Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

5-Step Investing Formula Online Course Manual: Section 10 of 11

Caricato da

TOLYBERTTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

5-Step Investing Formula Online Course Manual: Section 10 of 11

Caricato da

TOLYBERTCopyright:

Formati disponibili

5-Step Investing Formula

Online Course Manual

Appendix

10

Section 10 of 11

www.investools.com

© 2005 INVESTools Inc. All rights reserved.

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

Section Contents

SECTION 10 APPENDIX

Phase 2 Stock Scoring Form ................................................................. 4

Phase 2 Quick List for Zacks Report and Market Guide ....................... 6

Investment Tracking Record .................................................................. 8

© 2005 INVESTools Inc. All rights reserved. page 2 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

Course Overview

INTRODUCTION SECTION 6 Step 4: Technical Analysis

SECTION 1 Getting Started Technical Indicators

Logging into the INVESTools Investor Toolbox Moving Averages

Support Links MACD

Workshop Review Stochastics

Account Information Volume

Subscription Renewal Support & Resistance

Technical Support Buy Signals

Contact an Instructor Money Management

Sell Stop Orders

SECTION 2 Introduction to Investing How Many Shares to Buy

Tolerance for Risk Sell Signals

Setting Goals Insider Trading

Asset Allocation

Tax Exposure SECTION 7 Step 5: Portfolio Management

Brokerage Firms Creating a Portfolio

Introduction to the 5-Step Investing Formula Managing Your Portfolio

Paper Trading Account

THE 5-STEP INVESTING FORMULA

BONUS SECTION

SECTION 3 Step 1: Searching for Stocks

Using a Prebuilt Search SECTION 8 Bonus Topics

Navigating the List of Stocks TurboSearch

Index Tracking Stocks / Exchange-Traded Funds

SECTION 4 Step 2: Industry Group Analysis Dow Jones Industrial Average—

Top-Down Analysis The Diamonds (DIA)

Big Chart S&P 500—The Spider (SPY)

AutoAnalyzing All Stocks in a Group NASDAQ—The Qs (QQQQ)

Best & Worst Industries List

SECTION 9 Introduction to Options

SECTION 5 Step 3: Fundamental Analysis Advantages /Risks of Options

Phase 1 Leverage

Phase 2 Call Options

Price Pattern Put Options

Volatility Covered Calls

Zacks Report

Market Guide

News SECTION 10 Appendix

AutoAnalyzer™ Phase 2 Stock Scoring Form

Phase 2 Quick List for Zacks Report and

Market Guide

Investment Tracking Record

SECTION 11 Glossary

© 2005 INVESTools Inc. All rights reserved. page 3 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

PHASE 2 STOCK SCORING FORM

Price Market

Symbol Pattern Volatility Zacks Guide News

Score each stock using the following scale:

A = EXCELLENT

B = VERY GOOD

C = NEUTRAL

D = POOR

F = BAD

© 2005 INVESTools Inc. All rights reserved. page 4 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

PHASE 2 STOCK SCORING FORM

Price Market

Symbol Pattern Volatility Zacks Guide News

Score each stock using the following scale:

A = EXCELLENT

B = VERY GOOD

C = NEUTRAL

D = POOR

F = BAD

© 2005 INVESTools Inc. All rights reserved. page 5 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

Phase 2 Quick List for

Zacks Report and Market Guide

Zacks Report

Zacks Estimates Section

• Year-over-Year Estimates should be rising

• Quarter-over-Quarter Estimates should be rising

• 20% or more projected Earnings Growth Next 5 Years

• Preponderance of Estimate Increases as opposed to Decreases (zeros are considered positive)

All of the above items should meet the standards to score an “A” for this section.

Company/Industry Comparison

(The company is on the top line and the Industry Group is on the next line.)

• 5-Year PAST Growth is equal to or higher than the Industry

• Current-Year Growth is equal to or higher than the Industry

• Next-Year Growth is equal to or higher than the Industry

• 5-Year FUTURE Growth is equal to or higher than the Industry

All four of the above items must meet the standards to score an “A” for this section. (Any item marked “N/A” is

ignored and the score is not penalized.)

Projected P/E will normally be higher for the stock if it scores high against the group. Expect this. If it is lower than

the group, it is considered a bonus but has no score.

Quarterly Earnings Surprises

• The top line is the analysts’ estimates, and the bottom line is the actual number turned in by the company

• All items in the bottom line must be equal to or larger than the top line to score an “A” for this section

(If a bottom-line number scores lower than the top-line number, the score is a “B,” two would be a “C,” etc.)

Current Ratings: Buy, Sell, or Hold Recommendations

• 1.0 to 1.5 scores an A

• 1.6 to 2.5 scores a B

• 2.6 to 3.5 scores a C

• 3.6 and over scores an F

© 2005 INVESTools Inc. All rights reserved. page 6 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

Market Guide

Return on Equity (ROE)

• Look for ROE to meet or exceed the national average of 18%

• If the ROE is less than the national average, check to see what the average ROE is for the industry; if the

industry ROE is less than the national average, measure your company to the industry

• Whether the ROE is scored against the national standard or the industry standard, subtract one grade for

each three (3) points below the standard used (18% or the industry standard)

(The Company-to-Industry ROE can be checked in the Company Profile under the “Company Reports’’ section.)

Share-Related Information

• Float should be 5M shares or more (this is not a requirement and is not scored, but it’s nice to have)

Revenues and Earnings

• Year over year Revenue Growth continually increasing

• Year over year Earnings Growth continually increasing

Growth Comparisons (1-Year Column Only)

• Revenues growing 25% or more

• EPS (earnings) growing 25% or more

• EPS (earnings) growing faster than Revenues

Any item with less than 25% growth or earnings that is not growing faster than revenues penalizes the score one

grade for each item not meeting the standard.

The worst score would be a D for the “Growth Comparison’’ section, but by that time, you might not even care!

© 2005 INVESTools Inc. All rights reserved. page 7 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

Investment Tracking Record

Stock Name/Symbol:____________________________________________________________________________________

Phase 1 Score: #Positives______ #Negatives______

Phase 2 Scores – A, B, C, D or F for:

Price Pattern ______

Volatility ______

Zacks ______

Market Guide ______

News ______

Entry Profile

Industry Group and Rank: Up______ Down______ Sideways______

MACD 1 Year Green______ Red______

MACD 5 Year (long term) Green______ Red______

Stochastics Green______ Red______

30-Day Moving Average Green______ Red______

Volume 150% of Average Yes______ No______

Date Purchased: _____/_____/_____

Price Paid: $_____

Number of Shares: #_____

Target Price: $_____

Entry Stop-Loss: $_____

Did you buy this stock for the long term or short term? Why?_________________________________________________

Exit Profile

Date Sold: _____/_____/_____

Price Sold: $______

MACD 1 Year Green______ Red______

MACD 5 Year Green______ Red______

Stochastics Green______ Red______

30-Day Moving Average Green______ Red______

Why did you sell?_____________________________________________________________

How would you rate this trade overall (10 is high)? 1 2 3 4 5 6 7 8 9 10

What did you do in this trade that you want to use in future trades? __________________________________________

_____________________________________________________________________________________________________

What did you do in this trade that you want to avoid in future trades?_________________________________________

__________________________________________________________________________________________

© 2005 INVESTools Inc. All rights reserved. page 8 of 9

THE 5-STEP INVESTING FORMULA www.investools.com Appendix

© 2005 INVESTools Inc. All rights reserved. Neither INVESTools or its subsidiaries nor any of their respective officers, employees, representatives, agents or independent

contractors are, in such capacities, licensed financial advisers, registered investment advisers or registered broker-dealers. Neither do they provide investment or financial

advice or make investment recommendations, nor are they in the business of transacting trades. Nothing contained in this manual constitutes a solicitation, recommendation,

promotion, endorsement or offer (buy or sell) by INVESTools, or others described above, of any particular security, transaction or investment.

Warranty disclaimer: The content included in this manual and the Investor Toolbox Web site is provided as is, without any warranties. Neither INVESTools

no any of its subsidiaries or affiliates make any guarantees or warranties as to the accuracy or completeness of, or results to be obtained from using, any of its

products or services (including any content therein). INVESTools and its subsidiaries and affiliates hereby disclaim any and all warranties, express or implied,

including warranties of merchantability or fitness for a particular purpose or use. Neither INVESTools nor any of its subsidiaries or affiliates shall be liable to you

or anyone else for any inaccuracy, delay, interruption in service, error or omission, regardless of cause, or for any damages resulting therefrom. In no event will

INVESTools nor any of its subsidiaries or affiliates be liable for any indirect, special or consequential damages, including but not limited to lost time, lost money,

lost profits or lost good will, whether in contract, tort, strict liability or otherwise, and whether or not such damages are foreseen or unforeseen with respect to any

use of our products or services. In the event that liability is nevertheless imposed on INVESTools or any of its subsidiaries or affiliates, such parties’ cumulative

liability for damages under any legal theory shall not exceed the amount of fees you paid for the particular product or service. This warranty addresses specific

legal rights; you may also have other rights, which vary from state to state. Some states do not allow the exclusion or limitation of incidental or consequential

damages, so the above limitation or exclusion may not apply to you.

The principals and employees of, as well as those who provide contracted services for, INVESTools have not promised, represented or warranted that you will earn a profit

when or if you purchase securities. It is recommended that anyone trading securities should do so with caution and consult with a broker before doing so. Past performances

of any principals and employees of, as well as those who provide contracted services for, INVESTools or any of its subsidiaries or affiliates may not be indicative of

futur performance. Securities used as examples presented in this manual or the Investor Toolbox Web site are used for illustrative purposes only and do not constitute a

recommendation to buy or sell individual securities. They should be considered speculative with a high degree of volatility and risk.

Trading securities can involve high risks and the loss of any funds invested; trading options can result in the loss of more than the original amount invested.

No part of this manual may be reproduced in any form, by any means, photocopying, electronic or otherwise, without written permission from the publisher.

© 2005 INVESTools Inc. All rights reserved. page 9 of 9

Potrebbero piacerti anche

- Initial Public Offerings (IPO): An International Perspective of IPOsDa EverandInitial Public Offerings (IPO): An International Perspective of IPOsValutazione: 5 su 5 stelle5/5 (2)

- Managing Financial Information in the Trade Lifecycle: A Concise Atlas of Financial Instruments and ProcessesDa EverandManaging Financial Information in the Trade Lifecycle: A Concise Atlas of Financial Instruments and ProcessesNessuna valutazione finora

- 5-Step Investing Formula Online Course Manual: Introduction To OptionsDocumento21 pagine5-Step Investing Formula Online Course Manual: Introduction To OptionsjaneNessuna valutazione finora

- Step 5 - Portafolio ManagementDocumento20 pagineStep 5 - Portafolio ManagementjaneNessuna valutazione finora

- Step 2 - Industry Group AnalysisDocumento16 pagineStep 2 - Industry Group AnalysisjaneNessuna valutazione finora

- Step 3 - Fundamental AnalysisDocumento31 pagineStep 3 - Fundamental AnalysisjaneNessuna valutazione finora

- 5-Step Investing Formula Online Course Manual: Section 11 of 11Documento28 pagine5-Step Investing Formula Online Course Manual: Section 11 of 11janeNessuna valutazione finora

- Backstop Ebook Allocators-Key-Reports For CIOs Capital MarketsDocumento45 pagineBackstop Ebook Allocators-Key-Reports For CIOs Capital MarketsDanial OngNessuna valutazione finora

- Course OutlineDocumento1 paginaCourse OutlineNaumaanNessuna valutazione finora

- Investing in Stock Markets (Vanita-CBCS) ContentsDocumento4 pagineInvesting in Stock Markets (Vanita-CBCS) Contentspatrickndegwa861Nessuna valutazione finora

- Master of Business Adminstration.: Infosys Interview Sap Fico QuestionsDocumento8 pagineMaster of Business Adminstration.: Infosys Interview Sap Fico QuestionsJyotiraditya BanerjeeNessuna valutazione finora

- Busfin 1Documento24 pagineBusfin 1Maica David San AndresNessuna valutazione finora

- ValueGuide Sept2018Documento65 pagineValueGuide Sept2018San JayNessuna valutazione finora

- BPG Deck TLDocumento22 pagineBPG Deck TLAbhinav KeshariNessuna valutazione finora

- Certificate 4 Fundamental Analysis and Applied Equity ResearchDocumento22 pagineCertificate 4 Fundamental Analysis and Applied Equity Researchyakuza senseiNessuna valutazione finora

- Foreword I-3 Acknowledgement I-5 About NISM Certifications I-7 About The NISM-Series-XI: Equity Sales Certification Examination I-9Documento4 pagineForeword I-3 Acknowledgement I-5 About NISM Certifications I-7 About The NISM-Series-XI: Equity Sales Certification Examination I-9ABC 123Nessuna valutazione finora

- AP BizPlan - 1 Table of Content & RequirementsDocumento24 pagineAP BizPlan - 1 Table of Content & RequirementsHakeem AdesanyaNessuna valutazione finora

- Stock Pitch InformationDocumento30 pagineStock Pitch InformationBudhil KonankiNessuna valutazione finora

- CMSA Role-Based Learning PathsDocumento3 pagineCMSA Role-Based Learning PathsPallav DaruNessuna valutazione finora

- Trading Smart With Fundamental AnalysisDocumento51 pagineTrading Smart With Fundamental Analysisjihad jamarei100% (1)

- Fundamental AnalysisDocumento52 pagineFundamental Analysisrahairi100% (4)

- Ic Product StrategyDocumento15 pagineIc Product StrategyPNG networks100% (1)

- TEC Commercialization Process ModelDocumento7 pagineTEC Commercialization Process ModelPandu PrawiraNessuna valutazione finora

- EDUMO PRO Ref Material - ClientDocumento21 pagineEDUMO PRO Ref Material - ClientShubham KamerkarNessuna valutazione finora

- SIE Learning Guide v08Documento153 pagineSIE Learning Guide v08Angelo ImmacolatoNessuna valutazione finora

- Investment Journey and Key Learnings Kumar SaurabhDocumento7 pagineInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELNessuna valutazione finora

- Online Trading Academy - Course Curriculum-InvestorDocumento2 pagineOnline Trading Academy - Course Curriculum-Investorscreen1 recordNessuna valutazione finora

- Online Trading Academy - Course Curriculum-Investor PDFDocumento2 pagineOnline Trading Academy - Course Curriculum-Investor PDFscreen1 recordNessuna valutazione finora

- Goldsmith Technology Commercialization Model©Documento24 pagineGoldsmith Technology Commercialization Model©FiqriNessuna valutazione finora

- WarrenEquity UpdatedSitemap ContentMappingDocumento2 pagineWarrenEquity UpdatedSitemap ContentMappingMarcos AlvarezNessuna valutazione finora

- SIE Learning Guide v08Documento153 pagineSIE Learning Guide v08Nredfneei riefh100% (7)

- Ba7021 Security Analysis and Portfolio Management 1Documento113 pagineBa7021 Security Analysis and Portfolio Management 12203037Nessuna valutazione finora

- Sapm Full Unit Notes PDFDocumento112 pagineSapm Full Unit Notes PDFnandhuNessuna valutazione finora

- KE25 Line Item Display - Plan Data CO-PADocumento5 pagineKE25 Line Item Display - Plan Data CO-PAReddy BDNessuna valutazione finora

- Summative AssessmentDocumento17 pagineSummative AssessmentElis NidalianaNessuna valutazione finora

- OptiSuite Forms Tracking - User Manual 710 - 740 v1Documento316 pagineOptiSuite Forms Tracking - User Manual 710 - 740 v1sintonaNessuna valutazione finora

- 1 a Project Report on “Investment Opportunity in Stock Market With Special Focus on Oil Sector” for “Indiainfoline Securities Limited”Lunkad Poonam” Mba Semester III Project Guide _ Ram Priya Kannan - Academia.eduDocumento71 pagine1 a Project Report on “Investment Opportunity in Stock Market With Special Focus on Oil Sector” for “Indiainfoline Securities Limited”Lunkad Poonam” Mba Semester III Project Guide _ Ram Priya Kannan - Academia.eduHarish0% (1)

- Financial Statements and Dot-Com Crash 2008Documento9 pagineFinancial Statements and Dot-Com Crash 2008HonChouNessuna valutazione finora

- IQ Basics of Range GuidesDocumento21 pagineIQ Basics of Range GuidesWorld in 3 MinutesNessuna valutazione finora

- Foreword Acknowledgement About NISM Certifications About The NISM-Series-XI: Equity Sales Certification ExaminationDocumento4 pagineForeword Acknowledgement About NISM Certifications About The NISM-Series-XI: Equity Sales Certification ExaminationMonica SainiNessuna valutazione finora

- Module3 1 PDFDocumento85 pagineModule3 1 PDFlalu0123100% (1)

- I3t3 Mega Webinar Ed9 - BrochureDocumento27 pagineI3t3 Mega Webinar Ed9 - BrochureTraders GurukulNessuna valutazione finora

- Session 14-WTC PPT (Apr 08, 2019) PDFDocumento39 pagineSession 14-WTC PPT (Apr 08, 2019) PDFrreddy obu100% (2)

- Fact2003 TocDocumento6 pagineFact2003 TocfdsfasdfNessuna valutazione finora

- How To Download Fundamentals of Investing Pearson Series in Finance Ebook PDF Version Ebook PDF Docx Kindle Full ChapterDocumento36 pagineHow To Download Fundamentals of Investing Pearson Series in Finance Ebook PDF Version Ebook PDF Docx Kindle Full Chapterannie.root658100% (27)

- RESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofDocumento5 pagineRESEARCH: Knowledge Bank: Chapter 7.5: How To Perform Fundamental Analysis ofsumonNessuna valutazione finora

- Certified Investment Research Analyst (CIRA) : 1. Investments-Concepts & FeaturesDocumento6 pagineCertified Investment Research Analyst (CIRA) : 1. Investments-Concepts & Featuresprithvisingh thakur100% (1)

- Business Plan Checklist: Property of STIDocumento11 pagineBusiness Plan Checklist: Property of STIRandolf B. de GuzmanNessuna valutazione finora

- Technical Analysis Project of PGPM MohitDocumento93 pagineTechnical Analysis Project of PGPM Mohitmohitalk2meNessuna valutazione finora

- Part 2 PDFDocumento9 paginePart 2 PDFAnonymous R9644t9RNessuna valutazione finora

- SAPM-Background Materials-JIMS-2010Documento48 pagineSAPM-Background Materials-JIMS-2010johnleh17Nessuna valutazione finora

- ch04 PDFDocumento73 paginech04 PDFHanna UnnailiNessuna valutazione finora

- Avanza Matrix Investment Management SolutionDocumento18 pagineAvanza Matrix Investment Management SolutionBabarNessuna valutazione finora

- Trading & Investing Guides - Important Resources For Traders - InvestorsDocumento38 pagineTrading & Investing Guides - Important Resources For Traders - InvestorsthebrahyzNessuna valutazione finora

- Stock Market BrochureDocumento9 pagineStock Market BrochureAkshay VermaNessuna valutazione finora

- 01.the I3t3 Mega Webinar 2019 - Training BrochureDocumento27 pagine01.the I3t3 Mega Webinar 2019 - Training BrochureRohit SharmaNessuna valutazione finora

- Business Management: Chapter 5Documento24 pagineBusiness Management: Chapter 5Javier BallesterosNessuna valutazione finora

- Exchange Traded Funds - : Structures and StrategiesDocumento40 pagineExchange Traded Funds - : Structures and StrategiesYe koNessuna valutazione finora

- Impact of Increase in The Trading Timings of NSE & BseDocumento94 pagineImpact of Increase in The Trading Timings of NSE & BsehariomxeroxNessuna valutazione finora

- IT (Information Technology) Portfolio Management Step-by-Step: Unlocking the Business Value of TechnologyDa EverandIT (Information Technology) Portfolio Management Step-by-Step: Unlocking the Business Value of TechnologyNessuna valutazione finora

- Humarp09 eDocumento119 pagineHumarp09 eTOLYBERTNessuna valutazione finora

- Search Librarian Request For Info Form June 2011Documento2 pagineSearch Librarian Request For Info Form June 2011TOLYBERTNessuna valutazione finora

- Product Fact Sheet: Optional Productivity ValuesDocumento4 pagineProduct Fact Sheet: Optional Productivity ValuesTOLYBERTNessuna valutazione finora

- APro 5 Digital Slide ScannerDocumento2 pagineAPro 5 Digital Slide ScannerTOLYBERTNessuna valutazione finora

- PFS XN-1000Documento3 paginePFS XN-1000TOLYBERT0% (1)

- Elisys Quattro: Fully Automated ELISA AnalyzerDocumento4 pagineElisys Quattro: Fully Automated ELISA AnalyzerTOLYBERTNessuna valutazione finora

- UNITAID-HIV Diagnostic Landscape-3rd EditionDocumento187 pagineUNITAID-HIV Diagnostic Landscape-3rd EditionTOLYBERTNessuna valutazione finora

- Sample Curriculum Vitae (American Style - 1) Curriculum VitaeDocumento3 pagineSample Curriculum Vitae (American Style - 1) Curriculum VitaeTOLYBERTNessuna valutazione finora

- Fees For The Exams and Other Services: Associate and Fellowship QualificationsDocumento3 pagineFees For The Exams and Other Services: Associate and Fellowship QualificationsTOLYBERTNessuna valutazione finora

- Elisys Duo: Fully Automated ELISA AnalyzerDocumento4 pagineElisys Duo: Fully Automated ELISA AnalyzerTOLYBERTNessuna valutazione finora

- Actity Plan For Philadelphia Andenturer Club 2014Documento2 pagineActity Plan For Philadelphia Andenturer Club 2014TOLYBERTNessuna valutazione finora

- Business Manager CV TemplateDocumento2 pagineBusiness Manager CV TemplateAnonymous ixUbm2WsENessuna valutazione finora

- Employees: TOTAL: P6000.00Documento1 paginaEmployees: TOTAL: P6000.00TOLYBERTNessuna valutazione finora

- Application LetterDocumento1 paginaApplication LetterTOLYBERTNessuna valutazione finora

- BPC Concern LetterDocumento2 pagineBPC Concern LetterTOLYBERTNessuna valutazione finora

- These Are 11th or 12 Grade Pathfinders And/or Staff Who Have Indicated That They Are Working On The Master Guide CurriculumDocumento1 paginaThese Are 11th or 12 Grade Pathfinders And/or Staff Who Have Indicated That They Are Working On The Master Guide CurriculumTOLYBERTNessuna valutazione finora

- Introduction LetterDocumento1 paginaIntroduction LetterTOLYBERTNessuna valutazione finora

- Scope and Limitation of The StudyDocumento3 pagineScope and Limitation of The StudyArs VuelvaNessuna valutazione finora

- Financial Derivatives (Finance Specialization) (2019 Admission) 2022 MarchDocumento6 pagineFinancial Derivatives (Finance Specialization) (2019 Admission) 2022 MarchkcashiquaNessuna valutazione finora

- Reasons For Trading in Commodity ExchangesDocumento19 pagineReasons For Trading in Commodity ExchangesAnkit LavaniaNessuna valutazione finora

- Midterm Examination - Finamr - AnswersDocumento10 pagineMidterm Examination - Finamr - AnswersAeron Arroyo IINessuna valutazione finora

- Take Home Exercises 1Documento4 pagineTake Home Exercises 1AchefNessuna valutazione finora

- 10Documento24 pagine10Abhishek GuptaNessuna valutazione finora

- Equity SwapsDocumento12 pagineEquity SwapsKrishnan ChariNessuna valutazione finora

- Sample Final Exam Questions W19 March 31 With Answers - Leverage DividendsDocumento3 pagineSample Final Exam Questions W19 March 31 With Answers - Leverage Dividendsbusiness docNessuna valutazione finora

- Summer Internship Project ReportDocumento73 pagineSummer Internship Project ReportVishal Patel100% (1)

- Maths From Cost ND CapitalDocumento5 pagineMaths From Cost ND CapitalTahamina Sultana BipashaNessuna valutazione finora

- Exchange Summary Volume and Open Interest Energy Futures: FinalDocumento9 pagineExchange Summary Volume and Open Interest Energy Futures: FinalavadcsNessuna valutazione finora

- MFE Lesson 1 SlidesDocumento38 pagineMFE Lesson 1 SlidesRudy Martin Bada AlayoNessuna valutazione finora

- Capital Market PDFDocumento12 pagineCapital Market PDFAyush BhadauriaNessuna valutazione finora

- Letter of Transmittal: Term PaperDocumento20 pagineLetter of Transmittal: Term PaperMd SaifNessuna valutazione finora

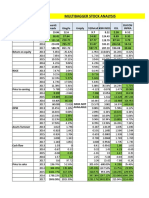

- Multi Bagger AnalysisDocumento3 pagineMulti Bagger AnalysisKrishnamoorthy SubramaniamNessuna valutazione finora

- Group 14 Options Pricing Model Questions Block 3Documento9 pagineGroup 14 Options Pricing Model Questions Block 3Mark AdrianNessuna valutazione finora

- Financial Markets and Instiutions Wcmw4e8ThMDocumento3 pagineFinancial Markets and Instiutions Wcmw4e8ThMKhushi SangoiNessuna valutazione finora

- SEBI - The Securities and Exchange Board of IndiaDocumento35 pagineSEBI - The Securities and Exchange Board of IndiaRohan FodnaikNessuna valutazione finora

- 1 637143432596402245 2273042 - AnswerDocumento2 pagine1 637143432596402245 2273042 - Answerfayyasin99Nessuna valutazione finora

- Investment Pattern in Commodities and Associated RisksDocumento121 pagineInvestment Pattern in Commodities and Associated RisksWWW.150775.BUGME.PW0% (1)

- SIE QuickSheet, 2E PDF (Secured)Documento4 pagineSIE QuickSheet, 2E PDF (Secured)Henry Jose Codallo Siso89% (9)

- Fin 630 Final Term Solved Papers Mega FileDocumento139 pagineFin 630 Final Term Solved Papers Mega Filerabeel_697462555100% (1)

- Advance Accounting Cp.3Documento2 pagineAdvance Accounting Cp.3Sandra Sholehah100% (2)

- Part Four World Financial EnvironmentDocumento39 paginePart Four World Financial EnvironmentsalmanlodhiNessuna valutazione finora

- Pricing With SmileDocumento4 paginePricing With Smilekufeutebg100% (1)

- A Project Report On Overview of Indian Stock MarketDocumento25 pagineA Project Report On Overview of Indian Stock MarketAshok Chowdary GNessuna valutazione finora

- Only Problems BetaDocumento4 pagineOnly Problems BetaSupriya Rane0% (1)

- Christensen 12e Chap09 2019Documento86 pagineChristensen 12e Chap09 2019DifaNessuna valutazione finora

- Question On Bond ValuationDocumento3 pagineQuestion On Bond ValuationHarsh RajNessuna valutazione finora