Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Assessment Method 2 - Case Study - Part 1: Instructions To Students

Caricato da

Salma ShomaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Assessment Method 2 - Case Study - Part 1: Instructions To Students

Caricato da

Salma ShomaCopyright:

Formati disponibili

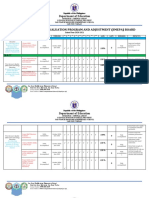

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

ASSESSMENT METHOD 2 – CASE STUDY – PART 1

Instructions to students

1. This assessment requires you to manage and report on budgets

2. You must complete following tasks in this assessment

Task 1- Monitor budgets

Task 2 -Calculate variances

Task 3- Complete budget report

3. To be satisfactory in this assessment you must demonstrates all the skills satisfactory listed

in the marking guide

4. You must use a word processing software to complete Task 1 & Task 3 in & spreadsheet

software to complete task 2.

5. Your assessor will provide you the soft copies of required templates for this assessment

6. Recommended font sizes of the document should range between 10 and 14 and font type

should be as Calibri, Arial, Times New Roman or Tahoma

7. You could complete this assessment in classroom, Computer lab or self-paced.

8. You must spend approximately 2 hours to complete this assessment.

9. Ask your assessor, if you do not understand a question. Your assessor cannot tell you the

answer he/she may be able to re-word the question for you

10. On completion, you are required to submit all the parts to your assessor.

11. Your trainer/assessor will inform you the submission date

12. The additional and specific instructions are listed under each task

Version: September 2019

Page 1 of 7

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

Instructions to complete task 1 task 2 and task 3

1. Read the scenarios and complete reports.

2. Round all dollar values to the nearest whole number when calculating financial information;

for example, $12.55 becomes $13, $18.22 becomes $18.

3. Unless stated otherwise, round all percentages to one decimal point when calculating

financial information; for example, 12.55% becomes $12.6%, 18.22% becomes 18.2%.

4. All budget calculations must be completed using accounting software or computer-based spreadsheet software,

such as Microsoft Excel or Google Sheets.

Case study

The Jackson hotel has a bistro, two bars (public and sports), a drive-through and walk-in bottle

shop and TAB situated beside the sports bar.

You are the manager of JJ’s Bistro. It seats 210 people and is open for lunch and dinner, seven

days a week. The hotel promotes a family environment and has a playroom for younger children

and an activity centre for pre-teens containing electronic and other games. These glass walled

areas are within view of customers seated in the rear section of the bistro.

The hotel’s management team develop an operational budget for the business based on

previous budgets, anticipated business and any special projects, such as renovations or new

products. Each operational area within the hotel is given a departmental budget based on

organisational goals and their anticipated revenue and expenses.

Budgets are developed on a quarterly basis. Each department has quarterly and monthly

budget targets. Monthly budgets can be adjusted during a quarterly cycle if circumstances

within the department change.

The following events have taken place during the April budget period.

Prices for meat, fruit and vegetables have increased as a result of recent drought in some

regions and floods or storms in others.

Prices for many wines have fallen due to a surplus in the market.

Beer prices have risen slightly, again due to the drought leading to shortages of ingredients

and an increase in government taxes.

A major wine supplier has been running an in-house promotional campaign, with staff

product knowledge training provided to help increase sales.

The bistro menu changes to the new winter menu on May 1 st. Its introduction is being

promoted in April throughout the hotel.

Version: September 2019

Page 2 of 7

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

Task 1: Monitor budgets

1. You must analyse the “Budget” given by the assessor and provide a report based on the

contents and outcomes of the Jackson Hotel operational budget – June quarter.

Budget Report

Variable direct

costs

Variable indirect

List the hotel’s financial commitments under their costs

correct cost category. Name at least two

commitments for each category

Fixed indirect

costs

Name the top four cost categories the business

has allocated the most funds too in this budget

period.

Explain why have significant funds been allocated

to these categories?

Discuss their importance to the business and

consequences if inadequate funds are allocated

Consider budget – April.

You are holding a team meeting to discuss the

financial targets provided in the organisational and

April bistro budgets.

Explain what information do you need to

communicate to the team to ensure they

understand the targets and goals to be achieved

Explain what techniques can you use to promote

awareness of methods of controlling costs or

increasing sales so you can achieve budget targets

Version: September 2019

Page 3 of 7

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

Task 2: Calculate variances

1. You must analyse the “Budget” given by the assessor and provide a report based on the

contents and outcomes of the Jackson Hotel operational budget – June quarter

2. Complete the comparative analysis report for the Bistro departmental budget – April by

calculating all missing dollar value and percentage variances.

3. Complete the Favourable/Unfavourable column by indicating if the budget results are

favourable (F) or unfavourable (UF) for the business.

4. You must complete the above tasks using suitable spreadsheet software. Eg MS Excel.

Task 3: Complete Budget Report- April

1. Complete the below report based on the budget outcomes in the completed April budget

comparative report in Task 2 and case study information.

Document if there are any significant variances in

the sales figures that you should be concerned

about. If so explain what the results indicate and

why you are/are not concerned about them

List any significant variances in any of the expenses

categories that you think should be investigated

further. If so, discuss which categories and why

you think they need investigation. If no, discuss

why the deviations do not warrant investigation

Based on your responses to the above 2 contents,

explain your overall evaluation of the budget

results. Is the bistro meeting its financial targets

Which expense category has the most funds

allocated to it? Explain why it is important you

manage costs in this category carefully.

Version: September 2019

Page 4 of 7

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

Using the results and information obtained from

the April comparative report, your responses to

the to the previous contents and the background

information, write a transcript of the outcomes of

your report ready to deliver to the bistro staff at

the next team meeting. The transcript should

include the following information.

The current status of the budget; is the work

area meeting its budget targets, is it on track

to meet June quarter budget targets?

Which areas are underperforming or

performing better than expected?

What changes, if any, need to be made to help

the team meet next month’s budget targets?

An outline of budget targets for May.

Organisational factors that contributed to the

setting of these targets.

Version: September 2019

Page 5 of 7

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

To be completed by the assessor.

Marking Guide – case study Part 1

Student successfully demonstrate evidence of their Satisfactory If not satisfactory please comment

ability to do the following

Yes No

Monitor income and expenditure and evaluate

budgetary performance over budgetary life cycle.

Inform the changes to income and expenditure

priorities to team members before implementation

Allocate funds according to budget and agreed

priorities.

Use financial records to regularly check actual

income and expenditure against budgets.

Provide explanation report for consultation to

relevant personnel about resources decisions

Make awareness of the importance of

maintaining and controlling the budget

Problem solving skills to identify and report

deviations according to significance of deviation.

Include financial commitments in all

documentation to ensure accurate monitoring

Investigate appropriate options for more effective

management of deviations

Identify and report deviations as per the

significance of deviation

Version: September 2019

Page 6 of 7

SITXFIN003 MANAGE FINANCES WITHIN A BUDGET-Case Study-Part 1

Student successfully demonstrate evidence of their Satisfactory If not satisfactory please comment

ability to do the following

Yes No

Communicate with and advise colleagues of

budget status in relation to targets.

Assess existing costs and resources and

proactively identify areas for improvement.

Numeracy skills to interpret and use budget

figures in day-to-day work operations.

Interpret business and financial documents and

document clear recommendations based on

budget information and reports.

Version: September 2019

Page 7 of 7

Potrebbero piacerti anche

- SITHKOP005 Coordinate Cooking Operations Quiz PDFDocumento4 pagineSITHKOP005 Coordinate Cooking Operations Quiz PDFNarongdech PromdaoNessuna valutazione finora

- SITXFIN003 Assessment 1 - Short AnswersDocumento9 pagineSITXFIN003 Assessment 1 - Short AnswersCristine Cunanan24% (17)

- SITXMGT001 Assessment 2 - Project DaDocumento10 pagineSITXMGT001 Assessment 2 - Project Dadaniela castillo0% (2)

- 1169 ROSSAYE SITXGLC001 Ass 2 ProjectDocumento17 pagine1169 ROSSAYE SITXGLC001 Ass 2 Projectmilan shrestha80% (5)

- Paul Lee SITXCCS008 Assessment 1 - Short Answer QuestionsDocumento24 paginePaul Lee SITXCCS008 Assessment 1 - Short Answer QuestionsAndy Lee0% (1)

- Paul LeeSITXCCS008 Assessment 2 - Case StudyDocumento17 paginePaul LeeSITXCCS008 Assessment 2 - Case StudyAndy LeeNessuna valutazione finora

- SITXINV004 Assessments 3Documento7 pagineSITXINV004 Assessments 3Boban GorgievNessuna valutazione finora

- This Study Resource Was: Assessment C - Case Study (Part 1)Documento6 pagineThis Study Resource Was: Assessment C - Case Study (Part 1)Jaydeep Kushwaha100% (3)

- SITXFIN004 Assessment 2 - AssignmentDocumento10 pagineSITXFIN004 Assessment 2 - Assignmentlux tamg0% (2)

- SITXMGT002 Assessment 2 Project FinishedDocumento22 pagineSITXMGT002 Assessment 2 Project FinishedGorkhali GamingNessuna valutazione finora

- ASSESSMENT 1 SITXHRM002 Roster StaffDocumento7 pagineASSESSMENT 1 SITXHRM002 Roster Staffrose0% (1)

- ProjectDocumento17 pagineProjectajay0% (5)

- Assessment Task 1: Research Project: Full Name: Student ID: ANIE200158Documento17 pagineAssessment Task 1: Research Project: Full Name: Student ID: ANIE200158Jaydeep KushwahaNessuna valutazione finora

- SITXFIN003Manage Finances Within A Budget: Futura Group SIT Version 1.0 Page 1 of 4Documento4 pagineSITXFIN003Manage Finances Within A Budget: Futura Group SIT Version 1.0 Page 1 of 4daniela castillo67% (3)

- SITXFIN003 Assessment 2 - ProjectDocumento6 pagineSITXFIN003 Assessment 2 - ProjectJot Khehra0% (3)

- Ass 2 FinaleDocumento9 pagineAss 2 FinaleDavis Sagini ArtNessuna valutazione finora

- Sithkop004: Develop Menus For Special Dietary RequirementsDocumento9 pagineSithkop004: Develop Menus For Special Dietary Requirementsbhshdjn0% (2)

- SITXCCS007 Assessment Task 2Documento10 pagineSITXCCS007 Assessment Task 2Deepika Bhandari0% (2)

- Name: Ashish Acharya Course: Sithind002 Student Number: DC5370 Assesment 2Documento9 pagineName: Ashish Acharya Course: Sithind002 Student Number: DC5370 Assesment 2Ashish Acharya100% (2)

- SITHCCC007 Updated 19.10.20...... Complete File......Documento22 pagineSITHCCC007 Updated 19.10.20...... Complete File......SubhamUprety50% (2)

- BSBMGT517 Manage Operational Plan Assessment: Project The Scenario - Summary Background To ScenarioDocumento18 pagineBSBMGT517 Manage Operational Plan Assessment: Project The Scenario - Summary Background To ScenarioTaniya100% (1)

- SITHKOP005 - AT1 of 5 - Short Answer QuestionsDocumento15 pagineSITHKOP005 - AT1 of 5 - Short Answer Questionszamuel capalunganNessuna valutazione finora

- SITXCCS008 Assessment Task CHDocumento12 pagineSITXCCS008 Assessment Task CHAH GROUP33% (3)

- Sitxhrm003 Project TaskDocumento18 pagineSitxhrm003 Project TaskThilina Dilan WijesingheNessuna valutazione finora

- Bsbsus401 Implement and Monitor Environmentally Sustainable Work PracticesDocumento19 pagineBsbsus401 Implement and Monitor Environmentally Sustainable Work PracticesPahn Panrutai67% (6)

- Assignment SITXFIN004 21aug19 Ver5Documento16 pagineAssignment SITXFIN004 21aug19 Ver5Aryan Singla25% (4)

- Sitxfin003 Task 2Documento2 pagineSitxfin003 Task 2Cristine Cunanan0% (8)

- Unit Result Record Sheet: Amrinder SinghDocumento45 pagineUnit Result Record Sheet: Amrinder SinghVirender Arya100% (1)

- Assessment Method 2 - Project: Instructions For StudentsDocumento8 pagineAssessment Method 2 - Project: Instructions For StudentsJyoti Verma0% (1)

- SITXMGT001 Appendix BDocumento4 pagineSITXMGT001 Appendix Bvasavi yennu100% (2)

- SITXHRM006Documento10 pagineSITXHRM006ajay80% (5)

- SITXHMR002 Melinda Agustina Revised PDFDocumento3 pagineSITXHMR002 Melinda Agustina Revised PDFSonu SainiNessuna valutazione finora

- Ass 2 Manage ConflictDocumento8 pagineAss 2 Manage ConflictNguyen Huong Quynh0% (3)

- SITXFIN003 Assessment TaskDocumento11 pagineSITXFIN003 Assessment TaskAH GROUP0% (1)

- Assessment 2 Cluster SITXMGT001, SITXMGT002 PerformanceDocumento16 pagineAssessment 2 Cluster SITXMGT001, SITXMGT002 PerformanceBoban Gorgiev0% (2)

- ASSESSMENT 2 SITXMGT001 Monitor Work OperationsDocumento19 pagineASSESSMENT 2 SITXMGT001 Monitor Work OperationsJanagama Sneha100% (1)

- SITXMPR007 Assessment Task 1 - Short AnswerDocumento20 pagineSITXMPR007 Assessment Task 1 - Short AnswerHashini RanaweeraNessuna valutazione finora

- BSBMGT517 Assessment 1 - Short AnswerDocumento12 pagineBSBMGT517 Assessment 1 - Short AnswerThayse CarrijoNessuna valutazione finora

- Sithkop005 - Coordinate Cooking Operations S3427 Brandon Benedick A PhilipDocumento4 pagineSithkop005 - Coordinate Cooking Operations S3427 Brandon Benedick A PhilipBrandon0% (1)

- TASK 2 BSBMGT517 Manage Operational Plan TASK 2 BSBMGT517 Manage Operational PlanDocumento15 pagineTASK 2 BSBMGT517 Manage Operational Plan TASK 2 BSBMGT517 Manage Operational PlanRahul MalikNessuna valutazione finora

- BSBMGT517 Assessment 3 - Operational Plan: Assessment Tasks and InstructionsDocumento7 pagineBSBMGT517 Assessment 3 - Operational Plan: Assessment Tasks and InstructionsArmughan Bukhari0% (1)

- DocxDocumento18 pagineDocxFactwale bhaiyajee100% (1)

- Sabic DirectoryDocumento9 pagineSabic DirectoryPranabesh MallickNessuna valutazione finora

- Bekaert BrochureDocumento14 pagineBekaert BrochurePankaj AhireNessuna valutazione finora

- ORENDAIN vs. TRUSTEESHIP OF THE ESTATE OF DOÑA MARGARITA RODRIGUEZ PDFDocumento3 pagineORENDAIN vs. TRUSTEESHIP OF THE ESTATE OF DOÑA MARGARITA RODRIGUEZ PDFRhev Xandra Acuña100% (2)

- PAS 26 Accounting and Reporting by Retirement Benefit PlansDocumento25 paginePAS 26 Accounting and Reporting by Retirement Benefit Plansrena chavezNessuna valutazione finora

- Task 1 Customer Service Research Report Acumen Restaurant: 1.marketingDocumento18 pagineTask 1 Customer Service Research Report Acumen Restaurant: 1.marketingvasavi yennu50% (2)

- Assessment A Project Tasks - Docx 30 PDFDocumento10 pagineAssessment A Project Tasks - Docx 30 PDFSonu SainiNessuna valutazione finora

- Assessment C - Work Book PDFDocumento12 pagineAssessment C - Work Book PDFUtsab Aryal100% (1)

- Word SITXMGT001 Monitor Work Operations 1 Assessment TaskDocumento9 pagineWord SITXMGT001 Monitor Work Operations 1 Assessment TaskVirajkanwal KanwalNessuna valutazione finora

- SITXMGT001 Monitor Work Operations - Learner Assessment 1 - DemonstrationDocumento26 pagineSITXMGT001 Monitor Work Operations - Learner Assessment 1 - DemonstrationSi Slime0% (1)

- S.A.Q - Sitxglc001Documento25 pagineS.A.Q - Sitxglc001bharti50% (8)

- Sitxccs008 12Documento17 pagineSitxccs008 12sayan goswami100% (2)

- Assessment: Canterbury Business CollegeDocumento15 pagineAssessment: Canterbury Business CollegeNazmoon Nahar100% (1)

- SITXCOM005 Assessment 1 - ScenariosDocumento11 pagineSITXCOM005 Assessment 1 - ScenariosJot KhehraNessuna valutazione finora

- At2-Sitxmgt001 (1) Done 1 MayDocumento8 pagineAt2-Sitxmgt001 (1) Done 1 MayDRSSONIA11MAY SHARMA100% (1)

- MANAGE CONFLICT Assessment 2Documento20 pagineMANAGE CONFLICT Assessment 2geeta bhatiaNessuna valutazione finora

- BSBSUS401Documento10 pagineBSBSUS401RV P50% (2)

- NEW PLACEMENT SITXCCS007 - SITXCCS008 Assignment 3Documento7 pagineNEW PLACEMENT SITXCCS007 - SITXCCS008 Assignment 3Joey Yadao0% (1)

- Assessment A - Short - QuestionsDocumento59 pagineAssessment A - Short - Questionsjoe joy0% (1)

- Assessment 2 - V2 - April 2021Documento18 pagineAssessment 2 - V2 - April 2021kimmi grewal100% (1)

- Student Instructions To Students: Assessment Method 2 - Case StudyDocumento2 pagineStudent Instructions To Students: Assessment Method 2 - Case StudyAsfara Amir Sheikh50% (2)

- At2-Sitxfin003 Done 30Documento6 pagineAt2-Sitxfin003 Done 30DRSSONIA11MAY SHARMANessuna valutazione finora

- At2-Sitxfin003 (1) 1 MayDocumento6 pagineAt2-Sitxfin003 (1) 1 MayDRSSONIA11MAY SHARMANessuna valutazione finora

- Ebook4Expert Ebook CollectionDocumento42 pagineEbook4Expert Ebook CollectionSoumen Paul0% (1)

- ASSIGNMENT MGT 657 myNEWSDocumento35 pagineASSIGNMENT MGT 657 myNEWSazrin aziziNessuna valutazione finora

- Career Oriented ProfileDocumento3 pagineCareer Oriented ProfileSami Ullah NisarNessuna valutazione finora

- Aquarium Aquarius Megalomania: Danish Norwegian Europop Barbie GirlDocumento2 pagineAquarium Aquarius Megalomania: Danish Norwegian Europop Barbie GirlTuan DaoNessuna valutazione finora

- SJDM Es Smepa Board 2020-2021Documento5 pagineSJDM Es Smepa Board 2020-2021Loreto Capitli MoralesNessuna valutazione finora

- 173 RevDocumento131 pagine173 Revmomo177sasaNessuna valutazione finora

- History of Anthropology in India by Dr. Abhik GhoshDocumento50 pagineHistory of Anthropology in India by Dr. Abhik GhoshVishal hingeNessuna valutazione finora

- Concept Note Digital Platform Workshop - en PDFDocumento3 pagineConcept Note Digital Platform Workshop - en PDFgamal90Nessuna valutazione finora

- Reflection (The Boy Who Harnessed The Wind)Documento1 paginaReflection (The Boy Who Harnessed The Wind)knightapollo16Nessuna valutazione finora

- Lambda Exercises - Copy (11Documento6 pagineLambda Exercises - Copy (11SamNessuna valutazione finora

- Kukurija: Shuyu KanaokaDocumento10 pagineKukurija: Shuyu KanaokaMarshal MHVHZRHLNessuna valutazione finora

- Quality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection StandardsDocumento29 pagineQuality & Inspection For Lead-Free Assembly: New Lead-Free Visual Inspection Standardsjohn432questNessuna valutazione finora

- James Jagger AffidavitDocumento3 pagineJames Jagger Affidavitmary engNessuna valutazione finora

- DigestDocumento9 pagineDigestOliveros DMNessuna valutazione finora

- 520082272054091201Documento1 pagina520082272054091201Shaikh AdilNessuna valutazione finora

- 50CDocumento65 pagine50Cvvikram7566Nessuna valutazione finora

- Com Ad Module 2Documento10 pagineCom Ad Module 2Gary AlaurinNessuna valutazione finora

- Double JeopardyDocumento5 pagineDouble JeopardyDeepsy FaldessaiNessuna valutazione finora

- H8 Pro: Pan & Tilt Wi-Fi CameraDocumento12 pagineH8 Pro: Pan & Tilt Wi-Fi CameravalladaresoscarNessuna valutazione finora

- JioMart Invoice 16776503530129742ADocumento1 paginaJioMart Invoice 16776503530129742ARatikant SutarNessuna valutazione finora

- KALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)Documento9 pagineKALIC J - Palata Srpskih Despota U Budimu (Zograf 6, 1975)neven81Nessuna valutazione finora

- Social Inequality and ExclusionDocumento3 pagineSocial Inequality and ExclusionAnurag Agrawal0% (1)

- Egyptian Gods and GoddessesDocumento5 pagineEgyptian Gods and GoddessesJessie May BonillaNessuna valutazione finora

- Wearables & Homestyle Accomplishment Report - CY 2023Documento6 pagineWearables & Homestyle Accomplishment Report - CY 2023Jonathan LarozaNessuna valutazione finora

- IMS-PRO-02 Hazard and Risk Assessment & Aspect ImpactDocumento6 pagineIMS-PRO-02 Hazard and Risk Assessment & Aspect ImpactISO Consultancy100% (1)

- Udom Selection 2013Documento145 pagineUdom Selection 2013Kellen Hayden100% (1)