Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Engro Foods: Finnacial Ratios Formulas

Caricato da

Abdullah QureshiDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Engro Foods: Finnacial Ratios Formulas

Caricato da

Abdullah QureshiCopyright:

Formati disponibili

Engro Foods

FINNACIAL RATIOS FORMULAS

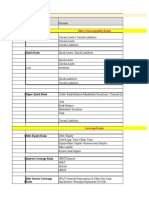

LIQUIDITY RATIOS

CURRENT RATIO current assets/current liabilities

QUICK RATIO liquid assets/current liabilities

CASH RATIO (cash+cash equvilants)/current liabilities

TOTAL

ACTIVITY RATIOS

INVENTORY TURN-OVER RATIO COGS/inventory

INVENTORY TURN-OVER IN DAYS 365/inventory turn-over

AVERAGE COLLECTION PERIOD (in days) account recievables/average sales per day

AVERAGE PAYMENT PERIOD account payables/average purchasing per day

CASH CONVERSION CYCLE inventory+account recievables-account payables

TOTAL ASSETS TURN-OVER sales/total assets

FIXED ASSETS TURN-OVER sales/fixed assets

Total

DEBT RATIO total liabilities/total assets

INTEREST COVERAGE RATIO EBIT/interest expense

DEBT TO EQUITY RATIO total debts/total equity

FINANCIAL LEVERAGE MULTIPLIER total assets/total equity

TOTAL

PROFITABILITY RATIOS

GROSS PROFIT MARGIN (gross profit/sales)*100

OPERATING PROFIT MARGIN (operating profit/sales)*100

NET PROFIT MARGIN (net profit or loss/sales)*100

RETURN ON ASSET (net income/total assets)*100

RETURN ON EQUITY (net income/total equity)*100

EARNING PER SHARE net income/no. of share of commonstock

DIVIDENT PER SHARE divident/no of share of commonstock

TOTAL

MARKET RATIOS

PRICE EARNING RATIO market price purchase/earning per share

MARKET/BOOK VALUE RATIO common stockequity/book value per share

TOTAL

*average purchasing per day = (CGS-Dep)/365

ro Foods

YEAR

2015 2016 2017 2018 2019

2.0007021797794 1.9180016968 1.2035747286 1.0869970344 0.915529302

1.1183875107994 0.843856907 0.7258504793 0.67370409 0.365908014

1.2226861702601 1.0668135001 0.7016850881 0.6487352727 0.549605459

1.2226861702601 3.8286721039 2.631110296 2.409436397 1.831042776

1217.6203664906 1086.4334276 15919.689525 20290.442527 19130.81403

0.0755326083583 0.3359616803 0.0229285759 0.0179887649 0.019079167

0.0003135665999 0.0004430436 0.0013269774 0.002333244 0.004053337

0.2906078378546 0.2931085773 0.9658725143 1.210484108 1.428741867

3547.04 3324.8 286.21 -366.09 -899.04

1.7233967850297 6.3611500795 5.7876987154 7.5353328528 9.586652013

11.925291317906 11.186458528 9.5055654197 13.169628979

4766.7502172884 4429.4105496 16222.182917 19946.288295 18242.81255

0.0531801446167 0.220825475 0.3190451308 0.3869757967 0.644206296

-2.0045957918051 -217.1438272 -51.64954128 100.78106509 26.68833374

0.0349024771093 0.029153635 0.423961683 0.4282169261 0.430994899

5.6586043734415 1.4409924597 2.2855965732 2.437461059 2.810617472

3.7420912033625 -215.4528556 -48.6209379 104.03371887 30.57415241

6% 23% 4% 19% 2%

2% 2% 1% 0% 0%

1% 2% 0% 0% 0%

2% 2% 17% 0% -4%

14% 14% 4% 1% -11%

0.460098930858 0.3113386973 0.0494784737 0.0083198973 -0.12455974

1.2992958481391 1.1339949595 0.1657131005 0.1236074803 -0.00190452

202% 187% 48% 33% -27%

3526.6263491381 8693.1365811 379.20773261 63.729794137 -14.6012201

0.0014078558356 0.0013044613 0.0012820513 0.0012655024 0.001350804

3526.6277569939 8693.1378856 379.20901466 63.731059639 -14.5998693

horizontal analysis

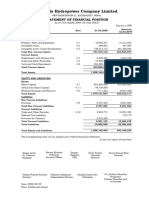

Consolidated Statement of Financial Position

(Amounts in millions)

2019 19 Vs. 18

Rs. %

EQUITY AND LIABILITIES

EQUITY

13,353 -

Share capital

Share premium 3,385 -

Advance against issue of shares - -

Exchange revaluation reserves - -100

Hedging reserve - -

Remeasurement of post employment benefits -57 26.7

Unappropraited profits 26,598 -6.4

43,279 -4.9

NON-CURRENT LIABILITIES

22,192 -13.7

Borrowing

Working capital loan from Parent Company - -

Derivative financial instruments - -

Deferred taxation 12,183 71.6

Deferred liabilities 257 1.3

34,632 4.7

CURRENT LIABILITIES

37,686 29.5

Trade and other payables

Accrued interest / mark-up 588 38

Taxation - net - -100

Current portion of

8,760 71.9

8,760 71.9

- Borrowings

- Retirement and other service benefits obligations 56 9.9

Short-term borrowings 1,986 96.6

Unclaimed dividend 60 -9

Derivative financial instruments - -

49,136 25.5

TOTAL EQUITY AND LIABILITIES 7.9

127,047

ASSETS

NON-CURRENT ASSETS

65,924 -3.3

Property, plant and equipment

Intangible assets 5,071 13

Deferred taxation - -

Long term loans and advances 164 14.9

71,159 -2.3

CURRENT ASSETS

5,301 -0.5

Store, spares and loose tools

Stock-in-trade 12,478 8.1

Trade debts 14,175 55.6

Derivative financial instruments - -

Loans, advances, deposits and prepayments 2,949 116.3

Other receivables 9,412 3.8

Taxation - net 2,542 100

Accrued income 106 96.1

Short-term Investments 5,512 -28.6

Cash and bank balances 3,413 367.9

55,888 24.4

TOTAL ASSETS 7.9

127,047

133 engro fertilizers limited

2018 18 Vs. 17 2017 17 Vs. 16 2016 16 Vs. 15 2015

Rs. % Rs. % Rs. %

13,353 - 13,353 0.3 13,309 - 13,309

3,385 - 3,385 8.1 3,132 - 3,132

- - - - - - -

409 392.8 83 654.5 11 -21.4 14

- - - - - -100 -4

-45 -4.3 -47 74.1 -27 -32.5 -40

28,421 10.6 25,696 1.9 25,223 -2.7 25,921

45,523 7.2 42,470 2 41,648 -1.6

25,715 12.9 22,784 -22.5 29,380 16.2 25,290

- - - - - - -

- - - - - - -

7,099 -24.4 9,388 25.3 7,492 27.3 5,888

254 5.8 240 6.2 226 14.4 198

33,068 2 32,412 -12.6 37,098 18.2

29,095 32.5 21,966 46.7 14,969 -15.4 17,702

426 -28.4 595 1.9 584 -31.5 852

3,408 273.3 913 -17.3 1,104 -57.4 2,593

5,096 -37.2 8,120 57 5,172 -51.8 10,737

5,096 -37.2 8,120 57 5,172 -51.8 10,737

51 2 50 2 49 2.1 48

1,010 -80.8 5,264 175.6 1,910 2,446.70 75

66 164 25 25 20 233.3 6

- - - -100 250 -31.7 366

39,152 6 36,933 53.5 24,058 -25.7

5.3 8.8 -3.1

117,743 111,815 102,804 106,086

68,204 -1 68,923 -1.8 70,168 -2.8 72,199

4,488 0.3 4,475 0.5 4,451 -0.2 4,462

- - - - - -100 73

143 5.6 135 11.6 121 -24.4 160

72,834 -1 73,533 -1.6 74,740 -2.8

5,325 0.9 5,280 8 4,887 5.3 4,639

11,538 51.1 7,636 12.3 6,799 -3.3 7,029

9,110 68.1 5,419 -28.6 7,585 235.3 2,262

- - - - - -100 29

1,363 17.8 1,157 69.4 683 14.8 595

9,067 3 8,807 26.1 6,986 414.1 1,359

- - - - - -100 705

54 116 25 100 - - -

7,722 -5.4 8,163 684.9 1,040 -91.1 11,650

730 -59.4 1,796 2,038.10 84 -90.9 924

44,909 17.3 38,282 36.4 28,064 -3.9

5.3 8.8 -3.1

117,743 111,815 102,804 106,086

2015 15 Vs. 14

Rs. %

13,309 1 12,228

3,132 38.5 11

- - 2,119

14 100 -

-4 -89.7 -148

-40 185.7 -21

25,921 35.8 10,880

42,332 22.8

25,290 -29.9 52,896

- - 3,000

- -100 1,531

5,888 14.3 4,574

198 4 185

31,375 -24.3

17,702 -28.4 18,012

852 -37.4 1,480

2,593 283.6 -

10,737 35.7 2,924

10,737 35.7 2,924

48 11.6 44

75 100 -

6 100 -

366 -66.4 213

32,379 -9.6

-5

106,086 109,928

72,199 -3.7 79,315

4,462 3,681.40 138

73 100 -

160 70.2 109

76,894 2.3

4,639 -1.6 4,369

7,029 538.4 1,382

2,262 198.8 758

29 100 130

595 37.4 626

1,359 7,052.60 28

705 100 557

- - -

11,650 -53.6 18,058

924 -79.2 4,458

29,192 -20.1

-5

106,086 109,928

Potrebbero piacerti anche

- Ratio Analysis of WiproDocumento7 pagineRatio Analysis of Wiprosandeepl4720% (2)

- Accounting & Financial Reporting CarrefourDocumento26 pagineAccounting & Financial Reporting Carrefouryasser massryNessuna valutazione finora

- HBL GROUP 6 Strategic Finance ReportDocumento11 pagineHBL GROUP 6 Strategic Finance ReportFaizan JavedNessuna valutazione finora

- Course Activity 1: Comparison Of: YearsDocumento6 pagineCourse Activity 1: Comparison Of: YearsNae InsaengNessuna valutazione finora

- FinShiksha Maruti Suzuki UnsolvedDocumento12 pagineFinShiksha Maruti Suzuki UnsolvedGANESH JAINNessuna valutazione finora

- Netflix Inc.: Balance SheetDocumento16 pagineNetflix Inc.: Balance SheetLorena JaupiNessuna valutazione finora

- Maruti Vs Tata - EXCELDocumento15 pagineMaruti Vs Tata - EXCELParth MalikNessuna valutazione finora

- Soal Manajemen KeuanganDocumento7 pagineSoal Manajemen Keuanganminanti100% (1)

- SHELL Pakistan: Finnacial Ratios Formulas YearDocumento2 pagineSHELL Pakistan: Finnacial Ratios Formulas YearAbdullah QureshiNessuna valutazione finora

- Krsnaa Diagnostics PVT LTD - v2Documento67 pagineKrsnaa Diagnostics PVT LTD - v2HariharanNessuna valutazione finora

- Interloop Limited Income Statement: Rupees in ThousandDocumento13 pagineInterloop Limited Income Statement: Rupees in ThousandAsad AliNessuna valutazione finora

- Income Statement - PEPSICODocumento11 pagineIncome Statement - PEPSICOAdriana MartinezNessuna valutazione finora

- Statement of Profit and Losss Account For The Year Ended 31 ST March 2019Documento9 pagineStatement of Profit and Losss Account For The Year Ended 31 ST March 2019Chirag SinghNessuna valutazione finora

- ValuationDocumento31 pagineValuationAman TaterNessuna valutazione finora

- Stock Analysis Excel Revised March 2017Documento26 pagineStock Analysis Excel Revised March 2017devang asherNessuna valutazione finora

- Gmfi LK TW Iv 2019Documento87 pagineGmfi LK TW Iv 2019Arif RahmanNessuna valutazione finora

- Gmfi LK TW Iv 2019 PDFDocumento87 pagineGmfi LK TW Iv 2019 PDFArif RahmanNessuna valutazione finora

- LWL Dec2021Documento7 pagineLWL Dec2021Shabry SamoonNessuna valutazione finora

- Financial Ratio Analyses and Their Implications To ManagementDocumento31 pagineFinancial Ratio Analyses and Their Implications To ManagementKeisha Kaye SaleraNessuna valutazione finora

- Case StudyDocumento10 pagineCase StudyMani ManandharNessuna valutazione finora

- Britannia (MA) Group 2Documento33 pagineBritannia (MA) Group 2SimarpreetNessuna valutazione finora

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocumento6 pagineBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranNessuna valutazione finora

- Roll No-010,011,012,013 (Group No 3)Documento7 pagineRoll No-010,011,012,013 (Group No 3)Ayush SatyamNessuna valutazione finora

- Loads IbfDocumento14 pagineLoads IbfhipptsNessuna valutazione finora

- Liquidity Ratios: Profitability RatiosDocumento4 pagineLiquidity Ratios: Profitability RatioslobnadiaaNessuna valutazione finora

- NRSP-MFBL-Q3-Financials-Sept 2022 - V1Documento15 pagineNRSP-MFBL-Q3-Financials-Sept 2022 - V1shahzadnazir77Nessuna valutazione finora

- KKL25Documento5 pagineKKL25kalharaeheliyaNessuna valutazione finora

- Assessment 4 Written Assignment Final Zhaoming ZhengDocumento4 pagineAssessment 4 Written Assignment Final Zhaoming ZhengNawshin DastagirNessuna valutazione finora

- Stock Analysis Excel Revised March 2017Documento26 pagineStock Analysis Excel Revised March 2017Sangram Panda100% (1)

- Pak SuzukiDocumento17 paginePak SuzukiSyed Usarim Ali ShahNessuna valutazione finora

- Alkem LabroriesDocumento17 pagineAlkem LabroriesMukesh kumar singh BoraNessuna valutazione finora

- IN Financial Management 1: Leyte CollegesDocumento20 pagineIN Financial Management 1: Leyte CollegesJeric LepasanaNessuna valutazione finora

- For Fixed AssetsDocumento27 pagineFor Fixed AssetsaryalsajaniNessuna valutazione finora

- CF Export 30 11 2023Documento8 pagineCF Export 30 11 2023Sayantika MondalNessuna valutazione finora

- Rosine China Holdings Limited - ExcelDocumento116 pagineRosine China Holdings Limited - ExcelRobert ManjoNessuna valutazione finora

- ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - BloombergDocumento2 pagineROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - BloombergImmanuel Billie AllenNessuna valutazione finora

- Chapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountDocumento8 pagineChapter 3. Finance Department 3.1 Essar Steel LTD.: 3.1.1 P&L AccountT.Y.B68PATEL DHRUVNessuna valutazione finora

- Suzuki Motors (AutoRecovered)Documento8 pagineSuzuki Motors (AutoRecovered)AIOU Fast AcademyNessuna valutazione finora

- Financial Ratio AnalyisisDocumento16 pagineFinancial Ratio AnalyisisNeil Jasper CorozaNessuna valutazione finora

- Accounts Assignement 21MBA0106Documento4 pagineAccounts Assignement 21MBA0106TARVEEN DuraiNessuna valutazione finora

- 2019 Annual Audited Financial StatementDocumento135 pagine2019 Annual Audited Financial StatementAlexis Kaye DayagNessuna valutazione finora

- M4 Example 2 SDN BHD FSADocumento38 pagineM4 Example 2 SDN BHD FSAhanis nabilaNessuna valutazione finora

- Naver 2q20 Eng ConsolDocumento48 pagineNaver 2q20 Eng ConsolPhong NguyenNessuna valutazione finora

- Assignment1 PDFDocumento93 pagineAssignment1 PDFNaman NandwanaNessuna valutazione finora

- FS NvidiaDocumento22 pagineFS NvidiaReza FachrizalNessuna valutazione finora

- Fin ProjectDocumento7 pagineFin Projectdil afrozNessuna valutazione finora

- Aurobindo Pharma Ratio Analysis Anuja Vagal SampleDocumento13 pagineAurobindo Pharma Ratio Analysis Anuja Vagal SampleAryan RajNessuna valutazione finora

- Aurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleDocumento13 pagineAurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleAryan RajNessuna valutazione finora

- Balance Sheet: Particulars Mar-14 Mar-15 Mar-16Documento17 pagineBalance Sheet: Particulars Mar-14 Mar-15 Mar-16akanksha raghavNessuna valutazione finora

- AnalysisDocumento14 pagineAnalysisMaryiam HashmiNessuna valutazione finora

- Fauji Cement Data EntryDocumento17 pagineFauji Cement Data EntryRafay RashidNessuna valutazione finora

- Topic 3.5 Ratio AnalysisDocumento22 pagineTopic 3.5 Ratio AnalysisSevarakhon UmarovaNessuna valutazione finora

- HW2b Walmart SolutionDocumento16 pagineHW2b Walmart Solutionherrajohn100% (1)

- Tubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307Documento8 pagineTubes - Analisa Laporan Keuangan - M Revivo Andrea Vadsya - 1202194122 - Si4307M REVIVO ANDREA VADSYANessuna valutazione finora

- CHB Jun19 PDFDocumento14 pagineCHB Jun19 PDFSajeetha MadhavanNessuna valutazione finora

- GR-I-Crew-II-2018-Bajaj FinanceDocumento51 pagineGR-I-Crew-II-2018-Bajaj FinanceMUKESH KUMARNessuna valutazione finora

- BA Financial RatiosDocumento7 pagineBA Financial RatiosRegen Mae OfiazaNessuna valutazione finora

- Abrar Engro Excel SheetDocumento4 pagineAbrar Engro Excel SheetManahil FayyazNessuna valutazione finora

- Kamel Genuine Parts CompanyDocumento4 pagineKamel Genuine Parts CompanyShamsher Ali KhanNessuna valutazione finora

- CV AssignmentDocumento1 paginaCV AssignmentAbdullah QureshiNessuna valutazione finora

- Careem - Term Project - Complete!Documento37 pagineCareem - Term Project - Complete!Abdullah QureshiNessuna valutazione finora

- Acc Final PDFDocumento20 pagineAcc Final PDFAbdullah QureshiNessuna valutazione finora

- Mamoona Zaheer CVDocumento2 pagineMamoona Zaheer CVAbdullah Qureshi0% (1)

- AsherDocumento10 pagineAsherAbdullah QureshiNessuna valutazione finora

- Accounting SlidesDocumento12 pagineAccounting SlidesAbdullah QureshiNessuna valutazione finora

- Careem PDFDocumento2 pagineCareem PDFAbdullah Qureshi0% (1)

- Answer Sheet For Fixed Income ValuationDocumento3 pagineAnswer Sheet For Fixed Income ValuationAbdullah QureshiNessuna valutazione finora

- SHELL Pakistan: Finnacial Ratios Formulas YearDocumento2 pagineSHELL Pakistan: Finnacial Ratios Formulas YearAbdullah QureshiNessuna valutazione finora

- Ratios 121 PDFDocumento2 pagineRatios 121 PDFAbdullah QureshiNessuna valutazione finora

- Name: Roll Number: Class: Submitted To:: M. Abdullah 190024 Bs-Af 3 Sir Ghazi AlamDocumento5 pagineName: Roll Number: Class: Submitted To:: M. Abdullah 190024 Bs-Af 3 Sir Ghazi AlamAbdullah QureshiNessuna valutazione finora

- SHELLDocumento6 pagineSHELLAbdullah QureshiNessuna valutazione finora

- Careem PDFDocumento2 pagineCareem PDFAbdullah Qureshi0% (1)

- Process Costing: Important Terms To UnderstandDocumento7 pagineProcess Costing: Important Terms To UnderstandAbdullah QureshiNessuna valutazione finora

- SHELLDocumento6 pagineSHELLAbdullah QureshiNessuna valutazione finora

- Ias 10 & 37 - 1Documento4 pagineIas 10 & 37 - 1Abdullah QureshiNessuna valutazione finora

- Role of Microfinance InstitutionsDocumento1 paginaRole of Microfinance InstitutionsSimon SimbakkyNessuna valutazione finora

- R3 Form Download Contribution Collection ListDocumento2 pagineR3 Form Download Contribution Collection ListRvn Nvr33% (3)

- People v. Nitafan, 207 SCRA 726Documento2 paginePeople v. Nitafan, 207 SCRA 726Ron Jacob AlmaizNessuna valutazione finora

- Jamuna Bank LTD: Daily Statement of AffairsDocumento3 pagineJamuna Bank LTD: Daily Statement of AffairsArman Hossain WarsiNessuna valutazione finora

- Pastor D. Ago vs. Court of Appeals CASE DIGEST 2Documento2 paginePastor D. Ago vs. Court of Appeals CASE DIGEST 2Marion Lawrence Lara100% (3)

- Making Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceDocumento25 pagineMaking Investment Decisions With The Net Present Value Rule: Principles of Corporate FinanceKumar GauravNessuna valutazione finora

- Commissioner of Internal Revenue vs. Goodyear Philippines, Inc.Documento2 pagineCommissioner of Internal Revenue vs. Goodyear Philippines, Inc.JoieNessuna valutazione finora

- For Sir Red - 20 MCQs - TAXATIONDocumento5 pagineFor Sir Red - 20 MCQs - TAXATIONRed Christian PalustreNessuna valutazione finora

- Insurance ManagementDocumento6 pagineInsurance ManagementJay KrishnaNessuna valutazione finora

- CBDT E-Payment Request FormDocumento1 paginaCBDT E-Payment Request FormAlicia Barnes67% (21)

- Asistensi 1 Kunci JawabanDocumento7 pagineAsistensi 1 Kunci JawabanNur Fitriah Ayuning BudiNessuna valutazione finora

- Rose Packing Co., Inc. v. CA., 167 SCRA 309Documento9 pagineRose Packing Co., Inc. v. CA., 167 SCRA 309Cza PeñaNessuna valutazione finora

- Economics Assignment: (Decline in Sales in Automobile Sector)Documento9 pagineEconomics Assignment: (Decline in Sales in Automobile Sector)Raghav MalhotraNessuna valutazione finora

- Chapter 8 Cost of CapitalDocumento18 pagineChapter 8 Cost of CapitalKenyi Kennedy SokiriNessuna valutazione finora

- CLASS - B Activity - FABM2Documento43 pagineCLASS - B Activity - FABM2FRANCES67% (3)

- 3063 20170921 Statement PDFDocumento4 pagine3063 20170921 Statement PDFAinur RahmanNessuna valutazione finora

- Texas LLC Update 0509141033Documento43 pagineTexas LLC Update 0509141033tortdogNessuna valutazione finora

- Reliance Industries Limited Annual Report 1991-92Documento75 pagineReliance Industries Limited Annual Report 1991-92Surjya BanerjeeNessuna valutazione finora

- 1 4907089629913546889 PDFDocumento68 pagine1 4907089629913546889 PDFGodha KiranaNessuna valutazione finora

- p-5 Multiple Choice Questions and Answers On Fapk PDFDocumento37 paginep-5 Multiple Choice Questions and Answers On Fapk PDFAakaashNessuna valutazione finora

- Recto LawDocumento9 pagineRecto LawDominic E. BoticarioNessuna valutazione finora

- G.R. No. 215954 Spouses Joven Sy and Corazon Que Sy, Petitioners China Banking Corporation, Respondent Decision Mendoza, J.Documento11 pagineG.R. No. 215954 Spouses Joven Sy and Corazon Que Sy, Petitioners China Banking Corporation, Respondent Decision Mendoza, J.Lizzette GuiuntabNessuna valutazione finora

- Chapter 1 The Securities Contract Regulation Act 1956 and The Securities Contract Regulation Rules 1957Documento42 pagineChapter 1 The Securities Contract Regulation Act 1956 and The Securities Contract Regulation Rules 1957Pragalbh Bhardwaj100% (1)

- Your Reservation: Ibis Bangkok SathornDocumento3 pagineYour Reservation: Ibis Bangkok SathornBusyBoy PriyamNessuna valutazione finora

- MSME Loans Upto Rs.10 Crore - CHECK LISTDocumento1 paginaMSME Loans Upto Rs.10 Crore - CHECK LISTArunkumarNessuna valutazione finora

- OpTransactionHistory06 03 2020Documento3 pagineOpTransactionHistory06 03 2020ramumallavarapuNessuna valutazione finora

- Taxation - Corporation - Quizzer - 2018Documento4 pagineTaxation - Corporation - Quizzer - 2018Kenneth Bryan Tegerero Tegio100% (4)

- Indemnity and Guarantee 1Documento4 pagineIndemnity and Guarantee 1arsalzee75% (4)

- Bar Q & A (Civil Law, 2013-2015)Documento39 pagineBar Q & A (Civil Law, 2013-2015)Jopito Agualada100% (1)

- PNB E-Auction Sale Notice ( (Rajveer Plot-94) PDFDocumento2 paginePNB E-Auction Sale Notice ( (Rajveer Plot-94) PDFAjay tiwariNessuna valutazione finora