Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Financial Accounting MCQS For Exam

Caricato da

Muhammad MidhatTitolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Financial Accounting MCQS For Exam

Caricato da

Muhammad MidhatCopyright:

Formati disponibili

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

1. Accounting is called of business:

a) Heart b) Eye

c) Ear d) Tongue

2. When a drawer discounts a bill, he debits:

a) Bank account b) Cash account

c) Drawee account d) B/R account

3. Journal means:

a) Monthly b) Yearly

c) Monthly d) Daily

4. The time after which the bill is to be paid:

a) Due date b) Tenure

c) Days of Grace d) A month

5. In three column cash book, contra entry means:

a) Balance b) Parallel side

c) same side d) Opposite Side

6. A cash discount always shows:

a) Zero balance b) Equal balance

c) Credit balance d) Debit balance

7 Interest paid on loan is a:

a) Financial expense b) Selling expense

c) Management expenses d) Loss

8. Goodwill, patents and copyrights are classified as:

a) Fixed assets b) Current assets

c) Tangible assets d) Intangible assets

9. Expenses increasing the earning capacity of business are:

a) Deferred expense b) Capital loss

c) Abnormal loss d) Capital Expenditure

10. Raw materials destroyed by fire show:

a) Abnormal loss b) Normal loss

c) Capital loss d) Revenue loss

11. Any difference in trial balance is transferred to:

a) Sales account b) Purchases account

c) Suspense account d) Capital account

12. Net income is equal to:

a) Revenue + Expenses b) Sales -- Purchases

c) Assets – Liabilities d) Revenue --Expenses

13. A trial balance is a:

a) Income statement b) Opening balance

c) Balance sheet d) List of ledger balances

14. A promissory note is made by:

a) Creditor b) Debtor

c) Seller d) Banker

15. A loss is a capital loss because it is due to:

a) Fixed assets b) Withdrawal of capital

c) Abnormal loss d) Business stoppage

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

16. A loss is a revenue loss because it relates to:

a) Normal reasons b) Current assets

c) Decrease in tax liability d) Income

17. Carriage paid for a new plant purchased if debited to carriage account would effect:

a) Carriage account b) Agents

c) Plant account d) Plant & carriage account

18. Prepaid expenses should appear in:

a) Stores b) Revenues

c) Assets d) Liabilities

19. Pre-received income is shown in:

a) Assets b) Liability

c) Revenues d) None

20. Net loss is always more than:

a) Gross profit b) Sales

c) Capital d) None

21.A person who owes money is:

a) A Creditor b) An Owner

c) A Debtor d) Agent

22. Entry made on both sides of cash book is called:

a) Double entry b) Compound entry

c) Contra entry d) Mixed entry

23. Petty cash book is a branch of:

a) Sales book b) Pass book

c) Cash book d) Purchase book

24. Double entry system involves at least:

a) One account b) Two account

c) Three account d) Four account

25. The arithmetical accuracy of books of accounts is verified through:

a) Journal b) Ledger

c) Trial balance d) Cash book

26. Commission received is:

a) Asset b) Liability

c) Income d) Expenses

27. Transaction which is omitted from the records is called:

a) Error of principle b) Error of Commission

c) Compensating error d) Error of Omission

28. Receipt on sale of fixed asset is:

a) Deferred receipt b) Current receipts

c) Capital receipt d) Revenue receipt

29. Cash discount is provided on:

a) Purchases b) Sales

c) Sales returns d) Prompt payment

30. Carriage inward is:

a) Direct expense b) Indirect expense

c) Operating expense d) Selling expense

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

31. Cash sales are recorded in:

a) Journal b) Cash book

c) Sales book d) Both A & B

32. Closing stock is recorded at the:

a) Balance sheet & Trading account b) Trading account

c) Balance sheet only d) Profit & loss account

33. Personal accounts are related to:

a) Assets & Liabilities b) Goodwill

c) Equity & Drawings d) Income & Expenses

34. Excess of debit over credit is called:

a) Credit balance b) Debit balance

c) Opening balance d) Closing balance

35. The excess of assets over liabilities is:

a) Revenue b) Profit

c) Loss d) Capital

36. A bill of exchange contains:

a) A promise b) An unconditional order

c) A conditional order d) A request to deliver goods

37. Wages paid to workers for erection of machinery are:

a) Revenue expenditure b) Capital expenditure

c) Capital loss d) Revenue loss

38. Withdrawal of merchandise for personal use is:

a) Drawings b) Sale of merchandise

c) Personal expense d) Charity

39. If business assets are more than its liabilities, this position is known as:

a) Insolvency b) Solvency

c) Both A & B d) Loan position

40. Which of the following is not a current asset?

a) Cash b) Bank

c) Debtors d) Machinery

41. The person to whom the goods have been sold on credit and amount is receivable from

them at determinable future date is called:

a) Owner b) Creditor

c) Bank d) Debtor

42. Accounting is language of:

a) Chemistry b) Science

c) Businessman d) Business

43. Any legal activity of production, exchange of goods and services for the purpose of earning

profit is called:

a) Social activity b) Religious activity

c) Business d) None

44. Business classification are:

a) Trading b) Manufacturing

c) Services d) All of these

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

45. Trial balance contains capital Rs.50, 000, interest on capital at 5% p.a. at the yearend:

a) Rs.2500 b) Rs.1800

c) Rs.1875 d) Rs.2000

46. Current liabilities do no include:

a) Unclaimed dividend b) Sundry creditors

c) Prepaid insurance d) Bank overdraft

47. Bill receivable account is a:

a) Nominal account b) Real account

c) Personal account d) Expense account

48. Which group only contains fixed assets?

a) Land, Machinery, Premises & Debtors b) Land, Machinery, Premises & Stock

c) Land, Machinery, Premises & Vehicles d) Land, Machinery, Premises & Cash

49. Discount allowed appearing in the trial balance will be recorded in the:

a) Balance sheet b) Trading account

c) Profit & loss account ( Dr.) d) Profit & loss account ( Cr.)

50. Outstanding wages appearing in the trial balance, will record only:

a) Balance sheet b) Trading account

c) Profit & loss account d) Both A & B

51. Return inward given in adjustment will affect:

a) Purchases returns & Debtor b) Sales returns & Debtor

c) Cash purchases d) Discount received

52. Outstanding income given adjustment Rs.250. Income in trial balance Rs.2500 what

` amount will be recorded in profit and loss account:

a) Rs.2250 b) Rs.2750

c) Rs.2500 d) Rs.2000

53. Retiring a bill under rebate means, payment a bill:

a) After due date b) Before due date

c) Dishonoring of bill d) All of these

54. Wrong addition is:

a) Error of Omission b) Error of Commission

c) Error of Principles d) None

55. Noting charges are paid, when bill is:

a) Met at maturity b) Discount of bill

c) Dishonored of bill d) None

56. Balance sheet is statement of:

a) Assets b) Liabilities

c) Both A & B d) Working capital

57. Written below each entry is the:

a) Narration b) Voucher No.

c) Transaction d) Date

58. A bill of exchange is accepted by:

a) Drawer b) Drawee

c) Payee d) Bank

59. Nominal accounts are related to:

a) Assets b) Liabilities

c) Creditors d) Expense + Income

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

60. The modern system of book keeping is based on:

a) Double account system b) Single entry system

c) Single account system d) Double entry system

61. Goods returned to supplier should be credited to:

a) Supplier account b) Sales return account

c) Purchase return account d) Purchases account

62. Which of these accounts is increased by credit entries?

a) Machinery account b) Sales account

c) Rent account d) Purchases account

63. Which of these accounts is a fixed asset?

a) Cash b) Stock

c) Plant d) Prepaid Expenses

64. If more than two accounts are involved in a journal entry it is called:

a) Double entry b) Compound entry

c) Contra entry d) Single entry

65. Wich of the following book is called the book of original entry:

a) Cash book b) Ledger

c) Journal d) Sales book

66. Bank reconciliation statement is prepared by:

a) Bank b) Auditors

c) Creditors d) Accountant

67. In accounting equation, assets are equal to:

a) Capital b) Capital + Liabilities

c) Liabilities d) Capital – Liabilities

68. Bad debts are shown in the:

a) Trading account b) Profit & Loss account

c) Both first d) None of these

69. Amount paid for the purchase of machinery.

a) Revenue expenditure b) Capital loss

c) Capital expenditure d) Revenue loss

70. Carriage paid on goods purchased:

a) Direct expense b) Indirect expense

c) Selling expense d) Operating expense

71. Unearned income is shown as:

a) Assets b) Liability

c) Expenses d) Income

72. Balance sheet does not contain:

a) Assets b) Liabilities

c) Expense & Income d) None of these

73. When the bank made the payment of the cheque it is called………cheque:

a) Honored b) Dishonored

c) Discounted d) None of these

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

74. The errors which cancel themselves out are called:

a) Error of omission b) Errors of commission

c) Compensating errors d) None of these

75. The amount of cash or goods withdrawn by the proprietor for personal use is called:

a) Expenses b) Capital

c) Revenue d) Drawings

76. The discount which is calculated on list price of goods is called:

a) Trade discount b) Cash discount

c) Rebate d) None of these

77. The book meant for recording all cash transactions is called:

a) Purchase book b) Sales book

c) Cash book d) Pass book

78. Trial balance is prepared to detect:

a) Errors of Omission b) Errors of Commission

c) Compensating errors d) Errors of Principles

79. The cheques which is returned by the bank unpaid is called:

a) Cross cheque b) Bearer cheque

c) Dishonor cheque d) Order cheque

80. Cash and goods invested by the proprietor in business is called:

a) Investment b) Drawings

c) Capital d) None of these

81. For payment of bills of exchange, grace days are:

a) 2 days b) 3 days

c) 4 days d) 5 days

82. Credit sales are recorded in:

a) Cash book b) Sales book

c) Purchase book d) Pass book

83. Which of the following account is increased by the debit entries?

a) Capital account b) Sales account

c) Building account d) Purchases return account

84. The person who draws a bill of exchange is known as:

a) Drawer ( Creditor ) b) Drawee ( Debtor )

c) Payee d) Bank

85. Goods returned by a customer should be debited to:

a) Sales account b) Purchases account

c) Customers account d) Sales return account

86. To any business bad debts are:

a) An asset b) A loss

c) An income d) A liability

87. How many branches of accounting are?

a) Two. b) Three

c) Four d) One

88. Discount received is a:

a) Asset b) Liability

c) Revenue d) Expenses

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

89. The amount of salaries paid to Javed should be credited to:

a) Javed account b) Salaries account

c) Cash account d) None of these

90. Favourable bank balance means:

a) Credit balance of cash book b) Debit balance of cash book

c) Debit balance of pass book d) None of these

91. Prepaid expenses are:

a) Expense b) Asset

c) Liability d) None of these

92. The science and art of correctly recording business dealing in a set of books is called:

a) Book keeping b) Accounting

c) Auditing d) Recording

93. The debts due by a business to its proprietor and others are termed ad:

a) Capital b) Drawings

c) Liabilities d) Assets

94. Sales return also called:

a) Return inward b) Return outward

c) Return to seller d) Both A & C

95. Accounting principles are generally based on:

a) Theory b) Practicability

c) Subjectively d) None of these

96. Bill receivable and debtor are:

a) Long term assets b) Fixed assets

c) Fictitious assets d) Current assets

97. Journal is prepared in:

a) Columnar form b) Vertical form

c) Horizontal form d) Raw form

98. Major accounts of ledger are:

a) General ledger b) Creditors ledger

c) Proprietor ledger d) Both A & B

99. Bank Reconciliation represents:

a) Ledger b) Journal

c) Statement d) Both A & C

100. Operating expenses represents:

a) Gross profit - Operating Exp. b) Selling + General Exp.

c) Selling & administrative Exp. d) All of these

101. Net loss is transferred in balance sheet to:

a) Capital b) Assets

c) Losses d) Deferred losses

102. Preliminary expenses incurred for formation of Joint Stock Company represent:

a) Capital loss b) Revenue loss

c) Capital expenditure d) Deferred revenue expenditure

103. Errors which affect income statement belong to:

a) Personal account b) Nominal account

c) Real account d) None of these

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

104. The process of recording business transactions in the journal is called:

a) Posting b) Journalizing

c) Classifying d) Entry

105. The book in which small payments like stationery, postage etc. are recorded is called:

a) Main cash book b) Petty cash book

c) Cash account d) Both A & B

106. Credit balance of cash book is also called:

a) Un-favorable balance b) Favorable balance

c) Negative balance d) Both favorable & unfavorable balance

107. Assets which come into existence upon the happening of a certain event are called:

a) Fictitious assets b) Contingent assets

c) Floating assets d) Dependent assets

108. Legal expenses incurred in purchasing land, property represent:

a) Capital expenditure b) Revenue expenditure

c) Revenue loss d) Deferred revenue expenditure

109. A payment for freight on raw material purchased is called:

a) Capital payment b) Revenue payment

c) Deferred revenue payment d) None of these

110. Cheque received but not deposited, recorded in cash book only:

a) Cash column b) Bank column

c) Discount column d) None of these

111. Carriage paid on goods sold:

a) Direct expense b) Indirect expense

c) Selling expense d) Operating expense

112. Expense paid in advance is called:

a) Prepaid expenses b) Expired expenses

c) Deferred expenses d) Both A & C

113. The purchase of machinery on account would effect:

a) Increase & decrease in asset b) Increase in asset & decrease in liability

c) Increase in asset & decrease liability d) Increase in asset & Increase in liability

114. Bad debts arise from:

a) Sale on account b) Cash sales

c) Account receivable d) Account payable

115. Any physical thing that has money value:

a) Transaction b) Intangible assets

c) Assets d) Goodwill

116. Stationery is classified into:

a) Factory supplies b) Office supplies

c) Sales supplies d) Trade supplies

117. To record, classify and summarize business transactions is called:

a) Cost accounting b) Financial accounting

c) Book-keeping d) Accounting

118. The party most interested in accounting information is:

a) Owners b) Managers

c) Creditors d) Investors

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

119. The book in which business transactions are recorded on daily basis is called:

a) Journal b) Ledger

c) Account d) Summary

120. The entry system in which cash account and personal accounts are maintained is called:

a) Double entry system b) Single entry system

c) Accounting d) None of these

121 Universally accepted customs, rules or traditions:

a) Accounting principles b) Accounting conventions

c) Accounting traditions d) Accounting rules

122. The amount allowed by the creditor to the debtor for making payment before due date:

a) Trade discount b) Cash discount

c) Payment discount d) Purchase discount

123. The unsold merchandise of business at the end of a day is called:

a) Closing stock b) Opening stock

c) Opening merchandise d) Stock to be carried forward

124. Anything valuable possessed by a business is called:

a) Property b) Resources

c) Asset d) Capital asset

125. Cash sale to Mr. A will be credited to:

a) Mr. A’s account b) Cash account

c) Sales account d) Good’s account

126. While balancing an account, the difference of two sides is recorded in:

a) Debit side b) Credit side

c) Larger side d) Smaller side

127. Excess of credit side over debit side is called:

a) Profit b) Income

c) Surplus & Deficit d) Credit balance

128. An order drawn by a bank on one of its branches to pay a specified sum of money to the

person named in is called:

a) Cheque b) Moner order

c) Hundi d) Bank draft

129. When a drawee signs his name across the face of the bill along with the word “accepted”

is called:

a) Acceptance b) Signing of bill

c) Approval d) None of these

130. The paper containing evidence of payment is called:

a) Debit voucher b) Debit note

c) Credit note d) Credit voucher

131. The term imprest system is used in relation to:

a) Purchase book c) Sales book

c) Cash book d) Petty cash book

132. Bank reconciliation statement is:

a) A memorandum statement b) A ledger account

c) A part of cash book d) None of these

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

133. Dealing between two persons or things is called:

a) Introduction b) Meeting

c) Discussion d) Transaction

134. The concession given by the supplier to the buyer on purchase of goods is known as:

a) Trade discount b) Cash discount

c) Sale discount d) Purchase discount

135. Real accounts are related to:

a) Incomes b) Losses

c) Assets d) Expense

136. Every transaction has:

a) Four aspect b) Triple aspect

c) Dual aspect d) Single aspeat

137. Which of the following books is called the king of books of accounts?

a) Journal b) Ledger

c) Trial balance d) Cash book

138. Liabilities normally show:

A) Debit balance b) Credit balance

c) None of them d) Both debit & credit

139. Transactions are finally recorded in:

a) Balance sheet b) Trial balance

c) Ledger d) Journal

140. A bill of exchange is exactly like a:

a) Hundi b) Pay order

c) Pay-in-slip d) Bank draft

141. When the cheque is paid by the drawer’s bank, it is said to be:

a) Accepted b) Endrosed

c) Dishonored d) Honored

142. The person to whom a bill is addressed is called:

a) Agent b) Holder

c) Debtor d) Creditor

143. Subsidiary books are called books of:

a) Secondary entry b) Original entry

c) Final entry d) Temporary entry

144. Bank account is:

a) Real account b) Nominal account

c) Personal account d) None of these

145. For a business concern “Capital” is a:

a) Asset b) Expense

c) Liability d) None of these

146. Money obtained by the issue of debenture is:

a) Revenue Receipt b) Capital receipt

c) Revenue profit d) Capital profit

147 The accounting equation is:

a) Assets = Capital + Liabilities b) Liabilities = Assets + Capital

c) Capital = Assets + Liabilities d) Assets = Capital - Liabilities

PUNJAB COLLEGE OF COMMERCE

An easy MULTIPLE CHOICE QUESTIONS WITH ANSWERS

approach

to pass

(ACCOUNTING-I)

148. The balance of petty cash book is:

a) An asset b) A gain

c) An expense d) A liability

149. Gross profit is equal to:

a) Gross profit – Expense b) Sale – Cost of sale

c) Capital – expense d) Sale – Expense

150. Day book is another name of:

a) Purchase book b) Cash book

c) Ledger d) Journal

151. How many forms of ledger are?

a) One b) Two

c) Three d) None of these

152. If two sides of an account are equal, that account will show:

a) Debit balance b) Credit balance

c) Zero balance d) All of them

PUNJAB COLLEGE OF COMMERCE

Potrebbero piacerti anche

- Namma Kalvi 11th Accountancy 1 Mark Questions Reduced Syllabus em 219820Documento9 pagineNamma Kalvi 11th Accountancy 1 Mark Questions Reduced Syllabus em 219820mageshwari mohanNessuna valutazione finora

- All MCQs of Finnancial AccountingDocumento13 pagineAll MCQs of Finnancial AccountingNoshair Ali100% (2)

- NME Fundments of Accounting III & IV UnitDocumento23 pagineNME Fundments of Accounting III & IV UnitSwathi LakshmiNessuna valutazione finora

- Accountancy XIDocumento8 pagineAccountancy XIGurmehar Kaur100% (1)

- ACCOUNTING MCQs With Answers by M.riaz KhanDocumento11 pagineACCOUNTING MCQs With Answers by M.riaz KhanRizwan KhanNessuna valutazione finora

- Principles of Accountancy MCQDocumento10 paginePrinciples of Accountancy MCQlindakutty50% (2)

- 1 Q For AAO SSCDocumento6 pagine1 Q For AAO SSCAkanksha Garg100% (1)

- Journal, Ledger, Trail Balance and Finnancial Statement MCQsDocumento5 pagineJournal, Ledger, Trail Balance and Finnancial Statement MCQsNoshair Ali100% (4)

- Accounts MCQDocumento41 pagineAccounts MCQHaripriya VNessuna valutazione finora

- Mcqs LedgerDocumento10 pagineMcqs LedgerUsama SaadNessuna valutazione finora

- MCQS AccountigDocumento7 pagineMCQS AccountigSofia MuneerNessuna valutazione finora

- Sem1 MCQ FinancialaccountDocumento14 pagineSem1 MCQ FinancialaccountVemu SaiNessuna valutazione finora

- Account's MCQDocumento7 pagineAccount's MCQMohitTagotraNessuna valutazione finora

- Accounting MCQs With AnswersDocumento77 pagineAccounting MCQs With AnswersAbhijeet AnandNessuna valutazione finora

- Afm MCQDocumento10 pagineAfm MCQSarannya PillaiNessuna valutazione finora

- Final McqsDocumento43 pagineFinal McqsShoaib Kareem100% (4)

- Personal Real Nominal McqsDocumento6 paginePersonal Real Nominal Mcqsasfandiyar100% (3)

- Accounting Cycle McqsDocumento7 pagineAccounting Cycle McqsasfandiyarNessuna valutazione finora

- MCQ-Financial AccountingDocumento13 pagineMCQ-Financial AccountingArchana100% (1)

- MCQs Financial Accounting BSCSDocumento11 pagineMCQs Financial Accounting BSCSPervaiz Shahid100% (1)

- Financial Accounting McqsDocumento3 pagineFinancial Accounting McqsMurad AliNessuna valutazione finora

- Journal, Ledger & Cash Book MCQs For FPSC and Other Related One Paper MCQs TestsDocumento8 pagineJournal, Ledger & Cash Book MCQs For FPSC and Other Related One Paper MCQs TestsIftikhar Ahmad100% (3)

- Trial Balance MCQsDocumento2 pagineTrial Balance MCQsasfandiyarNessuna valutazione finora

- MCQ JournalDocumento4 pagineMCQ JournalKanika BajajNessuna valutazione finora

- Accounting Mcqs For PPSCDocumento5 pagineAccounting Mcqs For PPSCizhar_buneriNessuna valutazione finora

- Accounting Cycle MCQsDocumento3 pagineAccounting Cycle MCQsNoshair Ali100% (3)

- General Accounting Principles 2 EPFODocumento22 pagineGeneral Accounting Principles 2 EPFOprajwal s reddyNessuna valutazione finora

- Xii Mcqs CH - 11 Redemption of DebenturesDocumento4 pagineXii Mcqs CH - 11 Redemption of DebenturesJoanna GarciaNessuna valutazione finora

- Journal, Ledger MCQDocumento7 pagineJournal, Ledger MCQSujan DangalNessuna valutazione finora

- The Accounting Education EPFO Accounting MCQ QUIZDocumento20 pagineThe Accounting Education EPFO Accounting MCQ QUIZAnmol ChawlaNessuna valutazione finora

- Account MCQ PDFDocumento93 pagineAccount MCQ PDFsunil kalura100% (1)

- Mcs QDocumento52 pagineMcs QNabeel GondalNessuna valutazione finora

- Financial Accounting Iii Sem: Multiple Choice Questions and AnswersDocumento24 pagineFinancial Accounting Iii Sem: Multiple Choice Questions and AnswersRamya Gowda100% (1)

- MCQ Cs Exe Material Cost and ControlDocumento16 pagineMCQ Cs Exe Material Cost and ControlKetan SinghNessuna valutazione finora

- MCQ On Budgetary ControlDocumento7 pagineMCQ On Budgetary ControlAmruta GholveNessuna valutazione finora

- MCQs Financial AccountingDocumento30 pagineMCQs Financial AccountingMehboob Ul-haq100% (1)

- Cost Accounting MCQ With Answer PDFDocumento3 pagineCost Accounting MCQ With Answer PDFMijanur Rahman100% (2)

- Joint Venture MCQDocumento3 pagineJoint Venture MCQSonu SagarNessuna valutazione finora

- Ratio Analysis McqsDocumento10 pagineRatio Analysis McqsNirmal PrasadNessuna valutazione finora

- Accounting Equation MCQDocumento8 pagineAccounting Equation MCQKulNessuna valutazione finora

- Multiple Choice Questions For CHDocumento3 pagineMultiple Choice Questions For CHjugnuNessuna valutazione finora

- Accounting Concepts MCQsDocumento6 pagineAccounting Concepts MCQsUmar SulemanNessuna valutazione finora

- MCQ - Cash Flow StatementsDocumento24 pagineMCQ - Cash Flow Statementsrthir100% (3)

- Advance Account II MCQ FinalbsisjshDocumento33 pagineAdvance Account II MCQ FinalbsisjshPranit Pandit100% (1)

- Chapter 8: Revenue ReceiptsDocumento6 pagineChapter 8: Revenue ReceiptsVivek RatanNessuna valutazione finora

- MCQ FA (UNIT 1 and UNIT 2)Documento13 pagineMCQ FA (UNIT 1 and UNIT 2)Udit SinghalNessuna valutazione finora

- Computerized Accounting MCQ'sDocumento20 pagineComputerized Accounting MCQ'sFaizan Ch100% (4)

- Cost Accounting BBA MCQsDocumento19 pagineCost Accounting BBA MCQsPhanikumar Katuri100% (1)

- Basic Accounting MCQs With AnswersDocumento7 pagineBasic Accounting MCQs With AnswersShahid NaikNessuna valutazione finora

- Multiple Choice QuestionsDocumento20 pagineMultiple Choice QuestionsHenryNessuna valutazione finora

- Cost Accounting MCQs - Senior Auditor BS-16Documento10 pagineCost Accounting MCQs - Senior Auditor BS-16Faizan Ch100% (2)

- Adjustment Depreciation MCQ SDocumento5 pagineAdjustment Depreciation MCQ SAtiq43% (7)

- Fundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersDocumento5 pagineFundamentals of Accounting - Multiple Choice Questions (MCQ) With AnswersAli Raja100% (4)

- Accntncy MCQs For SAS CAGDocumento12 pagineAccntncy MCQs For SAS CAGDeepak Kumar PandaNessuna valutazione finora

- Multiple Choice Questions: Journal - The First Phase of Accounting CycleDocumento4 pagineMultiple Choice Questions: Journal - The First Phase of Accounting CycleDohaa NadeemNessuna valutazione finora

- Financial Accounting 2 Solved MCQs (Set-8)Documento6 pagineFinancial Accounting 2 Solved MCQs (Set-8)Aarish AnsariNessuna valutazione finora

- Terminal Sample 2 SolvedDocumento11 pagineTerminal Sample 2 SolvedFami FamzNessuna valutazione finora

- MCQ - BasicDocumento22 pagineMCQ - BasicLalitNessuna valutazione finora

- Terminal Sample 2 UnsolvedDocumento7 pagineTerminal Sample 2 UnsolvedFami FamzNessuna valutazione finora

- CA 19ucc101 Financial AccountingDocumento32 pagineCA 19ucc101 Financial AccountingMuktha MathiNessuna valutazione finora

- Whole Month July 2020 Current Affairs MCQs-Prep4examsDocumento127 pagineWhole Month July 2020 Current Affairs MCQs-Prep4examsMuhammad MidhatNessuna valutazione finora

- Punjab Public Service Commission: SubjectDocumento1 paginaPunjab Public Service Commission: SubjectMuhammad MidhatNessuna valutazione finora

- 2020 09 22 UG1 NotificatinDocumento1 pagina2020 09 22 UG1 NotificatinMuhammad MidhatNessuna valutazione finora

- Economy of Pakistan - Challenges and Prospects (CSS Essay)Documento9 pagineEconomy of Pakistan - Challenges and Prospects (CSS Essay)Muhammad Midhat93% (15)

- PDF Resize PDFDocumento2 paginePDF Resize PDFMuhammad MidhatNessuna valutazione finora

- Subject:-: No.F.4-261/2018-RDocumento3 pagineSubject:-: No.F.4-261/2018-Rامین ثانیNessuna valutazione finora

- The Role of International Law in The Kashmir Conflict PDFDocumento27 pagineThe Role of International Law in The Kashmir Conflict PDFMuhammad MidhatNessuna valutazione finora

- Everyday Science 2005 PDFDocumento5 pagineEveryday Science 2005 PDFMuhammad MidhatNessuna valutazione finora

- Job Application Form: (In Capital Letters)Documento3 pagineJob Application Form: (In Capital Letters)Muhammad MidhatNessuna valutazione finora

- Custom Inspector Past Paper 2015 Batch 1: BABAR Ali TanoliDocumento17 pagineCustom Inspector Past Paper 2015 Batch 1: BABAR Ali TanoliMuhammad MidhatNessuna valutazione finora

- United States Court of Appeals, Third CircuitDocumento1 paginaUnited States Court of Appeals, Third CircuitScribd Government DocsNessuna valutazione finora

- CIP Program Report 1992Documento180 pagineCIP Program Report 1992cip-libraryNessuna valutazione finora

- Serological and Molecular DiagnosisDocumento9 pagineSerological and Molecular DiagnosisPAIRAT, Ella Joy M.Nessuna valutazione finora

- Ideal Weight ChartDocumento4 pagineIdeal Weight ChartMarvin Osmar Estrada JuarezNessuna valutazione finora

- 38 Bayan Muna Vs MendozaDocumento3 pagine38 Bayan Muna Vs MendozaDavid Antonio A. EscuetaNessuna valutazione finora

- tf00001054 WacDocumento22 paginetf00001054 WacHritik RawatNessuna valutazione finora

- SassigbmentDocumento7 pagineSassigbmentFurkaan Ali KhanNessuna valutazione finora

- FJ&GJ SMDocumento30 pagineFJ&GJ SMSAJAHAN MOLLANessuna valutazione finora

- Ghalib TimelineDocumento2 pagineGhalib Timelinemaryam-69Nessuna valutazione finora

- Process of CounsellingDocumento15 pagineProcess of CounsellingSamuel Njenga100% (1)

- AdverbsDocumento10 pagineAdverbsKarina Ponce RiosNessuna valutazione finora

- Panulaang FilipinoDocumento21 paginePanulaang FilipinoKriza Erin B BaborNessuna valutazione finora

- Customizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesDocumento191 pagineCustomizable Feature Based Design Pattern Recognition Integrating Multiple TechniquesCalina Sechel100% (1)

- Chhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDFDocumento18 pagineChhabra, D., Healy, R., & Sills, E. (2003) - Staged Authenticity and Heritage Tourism. Annals of Tourism Research, 30 (3), 702-719 PDF余鸿潇Nessuna valutazione finora

- Diploma Pendidikan Awal Kanak-Kanak: Diploma in Early Childhood EducationDocumento8 pagineDiploma Pendidikan Awal Kanak-Kanak: Diploma in Early Childhood Educationsiti aisyahNessuna valutazione finora

- Work Immersion Experience at Formaply Inustry in Brgy. de Ocampo, Trece Martires City, CaviteDocumento34 pagineWork Immersion Experience at Formaply Inustry in Brgy. de Ocampo, Trece Martires City, CaviteKen AshleyNessuna valutazione finora

- Insung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningDocumento81 pagineInsung Jung An Colin Latchem - Quality Assurance and Acreditatión in Distance Education and e - LearningJack000123Nessuna valutazione finora

- Analog Electronic CircuitsDocumento2 pagineAnalog Electronic CircuitsFaisal Shahzad KhattakNessuna valutazione finora

- Joshua 24 15Documento1 paginaJoshua 24 15api-313783690Nessuna valutazione finora

- Calendar of Cases (May 3, 2018)Documento4 pagineCalendar of Cases (May 3, 2018)Roy BacaniNessuna valutazione finora

- Origin of "ERP"Documento4 pagineOrigin of "ERP"kanika_bhardwaj_2Nessuna valutazione finora

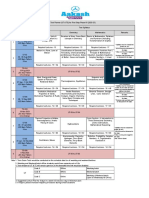

- UT & TE Planner - AY 2023-24 - Phase-01Documento1 paginaUT & TE Planner - AY 2023-24 - Phase-01Atharv KumarNessuna valutazione finora

- Leg Res Cases 4Documento97 pagineLeg Res Cases 4acheron_pNessuna valutazione finora

- Describing LearnersDocumento29 pagineDescribing LearnersSongül Kafa67% (3)

- Percy Bysshe ShelleyDocumento20 paginePercy Bysshe Shelleynishat_haider_2100% (1)

- 206f8JD-Tech MahindraDocumento9 pagine206f8JD-Tech MahindraHarshit AggarwalNessuna valutazione finora

- #6 Decision Control InstructionDocumento9 pagine#6 Decision Control InstructionTimothy King LincolnNessuna valutazione finora

- British Citizenship Exam Review TestDocumento25 pagineBritish Citizenship Exam Review TestMay J. PabloNessuna valutazione finora

- Atul Bisht Research Project ReportDocumento71 pagineAtul Bisht Research Project ReportAtul BishtNessuna valutazione finora

- Equine PregnancyDocumento36 pagineEquine Pregnancydrdhirenvet100% (1)