Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

4 Management Information Questions Nov Dec 2019 CL

Caricato da

Toaha0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

24 visualizzazioni2 pagineTitolo originale

4_MANAGEMENT_INFORMATION_QUESTIONS_NOV_DEC_2019_CL

Copyright

© © All Rights Reserved

Formati disponibili

PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

24 visualizzazioni2 pagine4 Management Information Questions Nov Dec 2019 CL

Caricato da

ToahaCopyright:

© All Rights Reserved

Formati disponibili

Scarica in formato PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 2

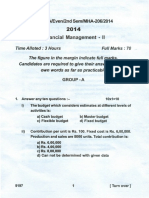

MANAGEMENT INFORMATION

Time allowed - 2:15 hours

Full marks: 100

[N.B.- The figures of the margin indicate full marks. Question must be answered in English. Examiner will take account

of the quality of language and of the way in which the answers are presented. Different parts, if any, of the

same question must be answered in one place in order of sequence]

Marks

1. Justify your answer, if you agree or disagree on the following statements:

a) A product showing a positive contribution under marginal costing will always show a profit

under absorption costing. 5

b) Closing inventory is valued in accordance with financial reporting standards. 5

2. a) What is transfer price? Briefly explain the aims of transfer pricing systems? 4

b) Division M manufactures product R incurring a total cost of Tk. 30 per unit. Fixed costs

represent 40% of the total unit cost.

Product R is sold to external customers in a perfectly competitive market at a price of Tk. 50

per unit. Division M also transfers product R to division N. If transfers are made internally

then Division M does not incur variable distribution costs, which amount to 10% of the

variable costs incurred on external sales.

Total demand for product R exceeds the capacity of Division M.

Calculate the optimum price per unit at which Division M should transfer product R to

Division N? 10

3. a) Define Zero Based Budgeting and what is the principle behind this? 5

b) A retailing company is preparing its annual budget. It plans to make a profit of 25% on the

cost of sales. Inventories will be maintained at the end of each month at 30% of the

following month’s sales requirements.

Details of budgeted sales are as follows:

Credit sales – gross Cash Sales

(Tk.’000) (Tk.’000)

December 1,900 400

January 1,500 250

February 1,700 350

March 1,600 300

Calculate the budgeted inventory level at the end of December and budgeted inventory

purchases for January? 7

4. a) What is the cornerstone of the master budget for a merchandising company? Why? 2+3=5

b) Sharp Company manufacturers jeans. In June, Sharp made 1200 pairs of jeans, but had

budgeted production at 1400 pairs of jeans. The allocation base for overhead costs is direct

labor hours. The following additional data is available for the month:

Variable overhead cost standard Tk.0.60 per DLHr

Direct labor efficiency standard 2.00 DLHr per jean

Actual amount of direct labor hours 2,520 DLHr

Actual cost of variable overhead Tk.1,512

Fixed overhead cost standard Tk.0.25 per DLHr

Budgeted fixed overhead Tk.700

Actual cost of fixed overhead Tk.750

Required:

Calculate the following variances: 6x2=12

i) Variable overhead cost variance.

ii) Variable overhead efficiency variance.

iii) Total variable overhead variance.

iv) Fixed overhead cost variance.

Page 1 of 2

v) Fixed overhead volume variance.

vi) Total fixed overhead variance.

5. a) Define flexible budget and briefly explain the steps followed to prepare the flexible

budgets? 7

b) ABC Limited manufactures and sells a single product, P. Since the P is highly perishable, no

inventories are held at any time. ABC Limited’s management uses a flexible budgeting

system to control costs. Extracts from the flexible budget are as follows:

Output and sales (units) 4,000 5,500

Budget cost allowances: Tk. Tk.

Direct material 16,000 22,000

Direct labor 20,000 24,500

Variable production overhead 8,000 11,000

Fixed production overhead 11,000 11,000

Selling & distribution overhead 8,000 9,500

Administrative overhead 7,000 7,000

Total expenditure 70,000 85,000

Production and sales of product P amounted to 5,100 units.

Calculate the following: 3x5=15

(i) Direct material.

(ii) Direct labor.

(iii) Variable production overhead.

(iv) Fixed production overhead.

(v) Selling & distribution overhead.

6. a) What conflicts can arise between using discounted cash flow methods for capital budgeting

decisions and accrual accounting for performance evaluation? How can these conflicts be

reduced? 4

b) Nirman Manufacturing Co. is interested in purchasing a high-tech widget machine for its

manufacturing plant. The new machine has been designed to basically eliminate all errors

and defects in the widget-making production process. The new machine will cost

Tk.150,000, and has a salvage value of Tk.70,000 at the end of its seven-year useful life.

Nirman has determined that cash inflows for years 1 through 7 will be as follows:

Tk.32,000; Tk.57,000; Tk.15,000; Tk.28,000; Tk.16,000; Tk.10,000, and Tk.15,000,

respectively. Maintenance will be required in years 3 and 6 at Tk.10,000 and Tk.7,000

respectively. Nirman uses a discount rate of 11 percent and wants projects to have a payback

period of no longer than five years.

Required:

i) Compute the net present value of the new machine.

4

ii) Compute the firm’s profitability index.

3

iii) Compute the payback period.

3

iv) Evaluate this investment proposal for Nirman Manufacturing Co.

3

7. Kamal Enterprise provides the following information for 2018:

Tk.

Net income 180,000

Market price per share of common stock 20.00/share

Common stockholders' equity at Jan. 1, 2018 1,100,000

Common stockholders' equity at Dec. 31, 2018 1,500,000

12% preferred stock outstanding 100,000

Required: Calculate the return on common stockholders' equity. (Round to two decimals.) 8

--- The End ---

Page 2 of 2

Potrebbero piacerti anche

- Schaum's Outline of Principles of Accounting I, Fifth EditionDa EverandSchaum's Outline of Principles of Accounting I, Fifth EditionValutazione: 5 su 5 stelle5/5 (3)

- M 2011 Dec PDFDocumento26 pagineM 2011 Dec PDFMoses LukNessuna valutazione finora

- Study Manual of Tax-I (Certificate Level) 12-10-2019-1 PDFDocumento402 pagineStudy Manual of Tax-I (Certificate Level) 12-10-2019-1 PDFToaha0% (1)

- Enduser CompanesDocumento273 pagineEnduser CompanesManish Shetty0% (1)

- MANAGEMENT INFORMATION REPORTDocumento2 pagineMANAGEMENT INFORMATION REPORTLaskar REAZNessuna valutazione finora

- Management Information May-Jun 2016Documento2 pagineManagement Information May-Jun 2016SomeoneNessuna valutazione finora

- Paper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionsDocumento47 paginePaper - 4: Cost Accounting and Financial Management Section A: Cost Accounting QuestionspranllNessuna valutazione finora

- MANAGEMENT INFORMATION DOCUMENTDocumento2 pagineMANAGEMENT INFORMATION DOCUMENTMahediNessuna valutazione finora

- Cost 2022-MayDocumento7 pagineCost 2022-MayDAVID I MUSHINessuna valutazione finora

- KL Business Finance May Jun 2017Documento2 pagineKL Business Finance May Jun 2017Tanvir PrantoNessuna valutazione finora

- KABARAK UNIVERSITY ACCT 520 EXAMDocumento5 pagineKABARAK UNIVERSITY ACCT 520 EXAMMutai JoseahNessuna valutazione finora

- KL Management Information May Jun 2017Documento3 pagineKL Management Information May Jun 2017Laskar REAZNessuna valutazione finora

- 51624bos41275inter QDocumento5 pagine51624bos41275inter QvarunNessuna valutazione finora

- 3) CostingDocumento19 pagine3) CostingKrushna MateNessuna valutazione finora

- Required: Prepare A Variable-Costing Income Statement For The Same PeriodDocumento2 pagineRequired: Prepare A Variable-Costing Income Statement For The Same PeriodFarjana AkterNessuna valutazione finora

- Issues in Management Accounting Bac 4407Documento6 pagineIssues in Management Accounting Bac 4407Rugeyye RashidNessuna valutazione finora

- First Time Login Guide MsDocumento6 pagineFirst Time Login Guide MskonosubaNessuna valutazione finora

- CA P. E. II Course PE II Exam Revision Test Papers NovembeDocumento25 pagineCA P. E. II Course PE II Exam Revision Test Papers Novembeakash yadavNessuna valutazione finora

- Knowledge Level Business Finance May Jun 2014Documento2 pagineKnowledge Level Business Finance May Jun 2014Laskar REAZNessuna valutazione finora

- Paper15 Revisionary Test PaperDocumento59 paginePaper15 Revisionary Test PaperKumar SAP100% (1)

- Part A: Managerial Accounting Assessment - ACC720 - March 2020Documento4 paginePart A: Managerial Accounting Assessment - ACC720 - March 2020Helmy YusoffNessuna valutazione finora

- Central College of Business Management: Mid Term Examination: February 2020Documento2 pagineCentral College of Business Management: Mid Term Examination: February 2020UNik ROnz OFFICIALNessuna valutazione finora

- 22 - Mtest - Management Accounting Morning 1st HalfDocumento4 pagine22 - Mtest - Management Accounting Morning 1st HalfZohaib NasirNessuna valutazione finora

- Cost Accounting Exams(1)Documento6 pagineCost Accounting Exams(1)aroridouglas880Nessuna valutazione finora

- Cost Management Accounting Full Test 1 Nov 2023 Test Paper 1689158389Documento17 pagineCost Management Accounting Full Test 1 Nov 2023 Test Paper 1689158389ahanaghosal2022Nessuna valutazione finora

- Managerial Accounting BBA MBA SMCHS BDocumento14 pagineManagerial Accounting BBA MBA SMCHS BSyed Ahmer Hasnain JafferiNessuna valutazione finora

- Cost Classification: Total Product/ ServiceDocumento21 pagineCost Classification: Total Product/ ServiceThureinNessuna valutazione finora

- 18 QuestionsDocumento11 pagine18 QuestionsiyerkannanvNessuna valutazione finora

- Principles of MarketingDocumento2 paginePrinciples of MarketingDbNessuna valutazione finora

- Management AccountingDocumento4 pagineManagement AccountinggundapolaNessuna valutazione finora

- Paper 15Documento35 paginePaper 15kunal mittalNessuna valutazione finora

- Test Series: April, 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocumento8 pagineTest Series: April, 2023 Mock Test Paper - 2 Intermediate: Group - I Paper - 3: Cost and Management AccountingKartik GuptaNessuna valutazione finora

- Cost 2021-NovDocumento6 pagineCost 2021-NovDAVID I MUSHINessuna valutazione finora

- Marginal CostingDocumento9 pagineMarginal CostingJoydip DasguptaNessuna valutazione finora

- CA Inter Cost & Management Accounting Marginal Costing ProblemsDocumento10 pagineCA Inter Cost & Management Accounting Marginal Costing ProblemsVishal Kumar 5504Nessuna valutazione finora

- Paper10_Set1Documento10 paginePaper10_Set1mvsvvksNessuna valutazione finora

- Tutorial 5 - Marginal and Absorption Costing QuestionsDocumento3 pagineTutorial 5 - Marginal and Absorption Costing QuestionsAnonymous 9GgsGYEf100% (1)

- KL Business Finance Nov Dec 2016Documento3 pagineKL Business Finance Nov Dec 2016Towhidul IslamNessuna valutazione finora

- Marginal and Absorption Costing TechniqueDocumento4 pagineMarginal and Absorption Costing TechniqueADEYANJU AKEEMNessuna valutazione finora

- Marginal Costing Chapter Satelite Centers PDFDocumento17 pagineMarginal Costing Chapter Satelite Centers PDFSwasNessuna valutazione finora

- Cost accounting quiz with answersDocumento8 pagineCost accounting quiz with answersZunaira TauqeerNessuna valutazione finora

- CH 05Documento3 pagineCH 05Gus JooNessuna valutazione finora

- 2014 December Management Accounting L2Documento17 pagine2014 December Management Accounting L2Dixie CheeloNessuna valutazione finora

- Institute of Cost and Management Accountants of PakistanDocumento11 pagineInstitute of Cost and Management Accountants of PakistanAsad RiazNessuna valutazione finora

- t7 2009 Dec QDocumento8 paginet7 2009 Dec Q595580Nessuna valutazione finora

- Set: A: Instructions For CandidatesDocumento10 pagineSet: A: Instructions For CandidatessaurabhNessuna valutazione finora

- Paper 8Documento7 paginePaper 8cmainter394Nessuna valutazione finora

- Part 3Documento76 paginePart 3Kofi Asaase100% (1)

- Paper 10Documento5 paginePaper 10Abhishek RoyNessuna valutazione finora

- Acctg201 Assignment 1Documento7 pagineAcctg201 Assignment 1sarahbeeNessuna valutazione finora

- RVU CMA Work Sheet March 2019Documento12 pagineRVU CMA Work Sheet March 2019Henok FikaduNessuna valutazione finora

- Bcom 5 Sem Cost Accounting 1 22100106 Jan 2022Documento4 pagineBcom 5 Sem Cost Accounting 1 22100106 Jan 2022Internet 223Nessuna valutazione finora

- Financial Management - IIDocumento7 pagineFinancial Management - IIR SheeNessuna valutazione finora

- Management AccountingDocumento8 pagineManagement AccountingVinu VaviNessuna valutazione finora

- 4 Management InformationDocumento2 pagine4 Management InformationsajedulNessuna valutazione finora

- Accounting for Decision Makers assignment analysisDocumento5 pagineAccounting for Decision Makers assignment analysisrasangana arampathNessuna valutazione finora

- Bchcr410 CIADocumento4 pagineBchcr410 CIA15Nabil ImtiazNessuna valutazione finora

- Assignment On CH 3 and 4 Cost 2Documento4 pagineAssignment On CH 3 and 4 Cost 2sadiya AbrahimNessuna valutazione finora

- Nov 2001Documento11 pagineNov 2001Altaf HussainNessuna valutazione finora

- Question Bank Paper: Cost Accounting McqsDocumento8 pagineQuestion Bank Paper: Cost Accounting McqsNikhilNessuna valutazione finora

- Question Bank Paper: Cost Accounting McqsDocumento8 pagineQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayNessuna valutazione finora

- Mba (2019 Pattern) - 230212 - 181328Documento171 pagineMba (2019 Pattern) - 230212 - 181328ManavNessuna valutazione finora

- Financial Ratio Cheatsheet PDFDocumento33 pagineFinancial Ratio Cheatsheet PDFJanlenn GepayaNessuna valutazione finora

- Financial Ratio Cheatsheet PDFDocumento33 pagineFinancial Ratio Cheatsheet PDFJanlenn GepayaNessuna valutazione finora

- Ratio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able ToDocumento21 pagineRatio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able TobanilbNessuna valutazione finora

- Financial Formulas - Ratios (Sheet)Documento3 pagineFinancial Formulas - Ratios (Sheet)carmo-netoNessuna valutazione finora

- Ratio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able ToDocumento21 pagineRatio Analysis: Objectives: After Reading This Chapter, The Students Will Be Able TobanilbNessuna valutazione finora

- Basic Economatrics (4204) : Assignment TitleDocumento1 paginaBasic Economatrics (4204) : Assignment TitleToahaNessuna valutazione finora

- Commonly Used Methods of ValuationDocumento50 pagineCommonly Used Methods of ValuationMakrand Kulkarni100% (1)

- Financial Formulas - Ratios (Sheet)Documento3 pagineFinancial Formulas - Ratios (Sheet)carmo-netoNessuna valutazione finora

- Cobb Douglas ReportDocumento16 pagineCobb Douglas ReportToahaNessuna valutazione finora

- Assurance ManualDocumento350 pagineAssurance Manualrubel khanNessuna valutazione finora

- Jurnal Akrab Juara - Mei Genap 2021 - Irwin Ananta VidadaDocumento18 pagineJurnal Akrab Juara - Mei Genap 2021 - Irwin Ananta Vidadasyafrizal rizalNessuna valutazione finora

- Public Company and Private Company by Prof. ReyazuddinDocumento6 paginePublic Company and Private Company by Prof. ReyazuddinSiddhesh BhosleNessuna valutazione finora

- Accounting For Liabilities and Equity 9Documento6 pagineAccounting For Liabilities and Equity 9Lynmar EnorasaNessuna valutazione finora

- AB Bank Audited ReportsDocumento120 pagineAB Bank Audited ReportsMd Ridwan Siddiquee WadudNessuna valutazione finora

- Calculating Depreciation MethodsDocumento86 pagineCalculating Depreciation MethodsSin TungNessuna valutazione finora

- Lifting of Corporate Veil Corporate LawDocumento23 pagineLifting of Corporate Veil Corporate Lawnouf khanNessuna valutazione finora

- Midterm Exam Formulas CAPM Returns Dividends Stocks PortfoliosDocumento4 pagineMidterm Exam Formulas CAPM Returns Dividends Stocks PortfoliosChristian Peralta ÜNessuna valutazione finora

- Cash and Cash Equivalents: Purchased Three Months Before MaturityDocumento8 pagineCash and Cash Equivalents: Purchased Three Months Before MaturityMary Lyn DatuinNessuna valutazione finora

- Unit 3 Module - 4: Fund Flow StatementDocumento19 pagineUnit 3 Module - 4: Fund Flow StatementSai Sandeep MNessuna valutazione finora

- Mohammad Ali Jinnah University: Financial Accounting WorksheetDocumento9 pagineMohammad Ali Jinnah University: Financial Accounting WorksheetAsh LayNessuna valutazione finora

- Hafiz Salman Majeed: Composed & SolvedDocumento13 pagineHafiz Salman Majeed: Composed & SolvedFun NNessuna valutazione finora

- English for AccountingDocumento2 pagineEnglish for AccountingDenitto GiantoroNessuna valutazione finora

- Q4 2018 Earnings ReleaseDocumento8 pagineQ4 2018 Earnings ReleaseMacy AndradeNessuna valutazione finora

- 13.5 AS 11 The Effects of Changes in Foreign Exchange RatesDocumento7 pagine13.5 AS 11 The Effects of Changes in Foreign Exchange RatesAakshi SharmaNessuna valutazione finora

- Group Assignment FMDocumento3 pagineGroup Assignment FMSarah ShiphrahNessuna valutazione finora

- The Smythe Davidson Corporation Just Issued Its Annual Report The CurrentDocumento1 paginaThe Smythe Davidson Corporation Just Issued Its Annual Report The CurrentMuhammad ShahidNessuna valutazione finora

- Ea Sport Bussiness PlanDocumento29 pagineEa Sport Bussiness PlanDawit AshenafiNessuna valutazione finora

- Fauji Fertilizer Company LimitedDocumento16 pagineFauji Fertilizer Company Limitedkhan izharNessuna valutazione finora

- Auditing Problems With AnswersDocumento13 pagineAuditing Problems With AnswersVirgo Philip Wasil ButconNessuna valutazione finora

- Digital Guidebook 21 Tabs SlidesManiaDocumento87 pagineDigital Guidebook 21 Tabs SlidesManiaFort Specter PedrosaNessuna valutazione finora

- Value CreationDocumento36 pagineValue CreationKamalapati BeheraNessuna valutazione finora

- ACCT224Documento9 pagineACCT224thinkstarzNessuna valutazione finora

- Mids-Paper Numerical Questions SolutionDocumento16 pagineMids-Paper Numerical Questions SolutionBurhan Ahmed MayoNessuna valutazione finora

- Paci Fic-Basin Finance Journal: Chun Chang, Xin Chen, Guanmin LiaoDocumento27 paginePaci Fic-Basin Finance Journal: Chun Chang, Xin Chen, Guanmin LiaoRafael G. MaciasNessuna valutazione finora

- FX Gains and Losses Tax TreatmentDocumento46 pagineFX Gains and Losses Tax TreatmentchelasimunyolaNessuna valutazione finora

- History of Cadbury India: Company OverviewDocumento19 pagineHistory of Cadbury India: Company OverviewAditya PonugotiNessuna valutazione finora

- Over View OFF S AUD It PR OcesDocumento47 pagineOver View OFF S AUD It PR OcesYamateNessuna valutazione finora

- Apply Loan RHBDocumento13 pagineApply Loan RHBaida_faisal81Nessuna valutazione finora

- Lecture-7 8 Project-AppraisalDocumento27 pagineLecture-7 8 Project-AppraisalmaxNessuna valutazione finora