Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

De Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-Modifications

Caricato da

Nita Costillas De MattaDescrizione originale:

Titolo originale

Copyright

Formati disponibili

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

Formati disponibili

De Matta, Nicka Suzane-Bsa22a1-Case-Problems-Lease-Modifications

Caricato da

Nita Costillas De MattaCopyright:

Formati disponibili

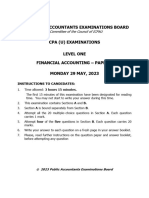

LEASE MODIFICATIONS

MAY 28,2020

CASE PROBLEMS

1. On January 1, 2020 , Silver Company entered into a 5-year lease of a

floor of a building with these terms: annual rent for the first two years

payable at year end.-200,000; annual rent for the next 3 yrs. payable

at the end of each year-300,000; initial direct cost paid by the lessee-

100,000; leasehold improvement-250,000; present value of restoration

cost required by contract- 50,000; useful life of building- 20 yrs.;

implicit interest rate-8%; PV of an ordinary annuity of 1 at 8% for 2

yrs.-1.783; PV of an ordinary annuity of 1 at 8% for 3 yrs.-2.577 and

PV of 1 at 8% for 2 years-0.857.

Required:

1. Compute the following: lease liability on 1/1/20; right of use asset;

depreciation for 2020.

2. Prepare the following: table of amortization; journal entries for

2020 and on 12/31/22.

2. On Jan. 1, 2020, Southstar Company entered into an 8-year lease of a floor

building with useful life of 15 years with the ff. terms: annual rent for first 3

years due at end of each year-300,000; annual rent for the next 5 years due at

the end of each year-400,000; implicit interest rate-10%; PV of an ordinary

annuity of 1 at 10% for 3 periods-2.49;PV of an ordinary annuity of 1 at 10% for

5 periods-3.79; PV of 1 at 10% for 3 periods-0.75. The lease provides for neither

a transfer of title to the lessee nor a purchase option.

Required:

1. What is the lease liability on January 1, 2020?

a. 1,516,000 c. 1,884,000

b. 2,263,000 d. 1,697.250

Solution: C. 1,884,000

Present value for first 3 years(300,000 x 2.49) 747,000

Present value for next 5 years(400,000 x 3.79) 1,516,000

Multiply by PV of 1 at 10% for 3 periods 0.75

Present Value-January 1, 2020 1,137,000

Present value for first 3 years 747,000

Lease liability 1,884,000

2. What is the interest expense for 2020?

a. 188,400 c. 151,600

b. 226,300 d. 169,725

Solution: A. 188,400

Interest expense for 2020 1,884,000 x 10% 188,400

3. What is the interest expense for 2023

a. 151,460 c. 164,964

b. 126,606 d. 200,000

Solution: A. 151, 460( see table)

4. What is the lease liability on December 31, 2023

a. 1,614,604 c. 1,366,064

b. 1,266,064 d. 1,214,604

Solution: B. 1,266,064

Date Payment (10%) Principal Present Value

interest

1/1/2020 1,884,000

12/31/2020 300,000 188,400 111,600 1,772,400

12/31/2021 300,000 177,240 122,760 1,649,640

12/31/2022 300,000 164,964 135,036 1,514,604

12/31/2023 400,000 151,460 248,540 1,266,064

ANSWERS:

Requirement 1:

**Lease liability on January 1, 2020

Annual rental for first 2 years P200,000

Multiply by PV of an ordinary annuity of 1 at 8% for 2 periods 1.783

Present Value – January 1, 2023 356,600

Annual rental for next 3 years 300,000

Multiply by PV of an ordinary annuity of 1 at 8% for 3 periods 2.577

Present Value-January 1, 2022 773,100

Multiply by PV of an ordinary annuity of 1 at 8% for 2 periods 0.857

Present Value-January 1, 2020 662,547

The present value of annual rental for 2 years 356,600

Present Value of annual rentals for next 3 years 662,547

Total present value-January 1, 2020 1,019,147

**Right of use asset

Initial lease liability 1,019,147

Initial direct cost 100,000

Estimated restoration cost 50,000

Total cost of right of use of asset 1,169,147

**Depreciation for 2020

Depreciation (1,169,147/5) 233,829

Requirement 2:

**table of amortization

Date Payment (8%) interest Principal Present Value

1/1/2020 1,019,147

12/31/2020 200,000 81,532 118,468 900,679

12/31/2021 200,000 72,054 127,946 772,733

12/31/2022 300,000 61,819 238,181 534,552

12/31/2023 300,000 42,779 257,221 277,331

12/31/2024 300,000 22,669 227,331 -

** journal entries for 2020

Right of use of asset 1.069,147

Lease Liability 1,019,147

Cash 100,000

Estimated liability-restoration cost 50,000

Depreciation 233,829

Accumulated depreciation 233,829

Interest Expense 81,352

Lease liability 118,468

Cash 200,000

**Journal entries for 12/31/22.

Interest Expense 61,819

Lease liability 238,181

Cash 300,000

Potrebbero piacerti anche

- Problem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDocumento2 pagineProblem 11-7 Given:: Date Payment 10% Interest Principal Present ValueDominic RomeroNessuna valutazione finora

- Lease Modules ContinuedDocumento8 pagineLease Modules ContinuedMariz RapadaNessuna valutazione finora

- Lease Modules ContinuedDocumento8 pagineLease Modules ContinuedKenneth Marcial Ege0% (1)

- Security DepositsDocumento3 pagineSecurity DepositsQueen ValleNessuna valutazione finora

- Seatwork 11.1 TaliteDocumento10 pagineSeatwork 11.1 Taliteandrea taliteNessuna valutazione finora

- Intacc2-Quiz ExamDocumento10 pagineIntacc2-Quiz ExamCmNessuna valutazione finora

- Module 7-Lessee Accounting - (OTHER ACCTG ISSUES)Documento10 pagineModule 7-Lessee Accounting - (OTHER ACCTG ISSUES)Jeanivyle CarmonaNessuna valutazione finora

- Problem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDocumento2 pagineProblem 11-1 Given: (Refer To Book) Required:: Date Payment 9% Interest Principal Present ValueDominic RomeroNessuna valutazione finora

- Date Payment Interest Principal Present Value: Table of AmortizationDocumento6 pagineDate Payment Interest Principal Present Value: Table of AmortizationJekoeNessuna valutazione finora

- Reassessment of Lease LiabilityDocumento6 pagineReassessment of Lease LiabilityJULIA CHRIS ROMERONessuna valutazione finora

- BSA 314 Module 4 Output, Atillo Lyle CDocumento10 pagineBSA 314 Module 4 Output, Atillo Lyle CJeth MahusayNessuna valutazione finora

- Leases Robles Empleo Solution Manual - CompressDocumento18 pagineLeases Robles Empleo Solution Manual - Compresschnxxi iiNessuna valutazione finora

- Accounting LesseeDocumento7 pagineAccounting Lesseeangelian bagadiongNessuna valutazione finora

- Lobrigas Unit5 Topic1 AssessmentDocumento3 pagineLobrigas Unit5 Topic1 AssessmentClaudine LobrigasNessuna valutazione finora

- Problem 1: ComputationsDocumento6 pagineProblem 1: ComputationsClarissa BorbonNessuna valutazione finora

- 5 27 LoansDocumento9 pagine5 27 LoansRengeline LucasNessuna valutazione finora

- Leases - Practice QuestionsDocumento18 pagineLeases - Practice Questionsosama saleemNessuna valutazione finora

- Angelica S. Rubios: Problem 10-19Documento4 pagineAngelica S. Rubios: Problem 10-19Angel RubiosNessuna valutazione finora

- IAS 40 - IAS 23 Benchark Question With SolutionDocumento4 pagineIAS 40 - IAS 23 Benchark Question With Solutionfahadkhn871Nessuna valutazione finora

- 2017 Vol 2 CH 4 AnsDocumento18 pagine2017 Vol 2 CH 4 AnsBSANessuna valutazione finora

- Quiz Box 2 - QuestionnairesDocumento13 pagineQuiz Box 2 - QuestionnairesCamila Mae AlduezaNessuna valutazione finora

- Intacc2-Quiz ExamDocumento5 pagineIntacc2-Quiz ExamCmNessuna valutazione finora

- Problem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesDocumento5 pagineProblem 4-1: GUILLENA, Isabelle Dynah E. BSA 2-10 Assignment #2: LeasesIsabelle GuillenaNessuna valutazione finora

- Finance Lease Exercise 1Documento13 pagineFinance Lease Exercise 1Jenyl Mae NobleNessuna valutazione finora

- IA2Documento9 pagineIA2Claire BarbaNessuna valutazione finora

- Reviewer - Bonds PayableDocumento16 pagineReviewer - Bonds PayableKrisha Joselle MilloNessuna valutazione finora

- (Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualDocumento6 pagine(Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualRENZ ALFRED ASTRERONessuna valutazione finora

- Ia PPT 6Documento20 pagineIa PPT 6lorriejaneNessuna valutazione finora

- Interact MaterialsDocumento2 pagineInteract MaterialsJays DomeNessuna valutazione finora

- IntAcc 2 - CHAPTER 11 NotesDocumento5 pagineIntAcc 2 - CHAPTER 11 NotesikiNessuna valutazione finora

- Audit of Long Term Liabilities 2Documento5 pagineAudit of Long Term Liabilities 2Cesar EsguerraNessuna valutazione finora

- Module 8 - Answer KeyDocumento3 pagineModule 8 - Answer KeyFiona MiralpesNessuna valutazione finora

- CPA Paper 1 Financial Accounting 2Documento9 pagineCPA Paper 1 Financial Accounting 2philipisingomaNessuna valutazione finora

- Ppe Borrowing Cost July 12 SummerDocumento12 paginePpe Borrowing Cost July 12 SummerJelyn RuazolNessuna valutazione finora

- Corporate Accounting - IiDocumento26 pagineCorporate Accounting - Iishankar1287Nessuna valutazione finora

- Accounts Payable and Notes PayableDocumento3 pagineAccounts Payable and Notes PayablenjsrzaNessuna valutazione finora

- Sample QuestionsDocumento3 pagineSample QuestionstulikaNessuna valutazione finora

- Problem 7-1 Requirement 1: Date Payment Interest PrincipalDocumento9 pagineProblem 7-1 Requirement 1: Date Payment Interest PrincipalMarya GonzalesNessuna valutazione finora

- Illustrative Problem 1 - Direct Financing Lease - With Residual ValueDocumento2 pagineIllustrative Problem 1 - Direct Financing Lease - With Residual ValueQueen ValleNessuna valutazione finora

- Acctg Lab 7Documento8 pagineAcctg Lab 7AngieNessuna valutazione finora

- Finalchapter 17Documento4 pagineFinalchapter 17Jud Rossette ArcebesNessuna valutazione finora

- Leases Problems Solution GuideDocumento11 pagineLeases Problems Solution Guidedane f.100% (1)

- Exercise 21Documento3 pagineExercise 21Ruth UtamiNessuna valutazione finora

- Quiz 2 Solution LeaseDocumento5 pagineQuiz 2 Solution LeaseLalaine BeatrizNessuna valutazione finora

- Discussion Answers On Leases 2DDocumento6 pagineDiscussion Answers On Leases 2DJoeneil DamalerioNessuna valutazione finora

- Loan Receivable ProblemsDocumento6 pagineLoan Receivable ProblemsKathleen Frondozo100% (1)

- Lecture 2 - Practice QuestionsDocumento2 pagineLecture 2 - Practice Questionsdonkhalif13Nessuna valutazione finora

- Acyfar4 K31 HWDocumento442 pagineAcyfar4 K31 HWarmiejimenezzNessuna valutazione finora

- IA Chap7Documento13 pagineIA Chap7Patrick Jayson VillademosaNessuna valutazione finora

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsDocumento5 pagineFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniNessuna valutazione finora

- Answer Key Final Exam IA 2Documento4 pagineAnswer Key Final Exam IA 2Carlos arnaldo lavadoNessuna valutazione finora

- Fin - ExerciseDocumento7 pagineFin - ExerciseJARNENDU REANG PGP 2019-21 BatchNessuna valutazione finora

- Session 12 - LeasingDocumento7 pagineSession 12 - LeasingAlfatih 1453100% (1)

- Tutorial Solution Lease LessessDocumento13 pagineTutorial Solution Lease LessessOm PrakashNessuna valutazione finora

- Financial Analysis of WSPsDocumento3 pagineFinancial Analysis of WSPsAnju KarkiNessuna valutazione finora

- Jawaban CH 21 Leasing (Fix)Documento7 pagineJawaban CH 21 Leasing (Fix)abd storeNessuna valutazione finora

- Akm 2Documento10 pagineAkm 2Putu DenyNessuna valutazione finora

- Interm 3 Quizzes Answer KeyDocumento9 pagineInterm 3 Quizzes Answer KeyDanna VargasNessuna valutazione finora

- Corporate Actions: A Guide to Securities Event ManagementDa EverandCorporate Actions: A Guide to Securities Event ManagementNessuna valutazione finora

- Belarus Heat Tariff Reform and Social Impact MitigationDa EverandBelarus Heat Tariff Reform and Social Impact MitigationNessuna valutazione finora

- Asynchronousactivity - (10.20.2020) de MattacisDocumento1 paginaAsynchronousactivity - (10.20.2020) de MattacisNita Costillas De MattaNessuna valutazione finora

- Total Asset P10,000,000Documento2 pagineTotal Asset P10,000,000Nita Costillas De MattaNessuna valutazione finora

- Preliminary Examination: Multiple ChoiceDocumento4 paginePreliminary Examination: Multiple ChoiceNita Costillas De MattaNessuna valutazione finora

- DEMATTA. INCOMETAXAsych12.02Documento1 paginaDEMATTA. INCOMETAXAsych12.02Nita Costillas De MattaNessuna valutazione finora

- ASYNCHRONOUS ACTIVITY (10.21.2020) Advanced AccountingDocumento1 paginaASYNCHRONOUS ACTIVITY (10.21.2020) Advanced AccountingNita Costillas De MattaNessuna valutazione finora

- Build Operate TransferDocumento5 pagineBuild Operate TransferNita Costillas De MattaNessuna valutazione finora

- Preliminary ExaminationDocumento2 paginePreliminary ExaminationNita Costillas De MattaNessuna valutazione finora

- De Matta, Nicka Suzane C. BSA33A1 Auditing in Cis Asychchronous Act DEC.11,2020Documento1 paginaDe Matta, Nicka Suzane C. BSA33A1 Auditing in Cis Asychchronous Act DEC.11,2020Nita Costillas De MattaNessuna valutazione finora

- Details of Sales ForecastDocumento1 paginaDetails of Sales ForecastNita Costillas De MattaNessuna valutazione finora

- DEMATTA. INCOMETAXAsych12.02Documento1 paginaDEMATTA. INCOMETAXAsych12.02Nita Costillas De MattaNessuna valutazione finora

- Of Alabang: ISO 9001:2015 CERTIFIEDDocumento3 pagineOf Alabang: ISO 9001:2015 CERTIFIEDNita Costillas De MattaNessuna valutazione finora

- Photography Mobile: Chrisha M. GalvanDocumento44 paginePhotography Mobile: Chrisha M. GalvanNita Costillas De MattaNessuna valutazione finora

- Compiled Activity in Auditing: Wrapping UpDocumento3 pagineCompiled Activity in Auditing: Wrapping UpNita Costillas De MattaNessuna valutazione finora

- II. CASE PROBLEM-Group WorkDocumento3 pagineII. CASE PROBLEM-Group WorkNita Costillas De MattaNessuna valutazione finora

- I. Identification: Accounting Research BSA 31E1 Asynchronous Activities OCTOBER 13, 2020Documento4 pagineI. Identification: Accounting Research BSA 31E1 Asynchronous Activities OCTOBER 13, 2020Nita Costillas De MattaNessuna valutazione finora

- TAX 03 Fundamentals of Income Taxation PDFDocumento9 pagineTAX 03 Fundamentals of Income Taxation PDFNita Costillas De MattaNessuna valutazione finora

- Of Alabang: ISO 9001:2015 CERTIFIEDDocumento8 pagineOf Alabang: ISO 9001:2015 CERTIFIEDNita Costillas De MattaNessuna valutazione finora

- Health Related Fitness: Ms. Ardeth MarcelinoDocumento31 pagineHealth Related Fitness: Ms. Ardeth MarcelinoNita Costillas De MattaNessuna valutazione finora

- (College Department) : Midterm ExaminationDocumento2 pagine(College Department) : Midterm ExaminationNita Costillas De MattaNessuna valutazione finora

- De Matta, Nicka Suzane C. Bsa22A1Documento8 pagineDe Matta, Nicka Suzane C. Bsa22A1Nita Costillas De MattaNessuna valutazione finora

- (Preliminaries) Itle Page of Group 5Documento11 pagine(Preliminaries) Itle Page of Group 5Nita Costillas De MattaNessuna valutazione finora

- Eapp Las Q3 Week 1Documento8 pagineEapp Las Q3 Week 1Maricel VallejosNessuna valutazione finora

- Cambridge Assessment International Education: Information Technology 9626/13 May/June 2019Documento10 pagineCambridge Assessment International Education: Information Technology 9626/13 May/June 2019katiaNessuna valutazione finora

- New Tally 3Documento3 pagineNew Tally 3Yashaswini JettyNessuna valutazione finora

- Probet DocxuDocumento12 pagineProbet DocxuAbuuAwadhNessuna valutazione finora

- Social PsychologyDocumento6 pagineSocial Psychologyshakti1432ss100% (3)

- Dbms QuoteDocumento2 pagineDbms QuoteAnonymous UZFenDTNMNessuna valutazione finora

- CWWDocumento2 pagineCWWmary joy martinNessuna valutazione finora

- Icecream ScienceDocumento6 pagineIcecream ScienceAnurag GoelNessuna valutazione finora

- Individual Development Plans: A. Teaching Competencies (PPST) Objective 13, KRA 4 Objective 1, KRA 1Documento2 pagineIndividual Development Plans: A. Teaching Competencies (PPST) Objective 13, KRA 4 Objective 1, KRA 1Angelo VillafrancaNessuna valutazione finora

- Proiect La EnglezăDocumento5 pagineProiect La EnglezăAlexandraNessuna valutazione finora

- (2010) Formulaic Language and Second Language Speech Fluency - Background, Evidence and Classroom Applications-Continuum (2010)Documento249 pagine(2010) Formulaic Language and Second Language Speech Fluency - Background, Evidence and Classroom Applications-Continuum (2010)Như Đặng QuếNessuna valutazione finora

- Auditing Integrated Management System (ISO 9001:2015, ISO 14001:2015 & BS OHSAS 18001:2007)Documento50 pagineAuditing Integrated Management System (ISO 9001:2015, ISO 14001:2015 & BS OHSAS 18001:2007)WaliNessuna valutazione finora

- Jurisprudence Examination (Je) Information Guide: 5029-Reginfo - Je V2015.6.Docx Revised July 30, 2015Documento10 pagineJurisprudence Examination (Je) Information Guide: 5029-Reginfo - Je V2015.6.Docx Revised July 30, 2015yasahswi91Nessuna valutazione finora

- UCCP Magna Carta For Church WorkersDocumento39 pagineUCCP Magna Carta For Church WorkersSilliman Ministry Magazine83% (12)

- Jurnal Arang AktifDocumento7 pagineJurnal Arang AktifSurya KrisNessuna valutazione finora

- Polymer ConcreteDocumento15 paginePolymer ConcreteHew LockNessuna valutazione finora

- Nail DisordersDocumento123 pagineNail DisordersyaraamadoNessuna valutazione finora

- Form Filling & Submission QueriesDocumento3 pagineForm Filling & Submission QueriesMindbanNessuna valutazione finora

- The 296 Proposed New (Baseline & Monitoring) Methodologies Sent To The Executive BoardDocumento264 pagineThe 296 Proposed New (Baseline & Monitoring) Methodologies Sent To The Executive Boarddjuneja86Nessuna valutazione finora

- Partnership Liquidation May 13 C PDFDocumento3 paginePartnership Liquidation May 13 C PDFElla AlmazanNessuna valutazione finora

- Applied Chemistry-IDocumento16 pagineApplied Chemistry-Islm.sbipNessuna valutazione finora

- Discuss Both Views Introduction PracticeDocumento3 pagineDiscuss Both Views Introduction PracticeSang NguyễnNessuna valutazione finora

- KodalyDocumento11 pagineKodalySally Di Martino100% (3)

- Scrabble Scrabble Is A Word Game in Which Two or Four Players Score Points by Placing Tiles, EachDocumento4 pagineScrabble Scrabble Is A Word Game in Which Two or Four Players Score Points by Placing Tiles, EachNathalie Faye De PeraltaNessuna valutazione finora

- 2202 Infantilization Essay - Quinn WilsonDocumento11 pagine2202 Infantilization Essay - Quinn Wilsonapi-283151250Nessuna valutazione finora

- Prayer Points 7 Day Prayer Fasting PerfectionDocumento4 paginePrayer Points 7 Day Prayer Fasting PerfectionBenjamin Adelwini Bugri100% (6)

- Frontpage: Don'T Befriend Brutal DictatorsDocumento16 pagineFrontpage: Don'T Befriend Brutal DictatorsFrontPageAfricaNessuna valutazione finora

- Kenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Documento8 pagineKenneth Dean Austin v. Howard Ray, Warden, Jackie Brannon Correctional Center and Attorney General of The State of Oklahoma, 124 F.3d 216, 10th Cir. (1997)Scribd Government DocsNessuna valutazione finora

- Grade Up CurrentsDocumento273 pagineGrade Up CurrentsAmiya RoyNessuna valutazione finora

- PCU 200 Handbook 2018-19 PDFDocumento177 paginePCU 200 Handbook 2018-19 PDFVica CapatinaNessuna valutazione finora