Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Usbank Sig Card

Caricato da

lilvprDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Usbank Sig Card

Caricato da

lilvprCopyright:

Formati disponibili

9619752673357

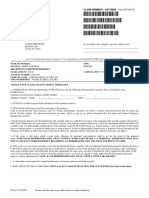

SIGNATURE CARD

U.S. Bank National Association - Signature Card

CHECKING ACCOUNT INFORMATION (Minnesota Residents must complete)

The person initializing below agrees that the following information and all information on the application are true*

1. Have you had a transaction account at this or another financial institution within the past year?

Yes___ No___ Name of institution______________________________________________

2. Have you had a transaction account closed, without your consent, within the past year?

Yes___ No___ Reason for closing ______________________________________________

3. Have you had a criminal conviction, involving a check related offense, within the past two years?

Yes___ No___ Date: _____________________________ Initials: ______________________

*In MN only, the above statements are made under oath and subject to penalty of perjury.

Account Type: Elite Checking Individual Joint

Name: Jose R Arizaga Account#: XXXXXXXX6117

Date: 11/12/2010

Mailing Address: 565 Texas St Primary Date of Birth: 08/03/1982

Pomona, CA 91768

Identification Type: Driver's License

Primary Identification: (CA) d1831415

Authorized Signers:

By signing this signature card, you are acknowledging your express consent to the terms and conditions in your applicable account agreement, including but not

limited to our policies on funds availability and our cellular phone contact policy, and you are acknowledging receipt of a copy of that account agreement. Joint

Accounts: This Account is jointly owned by the parties named hereon. Upon the death of any of them, ownership passes to the survivor(s). Joint tenancy

intended.

X_______________________________________________

Jose R Arizaga

Tax Identification Number Certification

Account Tax Identification Number: 568-73-3170 Date: 11/12/2010

Certification: Under penalties of perjury, I certify that:

(1) The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

(2) I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS)

that I am subject to backup withholding as a result of failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup

withholding, and

(3) I am a U.S. person (including a U.S. resident alien).

(4) I am exempt from reporting. To claim exemption you must check this box.

Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you

have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or

abandonment of secured property, consolation of debt, contributions to an individual retirement arrangement (IRA) and generally, payments other than interest and

dividend you are not required to sign the Certification, but you must provide your correct TIN.

The Internal Revenue Service does not require your consent to any provision of this document other than the certification required to avoid backup withholding.

Signature: Date :

( U.S. Person whose taxpayer identification number is entered above. )

For internal use only

Branch #: 4995 FOR BRANCH USE ONLY:

PLEASE SEND TO DIRECT BANK AT EPMNWS5B OR FAX TO 651-495-8222

8236732673358

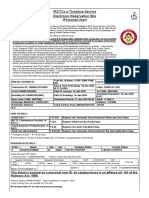

SIGNATURE CARD

U.S. Bank National Association - Signature Card

CHECKING ACCOUNT INFORMATION (Minnesota Residents must complete)

The person initializing below agrees that the following information and all information on the application are true*

1. Have you had a transaction account at this or another financial institution within the past year?

Yes___ No___ Name of institution______________________________________________

2. Have you had a transaction account closed, without your consent, within the past year?

Yes___ No___ Reason for closing ______________________________________________

3. Have you had a criminal conviction, involving a check related offense, within the past two years?

Yes___ No___ Date: _____________________________ Initials: ______________________

*In MN only, the above statements are made under oath and subject to penalty of perjury.

Account Type: Goal Savings Individual Joint

Name: Jose R Arizaga Account#: XXXXXXXX8254

Date: 11/12/2010

Mailing Address: 565 Texas St Primary Date of Birth: 08/03/1982

Pomona, CA 91768

Identification Type: Driver's License

Primary Identification: (CA) d1831415

Authorized Signers:

By signing this signature card, you are acknowledging your express consent to the terms and conditions in your applicable account agreement, including but not

limited to our policies on funds availability and our cellular phone contact policy, and you are acknowledging receipt of a copy of that account agreement. Joint

Accounts: This Account is jointly owned by the parties named hereon. Upon the death of any of them, ownership passes to the survivor(s). Joint tenancy

intended.

X_______________________________________________

Jose R Arizaga

Tax Identification Number Certification

Account Tax Identification Number: 568-73-3170 Date: 11/12/2010

Certification: Under penalties of perjury, I certify that:

(1) The number shown on this form is my correct taxpayer identification number (or I am waiting for a number to be issued to me), and

(2) I am not subject to backup withholding because (a) I am exempt from backup withholding, or (b) I have not been notified by the Internal Revenue Service (IRS)

that I am subject to backup withholding as a result of failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to backup

withholding, and

(3) I am a U.S. person (including a U.S. resident alien).

(4) I am exempt from reporting. To claim exemption you must check this box.

Certification Instructions. You must cross out item 2 above if you have been notified by the IRS that you are currently subject to backup withholding because you

have failed to report all interest and dividends on your tax return. For real estate transactions, item 2 does not apply. For mortgage interest paid, acquisition or

abandonment of secured property, consolation of debt, contributions to an individual retirement arrangement (IRA) and generally, payments other than interest and

dividend you are not required to sign the Certification, but you must provide your correct TIN.

The Internal Revenue Service does not require your consent to any provision of this document other than the certification required to avoid backup withholding.

Signature: Date :

( U.S. Person whose taxpayer identification number is entered above. )

For internal use only

Branch #: 4995 FOR BRANCH USE ONLY:

PLEASE SEND TO DIRECT BANK AT EPMNWS5B OR FAX TO 651-495-8222

Potrebbero piacerti anche

- BondedPromissoryNoteExample PackageToPayOffPublicDebtDocumento7 pagineBondedPromissoryNoteExample PackageToPayOffPublicDebtLucy Maysonet94% (34)

- Credit Repair Dispute Letters PDFDocumento13 pagineCredit Repair Dispute Letters PDFJaz CiceroSantana Boyce96% (24)

- N0 SSN For BAnk AccountDocumento6 pagineN0 SSN For BAnk AccountColton Robert100% (14)

- Affidavit of Notice of Default: Secured PartyDocumento3 pagineAffidavit of Notice of Default: Secured PartyClaire T92% (12)

- Affidavit of Notary PresentmentDocumento7 pagineAffidavit of Notary Presentmentpreston_402003100% (7)

- U.S. Treasury Account Authorization FormDocumento1 paginaU.S. Treasury Account Authorization Formdarius318100% (3)

- Bailment Bond and Eft Over LetterDocumento7 pagineBailment Bond and Eft Over LetterNikki Cofield100% (10)

- How to Make Your Credit Card Rights Work for You: Save MoneyDa EverandHow to Make Your Credit Card Rights Work for You: Save MoneyNessuna valutazione finora

- 133304Documento3 pagine133304Sharon Downing OstremNessuna valutazione finora

- Remove fraudulent info from credit reportDocumento2 pagineRemove fraudulent info from credit reportnanna bio100% (1)

- MyDocument PDFDocumento6 pagineMyDocument PDFTelc3Nessuna valutazione finora

- Request Form (Request For Modification and Affidavit)Documento3 pagineRequest Form (Request For Modification and Affidavit)eagles39100% (1)

- Direct Deposit FormDocumento3 pagineDirect Deposit FormRabindra ShakyaNessuna valutazione finora

- FS Form 5188Documento3 pagineFS Form 51882Plus100% (4)

- ID Card Printer & Photo Card Printing MachinesDocumento5 pagineID Card Printer & Photo Card Printing MachinesId Card PrinterNessuna valutazione finora

- Special Form of Request For Payment of United States Savings and Retirement Securities Where Use of A Detached Request Is AuthorizedDocumento4 pagineSpecial Form of Request For Payment of United States Savings and Retirement Securities Where Use of A Detached Request Is AuthorizedMalika Shamsid-deenNessuna valutazione finora

- Updated Letter To Escrow Holder 1aDocumento3 pagineUpdated Letter To Escrow Holder 1aapi-19731109100% (7)

- Care Credit AppDocumento7 pagineCare Credit AppwvhvetNessuna valutazione finora

- Credit Repair KitDocumento9 pagineCredit Repair KitChristine Skiba0% (1)

- Application Details and Consumer AuthorizationDocumento10 pagineApplication Details and Consumer AuthorizationAnna GassettNessuna valutazione finora

- Sav 2243Documento5 pagineSav 2243MichaelNessuna valutazione finora

- Financial Information Sheet: Bal 1 Bal 2 TTLDocumento4 pagineFinancial Information Sheet: Bal 1 Bal 2 TTLSteve MontroseNessuna valutazione finora

- Sav 5188Documento3 pagineSav 5188sopor,es painNessuna valutazione finora

- Oman Driving LicenseDocumento16 pagineOman Driving LicenseswelitshhNessuna valutazione finora

- Bill of Sale Form DetailsDocumento2 pagineBill of Sale Form DetailsbigbearzukeNessuna valutazione finora

- FS Form 1071 (Statement of Ownership)Documento2 pagineFS Form 1071 (Statement of Ownership)Benne James100% (3)

- File 9210Documento8 pagineFile 9210JustaNessuna valutazione finora

- Notary LetterDocumento3 pagineNotary LetterAdrien WilliamsNessuna valutazione finora

- Bank Authorization (BA) FormDocumento4 pagineBank Authorization (BA) FormAilec FinancesNessuna valutazione finora

- Citi Card Dispute DetailsDocumento4 pagineCiti Card Dispute Detailskayla tranNessuna valutazione finora

- Account AgreementDocumento2 pagineAccount AgreementLocationNessuna valutazione finora

- Credit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsDocumento4 pagineCredit Card Automatic Payment Plan (Autopay) : 1. Customer DetailsaksynNessuna valutazione finora

- Check List On Guidelines Pre-Arranged Visa 9gDocumento1 paginaCheck List On Guidelines Pre-Arranged Visa 9gGet CraftNessuna valutazione finora

- Signature Card InfoDocumento1 paginaSignature Card Infosadik lawanNessuna valutazione finora

- NQ Non-Spouse Rind - 0080Documento5 pagineNQ Non-Spouse Rind - 0080Alexander HerbertNessuna valutazione finora

- Generic Form Preview DocumentDocumento1 paginaGeneric Form Preview Documentelena.69.mxNessuna valutazione finora

- Mortgage Settlement LetterDocumento4 pagineMortgage Settlement LetterChris Otts100% (1)

- Supplier ContarctarDocumento7 pagineSupplier ContarctarAbdiaziz M. YusoufNessuna valutazione finora

- FATCA CRS Individual Declaration FormDocumento2 pagineFATCA CRS Individual Declaration FormSrigandh's WealthNessuna valutazione finora

- Final Application Form (Study Loan Form)Documento6 pagineFinal Application Form (Study Loan Form)Fahim ZaharNessuna valutazione finora

- IHI - SSPKT Template AuthDocumento4 pagineIHI - SSPKT Template AuthstevebuckNessuna valutazione finora

- SIGNED-Foreign Account Tax Compliance Act - 140119Documento2 pagineSIGNED-Foreign Account Tax Compliance Act - 140119skn bharatNessuna valutazione finora

- Ranco Costa Verda ContractDocumento21 pagineRanco Costa Verda ContractGregory RussellNessuna valutazione finora

- Non-Recourse Loan Application for IRA PropertyDocumento5 pagineNon-Recourse Loan Application for IRA PropertyAli MuhammadNessuna valutazione finora

- Ca DD 0Documento2 pagineCa DD 0rfortier6760Nessuna valutazione finora

- PDFDocumento2 paginePDFAntonio BrookinsNessuna valutazione finora

- State Bank Guide to Opening AccountsDocumento8 pagineState Bank Guide to Opening Accountsrafi617Nessuna valutazione finora

- FS 5444 Treasury Direct Account VerificationDocumento2 pagineFS 5444 Treasury Direct Account VerificationMr CutsforthNessuna valutazione finora

- Life Insurance Surrender FormDocumento2 pagineLife Insurance Surrender FormpghoshNessuna valutazione finora

- Foreign Account Tax Compliance Act - 140119Documento2 pagineForeign Account Tax Compliance Act - 140119skn bharatNessuna valutazione finora

- Great American Forms FILL OUT 2020Documento2 pagineGreat American Forms FILL OUT 2020Max Power100% (1)

- PRE-PAID LEGAL SERVICES APPLICATIONDocumento2 paginePRE-PAID LEGAL SERVICES APPLICATIONHunter GrayNessuna valutazione finora

- Fannie Mae Hardship AffidavitDocumento2 pagineFannie Mae Hardship AffidavitkwillsonNessuna valutazione finora

- Credit Card AuthorizationDocumento1 paginaCredit Card AuthorizationSharon RingierNessuna valutazione finora

- Sav 0385Documento2 pagineSav 0385datlavarma25Nessuna valutazione finora

- FATCA Form - Individual PDFDocumento1 paginaFATCA Form - Individual PDFThomas ArsenalNessuna valutazione finora

- Ny Art SupplyDocumento1 paginaNy Art SupplynancymandinoNessuna valutazione finora

- Account DocumentsDocumento24 pagineAccount DocumentsSteven RenoNessuna valutazione finora

- Register for JKC Student ProgramDocumento3 pagineRegister for JKC Student ProgramAnonymous nTxB1EPvNessuna valutazione finora

- Bank Procedure and FormalitiesDocumento59 pagineBank Procedure and Formalitiesrakesh19865Nessuna valutazione finora

- Pan CardDocumento39 paginePan Cardfasttrack0420Nessuna valutazione finora

- List of Schools With 80% Passing Rate and Top Ten Successful ExamineesDocumento2 pagineList of Schools With 80% Passing Rate and Top Ten Successful ExamineesSunStar Philippine NewsNessuna valutazione finora

- CRC Application FormDocumento3 pagineCRC Application Formlchughes1970Nessuna valutazione finora

- Form p650Documento1 paginaForm p650Jun LiewNessuna valutazione finora

- FAQs Aadhaar Data Vault v1!0!13122017Documento11 pagineFAQs Aadhaar Data Vault v1!0!13122017GunjeshJhaNessuna valutazione finora

- V BalasubramaniamDocumento4 pagineV BalasubramaniamChandra SekaranNessuna valutazione finora

- Resolution Lobo Revised - Doc (Final)Documento26 pagineResolution Lobo Revised - Doc (Final)Maria Danielle Fajardo CuysonNessuna valutazione finora

- How To Register EUEEA CitizensDocumento1 paginaHow To Register EUEEA CitizensLeo CrisuNessuna valutazione finora

- Identification and TraceabilityDocumento16 pagineIdentification and TraceabilityVinod Kumar BajpaiNessuna valutazione finora

- NCHDs Guide To Working in IrelandDocumento50 pagineNCHDs Guide To Working in IrelandClaud ChongNessuna valutazione finora

- Cbs HandoutDocumento126 pagineCbs HandoutsudhaaNessuna valutazione finora

- Joining 2014-2015Documento4 pagineJoining 2014-2015Rashid BumarwaNessuna valutazione finora

- Application Form For International Driving Permits (I.D.O) : DATE: - Signature of ApplicantDocumento1 paginaApplication Form For International Driving Permits (I.D.O) : DATE: - Signature of ApplicantSyed Faisal BashirNessuna valutazione finora

- 1902 - BirDocumento2 pagine1902 - BirLilian Laurel Cariquitan0% (1)

- Mayank Nagpal PDFDocumento1 paginaMayank Nagpal PDFmanish sharmaNessuna valutazione finora

- MD Imtiaz Alam 5001733141 Self: Medi Assist Insurance Tpa Pvt. LTDDocumento2 pagineMD Imtiaz Alam 5001733141 Self: Medi Assist Insurance Tpa Pvt. LTDMaaz AlamNessuna valutazione finora

- CSC E-Governance Service India Limited - Ticket DetailsDocumento3 pagineCSC E-Governance Service India Limited - Ticket Detailsravindra272124Nessuna valutazione finora

- AFF - LOSS (Driver's License)Documento3 pagineAFF - LOSS (Driver's License)Doit Etre SebastianNessuna valutazione finora

- Instructions / Checklist For Filling KYC FormDocumento23 pagineInstructions / Checklist For Filling KYC FormGV ManikantaNessuna valutazione finora

- Chamber Registration PakistanDocumento23 pagineChamber Registration PakistanNida Sweet67% (3)

- Online Reading Test 2 Practice QuestionsDocumento16 pagineOnline Reading Test 2 Practice QuestionsThu Cúc VũNessuna valutazione finora

- Ticket Cancelation PDFDocumento2 pagineTicket Cancelation PDFShiv DyutiNessuna valutazione finora

- WBTC e-Ticketing Service for Durgapur to Salt LakeDocumento1 paginaWBTC e-Ticketing Service for Durgapur to Salt Lakeसौरव डेNessuna valutazione finora

- Patna To Pune PDFDocumento3 paginePatna To Pune PDFsudhir pimpaleNessuna valutazione finora