Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Credit Card Fees and Charges PDF

Caricato da

Larry Tobias Jr.Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

Credit Card Fees and Charges PDF

Caricato da

Larry Tobias Jr.Copyright:

Formati disponibili

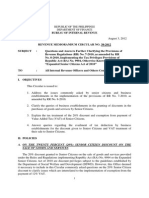

Easy Guide To HSBC Credit Card

Fees And Charges

Credit Card

Comparison

Classic Visa/ Red Gold Visa/ Platinum Visa Advance Visa Premier MC

MasterCard MasterCard MasterCard Highest level

Irresistible Serving up more Get closer to your Caters to all your of personalized

rewards rewards dream vacation needs service

Fees and charges

Primary Card Annual PHP1,200 PHP1,500 PHP2,500 PHP5,000 PHP2,500 Waived

Fee 1 (Effective Aug. 1, 2017)

Supplementary Card PHP600 PHP750 PHP1,250 PHP2,500 PHP1,250 Waived

Annual Fee 1 (Effective Aug. 1, 2017)

Retail Monthly 3.50% per month 3.50% per month 3.50% per month 3.50% per month 3.20% per month 3.10% per month

Effective Interest

Rate

Cash Advance 2 3.75% per month 3.75% per month 3.75% per month 3.75% per month 3.46% per month 3.36% per month

Monthly Effective

Interest Rate 3

(inclusive of Cash

Advance Fee

mentioned below)

Fees (All cards)

Cash advance fee 2

3% of amount drawn or PHP500, whichever is higher.

Minimum amount due Four percent (4%) of your current billed balances (including cash advances and cash

advance fees and charges, retail purchases, non-installment related fees and charges)

or PHP500, whichever is higher

+ 100% of the fixed monthly amortization of installment transactions and installment

related fees and charges

+ Past Due installment amortization amount PLUS the corresponding full amount of

finance charge incurred, if any

+ Any other Past Due or Overlimit amount, whichever is higher

Late payment fee PHP700 or unpaid minimum amount due, whichever is lower

(Effective November 1, 2017)

Overlimit fee PHP500 shall be charged if card account is overlimit on cut-off date.

Returned check fee PHP1,000 will be charged for check payments which are returned due to reasons

such as but not limited to insufficient funds, unsecured deposit, or any other reasons

resulting to bad faith by cardholder.

Sales slip retrieval fee PHP275 for each sales slip retrieved upon cardholder’s request.

Card Replacement Fee PHP400 for each replacement of lost, stolen or damaged card.

Service Fee for Foreign Currency Transactions 4 2.5% of the converted sum plus reimbursement of the assessment fee charged by

Visa/MasterCard to HSBC equivalent to 1% of the converted sum.

HIP Pre-termination Processing Fee PHP500 for each HSBC Installment Plan transaction pre-terminated.

Important Reminder: Paying less than the total amount due will increase the amount of interest you pay and the time it takes to repay your balance.

1 First year waived.

2 Also refers to quasi-cash transactions and related fees and interest charges.

3 The Effective Interest Rate is computed based on the actual number of days in a particular month/year. The beginning of the interest date is from the date

of the transaction. If you pay any amount less than the Total Due /Total Account Balance or make a cash advance transaction, finance charges at prevailing

interest rates will be computed from the date of the transaction until the end of the current statement period.

4 Details found on HSBC’s Terms and Conditions.

Below is an illustration of how the Effective Interest Rate (EIR) method is used in computing for the interest of loans including outstanding

balances in your credit card.

Sample Interest Computation

Retail Purchases

Monthly effective interest rate: 3.5% based on actual number of days in a month

Principal amount: PHP63,877

Month Retail Purchase Total Payment Interest Outstanding Principal Total Outstanding

Balance Balance

1 63,877 0 2,279 63,877 66,155

2 - 4,500 1,986 61,655 63,642

3 - 2,800 2,170 60,842 63,012

4 - 7,600 1,913 55,412 57,325

5 - 2,500 1,956 54,825 56,781

6 - 3,700 1,832 53,081 54,913

Cash Advance Transaction

Monthly effective interest rate: 3.75% based on actual number of days in a month

Principal amount: PHP20,000

Month Cash Advance Total Payment Interest Outstanding Principal Total Outstanding

Availment Balance (inclusive of Balance

Cash Advance Fee)

1 20,000 0 735 20,600 21,335

2 - 853 678 20,481 21,160

3 - 2,500 666 18,660 19,326

4 - 773 640 18,552 19,193

5 - 768 657 18,425 19,082

6 - 763 632 18,319 18,952

HSBC Effective Interest Rates*

HSBC’s Card Balance Transfer Program, HSBC’s Cash Installment Plan, and

HSBC’s Card Balance Conversion Plan

Tenor Effective Interest Rate Monthly

12 months 3.4588%

24 months 3.3917%

36 months 3.2715%

* HSBC may occasionally offer special rates applicable to your credit card account.

Issued by The Hongkong and Shanghai Banking Corporation Limited

Potrebbero piacerti anche

- LtvsvalenDocumento3 pagineLtvsvalenManny DerainNessuna valutazione finora

- Hilton v. GuyotDocumento66 pagineHilton v. GuyotLarry Tobias Jr.Nessuna valutazione finora

- Enforcement of Foreign Judgments: Contributing EditorDocumento9 pagineEnforcement of Foreign Judgments: Contributing EditorAprilleMaeKayeValentinNessuna valutazione finora

- Supreme Court Case DigestDocumento119 pagineSupreme Court Case DigestCon Pu50% (2)

- 2016 ECP LectureDocumento45 pagine2016 ECP LectureMarlon LatNessuna valutazione finora

- Johnston v. Comp. Generale TransatlantiqueDocumento3 pagineJohnston v. Comp. Generale TransatlantiqueLarry Tobias Jr.Nessuna valutazione finora

- Pfizer's Nonconsensual Drug Testing on Nigerian ChildrenDocumento41 paginePfizer's Nonconsensual Drug Testing on Nigerian ChildrenLarry Tobias Jr.Nessuna valutazione finora

- Public International Law ReviewerDocumento39 paginePublic International Law ReviewerAnthony Rupac Escasinas97% (75)

- Pfizer's Nonconsensual Drug Testing on Nigerian ChildrenDocumento41 paginePfizer's Nonconsensual Drug Testing on Nigerian ChildrenLarry Tobias Jr.Nessuna valutazione finora

- Agcaoili LTD PDFDocumento32 pagineAgcaoili LTD PDFruss8dikoNessuna valutazione finora

- Civ Pro Consi NotesDocumento97 pagineCiv Pro Consi NotesChris Bonecile NadresNessuna valutazione finora

- BIR Clarification On Senior Citizens DiscountDocumento13 pagineBIR Clarification On Senior Citizens DiscountPaolo Antonio EscalonaNessuna valutazione finora

- Frequently Asked Questions on the 105-Day Expanded Maternity Leave LawDocumento6 pagineFrequently Asked Questions on the 105-Day Expanded Maternity Leave Lawricardo revecheNessuna valutazione finora

- Local Government Evolution and Early CodesDocumento90 pagineLocal Government Evolution and Early CodesJamey SimpsonNessuna valutazione finora

- RR No. 22-2020 PDFDocumento2 pagineRR No. 22-2020 PDFSandyNessuna valutazione finora

- IRR-Data Privacy Act (Aug 25, 2016)Documento49 pagineIRR-Data Privacy Act (Aug 25, 2016)BlogWatch100% (1)

- Peza - RMC 74-99 PDFDocumento4 paginePeza - RMC 74-99 PDFRonnel TagalogonNessuna valutazione finora

- Libro5 68Documento30 pagineLibro5 68Larry Tobias Jr.Nessuna valutazione finora

- UN Report Analyzes Legal Capacity Concept in Disability TreatyDocumento20 pagineUN Report Analyzes Legal Capacity Concept in Disability TreatyLarry Tobias Jr.Nessuna valutazione finora

- 3a.epublit of Tbe Ftbtlippine $) Upreme Qtou RT: !ffilantlaDocumento30 pagine3a.epublit of Tbe Ftbtlippine $) Upreme Qtou RT: !ffilantlaValaris ColeNessuna valutazione finora

- 2016 ECP LectureDocumento45 pagine2016 ECP LectureMarlon LatNessuna valutazione finora

- 230 Philippine Legal DoctrinesDocumento24 pagine230 Philippine Legal DoctrinesCindy BallesterosNessuna valutazione finora

- RR No. 13-2018 CorrectedDocumento20 pagineRR No. 13-2018 CorrectedRap BaguioNessuna valutazione finora

- Revenue Memorandum Circular No.Documento5 pagineRevenue Memorandum Circular No.Joel SyNessuna valutazione finora

- Gti Ifrs Ias 12 Report UpdDocumento52 pagineGti Ifrs Ias 12 Report UpdMallet S. GacadNessuna valutazione finora

- CTA 8239 (AR Realty) - Excess Input Tax Carry-OverDocumento53 pagineCTA 8239 (AR Realty) - Excess Input Tax Carry-OverJerwin DaveNessuna valutazione finora

- Carbonell v. MetrobankDocumento2 pagineCarbonell v. MetrobankLarry Tobias Jr.Nessuna valutazione finora

- Revenue Memorandum Circular No. 48-2011: Bureau of Internal RevenueDocumento0 pagineRevenue Memorandum Circular No. 48-2011: Bureau of Internal RevenueEmil A. MolinaNessuna valutazione finora

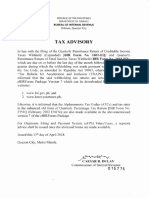

- Tax Advisory - BIR Form 1601EQ and FQDocumento1 paginaTax Advisory - BIR Form 1601EQ and FQLarry Tobias Jr.Nessuna valutazione finora

- Manila Tax Code PDFDocumento502 pagineManila Tax Code PDFJBBIllonesNessuna valutazione finora

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDa EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeValutazione: 4 su 5 stelle4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Da EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Valutazione: 4 su 5 stelle4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDa EverandNever Split the Difference: Negotiating As If Your Life Depended On ItValutazione: 4.5 su 5 stelle4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDa EverandShoe Dog: A Memoir by the Creator of NikeValutazione: 4.5 su 5 stelle4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDa EverandThe Emperor of All Maladies: A Biography of CancerValutazione: 4.5 su 5 stelle4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDa EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceValutazione: 4 su 5 stelle4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDa EverandThe Little Book of Hygge: Danish Secrets to Happy LivingValutazione: 3.5 su 5 stelle3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDa EverandTeam of Rivals: The Political Genius of Abraham LincolnValutazione: 4.5 su 5 stelle4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDa EverandGrit: The Power of Passion and PerseveranceValutazione: 4 su 5 stelle4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDa EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaValutazione: 4.5 su 5 stelle4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDa EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryValutazione: 3.5 su 5 stelle3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDa EverandOn Fire: The (Burning) Case for a Green New DealValutazione: 4 su 5 stelle4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDa EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureValutazione: 4.5 su 5 stelle4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDa EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersValutazione: 4.5 su 5 stelle4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDa EverandThe Unwinding: An Inner History of the New AmericaValutazione: 4 su 5 stelle4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDa EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyValutazione: 3.5 su 5 stelle3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDa EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreValutazione: 4 su 5 stelle4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Da EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Valutazione: 4.5 su 5 stelle4.5/5 (119)

- Her Body and Other Parties: StoriesDa EverandHer Body and Other Parties: StoriesValutazione: 4 su 5 stelle4/5 (821)

- Business Ethics: Case Study-River BlindnessDocumento3 pagineBusiness Ethics: Case Study-River BlindnessMUHAMMAD USAMANessuna valutazione finora

- AW101-OCCUPATIONAL SAFETY AND HEALTH TOPIC: WORKPLACE ERGONOMICSDocumento7 pagineAW101-OCCUPATIONAL SAFETY AND HEALTH TOPIC: WORKPLACE ERGONOMICSMuhamad Amirul Adhwa50% (2)

- Assessing the impact of warehousing on production efficiency at Richard Pieris & Company PLCDocumento19 pagineAssessing the impact of warehousing on production efficiency at Richard Pieris & Company PLCkaushalyaNessuna valutazione finora

- XII - Bahasa InggrisDocumento12 pagineXII - Bahasa InggrisBosgas GadingNessuna valutazione finora

- Williams-Sonoma Case Study AnalysisDocumento5 pagineWilliams-Sonoma Case Study AnalysishighinchiNessuna valutazione finora

- HRM Practices at Tata SteelDocumento34 pagineHRM Practices at Tata SteelRaj KumarNessuna valutazione finora

- CertificationDocumento2 pagineCertificationRenelito Dichos Tangkay0% (1)

- IFMR Capital: Securitizing Microloans For Non-Bank InvestorsDocumento30 pagineIFMR Capital: Securitizing Microloans For Non-Bank Investorsakash srivastavaNessuna valutazione finora

- Ref No Grade Job Title Division Location Closing Date For ApplicationsDocumento4 pagineRef No Grade Job Title Division Location Closing Date For Applicationskhalid IsmaelNessuna valutazione finora

- Guide To Validation - Drugs and Supporting Activities: June 29, 2021Documento41 pagineGuide To Validation - Drugs and Supporting Activities: June 29, 2021Konstantina BogNessuna valutazione finora

- The United Nations Meets The 21st Century-1Documento22 pagineThe United Nations Meets The 21st Century-1Ella Mae Cantuangco100% (1)

- Business Studies 2021 22Documento27 pagineBusiness Studies 2021 22kan PadmasreeNessuna valutazione finora

- CV Final Ilias Iliovits 1Documento4 pagineCV Final Ilias Iliovits 1api-341037183Nessuna valutazione finora

- Mac 301 Week 1Documento8 pagineMac 301 Week 1Roselene LansonNessuna valutazione finora

- Quiz in AuditingDocumento2 pagineQuiz in AuditingRose Medina Baronda100% (1)

- ODI's First Year: Annual ReportDocumento56 pagineODI's First Year: Annual ReportOpen Data Institute100% (1)

- Development Innovation Principles in PracticeDocumento35 pagineDevelopment Innovation Principles in PracticeOlivia ChangNessuna valutazione finora

- Full Download Test Bank For Organic Chemistry 6th Edition Janice Smith PDF Full ChapterDocumento36 pagineFull Download Test Bank For Organic Chemistry 6th Edition Janice Smith PDF Full Chapterprivitywoolhall.8hvcd100% (18)

- TMTQ - Chapter 5Documento22 pagineTMTQ - Chapter 5vu hoangNessuna valutazione finora

- RR Kabel Limited: Rating AdvisoryDocumento9 pagineRR Kabel Limited: Rating AdvisoryumamaheshNessuna valutazione finora

- MGT211 - Introduction To Business - Solved - Final Term Paper - 05 PDFDocumento7 pagineMGT211 - Introduction To Business - Solved - Final Term Paper - 05 PDFbc190204121 IRFA HAYATNessuna valutazione finora

- Lease Agreements Homestead RoadDocumento5 pagineLease Agreements Homestead Roadevans munakuNessuna valutazione finora

- RRL AbstractDocumento5 pagineRRL AbstractRogue AyalaNessuna valutazione finora

- Citi Bank StatementDocumento6 pagineCiti Bank Statementminhdang0306201733% (3)

- Basics of Multivariate Analysis (Mva)Documento13 pagineBasics of Multivariate Analysis (Mva)Nithin DanielNessuna valutazione finora

- Module #2 WORKSHOPDocumento12 pagineModule #2 WORKSHOPJeimy GomezNessuna valutazione finora

- Kinds of ObligationDocumento3 pagineKinds of ObligationCamilla Joiez AsuncionNessuna valutazione finora

- Incorporating Social Aspects in Sustainable Supply Chains - Trends and Future DirectionsDocumento35 pagineIncorporating Social Aspects in Sustainable Supply Chains - Trends and Future DirectionsAnaNessuna valutazione finora

- C300 Rim Vents: Tank AccessoriesDocumento2 pagineC300 Rim Vents: Tank AccessoriesAs'adNessuna valutazione finora

- Fin 235 Personal Finance Homework CH 8 - 14Documento4 pagineFin 235 Personal Finance Homework CH 8 - 14Tutorsglobe Educational ServicesNessuna valutazione finora