Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Conditii Generale de Afaceri en PDF

Caricato da

RobertTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Conditii Generale de Afaceri en PDF

Caricato da

RobertCopyright:

Formati disponibili

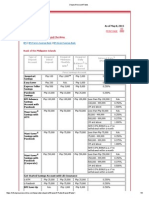

CONDITII GENERALE DE AFACERI/

GENERAL BUSINESS CONDITIONS

Rev.32/13.12.2019

INTRODUCERE PREAMBLE

Prezentele Conditii Generale de Afaceri (denumite in These General Business Conditions (“GBC”) govern the

continuare „CGA”) reglementeaza cadrul general de general framework for the contract relations between

desfasurare a raporturilor contractuale dintre UniCredit UniCredit Bank SA, a company administered in a two-tier

Bank SA, societate administrata in sistem dualist, cu system, having its registered offices in Romania,

st

sediul in Romania, Bucuresti, Bulevardul Expozitiei nr. Bucharest, 1F Expozitiei Blvd., 1 District, registered with

1F, inregistrata in Registrul Comertului sub nr. the Trade Register under no. J40/7706/1991, with the

J40/7706/1991, in Registrul Bancar sub nr.RB-PJR-40- Banking Register under no.RB-PJR-40-011/18.02.1999, ,

011/18.02.1999 , cod unic de inregistrare 361536, sole registration code 361536, fiscal attribute RO,

atribut fiscal RO, Identificator Unic la Nivel European European Unique Identifier (EUID):

(EUID): ROONRC.J40/7706/1991 capital social subscris ROONRC.J40 / 7706/1991, subscribed and paid

si varsat 455.219.478,30 Lei, prin unitatile sale registered capital of Lei 455.219.478,30, by means of its

teritoriale (denumita in continuare “Banca”) si Clientii territorial units (the “Bank”) and its Clients, legal entities,

sai, persoane juridice (denumiti in continuare “Client”). (the “Client”). The supervisory authority of the Bank is the

Autoritatea de supraveghere a Bancii este Banca National Bank of Romania (NBR), with registered offices

Nationala a Romaniei (BNR), cu sediul central in in Romania, Bucharest, 25 Lipscani Street, sector 3, and

Romania, Bucuresti, strada Lipscani nr.25, sector 3, cod postal code 030031.

postal 030031.

Baza relatiilor de afaceri dintre Client si Banca este The business relations between the Client and the Bank

increderea reciproca. CGA au valoare de contract, fiind are based on mutual trust. The GBC have the value of an

obligatorii pentru parti, si sunt incheiate pe o perioada agreement, are mandatory for the parties, and are

nedeterminata. In relatia de afaceri, urmatorii termeni se concluded for an undetermined period. Within the

vor interpreta dupa cum urmeaza: business relationship, the following terms shall be

construed as following:

„Client” reprezinta orice persoana juridica sau entitate ”Client” means any legal entity, or any entity with/ without

cu/ fara personalitate juridica care are achizitionat cel legal personality that has purchased at least one

putin un produs/ serviciu al Bancii. product/service of the Bank

„Contract specific” reprezinta contractul prin care ”Specific Agreement” means the agreement under

Clientul achizitioneaza un produs/ serviciu al Bancii. which the Client purchases a product/service of the Bank

„Contract-cadru” („Contract pentru de deschidere de “Framework Agreement” means the payment services

cont pentru persoane juridice”/Contract pentru furnizarea agreement concluded between the Bank and the Client,

produselor si serviciilor bancare ) reprezinta contractul under which payment operations are performed, including

de servicii de plata incheiat intre Banca si Client, prin the GBC and the General Conditions of Use.

care se executa operatiuni de plati si incasari. Contractul

cadru include si prezentele CGA. “Account” – a banking account, including a Payment

“Cont” reprezinta un cont bancar, inclusiv contul curent/ account which is used to highlight all available funds of

contul de plati, in care sunt evidentiate dupa caz the Client and/or the amounts the Bank places at his

disponibilitatile banesti ale Clientului si/sau sumele puse disposal

de Banca la dispozitia acestuia . “Current Account/Payment account” - an account held

„Cont curent/Cont de plati” reprezinta un cont detinut by the Client or on his behalf which is used for the

de Client, care este utilizat pentru executarea execution of payment transactions;

Operatiunilor de plati. “Online Payment account”– the Payment account that

„Contul de plăți accesibil online” reprezinta un cont de can be accessed by the Customer through an online

plăți care poate fi accesat de către Client prin intermediul interface (BussinesNet Services).

unei interfețe online (eg. BussinesNet ) ”Value Date” means the reference date being used by

„Data de valuta” reprezinta data de referinta utilizata de the Bank in order to calculate the interest on the funds

catre Banca pentru a calcula dobanda aferenta fondurilor debited from or credited to the Client’s account.

debitate sau creditate din/in contul Clientului.

„Descoperit neautorizat de cont” reprezinta depasirea ”Unauthorised Overdraft” means the exceeding of the

disponibilului din conturile de orice tip ale Clientului cu available funds in any type of accounts of the Client by

valoarea comisioanelor, taxelor, dobanzilor, oricaror the value of the fees, charges, interests, or any amounts

Conditii Generale de Afaceri [rev.32] Pagina/Page 1 / 37

General Business Conditions

sume datorate Bancii ca urmare a utilizarii oricarui being owed to the Bank as result of using any

produs/ serviciu pus la dispozitie de catre Banca. product/service provided by the Bank.

„Operatiuni de plati” reprezinta actiunea initiata de ”Payment transaction” means an action being initiated

platitor sau in numele platitorului sau de beneficiarul by the payer or in the name of the payer or by the payee

platii cu scopul de a depune, transfera sau retrage for the purpose of placing, transferring or withdrawing

fonduri dintr-un cont de plati utilizat in acest scop. funds from a payment account used for this purpose.

„Zi lucratoare” reprezinta orice zi a saptamanii, mai ”Business Day” means any day of the week, except for

putin sambata, duminica si orice sarbatoare nationala Saturdays, Sundays and any national and/or legal

si/sau legala, in care institutiile de credit din Romania holiday, on which the Romanian credit institutions are

sunt deschise pentru public si efectueaza activitati open for public and perform banking activities. Regarding

bancare. In ceea ce priveste operatiunile de plati, „ziua the payment operations, “business day” means any day

lucratoare” reprezinta orice zi a saptamanii in care of the week in which the Bank can execute, according to

Banca le poate executa, conform orelor limita specifice its cut-off-time, as they are communicated to the Client by

fiecarui tip de operatiune (cut-off-time), asa cum sunt displaying or other ways.

comunicate Clientului prin afisare sau alte mijloace.

„Program de lucru cu publicul” reprezinta perioada ”Public Working Hours” means the period of a Business

din ziua lucratoare in care Banca permite accesul Day during which the Bank allows the Client’s legal

reprezentantului legal al Clientului in incinta unitatilor representative to access the premises of its territorial

sale teritoriale in vederea efectuarii operatiunilor units in order to perform banking operations, according to

bancare, conform orelor limita specifice fiecarui tip de the limit hours that are specific for each and every

operatiune (cut-off time), asa cum sunt comunicate operation type (cut-off time) as notified to the Client by

Clientului prin afisare sau alte mijloace. posting, or by other means.

Prestator de servicii de plata tert – un prestator de “Third Party Payment Service Provider” (TPP)– a third

servicii de plata, altul decat Banca, autorizat de Banca party other than the Bank, licensed by the National Bank

Nationala a Romaniei sau de o autoritatea competenta of Romania or any other National Competent Authority

dintr-un stat membru al Uniunii Europene sa presteze from European Union to provide account information

servicii de informare cu privire la conturi si/sau servicii de service and/or payment initiation service and/or funds

initiere a platii si/sau servicii de confirmare disponibilitate check service.

fonduri.

Serviciu de informare cu privire la conturi - serviciu “Account Information Service” (AIS)- an online service

online, prestat de un Prestator de servicii de plată terț ensured by a Third Party Payment Service Provider

(altul decât Banca), ce furnizează informații consolidate (other than the Bank) through which consolidated

în legătură cu unul sau mai multe Conturi de plăți information on one or more payment accounts held by

accesibil online deținute de Client la Bancă și/sau la mai the Client with the Bank or either another payment

mulți prestatori de servicii de plată. service provider or with more than one payment service

Serviciu de inițiere a plății - serviciu de inițiere a unui provider is provided.

Ordin de plată cu privire la un Cont de plăți accesibil “Payment Initiation Service” (PIS) - a service provided

online deținut de Client la Bancă, prestat de un prestator by a Third Party Payment Service Provider (other than

de servicii de plată terț (altul decât Banca), la cererea the Bank) to initiate a payment order ,with respect to a

Clientului. Payment account accessible online held by the Client at

the Bank, at the Client’s request.

I. Deschiderea si administrarea conturilor I. Account opening and management

Art.1 Titularul contului Art. 1 Account holder

(1) La deschiderea unui cont, trebuie sa se indice (1) Upon opening an account, the Client that is the

denumirea Clientului care este titularul contului si care account holder shall identify according to the law.

trebuie sa se identifice corespunzator.

(2) Clientul va fi reprezentat prin persoane autorizate sa (2) The Client shall be represented by persons being

angajeze valabil societatea. Clientul poate numi authorised to validly bind the company. The Client may

persoane imputernicite sa opereze pe cont in limitele appoint persons to be authorized to operate by the

legale si statutare. account within the limits under the law, and under the

articles of association of the company.

(3) Mandatul acordat imputernicitilor se poate referi (3) The powers to be granted to the attorneys-in-fact may

inclusiv la limitele de cheltuieli aferente instrumentului also refer to expenses limits related to the payment

de plata utilizat de catre acestia, conform contractului instrument to be used by them under the Specific

Conditii Generale de Afaceri [rev.32] Pagina/Page 2 / 37

General Business Conditions

specific aferent produsului contractat, sau la transferul Agreement related to the contracted product, or to the

contului intre unitatile teritoriale ale Bancii sau la account transfer between the territorial units of the Bank,

inchiderea de cont. or to the account closing.

(4) Prezentele Conditii Generale de Afaceri sunt (4) Should the Client have appointed a representative,

opozabile si imputernicitilor Clientului. the present GBC shall also apply to it the same.

Art.2 Deschiderea conturilor Art. 2 Account opening

(1) Deschiderea conturilor plati/ curente si a altor (1) The opening of current/payment and other account

tipuri de cont (depozit, escrow etc.), in moneda types (deposit, escrow, etc.) in the national currency

nationala si/sau in orice alta moneda, se face conform and/or in any other currency, shall be performed under

procedurilor interne ale Bancii si a reglementarilor the internal procedures of the Bank, and under the legal

legale in vigoare, cu conditia respectarii de catre regulations in force, provided that the Client follows the

Client a regulilor stabilite de catre Banca pentru rules having been set by the Bank for the opening of such

deschiderea acestor tipuri de conturi, in baza accounts based on the documents being required by the

documentelor solicitate de catre Banca. Bank.

(2) Banca poate refuza cererea de deschidere de cont, (2) The Bank may decline the account opening

nefiind obligata sa motiveze acest refuz. application, and shall have no obligation to give reasons

for such decision.

(3) Persoanele imputernicite sa opereze pe cont in (3) The persons being authorised to operate by the

numele Clientului vor furniza Bancii documentele account in the name of the Client shall provide the Bank

solicitate de aceasta si isi vor depune specimenul de with the required documents, and shall file their signature

semnatura la Banca. samples with the Bank.

(4) Banca va permite efectuarea de operatiuni pe cont (4) The Bank shall only allow operations to be performed

numai in baza semnaturilor persoanelor autorizate sa on the account based on the signatures of the persons

efectueze operatiuni pe cont si in limita mandatului being authorised to perform operations on the account,

dat de catre Client. Specimenele de semnaturi depuse and within the limits of their powers as granted by the

la Banca sunt valabile pana la inlocuire/ revocare in Client. The signature specimens having been filed with

scris. the Bank are valid until replaced/revoked in writing.

(5) In cazul in care Banca ia cunostinta, prin orice (5) Should the Bank become aware by any means of the

mijloace, despre aparitia unor divergente/ conflicte/ occurrence of frictions/ conflicts/ differences of any nature

neintelegeri de orice natura intre asociatii/ actionarii/ between the partners/ shareholders/ directors/ attorneys-

administratorii/ imputernicitii Clientului, Banca are dreptul in-fact of the Client, the Bank shall be entitled to suspend

sa suspende nelimitat executarea oricarei instructiuni on an unlimited basis the performance of any direction

(ex.: creditarea/ debitarea contului, instructiuni in temeiul (e.g. account crediting/debiting, instructions based on any

oricarui contract specific incheiat cu Banca etc.), pana la Specific Agreement concluded with the Bank, etc.), until

lamurirea situatiei in baza unor acte in forma si the situation is sorted out based on documents in a form

substanta satisfacatoare pentru Banca. Daca intr-o and substance the Bank deems satisfactory. Should the

perioada de timp rezonabil situatia nu este clarificata, situation be not sorted out within a reasonable period of

Banca poate decide incetarea raporturilor contractuale. time the Bank may decide to terminate the contractual

Clientul exonereaza Banca de orice raspundere pentru relationship. The Client exonerates the Bank from any

pierderile pe care Clientul le-ar putea suferi ca urmare a liability for the losses the Client might suffer as result of

aparitiei unei astfel de situatii. such a situation arising.

(6) Orice operatiune de plata (ex. incasari, plati, (6) Any payment operation (e.g. collection, payments,

retrageri/ depuneri de numerar etc.) se efectueaza d e cash withdrawing/ depositing etc.) shall be performed by

catre Client prin intermediul contului curent /contului de the Client means of the current account opened with the

plati deschis la Banca, cu exceptia situatiilor in care prin Bank except in situations where in the Specific

Contractele specifice s-a stabilit altfel. Agreements has been otherwise established.

Art.3 Modificari ale datelor de identificare ale Art.3 Changes to the Client’s identification data

Clientului

(1) Clientul are obligatia sa informeze Banca, in scris si (1) The Client has the obligation to immediately notify the

imediat, prezentand documentele justificative aferente, Bank in writing, also producing the relevant supporting

despre orice modificari aparute in situatia sa (referitoare, documents, about any changes to its status (referring

dar fara a se limita la date de identificare/ autorizatie de without limitation to identification information / operation

functionare/ date din actul constitutiv/ reprezentanti legali/ authorisation/ information within the articles of

drepturi de semnatura in relatia cu Banca si/sau tertii/ incorporation/ legal representatives/ signature rights in

forma juridica/ capacitate juridica), a documentelor/ relation to the Bank and/or third parties/ legal form/ legal

informatiilor ce au stat la baza deschiderii de cont, capacity), of the documents/ information which are

Conditii Generale de Afaceri [rev.32] Pagina/Page 3 / 37

General Business Conditions

respectiv la baza acordarii produsului/serviciului bancar, relevant for the account opening, respectively for granting

precum si orice alte documente/ informatii care sunt of banking products/services, and of any other

relevante in relatia cu Banca. Modificarile considerate documents/ information that are relevant for the

conform legii ca fiind publice trebuie de asemenea relationship with the Bank. Any changes that under the

notificate Bancii in scris si imediat. Banca nu raspunde in law are considered public must also be immediately

nici un fel de eventualele prejudicii suferite de Client sau notified to the Bank in writing. The Bank shall in no way

de terti ca urmare a comunicarii cu intarziere a be liable for the possible damages to be suffered by the

modificarilor survenite si a actelor justificative aferente Client or by third parties as result of late notifying about

sau a necomunicarii lor. the changes to have occurred, or of a failure to notify

about the same.

(2) Comunicarea modificarilor de mai sus este (2) The notification about changes as mentioned above

opozabila Bancii incepand cu ziua lucratoare shall be opposable to the Bank starting with the Business

urmatoare primirii de catre Banca a informarii, dovedita Day following the receipt by the Bank of the notice as

prin stampila de inregistrare a Bancii, aplicata pe copia evidenced by the registration stamp of the Bank on the

Clientului, sau prin confirmarea de primire semnata de duplicate of the Client or by the receipt confirmation

Banca. Orice comunicare primita in afara Programului de signed by the Bank. Any notice to be received outside the

lucru cu publicul se considera primita incepand cu Public Working Hours shall be deemed received starting

urmatoarea Zi lucratoare. with the next Business Day.

Art.4 Depozite Art.4 Deposits

(1) La cererea Clientului, Banca poate constitui depozite (1) By request from the Client the Bank may establish

in moneda nationala si/sau alta moneda, pentru suma si deposits in the national and/or other currency with the

termenul indicate de catre Client in instructiunile de amount and the term as stated by the Client within the

constituire a unui depozit bancar. directions for establishing a bank deposit.

(2) Depozitele constituite de catre Client la Banca vor fi (2) The deposits to be established by the Client with the

guvernate de catre termenii si conditiile agreate pentru Bank shall be governed by the terms and conditions as

Depozite intre Banca si Client, cat si de prezentele CGA. agreed upon for Deposits between the Bank and the

Client, as well as by these GBC.

Art.5 Operatiuni pe cont cu acceptul/ la instructiunile Art.5 Account operations by consent/ direction from

Clientului the Client

5.1 Instructiunile de orice tip (incasari, plati etc.) se pot 5.1 Directions of any type (collection, payments, etc.)

receptiona in format fizic de catre Banca, in vederea may only be received by the Bank in physical format, in

executarii acestora (creditarii/ debitarii) pe/din conturile order to be performed (crediting/debiting) by/from the

Clientului, numai in Zilele lucratoare, in timpul accounts of the Client, on business days during the public

Programului de lucru cu publicul si cu respectarea orelor working hours, and in observing the limit receipt time

limita de primire (cut-off time) pentru fiecare tip de (cut-off time) for each and every direction type, as notified

instructiune, asa cum sunt aduse la cunostinta Clientului to the Client by the Bank. The instructions sent to the

de catre Banca. Instructiunile transmise Bancii de catre Bank by the Client using different ways (e.g electronic

Client in alt mod (ex printr-un canal electronic), se vor channel) will be received and executed in accordance

receptiona si executa in conformitate cu prevederile with the specific Contracts, according to its cut-off-time,

Contractelor specifice, conform orelor limita specifice as they are communicated to the Client by displaying or

fiecarui tip de operatiune (cut-off time), asa cum sunt other ways.

comunicate Clientului prin afisare sau alte mijloace.

5.2 Orice operatiune de plata va fi executata de catre 5.2 Any payment operation shall be performed by the

Banca exclusiv in baza Codului unic, asa cum este Bank exclusively based on the Sole Code as defined

definit mai jos, iar raspunderea Bancii este limitata la below, and the liability of the Bank shall be limited to

executarea operatiunii de plata in conformitate cu Codul performing the payment operation in accordance with the

unic furnizat de catre Client, indiferent de celalalte Sole Code as provided by the Client notwithstanding the

informatii suplimentare primite de catre Banca other additional information received by the Bank

(referitoare la platitor, Client, tranzactie etc.). (regarding the payer, the Client, the transaction, etc).

5.3 Banca poate refuza efectuarea operatiunilor de 5.3 The Bank may decline performing payment

plata: a) in cazul in care informatiile solicitate si operations: a) in the case where the information

furnizate de Client sunt ilizibile, incomplete sau requested and provided by the Client is illegible,

incorecte, b) daca Clientul nu pune la dispozitia Bancii, incomplete or incorrect, b) should the Client do not

la cererea acesteia, ori de cate ori aceasta considera provide the Bank, by request from the same, whenever

necesar, orice documente si/sau declaratii considerate the same would so deem necessary, any documents

Conditii Generale de Afaceri [rev.32] Pagina/Page 4 / 37

General Business Conditions

necesare pentru justificarea operatiunilor derulate prin and/or statements deemed required in order to justify the

Banca si/sau determinarea situatiei reale a Clientului, operations being performed by means of the Bank and/or

c) daca operatiunea nu este in conformitate cu legile to determine the actual condition of the Client, c) should

aplicabile (inclusiv reglementarile valutare in vigoare), the operation do not comply with the applicable laws

regulamentele si practicile bancare sau Banca are (including foreign exchange regulations in force),

suspiciuni cu privire la scopul sau natura tranzactiei (de regulations and banking practices, or should the Bank

ex. operatiunea are conexiuni cu tranzactii de finantare a have doubts regarding the purpose or the nature of the

actelor de terorism sau spalare de bani), d) daca transaction (for example, the operation is in connection

operatiunea de plata este derulata prin/ catre tari cu care with a terrorist financing or money-laundering

Banca nu colaboreaza, datorita prevederilor legale sau transaction), d) should the payment operation be

regulamentelor si politicii Bancii, e) daca operatiunea performed through/towards countries the Bank does not

implica, direct sau indirect, o conexiune cu unul din cooperate with due to the legal provisions, or to the

elementele ce sunt subiect al unor Sanctiuni sau care regulations and policies of the Bank, e) if the operation

contravin regulamentelor si politicii Bancii si ale Grupului involves, directly or indirectly, a connection with one of

UniCredit, precum, insa nu in mod limitativ reprezentate the items that are the subject of certain Sanctions or that

de valuta operatiunii, persoane, entitati, teritorii sau tari, are inconsistent with the regulations and policies of the

bunuri, servicii sau tehnologie, f) daca operatiunea de Bank and the UniCredit Group, such as, but not limited,

plata este initiata prin intermediul unui Prestator tert de to the currency of the operation, persons, entities,

servicii de inițiere a plății, din motive justificate legate de territories or countries, goods, services or technology,

initierea neautorizata sau frauduloasa a operatiunii f) if the payment transaction is initiated through an

conform prevederilor legale în vigoare. Intr-o astfel de Payment Initiation Service Provider, for justified reasons

situatie, Banca va informa Clientul, in modul convenit in related to the unauthorized or fraudulent initiation of the

Contractele specifice si/sau prezentele CGA, notificarea transaction in accordance with the legal provisions in

de refuz si motivele refuzului daca este posibil, inainte de force. In such a case, the Bank shall inform the Client, as

refuz si, cel mai tarziu, imediat dupa acesta in masura in agreed in the Specific Agreements and / or in the present

care prevederile legislative permit/ nu interzic. Banca va document (GBC), with the refusal notification and the

permite accesul la contul de plati odata ce motivele de reasons for the refusal if possible, before the refusal and

blocare inceteaza sa mai existe. at the latest, immediately after the refusal, in case the

provisions allow it / do not prohibit it. The bank will allow

access to the payment account once the reasons for the

refusal cease to exist.

5.4 Instructiuni de incasare 5.4 Collection instructions

(1) Pe durata relatiilor de afaceri, Banca este irevocabil (1) During the business relationship, the Bank shall be

abilitata sa accepte incasari pentru Client. irrevocably entitled to accept amounts for collection for

the Client.

(2) Pentru procesarea de catre Banca a incasarilor, (2) In order for the Bank to perform collections, the

urmatoarele informatii trebuie sa fie receptionate de following information need to be cumulatively received by

catre Banca cumulativ: a) codul unic de identificare the Bank: a) the sole identification code as required for

necesar pentru executarea corecta a incasarii (denumit the proper performance of the collection (referred to in

in prezentele CGA „Codul unic”), alcatuit din: the present GBC as the “Sole Code”), which is formed of:

( i) numarul de cont deschis de Client la Banca sau (i) the number of the account opened by the Client with

codul IBAN – International Bank Account Number the Bank, or the related IBAN code – International Bank

aferent si (ii) codul de identificare al Bancii (BIC/ SWIFT) Account Number, and (ii) the identification code of the

– BACXROBU; b) informatii complete cu privire la Bank (BIC/SWIFT) – BACXROBU; b) complete

platitor: nume, numar de cont/IBAN si adresa, care information regarding the payer: name, account

poate fi inlocuita cu data si locul nasterii, numarul de number/IBAN, and address, which may be replaced by

identificare al platitorului sau numarul national de the birth date and place, the payer’s identification number

identitate. or the national identity number.

(3) Clientul si Banca convin de comun acord ca Banca (3) The Client and the Bank hereby mutually agree that

este indreptatita sa perceapa din fondurile transferate, the Bank is entitled to deduct the value of the fees/

contravaloarea comisioanelor/ taxelor aferente incasarii, charges related to the collection from the amounts

inainte de a credita contul Clientului cu suma transferred before crediting it to the Client's account. The

respectiva. Banca va evidentia separat valoarea totala Bank shall separately record the aggregate value of the

a operatiunii de plata si comisioanele/ taxele percepute. payment transaction and the collected fees/charges.

(4) Banca, in calitate de prestator de servicii de plata al (4) The Bank, as payment services provider for the payee

Clientului beneficiar al platii, transmite prestatorului de Client, shall deliver a payment order initiated by or

servicii de plata al platitorului ordinul de plata initiat de through the payee Client to the payer’s payment service

catre sau prin intermediul Clientului, in termenele provider, within the time limits agreed upon between the

Conditii Generale de Afaceri [rev.32] Pagina/Page 5 / 37

General Business Conditions

convenite intre Client si Banca, astfel incat plata sa payee Client and the Bank, enabling settlement, as far as

poata fi facuta, in ceea ce priveste debitarea directa, la direct debiting is concerned, on the agreed due date.

data scadenta convenita.

(5) Pe durata relatiilor de afaceri, Banca este irevocabil (5) During business relationship, the Bank is irrevocably

si neconditionat mandatata de catre Client sa accepte pe and unconditionally authorised by the Client to accept on

contul acestuia depuneri de numerar, inclusiv din partea the account of the same cash deposits, including from

unor terti, Clientul si/ sau deponentul fiind direct third parties, and the Client and/or the depositor shall be

raspunzatori pentru aceasta operatiune din punct de directly liable for such transaction from the standpoint of

vedere al legislatiei romane, precum si pentru the Romanian legislation, as well as for providing the

prezentarea documentelor si/sau declaratiilor documents and/or declarations required in order to justify

considerate necesare pentru justificarea depunerilor de the cash deposits. Cash deposits made on the account of

numerar. Depunerile in numerar efectuate pe contul the Client shall be credited and remunerated with the

Clientului vor fi creditate si remunerate cu coeficientul relevant interest coefficient starting with the depositing

corespunzator de dobanda din ziua depunerii. date. Cash deposits made on Saturdays or Sundays will

Depunerile de numerar efectuate sambata sau duminica be processed with value date on the next Business Day.

se proceseaza avand data de valuta a Zilei lucratoare

imediat urmatoare.

(6) Banca va credita contul Clientului dupa ce aceasta a (6) The Bank shall credit the Client’s account after it has

primit fondurile. Data valutei creditarii contului Clientului received the funds. The value date of crediting the

nu este ulterioara Zilei lucratoare in care valoarea account is not subsequent to the Business day in which

Operatiunii de plata este creditata in contul Bancii in the amount of the payment transaction is credited to the

Bank's account except the following situations: i) there is

cazul in care: (i) nu exista o conversie monetara, (ii)

no currency conversion, (ii) there is a conversion

exista o conversie monetara intre EUR si o monedă unui between EUR and a currency of an EU Member State

stat membru UE (Uniunea Europeana)/sau intre doua (EU) / or between two EU Member States' currencies.

monede ale statelor membre UE.

5.5 Instructiuni de transfer/ plata 5.5 Transfer/ Payment instructions

(1) Banca va efectua platile in conformitate cu (1) The Bank shall execute payments according to the

instructiunile Clientului, daca sunt indeplinite cumulativ instructions of the Client if the following requirements are

urmatoarele conditii: a) instructiunile sunt intocmite in cumulatively met: a) the instructions are properly,

scris, pe formularele puse la dispozitie de catre Banca, completely, clearly, and unequivocally prepared in writing

in mod corect, complet, clar si neechivoc de catre on forms provided by the Bank, by the authorised

persoanele autorizate; b) soldul contului permite persons; b) the balance of the account allows the

executarea platii, respectiv acopera atat valoarea platilor payment transaction, respectively it covers both the value

cat si a comisioanelor aferente, si nu este of the payment, and of the related fees, and it was not

indisponibilizat; c) Clientul a furnizat Bancii Codul unic, blocked; c) the Client has provided the Bank with the

compus din: ( i) numarul de cont al beneficiarului platii Sole Code formed of: (i) the payee’s account number or

sau codul IBAN – International Bank Account Number the IBAN code – International Bank Account Number,

aferent si (ii) codul de identificare al bancii beneficiarului and (ii) the payee’s bank identification code

platii (BIC/ SWIFT/ Routing Code), cu exceptia platior in (BIC/SWIFT/Routing Code), with the exception of EUR

EUR catre beneficiari din UE/SEE si a platilor nationale payments with Beneficiaries from UE/EEA and Lei

in Lei unde nu este obligatorie furnizarea codului BIC. national payments where the BIC code is not mandatory..

(2) Instructiunile speciale care apar pe ordinul de transfer (2) Any special instruction being mentioned on the

cu privire la modul de utilizare a banilor privesc numai transfer order about to the way of using the money shall

beneficiarul platii si nu sunt adresate Bancii. only concern the payee and they are not addressed to

the Bank.

(3) Data valutei la care se face debitarea contului (3) The debit value date for the payer Client's account is

Clientului nu va fi anterioara momentului in care suma no earlier than the point in time at which the amount of

care face obiectul operatiunii de plata este debitata din the payment transaction is debited from the Client’s

cont. account

5.6 In cazul in care Banca refuza executarea unei 5.6 In the event the Bank would refuse to execute a

instructiuni de plata sau initierea unei Operatiuni de plata, payment or the initition of a payment transaction, it shall

aceasta pune la dispozitia Clientului, la ghiseele Bancii provide the Client, at the Bank’s counters, or through

sau prin alte mijloace agreate contractual, notificarea de other contractual agred means,with the refusal

refuz si, daca este posibil, motivele refuzului precum si notification, and if possible, with the reasons for it, as well

Conditii Generale de Afaceri [rev.32] Pagina/Page 6 / 37

General Business Conditions

modalitatea de remediere, in masura in care prevederile as with the remedying method, to the extent that the legal

legislative permit/ nu interzic. Clientul are obligatia sa se provisions allow/ do not prohibit it. The Client has the

prezinte la Banca, in vederea luarii la cunostinta a obligation to come to the Bank in order to acknowledge

refuzului sau sa acceseze notificarile trimise de Banca prin the refusal, or to access the notification sent by the Bank

alte mijloace, in termenele mentionate la art. 5.8 de mai through other means, within the periods mentioned in the

jos. art. 5.8 below.

5.7 In cazul in care refuzul de executare sau initiere al 5.7 In case the Bank objectively justifies the execution or

Bancii este justificat in mod obiectiv, respectiv cel putin initiation refusal, respectively at least one of the

una dintre conditiile de la art. 5.1, 5.3, 5.4 (2) si 5.5 conditions provided in art. 5.1, 5.3, 5.5 (2) and 5.5 (1)

(1) de mai sus nu este indeplinita, ordinul de plata se above is not fulfilled, the payment order shall be deemed

considera ca nu a fost primit, iar Banca percepe not to have been received, and the Bank shall collect the

comisionul pentru notificarea prevazuta la punctul 5.6 de fee for the notification provided under point 5.6 above,

mai sus, conform Tarifului de comisioane al Bancii/ according to the Bank’s rates /the Specific agreement.

contractului specific.

5.8 a) Banca se va asigura ca, dupa momentul primirii 5.8 a) The Bank shall ensure that, after the payment

ordinului de plata, suma Operatiunii de plata este order was received, the amount of the payment

debitata din contul Clientului si creditata in contul transaction shall be debited from the account of the

prestatorului de servicii de plata al beneficiarului platii Client, and credited to the account of the payee’s

cel mai tarziu pana la sfarsitul urmatoarei zi lucratoare payment services provider at latest by the end of the next

(T+1), pentru: (i) Operatiunile de plata in euro Business Day (T+1) at latest, for: (i) payment transactions

efectuate pe teritoriul Uniunii Europene (UE) sau in in Euro performed on the territory of the European Union

Spatiul Economic European (SEE), (ii) Operatiunile (EU), or on the European Economic Area (EEA), (ii)

nationale de plata in lei, (iii) Operatiunile de plata care national payment transactions in Lei, (iii) payment

implica o singura conversie monetara intre euro si lei, transactions involving only one currency conversion

efectuata in Romania, iar – in cazul Operatiunilor de between Euro and Lei, carried out in Romania, and – in

plata transfrontaliere pe teritoriul UE si SEE – transferul case of cross-border payment transactions carried out

transfrontalier are loc in euro. within the territory of the EU and the EEA – the cross-

border transfer takes place in Euro.

b) Prin acordul Clientului si al Bancii, perioadele anterior b) By agreement of the Client and of the Bank the

mentionate sunt prelungite cu o Zi lucratoare aforementioned periods are extended by one additional

suplimentara pentru Operatiunile de plata initiate pe Business Day for paper-initiated payment transactions.

suport de hartie.

c) Clientul si Banca convin ca termenul de executare c) The Client and the Bank hereby agree that the

pentru orice alte Operatiuni de plata altele decat cele execution time for any other Payment transactions, other

mentionate la lit.a) este de maximum 3 zile lucratoare than the ones mentioned at point a, is maximum 3

din momentul primirii ordinului de plata. business days from the time the payment order was

received by the Bank.

d) Banca va aplica pentru Operatiunile de plati prevazute d) The Bank shall apply for the payment transactions

la art. 5.8 modalitatea de percepere a comisioanelor provided in the art. 5.8, the method of charging the

aferente conform dispozitiilor art. 142 din Legea nr. related fees according to the provisions of art. 142 from

209/2019 privind serviciile de plată și pentru modificarea Law no. 209/2019 on payment services and for changing

unor acte normative, cu modificarile si completarile some legal acts („Law no. 209/2019”). Thus, for payment

ulterioare („Legea nr. 209/2019”). Astfel, pentru transactions performed within the EU/SEE, in any

Operatiunile de plata prestate in interiorul UE/SEE, in orice currency, if the payment service provider of the payee

valuta, daca prestatorul de servicii de plata al beneficiarului mentioned within the payment order is located in the EU /

platii din cadrul Operatiunii de plata se afla pe teritoriul EEA, the Bank will only accept the application of SHA

UE/SEE, Banca va accepta doar aplicarea regulii de charging principle ("SHA" - the principle of commissions

comisionare SHA (shared charging principle “SHA”- borne by each party), in which the payment payee bears

principiul comisioanelor suportate de catre fiecare parte), in the price charged by his payment services provider, and

care beneficiarul platii suporta pretul perceput de the Customer bears the price charged by the Bank.

prestatorul sau de servicii de plata, iar Clientul suporta e) For credit transfer Payment transactions rendered

pretul perceput de Banca. outside the EU and EEA, in any currency, the Client may

e) Pentru Operațiunile de plată prin transfer credit prestate choose to apply one of the following charging rules: a)

în afara UE si SEE, în orice monedă, Clientul poate opta SHA; b) OUR - in which all commissions are borne by the

pentru aplicarea uneia din urmatoarele reguli de payer, c) BEN - in which all commissions are borne by

comisionare: a) SHA; b) OUR – în care toate comisioanele the payee. If the Client does not indicate the charging

sunt suportate de plătitor, c) BEN – în care toate rule by the methods specific to the payment instrument,

Conditii Generale de Afaceri [rev.32] Pagina/Page 7 / 37

General Business Conditions

comisioanele sunt suportate de beneficiarul plăţii. In cazul in the Bank will process the Payment transaction using the

care Clientul nu indica regula de comisionare prin metodele SHA charging rule.

specifice instrumentului de plata, Banca va procesa

operatiunea de plata utilizand regula de comisionare SHA.

5.9 Banca nu raspunde pentru executarea unor ordine 5.9 The Bank shall not be liable for executing false or

de transfer false sau falsificate. forged transfer orders.

5.10 Clientul este responsabil pentru obtinerea tuturor 5.10 The Client is liable to obtain all licences and

avizelor si autorizatiilor, care vor fi comunicate si authorisations, which shall also be notified about to the

Bancii, in vederea executarii de catre Banca a Bank, in order for the Bank to execute the Client’s

instructiunilor de plata ale Clientului. payment transactions.

5.11 Clientul detinator de cont/uri in valuta va suporta 5.11 The Client holding foreign currency account(s) shall

cota parte din pierderile operationale sau legale bear the share of the operational or legal losses

generate de aparitia oricarui caz de forta majora, generated by the occurrence of any force majeure event,

razboaie sau alte evenimente similare sau datorate wars or other similar events, or due to sequestration

sechestrului instituit de terte persoane in strainatate sau established by third parties abroad, or due to actions of

datorate unor acte ale autoritatilor locale sau local or international authorities (e.g. seizure, restrictions

internationale (ex. confiscare, restrictii ale dreptului de a on the right to dispose, etc.) affecting the corresponding

dispune etc.) care afecteaza conturile de corespondent accounts of the Bank opened with resident/non-resident

ale Bancii, deschise la institutii ne/rezidente, institutions for the currency the accounts of the Client

corespunzatoare valutei in care sunt deschise conturile were opened in.

Clientului.

5.12 Prin derogare de la obligativitatea prezentarii in 5.12 By way of derogation from the obligation to submit

scris a instructiunilor de plata, Banca poate da curs payment instructions in writing, the Bank may only

instructiunilor Clientului transmise prin diferite mijloace proceed with the Client’s instructions transmitted through

de comunicatie (inclusiv, dar fara a se limita la telefon, various communication means (including, but not limited

fax si BussinesNet), numai in conditiile existentei unui to, telephone, fax and BussinesNet) provided that a

Contract-cadru sau Contract specific intre Banca si Framework Agreement or Specific Agreement is in place

Client in acest sens. between the Bank and the Client for such purpose.

5.13 Banca are dreptul de a refuza efectuarea 5.13 The Bank is entitled to refuse the execution of the

tranzactiilor ordonate de catre Client si/sau de a inceta transactions ordered by the Client and/or to terminate the

relatiile cu Clientul, in cazul unor declaratii false sau daca relationship with the Client, in cases of false statements,

are suspiciuni cu privire la realitatea celor declarate sau or should it have any doubts regarding the truthfulness of

documentelor furnizate de catre Client, precum si in the stated facts, or of the documents provided by the

cazul in care tranzactiile au fost ordonate fara Client, as well as in cases where the transactions were

respectarea normelor interne ale Bancii si/sau ale ordered without following the internal regulations of the

prevederilor legale in vigoare. Bank and/or the legal provisions in force.

5.14 Operatiunile de plata interbancare (incasari/ plati) 5.14 Inter-bank payment transactions (incomings/

se vor efectua in conformitate cu instructiunile din outgoings) shall be executed in accordance with the

mesajul de plata si cu prevederile CGA. In cazul in payment instructions, or in the payment transaction, and

care valuta creditarii/ debitarii este diferita de valuta with the provisions in the GBC. Should the

contului Clientului indicat pentru incasare/ plata, Banca crediting/debiting currency be different from the currency

este imputernicita expres sa converteasca suma of the account of the Client having been designated for

operatiunii de plata, la cursul de schimb practicat de incomings/ outgoings purposes, the Bank is expressly

catre Banca la data executarii operatiunii authorised to convert the amount of the payment

(creditare/debitare) in/din contul Clientului, astfel incat transaction, at the Bank’s exchange rate, applicable at

suma primita/ platita de catre Client sa fie creditata / execution date on the transaction (credit/debit) to/from

debitata din contul indicat in Operatiunea de plata, the Client’s account, so that the amount to be

conform prezentelor CGA. received/paid by the Client to be credited/debited in/from

the account as designated within the payment

transaction, according to the present GBC.

Conditii Generale de Afaceri [rev.32] Pagina/Page 8 / 37

General Business Conditions

5.15. Banca poate refuza accesul la Contul de plăți 5.15 The Bank may refuse access to the Online Payment

accesibil online din motive justificate în mod obiectiv, account for objectively justified reasons related to the

legate de accesarea neautorizată sau frauduloasă a unauthorized or fraudulent access of the Online Payment

Contului de plăți accesibil online de către un Prestator de account by a TPP. In such cases, as far as possible, the

servicii terț, inclusiv de inițierea neautorizată sau Bank shall inform the Client, where possible, before

frauduloasă a unei Operațiuni de plată. În aceste cazuri, denying access and at the latest, immediately after, by

în măsura în care este posibil, Banca informează Clientul phone or through electronic communication means

plătitor, dacă este posibil, înainte de refuzarea accesului (BusinessNet, e-mail, SMS, etc), that access to the

și cel mai târziu imediat după aceasta, telefonic sau Online Payment account is denied providing the reasons

printr-un mijloc de comunicare electronică (BussinesNet, for such refusal, unless the provision of such information

e-mail, SMS etc.) că accesul la Contul de plăți este would compromise the security reasons objectively

refuzat și motivele acestui refuz, cu excepția cazului în justified or it is prohibited by law. The Bank will allow

care furnizarea unor astfel de informații ar compromite access to the Online Payment account once the reasons

motivele de siguranță justificate în mod obiectiv sau este for the refusal cease to exist.

interzisă de lege. Banca permite accesul la Contul de

plăți odată ce motivele de refuz încetează să mai existe.

Art.6 Operatiuni fara acceptul Clientului Art.6 Transactions without Client’s approval

(1) Banca are dreptul de a efectua operatiuni pe (1) The Bank is entitled to execute transactions on the

conturile Clientului fara permisiunea acestuia, in Client’s account without approval from the same in the

urmatoarele situatii: (a) in baza unui titlu executoriu following cases: (a) based on an writ of execution issued

emis de catre un organ de executare; (b) in baza unui by a foreclosing body; (b) based on a document issued

document emis de catre organele abilitate conform by the bodies being authorised under the law for such

legii in acest sens, procedand la blocarea conturilor; purpose, by blocking the accounts; (c) payments for due

(c) plati pentru datorii scadente (comisioane, taxe, debts (fees, charges, interests, bank costs, overdraft,

dobanzi, speze bancare, descoperit de cont, inclusiv including unauthorized overdraft, overdue loans, etc.),

neautorizat, credite restante etc.) si pentru alte and for other commitments having previously been

angajamente asumate anterior de Client fata de Banca; undertaken by the Client towards the Bank; (d) reversal

(d) stornari ale operatiunilor efectuate eronat, precum si of incorrectly executed transactions, as well as of those

a celor efectuate cu mentiunea “sub rezerva” (cu executed with the mention “with reserves" (with

documente justificative anexate la extras); (e) in situatia supporting documents attached to the statement of

mentionata in art. 19 alin. (2); (f) orice alte cazuri account); (e) in the situation described under art. 19 para.

prevazute de lege. (2); (f) any other cases provided for by the law.

(2) In oricare din cazurile de mai sus, la sesizarea (2) In any of the cases above, by request from the payer,

platitorului, a prestatorului de servicii de plata al from the payer’s payment services provider, from the real

platitorului, a adevaratului beneficiar sau in urma beneficiary, or following the discovery of the error/ the

descoperirii erorii/ situatiei respective de catre Banca, respective case by the Bank, the Bank shall be entitled to

Banca va avea dreptul de a debita/ credita contul debit/credit the account of the Client with the relevant

Clientului cu sumele respective (inclusiv dobanzile amounts (including the related interests).

aferente).

(3) Daca Clientul are debite fata de Banca, din orice (3) Should the Client have debts towards the Bank for

motiv (operatiuni curente, credite, descoperit de cont, any reason (current operations, loans, overdraft,

inclusiv neautorizat etc.), Banca este autorizata including unauthorized overdraft etc.), the Bank is

irevocabil si neconditionat sa stinga aceste datorii prin: irrevocably and unconditionally authorized to cover such

(i) debitarea oricarui cont deschis de Client la Banca cu debts by: (i) debiting any account opened by the Client

prioritate fata de orice instructiune de transfer/ plata a with the Bank with priority to any transfer/ payment

Clientului, sau (ii) retinerea din orice sume datorate de instruction of the Client, or (ii) by set-off and withholding

Banca Clientului, fara a fi necesara permisiunea them from any amounts due by Bank to the Client, with

prealabila a Clientului. In acest caz, daca se debiteaza no need for prior consent from the Client. In such event,

un cont al Clientului denominat intr-o alta valuta decat should an account of the Client that is denominated in a

valuta datoriei catre Banca, Banca va efectua schimbul currency other than the currency of the debt towards the

valutar utilizand cursul de schimb al Bancii practicat la Bank be debited, the Bank shall perform the currency

momentul efectuarii conversiei. exchange using the exchange rate of the Bank that is

valid at the time of performing the conversion.

In cazul indisponibilizarii soldului unui cont in temeiul Should the balance of an account be blocked based on

unui titlu executoriu, sumele blocate pot fi transferate an enforceable deed the blocked amounts may only be

de catre Banca intr-un cont special la dispozitia transferred by the Bank to a special account, made

organului de executare numai in situatia in care sunt available to the enforcement body, in the case where

Conditii Generale de Afaceri [rev.32] Pagina/Page 9 / 37

General Business Conditions

cel putin egale cu sumele mentionate in titlul executoriu they are at least equal to the amounts being mentioned in

si comisioanele aferente platii si/sau in situatia in care s- the enforceable deed and the charges related to the

a dispus suspendarea executarii respectivului titlu payment, and/or in the case where suspension of the

executoriu. In situatia in care contul curent/de plati nu enforcement of such enforceable deed was ordered. In

este deschis in moneda in care trebuie efectuata plata case the current/payment account is not opened in the

conform titlului executoriu, Banca are dreptul sa deschida payment currency according to the enforcement deed,

unul sau mai multe conturi de speciale in functie de the Bank is entitled to open one or more special

valutele in care trebuie efectuata aceasta plata. Urmare a accounts depending on the currencies in which such

acestei operatiuni, restul disponibilului va ramane in payment shall be done. As result of such operation the

conturile Clientului si va putea fi utilizat de catre Client. remainder of the cash shall remain in the accounts of the

Sumele indisponibilizate in temeiul unui titlu executoriu Client and may be used by the Client. The amounts being

nu sunt purtatoare de dobanzi. blocked based on an enforceable deed do not bear

interests.

Art.7 Dreptul de creanta Art.7 Receivables

Banca are dreptul, iar Clientul renunta la orice drept pe The Bank is entitled, and the Client waives any right it

care l-ar putea avea in acest sens, sa compenseze orice may hold in such respect, to settle any claim, receivable it

pretentie, creanta pe care o are fata de Client, cu orice has against the Client, with any counter-claim, receivable

contra-pretentie, creanta a Clientului fata de Banca, of the Client against the Bank, notwithstanding the

indiferent de moneda in care este exprimata o astfel de currency such a claim, or receivable, is expressed in. The

pretentie, sau creanta. Pretentiile exprimate in valute claims being expressed in different currencies shall be

diferite vor fi compensate la cursul de schimb al Bancii settled at the exchange rate of the Bank on the

de la data efectuarii compensarii, dupa caz. settlement date, as appropriate.

Art.8 Extrasul de cont Art.8 Statement of account

(1) Banca va emite si transmite/pune la dispozitia (1) The Bank issues and transmits / makes available to

Clientului extrasul de cont in forma si prin mijloacele the Client the account statement in the form and means

agreate cu acesta. agreed with it.

(2) Extrasul de cont emis de Banca reprezinta (2) The statement of account issued by the Bank shall

dovada deplina fata de Client cu privire la sumele si represent the complete evidence to the Client in respect

rulajele aferente disponibilitatilor banesti ale acestuia. of the amounts and cash-flows.

(3) Banca este exonerata de raspundere pentru (3) The Bank is exonerated from liability for the possible

eventualele deficiente si/sau erori ce ar putea sa apara in deficiencies and/or errors that might occur within the

procesul de transmitere a extraselor de cont, conform process of delivering the statements of account according

optiunii Clientului. to the option of the Client.

(4) Clientul are obligatia sa verifice informatiile cuprinse (4) The Client has the obligation to check the information

in extrasul de cont. included to the statement of account.

Art.9 Comisioane si taxe Art.9 Fees and charges

(1) Pentru serviciile acordate (inclusiv, dar fara a se (1) For the provided services (including, but not limited to,

limita la, pentru furnizarea de date suplimentare, for further data provision, SWIFT, Routing Code of the

SWIFT, Routing Code ale prestatorilor de plata ai payee’s payment services providers, the switching of the

beneficiarilor platilor dispuse de Client, transformarea account number provided by the Client to an IBAN code,

numarului de cont furnizat de Client in cod IBAN, whenever the payment transaction requires an IBAN

atunci cand operatiunea de plata necesita furnizarea code to be provided) the Bank charges interests, fees,

codului IBAN), Banca percepe dobanzi, comisioane, costs, charges under the legislation in force, and under

speze, taxe, conform legislatiei in vigoare si a tarifelor the rates of the Bank, except for cases where there are in

Bancii, cu exceptia situatiilor in care exista conventii prin place agreements by means of which other levels of the

care s-au stabilit alte niveluri ale acestora. Clientul same were set. The Client shall pay the fees related to

suporta comisioanele aferente serviciilor prestate de the services having been provided by the Bank

catre Banca, indiferent de relatiile comerciale derulate notwithstanding the business relationship between the

intre Client si terte parti. Client and third parties.

(2) Banca si Clientul pot conveni asupra pretului total (2) The Bank and the Client may agree about the total

pentru furnizarea, la cererea acestuia, de informatii price for supplying, at the Consumer’s request, additional

suplimentare sau intr-un mod mai frecvent sau prin alte information or in a frequent manner or through any other

Conditii Generale de Afaceri [rev.32] Pagina/Page 10 / 37

General Business Conditions

mijloace de comunicare decat cele specificate in communication means specific to the Specific agreement.

contractul-cadru.

(3) Operatiunile bancare speciale/ suplimentare, precum (3) The special/additional banking operations, as well as

si cele care nu sunt prevazute in tarifele Bancii, se those that are not provided for in the rates of the Bank,

taxeaza suplimentar prin asimilarea cu operatiuni shall be additionally charged by assimilating them with

asemanatoare sau, in cazul in care nu se pot asimila, similar transactions, or in the event they cannot be

prin negociere cu Clientul solicitant al serviciului assimilated, by negotiation with the Client having

respectiv. requested such service.

(4) Banca este indreptatita sa modifice nivelul (4) The Bank is entitled to change the level of the

dobanzilor, comisioanelor, spezelor si taxelor, in interests, fees, costs, and charges, under the conditions

conditiile legii si/sau in corelatie directa cu costurile sale in the law and/or in direct correlation with the real costs

reale privind serviciile prestate sau a costurilor de regarding the services rendered or the financing costs

finantare si/sau in conformitate cu Contractele specifice and/or in accordance with the Specific Agreements

incheiate cu Clientul. having been concluded with the Client.

(5) Orice modificare (incluzand, dar fara a se limita la, (5) Any change (including, but not limited to, the

introducerea unor penalitati, comisioane, speze, taxe ori implementing of penalties, fees, bank costs, charges, or

alte costuri noi) privind dobanzile, comisioanele, spezele other new costs) to the interests, fees, bank costs, and

si taxele vor fi aduse la cunostinta Clientului in timp util, charges shall be timely notified to the Client, by direct

prin mailing direct si/sau postare la sediile unitatilor mailing and/or by posting in the Bank’s territorial units

bancare si/sau postare pe site-ul Bancii si/sau prin orice and/or by posting on the bank’s site and/or by any other

alta modalitate agreata de comun acord cu Clientul. means agreed with the Client...

(6) In plus fata de dobanzile, taxele si comisioanele (6) Besides the interests, charges, and fees as

mentionate in prezentul articol 9, Clientul suporta si mentioned within the present article 9, the Client shall

cheltuielile extraordinare, in special taxele de timbru si also bear the extraordinary expenses, particularly stamp

taxele legale, timbru judiciar, impozitele, costurile duties and legal charges, legal stamp, taxes, costs

aferente asigurarilor si reprezentarilor legale, costul related to insurances and legal representation, the cost of

comunicatiilor telefonice, telegrafice si prin telex, ca si telephone, telegraph and telex communications, as well

taxele postale platite in cursul relatiilor de afaceri. Banca as postal charges paid during the business relationship.

poate incasa de la Client toate aceste sume intr- o The Bank may collect all such amounts from the Client in

singura transa, fara a fi obligata sa emita o situatie a single instalment, without obligation to issue a detailed

detaliata a cheltuielilor. statement of expenses.

(7) Banca isi rezerva dreptul de a calcula si percepe (7) The Bank reserves the right to calculate and charge

pentru orice sume datorate si neachitate de catre for any amounts owed, and unpaid by the Client on their

Client la scadenta (inclusiv comisioane si taxe) o due dates (including fees and charges) an interest equal

dobanda egala cu cea aplicabila unui descoperit de cont to the one that is applicable for an unauthorised

neautorizat. overdraft).

(8) Banca are dreptul sa debiteze conturile Clientului, (8) The Bank is entitled to debit the accounts of the

fara permisiunea prealabila a acestuia, cu sumele Client, without the latter prior consent, with the amounts

reprezentand taxe si/sau impozite aferente representing duties and/or taxes related to the

operatiunilor/ documentelor ordonate/ primite de la/ operations/ documents ordered by/ received from/for the

pentru Client. In cazul in care acest lucru nu este posibil, Client. If this is not possible, the Bank is entitled not to

Banca are dreptul de a nu efectua operatiunea si de a perform the operation, and return the documents.

returna documentele.

(9) Clientul va despagubi integral Banca pentru orice (9) The Client shall completely indemnify the Bank for

costuri, cheltuieli si alte obligatii pe care Banca trebuie any costs, expenses, and other liabilities the Bank has to

sa le suporte in cadrul procedurilor judiciare si bear within the legal and extra-legal procedures should

extrajudiciare, in cazul in care Banca devine parte in the Bank become a party in legal procedures and dispute

proceduri legale si dispute dintre Client si o terta parte. between the Client and a third party.

(10) Toate comisioanele platibile in alta valuta decat (10) All of the fees that are payable in a currency other

cea exprimata in Lista de comisioane se vor calcula si than the one as specified within the Fees List shall be

percepe folosind cursul de schimb al Bancii la data calculated and charged using the exchange rate of the

debitarii contului. Bank on the account debiting date.

(11) Orice suma platibila de Client Bancii conform (11) Any amount that is payable by the Client to the Bank

prezentului articol va putea fi debitata de Banca din according to the present article may be debited by the

orice cont al Clientului. Bank from any account of the Client.

Conditii Generale de Afaceri [rev.32] Pagina/Page 11 / 37

General Business Conditions

Art.10 Reclamatii Art.10 Complaints

(1) Reclamatiile cu privire la informatiile evidentiate in (1) The complaints regarding the information in the

extrasul de cont, altele decat cele privind operatiunile de statement of account, other than that regarding

plata neautorizate sau executate incorect, precum si cu unauthorized or incorrectly executed payment

privire la orice alta comunicare a Bancii trebuie notificate transactions, as well as those regarding any other notice

Bancii in scris, in maxim 5 zile de la data comunicarii from the Bank, need to be notified to the Bank in writing

extrasului de cont in forma agreata/ comunicarii within maximum 5 days after the statement of account/

respective. Lipsa unei notificari in termenul mentionat va the relevant notice was delivered in the agreed form. The

fi considerata ca acceptare tacita din partea Clientului a failure to notify within the mentioned term shall be

continutului respectivului extras/ respectivei comunicari, considered a silent acceptance by the Client of the

decazandu-l in acelasi timp din dreptul de contestatie content of such statement of account/ notice, decaying

ulterioara. him from the right of ulterior appeal.

(2) Banca nu este obligata sa informeze Clientul cu (2) The Bank is not obliged to notify the Client about the

privire la efectuarea oricarei tranzactii. performance of any transaction.

(3) In cazul unei operatiuni de plata neautorizate sau (3) In the event of an unauthorized or incorrectly

executate incorect, inclusiv in cazul operatiunilor de executed payment transaction, including Payment

plata initiate printr-un Prestator tert de servicii de transactions initiated via a Payment Initiation Service

inițiere a plății, Clientul are obligatia sa notifice deindata Provider (PISP), the Client has the obligation to

Banca, fara intarziere nejustificata, dar nu mai tarziu immediately notify the Bank, without unjustified delay, not

de 3 luni de la data debitarii, asupra faptului ca a later than 3 months after the debiting date, about the fact

constatat o operatiune de plata neautorizata sau that it has found an unauthorized or incorrectly executed

executata incorect, care da nastere unei plangeri. payment transaction that led to a complaint.

(4) In termen de maxim 15 zile lucratoare de la data (4) Within no more than 15 business days from receipt of

primirii unei reclamatii în legătură cu o operatiune de a complaint in connection with a payment transaction, the

plata , Banca: (i) va transmite un raspuns Clientului sau Bank shall: (i) provide a response to the Client; or (ii) in

exceptional circumstances where the response can’t be

(ii) in situatii exceptionale in care raspunsul nu poate fi

sent within the above-mentioned deadline, shall

transmis in termenul mai sus mentionat, va comunica communicate to the Client a provisional response,

Clientului un răspuns provizoriu, care să indice în mod indicating the reasons why the response to the complaint

clar motivele pentru care răspunsul la plângere va will be delayed and the deadline for the final reply,

ajunge cu întârziere si cu precizarea termenului de without exceeding 35 working days.

trasmitere a raspunsului definitiv, fara ca acesta sa

depaseasca de 35 de zile lucrătoare.

Art.11 Incetarea dreptului de a efectua operatiuni pe Art.11 Termination of the right to perform account

cont operations

(1) In cazul decesului reprezentantului/ imputernicitului (1) In the event of the Client’s legal representative death,

legal al Clientului, acesta (Clientul) va notifica de indata the Client shall immediately notify the Bank and it shall

Banca si va modifica in mod corespunzator fisa accordingly modify the signature specimen.

specimenelor de semnatura.

(2) In cazul in care, din motive interne ce tin strict de (2) If the Client’s legal representative signature right is

vointa Clientului, dreptul de semnatura al withdrawn due to the Client’s internal reasons, the Client

reprezentantului/imputernicitului legal al Clientului este shall immediately notify the Bank, it shall provide the

retras, Clientul va notifica de indata Banca, va depune justifying documents and it shall present a new signature

documentele justificative in acest sens si va reface fisa specimen.

specimenelor de semnatura.

(3) Lipsa notificarii Bancii si/sau nedepunerea (3) The Bank shall be in no case liable, if the above-

documentelor justificative conform prevederilor legale, mentioned notification and/or justifying documents are

aferente modificarilor de mai sus, exonereaza Banca de not presented.

orice raspundere.

(4) Persoanelor care primesc, pe baza unor documente (4) The persons that receive, based on legal documents,

legale, dreptul de a dispune de sumele existente in the right to dispose of the amounts in the accounts

conturile deschise la Banca, li se va permite sa opened with the Bank shall be allowed to benefit from

beneficieze de acest drept la prezentarea documentelor such right upon producing the relevant documents (in

respective (in original sau in copie legalizata de un original, or in copy having been certified by a Notary

Conditii Generale de Afaceri [rev.32] Pagina/Page 12 / 37

General Business Conditions

Notar Public, consulat, grefa instantei emitente, dupa Public, a consulate, a clerk of the issuing court, as

caz). appropriate).

II. Derularea relatiilor de afaceri II. Carrying-on of the business relationship

Art.12 Circuitul documentelor Art.12 Documents flow

(1) Banca nu isi asuma nicio raspundere pentru (1) The Bank undertakes no liability for the authenticity,

autenticitatea, validitatea sau caracterul complet al the validity, or the completeness of the documents or for

documentelor si nici pentru efectele adverse care ar the adverse effects that could occur as result of using

putea aparea ca urmare a utilizarii unor materiale improper materials, or for the incorrect construction or

nepotrivite, nici pentru interpretarea sau traducerea translation of such documents, or for the type, the

incorecta a acestor documente, si nici pentru tipul, quantity, or the nature of the goods that could be

cantitatea sau natura bunurilor care ar putea fi mentioned within such documents.

mentionate in aceste documente.

(2) Documentele emise de o autoritate straina prezentate (2) The documents issued by a foreign authority being

Bancii, cum ar fi acte de identitate sau autorizatii vor fi submitted to the Bank, such as identity documents or

examinate cu diligenta de catre Banca. Totusi, Banca authorisations, shall be diligently examined by the Bank.

nu isi asuma nicio responsabilitate in ceea ce priveste However, the Bank undertakes no liability for the

autenticitatea acestora. authenticity of the same.

(3) Banca nu este obligata sa verifice autenticitatea, (3) The Bank shall not be bound to check the authenticity,

caracterul complet sau validitatea unor documente the completeness, or the validity of documents having

redactate in limba romana sau intr-o limba straina care been prepared in Romanian, or in a foreign language,

privesc numirea judecatorilor sindici sau a altor that regard the appointment of bankruptcy judges or of

administratori. other executors/ administrators.

(4) Clientul va suporta orice pierdere curenta sau viitoare (4) The Client shall bear any current or future loss due to

datorata falsificarii, nevalabilitatii legale sau interpretarii forgery, legal invalidity, or misinterpretation, and/or wrong

si/sau traducerii incorecte a unor astfel de documente translation of such documents being delivered to the

transmise Bancii. Bank.

Art.13 Comunicari ale Bancii catre Client Art.13 Bank’s notices to the Client

(1) Prin comunicari se intelege transmiterea de catre (1) By notices there is understood the delivery by the

Banca a oricarui document, informatie, notificare Bank of any document, information, notice (including a

(inclusiv extras de cont) catre Client, in executarea statement of account) to the Client, in performing under

prezentelor CGA si/sau a contractelor specifice, prin the present GBC, and/or under the Specific Agreements,

mijloacele de comunicatie stabilite de comun acord in by means of the communication means as mutually

CGA sau Contractele specifice, care cuprind si cerintele agreed upon within these GBC, or within the Specific

tehnice ale echipamentelor necesare, daca este cazul. Agreements, which may also include the technical

requirements for the required equipment, if any.

(2) Comunicarile scrise ale Bancii sunt considerate (2) The written notices from the Bank shall be deemed

primite de catre Client, dupa perioada de timp normala received by the Client after the regular time period as

conform circuitului postei pentru receptia respectivelor required according to the postal circuit in order to receive

comunicari, daca acestea au fost expediate la ultima such notices, should the same have been sent by the

adresa notificata Bancii de catre Client, chiar daca Client at the latest notified address of the Bank, even

adresa respectiva este a unui tert indreptatit sa though such address may belong to a third party that is

primeasca corespondenta. entitled to receive the mail.

(3) Expedierea se considera indeplinita daca Banca (3) The sending shall be deemed accomplished should

intra in posesia unei confirmari de orice fel, a unei the Bank receive any kind of acknowledgement, a copy of

copii a scrisorii in discutie, purtand semnatura in original the relevant letter bearing the original signature of the

a Clientului sau a reprezentantilor acestuia, sau daca Client, or of the representatives of the same, or the

primirea este confirmata printr-o confirmare de primire receipt be acknowledged by means of the

emisa de posta sau de un serviciu de curierat rapid, acknowledgement of receipt issued by the postal office or

dupa caz. by an express courier service, as appropriate.

(4) Banca poate folosi orice mijloc de comunicare (4) The Bank may use any means of communication

(scrisori, telefon, fax, SMS, posta electronica – e-mail, (letters, telephone, fax, SMS, electronic mail – e-mail,

afisare la sediile unitatilor teritoriale etc.) pentru a posting at the offices of the territorial units) in order to

informa Clientul, referitor la orice aspect, inclusiv, dar notify the Client about any issue, including, but not limited

fara a se limita la, refuzul accesului la contul accesibil to the refusal to of access to the Client’s Online Payment

online al Clientului prin intermediul unui Prestator de account through an Account Information Service Provider

Conditii Generale de Afaceri [rev.32] Pagina/Page 13 / 37

General Business Conditions

Servicii de informare cu privire la conturi sau de către (ASIP) or by a Payment Initiation Service Provider (PISP)

un Prestator de servicii de inițiere a platii, in conditiile under the terms of this document and legal provisions.

acestui document si al prevederilor legale.

(5) Banca nu isi asuma nicio responsabilitate in ceea ce (5) The Bank undertakes no responsibility as regards the

priveste efectele si consecintele de orice natura effects and the consequences of any nature to result from

decurgand din utilizarea vreunui mijloc de comunicatie the use of any means of communication in order to

pentru transmiterea catre Client a oricaror comunicari, deliver to the Client any notices, as well as from the

precum si din intarzierea, nereceptionarea, deteriorarea, delay, the non-receiving, damaging, loss, or other errors

pierderea sau din alte erori de transmisie a mesajelor, in transmitting messages, letters, or documents, including

scrisorilor sau documentelor, inclusiv a celor ce se refera those referring to inter- and intra-banking settlement

la operatiuni de decontare inter si intra bancare. operations.

(6) Clientul se obliga sa isi ridice corespondenta de la (6) The Client binds itself to pick up the mail from the

Banca intr-un timp rezonabil, in caz contrar, Banca Bank within a reasonable time period otherwise the Bank

putand distruge orice corespondenta neridicata de Client may destroy any mail to have not been picked up by the

in timp de 3 luni de la data emiterii. Client 3 months after its issue date.

Art.14 Autorizarea operatiunilor de plata. Revocare Art.14 Authorising payment operations. Revocation

(1) Pentru a da curs instructiunii Clientului, operatiunea (1) In order to proceed with a direction from the Client,

de plata trebuie sa fie autorizata inainte de executarea the payment transaction needs to be authorised before its

sa, respectiv Clientul si-a exprimat consimtamantul execution, respectively the Client has expressed his-/her-

pentru executarea respectivei operatiuni de plata, in /its consent to execute the relevant payment transaction,

forma agreata cu Banca. in the form as agreed upon with the Bank.

(2) Consimtamantul consta in: (a) pentru operatiunile pe (2) The consent consists of: (a) for hard copy

suport hartie – semnatura olografa a Clientului/ transactions – the handwritten signature of the Client/

mandatarului/ imputernicitului pe cont, conform attorney in fact/ authorised person by the account,

specimenului de semnaturi, anexa la contractul de according to the signature specimen as attached to the

deschidere de cont; (b) pentru operatiunile dispuse prin account opening agreement; (b) for transactions being

diferite mijloace de comunicatie (fax, telefon etc.), ordered through various means of communication (fax,

precum si pentru operatiunile dispuse prin alte telephone, etc.), as well as for transactions ordered

instrumente de plata (BusinessNet, card, Debitare through other payment instruments (BussinesNet, card,

Directa, etc.) – conform Contractelor specifice incheiate Direct Debit etc.) – according to the Specific Agreements

intre Client si Banca. having been concluded between the Client and the Bank.

(3) Clientul isi poate retrage consimtamantul in orice (3) The Client may withdraw its consent at any time,

moment, dar inainte de momentul primirii de catre provided that such time is before the Bank receives the

Banca a ordinului de plata, conform art.16 de mai jos. payment order under art.16 below.