Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Joaquin Cunanan & Co: VAT RULING NO. 011-01

Caricato da

Sor ElleTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Joaquin Cunanan & Co: VAT RULING NO. 011-01

Caricato da

Sor ElleCopyright:

Formati disponibili

March 8, 2001

VAT RULING NO. 011-01

Sec 107 (A) 000-00

Joaquin Cunanan & Co.

14th Floor, Multinational Bancorporation Centre

6805 Ayala Avenue

Makati City

Attention: Atty. Alexander B. Cabrera

Partner

Tax Services Department

Gentlemen :

This refers to your letter dated April 8, 1999 requesting, on behalf of your client,

Master Foods Philippines, Inc. (MFPI), for a con rmation of your opinion that its sale of

goods to Duty Free Philippines and other duty free entities consummated outside the

Philippines is not subject to value-added tax (VAT).

It is represented that MFPI is a domestic corporation engaged in the business of

importing food products for local distribution; that it now intends to sell these

products to duty free entities (DFE), including Duty Free Philippines and/or entities

located in Special Economic Zones; that in order for the products to be competitively

priced, the DFEs wish to avail of their tax and duty free privileges in the importation

thereof; that MFPI, thus, proposes to sell the goods to DFEs while they are still in transit

or outside the Philippines so that the DFEs will acquire title over the goods before the

goods enter the Philippines; that if MFPI were to import the goods before selling the

same to DFEs, its price will not be competitive as this will include the costs of import

taxes; that in such case, it will not pursue this business activity; that on the other hand, if

this business activity will be feasible, MFPI will generate additional revenue on which

income taxes (and local business taxes) will be paid, hence, its feasibility will be

beneficial to the government.

In reply, please be informed that pursuant to Section 107(A) of the Tax Code of

1997, "there shall be levied, assessed and collected on every importation of goods a

value-added tax equivalent to ten percent (10%) based on the total value used by the

Bureau of Customs in determining tariff and customs duties, plus customs duties,

excise taxes, if any, and other charges, such tax to be paid by the importer prior to the

release of such goods from customs custody: Provided, That where the customs

duties are determined on the basis of the quantity or volume of the goods, the value-

added tax shall be based on the landed cost plus excise taxes, if any", such tax to be

imposed on the IMPORTERS thereof.

Nonetheless, if, under the instant case, the importer/consignee of the subject

goods to be imported is the Duty Free Philippines, the said importation is exempt from

taxes pursuant to Executive Order No. 46 as restored by FIRB Resolution No. 10-87 but

subject to the following conditions:

CD Technologies Asia, Inc. 2018 cdasiaonline.com

(1) The said exemption shall be limited only to taxes arising out of

merchandise imported/purchased abroad by the Duty Free

Philippines and subsequently sold by it through authorized tax and

duty free shops; and

(2) Operations of tax and duty free shops shall be restricted only to the two

international airports situated in Manila and Cebu.

Conversely, if the importer of the subject merchandise is the MFPI itself, then the

said importation is subject to VAT. TIESCA

This ruling is being issued on the basis of the foregoing facts as represented. If

upon investigation, it will be disclosed that the facts are different, then this ruling shall

be considered null and void.

Very truly yours,

(SGD.) RENE G. BAÑEZ

Commissioner of Internal Revenue

CD Technologies Asia, Inc. 2018 cdasiaonline.com

Potrebbero piacerti anche

- Bir Ruling 418-03 PDFDocumento2 pagineBir Ruling 418-03 PDFSor Elle100% (1)

- 112034-2005-Commissioner of Internal Revenue v. Toshiba20180404-1159-12ci6skDocumento15 pagine112034-2005-Commissioner of Internal Revenue v. Toshiba20180404-1159-12ci6skCamshtNessuna valutazione finora

- CIR VS. Sekisui Jushi Philippines, Inc.Documento1 paginaCIR VS. Sekisui Jushi Philippines, Inc.Abdulateef SahibuddinNessuna valutazione finora

- Cir vs. Amex, GR No. 152609Documento5 pagineCir vs. Amex, GR No. 152609Jani MisterioNessuna valutazione finora

- Petitioner Respondent Litigation Division (BIR) Avisado Agan Montenegro & AssociatesDocumento17 paginePetitioner Respondent Litigation Division (BIR) Avisado Agan Montenegro & AssociatesRobert Jayson UyNessuna valutazione finora

- Sec 107 VatDocumento3 pagineSec 107 VatPatti Ramos-SysonNessuna valutazione finora

- I. Title: Tax Refund Case of Philippine Airlines On Its Imported Cigarettes, Wines, and LiquorsDocumento16 pagineI. Title: Tax Refund Case of Philippine Airlines On Its Imported Cigarettes, Wines, and LiquorsEina Rivera TapnioNessuna valutazione finora

- VAT Ruling No. 16-09Documento4 pagineVAT Ruling No. 16-09Rieland CuevasNessuna valutazione finora

- CIR Vs American ExpressDocumento3 pagineCIR Vs American ExpressRepolyo Ket CabbageNessuna valutazione finora

- Commissioner of Internal Revenue vs. Sekisui JushiDocumento6 pagineCommissioner of Internal Revenue vs. Sekisui Jushivince005Nessuna valutazione finora

- DomondonDocumento40 pagineDomondonCharles TamNessuna valutazione finora

- Coral Bay Tax DigestDocumento3 pagineCoral Bay Tax DigestJonathan Dela Cruz100% (1)

- Cir Vs American ExpressDocumento2 pagineCir Vs American ExpressAnonymous ubixYANessuna valutazione finora

- Week 3 BCDocumento173 pagineWeek 3 BCA GrafiloNessuna valutazione finora

- Silkair Singapore V. CirDocumento6 pagineSilkair Singapore V. CirConie NovelaNessuna valutazione finora

- Business Taxes: Certified Accounting Technician NIAT Office 2015Documento33 pagineBusiness Taxes: Certified Accounting Technician NIAT Office 2015Anonymous Lz2qH7Nessuna valutazione finora

- Bir Ruling Da (Vat 050) 282 09Documento3 pagineBir Ruling Da (Vat 050) 282 09doraemoanNessuna valutazione finora

- VAT Ruling 75-99Documento2 pagineVAT Ruling 75-99Marlene TongsonNessuna valutazione finora

- Week 3 Tax 2 - Assignment - MIPRANUM, RJAYDocumento2 pagineWeek 3 Tax 2 - Assignment - MIPRANUM, RJAYAileen Mifranum IINessuna valutazione finora

- BIR RULING (DA-203-06) : April 3, 2006Documento2 pagineBIR RULING (DA-203-06) : April 3, 2006Richard100% (1)

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Documento17 pagineRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNessuna valutazione finora

- Bar Review Lecture - VATDocumento71 pagineBar Review Lecture - VATIsagani DionelaNessuna valutazione finora

- Articles About VAT Zero-RatingDocumento8 pagineArticles About VAT Zero-RatingkmoNessuna valutazione finora

- 8 CIR v. American ExpressDocumento21 pagine8 CIR v. American ExpressHannah MedNessuna valutazione finora

- RR 13-2018Documento20 pagineRR 13-2018Nikka Bianca Remulla-IcallaNessuna valutazione finora

- RR No. 13-2018 (VAT Refund)Documento23 pagineRR No. 13-2018 (VAT Refund)Hailin QuintosNessuna valutazione finora

- CIR vs. ToshibaDocumento3 pagineCIR vs. ToshibaKayelyn Lat100% (1)

- Secretary Vs Lazatin: FactsDocumento6 pagineSecretary Vs Lazatin: FactsArah Mae BonillaNessuna valutazione finora

- Bir Train Vat 20180418Documento54 pagineBir Train Vat 20180418DanaNessuna valutazione finora

- Business Taxation Midterm Quiz 1 2 PhineeeDocumento4 pagineBusiness Taxation Midterm Quiz 1 2 PhineeeKaxy PHNessuna valutazione finora

- G.R. No. 150154Documento19 pagineG.R. No. 150154Henson MontalvoNessuna valutazione finora

- VAT Tax CasesDocumento12 pagineVAT Tax CasesAnna AbadNessuna valutazione finora

- Introduction To Business TaxesDocumento32 pagineIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Atlas Consolidated Mining V CIR (Case Digest)Documento2 pagineAtlas Consolidated Mining V CIR (Case Digest)Jeng Pion100% (1)

- RR No. 13-2018 CorrectedDocumento20 pagineRR No. 13-2018 CorrectedRap BaguioNessuna valutazione finora

- Commissioner OF Internal REVENUE, Petitioner, vs. American Express International, Inc. (Philippine BRANCH), RespondentDocumento18 pagineCommissioner OF Internal REVENUE, Petitioner, vs. American Express International, Inc. (Philippine BRANCH), RespondentJasfher CallejoNessuna valutazione finora

- Business Tax ReviewerDocumento22 pagineBusiness Tax ReviewereysiNessuna valutazione finora

- Tax - Special TopicsDocumento28 pagineTax - Special TopicsPrincess Diane VicenteNessuna valutazione finora

- 2 Value Added TaxDocumento216 pagine2 Value Added TaxnichNessuna valutazione finora

- Atlas Consolidated Mining and Development Corp. v. CIRDocumento1 paginaAtlas Consolidated Mining and Development Corp. v. CIRms_paupauNessuna valutazione finora

- Cir vs. Toshiba Information Equipment (Phils.), Inc.Documento2 pagineCir vs. Toshiba Information Equipment (Phils.), Inc.brendamanganaan100% (2)

- Value-Added Tax: Secs. 105 To 115Documento71 pagineValue-Added Tax: Secs. 105 To 115louise carinoNessuna valutazione finora

- CIR V Sekisui Jushi DigestDocumento2 pagineCIR V Sekisui Jushi DigestJomel ManaigNessuna valutazione finora

- Reviewer BTTDocumento14 pagineReviewer BTTAlthea Frances VasalloNessuna valutazione finora

- G.R. No. 178090 Panasonic Vs CIRDocumento4 pagineG.R. No. 178090 Panasonic Vs CIRRene ValentosNessuna valutazione finora

- Full Blown Case Commissioner Vs PhilphosDocumento4 pagineFull Blown Case Commissioner Vs PhilphosMary Imogen GdlNessuna valutazione finora

- 5 Cir Vs Toshiba Information Equipment Phils IncDocumento2 pagine5 Cir Vs Toshiba Information Equipment Phils Incsamaral bentesinkoNessuna valutazione finora

- Tax 56 Activity 2Documento2 pagineTax 56 Activity 2Hannah Alvarado BandolaNessuna valutazione finora

- VatDocumento50 pagineVatnikolaevnavalentinaNessuna valutazione finora

- Cir Vs Toshiba Information Equipment Phils IncDocumento1 paginaCir Vs Toshiba Information Equipment Phils IncJoseph FullNessuna valutazione finora

- Bureau of Internal RevenueDocumento11 pagineBureau of Internal RevenueRomer LesondatoNessuna valutazione finora

- Zero-Rated Sales PDFDocumento24 pagineZero-Rated Sales PDFNEstandaNessuna valutazione finora

- Excel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Documento3 pagineExcel Professional Services, Inc.: Management Firm of Professional Review and Training Center (PRTC)Mae Angiela TansecoNessuna valutazione finora

- Toshiba Information Equipment, Inc. v. CIRDocumento3 pagineToshiba Information Equipment, Inc. v. CIRJoshua AbadNessuna valutazione finora

- Cir V Gonzales FactsDocumento6 pagineCir V Gonzales FactsDawn BarondaNessuna valutazione finora

- CIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Documento12 pagineCIR Vs Toshiba Information Equipment (Phils) Inc: 150154: August 9, 2005: J.Iris MendiolaNessuna valutazione finora

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Da EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Nessuna valutazione finora

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesDa EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNessuna valutazione finora

- Impact Assessment AAK: Taxes and the Local Manufacture of PesticidesDa EverandImpact Assessment AAK: Taxes and the Local Manufacture of PesticidesNessuna valutazione finora

- KNCCI Vihiga: enabling county revenue raising legislationDa EverandKNCCI Vihiga: enabling county revenue raising legislationNessuna valutazione finora

- RMC No. 18-2020Documento1 paginaRMC No. 18-2020preNessuna valutazione finora

- Republic of The Philippines, Petitioner: vs. MARELYN TANEDO MANALO, ResponsdentDocumento3 pagineRepublic of The Philippines, Petitioner: vs. MARELYN TANEDO MANALO, ResponsdentSor Elle100% (2)

- RMC No. 18-2020Documento1 paginaRMC No. 18-2020preNessuna valutazione finora

- RMC No. 18-2020Documento1 paginaRMC No. 18-2020preNessuna valutazione finora

- 0504 JMC Dofdti PDFDocumento11 pagine0504 JMC Dofdti PDFBryan Yee LaborNessuna valutazione finora

- Batas Pambansa Bilang 68Documento29 pagineBatas Pambansa Bilang 68Sor ElleNessuna valutazione finora

- CITY of ManilaDocumento4 pagineCITY of ManilaSor ElleNessuna valutazione finora

- Guzman Bocaling Vs BonnevieDocumento2 pagineGuzman Bocaling Vs BonnevieSor Elle100% (1)

- Guzman Bocaling Vs BonnevieDocumento2 pagineGuzman Bocaling Vs BonnevieSor Elle100% (1)

- Ohio vs. RobinetteDocumento2 pagineOhio vs. RobinetteSor ElleNessuna valutazione finora

- Ignacio Barzaga v. CADocumento2 pagineIgnacio Barzaga v. CASor ElleNessuna valutazione finora

- Bill of Rights (Philippines)Documento2 pagineBill of Rights (Philippines)Jen100% (3)

- Yaptinchay vs. TorresDocumento2 pagineYaptinchay vs. TorresSor ElleNessuna valutazione finora

- Rule 70 MCQDocumento7 pagineRule 70 MCQSor ElleNessuna valutazione finora

- Negros SlashersDocumento4 pagineNegros SlashersSor ElleNessuna valutazione finora

- Naldoza, V. RepublicDocumento2 pagineNaldoza, V. RepublicSor ElleNessuna valutazione finora

- Paterno v. PaternoDocumento2 paginePaterno v. PaternoSor Elle100% (1)

- Belle Notes - SalesDocumento33 pagineBelle Notes - SalesSor ElleNessuna valutazione finora

- Terre vs. TerreDocumento2 pagineTerre vs. TerreSor ElleNessuna valutazione finora

- Gomez v. LipanaDocumento2 pagineGomez v. LipanaSor ElleNessuna valutazione finora

- Pedro de Guzman Vs CaDocumento11 paginePedro de Guzman Vs CaSor ElleNessuna valutazione finora

- Sun LifeDocumento4 pagineSun LifeSor ElleNessuna valutazione finora

- International Covenant On Civil and Political RightsDocumento92 pagineInternational Covenant On Civil and Political Rightsaudzgusi100% (1)

- Civil Law Rev Le Belle NotesDocumento10 pagineCivil Law Rev Le Belle NotesSor ElleNessuna valutazione finora

- Forcible Entry and Unlawful Detainer Applicable LawsDocumento10 pagineForcible Entry and Unlawful Detainer Applicable LawsSor ElleNessuna valutazione finora

- Katarungang Pambarangay: A HandbookDocumento134 pagineKatarungang Pambarangay: A HandbookCarl92% (101)

- BOC 2015 Civil Law Reviewer (Final)Documento602 pagineBOC 2015 Civil Law Reviewer (Final)Joshua Laygo Sengco88% (17)

- Primer On GrievanceDocumento67 paginePrimer On Grievanceymervegim02Nessuna valutazione finora

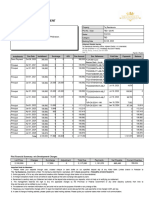

- Electronic Reservation Slip (ERS) : 4361490073 22503/Dbrg Vivek Exp Sleeper Class (SL)Documento3 pagineElectronic Reservation Slip (ERS) : 4361490073 22503/Dbrg Vivek Exp Sleeper Class (SL)vishnuvardhini121Nessuna valutazione finora

- Payroll Workshop: Alaras, Arla Gabrielle (A0012)Documento15 paginePayroll Workshop: Alaras, Arla Gabrielle (A0012)ellaine villafaniaNessuna valutazione finora

- Sumit PassbookDocumento5 pagineSumit PassbookSumitNessuna valutazione finora

- 6 Months Bank Statement Moaz MohsinDocumento2 pagine6 Months Bank Statement Moaz MohsinYuchu Asif100% (1)

- Bain Online Test PDFDocumento21 pagineBain Online Test PDFAvedeoNessuna valutazione finora

- Taj Residencia: Customer Account StatementDocumento1 paginaTaj Residencia: Customer Account StatementGohar SaeedNessuna valutazione finora

- Answers Bus Ad 4 MIDTERMDocumento3 pagineAnswers Bus Ad 4 MIDTERMJophie AndreilleNessuna valutazione finora

- MT760 HSBC PLC LondonDocumento2 pagineMT760 HSBC PLC LondonEdwin W Ng87% (15)

- Invoice DocumentDocumento1 paginaInvoice DocumentALL IN ONENessuna valutazione finora

- Mastering QuickBooks Payroll 2013Documento105 pagineMastering QuickBooks Payroll 2013Chanty Sridhar100% (2)

- Blessing Plastic: Tax Invoice Original For CompanyDocumento1 paginaBlessing Plastic: Tax Invoice Original For CompanyCharles NaveenNessuna valutazione finora

- Liechtenstein's New Tax LawDocumento8 pagineLiechtenstein's New Tax LawMaksim DyachukNessuna valutazione finora

- Advance Payment of TaxDocumento3 pagineAdvance Payment of TaxsadathnooriNessuna valutazione finora

- Incometaxation Chapter8Documento14 pagineIncometaxation Chapter8monneNessuna valutazione finora

- Resident Income Tax Return: Warning: Please Use A Different PDF ViewerDocumento5 pagineResident Income Tax Return: Warning: Please Use A Different PDF ViewermattNessuna valutazione finora

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocumento1 paginaBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountSidhant Singh100% (1)

- BALANCE CASH HOLDING AssignDocumento3 pagineBALANCE CASH HOLDING AssignJarra Abdurahman100% (2)

- выписка месяцDocumento3 pagineвыписка месяцeskanderzunisbaevNessuna valutazione finora

- 22 06 2023 - External Fund Transfer - AllDocumento17 pagine22 06 2023 - External Fund Transfer - Allmeliodas dragonNessuna valutazione finora

- Trimurti Travels: Igst SGST CGSTDocumento1 paginaTrimurti Travels: Igst SGST CGSTWORLD BINNessuna valutazione finora

- A/c Hoglo (876: AdjustmentDocumento1 paginaA/c Hoglo (876: AdjustmentUshat KanharNessuna valutazione finora

- A211 MC 7 - StudentDocumento4 pagineA211 MC 7 - StudentWon HaNessuna valutazione finora

- Company Unit 4th - Aug - 2021Documento17 pagineCompany Unit 4th - Aug - 2021cubadesignstudNessuna valutazione finora

- How To Understand Payment Industry in BrazilDocumento32 pagineHow To Understand Payment Industry in BrazilVictor SantosNessuna valutazione finora

- TGL AP - List Doc - Owner Code Supplier Vendor Invoice SistemDocumento4 pagineTGL AP - List Doc - Owner Code Supplier Vendor Invoice SistemBego BangetNessuna valutazione finora

- Black Book of GSTDocumento3 pagineBlack Book of GSTDeepak YadavNessuna valutazione finora

- Invoice OD119939448063285000Documento1 paginaInvoice OD119939448063285000ShivNessuna valutazione finora

- CAM-Accounting For Income Taxes - Nike 2020 10KDocumento1 paginaCAM-Accounting For Income Taxes - Nike 2020 10KnofeNessuna valutazione finora

- Chapter 4 Gross IncomeDocumento11 pagineChapter 4 Gross IncomeGlomarie Gonayon100% (1)

- 0ZQ73 0ZQ73 2075 20220101 W2Report W2Report 001Documento2 pagine0ZQ73 0ZQ73 2075 20220101 W2Report W2Report 001ligia vazquezNessuna valutazione finora