Documenti di Didattica

Documenti di Professioni

Documenti di Cultura

Accounting Generaljournal

Caricato da

sumbul0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni7 pagineThis document is a general journal containing various transactions from January 1st to May 30th. It records cash payments and receipts for items like rent, equipment purchases, supplies, salaries, marketing expenses, and more. Debits and credits are recorded to track increases and decreases in cash as well as increases in expenses and revenues over time.

Descrizione originale:

Titolo originale

accounting generaljournal

Copyright

© © All Rights Reserved

Formati disponibili

XLSX, PDF, TXT o leggi online da Scribd

Condividi questo documento

Condividi o incorpora il documento

Hai trovato utile questo documento?

Questo contenuto è inappropriato?

Segnala questo documentoThis document is a general journal containing various transactions from January 1st to May 30th. It records cash payments and receipts for items like rent, equipment purchases, supplies, salaries, marketing expenses, and more. Debits and credits are recorded to track increases and decreases in cash as well as increases in expenses and revenues over time.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

0 valutazioniIl 0% ha trovato utile questo documento (0 voti)

20 visualizzazioni7 pagineAccounting Generaljournal

Caricato da

sumbulThis document is a general journal containing various transactions from January 1st to May 30th. It records cash payments and receipts for items like rent, equipment purchases, supplies, salaries, marketing expenses, and more. Debits and credits are recorded to track increases and decreases in cash as well as increases in expenses and revenues over time.

Copyright:

© All Rights Reserved

Formati disponibili

Scarica in formato XLSX, PDF, TXT o leggi online su Scribd

Sei sulla pagina 1di 7

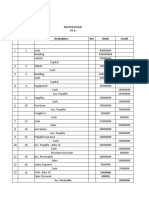

general journal

date transcation explanation debit credit

1/5/2019 comes in takes away

inc exp inc rev

cash 500000

o.e 250000

partners equity 250000

5/5/2019 advance rent 50000

50000

cash paid in advance for rent

6/5/2019 electrification 20000

cash 20000

cash paid for elecrifiication

8/5/2019 decoration 50000

cash 50000

cash paid for decortion

10/5/2019 furniture 110000

cash 50000

acount payable 60000

purchased funiture partial cash patial by credit

14/5/2019 refrigerators 25000

coffee machine 10000

juicer 5000

CCTV Camera 10000

A/C 50000

purchased machines in cash 100000

19/5/2019 supplies 30000

cash 30000

purchased supplies in cash

20/5/2019 computer 20000

generator 40000

cash 60000

paid for computer and genrator on cash

22/5/2019 Marketing expence 10000

cash 10000

paid marketing expence

30/5/2019 coffee bean and fruits 30000

cash 960000 30000

total 960000

juice and café date

generator 40000 20 cash in hand 450000

decoration 50000 8 cash in hand 50000

supplies 30000 19

rent/advance 50000 5/5/2019

machine 100000 14

coffee beans and fruits 30000 30

computer 20000 20

furniture 100000 10

mkting 10000 22

electrification 20000 6/5/2019

1st july

operations

customer dealing/services reenue 80000

inventory storge(vendor mgt) 30000

supplies usage 10000

employees salary(4*8000) 32000

quality cost and control 5000

maintenance

utilities 20000

dt ct

cash

revenue

dt ct

cash 80000

revenue 80000

revenue earned through cash

COGS 30000

fruits and coffee beans 30000

inventory consumed and goods sold

salary expense 32000

cash 32000

cash used for salary

maintenance expense 5000

cash 5000

cash used for maintenance

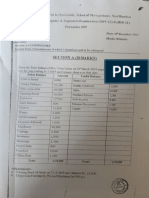

date account debit

2-Jan prepaid rent 36000

cash

cash used for rent expense

3-Jan equipment 80000

cash

notes payable

purchased eqipment on cash and incurred notes payable

4-Jan office supplies 17600

accounts payable

purchased supplies on credit

13-Jan cash 17600

customer services

received cash by rendering services

13-Jan accounts payable 17600

cash

used cash to pay accounts payable 19100

14-Jan salary expense

cash

used cash to pay salaries

18-Jan cash 32900

accountsrecievable 21200

customer services

received half cash by rendering services and half will be received later

23-Jan cash 15300

account reciavble

received remaining cash from customers for the services they used

25-Jan cash 4000

advance payment

26-Jan office supplies 5200

accounts payable

28-Jan wages expense 19100

cash

cash used to pay wages

31-Jan dividends 5000

cash

cash used to pay dividends

31-Jan electricity expense 2470

accounts payable

inccured liabilty to pay bill

31-Jan telephone bill 1494

accounts payable

incurred liability to pay bill

31-Jan miscellinous expense 3470

cash

cash used to pay miscelleneous expenses

credit

36000

60000

20000

17600

17600

17600

19100

54100

15300

4000

5200

19100

5000

2470

1494

3470

Potrebbero piacerti anche

- Company Final Accounts: Debit Rs. Credit RsDocumento5 pagineCompany Final Accounts: Debit Rs. Credit RsDebaditya SenguptaNessuna valutazione finora

- 12 BK Question Bank Group C 2020 21Documento6 pagine12 BK Question Bank Group C 2020 21PuranNessuna valutazione finora

- Test TB Final Ac Single EntryDocumento2 pagineTest TB Final Ac Single EntryMegha BhargavaNessuna valutazione finora

- Kapoor Software LTD CRCTD AnswerDocumento9 pagineKapoor Software LTD CRCTD AnswerMaryNessuna valutazione finora

- 11th BK Final Exam Quesiton Paper March 2021Documento5 pagine11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Financial Statement Class 11Documento3 pagineFinancial Statement Class 11KUNAL SHARMANessuna valutazione finora

- June 2019 ReportDocumento5 pagineJune 2019 ReportKamoga RonaldNessuna valutazione finora

- Financial Accounting Past Paper 2019Documento3 pagineFinancial Accounting Past Paper 2019Rana Hanzila TahirNessuna valutazione finora

- Mid Term Examination November 2014 II Puc AccountancyDocumento4 pagineMid Term Examination November 2014 II Puc AccountancyManju PNessuna valutazione finora

- Remidial Assignment B.tech - Bbs n'22Documento9 pagineRemidial Assignment B.tech - Bbs n'22Ramagopal VemuriNessuna valutazione finora

- Assets Liabilities: Cash Equipment Accounts Receivable Medical Supplies Furniture & Fixtures Accounts PayableDocumento12 pagineAssets Liabilities: Cash Equipment Accounts Receivable Medical Supplies Furniture & Fixtures Accounts PayableRicah MagalsoNessuna valutazione finora

- Accounting Journal of EntriesDocumento8 pagineAccounting Journal of EntriesKristo Ver TamposNessuna valutazione finora

- Financial Accounting - Mid Term Question PaperDocumento3 pagineFinancial Accounting - Mid Term Question PapersahittiNessuna valutazione finora

- Homework 2Documento2 pagineHomework 2SudeepNessuna valutazione finora

- Fam Cia-1 Sec-BDocumento7 pagineFam Cia-1 Sec-BswathiNessuna valutazione finora

- Financial Statements of Manufacturing CompanyDocumento10 pagineFinancial Statements of Manufacturing CompanyDesigner CliqueNessuna valutazione finora

- Instruction: Attempt Any 4 Questions. Each Question Carries Equal MarksDocumento3 pagineInstruction: Attempt Any 4 Questions. Each Question Carries Equal MarksSaurav KumarNessuna valutazione finora

- NTINDocumento28 pagineNTINAkanshaNessuna valutazione finora

- XDocumento5 pagineXSAI KISHORENessuna valutazione finora

- Final Acc Wid Adjustment PracticalDocumento20 pagineFinal Acc Wid Adjustment PracticalMuskan LohariwalNessuna valutazione finora

- Solution To Problem 1&2Documento5 pagineSolution To Problem 1&2Smriti singh0% (1)

- Assignment QuestionsDocumento3 pagineAssignment QuestionsKARTIK CHADHANessuna valutazione finora

- Grade XII Entrance ExamDocumento4 pagineGrade XII Entrance ExamMakeover plus BY Geeta AhujaNessuna valutazione finora

- Financial Accounting 2015 B Com Part 1 PDocumento5 pagineFinancial Accounting 2015 B Com Part 1 PPraver MalhotraNessuna valutazione finora

- NOMSA NYANDOWE - ACC136 November 2020 Question PaperDocumento8 pagineNOMSA NYANDOWE - ACC136 November 2020 Question Papernomsanyandowe371Nessuna valutazione finora

- 11th AccountsDocumento8 pagine11th AccountsShubham sumbriaNessuna valutazione finora

- Jurnal AmDocumento16 pagineJurnal Amsiti maisarah bt razaliNessuna valutazione finora

- Department of Commerce 1 Semester Exam 2020/2021 Grade 11 Accounting Page 1 of 9Documento9 pagineDepartment of Commerce 1 Semester Exam 2020/2021 Grade 11 Accounting Page 1 of 9Eshal KhanNessuna valutazione finora

- Exercises On Formation of Final Accounts: Particulars Amount AmountDocumento4 pagineExercises On Formation of Final Accounts: Particulars Amount AmountNeelu AggrawalNessuna valutazione finora

- Sreenivasa Degree College-Kalikiri: Ii Mid Examinations-2017Documento6 pagineSreenivasa Degree College-Kalikiri: Ii Mid Examinations-2017Prince Mansoor AhmedNessuna valutazione finora

- Sem-1 14 BCOM GENERAL CC-1.1CG FINANCIAL-ACCOUNTING-I-1348 PDFDocumento11 pagineSem-1 14 BCOM GENERAL CC-1.1CG FINANCIAL-ACCOUNTING-I-1348 PDFJude VascoNessuna valutazione finora

- PGBPDocumento3 paginePGBPJimmy ShergillNessuna valutazione finora

- 60 TransactionsDocumento14 pagine60 TransactionsArman AhmedNessuna valutazione finora

- Practice Questionstutorial Questions 26 April 2021Documento3 paginePractice Questionstutorial Questions 26 April 2021LaoneNessuna valutazione finora

- Worksheet-Income Statement & Balance SheetDocumento1 paginaWorksheet-Income Statement & Balance SheetPark EunbiNessuna valutazione finora

- MTC 821-CatDocumento10 pagineMTC 821-Catbmuli6788Nessuna valutazione finora

- INCOME TAX Professional Income ProblemsDocumento7 pagineINCOME TAX Professional Income ProblemsKulsum FathimaNessuna valutazione finora

- Accounts ProjectDocumento21 pagineAccounts Projectkaid30306Nessuna valutazione finora

- KFT Accounting Solutions: Instructions For TestDocumento10 pagineKFT Accounting Solutions: Instructions For TestKanika Sharma100% (1)

- Accountancy Comprehensive ProjectDocumento9 pagineAccountancy Comprehensive ProjectAlia BhattNessuna valutazione finora

- CIA 2 FA - 2020349 Khushi NaharDocumento13 pagineCIA 2 FA - 2020349 Khushi NaharKhushi naharNessuna valutazione finora

- Financial Accounting 2019Documento8 pagineFinancial Accounting 2019Ivy NinjaNessuna valutazione finora

- ParticularsDocumento17 pagineParticularsAyush SarawagiNessuna valutazione finora

- Paper 1Documento19 paginePaper 1GianNessuna valutazione finora

- BBA-1.4-A.D.M Finance 2015 NewDocumento3 pagineBBA-1.4-A.D.M Finance 2015 NewAnonymous NSNpGa3T93Nessuna valutazione finora

- General Jounal PTX No Date Deskription Ref. Debit Credit: Nama: Anivah Sari Nim: 4103 3403 19 1003Documento17 pagineGeneral Jounal PTX No Date Deskription Ref. Debit Credit: Nama: Anivah Sari Nim: 4103 3403 19 1003Euis LatifahNessuna valutazione finora

- Accounts Xerox Wala Question Paper 08-Jan-2022Documento16 pagineAccounts Xerox Wala Question Paper 08-Jan-2022Aquila GodaboleNessuna valutazione finora

- Karnataka II PUC Accountancy Sample Question Paper 18Documento6 pagineKarnataka II PUC Accountancy Sample Question Paper 18Kishu KishoreNessuna valutazione finora

- Taxation NotesDocumento33 pagineTaxation NotesNaina AgarwalNessuna valutazione finora

- Accounts HWDocumento12 pagineAccounts HWAastha AgarwalNessuna valutazione finora

- Journal Entries in The Books of MNM Co. Date Particulars Debit Rs. Credit RsDocumento3 pagineJournal Entries in The Books of MNM Co. Date Particulars Debit Rs. Credit RsMitesh GalaNessuna valutazione finora

- Adjustments To Financial Statements Tutorial No: 13Documento6 pagineAdjustments To Financial Statements Tutorial No: 13me myselfNessuna valutazione finora

- Unit 06 Questions Part 01Documento5 pagineUnit 06 Questions Part 01Sandunika DevasingheNessuna valutazione finora

- WWW - Isbr.in: International School of Business & ResearchDocumento2 pagineWWW - Isbr.in: International School of Business & ResearchAkshayNessuna valutazione finora

- Probs On PIDocumento9 pagineProbs On PIbekalgagan29Nessuna valutazione finora

- 11 Com Pre-ExamDocumento4 pagine11 Com Pre-ExamObaid Khan50% (2)

- Assignment Final AccountsDocumento9 pagineAssignment Final Accountsjasmine chowdhary50% (2)

- Lecture - 4 Model Example 2Documento37 pagineLecture - 4 Model Example 2sammie celeNessuna valutazione finora

- Brand ArchitectureDocumento23 pagineBrand ArchitecturesumbulNessuna valutazione finora

- Name: Sumbul Mughal Topic: Brand Leadership: Extract Taken From The Book Written by David A. AakerDocumento15 pagineName: Sumbul Mughal Topic: Brand Leadership: Extract Taken From The Book Written by David A. AakersumbulNessuna valutazione finora

- Creating Brand Identity: A Necessary ConceptDocumento45 pagineCreating Brand Identity: A Necessary ConceptsumbulNessuna valutazione finora

- Name: Sumbul Mughal Topic: Brand Leadership: Extract Taken From The Book Written by David A. AakerDocumento15 pagineName: Sumbul Mughal Topic: Brand Leadership: Extract Taken From The Book Written by David A. AakersumbulNessuna valutazione finora

- Creating Brand Identity: A Necessary ConceptDocumento45 pagineCreating Brand Identity: A Necessary ConceptsumbulNessuna valutazione finora

- (A) Creating Brand EquityDocumento14 pagine(A) Creating Brand EquitySuraj JainNessuna valutazione finora

- Brand ArchitectureDocumento23 pagineBrand ArchitecturesumbulNessuna valutazione finora

- GE Two Decades of TransformationDocumento2 pagineGE Two Decades of TransformationsumbulNessuna valutazione finora

- 2006Documento2 pagine2006sumbulNessuna valutazione finora

- (A) Creating Brand EquityDocumento14 pagine(A) Creating Brand EquitySuraj JainNessuna valutazione finora

- The Impact of Violence Against Women On Women'S Economic and Social LifeDocumento15 pagineThe Impact of Violence Against Women On Women'S Economic and Social LifesumbulNessuna valutazione finora

- The Impact of Violence Against Women On Women'S Economic and Social LifeDocumento15 pagineThe Impact of Violence Against Women On Women'S Economic and Social LifesumbulNessuna valutazione finora

- Ans 1Documento1 paginaAns 1sumbulNessuna valutazione finora

- History of KurramDocumento2 pagineHistory of KurramDuas and Urdu Dramas/MoviesNessuna valutazione finora

- BCG Matrix Analysis Of:: Assignment No.2Documento7 pagineBCG Matrix Analysis Of:: Assignment No.2sumbulNessuna valutazione finora

- Application For ConveyanceDocumento1 paginaApplication For ConveyancesumbulNessuna valutazione finora

- General Assembly: United NationsDocumento24 pagineGeneral Assembly: United NationssumbulNessuna valutazione finora

- Accounting Excel SheetDocumento44 pagineAccounting Excel SheetsumbulNessuna valutazione finora

- ApplicationDocumento1 paginaApplicationsumbulNessuna valutazione finora

- MemoDocumento1 paginaMemosumbulNessuna valutazione finora

- Accounting Excel SheetDocumento29 pagineAccounting Excel SheetsumbulNessuna valutazione finora

- NokiaDocumento5 pagineNokiasumbulNessuna valutazione finora

- 2006Documento2 pagine2006sumbulNessuna valutazione finora

- Assignment Bays TheorermDocumento1 paginaAssignment Bays Theorermsumbul100% (1)

- Maths AssignmentDocumento7 pagineMaths AssignmentsumbulNessuna valutazione finora

- Netflix AssignmentDocumento4 pagineNetflix AssignmentsumbulNessuna valutazione finora

- NokiaDocumento5 pagineNokiasumbulNessuna valutazione finora

- Maths 6 QuestionsDocumento1 paginaMaths 6 QuestionssumbulNessuna valutazione finora

- Income Taxation IndividualsDocumento19 pagineIncome Taxation IndividualsJenniNessuna valutazione finora

- FRA Assignment 4Documento6 pagineFRA Assignment 4AbhishekNessuna valutazione finora

- Asset Allocation and Security Selection: AcknowledgementDocumento11 pagineAsset Allocation and Security Selection: AcknowledgementyayomakNessuna valutazione finora

- 50 Flats Housing Project in Gurgaon, Haryana (India) : Project Cost (Capex) 3000 % of Project CostDocumento11 pagine50 Flats Housing Project in Gurgaon, Haryana (India) : Project Cost (Capex) 3000 % of Project Costavinash singhNessuna valutazione finora

- Commercial Lease ProposalDocumento4 pagineCommercial Lease ProposalREbroker1100% (3)

- Compensation Management: Presented By: M H KhanDocumento24 pagineCompensation Management: Presented By: M H KhanNazibul IslamNessuna valutazione finora

- Accounting For Decision Making: Unit - I Accounting EquationDocumento25 pagineAccounting For Decision Making: Unit - I Accounting EquationVishal ChandakNessuna valutazione finora

- Comparative Study of Services Provided by LIC ICICI Prudential Life InsuranceDocumento94 pagineComparative Study of Services Provided by LIC ICICI Prudential Life InsuranceSimran SomaiyaNessuna valutazione finora

- Checklist of Documents To Be Submitted by Applicant Organization Available IncompleteDocumento2 pagineChecklist of Documents To Be Submitted by Applicant Organization Available IncompleteMae HapalNessuna valutazione finora

- Rem145r8 MDocumento3 pagineRem145r8 MBrijesh Pratap SinghNessuna valutazione finora

- 10 Amortization GenmathDocumento41 pagine10 Amortization GenmathMac FerdsNessuna valutazione finora

- 52595bos42131-inter-INCOME TAX PDFDocumento8 pagine52595bos42131-inter-INCOME TAX PDFHapi PrinceNessuna valutazione finora

- An Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisDocumento24 pagineAn Options Approach To Commercial Mortgage and CMBS Valuation and Risk AnalysisCameronNessuna valutazione finora

- Stock Statement FormatDocumento6 pagineStock Statement Formatca_akr56% (25)

- CARES Act FundingDocumento17 pagineCARES Act FundingAshley Valenzuela0% (1)

- FIS ReportDocumento8 pagineFIS ReportVaibhav KapoorNessuna valutazione finora

- Meaning of Export FinanceDocumento2 pagineMeaning of Export Financeforamdoshi86% (7)

- SSRN Id3442539 PDFDocumento29 pagineSSRN Id3442539 PDFbrineshrimpNessuna valutazione finora

- USEFUL PHONE #S & EMAILs FOR PROPERTY PRESERVATIONDocumento4 pagineUSEFUL PHONE #S & EMAILs FOR PROPERTY PRESERVATION83jjmack100% (1)

- CREDIT RISK MANAGEMENT of Commercial Banks of Nepla PDFDocumento121 pagineCREDIT RISK MANAGEMENT of Commercial Banks of Nepla PDFPrem YadavNessuna valutazione finora

- Amendments To Tamil Nadu Document Writers Licence RulesDocumento2 pagineAmendments To Tamil Nadu Document Writers Licence RulesmoghlyNessuna valutazione finora

- Financial Risk Management Course OutlineDocumento3 pagineFinancial Risk Management Course Outlineaon aliNessuna valutazione finora

- Anusha Yenishetty PDFDocumento2 pagineAnusha Yenishetty PDFSrinivasa Rao JagarapuNessuna valutazione finora

- CA IPCC Inter Income Tax Revision - Kalpesh Classes PDFDocumento61 pagineCA IPCC Inter Income Tax Revision - Kalpesh Classes PDFSandra MaloosNessuna valutazione finora

- Unit 3: Financial Statement AnalysisDocumento24 pagineUnit 3: Financial Statement Analysissujata dawadiNessuna valutazione finora

- Financial Anal PMA EXCEL2222LDocumento27 pagineFinancial Anal PMA EXCEL2222LBhavna309100% (1)

- Start Up Expenses WorksheetDocumento16 pagineStart Up Expenses WorksheetArthur GreensteinNessuna valutazione finora

- Regulatory Framework For Business TransactionsDocumento36 pagineRegulatory Framework For Business TransactionsKriztleKateMontealtoGelogo100% (7)

- A Reflection Essay: My Experience in Buying and Selling of Stocks (Investagrams)Documento3 pagineA Reflection Essay: My Experience in Buying and Selling of Stocks (Investagrams)Roshenna Mae Tao-onNessuna valutazione finora

- Tugas 1Documento11 pagineTugas 1Ahmad HafidzNessuna valutazione finora