNessuna valutazione finora

- PRTC Tax Final Preboard May 2018Documento13 paginePRTC Tax Final Preboard May 2018BonDocEldRicNessuna valutazione finora

- Faqs Harvest Moon BTNDocumento245 pagineFaqs Harvest Moon BTNMurloc NightcrawlerNessuna valutazione finora

- Corruption in Indian ContextDocumento54 pagineCorruption in Indian ContextddevarshiNessuna valutazione finora

- Purposive Communication GROUP 9Documento61 paginePurposive Communication GROUP 9Oscar DemeterioNessuna valutazione finora

- 7th Sea CCG - Broadsides SpoilersDocumento19 pagine7th Sea CCG - Broadsides SpoilersmrtibblesNessuna valutazione finora

- New Norms of Upper Limb Fat and Muscle Areas For Assessment of Nutritional StatusDocumento6 pagineNew Norms of Upper Limb Fat and Muscle Areas For Assessment of Nutritional StatusDani Bah ViNessuna valutazione finora

- Ijara-Based Financing: Definition of Ijara (Leasing)Documento13 pagineIjara-Based Financing: Definition of Ijara (Leasing)Nura HaikuNessuna valutazione finora

- CASE STUDY GGHDocumento4 pagineCASE STUDY GGHSanthi PriyaNessuna valutazione finora

- Hamlet Test ReviewDocumento3 pagineHamlet Test ReviewAnonymous 1iZ7ooCLkj100% (2)

- Dergiler Ingilizce Okuma Gramer NotlariDocumento753 pagineDergiler Ingilizce Okuma Gramer NotlarierdemNessuna valutazione finora

- Addendum PDFDocumento2 pagineAddendum PDFIbaiMitxelenaSanchezNessuna valutazione finora