Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Chapter 2. Exhibits y Anexos

Caricato da

Julio Arroyo GilDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Chapter 2. Exhibits y Anexos

Caricato da

Julio Arroyo GilCopyright:

Formati disponibili

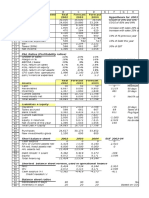

Profit and Loss Sta Real Forecast Forecast

(thousand of reale 2011 2012 2013 Hypothesis for 2012 and 2013

Sales 30,000 36,000 39,600 Growth of 20% and 10%

COGS 24,600 29,880 33,264 COGS of 83% and 84%

Gross Margin 5,400 6,120 6,336

Salaries 1,800 2,160 2,376 Increase with sales 20% and 10%

Overhead 470 564 620 Increase with sales 20% and 10%

Opex Operating Expen 2,270 2,724 2,996

EBITDA 3,130 3,396 3,340

Depreciation 600 600 600 10% of FA previous year

EBIT 2,530 2,796 2,740

Financial Expenses 527 573 488 10% of Debt this year

EBT 2,003 2,223 2,251 30% of EBT

Taxes (30%) 601 667 675

Net Income 1,402 1,556 1,576

P&L Ratios (Profitability Ratios)

Growth of Sales 50% 20% 10%

Gross Margin / Sales 18% 17% 16%

Opex / Sales 8% 8% 8%

Increase of Op 64% 20% 10%

EBITDA / Sales 10% 9% 8%

ROS, Net Income / Sal 4.7% 4.3% 4.0%

ROE, Net Income / Equi 30% 26% 21%

RONA, EBIT / Net Asse 22% 21% 19%

CFO, Cash Flow from O 2,002 2,156 2,176 Net Income + Depreciation

Assets Real Forecast Forecast

(thousand of reale 2011 2012 2013 SUF 2011-13 Hypothesis

Cash 50 50 50 0 Minimum 50

Receivables 6,575 8,877 9,764 3,189 90 days

Inventory 1,348 1,637 1,823 475 20 days

Current Assets, CA 7,973 10,564 11,637

Fixed Assets Net, FA 6,000 6,000 6,000 0 Net FA Constant

Total Assets 13,973 16,564 17,637

Liabilities + Equity

Payables 2,023 2,480 2,749 726 30 days

Other Liabilities 601 720 792 191 2% of sales

Bank Credit 3,267 4,226 3,881 614 Plug Figure

Current Liabilities 5,891 7,425 7,422

Loan (Long Term Debt) 2,000 1,500 1,000 -1,000 Pays 500 per year

Equity + Reserves 4,680 6,082 7,639 2,959 No dividends paid

Net Income of the year 1,402 1,556 1,576 174

Total Liab.+ Equity 13,973 16,564 17,637

Purchases 24,616 30,169 33,449 COGS + Variant of Inventory

New Investments FA Gross 600 600 Variation FA Net + Depreciation

Short Balance Shee 2011 2012 2013 SUF 2011-13

NFO or Current Assets 5,349 7,364 8,096 2,747

FA or Fixed Assets Net 6,000 6,000 6,000 0

NA or Net Assets 11,349 13,364 14,096

D, Debt 5,267 5,726 4,881 -386

E, Equity 6,082 7,639 9,215 3,132

Total Financing (D + E) 11,349 13,364 14,096

Cash Surplus ----> 0 0 0 0

Shortest Balance Sheet Version - used in Operational Finance

NFO 5,349 7,364 8,096 2,747

WC 2,082 3,139 4,215 2,132

Cash Surplus (+) -3,267 -4,226 -3,881 -614

Credit Needed (-)

Balance Sheet Ratios 2011 2012 2013

Receivables in days 80 90 90 Using 365 days

Inventory in days 20 20 20 Based on COGS of this year

Payables in days 30 30 30

NFO / Sales in % 18% 20% 20%

Leverage = Liab. / Equi 1.3 1.2 0.9

Debt / Ebitda 1.7 1.7 1.5

Debt / Net Income 3.8 3.7 3.1

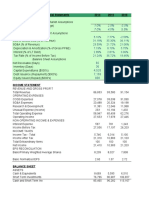

Profit and Loss Statement Forecast Forecast

(million of Euros) 2008 2009 2010 2011 2012

Sales 87,000 84,016 74,233 77,945 81,842

COGS 63,895 60,810 53,350 55,730 58,517

Gross Margin 23,105 23,206 20,883 22,214 23,325

Marketing, Selling an 10,376 11,329 10,200

Other Operating Expen 6,782 5,819 5,067

Opex 17,158 17,148 15,267 15,267 15,572

EBITDA 5,947 6,058 5,616 6,947 7,753

Depreciation 6,264 4,126 3,334 3,334 3,334

EBIT -317 1,932 2,282 3,613 4,419

Financial Income / Expense 2,995 1,543 1,090 1,500 1,500

EBT 2,678 3,475 3,372 5,113 5,919

Taxes 781 849 867 1,278 1,480

Minorities 191 -29 -60

Net Income 2,088 2,597 2,445 3,835 4,439

P&L Ratios (Profitability Ratios) Hypothesis for the Forecast

Growth of Sales na -3% -12% 5% 5%

Gross Margin / Sales 26.6% 27.6% 28.1% 28.5% 28.5%

Opex / Sales 20% 20% 21% 20% 19%

Increase of Opex na 0% -11% 0% 2%

EBITDA / Sales 6.8% 7.2% 7.6% 8.9% 9.5%

ROS, Return on Sales 2.4% 3.1% 3.3% 4.9% 5.4%

ROE, Return on Equity 8% 12% 11% 16% 17%

RONA, Return on Net Assets 0% 3% 3% 5% 7%

CFO, Cash Flow from Operat 8,352 6,723 5,779 7,169 7,773

Assets (million Euros) 2008 2009 2010 SUF 2008-11

Cash 8,593 11,595 12,799 4,206

Receivables 29,014 21,795 20,324 -8,690

Inventory 13,406 10,672 10,366 -3,040

Current Assets 51,013 44,062 43,489

Fixed Assets Net 39,105 33,877 34,116 -4,989

Total Assets 90,118 77,939 77,605

Liabilities + Equity

Payables 10,798 8,649 8,404 -2,394

Other Liabilities 754 661 870 116

Bank Credit 32,972 25,402 22,754 -10,218

Current Liabilities 44,524 34,712 32,028

Loan 17,762 19,165 21,228 3,466

Equity + Reserves 25,744 21,465 21,904 -3,840

Net Income of the year 2,088 2,597 2,445 357

Total Liab.+ Equity 90,118 77,939 77,605

Purchases 63,895 58,076 53,044

New Investments Gross -1,102 3,573 Variation Assets Net + Depreciation

Forecast Forecast

Short Balance Sheet 2008 2009 2010 UF 2008-11 2011 2012

Cash Surplus 8,593 11,595 12,799 4,206 12,799 12,799

NFO or Current Assets Net 30,868 23,157 21,416 -9,452 19,486 20,460

FA or Fixed Assets Net 39,105 33,877 34,116 -4,989 34,116 34,116

NA Net Assets 78,566 68,629 68,331 66,401 67,375

Debt 50,734 44,567 43,982 -6,752 39,717 37,753

Equity 27,832 24,062 24,349 -3,483 26,684 29,623

Total Financing 78,566 68,629 68,331 66,401 67,375

Shortest Balance Sheet version - used in Operational Finance

NFO 30,868 23,157 21,416 -9,452

WC 6,489 9,350 11,461 4,972

Cash Surplus (+) -24,379 -13,807 -9,955 14,424

Credit needed (-)

Verify: Cash - Credit = -24,379 -13,807 -9,955 The result must be the same as in line 64

Balance Sheet Ratios Hypothesis for the Forecast

Receivables in days 120 93 99

Inventory in days 76 63 70

Payables in days 61 51 57

NFO / Sales in % 35.5% 27.6% 28.8% 25% 25%

Leverage = Liab. / Equity 2.2 2.2 2.2

(Debt - Cash) / Ebitda 7.1 5.4 5.6 3.9 3.2

Profit and Loss Statement Forecast Forecast

(million of Euros) 2008 2009 2010 2011 2012

Sales 87,000 84,016 74,233

COGS 63,895 60,810 53,350

Gross Margin 23,105 23,206 20,883

Marketing, Selling an 10,376 11,329 10,200

Other Operating Expe 6,782 5,819 5,067

Opex 17,158 17,148 15,267

EBITDA 5,947 6,058 5,616

Depreciation 6,264 4,126 3,334

EBIT -317 1,932 2,282

Financial Income / Expense 2,995 1,543 1,090

EBT 2,678 3,475 3,372

Taxes 781 849 867

Minorities 191 -29 -60

Net Income 2,088 2,597 2,445

P&L Ratios (Profitability Ratios) Hypothesis for the Forecast

Growth of Sales na 5% 5%

Gross Margin / Sales 28.5% 28.5%

Opex / Sales

Increase of Opex na 0% 2%

EBITDA / Sales

ROS, Return on Sales

ROE, Return on Equity

RONA, Return on Net Assets

CFO, Cash Flow from Operations

Assets (million Euros) 2008 2009 2010 UF 2008-11

Cash 8,593 11,595 12,799

Receivables 29,014 21,795 20,324

Inventory 13,406 10,672 10,366

Current Assets 51,013 44,062 43,489

Fixed Assets Net 39,105 33,877 34,116

Total Assets 90,118 77,939 77,605

Liabilities + Equity

Payables 10,798 8,649 8,404

Other Liabilities 754 661 870

Bank Credit 32,972 25,402 22,754

Current Liabilities 44,524 34,712 32,028

Loan 17,762 19,165 21,228

Equity + Reserves 25,744 21,465 21,904

Net Income of the year 2,088 2,597 2,445

Total Liab.+ Equity 90,118 77,939 77,605

Purchases 63,895 58,076 53,044

New Investments Gross -1,102 3,573 Variation Assets Net + Depreciation

Forecast Forecast

Short Balance Sheet 2008 2009 2010 UF 2008-11 2011 2012

Cash Surplus

NFO or Current Assets net

FA or Fixed Assets Net

NA Net Assets

Debt

Equity

Total Financing

Shortest Balance Sheet Version - used in Operational Finance

NFO

WC

Cash Surplus (+)

Credit Needed (-)

Verify: Cash - Credit = The result must be the same as in line 64

Balance Sheet Ratios Hypothesis for the Forecast

Receivables in days

Inventory in days

Payables in days

NFO / Sales in % 25% 25%

Leverage = Liab. / Equity

(Debt - Cash) / Ebitda

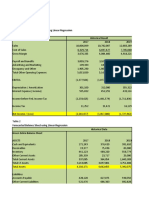

Cuenta de Resultados Real Previsto Previsto

(miles de reales) 2011 2012 2013 Hipótesis para 2012 y 2013

Ventas 30,000 36,000 39,600 Crecimiento 20% y 10%

CMV 24,600 29,880 33,264 CMV del 83% y 84%

Margen bruto 5,400 6,120 6,336

Salarios 1,800 2,160 2,376 Crece con las ventas, 20% y 10%

Gastos generales 470 564 620 Crece con las ventas, 20% y 10%

Opex o Gastos estructura 2,270 2,724 2,996

EBITDA 3,130 3,396 3,340

Amortización 600 600 600 10% del AF del año anterior

EBIT o BAIT 2,530 2,796 2,740

Gastos financieros 527 573 488 10% de la deuda de este año

EBT o BAT 2,003 2,223 2,251

Impuestos (30%) 601 667 675 30% de EBT

BN Beneficio neto 1,402 1,556 1,576

Ratios de cuenta de resultados

Crecimiento de ventas 50% 20% 10%

Margen bruto / Ventas 18% 17% 16%

Opex / Ventas 8% 8% 8%

Aumento de Op 64% 20% 10%

EBITDA / Ventas 10% 9% 8%

ROS, Beneficio neto / vent 4.7% 4.3% 4.0%

ROE, Benf neto / rec propi 30% 26% 21%

RONA, EBIT / activo neto 22% 21% 19%

CFO CF operativo 2,002 2,156 2,176 Beneficio neto + amortización

Activo Real Previsto Previsto

(miles de reales) 2011 2012 2013 COAF 2009-11Hipótesis

Caja 50 50 50 0 Caja mínima 50

Clientes 6,575 8,877 9,764 3,189 90 días

Existencias 1,348 1,637 1,823 475 20 días

Activo circulante, AC 7,973 10,564 11,637

Activo fijo neto, AF 6,000 6,000 6,000 0 AF neto constante

Activo total 13,973 16,564 17,637

Pasivo y rec. propios

Proveedores 2,023 2,480 2,749 726 30 días

Otros acreedores 601 720 792 191 2% de ventas

Crédito bancario 3,267 4,226 3,881 614 Cifra de cierre

Pasivo circulantes 5,891 7,425 7,422

Préstamo bancario 2,000 1,500 1,000 -1,000 Devuelve 500 por año

Recursos propios 4,680 6,082 7,639 2,959 No paga dividendos

Beneficio del año 1,402 1,556 1,576 174

Total pasivo 13,973 16,564 17,637

Compras 24,616 30,169 33,449 CMV + variac. existencias

Nueva inversión bruta 600 600 Variación AF + amortización

Balance resumido 2011 2012 2013 COAF 2009-11

NOF o circulante neto 5,349 7,364 8,096 2,747

AF o activo fijo neto 6,000 6,000 6,000 0

AN o activo neto 11,349 13,364 14,096

D, Deuda (a largo y corto) 5,267 5,726 4,881 -386

RP, Rec propios + Benef. 6,082 7,639 9,215 3,132

11,349 13,364 14,096

Cash Surplus ----> 0 0 0 0

Extracto del balance usado en finanzas operativas

NOF 5,349 7,364 8,096 2,747

FM 2,082 3,139 4,215 2,132

Caja excedente (+) -3,267 -4,226 -3,881 -614

o crédito necesario (-)

Ratios de balance 2011 2012 2013

Días de cobro 80 90 90 Con año de 365 días

Días de existencias 20 20 20 Basado en CMV de este año

Días de pago 30 30 30

NOF / Ventas en % 18% 20% 20%

Apalancamiento 1.3 1.2 0.9

Deuda / Ebitda 1.7 1.7 1.5

Deuda / Benef neto 3.8 3.7 3.1

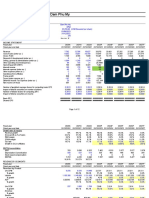

Pérdidas y Ganancias PyG Previsión Previsión

(millones Euros) 2008 2009 2010 2011 2012

Ventas 87,000 84,016 74,233 77,945 81,842

CMV 63,895 60,810 53,350 55,730 58,517

Margen bruto 23,105 23,206 20,883 22,214 23,325

Gastos de ventas y advos. 10,376 11,329 10,200

Otros gastos operativos 6,782 5,819 5,067

Opex 17,158 17,148 15,267 15,267 15,572

EBITDA 5,947 6,058 5,616 6,947 7,753

Amortización 6,264 4,126 3,334 3,334 3,334

EBIT -317 1,932 2,282 3,613 4,419

Resultado financiero 2,995 1,543 1,090 1,500 1,500

EBT 2,678 3,475 3,372 5,113 5,919

Impuestos 781 849 867 1,278 1,480

Minoritarios 191 -29 -60

Resultado del ejercicio 2,088 2,597 2,445 3,835 4,439

Ratios de cuenta de resultados Hipótesis para previsión

Crecimiento de ventas na -3% -12% 5% 5%

Margen bruto / Ventas 26.6% 27.6% 28.1% 28.5% 28.5%

Opex / Ventas 20% 20% 21% 20% 19%

Aumento de Opex na 0% -11% 0% 2%

EBITDA / Ventas 6.8% 7.2% 7.6% 8.9% 9.5%

ROS, rentabilidad s/ ventas 2.4% 3.1% 3.3% 4.9% 5.4%

ROE, rentab. recursos propi 8% 12% 11% 16% 17%

RONA, rentabilidad activo 0% 3% 3% 5% 7%

CFO, Cash Flow Operacione 8,352 6,723 5,779 7,169 7,773

Activo (millón Euros) 2008 2009 2010 COAF 2008-11

Caja 8,593 11,595 12,799 4,206

Clientes 29,014 21,795 20,324 -8,690

Existencias 13,406 10,672 10,366 -3,040

Activo circulante, AC 51,013 44,062 43,489

Activo fijo neto, AF 39,105 33,877 34,116 -4,989

Activo total 90,118 77,939 77,605

Pasivo y rec. propios

Proveedores 10,798 8,649 8,404 -2,394

Otros acreedores 754 661 870 116

Crédito bancario 32,972 25,402 22,754 -10,218

Pasivo circulantes 44,524 34,712 32,028

Préstamo bancario 17,762 19,165 21,228 3,466

Recursos propios 25,744 21,465 21,904 -3,840

Beneficio del año 2,088 2,597 2,445 357

Total pasivo 90,118 77,939 77,605

Compras 63,895 58,076 53,044 CMV + variac. existencias

Nueva inversión bruta -1,102 3,573 Variación AF + amortización

Previsión Previsión

Balance resumido 2008 2009 2010 COAF 2008-1 2011 2012

Caja excedente 8,593 11,595 12,799 4,206 12,799 12,799

NOF o circulante neto 30,868 23,157 21,416 -9,452 19,486 20,460

AF o activo fijo neto 39,105 33,877 34,116 -4,989 34,116 34,116

AN o activos netos 78,566 68,629 68,331 66,401 67,375

Deuda (a largo y corto) 50,734 44,567 43,982 -6,752 39,717 37,753

Recursos propios + Benefici 27,832 24,062 24,349 -3,483 26,684 29,623

Total financiación 78,566 68,629 68,331 66,401 67,375

Extracto del balance usado en finanzas operativas

NOF 30,868 23,157 21,416 -9,452

FM 6,489 9,350 11,461 4,972

Caja excedente (+) -24,379 -13,807 -9,955 14,424

o crédito necesario (-)

Verificación: Caja - Crédito -24,379 -13,807 -9,955 Debe ser igual a línea 64.

Ratios de balance Hipótesis para previsión

Días de cobro 120 93 99

Días de existencias 76 63 70

Días de pago 61 51 57

NOF / Ventas en % 35.5% 27.6% 28.8% 25% 25%

2.2

Apalancamiento (pasivo / rec. propios) 2.2 2.2

(Deuda - Caja) / Ebitda 7.1 5.4 5.6 3.9 3.2

Pérdidas y Ganancias PyG Previsión Previsión

(millones Euros) 2008 2009 2010 2011 2012

Ventas 87,000 84,016 74,233

CMV 63,895 60,810 53,350

Margen bruto 23,105 23,206 20,883

Gastos de ventas y advos. 10,376 11,329 10,200

Otros gastos operativos 6,782 5,819 5,067

Opex 17,158 17,148 15,267

EBITDA 5,947 6,058 5,616

Amortización 6,264 4,126 3,334

EBIT -317 1,932 2,282

Resultado financiero 2,995 1,543 1,090

EBT 2,678 3,475 3,372

Impuestos 781 849 867

Minoritarios 191 -29 -60

Resultado del ejercicio 2,088 2,597 2,445

Ratios de cuenta de resultados Hipótesis para previsión

Crecimiento de ventas na 5% 5%

Margen bruto / Ventas 28.5% 28.5%

Opex / Ventas

Aumento de Opex na 0% 2%

EBITDA / Ventas

ROS, rentabilidad s/ ventas

ROE, rentab. recursos propios

RONA, rentabilidad activo

CFO, Cash Flow Operaciones

Activo (millón Euros) 2008 2009 2010 COAF 2008-11

Caja 8,593 11,595 12,799

Clientes 29,014 21,795 20,324

Existencias 13,406 10,672 10,366

Activo circulante, AC 51,013 44,062 43,489

Activo fijo neto, AF 39,105 33,877 34,116

Activo total 90,118 77,939 77,605

Pasivo y rec. propios

Proveedores 10,798 8,649 8,404

Otros acreedores 754 661 870

Crédito bancario 32,972 25,402 22,754

Pasivo circulantes 44,524 34,712 32,028

Préstamo bancario 17,762 19,165 21,228

Recursos propios 25,744 21,465 21,904

Beneficio del año 2,088 2,597 2,445

Total pasivo 90,118 77,939 77,605

Compras 63,895 58,076 53,044 CMV + Variac. existencias

Nueva inversión bruta -1,102 3,573 Variación AF + Amortización

Previsión Previsión

Balance resumido 2008 2009 2010 COAF 2008-11 2011 2012

Caja excedente

NOF o circulante neto

AF o activo fijo neto

AN o activos netos

Deuda (a largo y corto)

Recursos propios + Beneficio

Total financiación

Extracto del balance usado en finanzas operativas

NOF

FM

Caja excedente (+)

o crédito necesario (-)

Verificación: Caja - Crédito = Debe ser igual a línea 64.

Ratios de balance Hipótesis para previsión

Días de cobro

Días de existencias

Días de pago

NOF / Ventas en % 25% 25%

Apalancamiento (pasivo / rec. propios)

(Deuda - Caja) / Ebitda

A B C D E F G H

1 Conta de Resultados Real Previsto Previsto

2 (em R$ mil) 2011 2012 2013 Hipóteses para 2012 e 2013

3 Vendas 30,000 36,000 39,600 Crescimento 20% e 10%

4 CMV 24,600 29,880 33,264 CMV de 83% e 84%

5 Margem Bruta 5,400 6,120 6,336

6 Salário 1,800 2,160 2,376 Cresce com as vendas, 20% e 10%

7 Despesas Gerais 470 564 620 Cresce com as vendas, 20% e 10%

8 Opex 2,270 2,724 2,996

9 EBITDA 3,130 3,396 3,340

10 Depreciação 600 600 600 10% do AF do ano anterior

11 EBIT ou LAJIR 2,530 2,796 2,740

12 Despesas Financeiras 527 573 488 10% da dívida deste ano

13 EBT ou LAIR 2,003 2,223 2,251

14 Impostos (30%) 601 667 675 30% do EBT

15 LL Lucro Líquido 1,402 1,556 1,576

16

17 Índices da conta de resultados

18 Crescimento das vendas 50% 20% 10%

19 Margen bruta / Vendas 18% 17% 16%

20 Opex / Vendas 8% 8% 8%

21 Aumento de O 64% 20% 10%

22 EBITDA / Vendas 10% 9% 8%

23 ROS, Lucro Líq. / Vendas 4.7% 4.3% 4.0%

24 ROE, Lucro Líq. / PL 30% 26% 21%

25 RONA, EBIT / Ativo Líqui 22% 21% 19%

26 CFO, FC operacional 2,002 2,156 2,176 Lucro Líquido + Depreciação

27

A B C D E F G H

28

29 Ativo Real Previsto Previsto

30 (em R$ mil) 2011 2012 2013 DOAR 2009-11 Hipóteses

31 Caixa 50 50 50 0 Caixa mínimo 50

32 Clientes ou Contas a Rec. 6,575 8,877 9,764 3,189 90 dias

33 Estoques 1,348 1,637 1,823 475 20 dias

34 Ativo Circulante, AC 7,973 10,564 11,637

35 Ativo Fixo Líquido, AF 6,000 6,000 6,000 0 AF Líq. Constante

36 Ativo Total 13,973 16,564 17,637

37

38 Passivo e Patrimônio Líquido

39 Fornecedores 2,023 2,480 2,749 726 30 dias

40 Outros Passivos 601 720 792 191 2% das vendas

41 Crédito bancário 3,267 4,226 3,881 614 Valor de fechamento

42 Passivo Circulante 5,891 7,425 7,422

43 Empréstimo Bancário 2,000 1,500 1,000 -1,000 Amortiza 500 por ano

44 Recursos Próprios 4,680 6,082 7,639 2,959 Não paga dividendos

45 Lucro do ano 1,402 1,556 1,576 174

46 Total pasivo 13,973 16,564 17,637

47

48 Compras 24,616 30,169 33,449 CMV + variação de estoques

49 Novos investimentos brutos 600 600 Variação do AF + depreciação

50

51 Balanço simplificado 2011 2012 2013 DOAR 2009-11

52 NOF ou circulante líq. 5,349 7,364 8,096 2,747

53 AF o u Ativo Fixo Líquido 6,000 6,000 6,000 0

54 AL ou Ativo Líquido 11,349 13,364 14,096

55

56 D, Dívida (de curto e lon 5,267 5,726 4,881 -386

57 PL, Patrimônio Líquido 6,082 7,639 9,215 3,132

58 11,349 13,364 14,096

59 Excedente de Caixa ----> 0 0 0 0

60

61 Extrato do balanço usado em finanças operacionais

62 NOF 5,349 7,364 8,096 2,747

63 CG 2,082 3,139 4,215 2,132

64 Caixa excedente (+) -3,267 -4,226 -3,881 -614

65 ou crédito necessário (-)

66

67 Índices do balanço 2011 2012 2013

68 Días de Cobrança 80 90 90 Com um ano de 365 dias

69 Dias de Estoques 20 20 20 Baseado no CMV deste ano

70 Dias de Pagamento 30 30 30

71 NOF / Vendas (em %) 18% 20% 20%

72 Alavancagem 1.3 1.2 0.9

73 Dívida / Ebitda 1.7 1.7 1.5

74 Dívida / Lucro Líquido 3.8 3.7 3.1

75

A B C D E F G H I

1 Conta de Resultados Previsão Previsão

2 (em € milhões) 2008 2009 2010 2011 2012

3 Vendas 87,000 84,016 74,233 77,945 81,842

4 CMV 63,895 60,810 53,350 55,730 58,517

5 Margem Bruta 23,105 23,206 20,883 22,214 23,325

6 Salário 10,376 11,329 10,200

7 Despesas Gerais 6,782 5,819 5,067

8 Opex 17,158 17,148 15,267 15,267 15,572

9 EBITDA 5,947 6,058 5,616 6,947 7,753

10 Depreciação 6,264 4,126 3,334 3,334 3,334

11 EBIT ou LAJIR -317 1,932 2,282 3,613 4,419

12 Despesas Financeiras 2,995 1,543 1,090 1,500 1,500

13 EBT ou LAIR 2,678 3,475 3,372 5,113 5,919

14 Impostos (30%) 781 849 867 1,278 1,480

15 Minoritários 191 -29 -60

16 Lucro Líquido do exercício 2,088 2,597 2,445 3,835 4,439

17

18 Índices da conta de resultados Hipóteses para previsão

19 Crescimento das vendas na -3% -12% 5% 5%

20 Margen bruta / Vendas 26.6% 27.6% 28.1% 28.5% 28.5%

21 Opex / Vendas 20% 20% 21% 20% 19%

22 Aumento de Opex na 0% -11% 0% 2%

23 EBITDA / Vendas 6.8% 7.2% 7.6% 8.9% 9.5%

24 ROS, Lucro Líq. / Vendas 2.4% 3.1% 3.3% 4.9% 5.4%

25 ROE, Lucro Líq. / PL 8% 12% 11% 16% 17%

26 RONA, EBIT / Ativo Líquido 0% 3% 3% 5% 7%

27 CFO, FC operacional 8,352 6,723 5,779 7,169 7,773

28

A B C D E F G H I

29

30 Ativo (em € milhões) 2008 2009 2010 DOAR 2008-11

31 Caixa 8,593 11,595 12,799 4,206

32 Clientes ou Contas a Rec. 29,014 21,795 20,324 -8,690

33 Estoques 13,406 10,672 10,366 -3,040

34 Ativo Circulante, AC 51,013 44,062 43,489

35 Ativo Fixo Líquido, AF 39,105 33,877 34,116 -4,989

36 Ativo Total 90,118 77,939 77,605

37

38 Passivo e Patrimônio Líquido

39 Fornecedores 10,798 8,649 8,404 -2,394

40 Outros Passivos 754 661 870 116

41 Crédito bancário 32,972 25,402 22,754 -10,218

42 Passivo Circulante 44,524 34,712 32,028

43 Empréstimo Bancário 17,762 19,165 21,228 3,466

44 Recursos Próprios 25,744 21,465 21,904 -3,840

45 Lucro do ano 2,088 2,597 2,445 357

46 Total pasivo 90,118 77,939 77,605

47

48 Compras 63,895 58,076 53,044 CMV + variação de estoques

49 Novos investimentos brutos -1,102 3,573 Variação do AF + depreciação

50 Previsão Previsão

51 Balanço simplificado 2008 2009 2010 DOAR 2008-11 2011 2012

52 Caixa Excedente 8,593 11,595 12,799 4,206 12,799 12,799

53 NOF ou circulante líq. 30,868 23,157 21,416 -9,452 19,486 20,460

54 AF o u Ativo Fixo Líquido 39,105 33,877 34,116 -4,989 34,116 34,116

55 AL ou Ativo Líquido 78,566 68,629 68,331 66,401 67,375

56

57 D, Dívida (de curto e longo) 50,734 44,567 43,982 -6,752 39,717 37,753

58 PL, Patrimônio Líquido 27,832 24,062 24,349 -3,483 26,684 29,623

59 Total Financiamento 78,566 68,629 68,331 66,401 67,375

60

61 Extrato do balanço usado em finanças operacionais

62 NOF 30,868 23,157 21,416 -9,452

63 CG 6,489 9,350 11,461 4,972

64 Caixa excedente (+) -24,379 -13,807 -9,955 14,424

65 ou crédito necessário (-)

66 Verificação: Caixa - Crédito -24,379 -13,807 -9,955 Deveria ser igual à linha 64.

67

68 Índices do Balanço Hipótese para previsão

69 Días de Cobrança 120 93 99

70 Dias de Estoques 76 63 70

71 Dias de Pagamento 61 51 57

72 NOF / Vendas (em %) 35.5% 27.6% 28.8% 25% 25%

73 Alavancagem (passivo / PL) 2.2 2.2 2.2

74 (Dívida - Caixa) / Ebitda 7.1 5.4 5.6 3.9 3.2

75

Conta de Resultados Previsão Previsão

(em € milhões) 2008 2009 2010 2011 2012

Vendas 87,000 84,016 74,233

CMV 63,895 60,810 53,350

Margem Bruta 23,105 23,206 20,883

Salário 10,376 11,329 10,200

Despesas Gerais 6,782 5,819 5,067

Opex 17,158 17,148 15,267

EBITDA 5,947 6,058 5,616

Depreciação 6,264 4,126 3,334

EBIT ou LAJIR -317 1,932 2,282

Despesas Financeiras 2,995 1,543 1,090

EBT ou LAIR 2,678 3,475 3,372

Impostos (30%) 781 849 867

Minoritários 191 -29 -60

Lucro Líquido do exercício 2,088 2,597 2,445

Índices da conta de resultados Hipóteses para previsão

Crescimento das vendas na 5% 5%

Margen bruta / Vendas 28.5% 28.5%

Opex / Vendas

Aumento de Opex na 0% 2%

EBITDA / Vendas

ROS, Lucro Líq. / Vendas

ROE, Lucro Líq. / PL

RONA, EBIT / Ativo Líquido

CFO, FC operacional

Ativo (em € milhões) 2008 2009 2010 DOAR 2008-11

Caixa 8,593 11,595 12,799

Clientes ou Contas a Rec. 29,014 21,795 20,324

Estoques 13,406 10,672 10,366

Ativo Circulante, AC 51,013 44,062 43,489

Ativo Fixo Líquido, AF 39,105 33,877 34,116

Ativo Total 90,118 77,939 77,605

Passivo e Patrimônio Líquido

Fornecedores 10,798 8,649 8,404

Outros Passivos 754 661 870

Crédito bancário 32,972 25,402 22,754

Passivo Circulante 44,524 34,712 32,028

Empréstimo Bancário 17,762 19,165 21,228

Recursos Próprios 25,744 21,465 21,904

Lucro do ano 2,088 2,597 2,445

Total pasivo 90,118 77,939 77,605

Compras 63,895 58,076 53,044 CMV + variação de estoques

Novos investimentos brutos -1,102 3,573 Variação do AF + depreciação

Previsão Previsão

Balanço simplificado 2008 2009 2010 DOAR 2008-11 2011 2012

Caixa Excedente

NOF ou circulante líq.

AF o u Ativo Fixo Líquido

AL ou Ativo Líquido

D, Dívida (de curto e longo)

PL, Patrimônio Líquido

Total Financiamento

Extrato do balanço usado em finanças operacionais

NOF

CG

Caixa excedente (+)

ou crédito necessário (-)

Verificação: Caixa - Crédito = Deveria ser igual à linha 64.

Índices do Balanço Hipótese para previsão

Días de Cobrança

Dias de Estoques

Dias de Pagamento

NOF / Vendas (em %) 25% 25%

Alavancagem (passivo / PL)

(Dívida - Caixa) / Ebitda

Loja A Loja B

Vendas 100 100

Lucro Líquido 10 25

Ativos 100 250

Patrimônio Líquido 50 125

ROS 10% 3%

Giro 1.0 4.0

Alavacangem 2.0 2.0

ROE 20% 20%

ROA 10% 10%

Janeiro Fevereiro Março Abril Maio Junho

Vendas 100 100 100 400 400 400

Clientes, 30 dias 100 100 100 400 400 400

Clientes, 60 dias 200 200 500 800 800

Clientes, 90 dias 300 600 900 1.200

Potrebbero piacerti anche

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryDa EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineDa EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNessuna valutazione finora

- Chapter 3. Exhibits y AnexosDocumento24 pagineChapter 3. Exhibits y AnexosJulio Arroyo GilNessuna valutazione finora

- Chapter 1. Exhibits y AnexosDocumento16 pagineChapter 1. Exhibits y AnexosJulio Arroyo GilNessuna valutazione finora

- Chapter 1. Exhibits y AnexosDocumento15 pagineChapter 1. Exhibits y AnexoswcornierNessuna valutazione finora

- Cap 1 TablasDocumento18 pagineCap 1 TablasWILDER ENRIQUEZ POCOMONessuna valutazione finora

- Hypothesis For 2003 and 2004: Profit and Loss Stateme Real Forecast Forecast 2002 2003 2004Documento12 pagineHypothesis For 2003 and 2004: Profit and Loss Stateme Real Forecast Forecast 2002 2003 2004FeRnanda GisselaNessuna valutazione finora

- A1.2 Roic TreeDocumento9 pagineA1.2 Roic Treesara_AlQuwaifliNessuna valutazione finora

- DCF 2 CompletedDocumento4 pagineDCF 2 CompletedPragathi T NNessuna valutazione finora

- 3 Statement Financial Analysis TemplateDocumento14 pagine3 Statement Financial Analysis TemplateCười Vê LờNessuna valutazione finora

- Ratio Modeling & Pymamid of Ratios - CompleteDocumento28 pagineRatio Modeling & Pymamid of Ratios - CompleteShreya ChakrabortyNessuna valutazione finora

- Case Study Operational FinanceDocumento13 pagineCase Study Operational FinanceJuan Ramon Aguirre Rondinel50% (2)

- Millat Tractors - Final (Sheraz)Documento20 pagineMillat Tractors - Final (Sheraz)Adeel SajidNessuna valutazione finora

- ATH Technologies: Case-3 Strategic ImplementationDocumento8 pagineATH Technologies: Case-3 Strategic ImplementationSumit RajNessuna valutazione finora

- IFS - Simple Three Statement ModelDocumento1 paginaIFS - Simple Three Statement ModelThanh NguyenNessuna valutazione finora

- A1.2 Roic TreeDocumento9 pagineA1.2 Roic TreemonemNessuna valutazione finora

- IFS Dividends IntroductionDocumento2 pagineIFS Dividends IntroductionMohamedNessuna valutazione finora

- Aamir Ali Bba Viii ADocumento9 pagineAamir Ali Bba Viii Aaamir aliNessuna valutazione finora

- Mayes 8e CH05 SolutionsDocumento36 pagineMayes 8e CH05 SolutionsRamez AhmedNessuna valutazione finora

- Income Statement: Company NameDocumento9 pagineIncome Statement: Company NameAkshay SinghNessuna valutazione finora

- Pran Group MIS ReportDocumento14 paginePran Group MIS ReportNazer HossainNessuna valutazione finora

- Gildan Model BearDocumento57 pagineGildan Model BearNaman PriyadarshiNessuna valutazione finora

- Analysis of Financial Statements - VICO Foods CorporationDocumento19 pagineAnalysis of Financial Statements - VICO Foods CorporationHannah Bea LindoNessuna valutazione finora

- IFS - Simple Three Statement ModelDocumento1 paginaIFS - Simple Three Statement ModelMohamedNessuna valutazione finora

- Comparative Income Statements and Balance Sheets For Merck ($ Millions) FollowDocumento6 pagineComparative Income Statements and Balance Sheets For Merck ($ Millions) FollowIman naufalNessuna valutazione finora

- EVA ExampleDocumento27 pagineEVA Examplewelcome2jungleNessuna valutazione finora

- 02 06 BeginDocumento6 pagine02 06 BeginnehaNessuna valutazione finora

- Tarea Heritage Doll CompanyDocumento6 pagineTarea Heritage Doll CompanyFelipe HidalgoNessuna valutazione finora

- Vertical AnalysisDocumento3 pagineVertical AnalysisJayvee CaguimbalNessuna valutazione finora

- 02 04 EndDocumento6 pagine02 04 EndnehaNessuna valutazione finora

- Green Zebra ComputationsDocumento14 pagineGreen Zebra ComputationsJessie FranzNessuna valutazione finora

- Latihan Soal Financial RatiosDocumento6 pagineLatihan Soal Financial RatiosInanda ErvitaNessuna valutazione finora

- Recap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioDocumento7 pagineRecap: Profitability:ROE - Dupont Solvency Capital Employed DER Debt/TA Interest Coverage RatioSiddharth PujariNessuna valutazione finora

- Pacific Grove Spice CompanyDocumento3 paginePacific Grove Spice CompanyLaura JavelaNessuna valutazione finora

- Under ArmourDocumento6 pagineUnder Armourzcdbnrdkm4Nessuna valutazione finora

- Less: Depreciation (CAPEX $ 6000,000) / 10 YearsDocumento15 pagineLess: Depreciation (CAPEX $ 6000,000) / 10 YearsC D BNessuna valutazione finora

- AnandamDocumento12 pagineAnandamNarinderNessuna valutazione finora

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocumento6 pagineParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNessuna valutazione finora

- Hasbro Single FEC Outlet FS - 5 YearsDocumento7 pagineHasbro Single FEC Outlet FS - 5 YearsC D BNessuna valutazione finora

- FINM 7044 Group Assignment 终Documento4 pagineFINM 7044 Group Assignment 终jimmmmNessuna valutazione finora

- Performance AGlanceDocumento1 paginaPerformance AGlanceHarshal SawaleNessuna valutazione finora

- Exhibit in ExcelDocumento8 pagineExhibit in ExcelAdrian WyssNessuna valutazione finora

- CFI 3 Statement Model CompleteDocumento14 pagineCFI 3 Statement Model CompleteMAYANK AGGARWALNessuna valutazione finora

- Gemini Electronics Template and Raw DataDocumento9 pagineGemini Electronics Template and Raw Datapierre balentineNessuna valutazione finora

- Forecasting ProblemsDocumento7 pagineForecasting ProblemsJoel Pangisban0% (3)

- MeharVerma IMT CeresDocumento8 pagineMeharVerma IMT CeresMehar VermaNessuna valutazione finora

- Three Statement PredictionDocumento8 pagineThree Statement PredictionKhush GosraniNessuna valutazione finora

- 545 L2 (Projection of Income Statement, Balance Sheet and Cash Flow)Documento10 pagine545 L2 (Projection of Income Statement, Balance Sheet and Cash Flow)Äyušheë TŸagïNessuna valutazione finora

- MeharVerma IMT Ceres 240110 163643Documento9 pagineMeharVerma IMT Ceres 240110 163643Mehar VermaNessuna valutazione finora

- Lecture - 5 - CFI-3-statement-model-completeDocumento37 pagineLecture - 5 - CFI-3-statement-model-completeshreyasNessuna valutazione finora

- CeresDocumento9 pagineCeresDebangana BaruahNessuna valutazione finora

- Input: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020EDocumento4 pagineInput: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020ERam persadNessuna valutazione finora

- Financial Statement AnalysisDocumento25 pagineFinancial Statement AnalysisAldrin CustodioNessuna valutazione finora

- Business ValuationDocumento2 pagineBusiness Valuationjrcoronel100% (1)

- Nke Model Di VincompleteDocumento10 pagineNke Model Di VincompletesalambakirNessuna valutazione finora

- BHEL Valuation of CompanyDocumento23 pagineBHEL Valuation of CompanyVishalNessuna valutazione finora

- DiviđenDocumento12 pagineDiviđenPhan GiápNessuna valutazione finora

- D.1. Financial Statement AnalysisDocumento3 pagineD.1. Financial Statement AnalysisIrfan PoonawalaNessuna valutazione finora

- Financial Model 3 Statement Model - Final - MotilalDocumento13 pagineFinancial Model 3 Statement Model - Final - MotilalSouvik BardhanNessuna valutazione finora

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryDa EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNessuna valutazione finora

- Jazz Guitar Soloing Etude F Blues 3 To 9 ArpsDocumento1 paginaJazz Guitar Soloing Etude F Blues 3 To 9 ArpsLeonardoPiresNessuna valutazione finora

- Impact of Empathy in The Patient-DoctorDocumento11 pagineImpact of Empathy in The Patient-DoctorFauzan AnugrahNessuna valutazione finora

- Professional Education: St. Louis Review Center, IncDocumento10 pagineProfessional Education: St. Louis Review Center, IncEarshad Shinichi IIINessuna valutazione finora

- Tamang GrammarDocumento12 pagineTamang Grammarsoftdina100% (1)

- NMC CBT Sample Q&a Part 3 AcDocumento14 pagineNMC CBT Sample Q&a Part 3 AcJoane FranciscoNessuna valutazione finora

- Libi Vs IACDocumento1 paginaLibi Vs IACBingoheartNessuna valutazione finora

- Consumer Information On Proper Use of YogaDocumento168 pagineConsumer Information On Proper Use of Yogaskwycb04Nessuna valutazione finora

- PEOPLE v. ROBERTO QUIACHON Y BAYONADocumento11 paginePEOPLE v. ROBERTO QUIACHON Y BAYONAMarkNessuna valutazione finora

- Soil MechDocumento21 pagineSoil MechAhsan AbbasNessuna valutazione finora

- Sistem Informasi Pencatatan Data Pelanggan Pada Telkomsel Grapari Banda AcehDocumento6 pagineSistem Informasi Pencatatan Data Pelanggan Pada Telkomsel Grapari Banda AcehJurnal JTIK (Jurnal Teknologi Informasi dan Komunikasi)Nessuna valutazione finora

- My Kindergarten BookDocumento48 pagineMy Kindergarten BookfranciscoNessuna valutazione finora

- Living GraceDocumento227 pagineLiving GraceÁdám NógrádiNessuna valutazione finora

- 3 Social Policy and Social Welfare AdministrationDocumento284 pagine3 Social Policy and Social Welfare AdministrationJoseph Kennedy100% (5)

- Enzyme Kinetics Principles and MethodsDocumento268 pagineEnzyme Kinetics Principles and MethodsCarlos Carinelli100% (4)

- Once Upon A Timein AmericaDocumento335 pagineOnce Upon A Timein Americaqwerty-keysNessuna valutazione finora

- EXERCISE 1-Passive FormDocumento5 pagineEXERCISE 1-Passive FormMichele LangNessuna valutazione finora

- Alcatel 9400 PDFDocumento4 pagineAlcatel 9400 PDFNdambuki DicksonNessuna valutazione finora

- Airplus CDF3 Technical SpecsDocumento38 pagineAirplus CDF3 Technical Specssadik FreelancerNessuna valutazione finora

- Project Proposal Environmental Protection Program-DeNRDocumento57 pagineProject Proposal Environmental Protection Program-DeNRLGU PadadaNessuna valutazione finora

- Floline Size eDocumento4 pagineFloline Size eNikesh ShahNessuna valutazione finora

- Global Perspectives Reflective PaperDocumento3 pagineGlobal Perspectives Reflective PaperMoaiz AttiqNessuna valutazione finora

- Enga10 Speaking Test3Documento2 pagineEnga10 Speaking Test3luana serraNessuna valutazione finora

- Catherine Davies - Modernity, Masculinity, and Imperfect Cinema in CubaDocumento16 pagineCatherine Davies - Modernity, Masculinity, and Imperfect Cinema in CubakahlilchaarNessuna valutazione finora

- Fellowship 2nd Edition Book 2 - Inverse Fellowship (Playbooks)Documento44 pagineFellowship 2nd Edition Book 2 - Inverse Fellowship (Playbooks)AleNessuna valutazione finora

- VA RESUME HelloracheDocumento1 paginaVA RESUME HelloracheJessa AbadianoNessuna valutazione finora

- Hitachi Zx330 3 Series Hydraulic ExcavatorDocumento15 pagineHitachi Zx330 3 Series Hydraulic ExcavatorAgung ArdhanaNessuna valutazione finora

- 2016 Lesson 9Documento34 pagine2016 Lesson 9Junas Jr LaputNessuna valutazione finora

- Clause: Extra Element + Independent Clause Dependent ClauseDocumento1 paginaClause: Extra Element + Independent Clause Dependent ClauseTieng HuangNessuna valutazione finora

- Buchanan, KeohaneDocumento34 pagineBuchanan, KeohaneFlorina BortoșNessuna valutazione finora

- Comparative Genomics 2 - PART 1Documento31 pagineComparative Genomics 2 - PART 1NnleinomNessuna valutazione finora